NYSE's Final Move: The Endgame of Stock Tokenization or the Dawn of Crypto-Friendly Brokerages?

TechFlow Selected TechFlow Selected

NYSE's Final Move: The Endgame of Stock Tokenization or the Dawn of Crypto-Friendly Brokerages?

The NYSE's launch of a 24/7 blockchain-based stock trading platform marks the entry of stock tokenization into an officially led, standardized phase. Privately issued tokens will be restricted, and future opportunities lie in building crypto-friendly brokerage services that integrate with official systems.

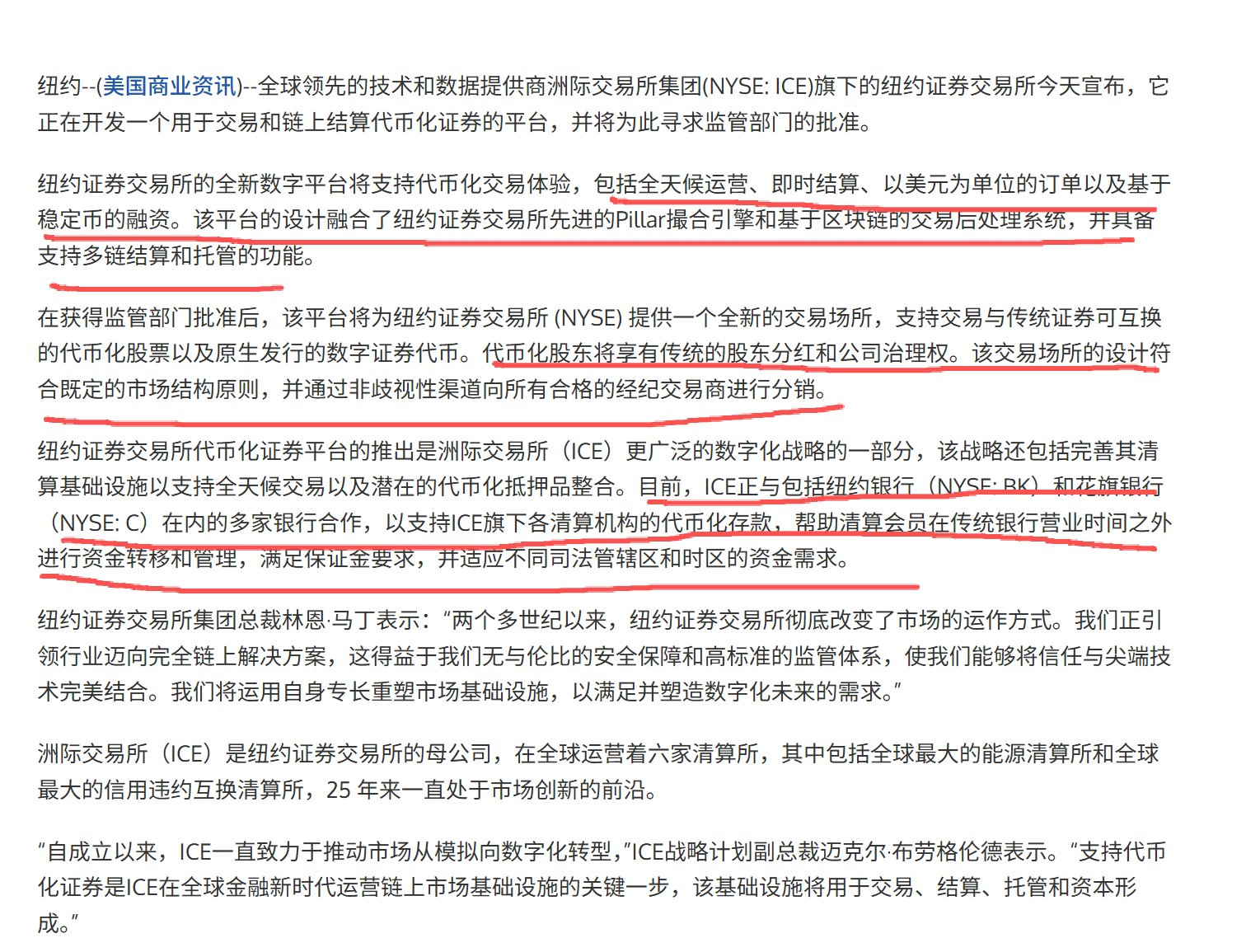

Just now, the NYSE announced it's launching a 24/7 on-chain stock trading platform. In simple terms: U.S. stocks will soon be tradable around the clock on blockchain.

NYSE will launch tokenization stock trading platform

Many people’s first reaction is: “Great! Stocks are finally going fully on-chain!” “Does this mean anyone can issue stock tokens now?”

But if you actually break this down, you’ll arrive at a counterintuitive conclusion:

The NYSE entering the space doesn’t mean stock tokenization becomes more open—it actually signals the end of the era where private companies freely issue stock tokens.

1. Plain Language: What Is Stock Tokenization?

No jargon—let’s use a straightforward analogy.

- Stocks: You hold a "share" in a company through a broker

- Tokenization: Using the broker’s infrastructure, users/institutions mint that "share" as a token on blockchain

Sounds great, right? That’s exactly what Stablestock thought earlier this year: Could we replicate the stablecoin model, using brokers as the backend to tokenize stocks and trade them freely on-chain? The problem lies here—there are numerous compliance and technical hurdles involved.

Let me give some examples. On the compliance side: without being a licensed broker, you lack custody rights over user assets, meaning users can’t transfer shares into your system—they can only buy from zero to one. On the technical side, take stock splits and reverse splits: once underlying stocks undergo such complex operations (which happen frequently), it’s extremely difficult for smart contracts to handle them correctly. If oracle data isn’t updated properly, it could trigger liquidations across perpetuals, lending, and other derivative products.

Over the past few months exploring stock tokenization, beyond these issues, we’ve encountered many more technical challenges—leading us to realize that the true foundation of stock tokenization lies not with the issuing company, but with DTCC, Nasdaq, or NYSE. Without support from NYSE/Nasdaq/DTCC at the base layer, stock tokenization risks becoming a dead-end sector.

2. Why Can Private Companies Issue Stablecoins But Not Stock Tokens?

Unlike stablecoins, stock tokens aren't something private companies can freely issue. Stablecoins can be issued by private firms because "the U.S. dollar itself is freely circulating." Stock tokens cannot, because "stocks aren’t truly under the control of brokers or individual companies."

Stablecoins are pegged to the U.S. dollar—a freely transferable asset. As long as you have a bank account, you can send, receive, and transfer dollars. Issuing a stablecoin is essentially just providing "convertibility": users deposit $1, you mint 1 stablecoin; they can redeem it anytime. As long as reserves are real and redemptions reliable, the logic holds. Dollars don’t involve dividends, voting rights, or ownership registration—making both technical and legal structures relatively simple.

Stocks are entirely different. They’re not stored within any single broker—the ultimate recordkeeping and custody reside in centralized systems like DTCC. The stock you buy represents shareholder identity, not merely a transferable asset. Transferring stocks requires clearing, reconciliation, and registry updates—far more complex than a simple wire transfer.

More importantly, stocks evolve throughout their lifecycle: dividends, voting, splits, secondary offerings—all changes must be legally valid and accurately reflected in the shareholder register. This means issuing a stock token isn’t a “set-and-forget” act; it demands responsibility for the entire life cycle of the asset.

Let’s illustrate this with two examples: transfers and stock splits.

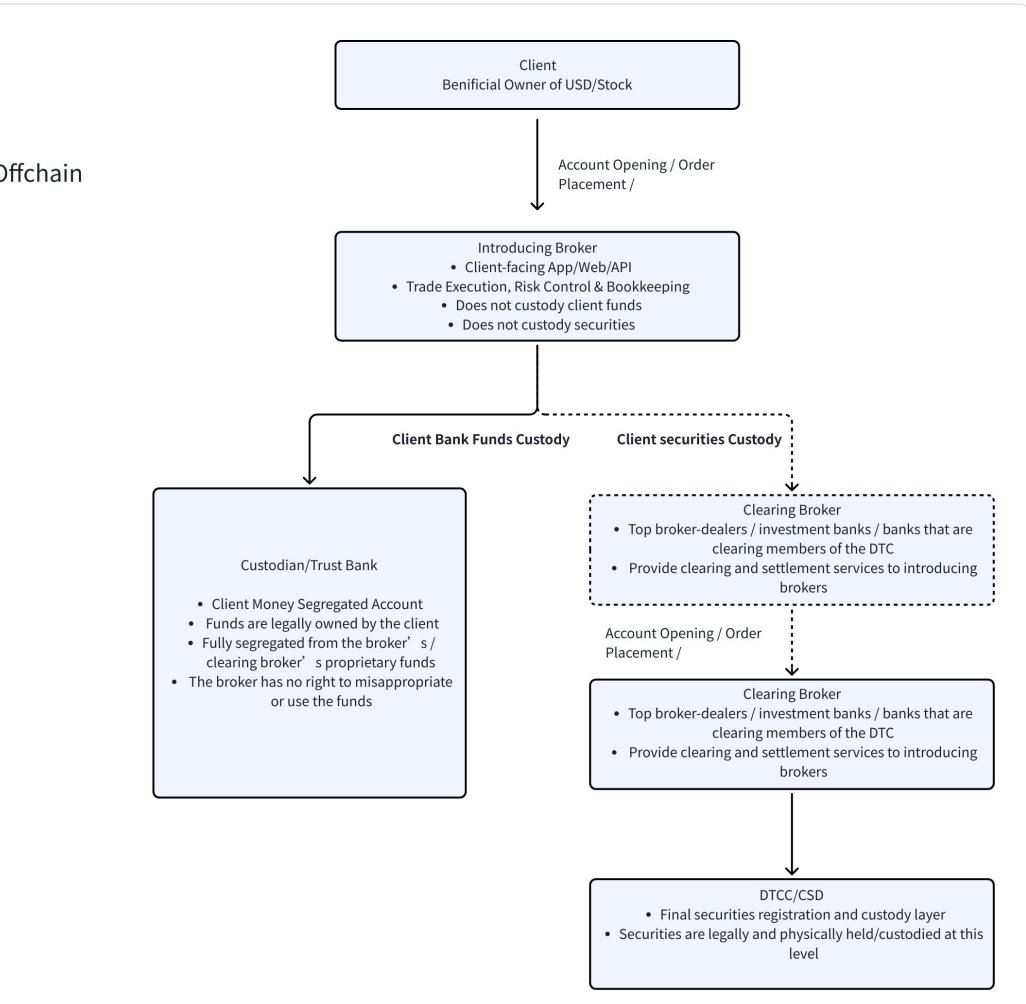

Transfers work seamlessly with bank accounts because USD flows through banking rails. No need to notify anyone or update ownership registries. But stocks aren’t money—they come with a full legal framework and ownership structure. Where are stocks actually held? Contrary to popular belief, when you buy stocks via a brokerage app, those shares aren’t stored with that broker. Final registration and custody sit with DTCC (see flowchart below). Shareholder lists, voting rights, and split adjustments all follow DTCC records. Unlike cash transfers, changing stock ownership requires updating shareholder registers, adjusting dividend entitlements, and coordinating between brokers, clearinghouses, and central depositories. Stocks were never meant to move freely—this business logic is fundamentally different from stablecoins.

Asset behaviors also differ drastically. Dollars sit idle. Stocks generate dividends, enable voting, undergo splits, mergers, and issuances. Consider a real example: Netflix announced a 1-for-10 split on November 17. Suppose a token issuer holds 1,000 NFLX shares in its broker inventory (registered at DTCC), and 1,000 NFLX tokens circulate on-chain pre-split. After the split, the broker automatically has 10,000 shares—handled seamlessly by clearing and custody systems. But how does this work on-chain?

It seems simple: mint an additional 9,000 tokens so each existing token becomes ten. But who executes this? Who ensures every wallet is correctly processed? What if tokens are locked in DeFi protocols, lending markets, or AMMs? How do you split tokens trapped in smart contracts? Can price oracles guarantee timely updates? (If relying solely on off-chain pricing feeds, the chain might show $10 while the actual value is $100.) Alternatively, keep the same number of tokens but change redemption ratios—e.g., 1 token = 10 shares. But then pricing becomes instantly messy, creating discrepancies between on-chain and off-chain values, risking distortion. Every corporate action would require rule changes. This is an incredibly complex—and frequent—challenge.

From these cases, it becomes clear: whether handling transfers or corporate actions like splits, the critical infrastructure is DTCC and NYSE/Nasdaq—not the stock token issuer.

3. When NYSE Enters, the Rules Change

When NYSE officially enters stock tokenization, it’s not just adding another player—it signifies a fundamental shift in industry dynamics.

In early 2025, stock tokenization was largely driven by private initiatives: projects issuing tokens mapping to stock value, attempting to solve limitations around trading hours, cross-border access, and efficiency. But this model only worked because there wasn’t yet a widely accepted, authoritative “official version” in the market.

Now, NYSE’s entry changes everything.

Once a stock tokenization solution emerges backed by top-tier exchanges, clearing systems, and regulatory frameworks, market choices become pragmatic: most clearing institutions, brokers, and users will opt directly for the official system rather than continue using privately issued stock tokens. The reason is simple—the official solution inherently offers superior foundational capabilities.

These official stock tokens are typically integrated directly with mature clearing and custody infrastructures, enabling native support for complex corporate actions like splits, reverse splits, dividends, voting, M&A, and new issuances—precisely the areas where private solutions struggle and often fail. For institutional players, functional completeness and legal clarity matter far more than whether something is “natively on-chain.”

Even more crucially, official backing creates gravitational pull for liquidity. When clearing firms, market makers, banks, and large institutions build services around official tokens, privately issued stock tokens will inevitably face illiquidity, pricing discounts, and high trust costs. Even if technically viable, they lose economic relevance. Privately issued stock tokens are essentially side pools built outside the massive liquidity of traditional exchanges.

Therefore, NYSE’s move doesn’t signal “widespread flourishing of stock tokenization,” but sends a clear message: stock tokenization is shifting from “multiple parallel experiments” toward “high concentration and standardization.”

In this new landscape, opportunities no longer lie with projects trying to “issue more tokens,” but with those capable of integrating into the official stock token ecosystem and building user-facing experiences and trading interfaces around it.

This is the real transformation triggered by NYSE’s entry.

4. Each Upgrade in Stock Infrastructure Has Triggered Broker Paradigm Shifts

Looking back at the past 100 years of stock trading history reveals a clear pattern: each paradigm shift in trading has given rise to entirely new types of brokers.

The first major turning point occurred before the 1970s. At that time, stock trading relied entirely on paper certificates and human intermediaries. Ordinary people had almost no access—the stock market was essentially a game for elites. This is the scene often depicted in old movies: trading floors filled with brokers shouting bids and offers.

The second shift came after the 1970s, with the establishment of DTC. Stock transactions began to be centrally processed by large investment banks and brokerages. Firms like Morgan Stanley, Goldman Sachs, and Merrill Lynch started executing trades and settlements on behalf of clients. This was the era portrayed in *The Wolf of Wall Street*: still highly professional, but opening up broader client access via telephone.

The third shift emerged after the 2000s, fueled by the internet and API-based trading. Online brokers like Interactive Brokers and Robinhood rose to prominence, democratizing stock trading for the masses. History has repeatedly shown: whenever the trading model undergoes systemic change, the broker ecosystem gets reshaped. We believe that by around 2026, stock tokenization will become an irreversible trend. As settlement and delivery gradually migrate onto blockchain infrastructure, the entire stock trading system will enter a new window of reconstruction.

The current upgrade initiated by NYSE—its stock tokenization initiative combined with stablecoin-based settlement—is precisely such a paradigm shift.

Companies like Stablestock betting on “crypto-native brokers” in H2 2025 are essentially wagering on the continued global penetration of stablecoins. For the first time, stablecoins will allow a vast population long excluded from traditional finance to participate in global stock markets with lower barriers and less friction. We believe this marks the rebirth of the next-generation brokerage.

5. Stablestock’s 1–2 Year Roadmap

We’ve decided to focus our core efforts over the next 12–24 months on building a more crypto-friendly, truly on-chain-native next-generation neobroker.

Imagine a future where, within a single broker app, users can not only settle trades with stablecoins, but also:

- High-leverage spot trading (launching June)

- Perpetual futures (launching H1)

- Options (launching September)

- Cross-margin system combining crypto assets and stocks

- Prediction markets and simplified binary options

- IPO access (launching March)

- Hong Kong stock trading (launching March)

- Stock lending

- Second-level deposits and withdrawals

All built atop a unified, crypto-friendly broker architecture.

Additionally, as this foundation matures, we’ll progressively release comprehensive developer documentation, empowering independent developers to build applications on StableBroker, including:

- Lending markets

- AI-driven trading

- Wealth management vaults

- Follow trading

- On-chain ETFs

- Stock-backed stablecoins

- And other innovative StockFi products

Looking ahead, building a complete and mature stock tokenization broker infrastructure remains a long journey.

6. Final Thoughts

NYSE’s entry will undoubtedly disrupt certain crypto-native stock token projects. Business models based on “private issuance” and “unformed rules” will now face higher standards, tougher comparisons, and increasing marginalization. But this isn’t a systemic bearish signal.

On the contrary, it’s a structural shakeout brought by industry maturation.

As stock tokenization integrates into more robust clearing systems and official frameworks, the real winners won’t be those issuing more assets—but those building infrastructure around trading, settlement, and capital flows. Stablecoins will become even more critical as funding gateways; derivatives will gain clearer, more trustworthy underlying assets; and crypto-friendly brokers will emerge as key bridges connecting traditional securities with the on-chain world.

Competition will intensify, but innovation won’t disappear. Instead, innovation will become more practical—shifting from “how to issue assets” to “how to use assets more efficiently”; moving away from superficial on-chain replication toward solving real user pain points in funding, trading, settlement, and holding.

If previous stock tokenization was about boundary-pushing experimentation, NYSE’s entry marks a new phase—one with clearer rules, more professional participants, and innovations increasingly aligned with genuine financial needs. For projects that deeply understand both finance and crypto, this isn’t the end—it’s a new beginning.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News