ERC-8004 Launches: Giving AI Agents Digital IDs—A New Business Opportunity for Ethereum?

TechFlow Selected TechFlow Selected

ERC-8004 Launches: Giving AI Agents Digital IDs—A New Business Opportunity for Ethereum?

There is currently no clean investment vehicle that allows you to precisely bet on the thesis “AI requires on-chain identity.”

By TechFlow

On January 28, Ethereum’s official team announced that the ERC-8004 protocol is set to launch on mainnet.

We mentioned this standard in an article last October. If you’re completely unfamiliar with it, refer to this piece: “x402 Gets Increasingly Competitive—Spot New Asset Opportunities in ERC-8004 Early”

In fact, it has an official name: “Trustless Agents.” In plain English, that means:

Giving AI Agents on-chain identities.

Ethereum Foundation rarely pushes an ERC standard this hard. It even formed a dedicated team called dAI, included ERC-8004 in its 2026 strategic roadmap, collaborated with Google, Coinbase, and MetaMask to draft the specification, and hosted a dedicated “Trustless Agents Day” at DevConnect in November to build momentum.

The last time Ethereum pushed an ERC standard this vigorously was with ERC-20 and ERC-721.

One defined tokens; the other defined NFTs.

Now it’s AI’s turn?

Ethereum’s AI Anxiety

Why the urgency?

Consider this data point: According to Cookie.fun, AI Agent tokens’ market capitalization is overwhelmingly concentrated on Solana and Base—combined, they account for 96%. On Ethereum mainnet, there are fewer than five AI Agent projects widely recognized by name.

As of April 2025, ETH’s BTC exchange rate plunged to 0.017—the lowest in five years. At the time, many declared, “Ethereum is not the future.”

During DeFi’s boom, Ethereum was the home ground. During NFT’s rise, Ethereum remained the home ground. Now that AI Agents are gaining traction, the home ground has shifted.

Solana processes 36 million transactions per day; Ethereum mainnet handles just 1.13 million. High gas fees and slow speeds have driven developers to vote with their feet. Virtuals Protocol launched on Base; ai16z chose Solana; even Coinbase’s own AI project bypassed Ethereum mainnet.

Ethereum needs a new narrative.

ERC-8004 may be the opening chapter of that story.

A Quick Refresher on ERC-8004

Let’s revisit the standard itself.

How exactly does ERC-8004 “issue on-chain IDs” to AI Agents?

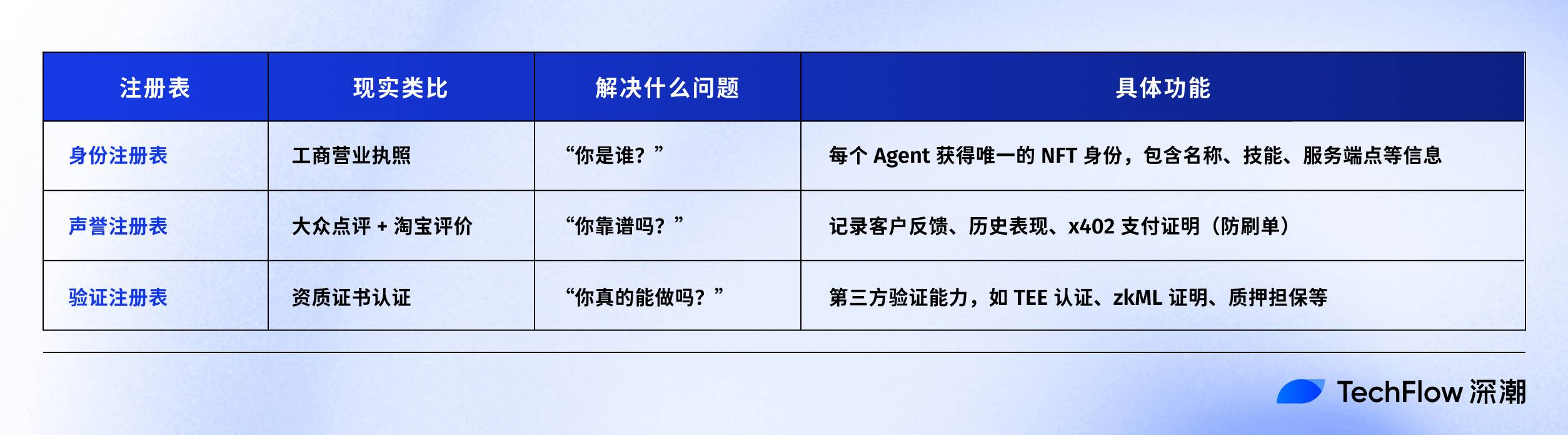

You don’t need deep technical knowledge—just remember three ledgers.

The first is the Identity Ledger. Built on ERC-721, each AI Agent mints an NFT to prove “I am who I claim to be.”

The second is the Reputation Ledger. It records an Agent’s historical performance—who has used it, how users rated it, whether it has misbehaved.

The third is the Verification Ledger. Third-party entities “stamp” or vouch for an Agent—for example, “This Agent passed security audit X.”

Together, these three ledgers address one core question: When two AI Agents meet on-chain, how do they assess each other’s reliability?

Previously, the answer was: You couldn’t know—reliance was purely human-mediated. ERC-8004’s answer: Check the on-chain record.

This framework wasn’t conceived by Ethereum alone.

Its underlying logic draws from Google’s A2A (Agent-to-Agent) protocol, released last year, which enables AI agents to communicate and invoke each other. ERC-8004 adds one critical layer on top:

Blockchain-backed trust.

Google’s A2A solves communication; Ethereum’s ERC-8004 solves trust. One handles talking; the other verifies identity.

Is Issuing IDs a Viable Business?

Let’s speculate boldly about Ethereum’s reasoning:

For AI Agents to become truly useful, they must manage real assets—not just tweet or chat, but directly execute on-chain operations: signing transactions, calling smart contracts, cross-protocol arbitrage…

No one dares scale this yet. Why? Simple: How do you know an Agent won’t abscond with your funds? ClawdBot’s recent surge in popularity has already drawn community reports of negative incidents.

In Web2, the solution is platform endorsement. You trust OpenAI’s API because you trust OpenAI—if something goes wrong, you go to OpenAI.

Web3 has no such mechanism. Agents are open-source, permissionlessly deployable, and run unmonitored on-chain. When you call an unfamiliar Agent’s service, you can’t determine who stands behind it, whether its code contains vulnerabilities, or whether it has a history of malicious behavior—all information currently inaccessible.

Put plainly, ERC-8004 essentially transplants traditional finance’s KYC process onto the blockchain. Ethereum is betting that once AI Agents begin handling real money, this capability will become indispensable.

DeFi protocols integrating external Agents will first check their on-chain identity. Institutions using Agents for trade execution will verify their historical records. Auditing firms could issue on-chain certifications for Agents—much like they audit smart contracts today.

This is a strategic positioning move.

Ethereum knows it has lost the battle on execution layers—but the trust layer remains unclaimed. Institutional credibility, a mature security-audit ecosystem, and TVL scale are Ethereum’s existing assets. ERC-8004 packages those assets into a standard, racing to define “what compliant AI Agents should look like”—before others do.

But does this demand exist today?

Standards Before Demand

Having outlined Ethereum’s calculus, let’s confront reality: What are on-chain AI Agents actually doing right now?

After last year’s AI meme wave subsided—and as leading AI companies rapidly advanced their products over the past one to two years—on-chain AI Agents have largely faded from mainstream attention.

Still, progress continues.

For instance, ai16z rebranded as ElizaOS, evolving from a single Agent into a cross-chain platform; Virtuals Protocol is building AI-powered dApps, with plans to enter physical robotics by 2026; and AI Agents embedded in platforms like Surf can now autonomously execute DeFi trading strategies.

Yet the question remains: Do they genuinely need ERC-8004?

Luna gains user trust because it’s built by Virtuals’ core team. Agents on ElizaOS gain adoption because they operate within ElizaOS’s trusted framework. Surf executes strategies for you—not because of its Agents’ on-chain credentials, but because you trust the application itself.

Trust stems from the platform—not from on-chain identity.

ERC-8004 envisions a different scenario: An unknown Agent approaches you—no platform backing, no brand recognition—leaving you to judge its reliability solely via on-chain records.

When will that scenario arise?

When AI Agents achieve true cross-protocol, cross-platform, and cross-organizational autonomous invocation: borrowing from Aave, trading on Uniswap, then deploying capital across another protocol—all without human approval…

But that scenario doesn’t exist yet.

Today’s AI Agents—even the most sophisticated ones—operate strictly within single platforms. They don’t need to prove themselves to unfamiliar protocols, because they never knock on unfamiliar protocols’ doors.

Given current crypto market sentiment, they have no incentive to do so—unless collaboration unlocks a new narrative.

So ERC-8004 addresses a future problem.

If AI Agents evolve from toys into tools, Ethereum’s trust infrastructure becomes valuable. If the Agent economy grows large enough—and cross-platform invocation becomes routine—ERC-8004 could collect tolls.

That hinges on many “ifs.”

Hence, this forward-looking move will likely be spearheaded first by institutions.

In late 2025, SharpLink Gaming announced a $170 million allocation to Ethereum restaking strategies. Around the same time, exchanges recorded net ETH outflows exceeding 23,000 ETH—flowing into private wallets and staking protocols.

That capital may be buying Ethereum 12–18 months ahead.

For retail investors, ERC-8004 isn’t a strong near-term catalyst.

Betting directly on ERC-8004? It’s an open standard—no token, no direct investment vehicle—so you’d need to identify associated micro-projects. Betting on Ethereum itself is possible, but ETH’s price reflects countless variables; AI Agents represent only one narrative among many.

Thus, there is currently no clean investment vehicle enabling precise exposure to the thesis “AI Agents require on-chain identity.”

Ethereum is not fully AI’s infrastructure—and its identity anxiety won’t vanish entirely with AI. Building AI identity infrastructure remains a long, arduous road.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News