Across governance scandal: Did the team manipulate votes and misappropriate $23 million?

TechFlow Selected TechFlow Selected

Across governance scandal: Did the team manipulate votes and misappropriate $23 million?

Insider threats pose a far greater risk to investors in the crypto space than external threats (such as hackers).

Written by: 1912212.eth, Foresight News

On June 27, the controversy surrounding Celestia's founder selling tokens to prepare for a prolonged battle had just begun to subside when another project team was exposed in a scandal. Ogle, founder of Glue, publicly accused the cross-chain bridge protocol Across of manipulating DAO votes and misappropriating up to $23 million in funds. This accusation not only triggered widespread community attention but also brought the transparency and security of DAO governance mechanisms back into sharp focus.

What exactly is Across Protocol? And how did its team manipulate voting to siphon off funds?

Former UMA Team’s New Venture

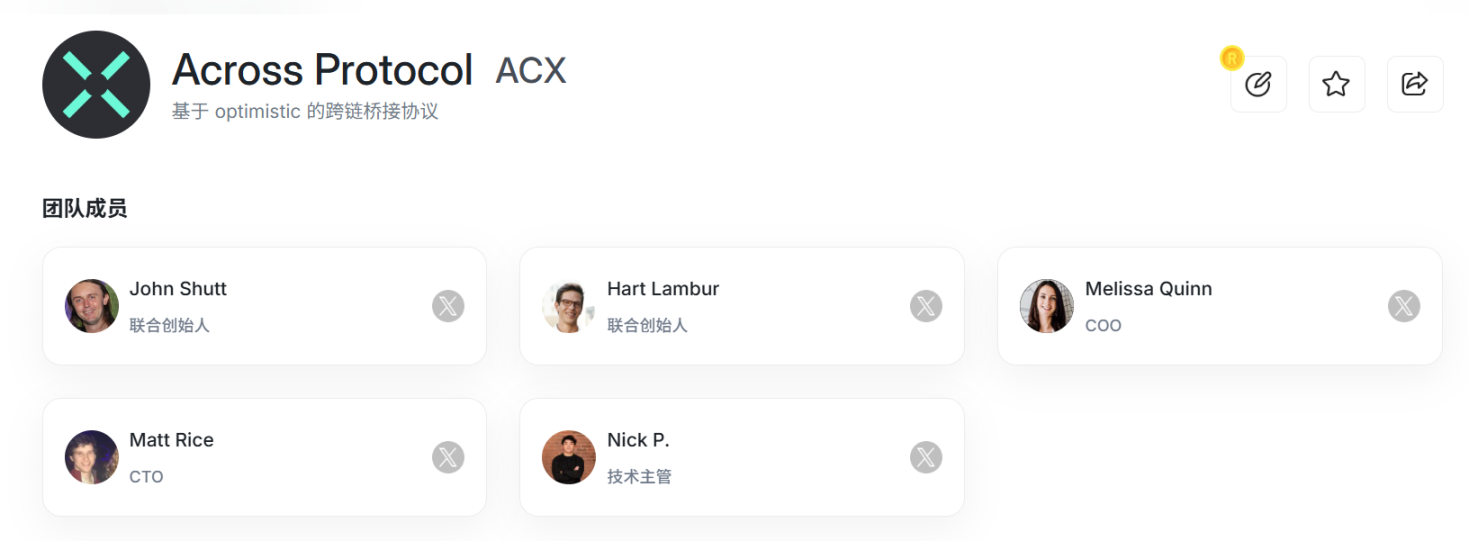

Across is a cross-chain bridge protocol designed to enable seamless asset transfers across different blockchains through efficient interoperability. As early as late 2022, it secured $10 million in funding from Hack VC and other investors. In March 2025, Across Protocol announced it had raised $41 million in a token sale led by Paradigm, with participation from Bain Capital Crypto, Coinbase Ventures, Multicoin Capital, and angel investor Sina Habinian—forming an impressive lineup of backers.

Its founder, John Shutt, previously served as a senior engineer at UMA. The other co-founder, Hart Lambur, is also the founder of both UMA and Risk Labs. Risk Labs is the organization behind UMA, the once-prominent synthetic assets protocol.

Since mid-2023, its token ACX has surged from a low of $0.05 to nearly $1.80—an increase of almost 36 times. However, since the end of last year, ACX has sharply declined due to broader market downturns, falling to around $0.14—a drop of more than tenfold within just six months.

Across relies on a DAO-based governance model that allows holders of governance tokens to vote on proposals regarding fund allocation and development direction. Yet, the decentralized nature of DAO governance often faces criticism over "centralized control"—precisely the core of Ogle’s allegations.

Voting Manipulation and Fund Misappropriation

Ogle detailed his accusations against the Across team in a lengthy post. He claimed that the team used opaque methods to manipulate DAO voting, bypassing normal community governance procedures to transfer $23 million to unknown accounts. Key points of Ogle’s allegations include:

Voting Manipulation: Ogle alleged that the Across team leveraged their large holdings of governance tokens to dominate proposal outcomes. By consolidating votes through multiple linked wallets, they created a false impression of broad community support—undermining the very principle of decentralization. This behavior mirrors past "governance attacks" seen in projects like Compound DAO and Jupiter DAO.

Fund Misappropriation: Ogle further accused the team of using manipulated proposals to redirect $23 million in DAO treasury funds to accounts outside community oversight. He questioned where these funds went, noting there were no public audit records or transparent explanations of their use—raising suspicions of a rug pull.

Lack of Transparency: Ogle criticized the Across team for insufficient communication during governance processes. Proposal details were inadequately disclosed, real-time on-chain voting data was unavailable, and community members found it difficult to verify the legitimacy of results. He called for full disclosure of fund flows and independent third-party audits.

Ogle also provided a detailed breakdown of specific incidents. In October 2023, Kevin Chan, a lead developer at Across, submitted a public proposal to transfer 100 million ACX tokens (worth approximately $15 million at current prices) from the DAO to Risk Labs—the founders’ private, for-profit entity.

On-chain analysis revealed that this proposal was secretly driven by Kevin and his team. While Kevin formally submitted the funding request using his public address “KevinChan.Lens,” he secretly cast a massive number of “yes” votes via another wallet, “maxodds.eth.” Several members of the Risk Labs team appeared to jointly approve the substantial disbursement. Another team member, Reinis FRP, used multiple hidden wallets holding millions of ACX tokens to vote “yes” on the proposal. Notably, the second-largest voting wallet in the entire proposal—accounting for nearly 14% of total votes—was originally funded by Hart Lambur.

Less than a year later, after facing no consequences from the first vote, the team returned seeking even more funds. This time, they requested a retroactive grant of 50 million ACX tokens (about $7.5 million). Once again, Kevin’s secret wallet played a central role: “maxodds.eth” and a newly funded wallet contributed 44% of all “yes” votes.

Ogle expressed frustration over this conduct: “In any other industry—be it public companies, nonprofits, government agencies, or others—there are strict rules prohibiting so-called ‘self-dealing,’ along with regulations governing ethical behavior to prevent breaches of duty.”

Some community members supported his view, expressing concern over the state of DAO governance; others questioned Ogle’s motives, suspecting the accusations might serve Glue’s competitive strategy.

Hart Lambur, co-founder of Across, denied all allegations made by Glue’s founder regarding fund misuse and vote manipulation. In response to claims of “privately withdrawing $23 million for personal gain,” Hart stated that Risk Labs is a nonprofit foundation governed by Cayman Islands law, and that the funds have been used solely for protocol development. He emphasized he earns only $100,000 annually and has not claimed any token rewards. According to him, fund usage aligns with standard DAO practices and has enabled the development of Across v3 and v4.

Regarding the claim that governance was internally manipulated, Hart asserted that team members are entitled to freely vote with tokens they personally purchased. He noted that Kevin’s wallet (“maxodds.eth”) is publicly known, and Reinis’s voting actions were legitimate. With no opposing votes, the proposal passed transparently.

Chronic Issues in DAO Governance Persist

Ogle’s accusations are not isolated—they reflect long-standing systemic problems in DAO governance. DAOs (Decentralized Autonomous Organizations), as innovative products of blockchain technology, aim to achieve decentralized decision-making through smart contracts and token-based voting.

However, in practice, DAO governance frequently deviates from its ideals, revealing several critical issues:

-

Concentration of Power: Despite aiming for decentralization, unequal token distribution often enables a small number of "whales" to control voting outcomes. For example, members of Jupiter DAO have previously complained about the team manipulating governance through large token holdings, marginalizing community voices. Similarly, the "Golden Boys" incident in Compound DAO revealed how a few token holders exploited governance proposals to divert $24 million.

-

Inadequate Voting Transparency: Many DAOs lack on-chain verifiability in their voting processes, making it hard for community members to track actual voting behavior. Studies show most current DAO governance systems fail to ensure long-term ballot privacy, and voting records may become public after voting ends—increasing risks of manipulation and coercion.

-

Fund Security Risks: DAO treasuries often hold significant capital, making them prime targets for hackers and insider threats. The 2016 hack of The DAO remains a classic case, where an attacker exploited a smart contract vulnerability to steal $50 million worth of Ether, forcing the Ethereum community into a hard fork. More recently, Beanstalk DAO fell victim to a flash loan attack, demonstrating how governance flaws can lead to instant draining of treasury funds.

-

Legal and Accountability Ambiguity: The decentralized structure of DAOs creates unclear legal status, potentially exposing members to unforeseen liabilities. In the 2023 Sarcuni v. bZx DAO case, a U.S. court ruled that DAO members could be treated as general partners, bearing joint liability for protocol losses—raising red flags about DAO legality and compliance.

Given these persistent challenges, Ogle pessimistically concluded: “Almost every DAO in the crypto space is either a complete scam or at least a facade. I believe insiders pose a far greater threat to crypto investors than outsiders such as hackers.”

Conclusion

To address the difficulties in DAO governance, the industry must pursue improvements across technical, structural, and cultural dimensions. Technically, safer smart contracts and voting protocols should be developed. For instance, zero-knowledge proofs (ZKP) can protect ballot privacy while maintaining on-chain verifiability; multi-signature schemes and timelocks can reduce the risk of treasury theft. Structurally, token distribution and voting weight designs need optimization to prevent whale dominance. Solutions like quadratic voting or reputation systems could empower active community members with greater influence. Additionally, mandatory independent audits of proposals and fund flows would enhance transparency.

Ogle’s allegations against Across serve as a wake-up call for the blockchain governance ecosystem. DAOs, envisioned as vessels of decentralization, carry the community’s hopes for fairness and transparency—but their evolution continues to face major hurdles. The industry should seize this moment to accelerate innovation and refinement of governance mechanisms.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News