Cryptocurrency tokens: A hunting game wrapped in "faith"?

TechFlow Selected TechFlow Selected

Cryptocurrency tokens: A hunting game wrapped in "faith"?

The crypto market does not reward followers, only those who "see through the illusion."

Author: hitesh.eth

Translation: Saoirse, Foresight News

Crypto tokens are fundamentally about belief. They are the purest financial instruments ever created, designed to extract hope from human beings and convert it into liquidity. Token price movements do not stem from utility value, but from narratives, manipulation, and the ability to turn "attention" into a weapon for market control. This is not a normal market—it's a psychological battlefield. Most people have no idea they are merely prey waiting to be slaughtered in this arena.

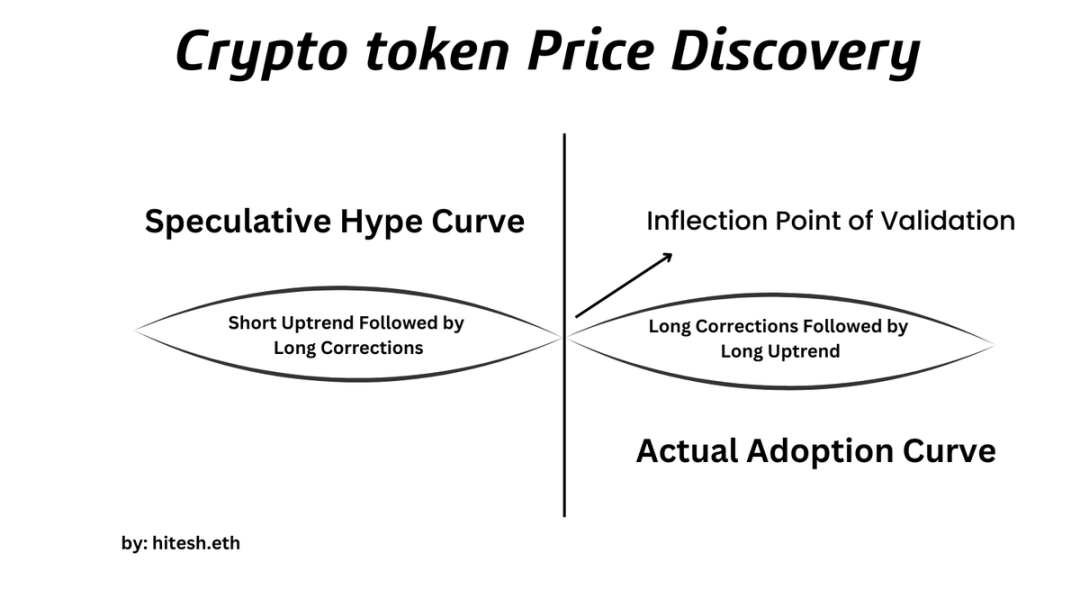

Price Discovery

No matter how grand the narrative, all crypto tokens follow the same price discovery cycle. It begins with the "0-to-1 phase": hype dominates completely while actual usage remains near zero. Prices surge purely on market sentiment, communities form around fictional "future blueprints," and promotional rhetoric drowns out reality. Then, inevitably, a brutal correction arrives—eliminating weak-handed holders and exposing investors who blindly entered based on mere "promises."

The deep downturn period is often the critical turning point. Projects without real demand quietly die: they stop updating tweets, halt technical development, gradually disappear from the market, and their liquidity migrates to other projects. But a few tokens survive and enter the "1-to-10 phase"—where hype cools and actual adoption begins. These tokens experience a slow, uneventful growth phase until real demand reignites a second wave of "belief." It is precisely this second wave that fuels long, powerful bull runs. Only such tokens endure cycle after cycle; most never reach this stage.

The Hidden Truth

Looking ahead, tokens will become meaningless for most projects. Once private companies can directly tokenize equity and raise liquid capital on-chain, the vast majority of crypto tokens will become worthless. Currently, only two areas possess real token value: decentralized physical infrastructure networks (DePIN) and certain segments of decentralized finance (DeFi)—because they incentivize supply-side participation and collaboration. All other token-based activities are本质上 financing schemes disguised as "innovation."

The existence of most tokens reflects founders' desire to quickly raise money—but this era is ending. Better funding methods are emerging, and regulatory policies are on the way. However, meme coins and junk tokens won't disappear; they'll multiply—because gambling is human nature. The only change will be a clearer distinction between "gambling" and "investing": in the future, you won't be able to hide gambling behind the excuse of "long-term investment." You'll have to choose: either admit you're gambling, or commit to real investing. Right now, everyone pretends to be an investor—even those chasing memes and hype.

Psychological Traps

Tokens are essentially "strings of promissory data" designed to manipulate human behavior. Token unlock schedules are engineered to control people's "hope"; vesting timetables are crafted to slowly inject "faith" into the market.所谓的 "incentives" are not just financial lures, but carefully designed emotional traps. The real "product" of these projects isn't the token—it's "belief." Every narrative aims at your reactive mind—the part driven by fear, anxiety, guilt, and desire.

People aren't buying tokens—they're buying an "escape from their current reality." That's why tokens spread faster than logic: belief spreads faster than truth. This is also why coordinated hype exists: VCs get in early, market makers manipulate price action, exchanges time listings, influencers stoke greed, whales quietly accumulate, and retail investors enter last—becoming the "exit liquidity" (bagholders). This isn't a conspiracy—it's the inherent market mechanism, the system's default state.

The Death of Tokens

Tokens grow due to speculation, not utility. Every token fights in the same "battle for attention"—those that fail to retain attention will ultimately die. In this market, attention matters more than "actual use," more than "yield," more than "product engagement." Yet most project teams fail to grasp this, obsessing over price movements while ignoring user growth.

Some projects fabricate "fake growth" through incentives, but once users care more about token price than the product itself, the game is already over. Incentives were meant to be a "bridge to real usage," but are treated as a "substitute for real demand." When a project loses control of its token dynamics and becomes a prisoner of its own price chart, its core mission collapses: founders stop focusing on development and resort to lip service; the vision dies, and the token becomes a curse. For projects that "could have succeeded without a token," the token ultimately becomes their grave.

Exit Liquidity

If you don't know whose hands you're buying tokens from, then you are someone else's "exit liquidity" (bagholder). The price discovery process is essentially a coordinated game orchestrated by insiders: VCs, exchanges, market makers, investment syndicates, whales, and key influencers—all working in tacit coordination to control the market. When retail sees a token "spiking in popularity," insiders have already built positions and are simply waiting for retail to provide liquidity. Seed rounds generate the greatest wealth, but retail never gets access—projects raise at extremely low valuations and list with fully diluted valuations in the billions.

Retail always thinks they're "early," but they're actually late—their entry merely provides an exit opportunity for those who got in at lower prices. To survive this game, you must anticipate narrative trends, enter before influencers start promoting, and accumulate before liquidity incentives launch. If you wait until YouTube bloggers recommend a token, you've already lost. If you're not doing your own research, it's not "investing"—you're merely "borrowing someone else's belief," and borrowed beliefs will eventually leave you broke.

Future Divergence

The crypto space is splitting into two worlds: "regulated crypto" and "crypto anarchy." The former is government-controlled, featuring compliant infrastructure, approved tokens, and full surveillance. The latter is raw, brutal, and free—privacy-driven blockchains and truly decentralized, builder-focused projects will survive here. Tokens were originally symbols of "counterculture," but that culture is dead. Cryptocurrency has betrayed its roots and become "Wall Street on blockchain." However, a "cleansing" is coming: tokens without real demand will die, projects without core missions will vanish.

Narratives without substance will collapse. Only tokens tied to "real applications, real cash flows, and real objectives" will survive; all others will disappear. You must clarify why you're here—because tokens act like mirrors, revealing your greed, impatience, and illusions. Most come seeking "freedom" but get trapped in speculation; seeking "wealth" but lose themselves in greed; seeking "truth" yet become addicted to lies. This market won't save you, nor will narratives—only discipline and insight can. The survival rule is simple: learn the rules, act before the crowd, never be the bagholder, know yourself, and engage in this "battle."

Conclusion

The crypto market doesn't reward followers—it rewards those who "see through the illusion." The crowd is always slow, always chasing hype, always becoming someone else's bagholder. Don't be part of the crowd: build your own process, create your edge, cultivate patience. If you understand this game, you won't fear it—you'll exploit it.

This "cleansing" won't destroy you—it will create opportunities for you. The road ahead won't be easy: the market will test your conviction, timing, patience, emotional control, and your ability to hold onto truth when the crowd drowns in noise. Now is not the time to pray for a bull market—it's time to build your own "belief." Only one question remains: when the next cycle begins, will you be an "early entrant," or once again the "bagholder"?

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News