USDD 2.0 officially deployed on Ethereum, stablecoin "dark horse" launches million-dollar incentives

TechFlow Selected TechFlow Selected

USDD 2.0 officially deployed on Ethereum, stablecoin "dark horse" launches million-dollar incentives

USDD aims to build a transparent, decentralized, and sustainable long-term value protocol.

Author: Bob, Baihua Blockchain

At a time when USDT and USDC dominate the market, most attention is focused on centralized stablecoins, while the importance of decentralized stablecoins is often underestimated. Leading institutions such as A16z and Messari have clearly stated in multiple reports that decentralized stablecoins are the cornerstone of the DeFi ecosystem, making their irreplaceable role worthy of significant attention.

Recently, there has been growing interest in the decentralized stablecoin USDD, which has deployed natively on Ethereum and launched a 12% reward campaign, drawing strong reactions from the crypto community. As a "dark horse" in the decentralized stablecoin market, USDD has maintained long-term stable operation and growth since its launch. Its 2.0 version, launched in January this year, saw its circulating supply surpass $100 million within two weeks and reached over $600 million in TVL within six months—demonstrating rapid momentum.

Next, we will examine the latest developments of USDD and analyze the reasons behind its swift rise.

01 USDD 2.0 Reaches Six-Month Milestone, Emerges as Stablecoin Dark Horse

USDD was initially launched in 2022 by TRON DAO as an over-collateralized decentralized stablecoin. Early versions of USDD failed to achieve scalable growth due to intense competitive pressures. However, by early 2025, the upgraded 2.0 version introduced enhancements in decentralization, community minting, and the Smart Allocator feature, quickly capturing market attention and establishing itself as a "dark horse" in the decentralized stablecoin space.

Recent community updates suggest USDD is preparing for a series of major moves—likely capitalizing on the strong growth momentum following its 2.0 upgrade to ensure sustainable development and continued expansion.

USDD's official social media announces native deployment on Ethereum

As reported, USDD officially launched native deployment on Ethereum on September 8, 2025, simultaneously introducing a high-yield 12% APY rewards program on Ethereum’s mainnet. Users holding native USDD on Ethereum can enjoy tiered APYs of up to 12%, with rewards claimable in one-time distributions via the Merkl platform after the campaign ends.

Leveraging its successful experience within the TRON ecosystem, multi-chain deployment allows USDD to expand use cases and adoption, broaden its user base, and achieve sustainable growth. Particularly, Ethereum's ecosystem—the largest DeFi hub today—offers vast opportunities for expansion.

According to official statements, USDD's vision for a multi-chain future includes extending the Smart Allocator to other chains such as Ethereum and BNB Chain, increasing accessibility and enabling higher returns.

Previously, USDD appeared in real-world payment use cases through integrations with AEON Pay and Uquid. Its adoption in real-world transactions can bring new use case pathways to multi-chain ecosystems like Ethereum and offer more choices for users across these crypto ecosystems.

02 Moving Beyond Algorithmic Labels: What’s New in Upgraded USDD 2.0

Prior to its multi-chain expansion, many may still associate USDD with the subsidy-driven USDD 1.0. However, the team's confidence in launching USDD across Ethereum and other ecosystems stems largely from the positive feedback generated by USDD 2.0 over the past several months. So, what exactly does the upgraded USDD 2.0 bring?

The original USDD functioned as a traditional over-collateralized decentralized stablecoin, whereas USDD 2.0 delivers significant improvements in security, decentralization, and stability.

Key differences between old and new versions of USDD

The USDD 2.0 upgrade introduces several changes listed in the table above. Notably, the integration of innovative modules such as the Price Stability Module (PSM), Smart Allocator, and secure liquidation and auction mechanisms are highlighted below:

-

Price Stability Module (PSM): Enables seamless, near-zero fee swaps between USDD and supported stablecoins (initially USDT), using arbitrage mechanisms to maintain USDD’s 1:1 peg to the US dollar.

-

Smart Allocator: Channels idle reserve funds into established DeFi platforms like Aave and JustLend to generate and distribute returns for USDD stakers. In simple terms, it acts as an intelligent "gunpool" for idle capital, shifting from reliance on external subsidies to a self-sustaining model where the protocol generates sustainable internal yields—eliminating the unsustainable interest subsidies of the previous version.

-

Secure Liquidation and Auction Mechanism: If collateral ratios fall below safety thresholds, the system triggers on-chain liquidations, recovering collateral assets through auctions to ensure system stability.

03 What Drives USDD’s Rise?

In fact, compared to centralized stablecoins, decentralized stablecoins—particularly over-collateralized ones—have long served as the foundation of the DeFi ecosystem. Their transparency, censorship resistance, and role as on-chain liquidity hubs give them irreplaceable significance, ensuring broad potential in future payments, cross-border transactions, and decentralized financial systems.

USDD’s rise is no accident. Since the launch of USDD 2.0, it has stood out among competing decentralized stablecoins thanks to its combined strengths in innovation, stability, security, and yield generation, offering a path toward sustainable development:

1. Strong Foundation from the TRON Ecosystem

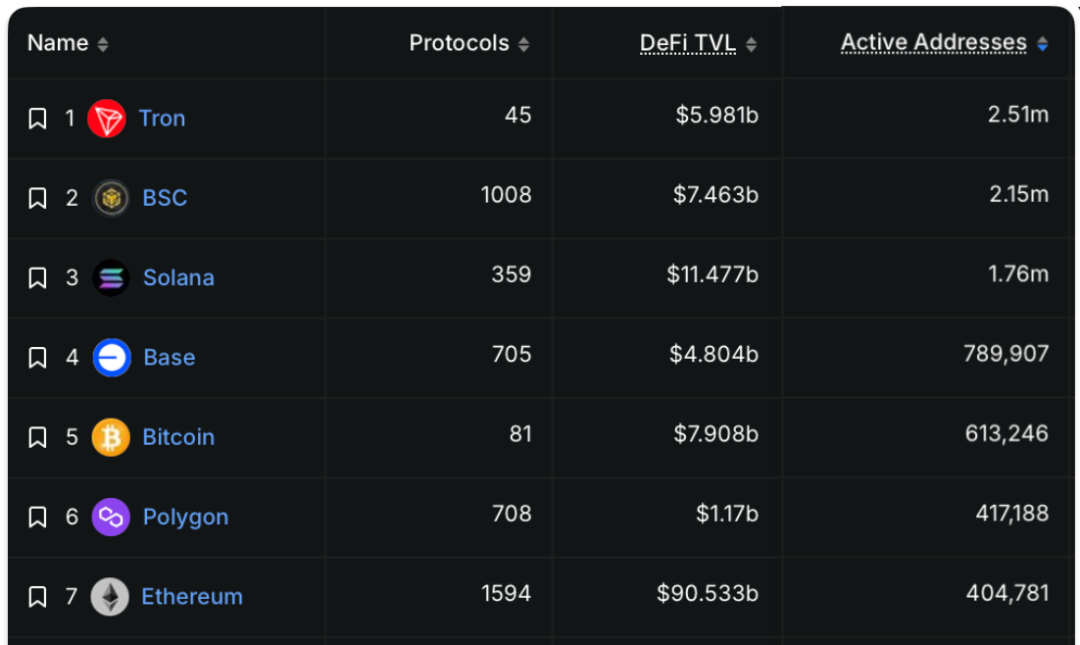

Data from Defillama shows that in terms of active addresses, TRON leads all blockchain networks with 2.5 million active addresses. TRON also ranks high in DeFi TVL, and USDT—the leading stablecoin—has the highest circulation volume on TRON, with overall stablecoin issuance ahead of other major public chains. Overall, TRON’s robust ecosystem provides fertile ground for high-performing projects.

Ranking of active addresses across major blockchains Source: Defillama

2. Innovation

As previously mentioned, the Smart Allocator is one of USDD’s core innovations—an on-chain yield strategy module. Unlike MakerDAO and Frax, which earn returns through real-world asset vaults or staking, the Smart Allocator utilizes internal reserves with conservative and transparent management, delivering genuine protocol-based rewards to users without requiring additional actions.

The Price Stability Module (PSM) further strengthens the 1:1 USD peg. Decentralized minting and governance return the “right to produce” stablecoins to users, enhancing community cohesion.

3. Stability and Security

As DeFi infrastructure, price stability and security are fundamental requirements for any stablecoin—the more stable and secure, the greater the liquidity it attracts. Beyond the stabilizing effect of PSM and the conservative yield strategies of the Smart Allocator, dynamic collateral ratios and risk management help withstand market volatility. To prevent excessive risk exposure, the Smart Allocator imposes capital deployment caps, with all operations fully transparent and traceable on-chain.

In addition, relevant contracts and protocols have undergone rigorous audits by blockchain security firm ChainSecurity.

4. Yield-Driven Model

Backed by the TRON ecosystem, USDD 2.0 offers APYs up to 20%, driven by subsidies from TRON DAO, the over-collateralization model, yield subsidy mechanisms, TRON’s leadership in the stablecoin market, and the operation of the Smart Allocator—ensuring stable and sustainable sources of user yield.

Furthermore, the upcoming sUSDD protocol will enable USDD users to earn interest through a transparent, decentralized savings system, serving users seeking passive appreciation of stablecoin assets.

04 Next Steps: Roadmap Ahead

Based on USDD’s published roadmap, its next moves will likely include deployment on additional major blockchains such as BNB Chain, opening possibilities for broader adoption and user growth. Upon entering more blockchain ecosystems, USDD is expected to integrate additional stablecoins and other crypto assets, further leveraging the stabilizing power of the PSM, supporting more collateral types, and injecting new vitality into these ecosystems.

The evolution in USDD’s minting mechanisms and governance models indicates a stronger emphasis on decentralized governance. The community will gain greater voice and control in decision-making and resource management, driving USDD toward a more autonomous and enduring protocol.

Through multi-chain deployment, USDD expands access to a wider range of crypto users, broadening its adoption scope and positioning itself with the potential to become foundational DeFi infrastructure across the broader crypto ecosystem—unlocking significant room for growth.

05 Conclusion

One generation plants trees; the next enjoys the shade. Over the past few years, stablecoin projects like LUNA, which experienced dramatic rises and collapses, have left valuable lessons for those that follow. USDD has drawn from these experiences through continuous upgrades, exploring new directions for decentralized stablecoins.

It has evolved from an initial single-chain protocol into a multi-chain DeFi infrastructure that balances innovation, optimization, and community autonomy.

This evolution reveals USDD’s goal: to build a transparent, decentralized, and sustainable long-term value protocol. If these strategic initiatives succeed, USDD could emerge as a representative project in the future of decentralized stablecoins.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News