Pump.fun: The tokenization trend has reached live streaming

TechFlow Selected TechFlow Selected

Pump.fun: The tokenization trend has reached live streaming

The livestream wind suddenly rises, fans buy tokens.

Author: Alea Research

Compiled by: TechFlow

The rise of live streaming has transformed content from entertainment into a high-leverage market. Traditional work offers fixed hourly returns, while live streaming multiplies one hour's output by the number of viewers. A single hour of streaming can generate thousands of hours of watch time—an asset that advertisers, platforms, and creators can monetize. However, income distribution among creators remains highly unequal.

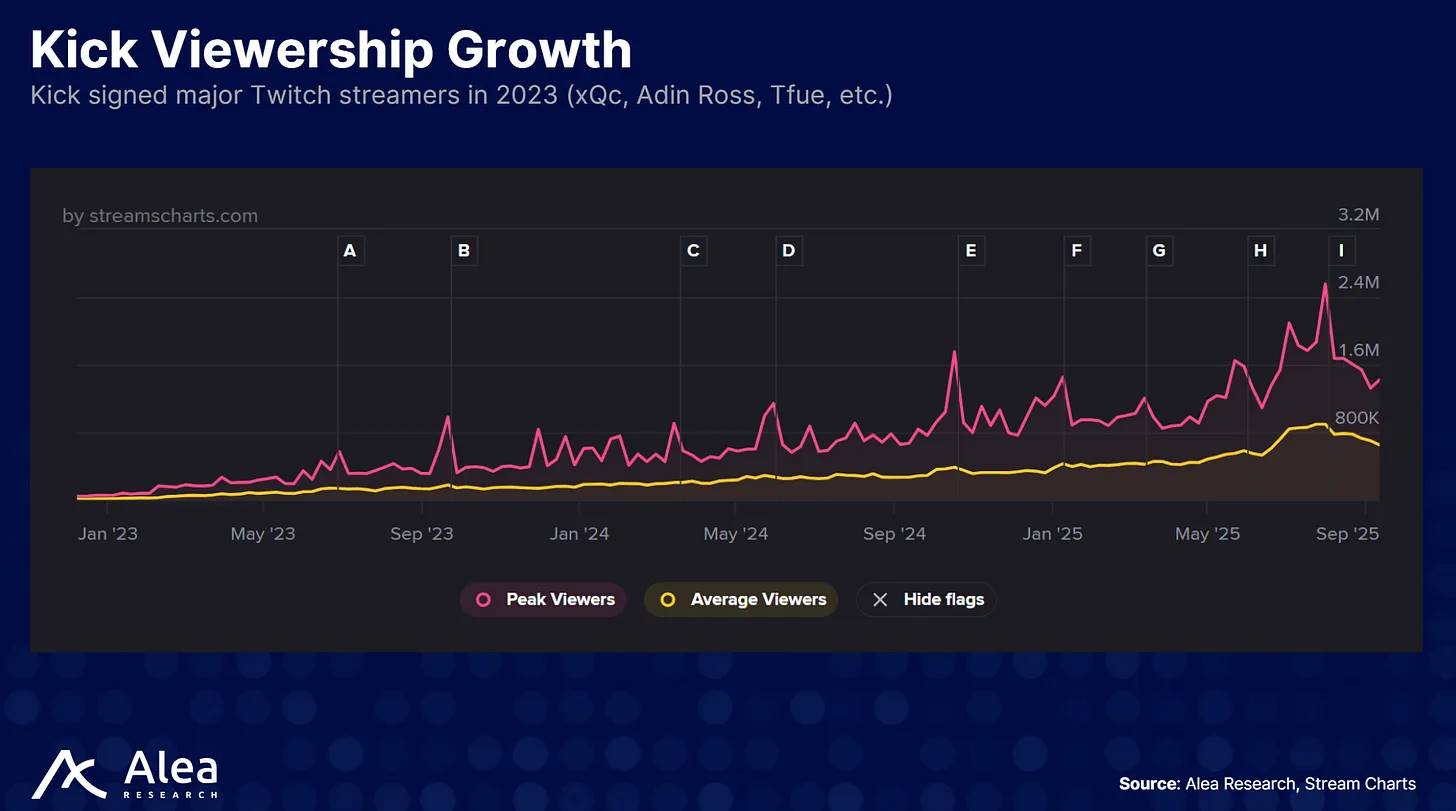

On Twitch and YouTube, revenue primarily comes from subscriptions and ads. Tiered revenue sharing means average streamers receive only 50% of subscription income, while top creators earn up to ten times more. New entrants like Kick have disrupted this model by allowing streamers to keep 95% of subscription revenue, triggering a "Kick vs Twitch" battle and multi-million dollar signing contracts.

Against this backdrop, Pump.fun—a platform known for launching memecoins—quietly introduced live streaming in mid-2025 with a dynamic fee model linking host earnings to their token’s performance.

In this article, we explore how Pump.fun’s creator capital markets work, why they matter in the competition against Kick and Twitch, and the rationale behind tokenizing live streams.

Stay updated on market trends ⬇️

Current State: Kick vs. Twitch

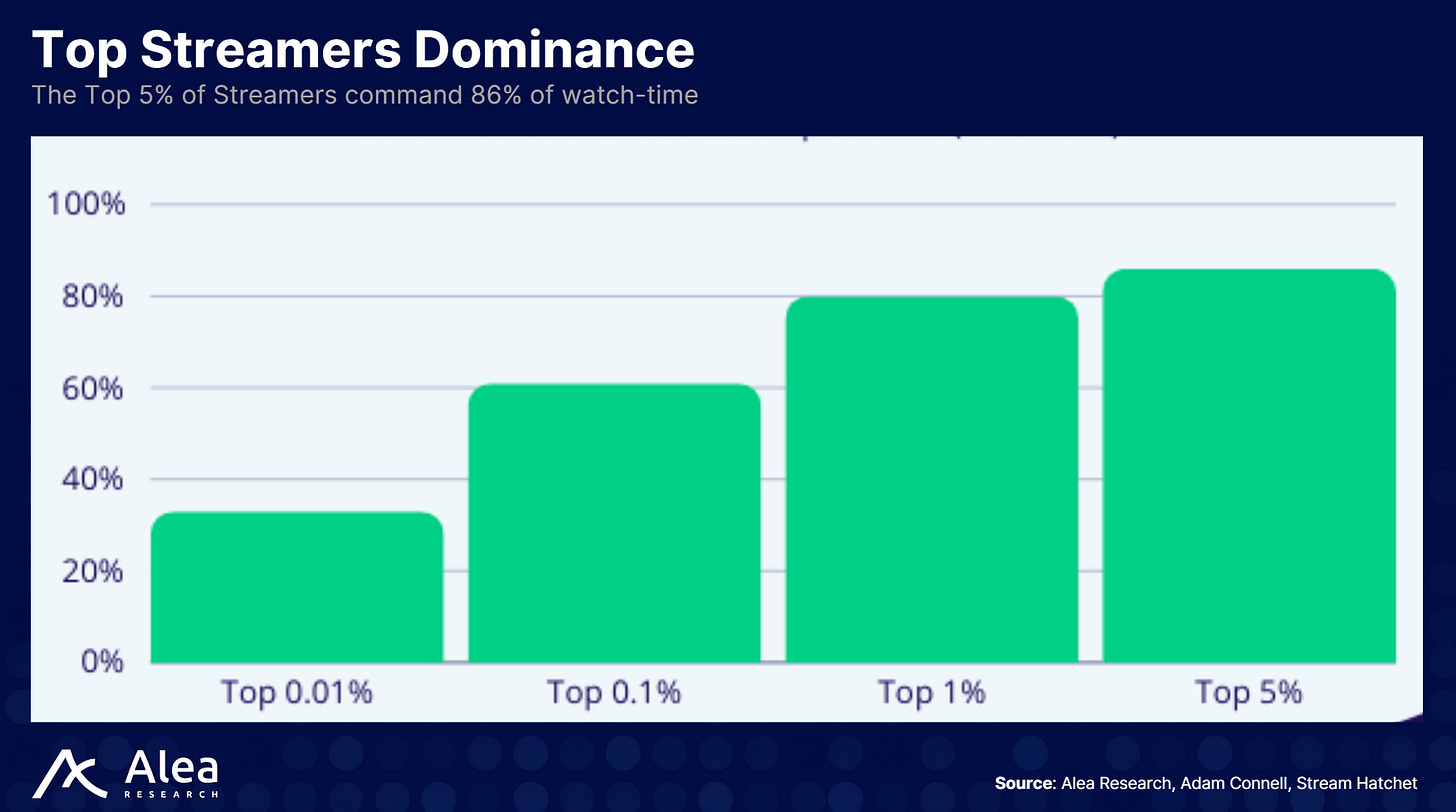

Twitch pioneered the live streaming industry, averaging 1.5 billion viewing hours per month. For most streamers, the standard subscription revenue split is 50/50 with Twitch, while ad revenue (via the Ads Incentive Program, AIP) is split 55/45. Top-tier streamers with Partner Plus status receive more favorable 70/30 subscription splits. This creates a Pareto dynamic where top creators capture 80% of viewing time and revenue, leaving smaller creators to compete for the remaining 20%.

For example, Twitch’s top streamer Kai Cenat has active subscriber counts and earnings nearly exceeding the combined total of streamers ranked #2 through #10.

Kick launched in 2022 backed by gambling platform Stake.com. It challenged Twitch by promising streamers 95% of subscription revenue and permitting content restricted on Twitch, such as gambling. Kick also signed lucrative deals with top Twitch streamers to migrate. For instance, it reportedly offered Twitch star xQc a two-year non-exclusive contract worth $100 million, and signed Amouranth for approximately $30–40 million.

Between these announcements, Kick added over a million new users. These moves show that streaming platforms are willing to spend heavily for attention, though revenue still largely stems from subscriptions, ads, and donations.

Attention Economy and the Pareto Effect

A common misconception is that live streaming is a zero-sum game, where rewards and viewing time dilute as more streamers join. In reality, attention follows a Pareto Distribution, where a small number of viral creators capture most of the audience share, while the majority struggle. When top creators like Kai Cenat or iShowSpeed go live, they expand the entire viewer pool, attracting millions of fans who may have never used a new platform before to sign up and watch.

This phenomenon explains why Kick is willing to pay massive signing fees: introducing attention capital grows the entire ecosystem rather than merely stealing viewers from existing streamers.

Traditional Twitch streamers have already begun migrating to Pump.fun (e.g., League of Legends streamer BunnyFuFuu).

Pump.fun attempts to amplify this dynamic by enabling fans to import their spending power via tokens. Core fans already budget monthly donations, and purchasing a streamer’s token simply converts this spending into a tradable asset. Token holders are incentivized to promote the streamer (driving price up), and early supporters can share in gains if the creator goes viral. In this sense, streamer tokens convert donations into equity, aligning fan incentives with creator success and potentially mitigating the “dilution” feeling when new streamers join.

Entering Creator Capital Markets

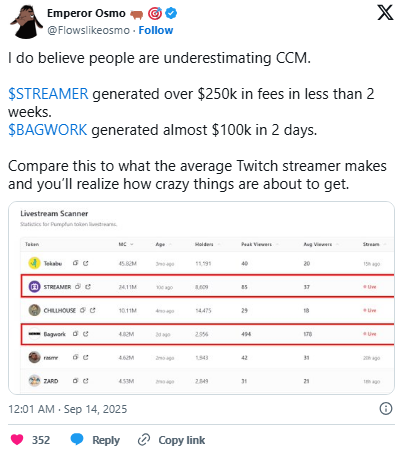

Pump.fun’s shift into live streaming introduces a completely different economic model: streamer tokens. Instead of supporting creators solely through tips or subscriptions, viewers now buy tokens tied to specific streamers. The value of these tokens fluctuates based on supply and demand, creating an investment-like mechanism allowing fans to speculate on a creator’s popularity.

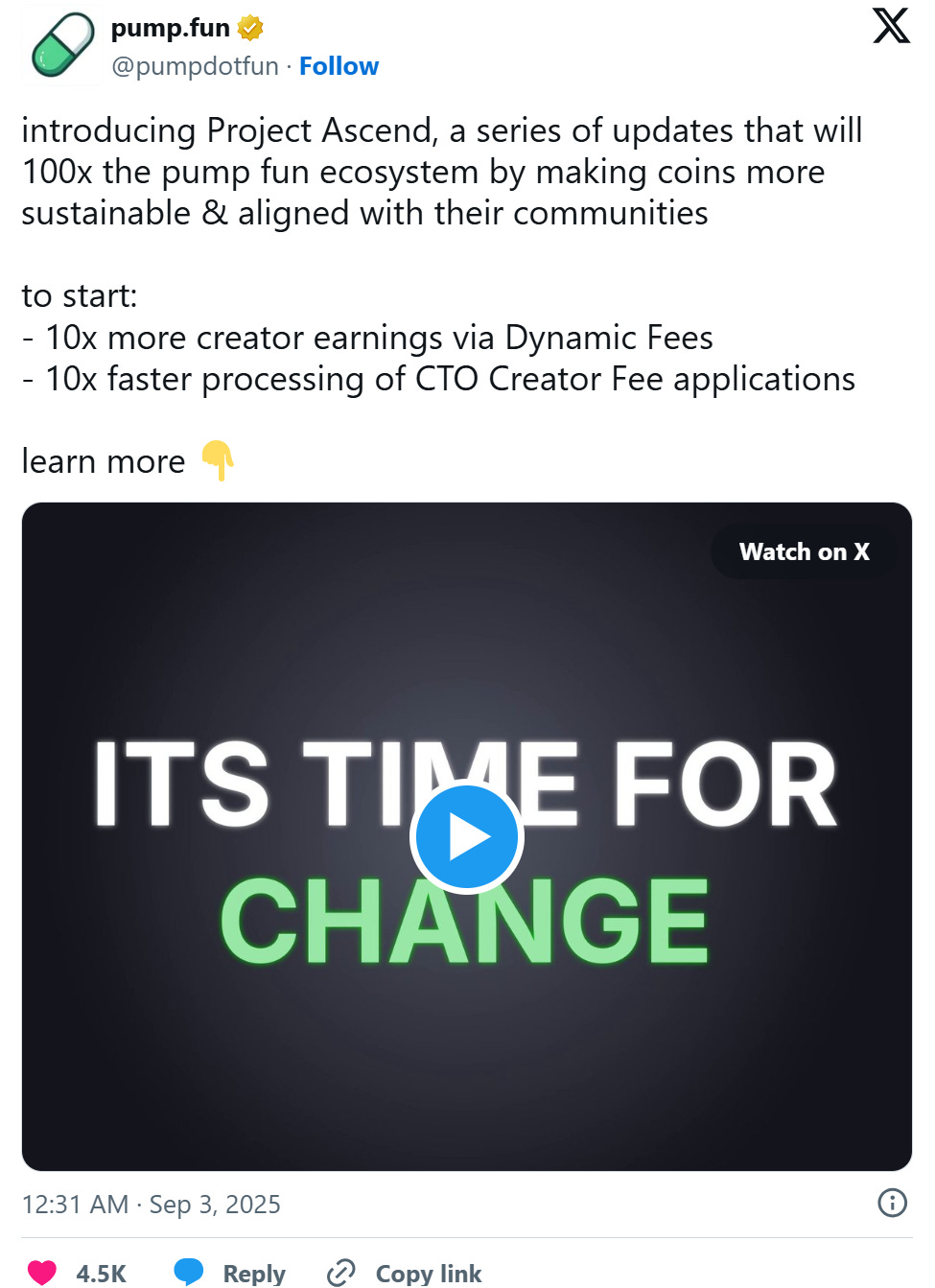

Streamers earn a fee with each token trade (up to 0.95% for smaller market cap projects under the Project Ascend initiative), which naturally decreases to 0.05% as the token’s market cap grows.

Pump.fun has also re-enabled live streaming for select users and improved content moderation by banning violent and animal abuse content. But its core innovation lies in this tokenized feedback loop, tightly linking fan engagement with creator revenue.

Pump.fun’s Tokenized Streaming Model

Project Ascend replaces Pump.fun’s flat 0.05% creator fee with a variable structure: 0.95% for tokens under $300K market cap, decreasing to 0.05% for those above $20M. This allows smaller creators to earn close to 1% on every token trade. According to Blockworks, this update helped Pump.fun regain market share, generating over $834 million in total revenue, with an annualized run rate nearing $492 million, while driving daily buybacks exceeding $68 million.

After pausing live streaming due to harmful behavior, Pump.fun relaunched the feature for 5% of users with stricter guidelines: violence, animal abuse, and hate speech are prohibited. While the platform expects some NSFW (not safe for work) content will still appear, it aims to allow edgy entertainment while maintaining a safety baseline—critical for mainstream user adoption and avoiding the pitfalls of its initial attempt.

Viewers can freely trade streamer tokens permissionlessly, with liquidity not controlled by any single entity. Long and short capabilities enhance market depth and provide price signals reflecting community sentiment. Tokens tied to creator performance also incentivize streamers to maintain consistent schedules and strengthen community interaction.

Why Choose Pump.fun Over Twitch or Kick?

-

Economic Incentives: On Twitch or Kick, fan donations or subscriptions yield no financial return; on Pump.fun, donations become assets. If a streamer gains popularity, their token may appreciate, offering speculative upside for early supporters.

-

Creator Earnings Scale with Success: Streamer income is no longer capped by fixed subscription rates. They earn fees from token trading volume and benefit from network effects as more traders join. Pump.fun’s dynamic fee model means small creators could earn up to 19 times more per transaction compared to older flat-fee systems.

-

Community Ownership: Streamers share economic incentives with their audience. This may encourage more collaborative content, such as joint challenges or community-driven decisions on future streams.

Conclusion

Pump.fun is betting on tokenized fanbases, unlocking larger attention and donation markets by letting fans share in the upside. Whether it can replicate Kick’s early success depends on its ability to attract top talent, maintain robust content moderation, and scale its dynamic fee model.

But if the experiment succeeds, it could create a new paradigm for the creator economy—merging live streaming, trading, and speculation into one.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News