If HYPE and PUMP were stocks, they'd both be undervalued

TechFlow Selected TechFlow Selected

If HYPE and PUMP were stocks, they'd both be undervalued

If these were stocks, they would trade at prices at least 10 times higher, or even more.

Author: Jeff Dorman, CFA

Translation: TechFlow

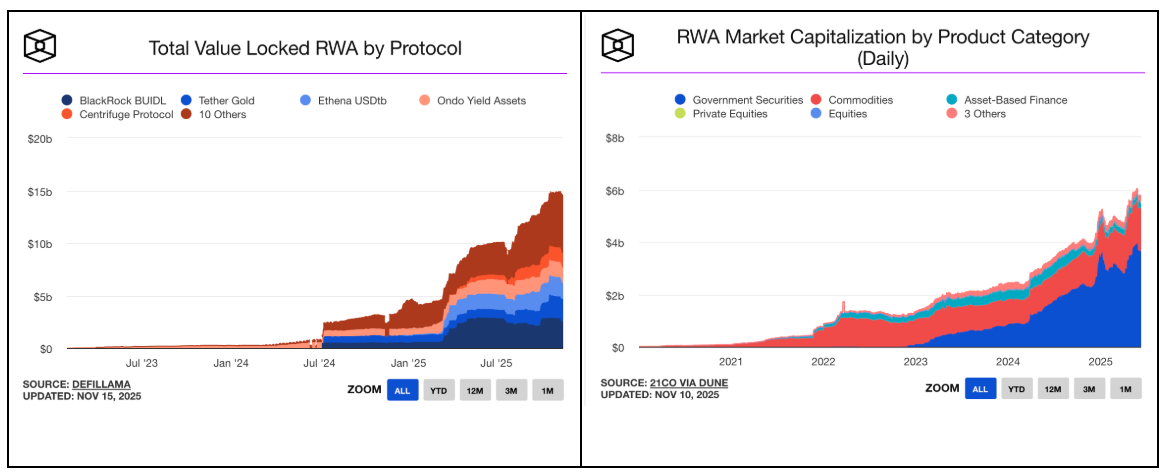

Revealing the Disconnect Between Fundamentals and Price

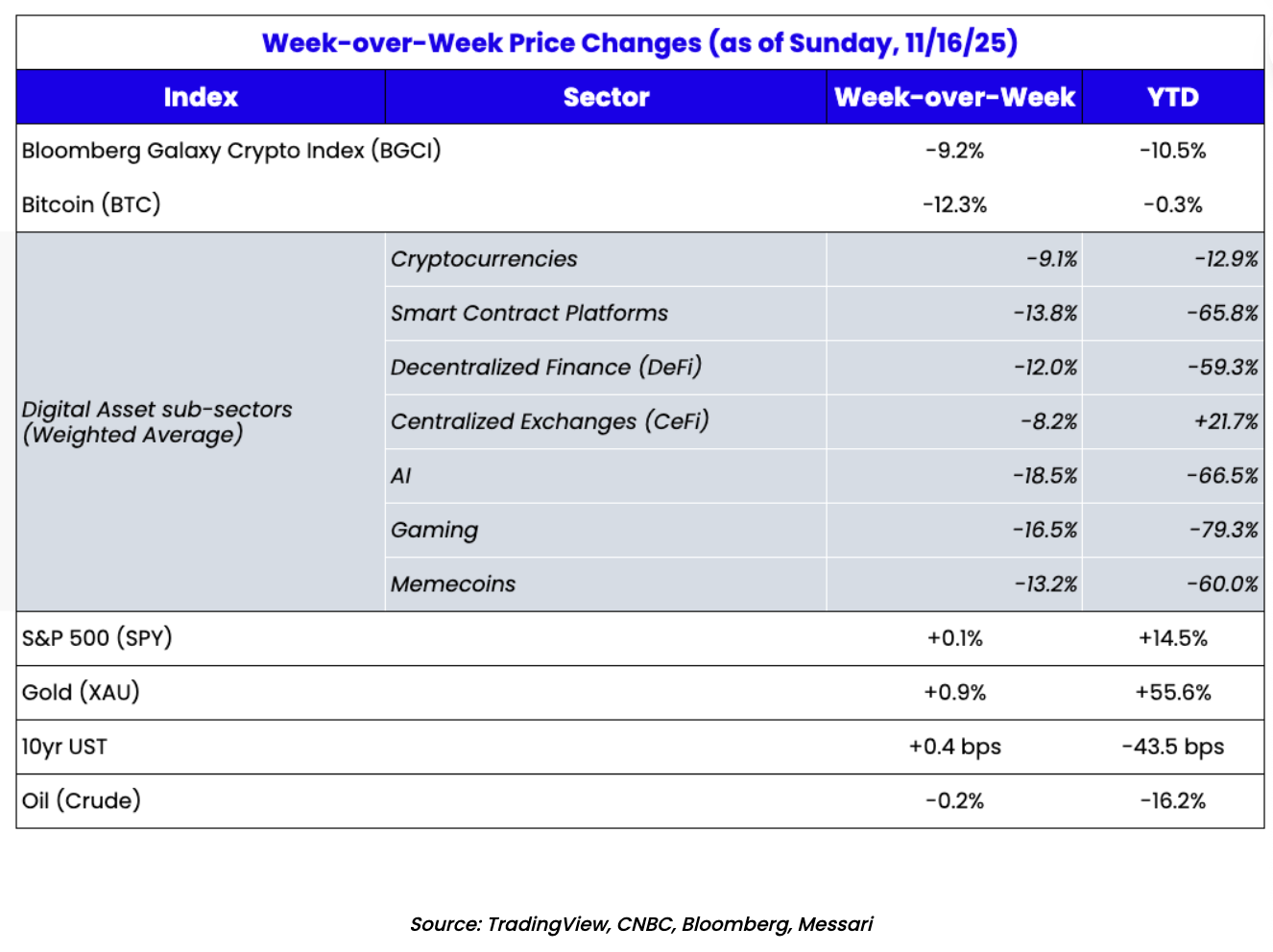

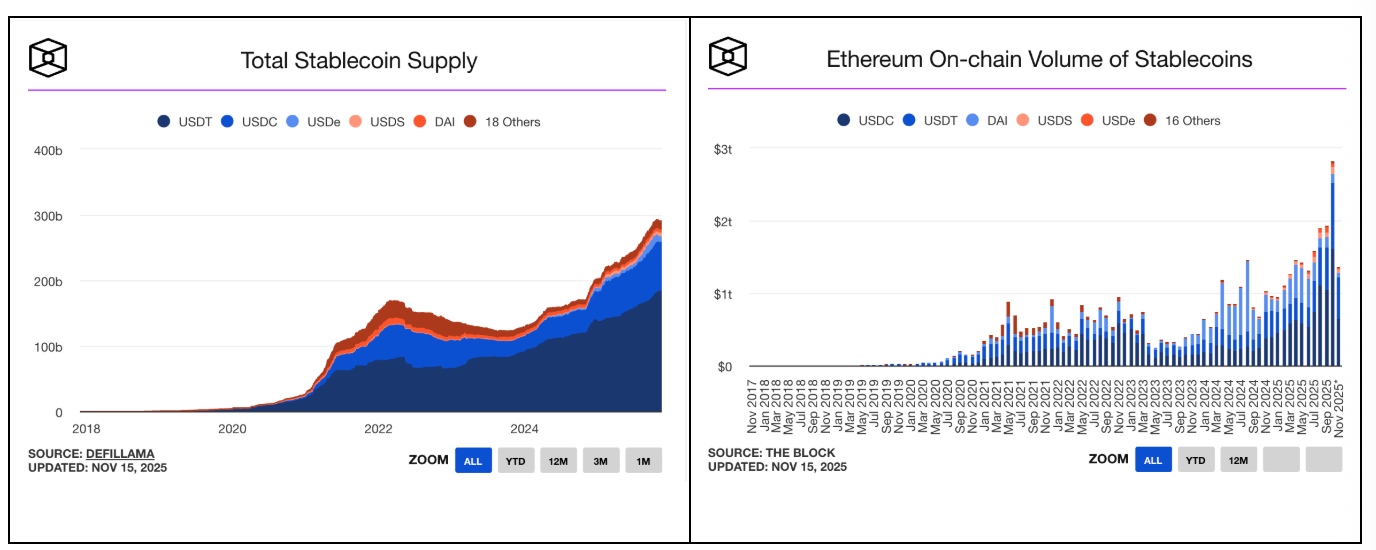

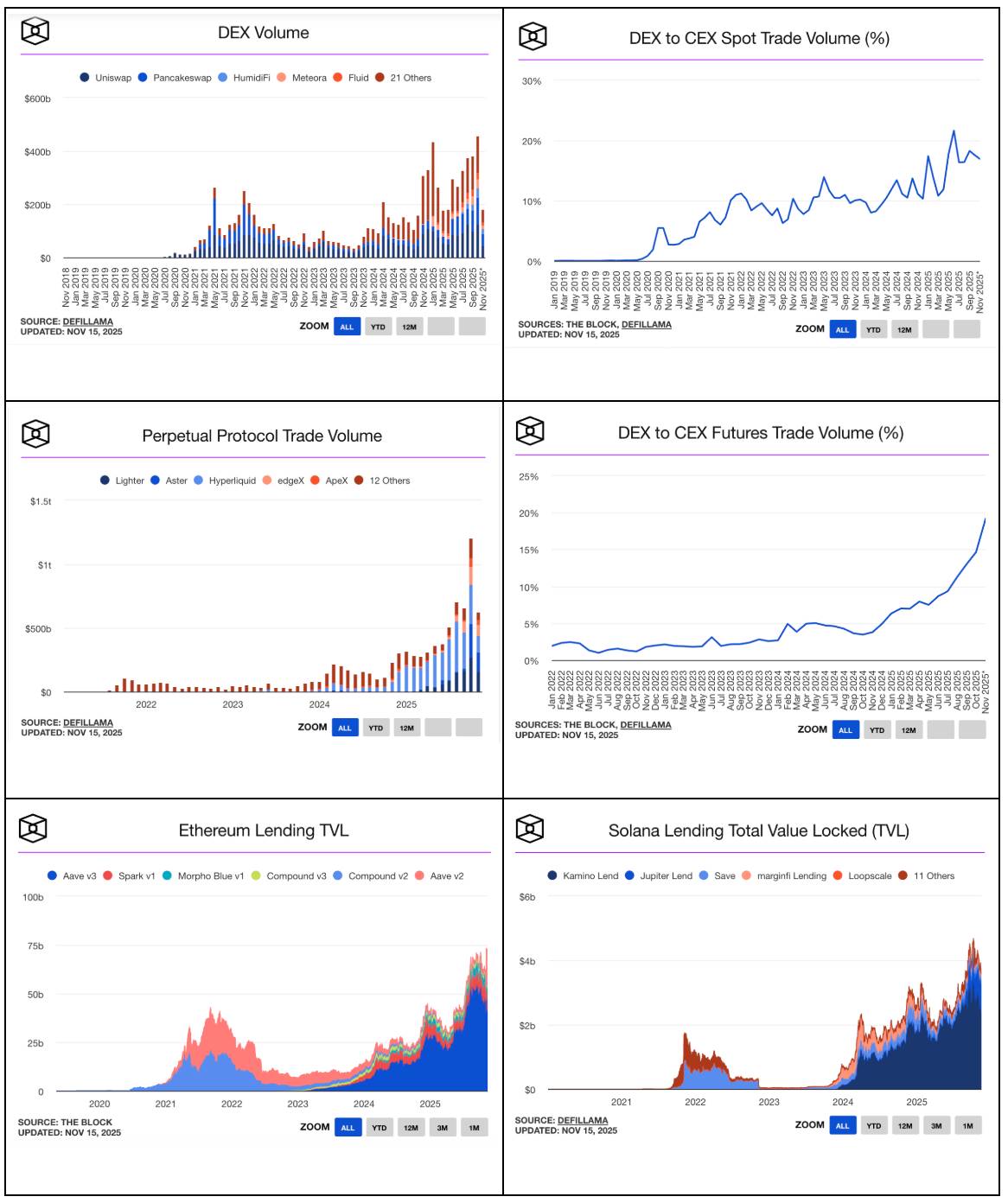

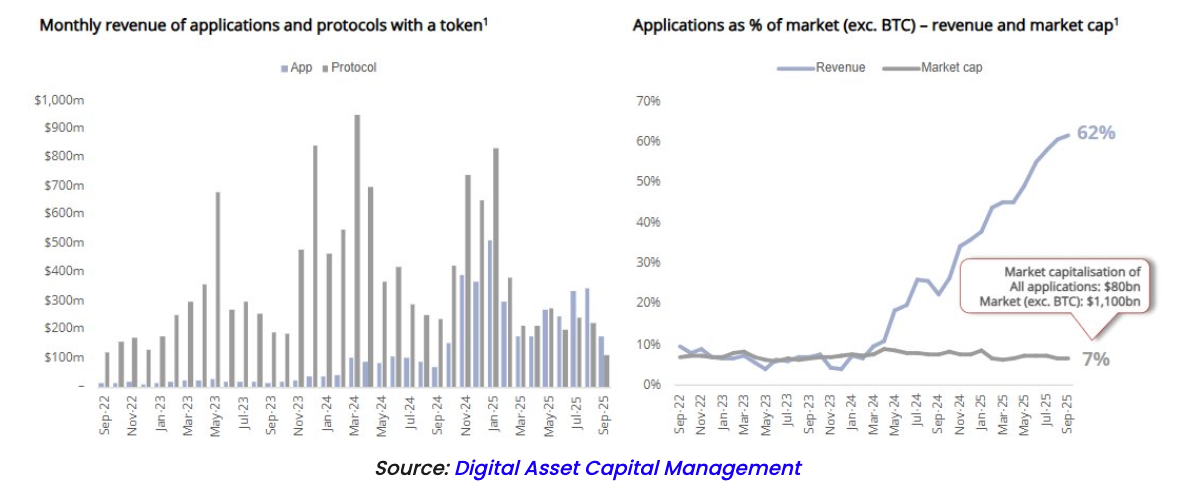

In crypto, only three sectors are consistently growing: stablecoins, decentralized finance (DeFi), and real-world assets (RWAs). And not just growing—these areas are experiencing explosive growth.

Consider the following charts:

-

Growth of stablecoins (click for more growth data):

-

DeFi growth (click for more data: here, here, and here):

-

Growth of real-world assets (RWA) (click for more data):

These are the applications that should define the crypto industry. Charts showing these growth trends should be featured on CNBC, in The Wall Street Journal, in Wall Street research reports, and highlighted on every crypto exchange and price tracking page. Any objective growth investor seeing data on stablecoin AUM and transaction volume growth, RWA expansion, and DeFi's booming activity would naturally ask: "How can I invest in these areas?"

The growth trajectories of these industries all follow an unmistakable "up and to the right" path. And aside from stablecoins, all of these sectors can be easily accessed via tokens (e.g., HYPE, UNI, AAVE, AERO, SYRUP, PUMP, etc.). These decentralized applications (dApps) now account for over 60% of the crypto industry’s total revenue, yet their underlying tokens represent only 7% of the total crypto market cap. Read that again—it’s staggering.

Yet, media and exchanges continue to focus on Bitcoin and memecoins. Most investors still equate crypto with Bitcoin (BTC), Layer-1 protocols (like ETH, SOL, and AVAX), and memecoins. However, the market has clearly shifted toward revenue and profitability, but many still fail to recognize that tokens are excellent instruments for capturing value and distributing profits.

Our industry has failed to attract fundamental investors who value high cash flow and sustained growth—despite this group being the largest and most important investor base globally. Instead, for some inexplicable reason, the industry continues catering to the smallest and least relevant investor segments (such as tech VCs and fast-money macro/CTA funds).

Worse still, many still believe investing in stocks gives them some legal claim to corporate cash flows, while token investments offer no ownership. I’ve pointed out this double standard between equity and crypto investors for over six years. As a shareholder, have you ever decided how a company spends its cash? Of course not. You have no control over employee compensation, R&D spending, acquisitions, stock buybacks, or dividend payments—all decisions made solely by management. As a shareholder, your only real legal rights or protections are:

-

You are entitled to proceeds if the company is sold (this is significant).

-

You have a residual claim on assets after debt in bankruptcy (but this is almost always irrelevant, as creditors typically receive all post-restructuring equity, leaving shareholders with nothing).

-

You may participate in proxy fights to replace management via board seats (but this also applies in crypto—Arca led three token activism campaigns over the past eight years, successfully forcing changes at Gnosis, Aragon, and Anchor).

Ultimately, whether as a shareholder or token holder, you are subject to management’s decisions on cash flow usage. With both stocks and tokens, outside of acquisition scenarios, you rely entirely on management to decide how to use corporate cash flow—such as whether to conduct buybacks. There is no fundamental difference between the two.

Hyperliquid (HYPE) and Pump.Fun (PUMP) have demonstrated strong market appeal through real earnings and burn mechanisms. Many established projects like Aave, Raydium, and PancakeSwap have adopted similar models. Last week, Uniswap (UNI) made headlines by finally launching its “fee sharing” feature, allowing UNI holders to earn a portion of protocol revenue.

Once again, the market is evolving. In 2025 alone, crypto protocols and companies have conducted over $1.5 billion in token buybacks, with ten tokens accounting for 92% of the total. (Though we believe the ZRO data in this article is incorrect—HYPE and PUMP buybacks are far higher than shown.)

To put this in perspective, the total market cap of liquid crypto assets (excluding Bitcoin and stablecoins) is just $1 trillion. The $1.5 billion in token buybacks represents only 0.15% of that. However, for the top-buyback tokens, buyback amounts can reach up to 10% of their market caps. By comparison, U.S. stock buybacks this year totaled about $1 trillion—1.5% of the $67 trillion market cap.

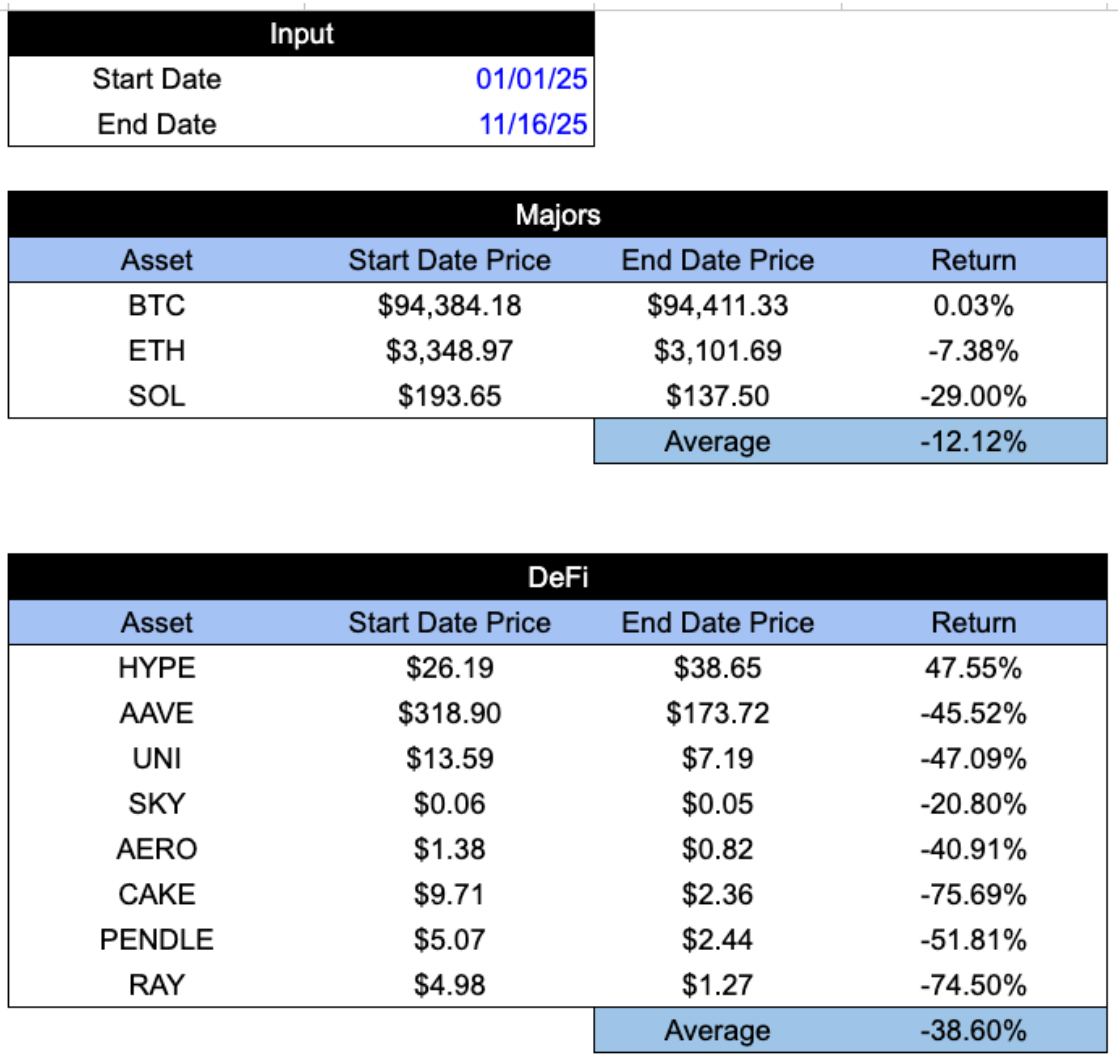

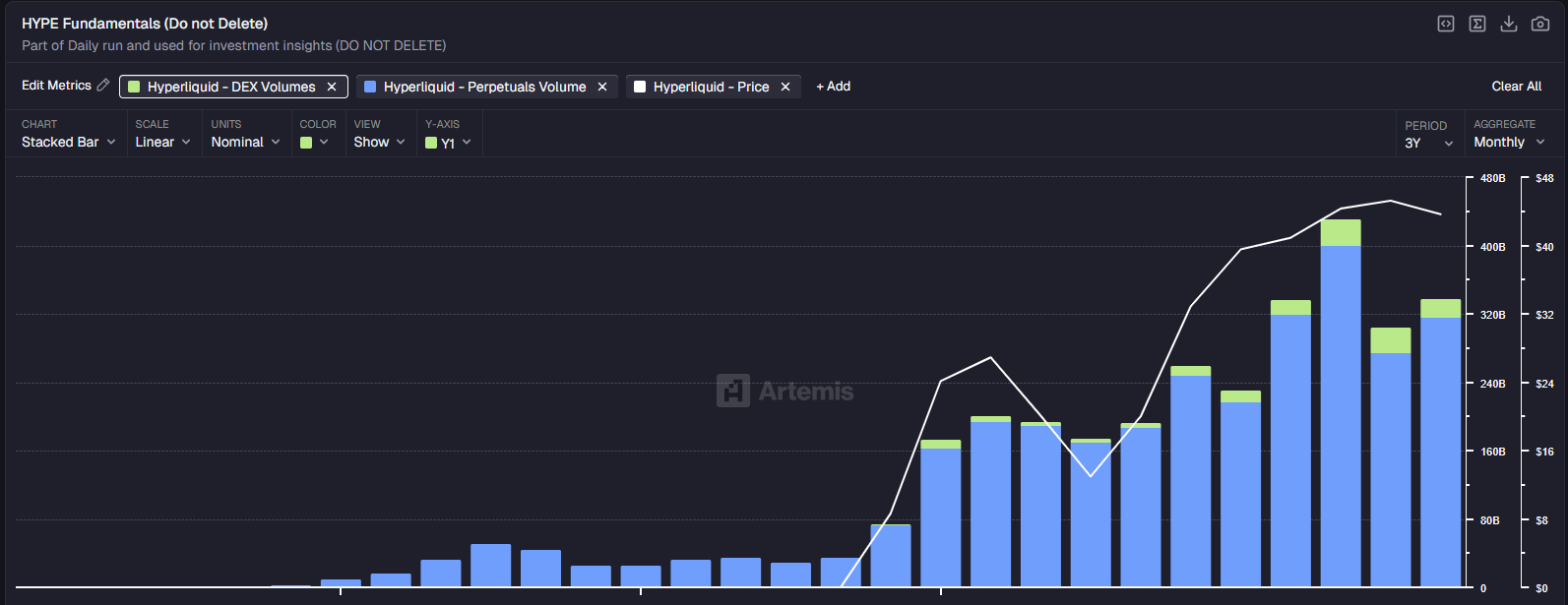

This gap in understanding crypto investment and value capture is stark. On one hand, it's fair to say most tokens lack investment merit; on the other, the best tokens are likely severely undervalued, probably dragged down by poor-quality assets. As a result, in many cases, project fundamentals and revenue rise steadily while token prices fall. Across the three fastest-growing, highest-revenue, and highest-buyback sectors, many top tokens have performed shockingly poorly.

The question remains: why aren’t more leaders in crypto focused on promoting the areas that are actually growing? Shouldn’t the industry showcase these tokens, highlight their strong tokenomics, and explain to investors how to access them? Investors need to understand there is logic and fundamentals behind crypto investing—only then will they dedicate time to research. If we want quality tokens to outperform junk, we must start educating people on how to identify them.

Just a few years ago, nearly no crypto products generated meaningful revenue. Today, many not only generate substantial income but also return a large portion—sometimes up to 99%—to investors via token buybacks. Moreover, these tokens trade at extremely low valuations compared to traditional equities. In essence, these tokens are stocks, lacking only an educated and committed buyer base.

So, if these assets were stocks, at what multiples would they trade? If investors understood the difference between revenue-generating, buyback-driven tokens versus generic “cryptocurrencies” or “smart contract platforms,” what valuations would they command?

Let’s examine two of the strongest examples in the market:

Hyperliquid (HYPE) and Pumpfun (PUMP)

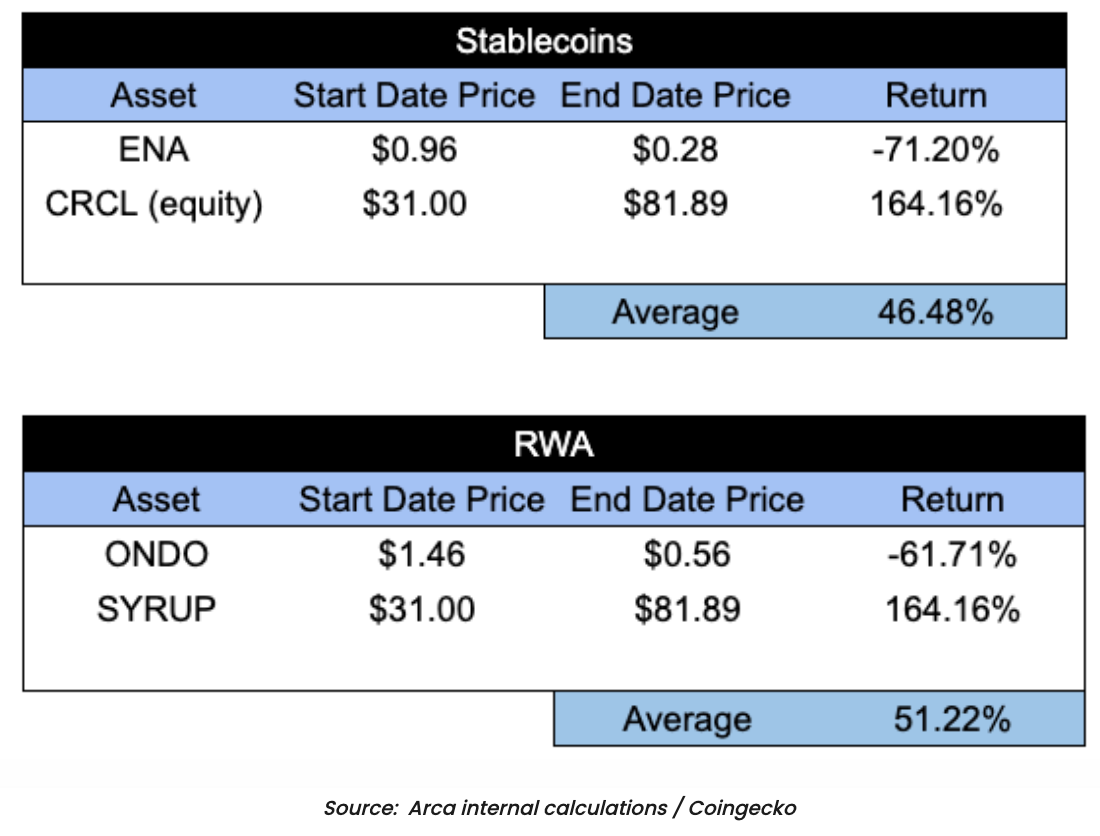

Hyperliquid is already the leading decentralized perpetuals exchange, with nearly every metric indicating rapid and sustainable growth.

Volume Growth:

Source: Artemis

Fees:

Source: Artemis

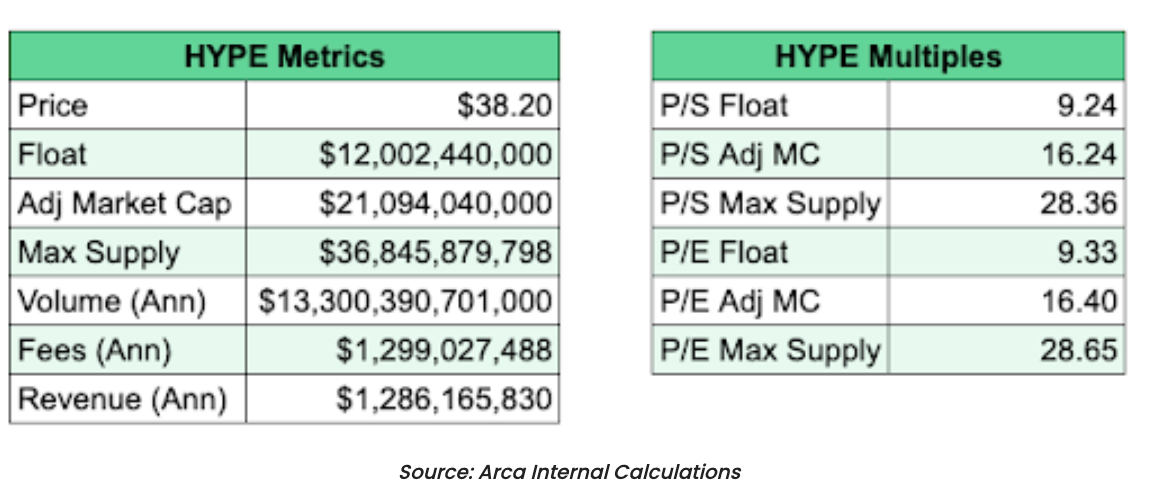

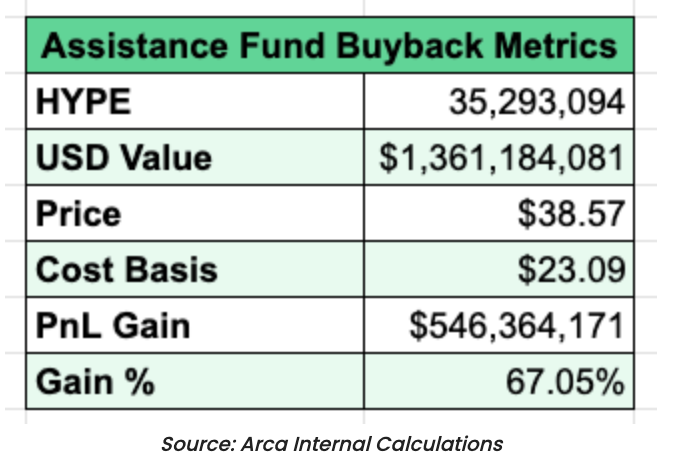

Driven by rising volume and fees, Hyperliquid has become one of the cheapest tokens under traditional valuation models. HYPE generates $1.28 billion in annualized revenue (based on the last 90 days), trades at a P/E of just 16.4x, and has grown revenues by 110% year-over-year. Even more impressively, the project allocates 99% of its revenue to token buybacks. To date, HYPE has repurchased over 10% of its circulating supply (worth $1.36 billion). This ranks among the most successful capital allocation cases in both crypto and financial market history.

In contrast, the S&P 500 trades at a P/E of ~24x, Nasdaq at ~27x. Coinbase trades around 25x, while Robinhood (HOOD) trades at a staggering 50x despite having only twice the revenue (~$2 billion vs. HYPE’s $1 billion).

HYPE’s year-to-date growth is also faster (110% vs. Robinhood’s 65%).

Additionally, Hyperliquid is a Layer-1 protocol—a feature not yet fully priced into the market. Currently, HYPE is viewed simply as an exchange.

More importantly, every dollar of HYPE’s revenue is returned to token holders via buybacks, whereas Robinhood has neither a buyback program nor a dividend policy.

This either implies the market expects Hyperliquid’s growth to slow dramatically and lose market share—or that key factors are being overlooked. It’s reasonable for HYPE to trade below Robinhood (HOOD): HYPE tokens launched only a year ago, face intense competition, and digital assets generally lack clear moats. Yet HOOD trades at 5x HYPE’s multiple, with slower growth and lower margins—an extreme disconnect likely due to the maturity of stock investors versus crypto investors, not the assets themselves.

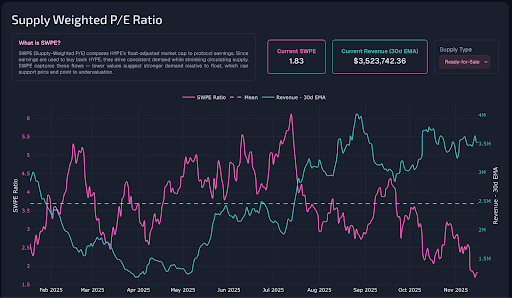

In any other industry, if you saw the chart below—earnings rising steadily while price falls—you’d likely allocate heavily without hesitation.

Source: Skewga

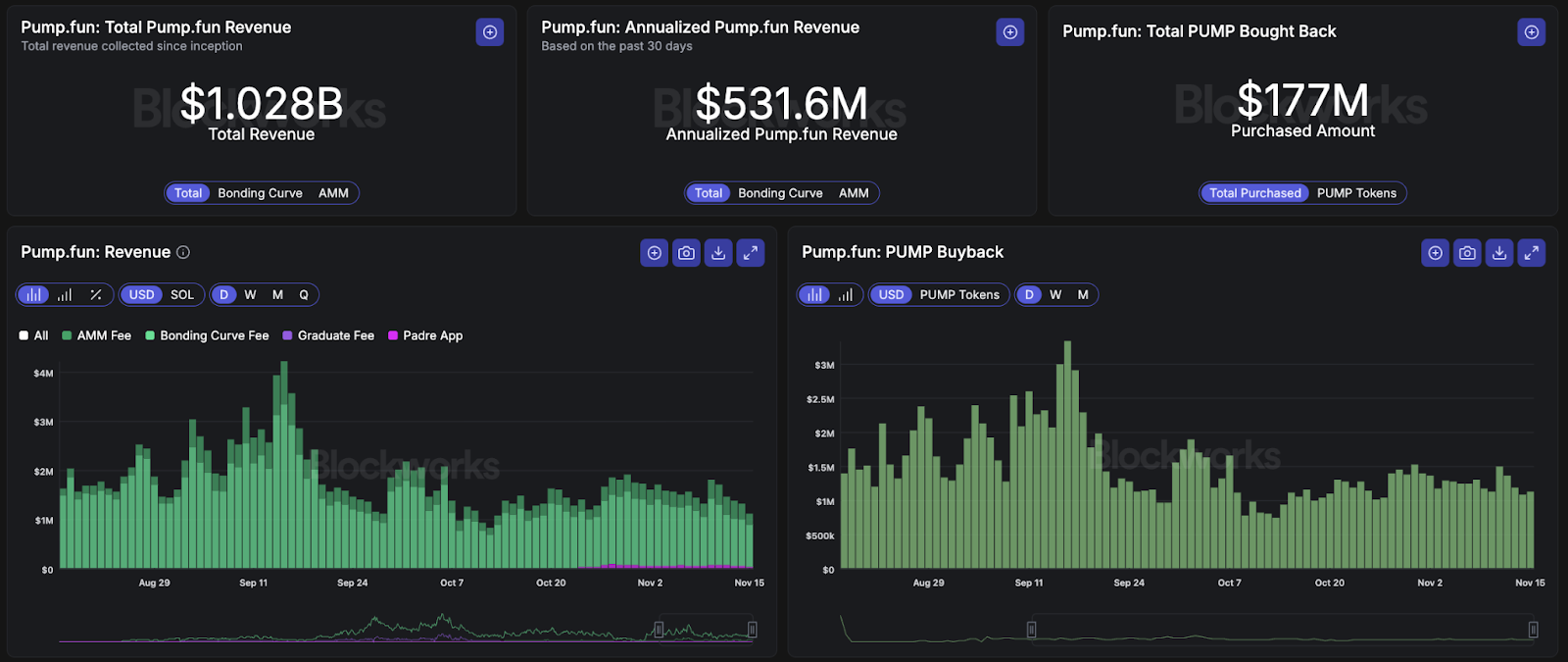

Now consider Pumpfun (PUMP). Like Hyperliquid, Pumpfun’s business model is straightforward: it helps token creators launch new tokens and earns fees from issuance and trading activity.

This too is one of the most successful ventures in crypto history, having generated over $1 billion in revenue to date.

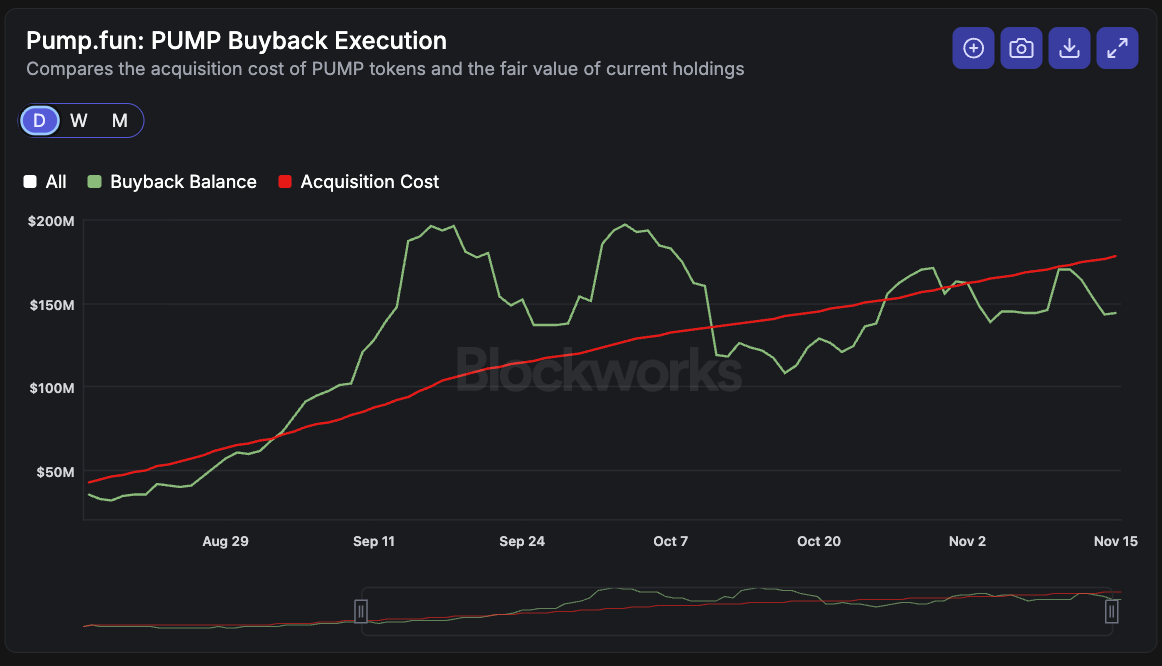

Source: Blockworks

PUMP tokens launched via ICO earlier this year at $0.004. While the max supply is 1 trillion, only 590 billion are currently in circulation. In under four months, Pumpfun has repurchased 3.97 billion PUMP tokens, allocating 99% of revenue to buybacks. On an adjusted market cap basis, PUMP trades at a mere 6.18x P/E—with all earnings going toward buybacks.

Source: Blockworks

Frankly, we’ve never seen companies grow as rapidly as Pumpfun and Hyperliquid—let alone return nearly all free cash flow directly to investors. These are among the most successful investment cases in history and the finest tokens ever created in crypto.

If these were stocks, they’d trade at least 10x higher, possibly much more. Unfortunately, the investor base isn’t mature enough yet. So those who recognize this value can only wait. The issue isn’t with the assets themselves, nor the mechanism of value transfer.

Education is the main problem.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News