SUN.io Brand Upgrade | Chinese brand "Sun Wukong" powers forward, strengthening the foundation of TRON liquidity

TechFlow Selected TechFlow Selected

SUN.io Brand Upgrade | Chinese brand "Sun Wukong" powers forward, strengthening the foundation of TRON liquidity

SUN.io drives product synergy, AI empowerment, and a deflationary model to build a self-sustaining value cycle and establish a next-generation DeFi ecosystem paradigm with sustainable growth.

As decentralized finance (DeFi) enters a new phase marked by greater maturity, ecosystem synergy, and capital efficiency, SUN.io—one of the core projects within the TRON ecosystem—has recently undergone a significant upgrade, launching its new Chinese brand identity "Sun Wukong" (Monkey King). This rebranding leverages a powerful cultural symbol to unite community consensus and usher in a new chapter of growth.

This upgrade is far more than a superficial visual refresh; it represents a profound strategic refocusing and ecological restructuring. Its central goal is to systematically build and strengthen a multi-layered, self-sustaining decentralized financial liquidity infrastructure across the TRON network through an integrated product matrix.

To achieve this, four key products—SunSwap (Wu Kong Exchange), SunX (Sun Wukong), SUND AO (Wu Kong Dao), and SunPump (Wu Kong Launchpad)—have been strategically unified under the powerful "Sun Wukong" brand identity. Previously operating as independent modules, they are now cohesively integrated into an aligned ecosystem consortium. This architecture aims to comprehensively cover the entire DeFi value chain from spot trading and risk management to community governance and asset innovation, unlocking the full potential of network effects.

The Four Pillars: Building the Foundation of the SUN.io Ecosystem

The construction of the SUN.io ecosystem stems from a deep integration of the full-chain needs in today’s DeFi market—from basic exchange and risk management to community governance and asset innovation. These four core product segments together form a well-structured, functionally robust financial services network. Their success is reflected not only in advanced technical architecture but also in hard metrics such as active user base, substantial capital deposits, and continuous innovation output.

- SunSwap (Wu Kong Exchange): The Liquidity Cornerstone and High-Activity Trading Gateway

As a long-established and battle-tested DEX on the TRON blockchain, SunSwap serves as the essential liquidity foundation and primary trading gateway for the SUN.io ecosystem. Its core mission is to establish an efficient, low-friction liquidity network, accumulating critical liquidity depth through sustained incentive models. It acts as public infrastructure supporting the stable operation of diverse financial applications across the broader TRON DeFi landscape.

In terms of ongoing innovation, SunSwap's latest V3 version introduces the industry-leading "concentrated liquidity" model, allowing liquidity providers to allocate funds within specific price ranges, dramatically improving capital efficiency. Additionally, its dynamic fee mechanism supports flexible rates ranging from 0.01% to 1%, enabling optimization based on different asset characteristics and market conditions. This creates a more attractive and sustainable return model for liquidity providers. Currently, the liquidity for core trading pairs (e.g., TRX/USDT) consistently exceeds $100 million, providing deep market depth and strong price stability for the entire TRON DeFi ecosystem.

- SunX (Sun Wukong): The Derivatives Layer for Professional Risk Management and Capital Efficiency

The decentralized perpetual contracts platform SunX forms the ecosystem’s risk management and capital derivatives layer, designed to meet demand for sophisticated financial strategies. SunX offers cryptocurrency perpetual contract trading, providing users with derivative tools for long/short positions and leverage-enhanced returns. It naturally caters to professional traders executing hedging strategies (e.g., spot vs. futures), arbitrage (capturing spreads between spot/perpetual or cross-platforms), and trend following.

Its strategic value lies in “deepening” the value of existing liquidity within the ecosystem: Active derivative activities on SunX—such as hedging and arbitrage—generate significant underlying spot trading demand. This demand directly feeds back into SunSwap, further enhancing spot market depth and trading volume. This bidirectional empowerment elevates capital utilization efficiency on TRON from the spot level to the derivatives level, attracting professional users seeking higher capital efficiency and strategic flexibility, thereby increasing the overall financial sophistication and appeal of the ecosystem.

Since launch, SunX has seen steady growth in total trading volume, now reaching hundreds of billions of dollars, supporting both spot and futures trading for major digital assets like Bitcoin (BTC) and Ethereum (ETH). With deep liquidity and tight bid-ask spreads, even large trades can be executed smoothly. This high market activity has propelled SunX to a leading position in the industry.

- SunPump (Wu Kong Launchpad): The Value Discovery Engine and Growth Catalyst for Innovative Assets

SunPump is positioned as the ecosystem’s innovation engine and value discovery layer, focusing on providing low-barrier issuance and launch support for early-stage projects within the TRON ecosystem—particularly community-driven assets like meme coins. Its key innovation is the introduction of SunGenX, an AI-powered token issuance agent built on the X platform. Through a revolutionary streamlined process, SunGenX enables users to deploy tokens with near-zero friction via one-click issuance, unleashing community creativity and returning control over asset creation directly to the market.

SunPump’s value extends beyond generating market hype—it actively filters and injects fresh talent into the ecosystem: successfully launched projects list on SunSwap, bringing new trading activity, community attention, and incremental capital to the DEX. Notably, popular meme assets such as SUNGOG and PePe have gained sufficient community momentum and liquidity to be listed on Binance Alpha. This not only validates individual project success but also demonstrates SunPump’s role as a core “innovation sandbox” within the TRON ecosystem—proving its acuity, explosive potential, and vital function as a pipeline for delivering top-tier assets to the broader ecosystem.

- SUN DAO (Wu Kong Dao): Transparent Governance and Coordination Based on Value Redistribution

SUN DAO is the central governance and coordination layer driving the evolution of the ecosystem, with its effectiveness rooted in transparent mechanisms for value redistribution. It establishes an on-chain governance framework powered by the SUN governance token, granting holders voting rights on protocol parameters, asset allocations, and other critical decisions.

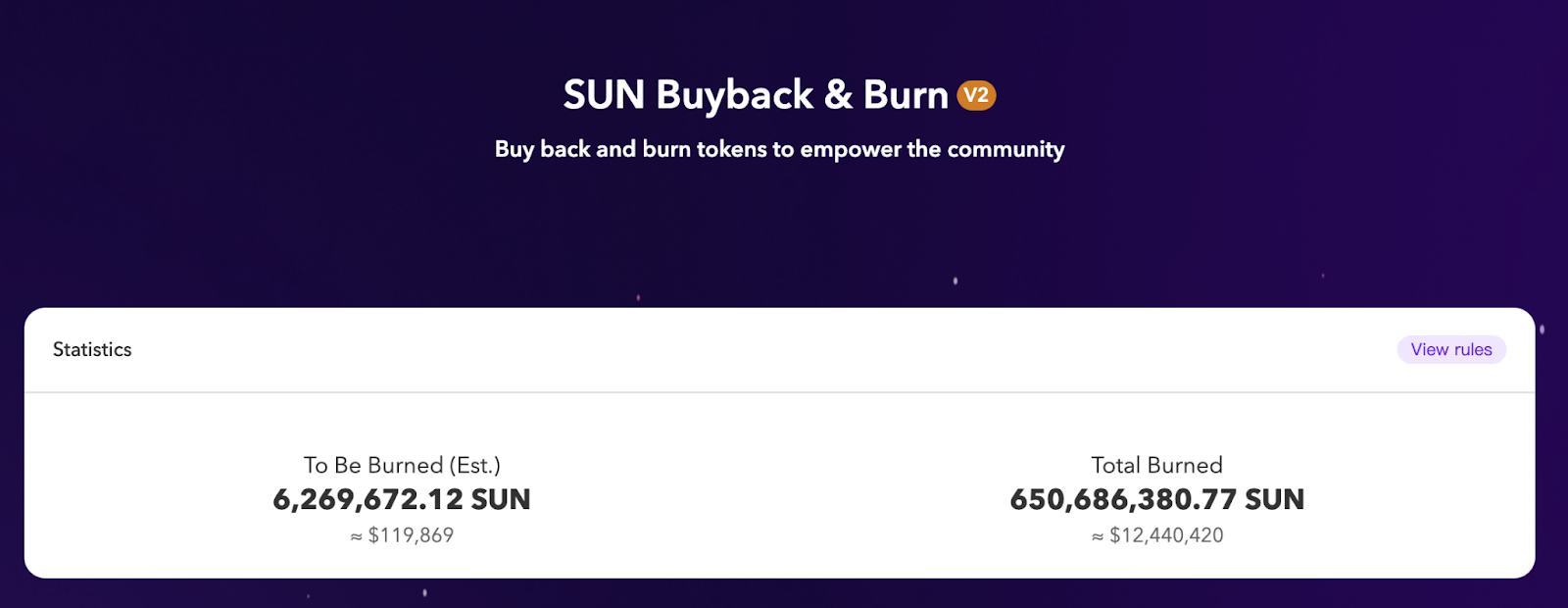

The credibility of this governance model is reinforced by a consistent and verifiable tokenomic design. The SUN.io ecosystem has implemented a mature buyback-and-burn mechanism via SUN DAO: a portion of transaction fees from SunSwap V2, along with all revenues from SunPump and SunX, are explicitly allocated to repurchase SUN tokens on the open market and send them to burn addresses.

As of January 16, over 650 million SUN tokens have been burned through this mechanism. This deflationary model tightly aligns platform growth with token holder interests, injecting long-term value into the SUN token while concretely demonstrating the principles of community co-governance and shared benefits. It serves as a crucial institutional safeguard for achieving anti-fragility and sustainable development within the ecosystem.

Ecosystem Synergy: The Value Cycle and Growth Flywheel of SUN.io

The strategic strength of the SUN.io ecosystem lies not just in its comprehensive product lineup, but in its precisely engineered internal synergies and external linkages. Its ultimate ambition is to become the central liquidity hub powering the development of the TRON blockchain.

Internally, SunPump, SunSwap, and SunX are the three core protocols driving prosperity within the SUN.io ecosystem. Deeply integrated with the SunAgent AI agent, they collectively form a comprehensive value network spanning the full lifecycle of digital assets. This system enables seamless internal workflows while deeply integrating users, developers, and capital into a self-reinforcing growth flywheel.

SunPump acts as the innovation engine and origin point for new assets. As a low-threshold launchpad, it unlocks immense creative potential within the community, continuously incubating and injecting novel crypto assets and market attention into the broader TRON ecosystem. These emerging assets bring initial liquidity and trading demand.

Next, SunSwap—the ecosystem’s liquidity core and value exchange center—receives and amplifies this value. By listing assets from SunPump and other ecosystem sources, SunSwap provides highly capital-efficient trading pools. This design ensures necessary liquidity depth and smooth trading experiences, effectively converting market attention into real trading volume and protocol revenue.

Building on this foundation, SunX expands the ecosystem’s reach and capabilities. Beyond basic issuance and trading, SunX extends the ecosystem’s footprint to other blockchains through advanced services such as cross-chain swaps. This attracts external assets and users while meeting professional traders’ demand for deeper financial instruments like derivatives. Together with SunPump and SunSwap, SunX completes a full business loop—from “asset issuance” to “spot trading” to “advanced financial services.”

Acting as the intelligent orchestrator enabling this closed-loop cycle, the SunAgent AI agent is redefining interaction paradigms and efficiency boundaries within the ecosystem. The upgrade of SunAgent marks a pivotal shift from basic automation to proactive intelligence. It understands natural language commands and autonomously executes complex, multi-step DeFi operations—such as optimal combinations of yield farming, swapping, and staking across various protocols—greatly lowering user entry barriers and maximizing capital efficiency.

Finally, the SUN.io ecosystem channels the momentum of protocol growth directly into long-term value for the SUN token through a continuous and transparent buyback-and-burn mechanism. This establishes a clear value transmission path: the higher the ecosystem’s revenue, the stronger the buybacks, and the more pronounced the deflationary pressure on SUN supply. It ensures that the fruits of ecosystem growth are shared by all token holders—not confined solely to the protocol level. As total trading volume and business scale expand, this mechanism reinforces the scarcity of SUN, strengthening its tokenomic foundation and serving as the fundamental driver and guarantor of confidence in the entire SUN.io value cycle.

In summary, SUN.io has established a complete ecosystem where protocols deliver closed-loop services, AI enhances interactive intelligence, governance ensures community co-ownership, and a deflationary model captures value. It is not only a critical liquidity hub on TRON but also represents the evolutionary direction of a next-generation DeFi paradigm—one that is self-sustaining, intelligently coordinated, and community-owned.

Crucially, the efficiency of this internal cycle is further amplified through external collaboration with core DeFi protocols on TRON. The synergy between SUN.io and JUST is particularly significant, forming a deep liquidity coupling centered around USDD. Users can collateralize assets in USDD 2.0 to mint USDD and earn base yields, then deposit their USDD into SUN.io’s stablecoin pools for additional liquidity mining rewards.

This process not only provides a clear yield-generating use case for USDD minting but also brings sustained, high-quality liquidity to SUN.io. Meanwhile, SUN.io’s PSM (Protocol Supported Module) ensures a stable 1:1 exchange rate between USDD and other major stablecoins, fundamentally boosting user confidence in using and holding USDD, reinforcing its status as a foundational currency within the TRON DeFi ecosystem.

This cross-protocol cooperation enables seamless circulation of capital, users, and yields between JUST and SUN.io, creating a more resilient, efficient, and trustworthy DeFi closed loop within the TRON ecosystem.

In conclusion, through meticulously designed internal synergies and an open external connectivity network, SUN.io has successfully integrated asset issuance, trading, stabilization, and value capture into a unified whole. It has become a central hub aggregating users and capital, while collaborating with protocols like JUST to continuously enhance liquidity depth, innovation vitality, and overall competitiveness across the TRON DeFi ecosystem. This not only fuels its own accelerating growth flywheel but also offers a scalable and sustainable blueprint for DeFi ecosystem development—one that benefits not just TRON, but the broader blockchain world.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News