JustLend DAO anchors JST’s sustained deflation with real yield to ensure long-term, resilient navigation across market cycles.

TechFlow Selected TechFlow Selected

JustLend DAO anchors JST’s sustained deflation with real yield to ensure long-term, resilient navigation across market cycles.

A total of 1.08 billion JST tokens have been burned, with over $38.7 million invested: JustLend DAO continues to substantiate JST’s long-term deflationary logic with real capital, solidifying the token’s long-term value foundation.

Recently, the cryptocurrency market has once again plunged into a deep correction. According to the latest data from HTX, Bitcoin (BTC) has dropped to the $60,000 level—the lowest since November 2024—triggering a broad market downturn and sustained pessimism across the industry. Yet amid this overall market pressure, key metrics within the TRON ecosystem have demonstrated remarkable resilience and growth: the on-chain USDT supply has surpassed $83.4 billion, setting a new all-time high; TRON’s network total revenue continues to rise, reaching $216 million in January 2026—a 4% increase month-on-month—highlighting the ecosystem’s unique developmental resilience and vitality.

Core projects within the TRON ecosystem are also delivering consistent positive developments. Notably, JustLend DAO—the ecosystem’s flagship DeFi platform—executed its second large-scale token buyback and burn on January 15. This round burned a total of 525 million JST tokens, representing 5.3% of the total token supply, with an actual investment exceeding $21 million.

In stark contrast to the broader market’s declining sentiment, thinning trading volumes, and weakening activity, JustLend DAO boldly deployed tens of millions of dollars to execute this aggressive JST deflationary burn—a move that stands out sharply against the prevailing market weakness and serves as a critical value anchor in adverse conditions.

Especially noteworthy is JST’s relatively stable price performance amid the current broad-based market decline. Its price trajectory has not fully mirrored the sharp swings of the wider market—an independence that directly reflects market recognition of its underlying value support.

Over 1.08 billion tokens burned cumulatively, with ~$38.7 million invested: JustLend DAO anchors JST’s deflationary certainty with real capital

Since the JustLend DAO community formally approved the JST buyback-and-burn mechanism proposal in October 2025, the project has executed two large-scale on-chain buyback-and-burn events in just three months—burning over 1.084 billion JST tokens (exactly 1,084,890,753), or 10.96% of the total token supply, with cumulative real capital investment exceeding $38.72 million. Through tangible funding and efficient execution, JustLend DAO has solidified JST’s deflationary certainty—demonstrating its firm commitment to establishing a long-term, sustainable deflationary mechanism.

The successful completion of these two large-scale buyback-and-burn events has rigidly contracted JST’s circulating supply—reducing the total token supply from 9.9 billion to approximately 8.815 billion. Such a massive scale of deflation, backed by real capital, is rare in cryptocurrency history—and clearly underscores JustLend DAO’s substantial financial strength and highly effective deflationary execution capability.

According to the previously published buyback-and-burn announcement, JST buyback-and-burn funds stem from two primary sources: (1) JustLend DAO protocol’s existing earnings and future net income; and (2) the portion of USDD’s multi-chain ecosystem revenue exceeding $10 million. As USDD’s multi-chain ecosystem revenue has yet to meet the established threshold, all current JST buyback-and-burn funding is fully supported by JustLend DAO protocol earnings.

This funding arrangement confirms that the JST buyback-and-burn mechanism is deeply rooted in JustLend DAO’s genuine ecosystem revenues. Thus, it is not a short-term, marketing-driven one-off operation—but rather a long-term,常态化 value-enabling program anchored to ongoing protocol earnings and codified into the protocol’s foundational mechanism. It establishes a clear and robust long-term deflationary closed loop for JST: “Real ecosystem earnings → drive token buybacks → deflation boosts value → value feeds back into ecosystem growth”—providing a solid, mechanism-level foundation for JST’s long-term stability and development.

As KOL OxPink observed, the core logic of JST’s buyback-and-burn closely mirrors traditional finance’s “profit-based stock buybacks”: actual protocol-generated earnings are directly channeled back to token holders via secondary-market buybacks and permanent burns—ensuring ecosystem growth dividends flow tangibly to token holders.

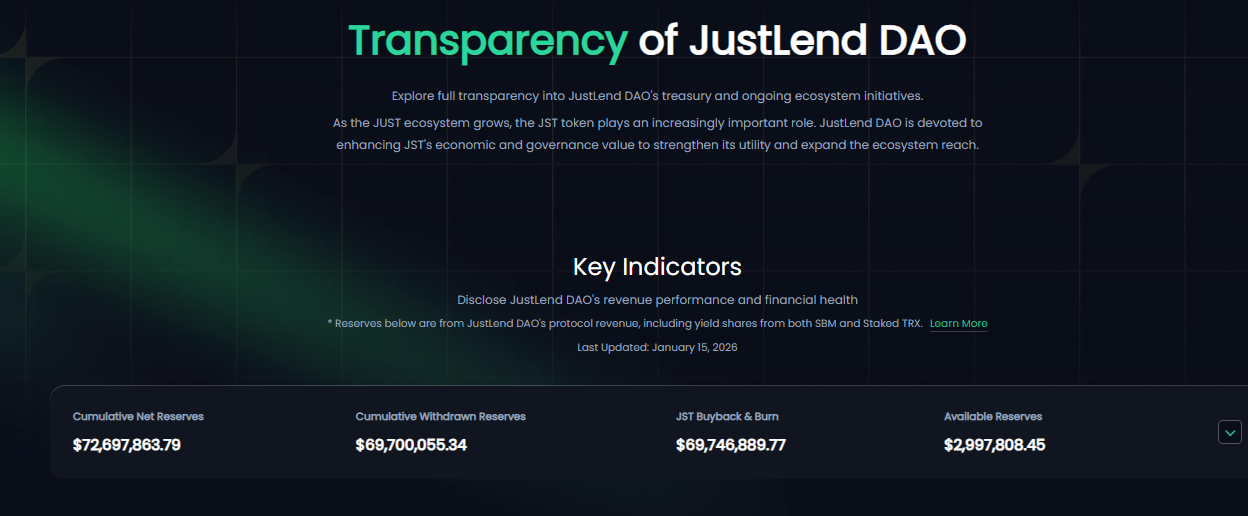

Notably, all JST buyback-and-burn operations are conducted entirely on-chain, with every transaction fully traceable and publicly verifiable. Users can currently monitor real-time progress—including pending burn amounts and fund details—via JustLend DAO’s official website Grants DAO section or its dedicated Transparency page, ensuring full end-to-end transparency.

As of February 4, 2026, JustLend DAO still holds approximately $31.02 million in reserved earnings earmarked for future burns. These funds will be gradually allocated toward JST buybacks and burns in subsequent quarters—ensuring steady, sustainable financial momentum for the mechanism’s ongoing execution and continuous release of deflationary effects.

Diversified business lines fuel strong profitability—solidifying JST buyback-and-burn support

As both the core funding source for JST buybacks and burns and TRON’s foundational financial infrastructure, JustLend DAO consistently aligns with real-world market demand—building a comprehensive, full-stack DeFi solution encompassing lending (SBM), liquid staking (sTRX), energy rental, and GasFree smart wallet functionality. This diversified and mature business portfolio not only generates stable, genuine, and recurring protocol revenue—ensuring healthy cash-flow growth—but also provides a continuous, sustainable funding stream for the JST buyback-and-burn mechanism, underpinning JST’s long-term deflationary value at the financial root.

JustLend DAO’s robust profitability forms the bedrock of its ability to sustain the JST buyback-and-burn mechanism long-term. This was directly validated during the second burn executed on January 15, 2026: of the $21 million deployed, $10.34 million came from pre-allocated reserves as planned, while the remainder originated from new net earnings generated by the protocol in Q4 2025. This implies JustLend DAO’s Q4 2025 net earnings alone exceeded $10 million—clear proof of its strong and sustainable profitability.

This solid earnings base stems from steadily expanding core operations. JustLend DAO’s platform-wide operational scale continues to grow, with standout metrics including: Total Value Locked (TVL) consistently exceeding $6 billion—ranking it firmly among the top three globally in the lending sector. Per its Transparency page, JustLend DAO’s cumulative net earnings have reached $72.69 million. Since the JST buyback-and-burn mechanism passed in October last year, nearly $69.7 million in reserve earnings have been drawn down over the past three months, leaving nearly $3 million in remaining net earnings.

Based on its proven, stable revenue performance, JustLend DAO’s “Q4 2025 JST Report,” released on January 28, forecasts another ~$21 million to be allocated toward buybacks and burns in Q1 2026—of which sTRX-related revenue is expected to contribute $10 million. The exact burn size will be dynamically adjusted based on actual quarterly performance. This delivers clear, verifiable expectations to the market—affirming the continuity and reliability of the deflationary logic: “Real business generates earnings → earnings drive buybacks → buybacks boost value.”

Beyond JustLend DAO’s core support, the decentralized stablecoin USDD ecosystem—set to become a major incremental funding source for future JST buybacks and burns—is experiencing rapid growth: USDD’s total supply has now surpassed $1 billion, with cumulative treasury earnings reaching $7.4678 million.

In summary, by anchoring itself to a diversified, high-growth core business matrix and building formidable profitability through consistently stable protocol earnings, JustLend DAO has deeply internalized the JST buyback-and-burn mechanism as a long-term token value-growth engine—underpinned by real earnings, secured by explicit mechanisms, and executed on a predictable, verifiable schedule. This achieves deep integration between deflationary operations and ecosystem development, and synchronous growth between token value and protocol profitability.

JST’s market performance further validates the effectiveness of this ecosystem construction. Amid the current broad-based crypto market downturn—with major cryptocurrencies suffering steep corrections—JST has demonstrated exceptional relative stability and resilience, avoiding severe volatility and charting an independent, bullish course. According to CoinGecko’s latest data as of February 4, since the market entered its crash phase on January 30, major cryptocurrencies posted heavy short-term losses: BTC fell ~15% over seven days; ETH and SOL fell more than 25%. In contrast, JST declined by less than 1% over the same period—and even rose slightly during certain intervals. This decoupled price action stands out vividly in a weak market—visibly reflecting its unique and resilient value foundation.

Tracing JST’s deflationary mechanism execution, its “value-growth logic” has been clearly validated by the market: each large-scale buyback-and-burn event has directly driven steady price appreciation—generating a pronounced “deflationary positive effect.”

- First-cycle catalyst (October–December 2025): Following formal approval of the JST buyback-and-burn proposal on October 21, 2025, market expectations materialized rapidly. JST’s price began rising steadily from $0.032 USDT, peaking at $0.045 USDT on December 3—achieving a ~40% short-term gain;

- Second-cycle catalyst (January 2026): After the second large-scale buyback-and-burn concluded on January 15, 2026, JST’s price surged again—from $0.040 USDT to $0.047 USDT by January 27—a ~17% gain within two weeks.

The market’s positive response reflects not only recognition of the deflationary model itself but also strong confidence in the long-term logic of “business growth driving value returns.”

In fact, JustLend DAO’s continuous, transparent, and earnings-backed buyback-and-burn operations have established for JST a fundamental value basis distinct from purely sentiment-driven assets. Meanwhile, JST’s resilient performance during this market downturn constitutes the strongest validation of its deflationary model—“business generates earnings → earnings drive buybacks → buybacks boost value”—and the long-term ecosystem development logic underpinning it.

TRON ecosystem accelerates across the board; JustLend DAO builds through market cycles

The deflationary logic embedded in the JST buyback-and-burn mechanism—deeply tying ecosystem earnings to token value—epitomizes how DeFi protocols return to commercial fundamentals and build sustainable value models. As market cycles ebb and flow, projects relying solely on short-term speculation and lacking genuine ecosystem foundations will inevitably falter when the tide recedes. Only those practitioners committed to deep ecosystem cultivation and long-term construction will stand firm—and emerge as leading forces shaping the next industry cycle. JustLend DAO embodies precisely this logic.

Colin Wu, founder of prominent crypto media outlet “Wu Talk,” previously noted that most crypto projects lack value-return mechanisms akin to traditional finance’s dividends or share buybacks. Typically, projects without real revenue rely on token sales to sustain operations, while even revenue-generating projects often retain earnings for their teams—making cases where earnings are meaningfully returned to token holders exceedingly rare. Therefore, truly high-quality crypto projects must not only generate real revenue but also embed rules for returning earnings to token holders directly into code and smart contracts—the hallmark of genuinely long-term token models.

JST’s buyback-and-burn mechanism is a vivid embodiment and industry benchmark of this philosophy. With tens of millions of dollars already deployed to steadily advance JST buybacks and burns, JustLend DAO demonstrates its deep commitment to ecosystem cultivation and long-term value capture. By tightly linking JST’s token value to the real-world development and earnings of core protocols like JustLend DAO and USDD, it aligns ecosystem development paths with JST holders’ interests. More importantly, the entire process rests on absolute transparency: clear funding sources, fully auditable on-chain execution, and sustainable earnings reserves—forming a long-term value practice grounded in real earnings, secured by transparent mechanisms, and driven by consistent execution.

Meanwhile, TRON—the powerful ecosystem backing JustLend DAO—continues accelerating across all fronts, growing counter-cyclically during the industry downturn and steadily amplifying its ecosystem momentum: on-chain USDT issuance continues hitting new all-time highs; TRON’s network total revenue climbed to a new peak in January 2026—robust growth metrics underscoring the ecosystem’s overall resilience and vitality.

In ecosystem expansion and cross-chain interoperability, TRON keeps widening its boundaries and introducing fresh traffic: On January 15, MetaMask—the world’s largest crypto wallet by user count—officially integrated the TRON network, opening a vital new traffic channel for the on-chain ecosystem; on January 26, cross-chain protocol WalletConnect added TRON network support—significantly enhancing TRON’s interoperability and attracting additional resources, thereby providing long-term growth impetus to core protocols like JustLend DAO.

Beyond TRON’s strong ecosystem support, JustLend DAO itself has operated stably across multiple bull and bear cycles—maintaining a flawless record of zero security incidents—and thus cultivated deep risk-resilience capabilities. During this market downturn, JustLend DAO’s decision to deploy substantial capital toward JST buybacks and burns powerfully demonstrates its technical strength and unwavering commitment to long-term construction.

Leveraging TRON’s deep ecosystem foundations and its own continuous product innovation, JustLend DAO—by deeply binding protocol earnings to token value—not only builds a cyclical-proof value floor for JST but also actively defines a new paradigm of long-termism in DeFi. When the tide recedes, builders like this will become the decisive force shaping the industry’s next chapter.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News