Interpretation of the “JST Q4 2025 Report”: Genuine Ecosystem Yield Drives Sustainable Deflation; JST Token Value Strongly Realized

TechFlow Selected TechFlow Selected

Interpretation of the “JST Q4 2025 Report”: Genuine Ecosystem Yield Drives Sustainable Deflation; JST Token Value Strongly Realized

JustLend DAO delivers outstanding performance; the JST deflationary value proposition is fully realized.

Recently, the broader cryptocurrency market has entered a correction phase. However, JUST—the core DeFi project within the TRON ecosystem—has bucked the trend through consecutive large-scale JST token buybacks and burns, drawing significant attention in the crypto space.

On January 28, the “JST Q4 2025 Report” was officially released, systematically disclosing key information including operational progress of the JST governance token, ecosystem value-enabling strategies, and quarterly performance metrics of the core protocol JustLend DAO—providing market participants with a clear, holistic view of ecosystem development and sending a strong long-term value signal.

The fourth quarter of 2025 marked a pivotal milestone for JST. The team successfully completed the full lifecycle implementation of the JST buyback-and-burn mechanism—from proposal voting to execution—and executed two rounds of buybacks and burns, formally ushering JST into a new era of常态化 deflationary operation and launching a fresh chapter for its value appreciation.

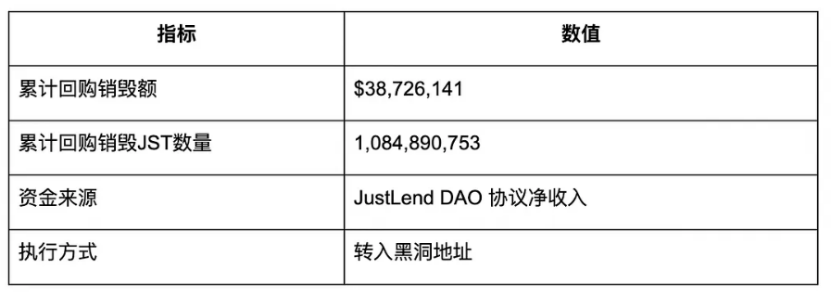

As of January 28, JST has completed two large-scale on-chain buybacks and burns, cumulatively destroying over 1 billion tokens—representing 10.89% of the total token supply. This steady, orderly burn process is driven by JustLend DAO’s real ecosystem earnings, directly channeling protocol revenue into token value enhancement and establishing a virtuous, revenue-driven deflationary cycle. As a result, the value effects of JST’s deflationary model have been fully realized, and the continuous delivery of deflationary benefits has solidified JST’s developmental foundation.

JustLend DAO serves as the primary funding source for JST buybacks and burns and plays a pivotal role in implementing this deflationary mechanism. Leveraging a diversified product suite—including lending, staking, and energy rental—JustLend DAO achieves consistent, stable profitability. Its genuine protocol revenue is fully allocated toward JST buybacks and burns, reinforcing JST’s long-term value growth while directly validating the protocol’s stable and sustainable profitability. These actions not only demonstrate JustLend DAO’s robust cash flow generation capacity to the market but also send a clear message: JST’s value growth is not based on speculative hype, but rather underpinned by solid, real-world economic fundamentals—a hard-backed endorsement from actual ecosystem earnings.

Cumulative Burns Exceed 1.08 Billion Tokens; JST Deflationary Effect Fully Amplified

According to the “JST Q4 2025 Report,” the quarter prioritized long-term JST value creation and sustainable ecosystem growth—deepening core business operations, refining ecosystem strategy, and focusing on executing the JST buyback-and-burn mechanism and building an on-chain transparent disclosure framework—with demonstrable, phased achievements already realized.

Currently, the JST buyback-and-burn mechanism operates on a quarterly, orderly, and常态化 basis. It is powered primarily by real earnings generated by the core protocol JustLend DAO and the stablecoin USDD, enabling a durable, smoothly functioning deflationary mechanism that consistently unlocks JST’s long-term value potential and strengthens its foundational ecosystem support for steady price appreciation.

Looking back at the implementation timeline: On October 21, 2025, the JustLend DAO community formally approved the JST buyback-and-burn proposal, specifying that all existing protocol earnings, future net income, and any portion of multi-chain USDD ecosystem revenue exceeding $10 million would be fully allocated toward JST buybacks and burns.

Following approval, Grants DAO—the decentralized community organization governing the JustLend DAO ecosystem—promptly withdrew over $59.08 million in USDT from existing protocol earnings and adopted a tiered execution strategy: “30% burned immediately in the first tranche + 70% held for quarterly interest accrual before subsequent burns.” This resulted in the first round of JST burns totaling approximately 560 million tokens—5.66% of the total supply—at a cost of roughly $17.72 million. These actions marked the substantive launch of the revenue-to-JST-value feedback loop within the JUST ecosystem and laid a solid foundation for future quarterly,常态化 buyback-and-burn operations.

On January 15 of this year, JST underwent its second large-scale buyback-and-burn round. A total of 525 million tokens were burned—5.3% of the total supply—with an equivalent token value of approximately $21 million. This round not only sustained JST’s stable, orderly buyback-and-burn rhythm but also demonstrated significantly stronger financial commitment: funds deployed increased by nearly $4 million compared to the first round—effectively pressing the “accelerator” on deflationary benefits and underscoring the project’s unwavering resolve and substantial financial capacity in executing its deflationary plan.

As of January 27, JST had successfully completed two large-scale on-chain buybacks and burns, with cumulative burns surpassing 1.08489 billion tokens (exactly 1,084,890,753 tokens), representing 10.96% of the total supply and corresponding to over $38.72 million in buyback funds. Such large-scale on-chain deflationary activity is exceptionally rare in cryptocurrency history.

The flawless execution of these two large-scale buyback-and-burn rounds has delivered rigid contraction of JST’s circulating supply, yielding pronounced deflationary results. With over 1.08 billion tokens burned, JST’s total supply decreased from 9.9 billion to approximately 8.815 billion. Crucially, JST has achieved 100% full circulation—no unvested or locked tokens remain. This means every token burned represents a real reduction in actual circulating supply, ensuring tangible, effective deflation, continuously optimizing supply-demand dynamics, enhancing token scarcity, and thereby propelling JST onto a long-term upward value trajectory.

These buyback-and-burn operations not only substantially shrink JST’s circulating supply in the short term but also send a clear, resolute signal to the market regarding the project team’s commitment to delivering value back to stakeholders. As the deflationary model operates常态化, JST’s deflationary effects are comprehensively unleashed, further reinforcing its long-term value support.

Meanwhile, JST’s market performance strongly validates the positive outcomes of ecosystem development and the deflationary mechanism—receiving enthusiastic market feedback following implementation. Since the buyback-and-burn proposal passed on October 21, 2025, JST’s price began a sustained upward trend from $0.032 USDT, peaking at $0.045 USDT on December 3, 2025—a cumulative increase of approximately 40%. This trajectory clearly reflects strong market recognition of JustLend DAO’s stable operational capability and JST’s long-term value growth logic. As of January 27, JST’s total supply stood at approximately 8.815 billion tokens, with a latest price of $0.044, corresponding to a market capitalization of roughly $387 million.

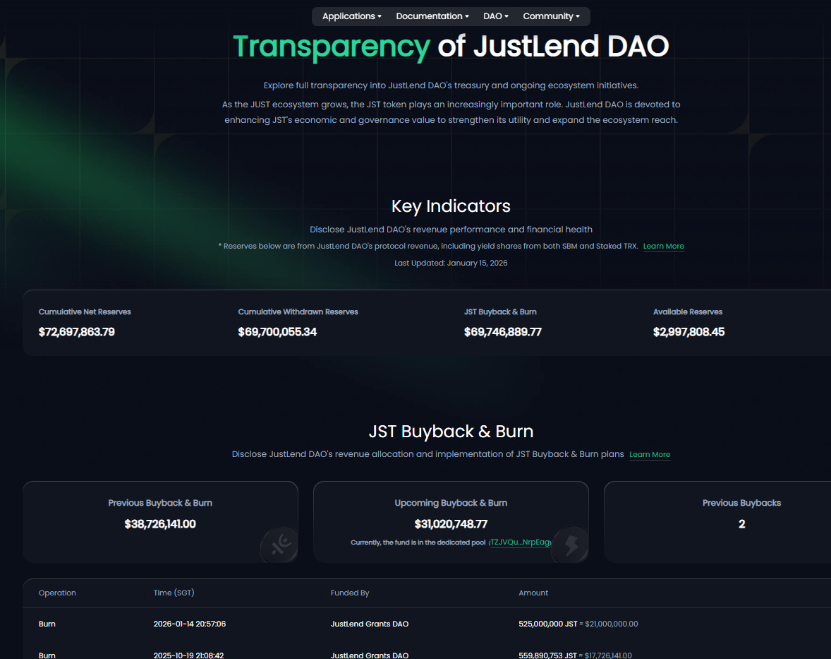

Additionally, on the front of ecosystem transparency, not only have reserve treasury asset details been disclosed and the on-chain reporting framework continuously refined—enabling community users to clearly grasp the full picture of treasury funds—but both JustLend DAO and the official USDD platform have also launched dedicated “Financial Operations Metrics (Transparency)” disclosure pages. These pages centrally display core data such as protocol treasury reserves, JST buyback-and-burn fund pool balances, executed buyback amounts, and complete on-chain transaction records—offering one-stop, visualized access to key operational metrics and empowering community members to track protocol revenue accumulation, fund allocation, and buyback-and-burn execution in real time.

JustLend DAO’s Cash Flow Engine Runs Steadily, Anchoring JST’s Long-Term Value Foundation

As the core “cash flow engine” of the JUST ecosystem, JustLend DAO continues expanding its revenue channels and enriching user application scenarios via a structured product suite. Currently, JustLend DAO’s product portfolio includes SBM lending, liquid staking sTRX, Energy Rental, and the GasFree smart wallet. Through these products, JustLend DAO achieves steady cash flow growth, providing continuous funding support for JST buybacks and burns—and thereby laying a solid foundation for JST’s long-term value.

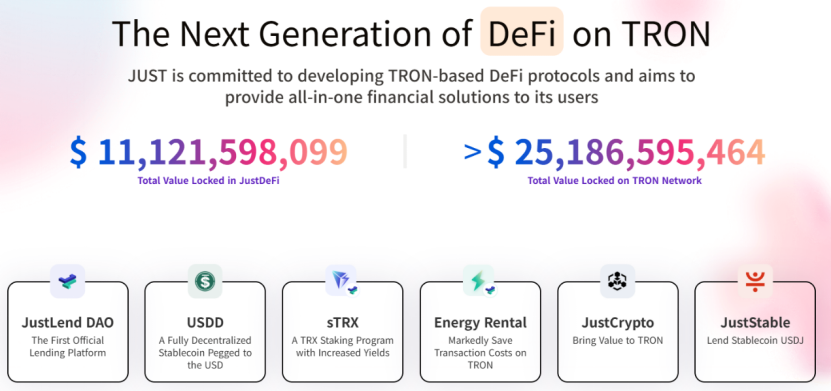

JST’s fundamental value rests upon the underlying JUST ecosystem. As a one-stop DeFi solution within the TRON ecosystem, JUST has built a comprehensive and mature DeFi ecosystem encompassing the core lending protocol JustLend DAO, the decentralized stablecoin USDD, the staking product sTRX, Energy Rental, and cross-chain solutions like JustCrypto—meeting users’ full spectrum of on-chain financial needs, from asset appreciation to flexible allocation. According to official data released on January 28, TRON’s network-wide total value locked (TVL) has reached $25.1 billion, of which JUST’s TVL stands at $11.1 billion—accounting for 44% and firmly securing its position as the core pillar of the TRON ecosystem.

Within the JUST ecosystem, JustLend DAO functions as the central hub for cash flow generation and value capture. By integrating diverse products—including SBM lending, liquid staking sTRX, Energy Rental, and the GasFree smart wallet—it continuously powers multi-dimensional revenue growth across the ecosystem.

Pursuant to the JST buyback-and-burn mechanism, funding originates from two primary sources: (1) JustLend DAO’s existing earnings and future net income, and (2) excess revenue from the multi-chain USDD ecosystem beyond $10 million. Currently, USDD’s multi-chain ecosystem revenue has not yet met this threshold; therefore, JST buyback-and-burn funding is fully supported by JustLend DAO’s protocol revenue.

In terms of execution, JustLend DAO demonstrates formidable operational strength and financial capacity: While the first round deployed $17.72 million, the second round alone committed approximately $21 million—funds drawn entirely from JustLend DAO’s Q4 2025 net income and accumulated historical earnings, significantly accelerating the planned schedule. Per the original plan, the remaining 70% of existing earnings from Round One would be allocated across four quarters, averaging $10.34 million per quarter; however, the second-round deployment far exceeds this expectation. This indicates JustLend DAO’s Q4 2025 net income alone exceeded $10 million—highlighting its powerful profitability.

Per official website data, JustLend DAO’s platform TVL reached $6.81 billion in Q4 2025—ranking among the top three globally in the Lending sector—with over 480,000 users, underscoring its strong competitiveness and broad market influence. Additionally, each business segment performed outstandingly:

· SBM Market Performance Stands Out: Deposit volume reached ~$4.03 billion, borrow volume ~$205 million, with total borrow volume increasing over 35% quarter-on-quarter. According to DeFiLlama data, SBM captured $2.2 million in interest fees in Q4 2025—the highest ever recorded—reflecting continued expansion of lending business scale. This growth not only signals strong market demand for SBM but also highlights JustLend DAO’s exceptional operational and market expansion capabilities in the lending domain.

· sTRX Liquid Staking Draws Strong User Participation: Over 9.32 billion TRX have been staked, with over 13,600 users participating cumulatively. Widespread user engagement not only delivers stable inflows to JustLend DAO but also enhances ecosystem vitality and stability.

· Energy Rental Service Continues Optimizing: Through multiple fee adjustments and lowered usage thresholds, the minimum deposit has been reduced to just 20 TRX—further cementing its infrastructure role in the resource marketplace and promoting efficient allocation and utilization of resources within the ecosystem.

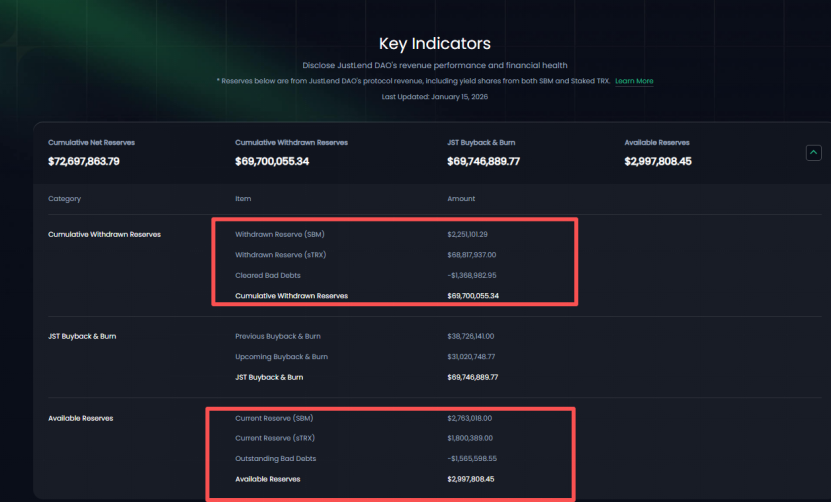

From a revenue perspective, per Transparency page data, JustLend DAO’s cumulative net earnings have reached $72.69 million. In Q4 2025, $69.7 million in reserve earnings were withdrawn from the protocol: over $68.81 million from sTRX and $2.25 million from SBM. Currently, JustLend DAO holds ~$2.99 million in remaining reserve earnings, including $1.8 million available in sTRX.

In terms of revenue composition, the liquid staking product sTRX has become JustLend DAO’s core segment for generating stable earnings and distributing protocol revenue—and remains the critical funding source for JST buybacks and burns. This revenue structure lays the groundwork for stable, sustainable earnings growth, continuously fueling the ecosystem’s long-term development.

Per disclosures in the “JST Q4 2025 Report,” JustLend DAO’s treasury and JST buyback-and-burn reserve address collectively hold 130 million sTRX and ~2.1 billion jUSDT. These reserve assets not only provide ample financial backing for JST buybacks and burns but also constitute a solid material foundation for the stable development of the JUST ecosystem.

The team remains committed to fulfilling its community governance pledge, prioritizing the use of existing earnings for JST buybacks and burns per the established roadmap. Following the completion of two rounds, approximately $31.02 million in equivalent assets remain in related addresses—set to be deployed in stages going forward, continually powering JST value enhancement and ecosystem growth.

Deepening Synergy Across the JUST Ecosystem Fuels Promising Growth Potential for JST

Today, JustLend DAO is directly returning ecosystem growth dividends to JST holders through a transparent, sustainable buyback-and-burn mechanism. Underpinned by hard, real-world earnings and empowered by a clear value logic, JST has evolved beyond a single-purpose utility token to become the core vehicle for capturing the growth value of the JUST ecosystem—its future growth potential meriting sustained market anticipation.

Per projections in the “JST Q4 2025 Report,” based on JustLend DAO’s revenue outlook, approximately $21 million is expected to be allocated toward JST buybacks and burns in Q1 2026, with the sTRX business projected to contribute $10 million. Actual burn volumes will be dynamically adjusted according to quarterly operating conditions.

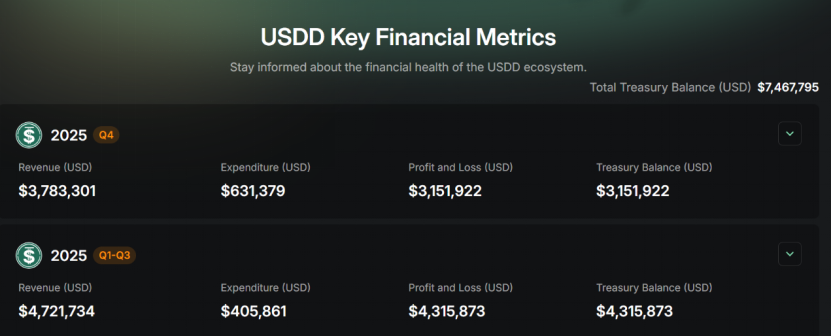

As a key incremental funding source for future JST buybacks and burns, the decentralized stablecoin USDD ecosystem is experiencing rapid growth: Its total supply has now surpassed $1.1 billion, and its platform TVL has crossed $1.3 billion—building substantial momentum to further strengthen JST’s deflationary mechanism. As of January 27, USDD’s cumulative treasury earnings reached $7.4678 million. As the ecosystem continues expanding, USDD’s future excess earnings will serve as another major incremental funding source for JST buybacks and burns—further amplifying JST’s deflationary effect and continuously supporting token value appreciation.

Thus, JST has now formed a deeply integrated value feedback loop with JUST ecosystem protocol earnings. Within this loop, the stable development of JustLend DAO and USDD provides hard-backed support for JST’s value growth, while JST’s rising value in turn attracts global users to participate in ecosystem development—feeding back into the business expansion and revenue growth of both protocols. This virtuous internal cycle not only injects strong endogenous momentum into the sustained development of the JUST ecosystem but also fortifies the long-term prosperity of the TRON ecosystem and advances the industry-wide shift toward ecosystem-based development in cryptocurrency.

Looking ahead, as the JUST ecosystem continues scaling and internal synergies deepen, the funding pool powering JST’s deflationary mechanism is poised for sustained expansion—ultimately constructing a self-reinforcing positive feedback loop: ecosystem expansion → increased revenue → accelerated deflation → enhanced value—continuously lifting JST’s long-term value ceiling.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News