Pump.fun lawsuit year in review: mysterious informant, internal records, and answers yet to be revealed

TechFlow Selected TechFlow Selected

Pump.fun lawsuit year in review: mysterious informant, internal records, and answers yet to be revealed

The core allegations are about more than just "losing money."

By: June, TechFlow

In January 2025, the Meme coin market was at the peak of frenzy. With former U.S. President Trump launching the TRUMP coin, an unprecedented speculative wave swept through the market, and the myth of "100x coins" captured widespread attention.

At the same time, a lawsuit targeting the Pump.fun platform quietly began.

Fast forward to recent days.

Alon Cohen, co-founder and Chief Operating Officer of Pump.fun, has not posted on social media for over a month. For Alon, who is usually active and constantly online “surfing and watching drama,” this silence is particularly noticeable. Data shows that Pump.fun’s weekly trading volume has plummeted from a peak of $3.3 billion in January to the current $481 million, a drop of over 80%. Meanwhile, the PUMP token price has fallen to $0.0019, down approximately 78% from its all-time high.

Back in July 12, just months ago, the situation was entirely different. Pump.fun's public sale launched at a fixed price of $0.004 per token, selling out within 12 minutes and raising around $600 million, pushing market sentiment to a fever pitch.

From the bustling start of the year to today’s quiet state, market attitudes have formed a stark contrast.

Amidst all these changes, one thing that hasn’t stopped is the buyback program. The Pump.fun team continues to execute its daily buyback plan systematically. To date, the total buyback amount has reached $216 million, absorbing about 15.16% of the circulating supply.

Meanwhile, the lawsuit overlooked during the market mania is now quietly growing in scale.

It All Started with Losses on $PNUT

The story begins in January 2025.

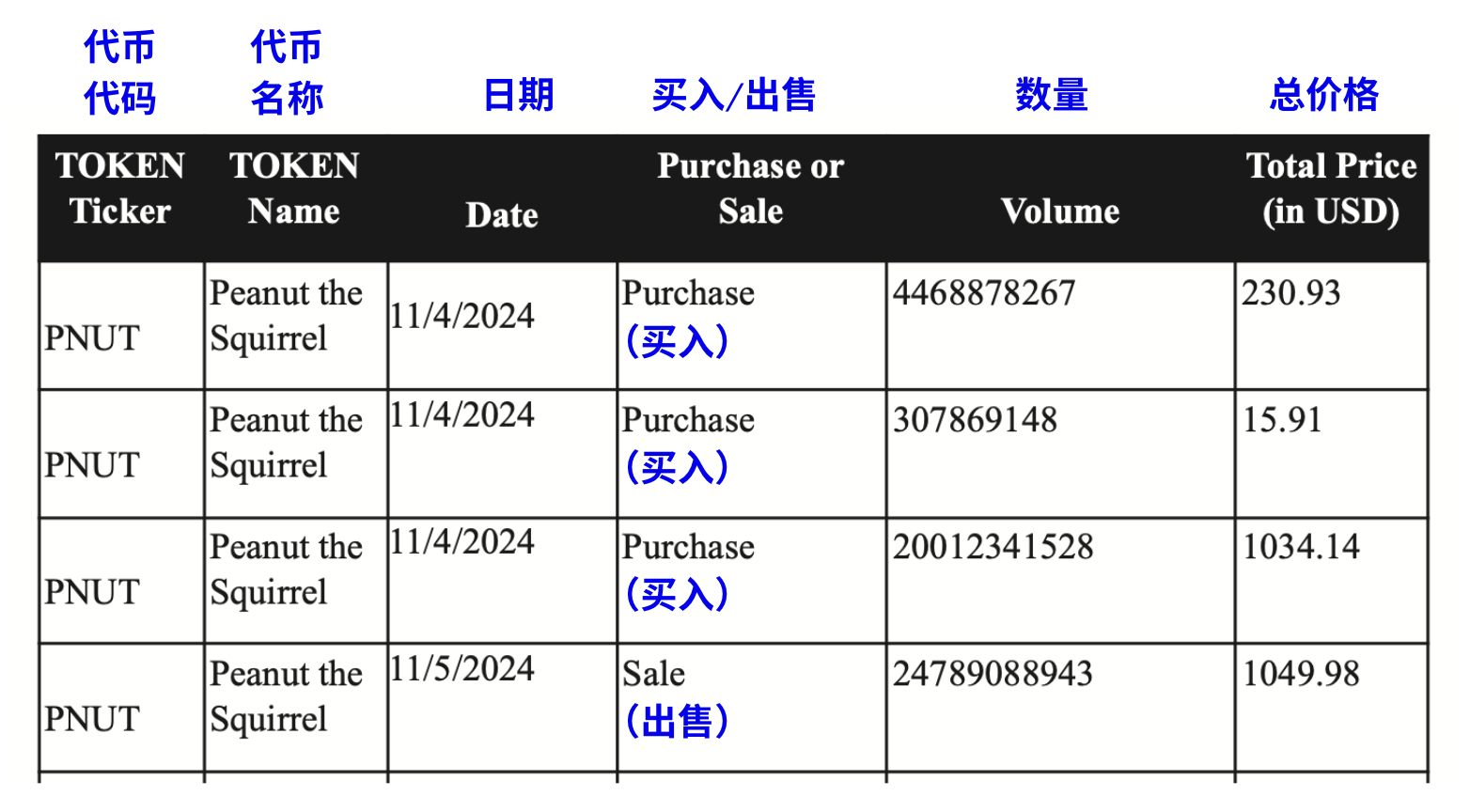

On January 16, investor Kendall Carnahan filed a lawsuit (Case No.: Carnahan v. Baton Corp.) in the U.S. District Court for the Southern District of New York, directly targeting Pump.fun and its three founders. Carnahan’s claim was clear: he suffered losses after purchasing the $PNUT token on the platform and accused Pump.fun of selling unregistered securities, violating the U.S. Securities Act of 1933.

According to the court documents, the actual loss incurred by this investor was only $231.

Just two weeks later, on January 30, another investor, Diego Aguilar, filed a similar lawsuit (Case No.: Aguilar v. Baton Corp.). Unlike Carnahan, Aguilar purchased multiple tokens, including $FRED, $FWOG, $GRIFFAIN, and other Meme coins issued on Pump.fun. His case had broader scope, representing all investors who bought unregistered tokens on the platform.

At this point, the two cases proceeded independently, with the same defendants:

Baton Corporation Ltd, the operating company behind Pump.fun, and its three founders—Alon Cohen (COO), Dylan Kerler (CTO), and Noah Bernhard Hugo Tweedale (CEO).

Merging the Cases: The Investor with $240K in Losses Becomes Lead Plaintiff

The two separate lawsuits soon caught the court’s attention. Judge Colleen McMahon of the U.S. District Court for the Southern District of New York noticed a problem: both cases targeted the same defendants, the same platform, and alleged the same violations—why were they being handled separately?

On June 18, 2025, Judge McMahon directly questioned the plaintiffs’ legal teams:

Why are there two separate lawsuits addressing the same issue? She demanded an explanation for why the cases should not be consolidated.

The plaintiffs’ lawyers initially tried to defend their position, arguing that two independent cases could be maintained—one focused solely on the $PNUT token, the other covering all tokens on Pump.fun—and suggested appointing two lead plaintiffs accordingly.

But the judge was clearly unconvinced. This “divide and conquer” strategy would not only waste judicial resources but could also lead to contradictory rulings. The core issue facing all plaintiffs was identical: they all accused Pump.fun of selling unregistered securities and claimed to be victims of the same fraudulent system.

On June 26, Judge McMahon ruledto formally consolidate the two cases. At the same time, in accordance with the Private Securities Litigation Reform Act (PSLRA), she officially appointed Michael Okafor—the plaintiff with the largest financial loss—as the lead plaintiff (court records indicate Okafor lost approximately $242,000 trading on Pump.fun, far exceeding other plaintiffs).

Thus, investors who were previously acting independently now formed a unified front.

Shifting Focus to Solana Labs and Jito

Just one month after consolidation, the plaintiffs dropped a bombshell.

On July 23, 2025, the plaintiffs filed an Amended Consolidated Complaint, dramatically expanding the list of defendants. This time, the accusations extended beyond Pump.fun and its founders to directly target key players within the Solana ecosystem.

The newly added defendants include:

-

Solana Labs, Solana Foundation, and their executives (Solana Defendants): Plaintiffs allege that Solana’s involvement went far beyond merely providing blockchain technology. According to the complaint, there was close technical coordination and communication between Pump.fun and Solana Labs, going well beyond a typical developer-platform relationship.

-

Jito Labs and their executives (Jito Defendants): Plaintiffs argue that it was Jito’s MEV technology that enabled insiders to pay extra fees to ensure priority execution of their trades, allowing them to buy tokens before ordinary users and profit risk-free through arbitrage.

The plaintiffs’ strategy is clear: they aim to prove that Pump.fun, Solana, and Jito did not operate independently, but instead formed a tightly-knit alliance of mutual interest. Solana provided the blockchain infrastructure, Jito supplied the MEV tools, and Pump.fun ran the platform—three entities jointly building a system that appeared decentralized but was in fact manipulated.

The Core Allegations: It’s Not Just About “Losing Money”

Many might assume this is simply a group of angry investors seeking redress after losing money speculating on coins. But a careful reading of the hundreds of pages of legal filings reveals that the plaintiffs are accusing the defendants of orchestrating a carefully designed fraud scheme.

First Allegation: Sale of Unregistered Securities

This forms the legal foundation of the entire case.

Plaintiffs argue that all Meme tokens issued on Pump.fun are essentially investment contracts. Under the *Howey Test, these tokens meet the definition of securities. However, the defendants never filed any registration statements with the U.S. Securities and Exchange Commission (SEC) before publicly selling these tokens to the public—a violation of Sections 5, 12(a)(1), and 15 of the Securities Act of 1933.

When selling tokens via the “bonding curve” mechanism, the platform also failed to disclose essential risk information, financial status, or project background—all of which are mandatory disclosures for registered securities offerings.

Note: Howey Test is a legal standard established by the U.S. Supreme Court in the 1946 case SEC v. W.J. Howey Co., used to determine whether a particular transaction or scheme constitutes an “investment contract.” If a transaction meets the criteria of the Howey Test, the asset is considered a “security” and must be regulated by the U.S. Securities and Exchange Commission (SEC), requiring compliance with registration and disclosure obligations under the Securities Act of 1933 and the Securities Exchange Act of 1934.

Second Allegation: Operating an Illegal Gambling Enterprise

Plaintiffs define Pump.fun as a “Meme Coin Casino.” They argue that users depositing SOL to buy tokens are essentially placing bets, with outcomes determined largely by luck and market speculation rather than the actual utility of the tokens. The platform, acting as the “house,” takes a 1% fee on every transaction—just like a casino rake.

Third Allegation: Wire Fraud and False Advertising

Pump.fun publicly promoted itself as offering a “fair launch,” “no presale,” and “rug-proof” environment, creating the impression that all participants started on equal footing. In reality, plaintiffs allege, this was an outright lie.

The complaint states that Pump.fun secretly integrated MEV technology provided by Jito Labs. This meant that insiders who knew the “inside information” and were willing to pay extra “tips” could use “Jito bundles” to front-run regular users’ transactions—buying tokens before others and immediately selling for profit upon price increases. This is known as frontrunning.

Fourth Allegation: Money Laundering and Unlicensed Money Transmission

Plaintiffs accuse Pump.fun of receiving and transferring large sums of money without holding any money transmission license. The complaint alleges that the platform even assisted North Korean hacker group Lazarus in laundering illicit funds. One cited example involves hackers issuing a Meme coin named “QinShihuang” (Qin Shi Huang) on Pump.fun, using the platform’s high traffic and liquidity to mix “dirty money” with legitimate retail investor funds.

Fifth Allegation: Complete Lack of Investor Protection

Unlike traditional financial platforms, Pump.fun lacks any “Know Your Customer” (KYC) procedures, anti-money laundering (AML) protocols, or even basic age verification.

The plaintiffs’ central argument can be summed up in one sentence: This was not a normal investment affected by market volatility, but a fraudulent system designed from the outset to make retail investors lose while enabling insiders to profit.

This expansion signifies a fundamental shift in the nature of the lawsuit. Plaintiffs are no longer content with accusing Pump.fun alone; instead, they portray it as part of a larger “criminal network.”

One month later, on August 21, plaintiffs submitted a RICO Case Statement, formally accusing all defendants of forming a “racketeering enterprise” that used Pump.fun—an ostensibly “fair launch platform”—to operate a manipulated “Meme Coin Casino.”

The plaintiffs’ logic is straightforward: Pump.fun does not operate in isolation. Behind it stands Solana, providing blockchain infrastructure, and Jito, supplying MEV tools. Together, the three form a tight-knit alliance defrauding ordinary investors.

But what evidence do the plaintiffs actually have to support these claims? The answer emerged months later.

Key Evidence: The Mysterious Whistleblower and Chat Logs

After September 2025, the nature of the case underwent a fundamental transformation.

Because the plaintiffs obtained smoking-gun evidence.

A “confidential informant” provided the plaintiffs’ legal team with the first batch of internal chat logs—approximately 5,000 messages. These chats allegedly originated from communication channels within Pump.fun, Solana Labs, and Jito Labs, documenting technical coordination and business interactions among the three parties.

The emergence of this evidence was a major breakthrough for the plaintiffs. Prior allegations regarding technical collusion, MEV manipulation, and insider trading advantages remained speculative due to lack of direct proof.

These internal chat logs, however, allegedly demonstrate a “conspiracy” among the three parties.

One month later, on October 21, the mysterious informant delivered a second batch of files—this time even more substantial, comprising over 10,000 chat messages and related documents. These materials allegedly detail:

-

How Pump.fun coordinated technical integration with Solana Labs

-

How Jito’s MEV tools were embedded into Pump.fun’s trading system

-

Discussions among the three parties on how to “optimize” trading processes (which plaintiffs interpret as coded language for market manipulation)

-

How insiders leveraged informational advantages to conduct trades

The plaintiffs’ attorneys stated in court filings that these chat logs “reveal a meticulously designed fraud network,” proving that the relationships between Pump.fun, Solana, and Jito go far beyond superficial “technical partnerships.”

Request to File Second Amended Complaint

Faced with such a massive volume of new evidence, the plaintiffs needed time to organize and analyze it. On December 9, 2025, the court granted the plaintiffs’ request to file a Second Amended Complaint, allowing them to incorporate the new evidence into the lawsuit.

However, the challenge remains: reviewing over 15,000 chat messages—sorting, filtering, translating (some possibly non-English), and analyzing their legal significance—is an enormous task. Combined with the upcoming Christmas and New Year holidays, the plaintiffs’ legal team clearly lacked sufficient time.

On December 10, the plaintiffs filed a motion requesting an extension to submit the Second Amended Complaint.

Just one day later, on December 11, Judge McMahon approved the extension. The new deadline was set for January 7, 2026. This means that after the new year, a potentially explosive Second Amended Complaint will be presented in court.

Current Status of the Case

To date, the lawsuit has been ongoing for nearly a year, but the real battle has only just begun.

On January 7, 2026, the plaintiffs will submit the Second Amended Complaint containing all new evidence, revealing what those 15,000 chat logs truly contain. Meanwhile, the defendants remain strikingly silent. Alon Cohen, co-founder of Pump.fun, has not spoken on social media for over a month, and executives from Solana and Jito have made no public response to the lawsuit.

Interestingly, despite the growing scale and impact of this litigation, the cryptocurrency market seems largely unfazed. Solana’s price has not experienced significant volatility due to the lawsuit, and while the $PUMP token continues to decline, this is more attributable to the collapse of the overall Meme coin narrative than the lawsuit itself.

Epilogue

A lawsuit born from losses on Meme coin trades has evolved into a class action targeting the entire Solana ecosystem.

The case has transcended the notion of “a few investors seeking redress for losses.” It touches on the most fundamental questions in the crypto industry: Is decentralization real, or merely a carefully crafted illusion? Is a “fair launch” truly fair?

Yet many critical questions remain unanswered:

-

Who exactly is the mysterious whistleblower? A former employee? A competitor? Or an undercover regulator?

-

What exactly is contained in the 15,000 chat logs? Solid evidence of conspiracy, or out-of-context snippets of normal business discussions?

-

How will the defendants respond in their defense?

In 2026, with the filing of the Second Amended Complaint and the progression of the trial, we may finally get some answers.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News