Tiger Research: What Makes This Crypto Winter Different?

TechFlow Selected TechFlow Selected

Tiger Research: What Makes This Crypto Winter Different?

The next bull market requires two conditions: the emergence of a killer application in the non-compliant zone + a macroeconomic environment shifting toward support.

Author: Ryan Yoon

Translated by TechFlow

TechFlow Intro: The market has entered a downturn, and skepticism toward the crypto market is growing. Tiger Research argues this cycle differs from prior ones: past winters were triggered by internal failures (Mt. Gox hack, ICO scams, FTX collapse), whereas this cycle’s rallies and corrections are driven entirely by external factors (ETF approval fueling the bull run; tariffs and interest-rate policy triggering the decline).

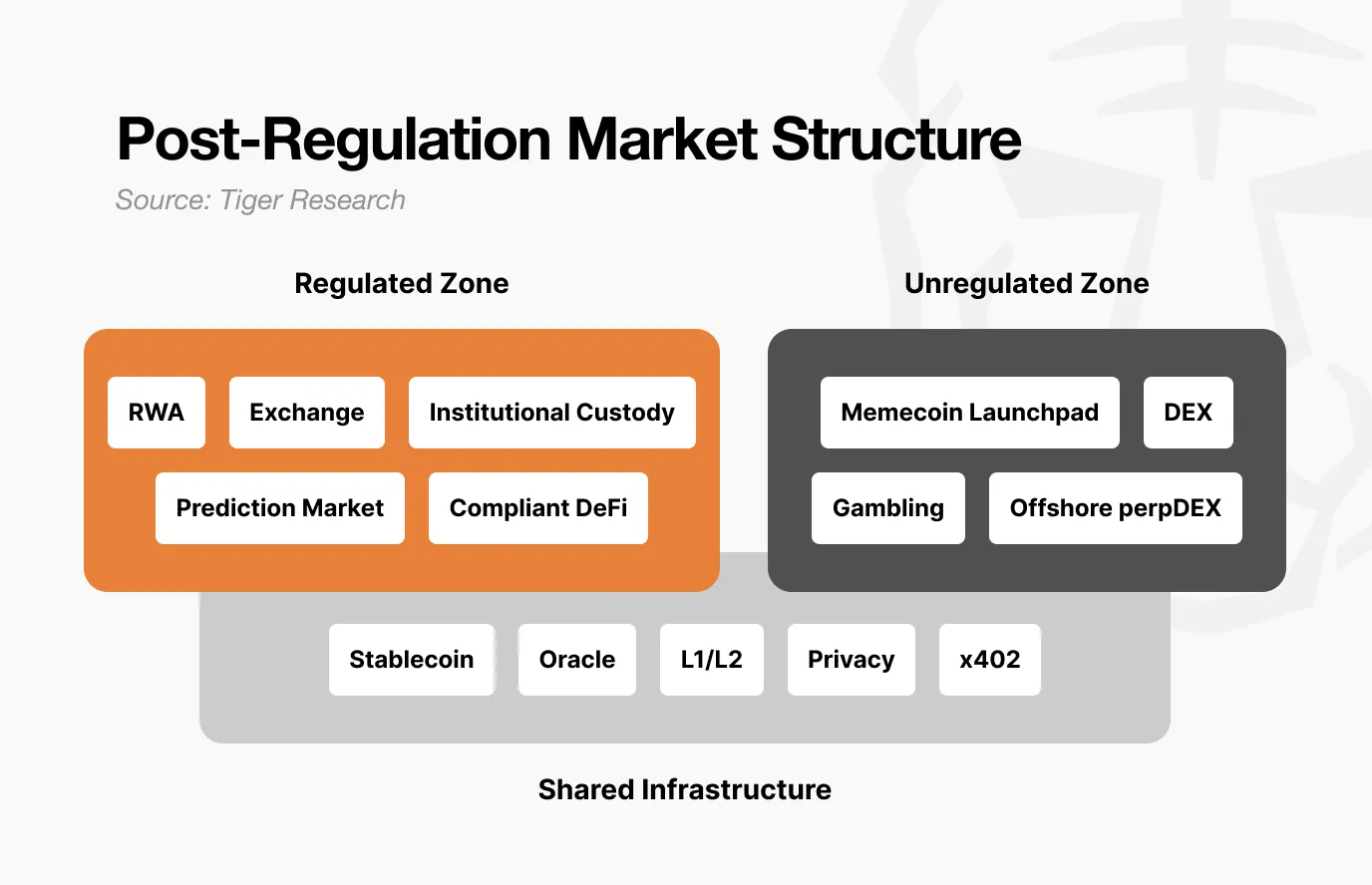

Post-regulation, the market has fractured into three layers: the compliant layer, the non-compliant layer, and shared infrastructure—capital no longer flows via the “trickle-down effect” as before. ETF inflows remain confined to Bitcoin and do not spill over into altcoins.

The next bull market requires two conditions: a killer application emerging from the non-compliant layer + a macroeconomic environment turning supportive.

Full Text Below:

As the market enters a downturn, skepticism toward the crypto market is growing. The question now is whether we have already entered a crypto winter.

Core Takeaways

- Crypto winters follow a sequence: major event → trust collapse → talent exodus

- Past winters stemmed from internal issues; current price swings are driven entirely by external factors—neither a winter nor a spring

- Post-regulation, the market has fractured into three layers: compliant, non-compliant, and shared infrastructure; the trickle-down effect has vanished

- ETF capital stays in Bitcoin and does not flow outside the compliant layer

- The next bull market requires a killer use case + a supportive macro environment

1. How Did Previous Crypto Winters Unfold?

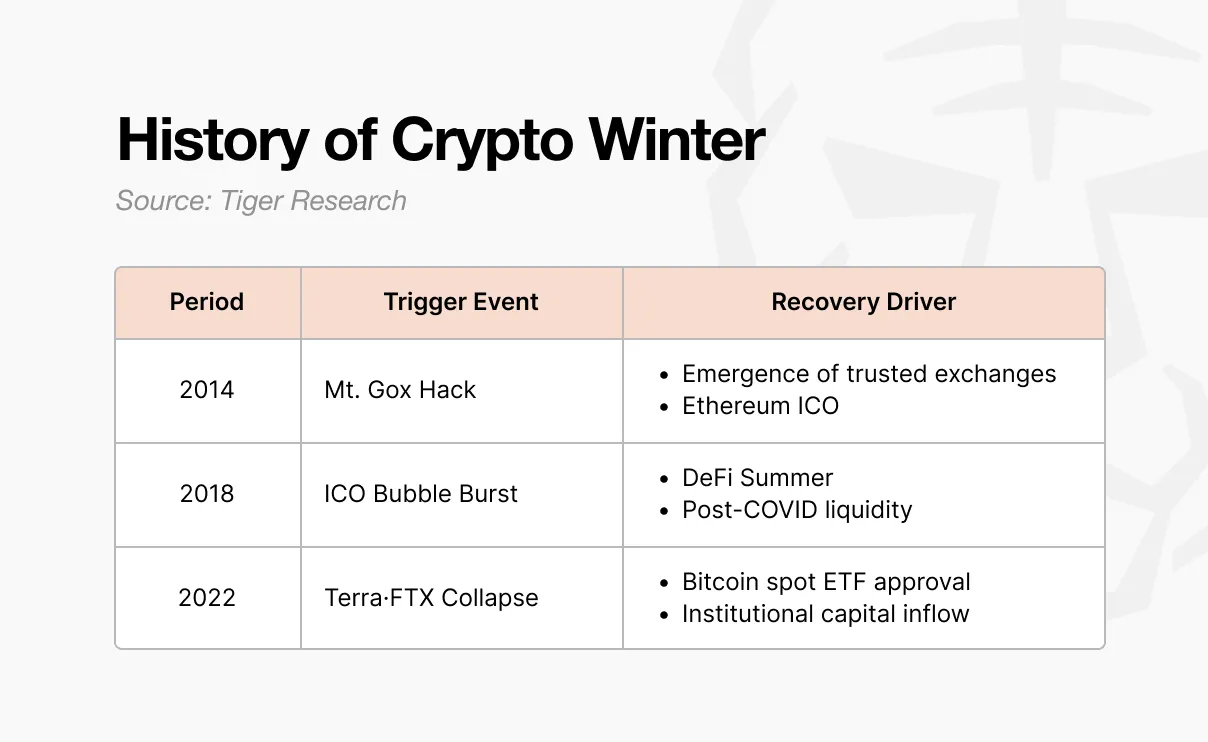

The first winter occurred in 2014. Mt. Gox handled roughly 70% of global Bitcoin trading volume at the time. Approximately 850,000 BTC disappeared in a hacker attack, triggering a collapse in market trust. New exchanges with robust internal controls and auditing capabilities emerged, gradually restoring trust. Ethereum also entered the scene via its ICO, opening new possibilities for both vision and fundraising models.

This ICO wave ignited the next bull market. When anyone could issue tokens and raise funds, the 2017 boom was set ablaze. Projects flooded in, raising hundreds of millions—or even billions—based solely on whitepapers, most lacking substance.

In 2018, regulatory crackdowns poured in from South Korea, China, and the U.S., bursting the bubble and ushering in the second winter. This winter lasted until 2020. Post-COVID, liquidity surged, drawing attention to DeFi protocols like Uniswap, Compound, and Aave—and capital began flowing back in.

The third winter proved the harshest. When Terra-Luna collapsed in 2022, Celsius, Three Arrows Capital, and FTX soon followed. This was more than just a price correction—the industry’s very architecture was shaken. In January 2024, the U.S. SEC approved spot Bitcoin ETFs, followed by the Bitcoin halving and Trump’s pro-crypto policies—sparking renewed capital inflows.

2. The Crypto Winter Pattern: Major Event → Trust Collapse → Talent Exodus

All three winters followed the same sequence: a major event triggers a collapse in trust, which then drives away talent.

It always begins with a major event—Mt. Gox’s hack, ICO regulation, or the FTX bankruptcy following the Terra-Luna collapse. Though each event differed in scale and form, the outcome was identical: the entire market was stunned.

That shock rapidly spreads into a collapse of trust. Those who had been focused on building the next thing began questioning whether crypto was meaningful technology at all. The collaborative spirit among builders evaporated, replaced by mutual finger-pointing over accountability.

Doubt leads to talent exodus. Builders who had been driving innovation in blockchain fell into doubt themselves. In 2014, many pivoted to fintech and Big Tech. In 2018, they moved into institutional finance and AI—seeking environments that appeared more certain.

3. Is This Currently a Crypto Winter?

The pattern of past crypto winters remains visible today.

- Major Event:

- Trump’s tariff policy rattled markets

- Fed interest-rate policy shifted

- The broader crypto market declined

- Trust Collapse: Skepticism is spreading across the industry. Focus has shifted from “what to build next” to mutual blame.

- Pressure on Talent Retention: The AI sector is expanding rapidly, promising faster exits and greater wealth than crypto.

Yet it’s difficult to label this a crypto winter. Past winters erupted from within the industry: Mt. Gox’s hack, the exposure of most ICO projects as scams, and FTX’s collapse—all eroded trust internally.

Today is different.

ETF approval launched the bull run; tariffs and interest rates drove the correction. External forces lifted the market—and external forces pushed it down.

Builders have not left.

RWA, perpDEX (perpetual contract DEX), prediction markets, InfoFi, privacy—new narratives continue to emerge and are still being built. They haven’t yet pulled the entire market upward like DeFi did, but neither have they disappeared. The industry hasn’t collapsed; rather, the external environment has changed.

We haven’t created spring—so there’s no winter either.

4. Structural Shifts in the Post-Regulation Market

Beneath this lies a fundamental structural shift in the post-regulation market. It has fractured into three layers: 1) the compliant layer, 2) the non-compliant layer, and 3) shared infrastructure.

The compliant layer includes RWA tokenization, exchanges, institutional custody, prediction markets, and compliance-based DeFi. These entities undergo audits, make disclosures, and enjoy legal protections. Growth is slow, but capital is large and stable.

However, once inside the compliant layer, explosive returns like those seen in the past are unlikely. Volatility declines, upside potential narrows—and downside risk is similarly constrained.

In contrast, the non-compliant layer will grow increasingly speculative. Low barriers to entry and high speed mean 100x gains in a day—and 90% losses the next—are likely to become more frequent.

Yet this space isn’t meaningless. Industries born in the non-compliant layer are highly innovative; once validated, they migrate into the compliant layer. DeFi did exactly that—and prediction markets are doing so now. This layer serves as an experimental sandbox. Still, the non-compliant layer itself will grow ever more distinct from compliant-layer business.

Shared infrastructure includes stablecoins and oracles. These are used across both compliant and non-compliant layers. The same USDC facilitates institutional RWA payments and Pump.fun trades. Oracles deliver data for tokenized Treasury verification and anonymous DEX liquidations alike.

In short, as the market fractures, capital flows have changed too.

In the past, when Bitcoin rose, altcoins rose along with it via the trickle-down effect. Not anymore. Institutional capital entering via ETFs stays in Bitcoin—and stops there. Compliant-layer capital does not flow into the non-compliant layer. Liquidity remains only where value has already been proven. Even Bitcoin, relative to risk assets, has yet to prove itself as a safe-haven asset.

5. Conditions for the Next Bull Market

Regulation is already underway. Builders are still building. So what remains?

First, a new killer use case must emerge from the non-compliant layer—a breakthrough that creates previously nonexistent value, like DeFi Summer in 2020. AI agents, InfoFi, and onchain social are candidates—but none has yet scaled to drive the entire market. The process by which non-compliant experiments gain validation and migrate into the compliant layer must be reestablished. DeFi achieved this; prediction markets are doing so now.

Second, the macroeconomic environment. Even with regulation progressing, builders building, and infrastructure accumulating, upside remains limited if macro conditions aren’t supportive. DeFi Summer in 2020 exploded amid post-COVID liquidity release. The rally following the 2024 ETF approval coincided with rate-cut expectations. Regardless of how well the crypto industry performs, it cannot control interest rates or liquidity. For the industry’s innovations to gain credibility, macro conditions must turn favorable.

A broad-based “crypto season,” where everything rises together as in the past, is unlikely to recur—because the market has fractured. The compliant layer grows steadily; the non-compliant layer experiences sharp rallies and crashes.

The next bull market will arrive—but it won’t arrive for everyone.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News