Bankless Founder: By 2026, Tokens Will Finally Be Treated as “Equity”

TechFlow Selected TechFlow Selected

Bankless Founder: By 2026, Tokens Will Finally Be Treated as “Equity”

Protocols have become smarter and more precise in their token distribution mechanisms.

Author: David Hoffman

Translated by TechFlow

TechFlow Intro: Are most tokens garbage? David Hoffman, co-founder of Bankless, points out that historically, teams have treated tokens far less seriously than equity—and markets have responded with pricing accordingly.

But 2026 marks a turning point:

MegaETH locks 53% of its token supply into a KPI-based vesting program—tokens unlock only upon achieving growth targets;

The Cap Protocol replaces governance-token airdrops with stablecoin airdrops (“stabledrops”), and only genuine investors can acquire CAP via token sales.

These innovative strategies are ending the era of “spray-and-pray” token distribution, shifting toward precise, conditional allocation mechanisms.

Full Text Below:

The crypto industry faces a “good coins problem.”

Most tokens are garbage.

Most tokens are not treated by teams with the same legal rigor or strategic seriousness as equity. Because teams have historically failed to grant tokens the same respect afforded to equity in traditional companies, markets have priced them accordingly.

Today, I’d like to share two developments that make me optimistic about the state of tokens in 2026 and beyond:

- MegaETH’s KPI-vesting program

- Cap’s stablecoin airdrop (“stabledrop”)

Conditioning Token Supply

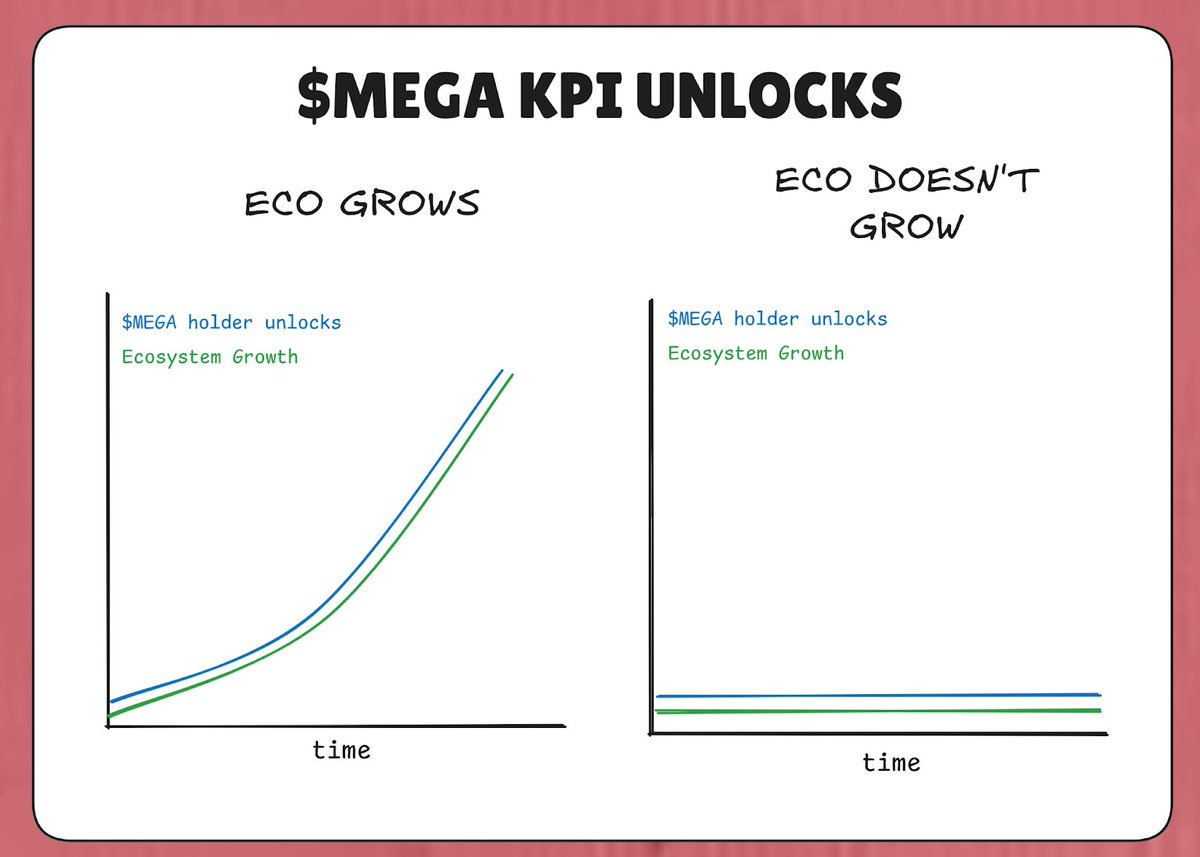

MegaETH locks 53% of its total MEGA token supply into a “KPI Program.” The logic is simple: if MegaETH fails to hit its KPIs (Key Performance Indicators), those tokens remain locked.

So in a pessimistic scenario—even if the ecosystem fails to grow—no additional tokens flood the market to dilute existing holders. MEGA tokens only enter circulation when the MegaETH ecosystem achieves real growth—as defined by its KPIs.

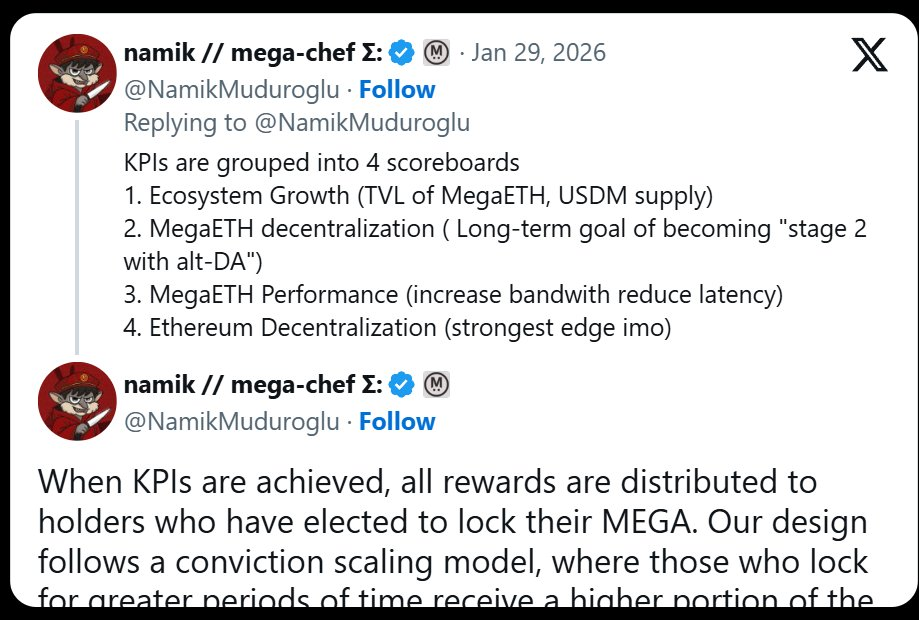

The program defines KPIs across four scoreboards:

- Ecosystem growth (TVL, USDM supply)

- MegaETH decentralization (L2Beat stage progress)

- MegaETH performance (IBRL)

- Ethereum decentralization

In theory, as MegaETH hits its KPI targets, the value of MegaETH should rise correspondingly—mitigating the negative price impact of MEGA dilution.

This strategy mirrors Tesla’s “pay-for-performance” compensation philosophy for Elon Musk. In 2018, Tesla granted Musk an equity compensation plan with tranches that vested only upon achieving both escalating market-cap and revenue targets. Musk received compensation only when Tesla’s revenue and market cap grew.

MegaETH is attempting to transplant that same logic into its tokenomics. “More supply” is not automatic—it must be earned by the protocol through real achievements on meaningful scoreboards.

Unlike Musk’s Tesla benchmarks, I don’t see any KPI targets tied to MEGA’s market cap in Namik’s proposal—perhaps for legal reasons. But as a public-sale MEGA investor, this KPI is genuinely interesting to me. 👀

Who Gets Unlocked Tokens Matters

Another intriguing aspect of this KPI program is who receives unlocked MEGA when KPIs are met. According to Namik’s tweet, those who stake MEGA into a locking contract receive the unlocked tokens.

Those who lock more MEGA—and for longer durations—gain access to the 53% of MEGA tokens entering circulation.

The logic is straightforward: allocate MEGA dilution to those who have already proven themselves as MEGA holders—and who demonstrate interest in holding more MEGA—the people least likely to sell MEGA.

Alignment and Trade-offs

It’s worth emphasizing that this structure also carries risks. History offers cautionary examples where similar designs went badly wrong. Consider this excerpt from Cobie’s article: “(content)”

If you’re a token pessimist, a crypto nihilist, or simply bearish, this alignment risk is exactly what worries you.

Or, from the same article: “Staking mechanisms should be designed to support ecosystem goals.”

Locking token dilution behind KPIs that genuinely reflect growth in the MegaETH ecosystem’s value is a far superior mechanism than the generic staking programs we saw during the 2020–2022 liquidity mining era—when tokens were issued regardless of team progress or ecosystem growth.

So the net effect of MEGA dilution is that it:

- Is proportionally constrained by MegaETH ecosystem growth

- Flows to those least likely to sell MEGA

This doesn’t guarantee MEGA’s value will rise—markets do what markets do. But it is an effective and honest attempt to fix a core underlying problem plaguing the entire crypto token industrial complex.

Treating Tokens Like Equity

Historically, teams have engaged in “spray-and-pray” token distribution across their ecosystems—airdrops, mining rewards, grants, etc. If they were distributing something truly valuable, teams wouldn’t engage in such activities.

Because teams distribute tokens just as casually as worthless governance tokens, markets price them as worthless governance tokens.

You can see the same philosophy reflected in MegaETH’s approach to CEX listings—especially after Binance opened MEGA futures on its platform (a move Binance has historically used to extract concessions from teams):

I hope teams begin to treat their token distributions more selectively. If teams start treating their tokens as precious, perhaps markets will respond in kind.

Cap’s Stablecoin Airdrop

The stablecoin protocol Cap introduced a “stabledrop”—not a traditional airdrop. Instead of distributing its native governance token CAP, Cap distributes its native stablecoin cUSD to users who earn Cap Points.

This method rewards “point farmers” with real value—fulfilling the social contract. Users who deposit USDC into Cap’s supply side accept smart-contract risk and opportunity cost; the stabledrop compensates them accordingly.

For those seeking CAP itself, Cap is conducting a token sale via Uniswap CCA. Anyone seeking CAP must become a genuine investor and commit real capital.

Filtering for Loyal Holders

The combination of stabledrop plus token sale filters for committed holders. A traditional CAP airdrop would flow to speculative farmers likely to dump immediately. By requiring capital investment via token sale, Cap ensures CAP flows to participants willing to absorb full downside risk for upside potential—a group far more likely to hold long-term.

The theory is that this structure increases CAP’s probability of success by building a concentrated holder base aligned with the protocol’s long-term vision—rather than relying on a blunt airdrop mechanism that places tokens directly into the hands of short-term profit seekers.

Watch this video:

https://x.com/DeFiDave22/status/2013641379038081113

Token Design Is Maturing

Protocols are becoming smarter and more precise in how they distribute tokens. Gone is the shotgun-style “spray-and-pray” issuance—MegaETH and Cap deliberately choose who gets their tokens.

“Optimizing distribution” is no longer the goal—perhaps a toxic hangover from the Gensler era. Instead, both teams are optimizing for concentration, building a stronger foundational holder base.

I hope that as more applications launch in 2026, they observe, learn from, and even improve upon these strategies—so the “good coins problem” ceases to be a problem, and all that remains are “good coins.”

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News