JustLend DAO launches a nearly $60 million JST buyback and burn program, powered by ecosystem revenues

TechFlow Selected TechFlow Selected

JustLend DAO launches a nearly $60 million JST buyback and burn program, powered by ecosystem revenues

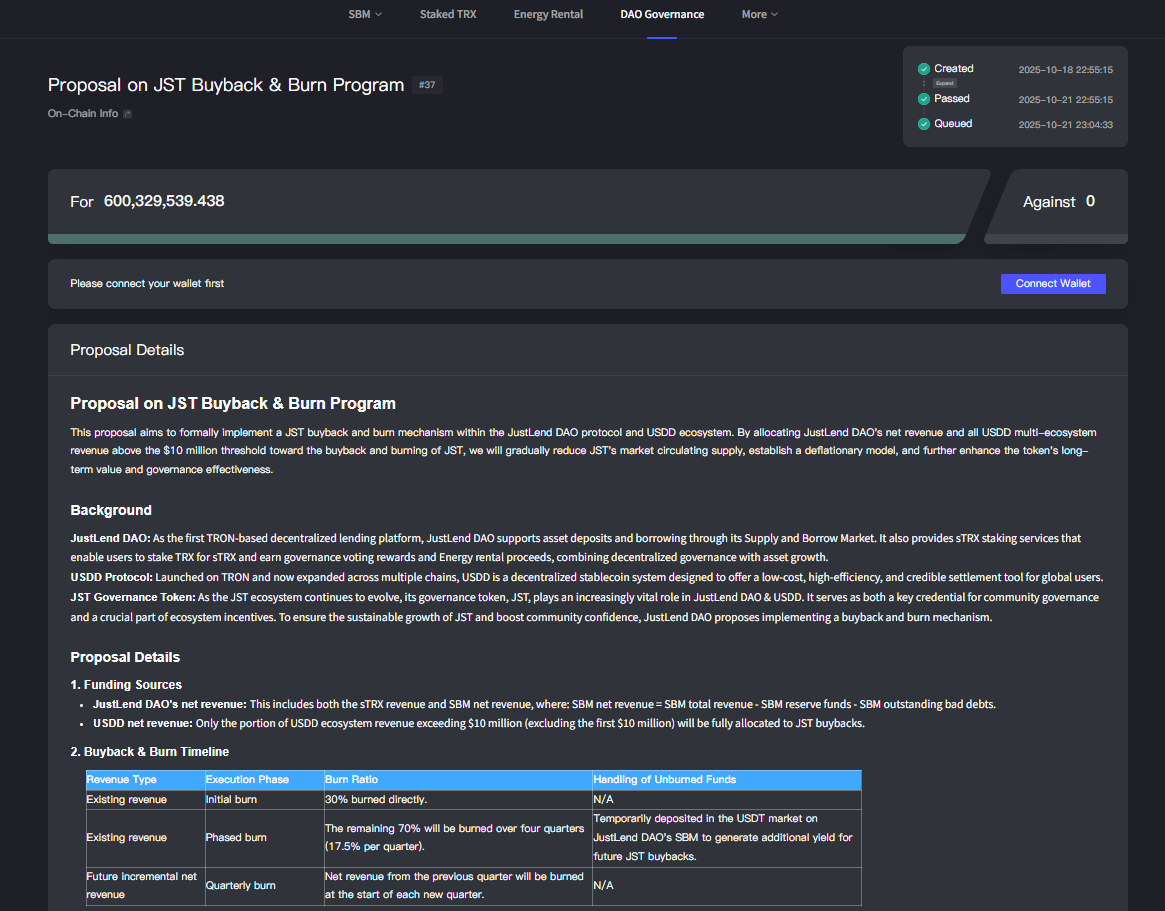

The "JST buyback and burn" proposal has been officially approved with a high number of votes in favor, marking the official implementation of JST's deflationary mechanism.

On the evening of October 21 (SGT), the JustLend DAO community, a core lending protocol within the TRON ecosystem, completed voting on the "JST buyback and burn" proposal. The proposal passed with a high majority, officially marking the implementation of JST's deflationary mechanism.

With the execution of this proposal, JST’s deflationary engine will be deeply tied to two key components of the JUST ecosystem: JustLend DAO and USDD. As one of the top four global lending protocols, JustLend DAO provides consistent revenue that funds ongoing JST burns. Meanwhile, USDD—TRON’s second-largest stablecoin—will contribute additional earnings to further strengthen the buyback pool. Together, these sustained revenues will serve as JST’s “deflationary fuel,” establishing a positive cycle of “ecosystem earnings → token deflation → value appreciation” and unlocking JST’s long-term value potential through a new upward trajectory.

Notably, JustLend DAO has accumulated approximately $60 million in total revenue to date. This amount will be gradually allocated into the JST buyback and burn program in phases: 30% of existing profits will be used for the initial burn, while the remaining 70% will be released over four quarters, ensuring a steady and prolonged deflationary effect.

In terms of data, JST currently has a market cap of around $300 million. The first-phase burn alone—funded by JustLend DAO’s current earnings—will eliminate more than 5.6% of the total JST supply. With cumulative platform earnings nearing $60 million, and based on current JST prices, the total number of tokens eligible for burning could reach approximately 20% of the overall supply.

JST Deflation Officially Begins: JustLend DAO to Inject ~$60M into Buyback & Burn, Total Burns to Exceed 20% of Supply

The successful implementation of the JST buyback and burn plan marks JST’s official entry into a deflationary era. This initiative is expected to open a new phase of value growth, unlock long-term potential, and spark broad market speculation about JST’s future.

On the evening of October 21 (SGT), the JustLend DAO community formally approved the “JST buyback and burn” proposal with strong support. This signifies that JST’s deflationary mechanism has moved from planning to execution, establishing a dedicated buyback and burn framework within the JustLend DAO and USDD ecosystems. This development ushers JST into a deflationary era, laying the foundation for renewed value appreciation and long-term growth potential.

"Sustainable funding + significant burn impact" are the two major highlights of this JST buyback and burn initiative. Funding sources are clear and highly sustainable, providing continuous momentum. Funds come primarily from two streams: first, JustLend DAO’s current and future net income (including sTRX earnings and SBM net revenue), covering both existing and incremental earnings to ensure solid financial backing; second, incremental earnings from USDD’s multi-chain ecosystem once its profitability exceeds $10 million. Upon surpassing this threshold, these additional gains will inject fresh momentum into JST’s deflationary process.

Since JustLend DAO announced the JST buyback and burn proposal on October 11, it has drawn significant community attention due to its direct implications for JST’s tokenomics and price outlook. Now that the plan is being implemented, JST’s value becomes deeply linked to two core components of the JUST ecosystem—JustLend DAO (ranked among the world’s top four lending protocols) and USDD (TRON’s second-largest stablecoin). These two pillars act as dual wings powering JST’s value ascent, with their ongoing earnings directly converted into JST’s “deflationary fuel.”

The introduction of this buyback and burn mechanism not only optimizes JST’s economic structure but also enhances its weight and value anchoring as a governance token, serving as a key driver for price appreciation. By periodically buying back and burning circulating JST tokens, the circulating supply is gradually reduced, creating a healthy deflationary effect, increasing scarcity, reinforcing its value foundation, and steering the JST ecosystem toward sustainable development.

Regarding the burn schedule, JustLend DAO’s accumulated earnings of approximately $60 million will be deployed under the principle of “phased execution with sustained impact.” The first phase will burn 30% of JustLend DAO’s existing earnings, with the remaining 70% released over four consecutive quarters at 17.5% per quarter, ensuring a smooth and long-lasting deflationary effect. After each buyback and burn event, JustLend DAO will publish an official announcement on its website containing full transaction details, including transaction hash, date, buyback amount, and number of tokens burned.

JST has a total supply of 9.9 billion tokens, all of which have been fully circulated since Q2 2023. This means the buyback and burn program will directly and continuously reduce JST’s circulating supply, forming a solid basis for deflation. Currently, JST has a market cap of about $300 million, over 440,000 holder addresses, and is listed on dozens of major global exchanges including Binance, HTX, OKX, UPbit, Bithumb, and Kraken.

Based on JST’s current $300 million market cap, JustLend DAO’s existing earnings alone could burn approximately 20% of the total JST supply, with the first burn accounting for over 5.6%. The scale of this buyback and burn effort far exceeds typical industry practices. Such aggressive measures are expected to significantly enhance JST’s scarcity, strengthening its value foundation and providing robust support for price appreciation.

It is particularly noteworthy that JustLend DAO, a veteran DeFi protocol deeply rooted in the TRON ecosystem, has consistently iterated and upgraded its product offerings since its 2020 launch, all while maintaining a zero-risk operational record—an exceptional achievement in the industry. Even amid broader DeFi market downturns, JustLend DAO leverages its stable profitability and financial reserves to deploy nearly $60 million in earnings toward JST buybacks and burns. This action demonstrates not only strong financial strength and execution capability but also validates the sustainability of its business model and the solidity of its ecosystem value.

JST Backed by the JUST Ecosystem, Which Holds 46% of TRON Network’s Total TVL

JST is not only the core governance token of JustLend DAO but also the native governance token of the entire JUST ecosystem. It is inherently tied to the development of JUST—the core DeFi system within the TRON ecosystem—and benefits from comprehensive bottom-layer empowerment and solid support.

JUST is a one-stop DeFi solution within the TRON ecosystem, focused on building DeFi protocols on the TRON network. Since launching in 2020, JUST has centered on “building an integrated DeFi ecosystem,” rolling out products and services such as stablecoins, staking, and cross-chain solutions, aiming to deliver low-barrier, full-scenario DeFi experiences for users.

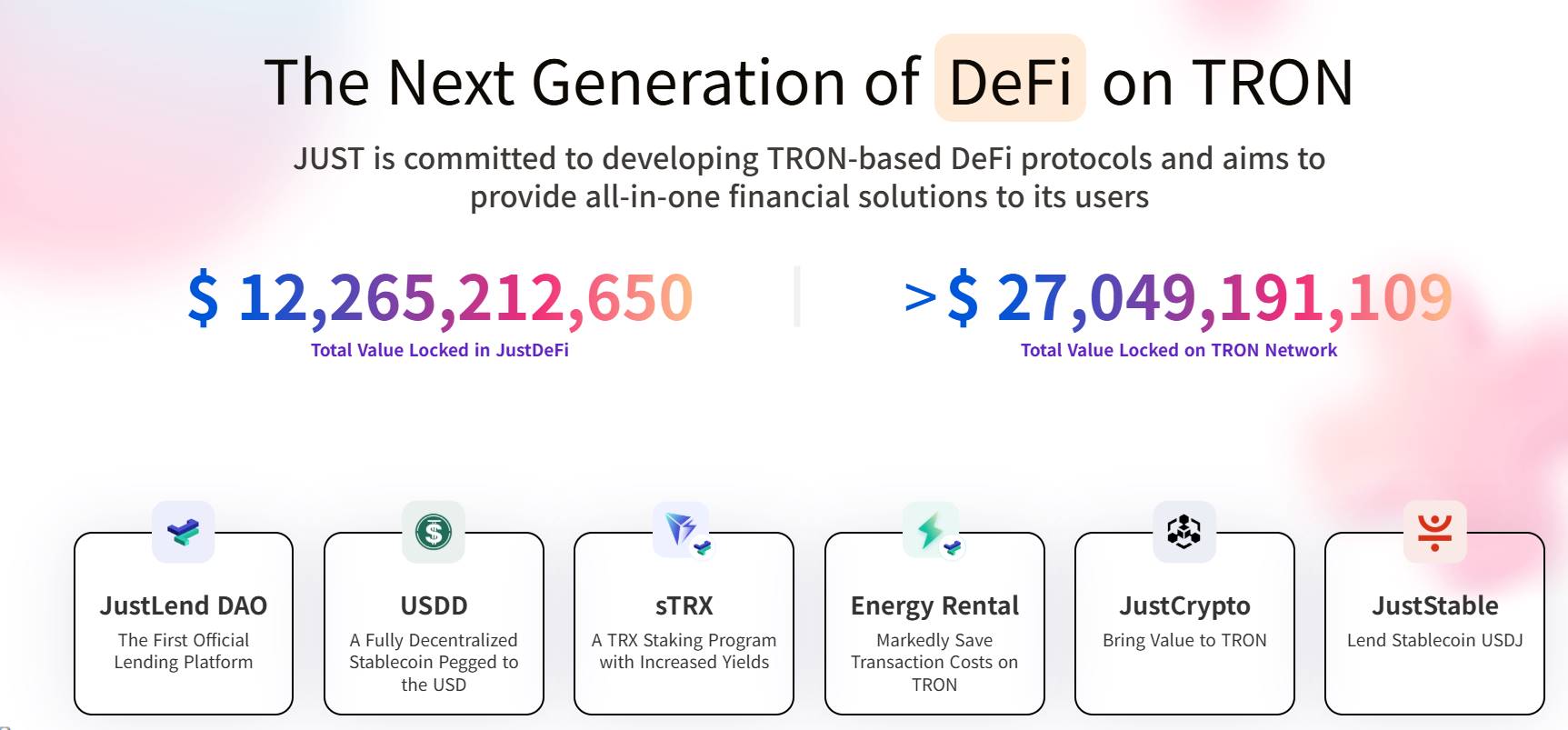

As a core DeFi system on TRON, JUST boasts strong ecosystem fundamentals, particularly in asset accumulation. According to official data from October 19, TRON’s total value locked (TVL) reached $27 billion network-wide, with JUST ecosystem TVL at approximately $12.2 billion—accounting for 46% of the entire TRON network. This indicates that nearly half of all crypto assets on the TRON chain are deposited within the JUST ecosystem, underscoring its irreplaceable role as the “keystone” of TRON’s DeFi infrastructure. Clearly, JUST is not only the highest-TVL DeFi system on TRON but also a pivotal force driving its overall growth.

Currently, JUST has built a complete DeFi product matrix, encompassing the core lending protocol JustLendDAO, decentralized stablecoin USDD, TRX staking product sTRX, Energy Rental, cross-chain product JustCrypto, and stablecoin system JustStable—offering a suite of on-chain financial tools that comprehensively meet user needs from “asset growth” to “flexible allocation.”

Among these, JustLend DAO is the flagship product of the JUST ecosystem and the leading DeFi application by TVL on the TRON network, consistently ranking among the top four globally in the lending sector.

USDD is a decentralized over-collateralized stablecoin jointly launched by JUST DAO and TRON DAO. After upgrading to version 2.0 in January this year, USDD’s circulation surged from zero to over $500 million, making it the second-largest stablecoin on the TRON network after USDT. Currently, USDD has a circulating supply of $476 million and holds over $525 million in collateralized crypto assets (TVL).

JST is the native governance token of the JUST ecosystem, with a total issuance of 9.9 billion tokens, all of which have been fully circulated since Q2 2023. JST grants holders the right to participate in governance and key decision-making processes within the JUST ecosystem, including voting on new proposals and system upgrades.

Thus, through core offerings like JustLend DAO’s lending infrastructure, USDD’s stablecoin support, and ecosystem services such as sTRX staking and energy rental, JUST has established a complete on-chain financial loop covering “deposit, lending, staking, cross-chain, and energy leasing.” For users, JUST serves as the go-to one-stop gateway to access TRON-based DeFi services—including asset deposit, borrowing, and staking—without needing to switch platforms.

Currently, JST’s buyback and burn program is linked to two core pillars of the JUST ecosystem: JustLend DAO (a top-four global lending protocol) and USDD (TRON’s second-largest stablecoin). This alignment ensures that the entire JUST ecosystem will provide stable and powerful support for JST across multiple dimensions—including revenue generation, use case expansion, and resource synergy.

Profit Engine JustLend DAO: Accumulated Revenue ~$60M, TVL Consistently Ranked Among Top Four Lending Protocols Globally

As the primary funding source for JST’s buyback and burn initiative, JustLend DAO itself demonstrates stable and substantial profitability, with prior cumulative earnings of approximately $60 million attesting to its strong revenue-generating capacity. Data from DeFiLlama shows that JustLend DAO captured nearly $2 million in fees during Q3 alone. Its robust profitability not only supports the current burn program but also holds immense potential for long-term reinvestment into JST’s value.

As a cornerstone of the JUST ecosystem, JustLend DAO has evolved since its 2020 launch from a basic lending service into a multifunctional “DeFi powerhouse” integrating “lending, staking, energy services, and smart wallets.” Its total value locked (TVL) has consistently ranked among the top four in the global lending sector, cementing its status as a financial cornerstone of the TRON ecosystem.

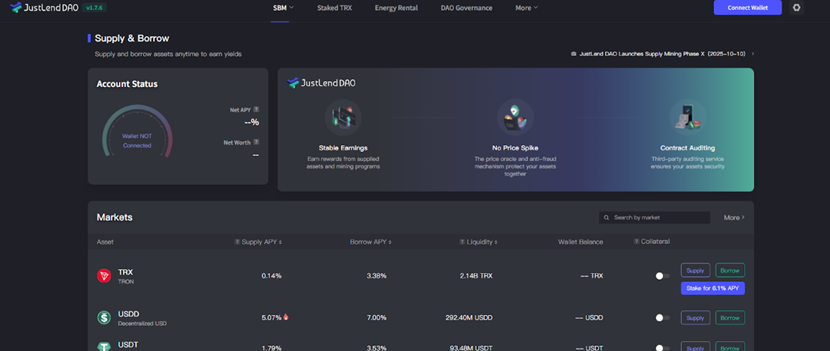

Lending remains its foundational offering. JustLend DAO uses smart contracts to automate the entire lending process, employing algorithms to monitor asset supply and demand in real time and dynamically adjust interest rates, ensuring efficient market equilibrium. Users can flexibly allocate assets—depositing idle crypto for stable returns or borrowing other cryptocurrencies via collateral for leveraged positions—meeting diverse needs from “stable appreciation” to “efficient allocation.”

In terms of product innovation, JustLend DAO continues to push boundaries. In April 2023, it launched two major features: “TRX Staking (sTRX)” and “Energy Rental,” expanding its service scope.

- sTRX is a liquid staking product in the TRON ecosystem, allowing users to stake TRX and receive sTRX as a liquid staking receipt. As of October 22, approximately 9 billion TRX are staked on the platform, with over 9,970 participating addresses, offering an annual yield of 6.05%, making it the preferred TRX staking entry point on TRON.

- Energy Rental leverages TRON’s unique “Bandwidth + Energy” gas mechanism. Traditional methods of obtaining energy require staking or burning TRX, which can be costly and complex. JustLend DAO’s Energy Rental allows users to “rent as needed and return anytime” without long-term TRX staking, reducing costs by about 70% compared to direct TRX burning and significantly lowering the barrier for small and mid-sized users.

To further enhance on-chain trading experience, JustLend DAO introduced the GasFree smart wallet feature, enabling gas fees for transfers to be deducted directly from the transferred token. This breaks the traditional requirement of holding native network tokens (e.g., TRX) to pay gas fees. With GasFree, users can now pay gas fees using stablecoins like USDT. Combined with JustLend DAO’s 90% fee subsidy policy, each USDT transfer currently costs only about 1 USDT, greatly improving convenience and cost-efficiency.

Today, JustLend DAO has integrated several core DeFi modules—including the lending market (SBM), liquid staking sTRX (Staked TRX), Energy Rental, and smart wallet (GasFree)—establishing itself as the de facto “one-stop DeFi gateway” on the TRON network. Going forward, the platform will continue integrating more ecosystem protocols, simplifying operations and deepening functionality to drive holistic growth of TRON’s DeFi ecosystem through a single application.

As clearly outlined in JUST’s "JUST Ecosystem Overview and Planning" published last March, JUST has built a composite service system around JustLend DAO encompassing “lending + staking + energy leasing.” Users no longer need to switch between multiple platforms; all diversified on-chain activities—from earning interest via deposits, staking mining, to energy leasing transactions—can be completed within the single JustLend DAO protocol, eliminating the inefficiencies of traditional multi-platform DeFi navigation.

JustLend DAO’s “hub” value extends beyond functional integration to its ability to connect global resources and institutional capital. By the end of June, Tron, the U.S.-listed company behind TRON, completed staking of 365 million TRX via JustLend DAO, positioning the platform as a critical bridge for traditional capital entering the TRON blockchain, with potential to attract more institutional inflows. In July of the same year, JustLend DAO achieved full integration with Binance Wallet, enabling seamless access for Binance users to perform lending and staking operations. Leveraging Binance’s global traffic, this partnership expands user reach and strengthens ecosystem influence.

According to DeFiLlama data, as of October 22, JustLend DAO’s total value locked (TVL) exceeds $4.5 billion, maintaining its position among the top four global lending protocols. Notably, JustLend DAO achieves these results operating solely on the TRON chain, yet remains highly competitive against multi-chain leaders like Aave and SparkLend.

This performance underscores JustLend DAO’s strong product competitiveness and operational efficiency, as well as the high activity and user stickiness within the TRON ecosystem. Evolving from a “single lending tool” to a “DeFi powerhouse,” JustLend DAO has become a key pillar of TRON’s financial architecture, with its value poised to grow further alongside the expansion of the TRON ecosystem.

JustLend DAO not only provides solid financial backing for JST’s current buyback and burn efforts but also signals a long-term commitment: as the ecosystem scales, it will continue fueling JST’s deflation and value appreciation, acting as JST’s enduring “profit keystone.”

JST Token Value Deeply Tied to Ecosystem Earnings, Poised to Enter New Growth Cycle

With the ongoing implementation of the JST buyback and burn plan, JST’s token value is now firmly linked to the sustained revenues of two core components of the JUST ecosystem: JustLend DAO and USDD. As it enters a clearly defined deflationary phase, JST’s long-term value will progressively emerge, supported by the comprehensive development of the JUST ecosystem.

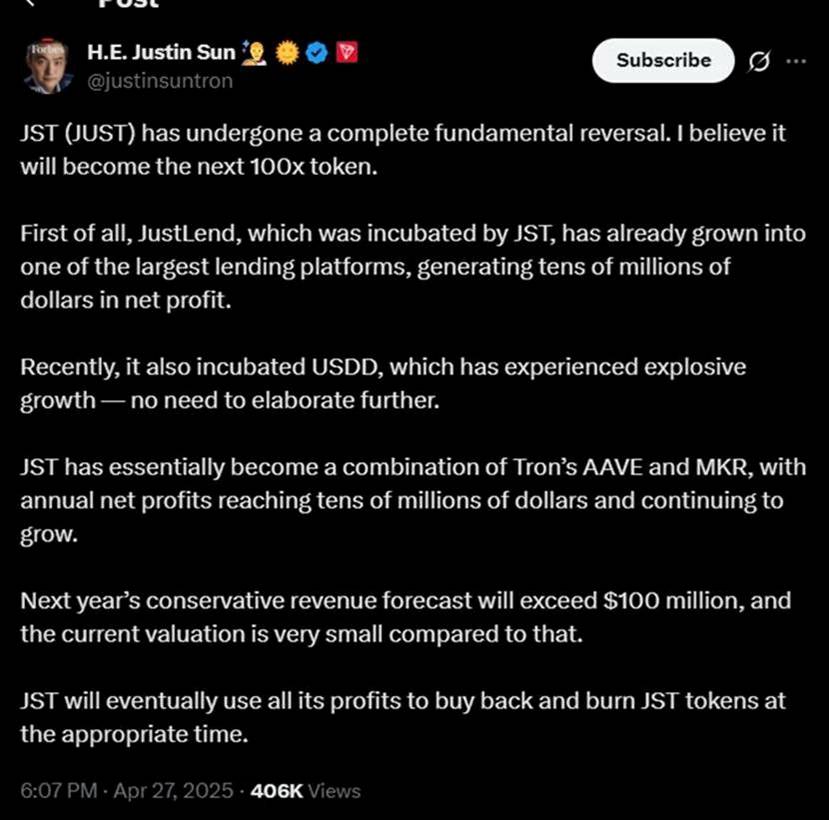

As early as April this year, TRON founder Justin Sun highlighted on social media platform X that JST had undergone a fundamental transformation and could become the next “100x token.” He emphasized that JustLend, incubated by JUST, has become one of the industry’s leading lending protocols, generating tens of millions in annual net profit, while its ecosystem stablecoin USDD is also experiencing strong growth. JST has effectively become a hybrid of “AAVE” and “MKR” within the TRON ecosystem, with rising annual profits. Revenues are projected to exceed $100 million next year.

Now, with the execution of the buyback and burn plan, JST’s long-term growth potential is beginning to materialize, driven by the “deep synergy between ecosystem earnings and deflationary mechanisms”: existing net earnings from JustLend DAO and future incremental net earnings from USDD will be directly used to buy back and burn JST. This means JST’s deflationary model is not theoretical but grounded in real, tangible ecosystem profits—creating a tight linkage between earnings and token value. Performance of JustLend DAO and USDD directly translates into internal drivers for JST’s value growth.

As the two core supporting products, JustLend DAO currently holds a TVL of approximately $7.7 billion and integrates multiple functions including lending, energy leasing, and sTRX staking, with growing user base and profitability. USDD, as TRON’s second-largest stablecoin, has a circulation approaching $500 million and is expanding into new use cases. As revenues from both protocols continue to rise, more funds will flow into the JST buyback pool.

Simultaneously, the overall “support strength” of the JUST ecosystem provides a solid endorsement for JST’s value: it reinforces JST’s value foundation by channeling sustained earnings from core pillars JustLend DAO and USDD into token deflation, while also expanding JST’s utility through a rich array of DeFi applications. Ultimately, this helps JST solidify its value anchor in the crypto space, broaden its development horizon, and achieve comprehensive enhancement from token economics to ecosystem value.

This model—“real earnings as foundation, ecosystem value transmitted through deflationary mechanisms”—is a hallmark of “value-backed tokens” in the crypto space, providing JST with a compelling long-term narrative. As the JUST ecosystem continues to grow, JST’s governance and economic value will rise in tandem with JustLend DAO’s TVL and USDD’s circulation, ultimately forming a sustainable growth loop of “ecosystem expansion → revenue growth → buyback & burn → deflationary appreciation,” perfectly aligning with the core logic of value accumulation in digital assets.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News