Token Sale Shake-Up: 10 New Trends for 2026

TechFlow Selected TechFlow Selected

Token Sale Shake-Up: 10 New Trends for 2026

"Institutional-grade sales" and "community-first" sales models will both continue to exist, but they will no longer compete with each other, instead serving different market demands.

Author: Stacy Muur

Compiled by: TechFlow

In 2026, token sale analysis became one of the key pillars of my work. Last year, I launched the Muur Score—a framework for evaluating protocols prior to token generation events (TGE)—and published in-depth analyses of the largest sales of 2025, including Flying Tulip, YieldBasis, Almanak, Lombard, and Falcon.

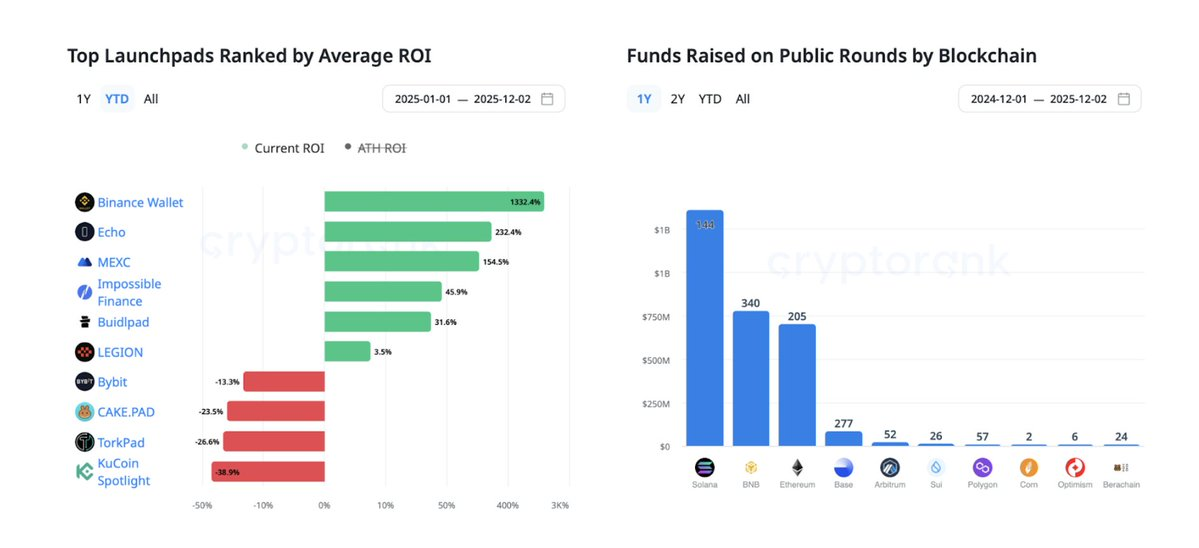

By mid-October 2025, trends in token sales had become unmistakably clear. Launches conducted on @buidlpad, @echodotxyz, @legiondotcc, @MetaDAOProject, @BinanceWallet, @CoinList, and @MEXC_Official consistently performed strongly in both participation and post-TGE return on investment (ROI). While retail market attention returned, it came more with a "gambler" label than an "investor" identity.

In this report, I combine my own first-hand research with insights and forecasts from teams at @legiondotcc, @CoinList, @Chain_GPT, and @impossiblefi. The goal is straightforward: to describe the actual trajectory of token sales in 2026, rather than pretending everything will simply keep going “upward.”

Token Sale Predictions for 2026

1. Continuous Clearing Auctions (CCA) Move from Niche to Mainstream

Uniswap v4's Continuous Clearing Auctions (CCA), highlighted by Aztec’s $2.8 billion fully diluted valuation (FDV) public sale, demonstrated that transparent, non-custodial, on-chain price discovery mechanisms can operate at scale. Around 15–20 major projects are expected to adopt similar models.

CCA directly addresses several long-standing issues:

-

Cyclical accusations of “rigged allocations”;

-

Opacity of off-chain order books;

-

Reputational risks like the FUD (fear, uncertainty, doubt) sparked by Monad’s Coinbase sale.

The broader theme: price discovery will shift from centralized exchanges to public infrastructure.

2. Exchange-integrated Launch Platforms Consolidate Market Share

Kraken’s partnership with Legion and Coinbase’s $375 million acquisition of Echo signal where the market is heading. Binance, OKX, and Bybit are almost certain to follow.

Expected developments:

-

60%–70% of top-tier sales will be conducted simultaneously on native exchange platforms and independent launchpads;

-

A two-tier system will emerge:

-

Tier A: Exchange-backed, high liquidity, institutional allocations;

-

Tier B: Independent platforms focused on community-driven launches.

-

This trend benefits distribution but makes life harder for those trying to run small launchpads out of their garage.

"Recent M&A activity reveals a clear direction: more platforms will integrate token sales as part of broader user acquisition strategies.

We’ll see more vertically integrated 'silos,' but the more interesting development will be the rise of global distribution networks. Imagine cross-regional ecosystems spanning exchanges, partners, and channels.

For example, Legion + Kraken + our upcoming Asian CEX partner—delivering chain-agnostic, platform-neutral global token distribution—will become standard."

——@matty_, Founder of Legion @legiondotcc

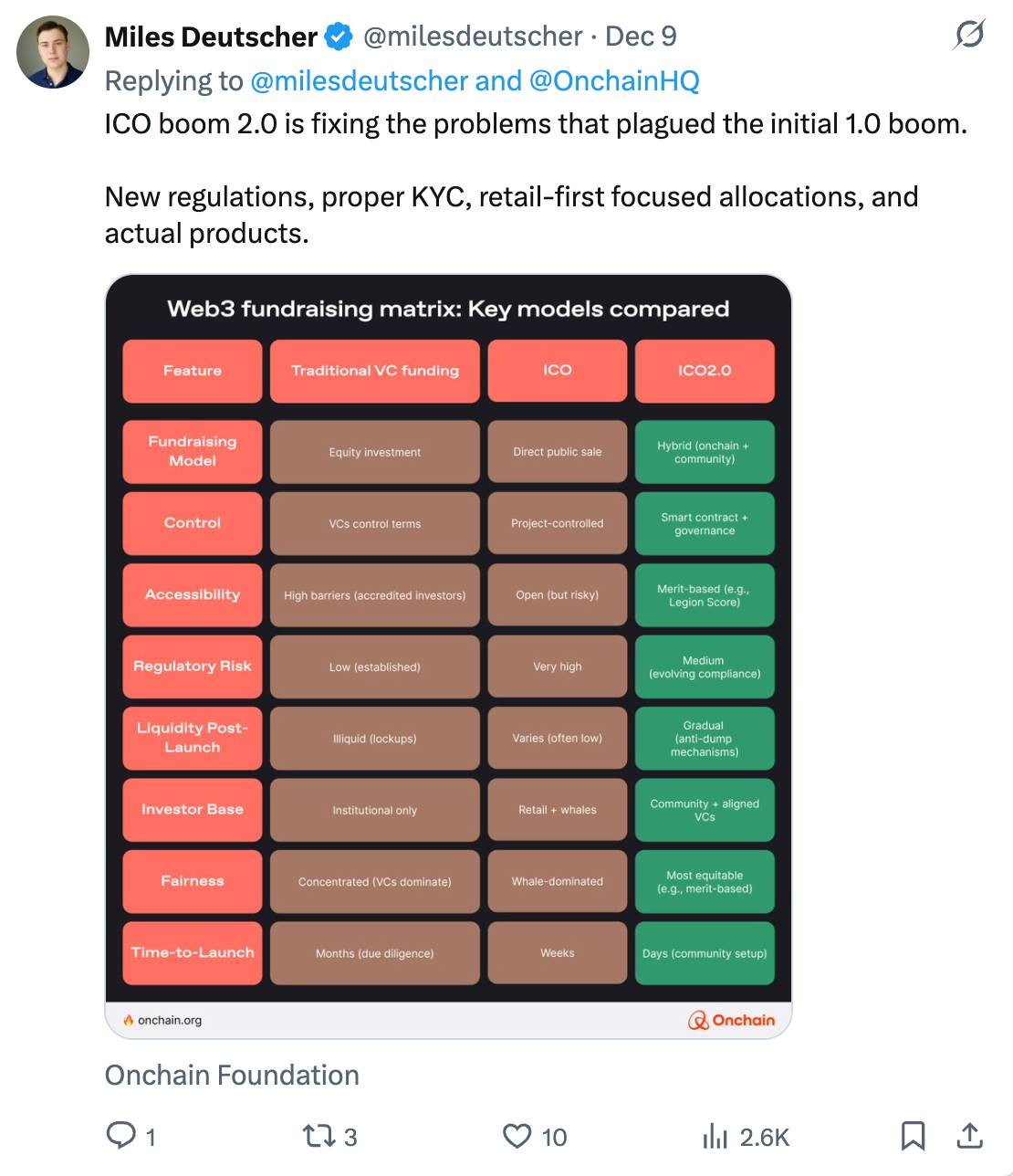

3. Merit-Based Allocation Replaces First-Come, First-Served

The first-come, first-served (FCFS) model is effectively dead, as bot armies have completely undermined its fairness.

Legion’s merit-based scoring system—factoring engagement, reputation, and value alignment—is becoming an industry template. Other platforms will introduce mechanisms such as:

-

On-chain history;

-

Long-term participation data;

-

Social graph scoring.

While this reduces Sybil attacks to some extent, it introduces new risks: systems akin to “crypto credit scores” will favor early adopters and disadvantage newcomers.

Fairer, but absolutely not equal.

"By 2026, the token sale market will polarize around two dominant models: fully compliant professional launchpads and permissionless 'meme' launchpads. Mid-sized, ambiguously positioned platforms will struggle, as distribution capability becomes the key competitive advantage—projects will choose platforms that reliably deliver real users, liquidity, and secondary market support."

——@0xr100, Chief Marketing Officer at Impossible Finance @impossiblefi

4. Institutional Allocations Become Standardized

As traditional finance deepens its involvement in tokenization, institutional allocation tiers are expected to become formal components of token sale structures, featuring:

-

20%–30% allocation quotas;

-

12–24 month lock-up periods;

-

Structured book-building processes.

Think of it as a “lightweight IPO on-chain.”

Platforms like Legion are already positioning themselves as underwriters in crypto, and 2026 will cement this role as industry standard.

"We’ll see deeper integration between launchpads and centralized exchanges (CEX). Specialized launchpads will evolve into modular infrastructure providers, offering KYC, audited sale contracts, and embeddable sale widgets for projects to host on their own websites. Anti-Sybil filters based on on-chain and social data will become standard, and lockdrop distributions will gain further traction as a core distribution mechanism."

——@0xr100, Chief Marketing Officer at Impossible Finance @impossiblefi

5. Multi-Platform Launches Become Normal for Top Projects

WalletConnect raised $10 million across CoinList, Bitget Launch X, and Echo, setting a benchmark for multi-platform distribution. For major projects:

-

Simultaneous launches across 3–5 platforms will become standard;

-

Distribution efficiency increases;

-

Concentration risk decreases;

-

Coordination complexity rises (but that’s the project’s problem, not yours).

"I believe projects will increasingly select launch platforms based on specific needs, often partnering with multiple platforms at once. This is definitely not a 'Coinbase-or-nothing' world. The ICO revival began well before Coinbase entered, which is exactly why they decided to get involved."

——@AlexTops1, Marketing Director at CoinList

Projects refusing multi-platform launches will appear either underfunded or overly centralized.

"We’re moving from isolated single launches to coordinated multi-platform fundraising. Launchpads and CEXs will collaborate more frequently, and the market will split into two distinct categories:

-

Institutional-focused sales: larger amounts, longer lock-ups, strict compliance;

-

Community-first sales: smaller allocations, merit-based access, usage-driven scoring.

Buyers will also begin demanding standardized safeguards: minimum liquidity and market-making commitments, clearer retail lock-up mechanisms, and even refund or clawback clauses if outcomes fall severely short. Less 'launch and pray,' more structured financing that makes sense for both projects and buyers—not just gut feeling, but data-driven rationale."**

——@CEOGuy, CEO & Founder of Chain_GPT

6. Compliance Becomes a Competitive Barrier

Legion’s MiCA-compliant structure and ongoing dialogue with the U.S. SEC mark a turning point:

Compliance is no longer an optional “signal”—it’s a business model.

Expected trends:

-

“Compliance-first” launchpads will emerge;

-

Full KYC and AML will become baseline requirements;

-

Exchanges will take a zero-tolerance stance toward non-compliant sales;

-

Demand for zero-knowledge (ZK)-based identity tech will rise (finally, a real use case beyond “anonymous Discord users proving they’re human”).

Projects launching on non-compliant platforms will face faster delistings and reduced institutional demand.

"To date, most crypto fundraising has been limited to native digital assets—such as utility tokens, gas tokens, and structures designed to avoid being classified as securities.

With the anticipated SEC working group introducing an ‘innovation exemption,’ ‘crypto projects’ framework, and possibly the Clarity Act in early 2026, we’ll see new asset classes attempt on-chain distribution.

This includes early-stage tokenized equity for startups."

——@matty_, Founder of Legion @legiondotcc

7. Bear Market Pressures Drive 'Quality Over Quantity'

Market conditions at the end of 2025 brought:

-

Pronounced bearish sentiment;

-

About $4 billion in ETF outflows;

-

Declining liquidity in major tokens.

If these trends persist into 2026, we’ll see:

-

Number of token launches drop from over 500 to 150–200;

-

Average raise size increase 3–5x;

-

Low-quality, meme-driven sales disappear;

-

Infrastructure and product-ready projects dominate.

This is a classic “flight to quality” cycle—fewer winners, but much larger ones.

"Both extremes of 2025 failed.

On one hand, high-FDV, high-raise projects whose underlying products couldn’t justify valuations—markets corrected immediately post-TGE.

On the other, low-FDV projects lacking liquidity, poor market making, weak exchange support—collapsed for precisely the opposite reasons.

In 2026, we shift from brute-force launches to carefully engineered ones. Serious buyers will focus on fundamentals that actually determine outcomes: FDV relative to progress, real user adoption, liquidity depth, quality of market makers, and platform reliability. High-quality projects will still raise substantial funds—but won’t try to drain the entire pool on day one.

Launchpads and CEXs will compete on downside protection, minimum liquidity standards, clear market-making commitments, and simple safety or refund mechanisms—not just hype."

——@CEOGuy, CEO & Founder of Chain_GPT

8. Dynamic Pricing Replaces Fixed FDV

The success of Continuous Clearing Auctions (CCA) has reignited interest in fairer pricing models. Expect to see:

-

Dutch auctions with soft floors;

-

Binding curves with circuit breakers;

-

Demand-based pricing driven by machine learning/AI systems.

The era of “Here’s our $4B FDV—applaud please” is over.

Fixed valuations will be replaced by pricing ranges—reducing post-TGE sell pressure, though dampening retail excitement (no one brags about their auction clearing price at parties).

"ICOs are no longer just fundraising tools.

They’re a way for projects to attract new users, build awareness, and decentralize their networks.

If Coinbase ICO buyers never leave the platform or dump their tokens the next day, how much real value did the project create?

As Aztec’s highly successful token sale showed, many teams want these users to enter their apps, with token sales and distribution fully decentralized and on-chain.

The market is shifting toward verifiable on-chain finance where users hold their own private keys. CoinList is meeting this demand by becoming more crypto-native and user-centric. The cypherpunk dream is returning. About time."

——@AlexTops1, @CoinList Marketing Director

9. Post-Launch Liquidity Guarantees Become Industry Standard

After the FUD (fear, uncertainty, doubt) caused by fake trading in the Monad launch, platforms realized that even the best launch mechanics are meaningless if post-launch liquidity collapses.

By 2026, expect:

-

Mandatory 6–12 month market-making commitments;

-

Platforms offering standardized liquidity service-level agreements (SLAs);

-

New post-TGE stability metrics.

Projects without professional liquidity providers will struggle to raise funds.

Today, retail investors care more about liquidity assurances than token code—a welcome shift.

10. Community Vesting Replaces Immediate Unlock

Coinbase’s “early sell → future penalty” model is evolving into:

-

3–6 month vesting periods for retail participants;

-

Vesting curves similar to team/seed rounds;

-

Transferable “vesting rights” (yes, a whole new secondary market will quickly emerge).

This model reduces sell pressure but risks “vesting fatigue”—a market flooded with illiquid, poorly priced vested assets.

By end of 2026, roughly half of all launches are expected to adopt community vesting models.

Market Structure Implications

Token sales will split into two ecosystems:

1. Institutional-Grade Sales

-

Multi-platform, exchange-integrated;

-

Raise sizes over $50 million;

-

Highly compliant;

-

12–24 month lock-ups;

-

Professional market-making services.

2. Community-First Sales

-

Single platform + merit-based scoring;

-

Raise sizes between $5M–$20M;

-

Partially compliant;

-

3–6 month lock-ups;

-

Social-graph-based participation mechanisms.

Both models will coexist, but they’ll serve different market needs rather than compete directly.

Key Risks to Watch

-

Regulatory actions against non-compliant platforms could fragment the market;

-

A prolonged bear market could shrink all predictions by ~50%;

-

Over-concentration on Coinbase and Kraken may weaken market competition;

-

Vesting overload could lead to chaos in gray markets for vested rights.

What Do Token Sale Experts Say?

Which protocols will raise funds most effectively?

@matty_, Founder of Legion @legiondotcc: Revenue-linked consumer apps and B2B tokens will continue to perform well

"We’ll see current performance trends amplified.

Consumer DeFi and apps users genuinely love—especially those with clear revenue paths or buyback logic, even at smaller scale—will continue leading the market.

In the institutional space, B2B tokens that generate real income streams for holders will remain among the strongest performers."

@CEOGuy, CEO of @Chain_GPT: Fundamentals will matter more

"Projects that raise effectively will look like real businesses, not just stories wrapped in tokens.

It comes down to three things:

-

Real users and use cases, not just testnets and whitepapers;

-

Clear product differentiation with significant advantages over existing alternatives;

-

Coherent token utility with credible, tangible value capture.

Add reasonable FDV, clear sale structure, and founding teams with real track records in big tech or prior crypto projects—and even in cold markets, capital won’t trickle in, it’ll rush in."

@0xr100, CMO at Impossible Finance @impossiblefi: High-growth projects and infrastructure solutions will dominate fundraising

"Applications with strong growth metrics (revenue, real users, meaningful TVL) backed by genuine distribution power—beyond just 'top VC' logos, but ecosystem giants that drive adoption—will stand out.

Infrastructure will remain a strong fundraising category, but apps with real users and revenue will increasingly outperform those relying solely on narrative.

Winning combinations will be 'hot narratives + infrastructure angles' across prediction markets, AI (especially robotics), and RWA (real-world assets), often delivered via lockdrops and data-driven distribution."

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News