Valuation Methods for Utility Tokens: An Analytical Framework Based on the Equation of Exchange

TechFlow Selected TechFlow Selected

Valuation Methods for Utility Tokens: An Analytical Framework Based on the Equation of Exchange

Using BNB as a representative case, conduct an in-depth analysis of its economic model, on-chain applications, and valuation logic.

Author:

Jessica Feng, Investment Manager of Hash Global BNB Fund;

James(KK) Shen, Founder of Hash Global.

CZ (Founder of Binance):

"I'm not skilled in valuation models, but Hash Global's previous forecasts have consistently come true. Token value likely consists of many dimensions, so if such a simple formula can capture all aspects of value, that would be impressive. Market prices often deviate from fundamentals—sometimes too high, sometimes too low. Binance will continue building and strengthening the fundamental value of BNB, while leaving market price assessments to experts like Hash Global."

Liang Xinjun (Co-founder of Fosun Group):

"I've collaborated with the Hash Global team for many years. One thing I particularly appreciate is that although their investments occasionally involve mistakes, every decision is grounded in rational analysis rather than blind faith. They communicated early with me about Binance’s ecosystem and the value of BNB. I participated early in their node staking and BNB fund investments, which delivered solid returns. I've reviewed numerous institutional research reports on Bitcoin and Ethereum; in the case of BNB, I believe Hash Global's analysis has been the earliest and best in the industry."

Chen Long (Secretary-General of Luohan Academy, Founder of Weixi, former Chief Strategy Officer at Ant Financial):

"Although Web3 is increasingly becoming a new pillar of the financial system, there remains no consensus on how to value digital assets. Hash Global's analytical framework based on the equation of exchange offers a highly valuable perspective.

If a country’s money supply grows in line with economic growth, inflation won’t occur—this is the well-known concept of seigniorage revenue. It implies that economic transactions require the lubricating function of money. Assuming stable velocity of money, the overall value of money moves in tandem with the scale of economic transactions.

Based on this principle, the equation-of-exchange framework can estimate the total value of ecosystem tokens by focusing on transaction volume. While this method relies on many assumptions, its logic is fundamentally grounded—an evident improvement over most existing digital asset valuation approaches—and deserves continuous refinement. Returning to first principles of value creation is a good starting point."

Wang Jingbo (Founder of Noah Wealth):

"As the largest wealth management platform serving the global Chinese community, Noah has consistently monitored emerging new asset classes and their value. Regions like the U.S. and Hong Kong are actively advancing regulatory frameworks for digital assets, and we observe that digital assets are being accepted by mainstream markets. We place strong emphasis on guiding and helping investors learn and understand the value of digital assets promptly. Over the past two years, we’ve invited the Hash Global team multiple times to share insights with our investors. Their research and analysis on 'value-functional tokens' have brought us many fresh perspectives and insights. Their attitude and methodology deserve attention and reference."

Wei Zhijie (Head of Wealth Management at KGI International):

"With years of experience in wealth management, I’ve long assisted family offices with intergenerational succession and asset allocation. KGI has observed that digital assets improve the risk-return profile of investment portfolios and are guiding clients toward rational understanding and accelerated adoption. We pay particular attention to utility tokens with clear economic models and real-world applications. Hash Global’s innovative research in this emerging asset class has provided us with significant inspiration. We’re collaborating with them to explore the value of these assets and advance traditional finance investors’ understanding of their worth."

I. Introduction

In recent years, the rapid development of Web3 financial infrastructure is reshaping capital market operations. Its programmability and openness are redefining sources of asset value, driving the emergence of a new class of assets. These novel assets not only carry traditional equity-like value—mirroring the value of platforms, protocols, or ecosystems—but also possess clear utility value, enabling fee payments, service discounts, access permissions, and more. This report refers to such new assets collectively as "value-functional tokens," denoting composite assets combining both "asset characteristics" and "usage rights."

The emergence of these new assets is evolving the very concept of "value," requiring value investors to evolve their valuation methodologies—just as the internet revolution in the early 21st century introduced new valuation logics for internet stocks. John Pfeffer, an early advocate of value investing in crypto assets, stated: "The first principle of value investing is independent thinking based on reliable valuation logic. When new assets emerge without established valuation methods, value investors should strive to discover new ones."

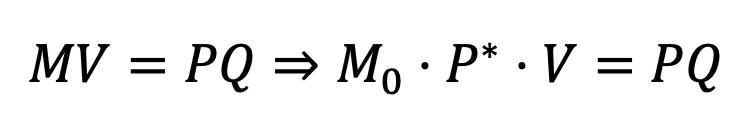

We believe the most representative current example of a value-functional token is Binance Coin (BNB), the native token of Binance, the world’s largest cryptocurrency exchange. BNB reflects platform value while serving practical functions within its ecosystem—making it the earliest and most mature exemplar of this asset class. As early as 2017, Binance finalized BNB’s tokenomics, pioneering the definition of value-functional tokens. In 2019, adhering to the first principles of value investing, we proposed a valuation framework based on the equation of exchange (MV = PQ) using BNB as a template to assess the value-generation logic of BNB and similar tokens.

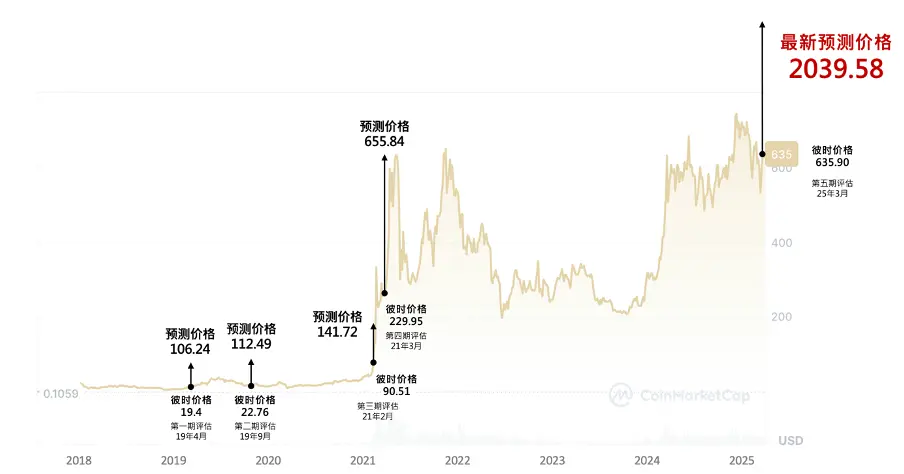

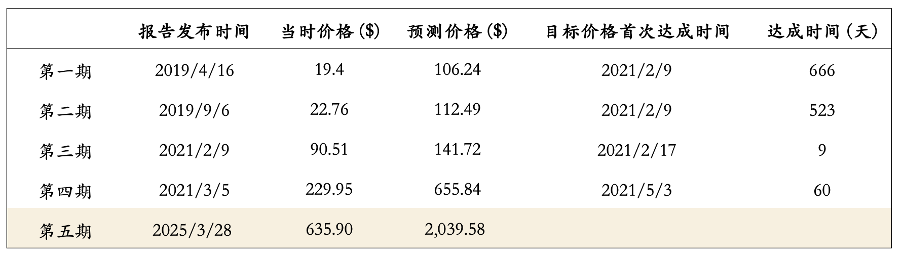

Over the past six years, we have released five successive reports, receiving extensive inquiries and feedback from investors and institutions. We have continuously refined our model, which has received preliminary market validation. We now present this methodology systematically, hoping it aids asset managers, investors, researchers, and project teams in analyzing and making decisions regarding investment evaluation, asset pricing, and tokenomic design for value-functional tokens.

Web3’s distributed ledger technology has already—and will permanently—transformed the foundation of capital markets. A more efficient, transparent Web3 financial system will become central to future financial infrastructure. With ongoing improvements in global crypto regulation—such as the recent U.S. passage of the “CLARITY Act” and stablecoin legislation in both the U.S. and Hong Kong—we anticipate a surge in value-functional tokens like BNB. Just as Tesla might issue new “stock,” it could instead launch a value-functional token on Ethereum or Binance Chain—carrying not just “equity value” but also usable benefits like discounted charging at EV stations via the ecosystem token. We expect value-functional tokens to become the dominant form of asset carriers in future capital markets!

II. Definition and Characteristics of Value-Functional Tokens

The value-functional token defined in this report refers to a crypto asset possessing both of the following value foundations:

1. Asset Characteristics / Equity-Like Attributes: Representing the value of a platform, protocol, or ecosystem. Its value is typically driven by macro factors such as ecosystem size, user growth, and transaction activity—logically analogous to corporate equity.

2. Functional Characteristics / Currency-Like Attributes: Serving practical roles in specific use cases, such as paying fees, gas (Gas), staking, governance participation, service redemption, or accessing platform discounts.

For this class of asset, this report adopts the equation of exchange (MV = PQ) as the basis for valuation modeling, primarily due to the following two considerations:

First, while value-functional tokens exhibit certain "equity-like" traits, their asset nature differs from traditional securities. Taking BNB as an example, the token does not represent any form of equity or cashflow rights in Binance the company. From inception, Binance’s founding team aligned incentives across all ecosystem participants (shareholders, management, users, and other stakeholders) by anchoring ecosystem value growth onto its sole native token, BNB—embodying Web3’s ethos of co-creation and shared benefits. Starting in 2021, Binance further evolved BNB’s burn mechanism from "profit-linked buyback and burn" to "on-chain volume-based automatic burn," deliberately severing the direct link between token value and platform financial performance to mitigate securities risks.

In 2025, the U.S. CLARITY Act clearly distinguished between "digital commodities" and "security tokens." Under this regulatory direction, we believe future value-functional tokens will trend toward the "digital commodity" category—drawing value support from traditional equity concepts while avoiding structural features that meet the criteria for "investment contracts" or the Howey Test for security tokens. Therefore, these tokens lack the legal attributes of traditional equity assets, and conventional discounted cash flow (DCF) enterprise valuation models are unsuitable for assessing them.

On the other hand, the value of utility tokens primarily stems from their actual use cases within the ecosystem. They serve functions such as payment, gas, staking, initial offerings, and governance—essentially operating as circulating currency within the economy. Their value is influenced by the scale of economic activity, frequency of token usage, and supply adjustment mechanisms. Thus, compared to securities valuation methods, the equation of exchange better captures the "currency-like" nature of these tokens and integrates diverse value sources into a unified logical framework.

In summary, the core advantage of applying the equation of exchange to value-functional tokens lies in providing a structured, quantifiable, and adaptable analytical framework capable of encompassing all value drivers of such tokens.

III. Valuation Model Construction

This methodology combines the equation of exchange (MV = PQ) with the discounted cash flow (DCF) approach to build a systematic valuation model suitable for value-functional tokens:

MV = PQ: To construct the structural logic framework for token value generation

+

DCF: Discounting and summing future "monetary appreciation" driven by ecosystem expansion to derive the token’s current theoretical price

3.1 Overview of the Equation of Exchange (MV = PQ)

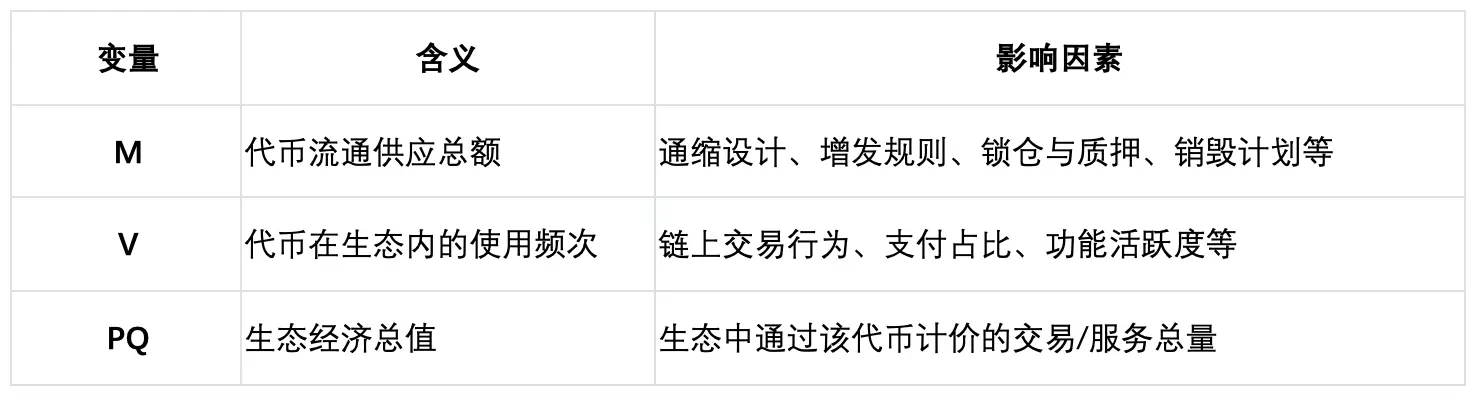

The quantity theory of money, proposed by economist Irving Fisher, is a classic theory explaining the relationship between money supply and economic activity. Where:

· M: Money Supply

· V: Velocity of Money

· P: Price Level

· Q: Total Volume of Transactions or Output

In traditional macroeconomics, MV represents total money demand, while PQ represents nominal economic output—both expected to equilibrate in the long run.

We argue that functional tokens with real-world use cases in on-chain ecosystems play an economic role highly analogous to "money within the ecosystem." Their value originates mainly from ecosystem expansion and changes in token supply-demand dynamics—aligning closely with the logic of the equation of exchange. This model is especially suitable for tokens exhibiting the following traits:

1. Serving as the primary medium of exchange within the ecosystem (e.g., fees, Gas);

2. Having a transparent issuance regime, deflationary design, or lock-up mechanisms affecting effective circulating supply;

3. Deriving value primarily from ecosystem activity growth.

3.2 Structural Modeling Based on the Equation of Exchange

Under the MV = PQ framework, a token’s theoretical value is driven by two main pathways:

· PQ: The total economic value of the ecosystem

· M × V: Representing token supply and its velocity of circulation

Any variable affecting token value (e.g., number of users, transaction volume, burn mechanisms) ultimately impacts the token price through its effect on either PQ or M × V.

Among these, V (velocity) presents a technical challenge in modeling. Due to lack of directly observable data, valuations often assume that current market prices reflect a reasonable equilibrium state, allowing backward calculation of V from known PQ and M values. This calculated velocity is then assumed to remain stable—or moderately increase or decrease—over time.

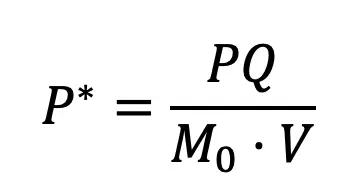

Theoretical Price Derivation:

Unlike national fiat currencies, ecosystem token prices are typically denominated in USD. Therefore, in the model, the total circulating value of the token (M) can be expressed as:

Where:

M0: Actual circulating supply of the token

P*: Theoretical token price (in USD)

V: Velocity of token circulation

Rearranging yields:

The theoretical token price equals the total ecosystem value (PQ) divided by the product of circulating supply and velocity. This formula forms the foundation of our valuation model.

3.3 Incorporating Discounted Cash Flow (DCF) for Quantitative Valuation

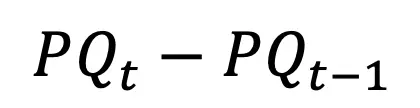

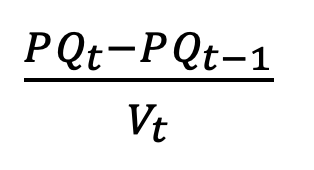

The equation of exchange provides a logical framework for token value generation but does not directly yield a price. Building on this, we introduce the discounted cash flow (DCF) method. By forecasting the growth of total ecosystem economics, combined with changes in token supply and velocity, we calculate annual increments in per-token value and discount and sum future values to obtain a theoretical valuation. This process can also be understood as calculating the present value of "monetary appreciation."

The specific steps are as follows:

1. Predict Key Variables (PQ, M₀, V)

Based on token mechanics and business outlooks, forecast annually the ecosystem economic scale PQt, actual circulating supply M0t, and velocity Vt.

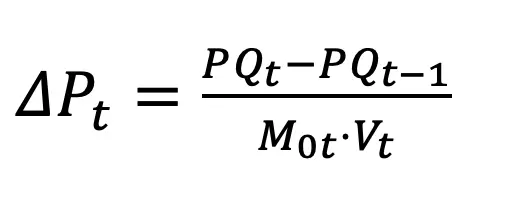

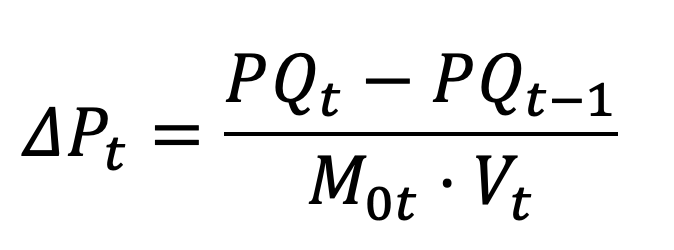

2. Calculate Annual Token Value Increment (ΔPt)

Annual incremental ecosystem value:

Corresponding incremental monetary demand:

Corresponding token value appreciation:

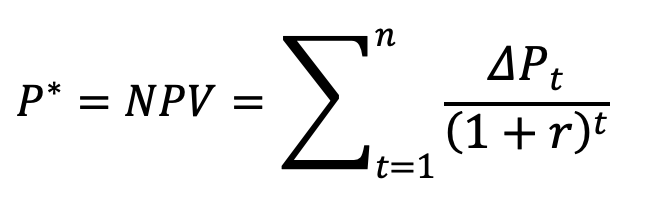

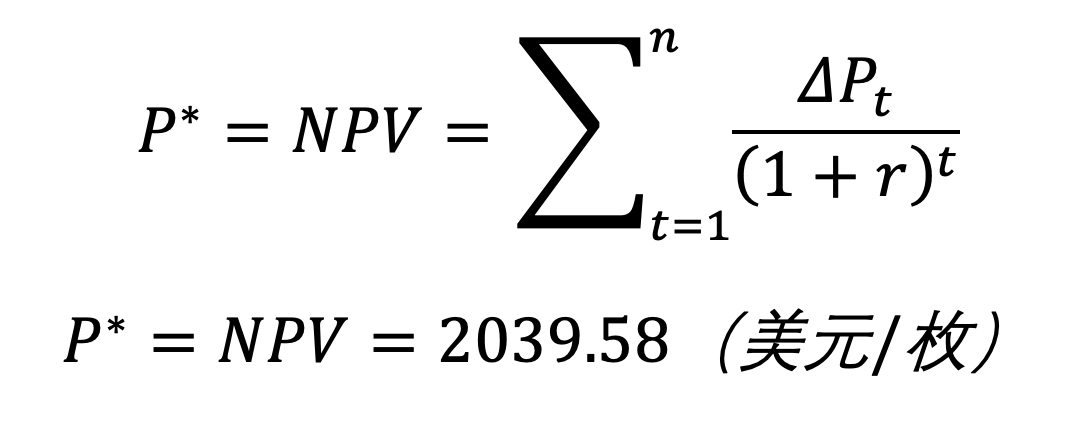

3. Discount Future Value Increments

Using a fixed discount rate (e.g., 10%), discount and sum each year’s ΔPt to obtain the total present value of appreciation—the theoretical token price:

Where:

r: Discount rate

NPV: Net Present Value of total appreciation

P*: Theoretical token price

IV. Valuation Case Study: BNB

To demonstrate the applicability of this valuation method, we apply our proposed "MV = PQ plus DCF" model to conduct a quantitative valuation analysis of BNB.

4.1 BNB as a Value-Functional Token: The Equation of Exchange Is the Optimal Valuation Model

BNB is the core value carrier of the Binance ecosystem (Binance Exchange + BNB Chain), with dual sources of value:

1. Asset Characteristics / Equity-Like Attributes: BNB’s economic model incorporates traditional financial value creation logic. Similar to U.S. companies enhancing shareholder equity through stock buybacks and cancellations, BNB uses quarterly burn mechanisms to continuously reduce circulating supply, creating a long-term deflationary trend that supports price stability. However, unlike traditional equity, BNB’s burn mechanism is not tied to platform profits but anchored to supply-demand dynamics within the ecosystem. Thus, BNB is not strictly an equity asset but possesses "equity-like" attributes—using burns to reduce BNB’s actual circulating supply and thereby establish a value linkage between BNB and the Binance ecosystem.

2. Functional Characteristics / Currency-Like Attributes: BNB serves multiple functions within the Binance Exchange and public chain ecosystem—including paying trading fees, participating in initial offerings, acting as Gas Fee on-chain, and engaging in governance. BNB has effectively become the "circulating currency" of the entire ecosystem, with its value dependent on changes in the scale of the ecosystem economy and the token’s supply-demand dynamics within it.

In summary, as the ecosystem’s circulating currency, BNB’s value primarily depends on monetary supply-demand (MV) and ecosystem economic value (PQ). Therefore, the equation of exchange comprehensively captures BNB’s core value drivers and is the optimal valuation model.

4.2 BNB Valuation Calculation

The analysis proceeds along three core steps:

1. Define and forecast key variables PQ, M₀, V

2. Calculate annual token value increment ΔPt

3. Apply discounted cash flow to sum future incremental values

1. Define and Forecast Key Variables: PQ, M₀, V

Total Ecosystem Economic Value PQ

The Binance ecosystem includes Binance Exchange and BNB Chain. Thus, PQ represents the total economic activity driven by BNB across both components, including:

1. Portion of spot and derivatives trading fees on Binance CEX paid in BNB (trading volume × fee rate × proportion paid in BNB, assumed at 50%);

2. BNB Chain Gas fees (total Gas revenue on-chain).

In projections, assuming annual ecosystem growth rates as follows, we aggregate to obtain the nominal economic output PQt for each future year:

· 2025–2027: 25%, 15%, 10% respectively;

· 2028 onward: long-term stable growth rate of 3%.

Total Circulating Supply M₀

According to Binance’s whitepaper and on-chain data, BNB’s initial total supply was 200 million. After deducting team-locked holdings (~80 million) and cumulative historical burns (~11.65 million), the current theoretical circulating supply is approximately 108 million. Given Binance’s current and projected burn mechanisms, circulating supply is expected to remain around this level from 2025 to 2027, gradually stabilizing long-term at 100 million. This represents the maximum supply available for secondary market trading, excluding ecological use cases.

Further subtracting four major locked-use scenarios (fee payments, node staking, financial products, long-term value holding), we obtain the actual circulating supply M₀t.

Velocity V

BNB’s velocity cannot be directly measured. We use reverse calculation: deriving a base velocity value of 0.57 from 2024’s actual market price, PQ, and M₀. For future years, we set a ±10% range and validate its impact on valuation through sensitivity analysis.

2. Calculate Annual Value Increment ΔPt

Using the formula from the previous section:

We compute annual incremental ecosystem value and divide by BNB’s annual actual circulating supply and velocity to obtain the theoretical per-token value increment each year.

Based on 2024 actual data, assuming growth of 25%, 15%, 10% over the next three years, then 3% long-term:

3. Discount and Sum Values: Compute Theoretical Valuation

Using a 10% discount rate, discount each year’s ΔPt to obtain the net present value of all future "monetary appreciation":

4.3 Hash Global’s Past Four Reports – BNB Target Price Achievement Timeline

V. Conclusion

This report, using BNB as a case study, introduces the concept of "value-functional tokens" as a new asset class and constructs a systematic valuation framework based on the equation of exchange. We hope this framework provides reference and inspiration for project teams designing tokenomics, investors making value judgments, and researchers evaluating models.

Given that the Web3 industry remains in rapid evolution, we will continue updating our models and research findings. We welcome discussions and feedback from investment institutions, researchers, and developers.

To receive report updates, model details, or initiate further dialogue, please visit our official website or contact team members. We look forward to your feedback and suggestions:

• Website: www.hashglobal.io

• Authors’ Twitter: @longwinsk, @Jf4172

• Contact Email: contact@hashglobal.net

Disclaimer

This report is intended solely for informational purposes and does not constitute investment advice nor should it be construed as a guarantee of future market performance. The report is based on independent research and publicly available information by Hash Global. While we have made every effort to ensure the accuracy and completeness of the data and analysis, we make no commitments or warranties regarding the applicability of the final results or opinions. Investing in crypto assets involves high uncertainty and volatility. Readers should fully understand the associated risks and bear full responsibility for any investment decisions. Hash Global and its personnel shall not be liable for any direct or indirect losses arising from the use of this report.

As of the date of this report, Hash Global and its managed funds hold certain BNB assets, and related analyses and views may be influenced by such holdings. We will continue monitoring these assets based on market developments and update our research when necessary.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News