Hyperliquid and Pump.fun's "Token Deflation Experiment"

TechFlow Selected TechFlow Selected

Hyperliquid and Pump.fun's "Token Deflation Experiment"

Cryptocurrency projects are attempting to replicate the long-standing success path of Wall Street's "dividend aristocrats" (such as Apple, Procter & Gamble, and Coca-Cola).

By: Prathik Desai

Translation: Saoirse, Foresight News

Seven years ago, Apple accomplished a financial feat whose impact surpassed even its most iconic products. In April 2017, the company opened its $5 billion "Apple Park" campus in Cupertino, California; a year later, in May 2018, it announced a $100 billion stock buyback program—20 times the amount invested in the sprawling 360-acre headquarters known as the "spaceship." This sent a clear message from Apple: beyond the iPhone, it had another product of equal—or perhaps even greater—importance.

This was the largest stock buyback in global history at the time and part of Apple’s decade-long repurchase spree—during which it spent over $725 billion buying back its own shares. Exactly six years later, in May 2024, the iPhone maker broke its own record by announcing an $110 billion buyback plan. This move demonstrated that Apple not only knows how to create scarcity in hardware but also masters the art of doing so with its stock.

Now, the cryptocurrency industry is adopting similar strategies—faster and at larger scale.

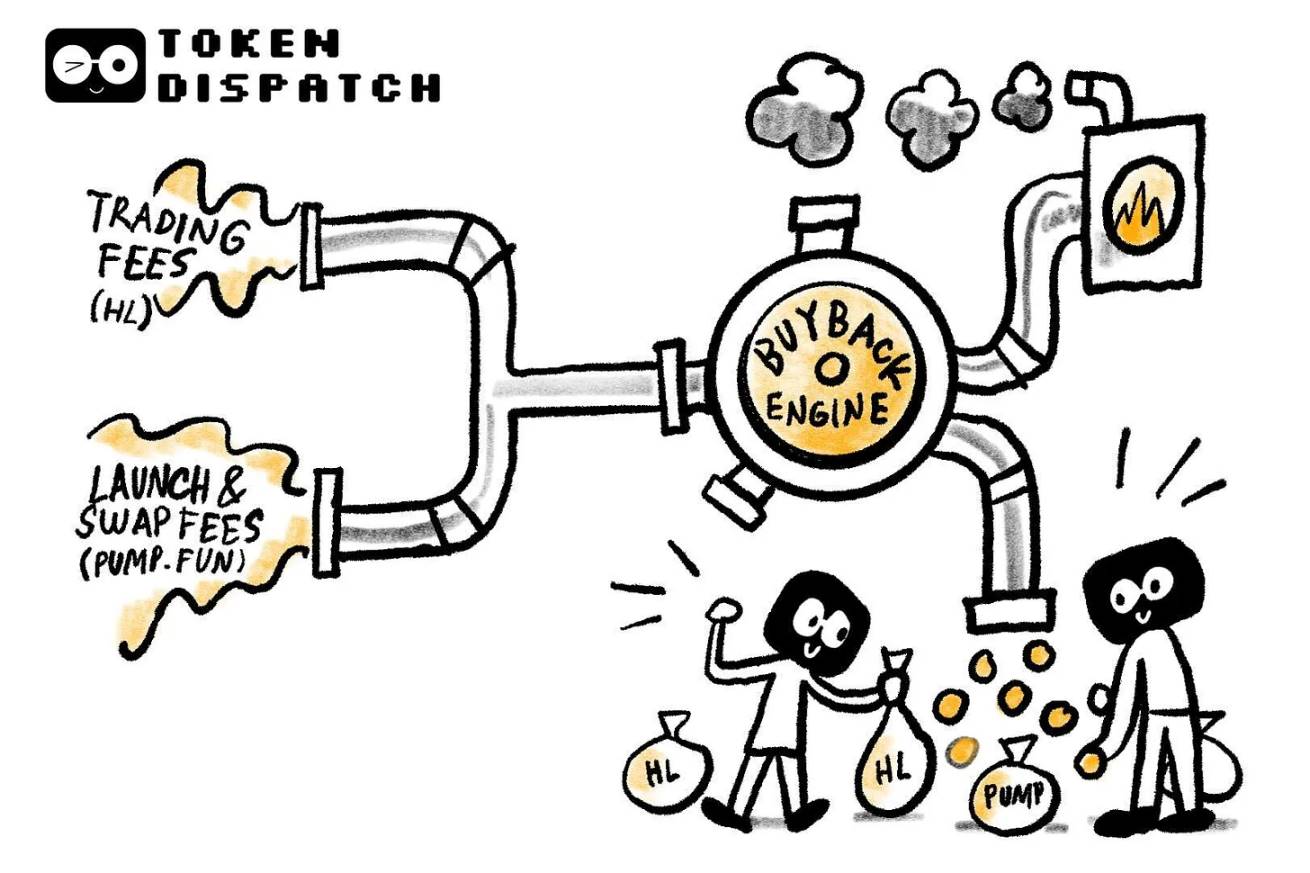

The two major "revenue engines" in the sector—the perpetual futures exchange Hyperliquid and the meme coin launch platform Pump.fun—are using nearly every dollar of fee revenue to repurchase their native tokens.

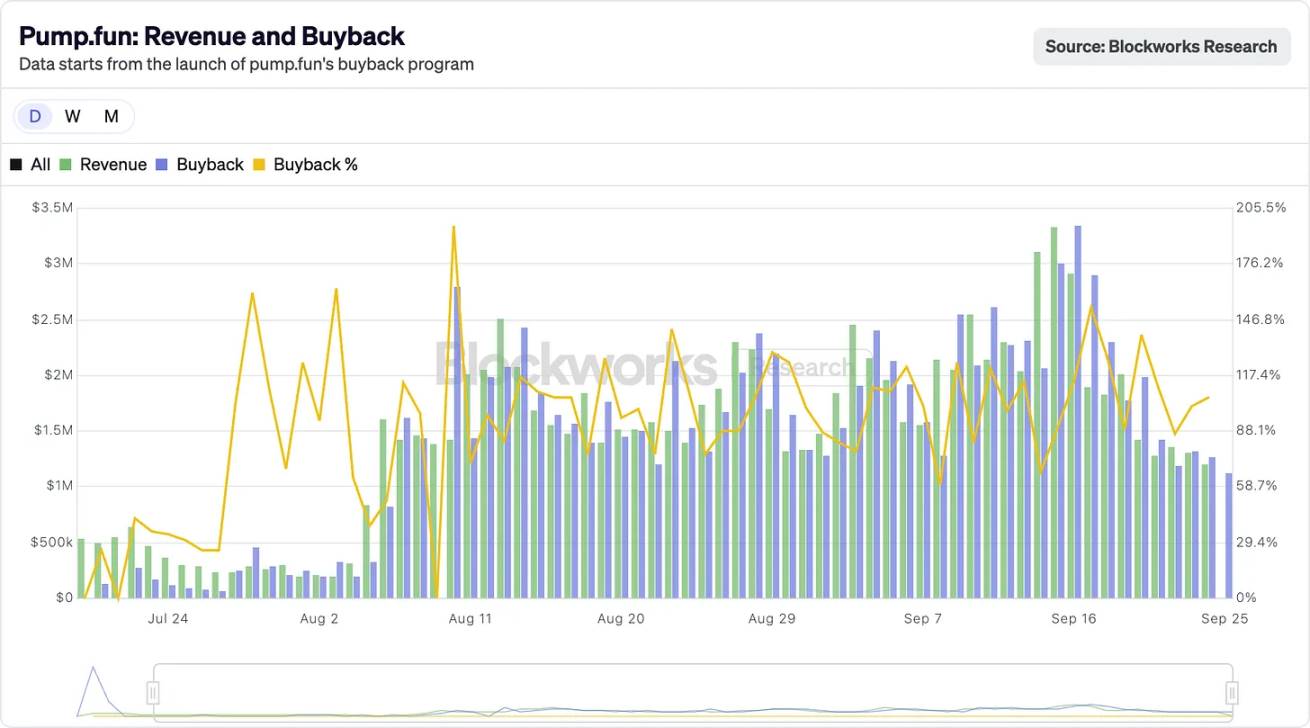

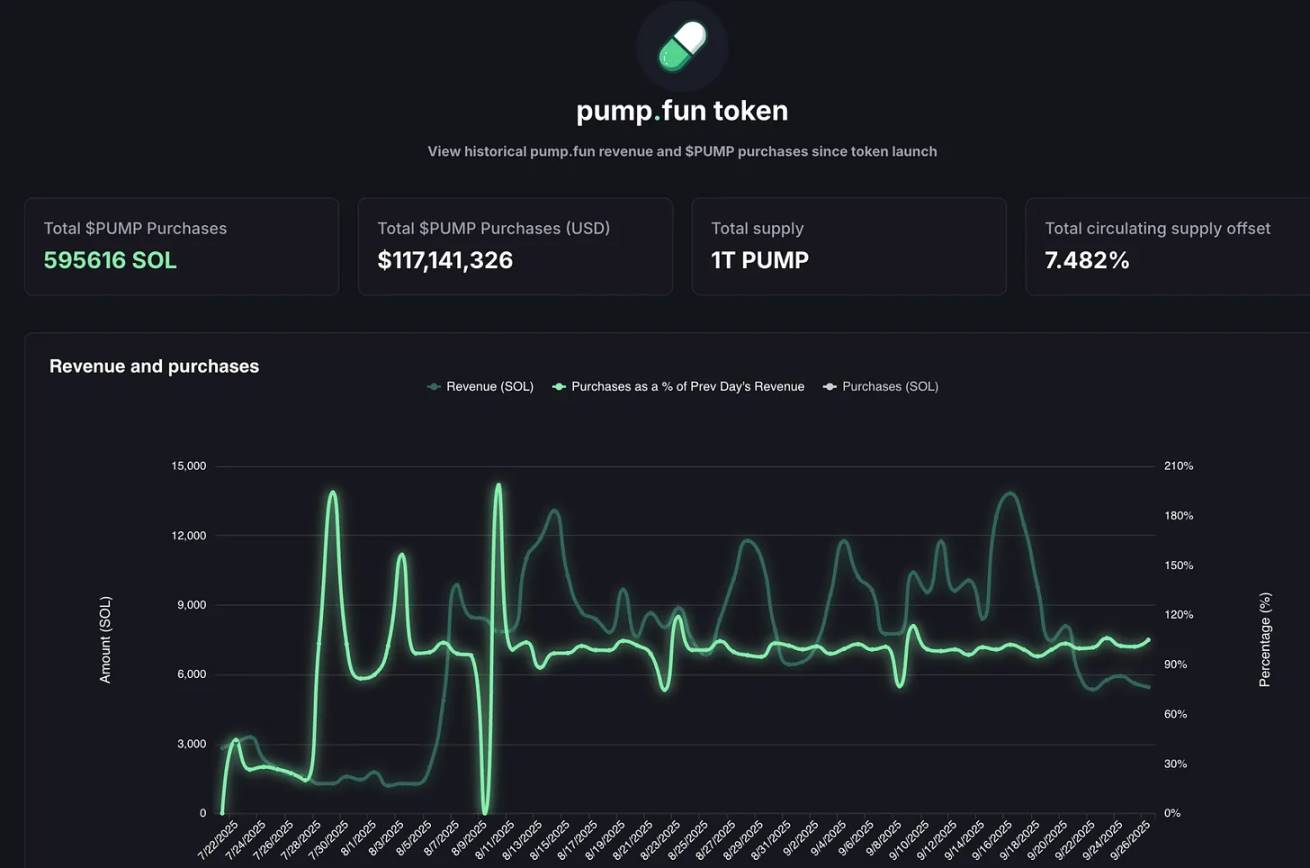

In August 2025, Hyperliquid set a record with $106 million in fee revenue, over 90% of which was used to repurchase HYPE tokens on the open market. Meanwhile, Pump.fun briefly outpaced Hyperliquid in daily revenue—on one day in September 2025, the platform earned $3.38 million. Where does this revenue go? The answer: 100% is used to repurchase PUMP tokens. In fact, this buyback model has been sustained for over two months.

@BlockworksResearch

These actions are gradually giving crypto tokens attributes of “proxy shareholder equity”—a rarity in cryptocurrency, where tokens are typically dumped onto investors at the first opportunity.

The logic behind this is that crypto projects are attempting to replicate the long-term success path of Wall Street’s “dividend aristocrats” (like Apple, Procter & Gamble, Coca-Cola): rewarding shareholders through steady cash dividends or share buybacks. For example, Apple spent $104 billion on buybacks in 2024, roughly 3%-4% of its market value at the time; Hyperliquid, by contrast, achieved a “supply offset ratio” of up to 9% through buybacks.

Even by traditional stock market standards, such figures are astonishing; in the world of crypto, they are unprecedented.

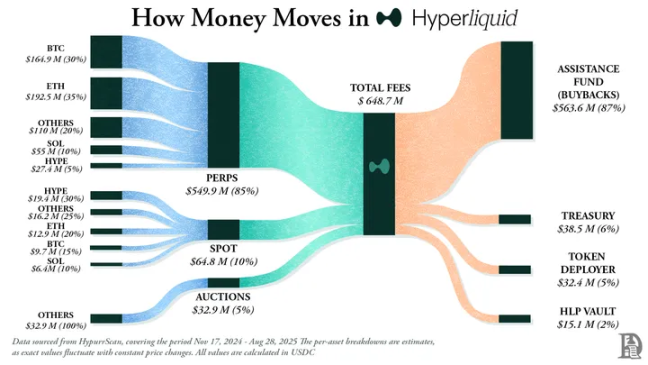

Hyperliquid’s positioning is clear: it built a decentralized perpetual futures exchange with the smooth user experience of centralized platforms like Binance, yet fully operates on-chain. Supporting zero gas fees, high-leverage trading, and functioning as a Layer1 centered around perpetual contracts, by mid-2025 its monthly trading volume exceeded $400 billion, capturing about 70% of the DeFi perpetuals market.

What truly sets Hyperliquid apart is how it deploys its capital.

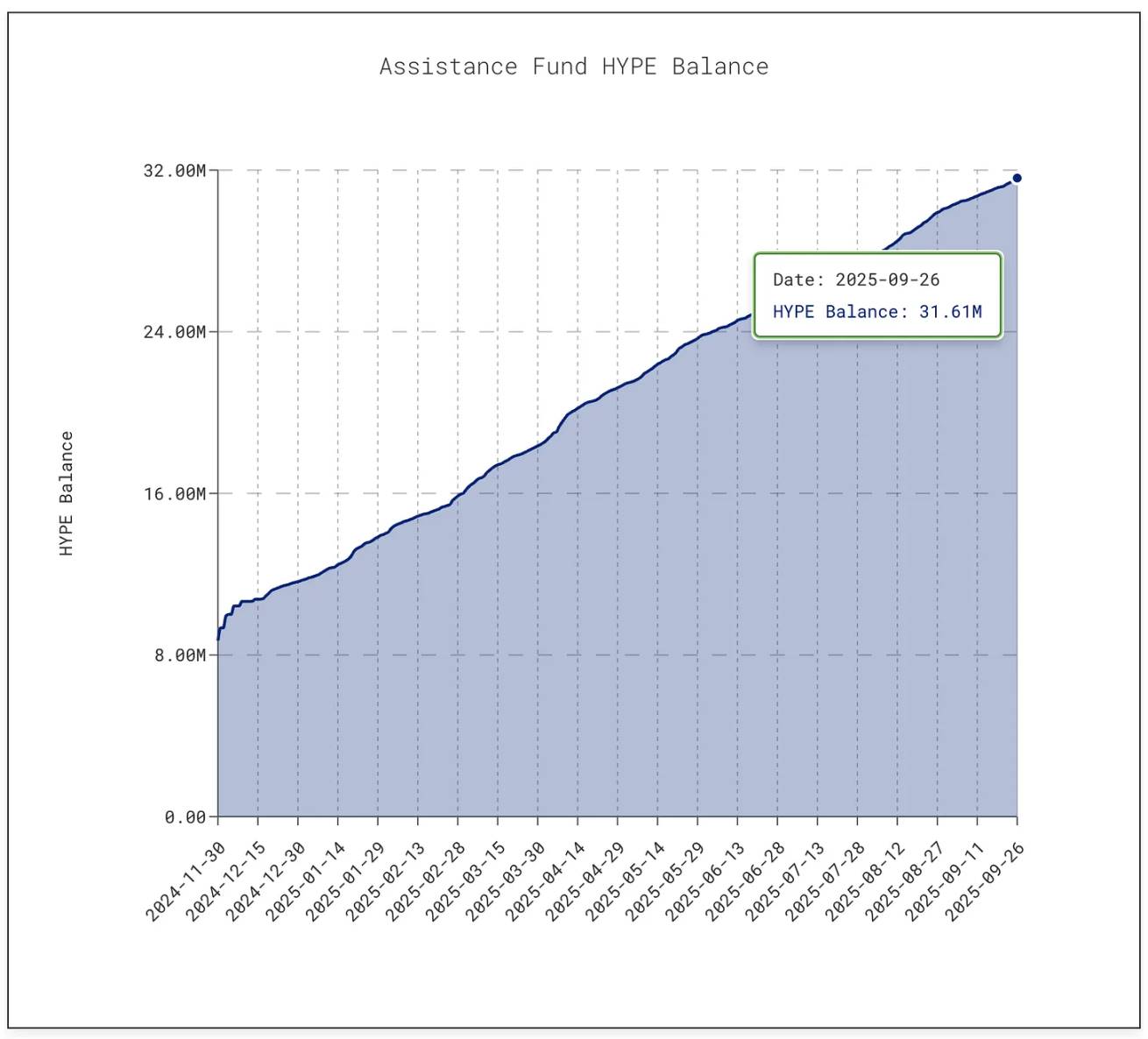

The platform allocates over 90% of its daily fee revenue into an “Aid Fund,” which directly purchases HYPE tokens on the open market.

@decentralised.co

As of this writing, the fund holds over 31.61 million HYPE tokens worth approximately $1.4 billion—ten times more than the 3 million held in January 2025.

@asxn.xyz

This buyback wave has reduced the circulating supply of HYPE by about 9%, pushing the token price to a peak of $60 in mid-September 2025.

Meanwhile, Pump.fun has reduced the circulating supply of PUMP tokens by approximately 7.5% through buybacks.

@pump.fun

The platform has turned the meme coin frenzy into a sustainable business model with minimal fees: anyone can launch a token and establish a bonding curve, allowing market momentum to unfold organically. What began as a joke tool has evolved into a factory for speculative assets.

But risks remain.

Pump.fun’s revenue is highly cyclical—it is directly tied to the热度 of meme coin launches. In July 2025, the platform’s revenue dropped to $17.11 million, the lowest since April 2024, leading to smaller buybacks; by August, monthly revenue rebounded to over $41.05 million.

Yet, sustainability remains an open question. When the “meme season” cools down (as it has before and inevitably will again), token buybacks will shrink accordingly. More seriously, the platform faces a $5.5 billion lawsuit alleging its operations resemble illegal gambling.

At the core of what currently supports Hyperliquid and Pump.fun is their willingness to return earnings to the community.

Apple returned nearly 90% of profits to shareholders via buybacks and dividends in certain years, but these were often阶段性 “bulk announcements.” In contrast, Hyperliquid and Pump.fun continuously funnel almost 100% of daily revenue back to token holders—a persistent, ongoing model.

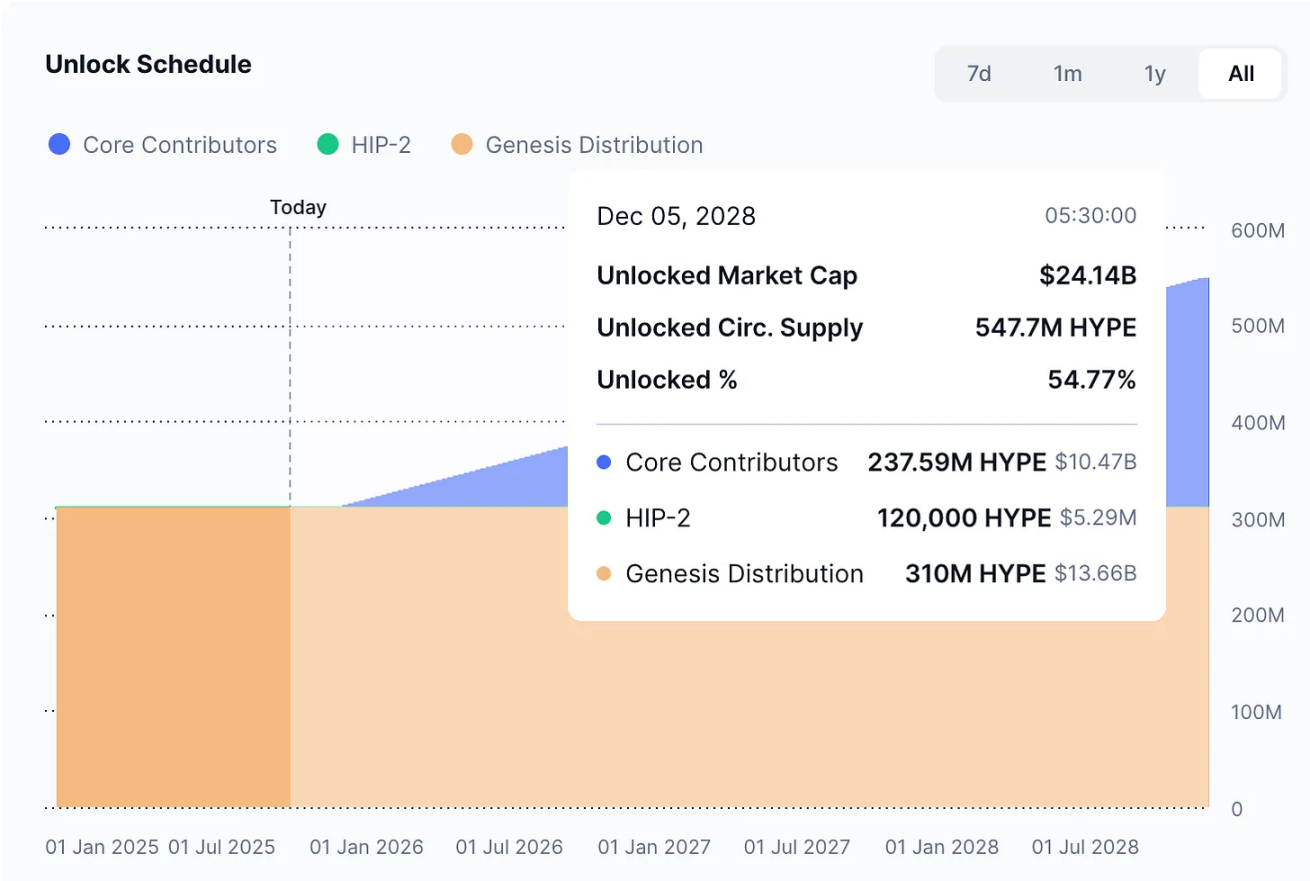

Of course, there remains a fundamental difference: cash dividends are tangible returns—less tax-efficient but stable—while buybacks are at best “price support tools.” If revenue declines or unlock volumes far exceed buyback capacity, the effectiveness collapses. Hyperliquid faces an upcoming “unlock shock,” while Pump.fun must contend with the risk of meme coin热度 shifting. Compared to Johnson & Johnson’s record of 63 consecutive years of dividend increases or Apple’s consistent buyback strategy, these two crypto platforms are walking a tightrope.

But perhaps this is already remarkable within the crypto industry.

Crypto is still maturing, lacking established business models, yet it has shown astonishing speed of development. Buyback strategies happen to contain key ingredients for accelerating the industry: flexibility, tax efficiency, and deflationary mechanics—perfectly aligned with the speculation-driven crypto market. So far, this approach has turned two fundamentally different projects into top-tier “revenue machines” in the sector.

Whether this model can last long-term remains uncertain. But clearly, it has for the first time helped crypto tokens shed their label as mere “casino chips”, bringing them closer to being seen as “company stocks that generate returns for holders”—returns that may even pressure Apple in terms of velocity.

I believe there’s a deeper insight here: long before crypto existed, Apple realized it wasn’t just selling iPhones, but its own stock. Since 2012, Apple has spent close to $1 trillion on buybacks (more than the GDP of most countries), reducing its share count by over 40%.

Today, Apple maintains a market cap above $3.8 trillion partly because it treats its stock as a “product” that needs marketing, refinement, and scarcity management. Apple doesn’t need to raise capital through share issuance—its balance sheet is flush with cash—so the stock itself becomes the product, and shareholders become customers.

This logic is now gradually permeating the crypto space.

Where Hyperliquid and Pump.fun succeed is that instead of reinvesting or hoarding the cash generated by their operations, they convert it into purchasing power that drives demand for their own tokens.

This also shifts investor perception of crypto assets.

iPhone sales matter, but investors bullish on Apple know there’s another engine: scarcity. Today, traders are beginning to form a similar view of HYPE and PUMP tokens—they see an explicit promise behind these assets: over 95% of every transaction or usage event involving the token will likely be converted into market buybacks and burns.

But Apple’s case also reveals another side: the strength of buybacks always depends on the robustness of underlying cash flows. What happens if revenue drops? When iPhone and MacBook sales slowed, Apple’s strong balance sheet allowed it to borrow and maintain its buyback commitments; Hyperliquid and Pump.fun have no such cushion—if trading volume shrinks, buybacks stop. More importantly, Apple can pivot to dividends, services, or new products during crises, whereas these crypto protocols currently lack backup plans.

For crypto, there is also the risk of “token dilution.”

Apple doesn’t worry about 200 million new shares flooding the market overnight, but Hyperliquid does: starting November 2025, nearly $12 billion worth of HYPE tokens will unlock for insiders—an amount far exceeding daily buyback volumes.

@coinmarketcap

Apple controls its share supply autonomously, while crypto protocols are bound by immutable token unlock schedules written in stone years ago.

Even so, investors recognize the value and want to participate. Apple’s strategy is obvious, especially to those familiar with its decades-long journey—by turning its stock into a financial product, it cultivated shareholder loyalty. Now, Hyperliquid and Pump.fun are attempting to replicate this path in crypto, only faster, louder, and riskier.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News