New Breakthroughs in the TRON ECO Ecosystem for 2025: Deepening DeFi Application Value, Successive Explosions in the Meme Ecosystem, and Forward-Looking Layout in the AI Track

TechFlow Selected TechFlow Selected

New Breakthroughs in the TRON ECO Ecosystem for 2025: Deepening DeFi Application Value, Successive Explosions in the Meme Ecosystem, and Forward-Looking Layout in the AI Track

In 2025, TRON successfully achieved a critical leap from being a benchmark in the cryptocurrency industry to becoming a new global financial infrastructure. Leveraging its dominant position as the stablecoin leader with an $80 billion USDT circulation, the authoritative recognition as a designated public chain for U.S. stock listings and U.S. GDP releases, and the development of DeFi infrastructure such as JustLend DAO and SUN.io, a Meme ecosystem driven by SunPump, and AI initiatives led by AINFT, TRON has established a mature ecosystem characterized by diversified symbiosis and the efficient operation of a value flywheel.

Looking back at 2025, TRON achieved a critical leap from being a benchmark in the crypto industry to becoming a new global financial infrastructure, thanks to a series of groundbreaking accomplishments. Its robust value-creation capabilities and exponential ecosystem evolution have consistently attracted attention from global financial markets.

In the stablecoin sector, TRON has demonstrated absolute dominance. The circulating supply of USDT on its chain has continuously set new historical records, surpassing $80 billion and steadily advancing towards the $100 billion milestone, solidifying its unshakable leading position.

In global financial markets, TRON's listing on the US stock market integrated it into the mainstream financial ranks, building a bridge connecting the crypto world with traditional capital. It was also selected as one of the official US GDP release designated public chains, receiving the highest level of recognition for its authority and reliability, marking its deep integration into the core global financial infrastructure.

Simultaneously, the TRON ECO ecosystem achieved leapfrog breakthroughs across multiple sectors: benchmark DeFi infrastructures like JustLend DAO and SUN.io continued to iterate and upgrade, solidifying the foundational value of the ecosystem; the Meme launch platform SunPump drove successive waves of new asset matrices, continuously activating network-wide traffic and completing value conversion; AINFT seized the forefront AI sector, anchoring a new engine for the ecosystem's future growth.

Currently, the TRON ECO ecosystem, relying on core products such as DeFi protocols, AI infrastructure, and new Meme applications, has formed a mature ecosystem characterized by diversified symbiosis and the efficient operation of a value flywheel. Each business segment precisely exerts its force and resonates synergistically, constructing a mutually empowering growth flywheel. This not only provides core support for the prosperity and long-term development of the TRON ecosystem but also injects a continuous stream of momentum for its sustained industry leadership, pioneering new development spaces in the crypto field.

DeFi Sector Value Deepens: Steady Iteration and Innovative Breakthroughs

As the core financial engine of the TRON ecosystem, the DeFi sector in 2025 successfully achieved a leapfrog development from providing basic functions to becoming the ecosystem's value hub through the continuous iteration and innovative expansion of core protocols. It has built a decentralized financial service system that is both secure, efficient, and innovative.

Core DeFi products within the TRON ecosystem have seen new breakthroughs: JST advanced large-scale buyback and burn, strengthening asset value support; SUN.io added the derivative SunX, enriching its product matrix; BTTC optimized its token model, enhancing ecosystem compatibility; WINkLink continued to expand data service scenarios, solidifying the foundation for empowering on-chain applications.

Currently, TRON has established a comprehensive DeFi infrastructure matrix with clear division of labor and efficient synergy: SUN.io, as the liquidity core, provides convenient asset exchange and circulation services; JustLend DAO, acting as the lending hub, facilitates capital appreciation and allocation optimization; BTTC undertakes cross-chain responsibilities, ensuring free capital flow; WINkLink oracle empowers DApps with real-time off-chain data, enhancing the security and reliability of DeFi applications. These four core applications combine forces to jointly build a multi-dimensional, integrated service system of "liquidity supply - asset appreciation - cross-chain interoperability - security empowerment," providing robust support for ecosystem development.

According to DeFiLlama data, as of December 25th, the Total Value Locked (TVL) in DeFi on the TRON chain exceeded $4.4 billion, consistently ranking among the top five global public chains. This data not only confirms the solid foundation and strong resilience of the TRON DeFi ecosystem but also reflects the market's high recognition of its technical strength, ecosystem layout, and future potential.

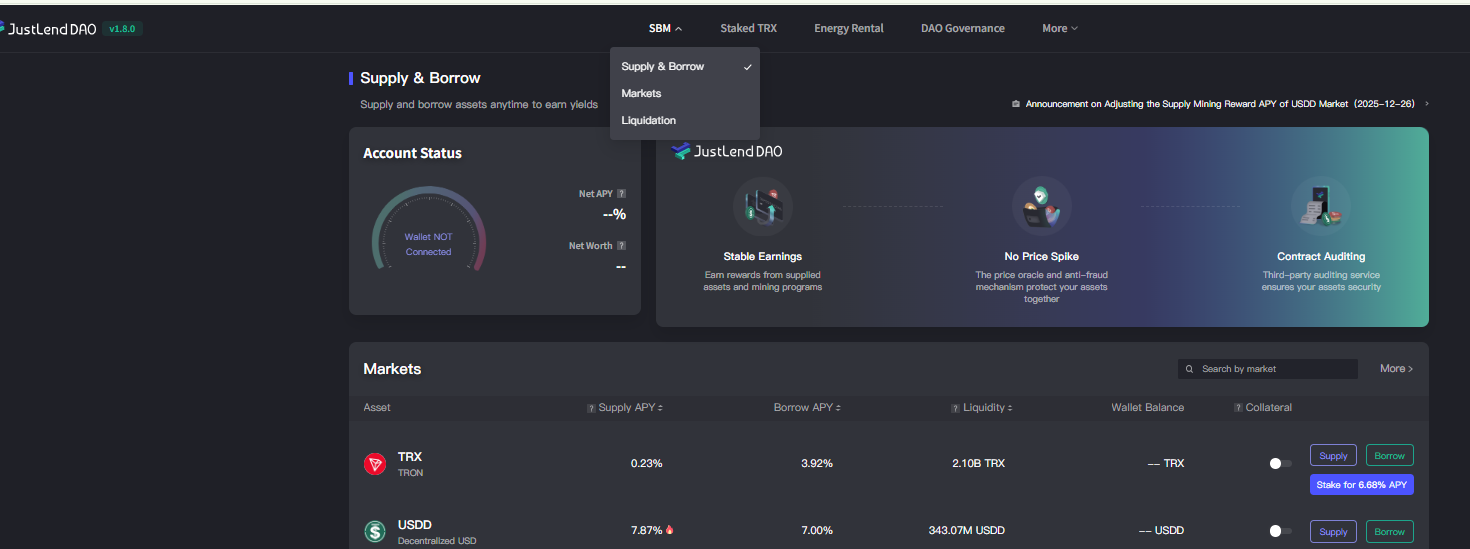

JustLend DAO: From Lending Protocol to Ecosystem Value Hub

As a core pillar of the TRON ecosystem's financial infrastructure, JustLend DAO has achieved a leapfrog development from a lending protocol to an ecosystem value hub through continuous functional integration and strategic upgrades. It has built a full-chain decentralized financial solution integrating asset lending and appreciation, staking services, and Gas cost optimization.

Currently, JustLend DAO has completed deep integration of multiple core DeFi modules, forming an integrated product matrix covering the lending market (SBM), liquid staking sTRX (Staked TRX), and Energy Rental, providing users with comprehensive and diverse on-chain financial services.

Beyond core products, JustLend DAO, with a focus on user experience, innovatively launched the GasFree smart wallet in March this year. It allows users to deduct transaction fees directly from the transferred tokens, breaking the industry limitation of "needing to hold native tokens to transact." Additionally, JustLend DAO simultaneously launched a 90% transaction fee subsidy campaign, enabling users to pay only about 1 USDT in actual fees for each GasFree USDT transfer (regardless of amount).

In mid-October, JustLend DAO formally implemented a large-scale JST buyback and burn mechanism, explicitly allocating all protocol net income and a portion of profits exceeding $10 million from the USDD multi-chain ecosystem entirely into the JST buyback and burn fund pool. Subsequently, JustLend DAO extracted approximately $59.087 million from existing revenue to initiate the first round of burns, executing the first phase at a 30% ratio (approximately $17.726 million), corresponding to the destruction of 559.8 million JST tokens, accounting for 5.66% of the total token supply. The remaining 70% will be executed quarterly in installments.

This buyback and burn initiative optimizes the JST economic model at its foundation: on one hand, by actively reducing the circulating supply, it strengthens token scarcity through a deflationary effect, solidifying long-term value support; on the other hand, it achieves deep alignment between ecosystem profits and token holder interests.

In the process of bridging traditional finance and the on-chain ecosystem, JustLend DAO has also made breakthrough progress. As early as the end of June this year, Tron, the US-listed company of TRON, completed a staking operation of 365 million TRX through the JustLend DAO platform. This milestone event not only fully validated the platform's industry-leading level in compliance, security, and large-asset handling capabilities but also established JustLend DAO's position as the core gateway for traditional compliant capital to enter the TRON ecosystem.

As of December 19th, the Total Value Locked (TVL) on the JustLend DAO platform reached $6.37 billion, consistently ranking among the top three global lending protocols. Within this, the Supply asset size in the SBM lending market reached $3.92 billion; the sTRX liquid staking sector attracted over 9.2 billion TRX; the Energy Rental service, due to its utility, has covered 72,000 users. These figures fully attest to the platform's strong ecosystem value and widespread user recognition.

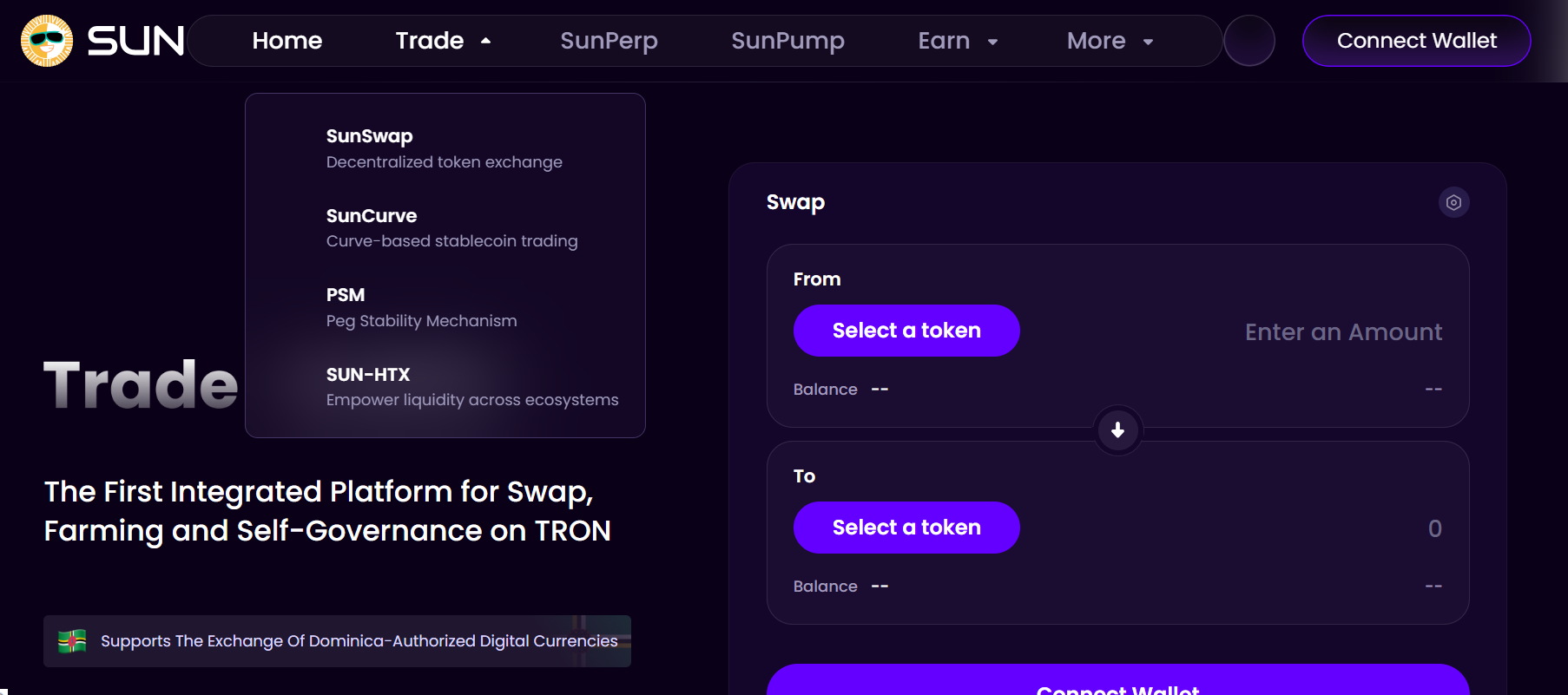

SUN.io: Innovative Evolution and Ecosystem Expansion of the Liquidity Hub

As the largest asset issuance and trading hub within the TRON ecosystem, SUN.io in 2025, through continuous product innovation and iteration, successfully built a complete product matrix covering four core businesses: DEX trading, stablecoin swapping, Meme asset issuance, and derivative contracts. It has become a key liquidity infrastructure supporting the efficient flow of assets within the TRON ecosystem.

Currently, the SUN.io ecosystem encompasses product components such as the DEX platform SunSwap, stablecoin swap services SunCurve and PSM, the Meme issuance tool SunPump, and the decentralized perpetual contract platform SunX (formerly SunPerp), enabling one-stop access to multi-scenario financial trading services.

This year, SUN.io achieved breakthroughs across multiple core businesses with remarkable results.

In the core trading domain, SunSwap handles approximately 90% of the asset trading volume on the TRON network, with daily trading volume consistently stable above $100 million, serving as the core channel for asset liquidity within the TRON ecosystem.

In the innovative asset domain, SunPump continuously ignited the Meme asset ecosystem frenzy, becoming a key engine for activating ecosystem vitality.

In the derivatives sector, September saw the launch of SunX, the first native on-chain perpetual contract platform within the TRON ecosystem. This platform not only filled the gap in derivative services within the TRON ecosystem but also redefined the DeFi derivatives trading experience with institutional-grade risk control standards and trading experience. To date, SunX's cumulative trading volume has exceeded $16 billion, ranking among the top 11 in the global decentralized perpetual contract sector.

Furthermore, as the governance token of the SUN.io ecosystem, SUN achieved significant results in globalization and compliance this year. In March, it was listed on the compliant exchange Hashkey Global, marking an important step in compliance layout. In April, it was listed on the globally renowned compliant exchange Kraken, attracting global institutions and high-quality individual traders, significantly enhancing its liquidity and international influence. In September, South Korea's largest crypto exchange, Upbit, listed trading pairs like SUN/KRW (Korean Won) and SUN/USDT, igniting the South Korean market. This series of initiatives not only greatly improved SUN's compliance recognition but also significantly enhanced its market liquidity and global influence.

From DEX trading to Meme ecosystem building, and to exploring the derivatives market, SUN.io has constructed multiple growth curves through continuous product innovation and scenario expansion. It is reported that SUN.io is brewing a series of important upgrades, with related progress expected to be announced gradually in the near future.

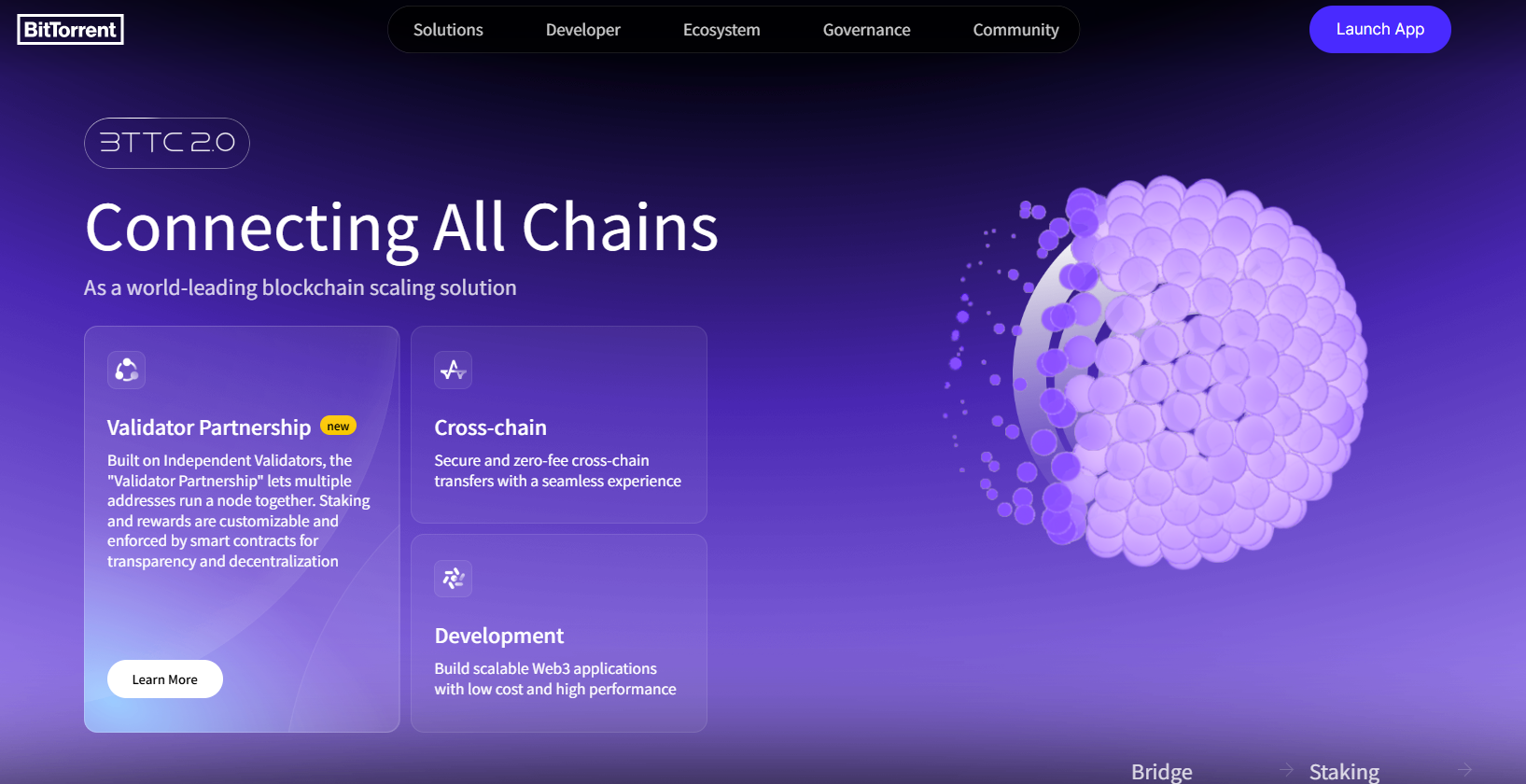

BTTC: Upgrade Iteration and Token Deflation for Cross-Chain Interconnectivity

As the core hub of cross-chain infrastructure within the TRON ecosystem, the cross-chain protocol BTTC completed a series of strategic upgrade iterations in 2025, achieving breakthrough improvements in both network security and cross-chain transmission efficiency.

In June this year, BTTC officially upgraded to version 2.0, reconstructing the underlying cross-chain technical architecture through modular layering and standardized process decomposition design. This version transforms the cross-chain process of "source chain request initiation - information transmission - target chain execution" into a universal logic and standardized protocol, correspondingly establishing a three-layer architecture: Root Contracts (root chain layer: cross-chain request initiation) – Delivery (relay layer: information transmission) – BitTorrent Chain (execution layer: DApp application runtime platform layer), while adopting a PoS consensus mechanism. Ultimately, BTTC constructed a secure, efficient, and scalable cross-chain network, providing a solid technical foundation for asset flow and application synergy across multiple chains.

Simultaneously, BTTC 2.0 also optimized the core economic model of the BTT token: by adjusting the total supply to reduce the overall BTT supply, it strengthened token scarcity; and it set a stable staking baseline yield of 6%, allowing BTT holders to participate in network governance and security maintenance through staking. This design enhanced the participation enthusiasm of BTTC network nodes and network protection capabilities while injecting sustained momentum into the long-term value of BTT.

On July 29th, BTTC further launched an upgraded Layer 2 scaling solution, aiming to enhance network scalability and user experience while maintaining decentralization. This solution is compatible with the Ethereum ecosystem, supports seamless migration of existing applications, and provides users with a high-throughput, low-cost trading environment.

Relying on continuous technological innovation, iteration, and ecosystem collaboration, BTTC has upgraded into a core hub for multi-chain value interconnectivity: Externally, it opens asset transfer channels between TRON and mainstream public chains like Ethereum and BNB Chain, attracting external capital, projects, and users to efficiently flow into the TRON ecosystem. Internally, it provides cross-chain circulation outlets for TRON-based Meme assets, DeFi products, etc., helping them expand into other public chain ecosystem markets, achieving cross-domain radiation of ecosystem influence.

WINkLink: The Data Bridge Connecting On-Chain and Off-Chain Worlds

As the core oracle infrastructure of the TRON ecosystem, WINkLink empowers DApps with real-time off-chain data, providing accurate price feeds and verifiable random numbers, building a trust bridge between blockchain and the real world. With WINkLink, developers can obtain precise price data and on-chain information, thereby enhancing the security and reliability of on-chain applications like DeFi.

In August, WINkLink announced the completion of a comprehensive ecosystem upgrade, officially opening to global developers. This upgrade will provide higher security levels, more reliable,

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News