Stablecoin USDD on JustLend DAO's "Demand Deposit Gold Mine": Risk-free 6% annual yield to start, TRX players can earn over 20% passively

TechFlow Selected TechFlow Selected

Stablecoin USDD on JustLend DAO's "Demand Deposit Gold Mine": Risk-free 6% annual yield to start, TRX players can earn over 20% passively

No matter how the market fluctuates, users depositing USDD in JustLend DAO can enjoy stable annualized returns, ushering in a new chapter of steady wealth growth.

Recently, the stablecoin sector has witnessed a major breakthrough as Circle, the issuer of USDC, successfully listed on the U.S. stock market with its share price far exceeding expectations. This development has drawn intense attention from global institutions toward the stablecoin space, prompting tech and retail giants such as Walmart, Amazon, JD.com, and Ant Group to enter the race by planning their own stablecoins, making stablecoins a global focal point.

In this booming stablecoin landscape, TRON has emerged as a core transaction infrastructure, and its early strategic bet on the stablecoin sector is now widely praised. Beyond actively expanding USDT adoption, TRON announced earlier this year the upgrade of its native decentralized stablecoin USDD to version 2.0. Today, thanks to its outstanding performance and broad application, USDD is thriving within the TRON ecosystem and has become the second-largest stablecoin after USDT, securing a vital position in the ecosystem.

For users, amid the volatility of crypto markets, stablecoins have long surpassed their traditional role as mere trading intermediaries. The focus has shifted toward how to achieve wealth appreciation using stablecoins while ensuring security.

Always at the forefront of the industry, TRON has keenly captured this user demand. By seamlessly integrating USDD with DeFi applications within its ecosystem such as JustLend DAO and Sun.io, TRON has created an elegant "crypto money market fund" solution — a set-it-and-forget-it yield strategy that ushers in a new era of “steady gains.” Regardless of market movements, users who deposit USDD into JustLend DAO can earn stable annualized returns, opening a new chapter of steady wealth growth.

USDD: The "Hard Currency" of the TRON Ecosystem

In the stablecoin arena, TRON has established itself as the premier destination due to its leading ecosystem advantages. Even the much-anticipated USD1 stablecoin backed by the Trump family began minting on the TRON network on June 11. As TRON’s native stablecoin, USDD plays a pivotal role in its broader stablecoin strategy.

As a fully decentralized stablecoin, USDD fundamentally differs from traditional stablecoins. It operates without reliance on centralized entities, maintaining a strict 1:1 peg to the U.S. dollar through an over-collateralization mechanism. This decentralized, over-collateralized model ensures high transparency and stability, earning strong trust and favor among users and investors.

Within the TRON ecosystem, USDD holds a central position. Not only can it circulate across chains and participate in various DeFi activities to generate yield for users, but notably, USDD has also entered real-world utility, being adopted in physical retail environments.

On June 5, TRON announced a partnership with AEON, enabling users to use native TRON assets including TRX, USDT, and USDD for QR code payments at offline retail stores via AEON Pay, a payment tool under AEON. This move transforms USDD from a purely digital asset into a bridge between the virtual and real worlds, significantly enhancing its practicality and acceptance — solidifying its reputation as a true "hard currency."

Originally an algorithmic stablecoin within the TRON ecosystem, USDD underwent a significant upgrade in January, officially launching as USDD 2.0. This upgrade marked a qualitative leap: compared to previous versions, USDD 2.0 features a deeply optimized collateral mechanism and achieves fully decentralized governance. In the new version, control over the minting mechanism is entirely handed over to the community. Users can deposit collateral and customize their collateral ratios to mint new USDD based on individual needs. This highly autonomous minting process enhances democratic governance and improves capital efficiency, allowing users greater flexibility in contributing to the USDD ecosystem.

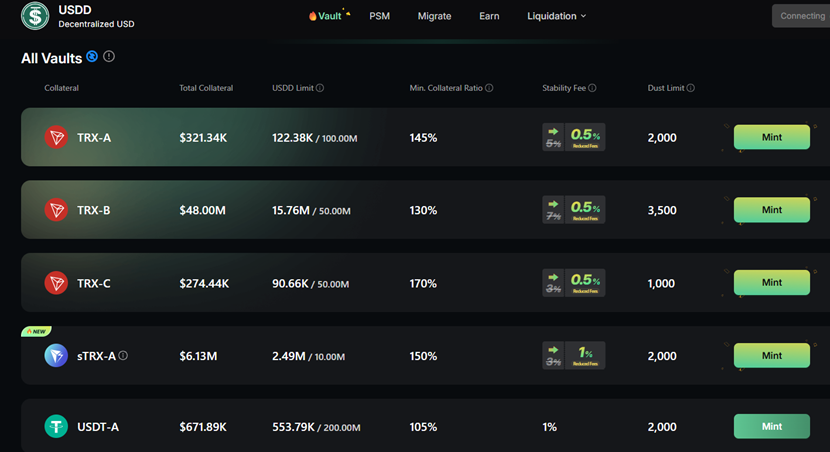

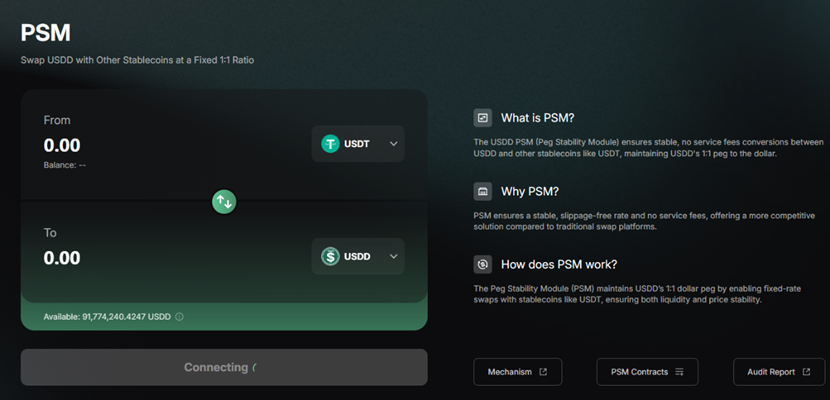

Currently, there are three primary ways to obtain USDD: (1) Over-collateralized minting, currently supporting high-quality crypto assets such as TRX, sTRX, and USDT as collateral; (2) Direct exchange via the PSM (Protocol Supported Mechanism) tool using USDT; (3) Direct purchase on exchanges, already supported on platforms such as HTX, Bybit, MEXC, and BingX.

(1. Mint USDD by over-collateralizing TRX, sTRX, or USDT)

(2. Exchange USDT directly for USDD using the PSM tool)

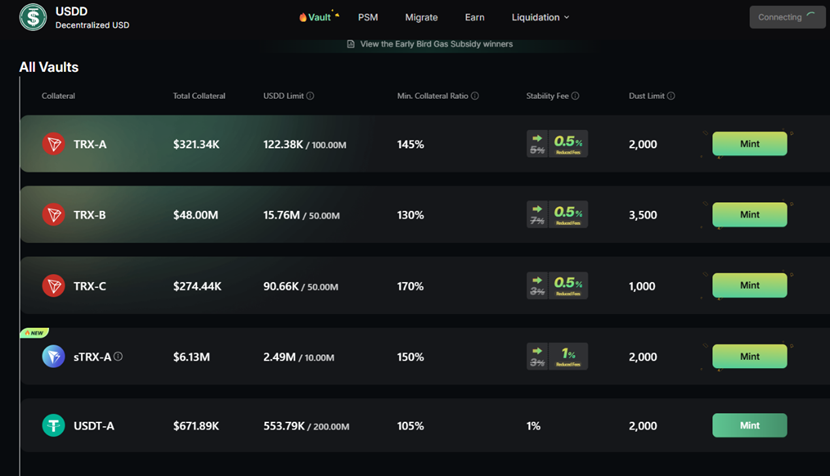

On minting fees, USDD has rolled out a series of promotional fee waivers, delivering tangible benefits to users. On June 15, USDD launched a new round of discounted minting fees. During the promotion period, for TRX-A, TRX-B, and TRX-C vaults with varying collateral ratios and minting fees, the stability fee was uniformly reduced to 0.5%. Meanwhile, the stability fee for the sTRX-A vault was significantly lowered from 3% to 1%. The promotional period runs until July 15. These incentives substantially reduce the cost of minting USDD, stimulating user engagement and encouraging broader participation in the USDD ecosystem.

In terms of use case expansion, USDD has been deeply integrated into multiple DeFi applications within the TRON ecosystem. Users can easily engage in broader DeFi activities such as lending, staking, and trading to generate additional yields. Clearly, USDD has become an indispensable "hard currency" within the TRON ecosystem, injecting strong momentum into its overall growth.

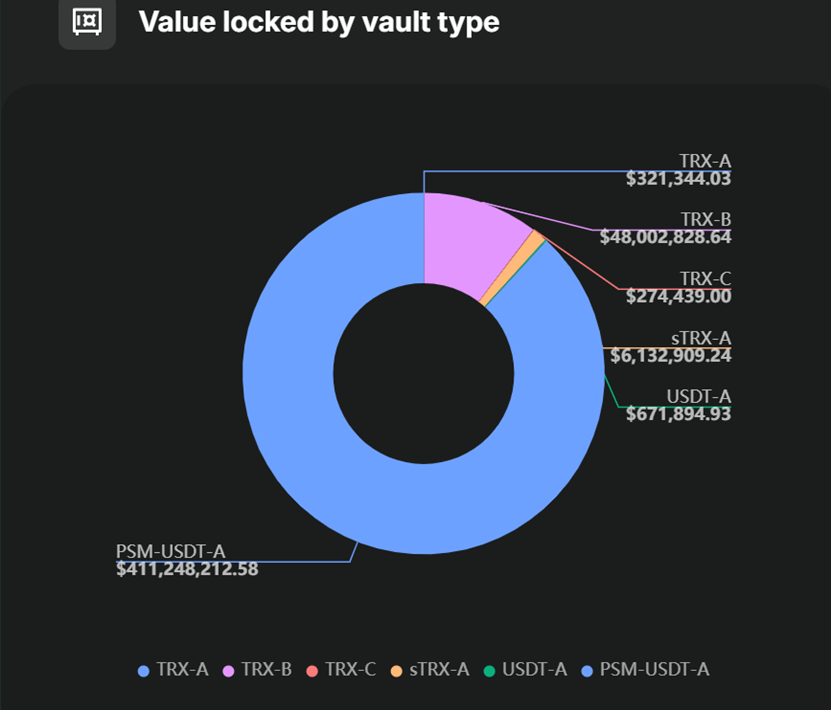

As of June 18, the circulating supply of USDD has exceeded 431 million, ranking third among over-collateralized decentralized stablecoins (after DAI from SKY, formerly MakerDAO, and USDS). The total value of assets locked in the USDD collateral pool exceeds $466 million, with a collateral ratio of approximately 108%.

Real-world testing of three yield-generating paths for USDD on JustLend DAO and Sun.io: Risk-free yields starting at 6% APY

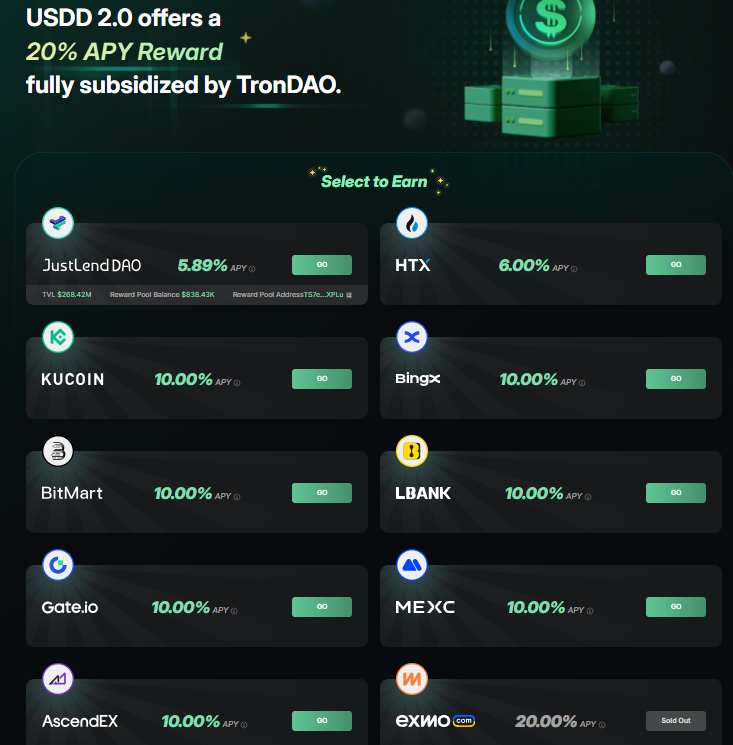

In today's volatile market environment, generating stable returns through stablecoins has become a key concern for many investors. In January, USDD launched the USDD Earn staking rewards program. By simply depositing USDD into JustLend DAO, users can earn interest, with initial maximum yields reaching as high as 20%. However, these yields decrease in stages as total deposits grow. All rewards are distributed in USDD and subsidized by the TRON DAO.

As of June 18, the USDD Earn program has entered its fifth stage and now includes DeFi protocols like JustLend DAO and multiple exchanges including HTX and GATE. According to the current tiered structure, the annualized yield for USDD on JustLend DAO is approximately 6%, while partner exchanges offer yields of up to 10%.

Based on differences in yield rates, participation methods, and associated DeFi protocols, the income-generating strategies can be categorized into three main pathways:

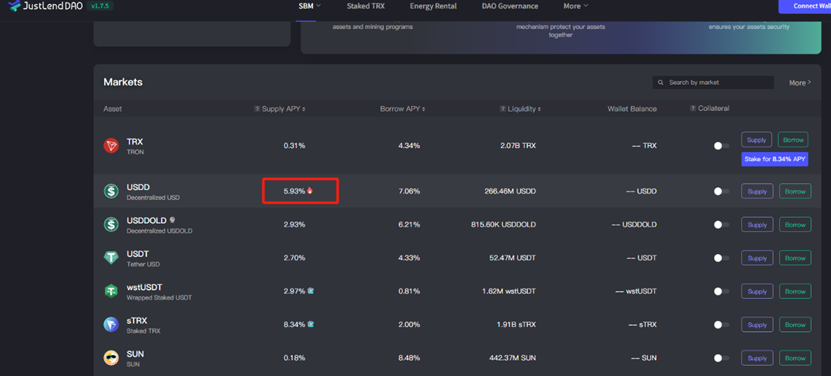

Path One: Risk-Free Savings with ~6%+ APY (Deposit USDD → Instant Interest)

The process is extremely simple: deposit USDD directly into JustLend DAO to earn interest, currently offering a risk-free annualized yield of about 6%. This model allows for instant deposits and withdrawals — just like a bank checking account — providing zero risk, full principal safety, no minimums, and maximum flexibility. It's ideal for investors seeking stable returns. For comparison, Sky's USDS currently offers a real-time deposit rate of only 4.5% APY, while DAI stands at just 3.25% APY.

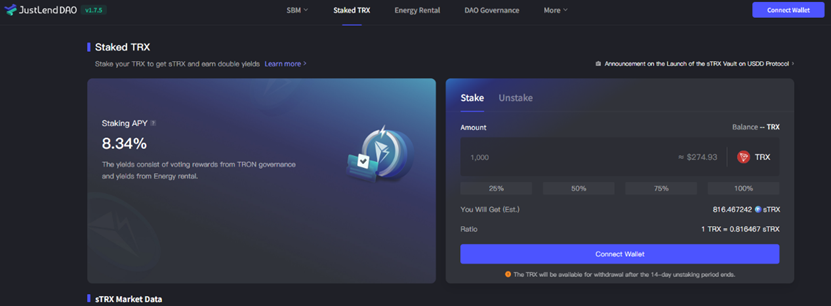

Path Two: The "Yield Amplifier" for TRX Holders – Up to 15%+ APY (sTRX Staking + USDD Yield)

Users stake TRX as sTRX on JustLend DAO, then collateralize sTRX to mint the stablecoin USDD, and deposit the newly minted USDD back into JustLend DAO to earn interest. This way, TRX holders earn dual returns: staking rewards from sTRX and interest from USDD deposits. Over the past seven days, sTRX staking yielded 8.34%, while USDD deposit interest was around 6%, resulting in a combined TRX-denominated return of approximately 15%. With continuous recycling (TRX → sTRX → USDD → TRX), cumulative TRX-denominated returns can exceed 20%.

Path Three: Zero-Cost Swaps + Flexible Investing (Sun.io: PSM + SunSwap)

This path leverages two key functions on the all-in-one trading platform Sun.io — SunSwap and the PSM swap tool. SunSwap enables users to buy any asset with USDD, such as SUNC, JST, and other tokens within the TRON ecosystem, further expanding investment options. Meanwhile, the PSM tool supports 1:1 fixed-ratio swaps between USDD and other stablecoins like USDT, USDC, and TUSD, offering a seamless experience with zero slippage and zero fees.

If users hold USDT, USDC, or TUSD, they can use PSM to exchange them for USDD at a 1:1 ratio. After conversion, USDD can be used on SunSwap to purchase any token or directly deposited into JustLend DAO to participate in the USDD Earn yield program.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News