Nasdaq floors the accelerator: from dipping into soup to feasting on meat—has the U.S. stock tokenization race entered its decisive phase?

TechFlow Selected TechFlow Selected

Nasdaq floors the accelerator: from dipping into soup to feasting on meat—has the U.S. stock tokenization race entered its decisive phase?

If history is any guide, today's tokenization is roughly at the same stage as the internet in 1996.

Author: Frank, MSX Research Institute

"Tokenization will ultimately consume the entire financial system."

For Nasdaq, this is no longer an empty slogan, but its most urgent strategic mission.

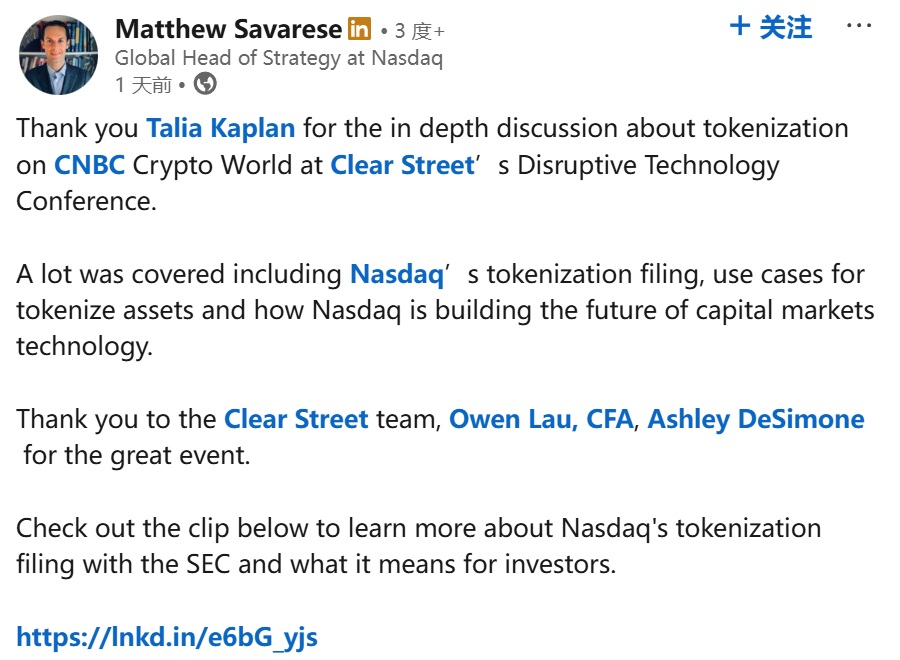

On November 25, Matt Savarese, Nasdaq’s Head of Digital Asset Strategy, stated in an interview with CNBC that securing SEC approval for its tokenized stock proposal has become a top priority and will be pushed forward "at the fastest possible speed." He cautiously emphasized, however, that Nasdaq does not aim to disrupt the existing system, but rather to advance asset tokenization in a "responsible" manner within the regulatory framework.

Yet regardless of how carefully worded, actions speak louder than words.

While other giants remain cautious or conduct only peripheral tests, Nasdaq—positioned at the core of TradFi—appears to have made a definitive decision and is aggressively accelerating.

I. It's Not Crypto Pushing Hard—It's Nasdaq

Go back three months to September 8, when Nasdaq filed a landmark rule change application with the U.S. Securities and Exchange Commission (SEC). At first glance, the goal seemed quite radical: allowing investors to directly trade blockchain-based tokens representing shares of major listed companies like Apple and Microsoft, as well as exchange-traded products (ETPs), on the Nasdaq main board.

However, a closer look at the details reveals that beneath this apparent radicalism lies a politically astute “hybrid architecture” solution—one that reflects Nasdaq’s deep understanding of where the SEC’s red lines lie. Rather than tearing everything down, it cleverly decouples “trading” from “settlement”:

The crux of the application treats tokenized stocks as regular stock transactions. Each tokenized stock trade will still be cleared and settled through the Depository Trust Company (DTC), while trade matching continues to occur on the same order book. Even if an order includes tokenized shares, it will not affect the exchange’s priority in executing the order.

In other words, on the front end, everything remains unchanged. Investors’ experience sees almost no difference—trade matching still happens on the same Order Book, tokenized stock orders receive no special priority, trades are still included in the National Best Bid and Offer (NBBO), and buyers of tokens retain full shareholder rights, including voting and liquidation rights.

The real revolution occurs in the backend settlement layer. Once a trade is executed, instead of following traditional processes, Nasdaq will send instructions to DTC to initiate a new on-chain workflow:

-

Lock-and-map: After trade execution, Nasdaq sends settlement instructions to DTC;

-

On-chain minting: DTC locks the equivalent traditional shares in a dedicated account, and the system mints corresponding tokens on-chain;

-

Instant distribution: Tokens are instantly distributed to brokers’ blockchain wallets;

In short, tokenized stocks remain fully aligned with traditional stocks during trading, introducing on-chain representation only at the settlement layer. This design ensures tokenized stocks do not operate outside the National Market System (NMS), but are seamlessly integrated into the existing regulatory and transparency framework—leveraging the vast existing liquidity pools while using blockchain as the next-generation settlement tool.

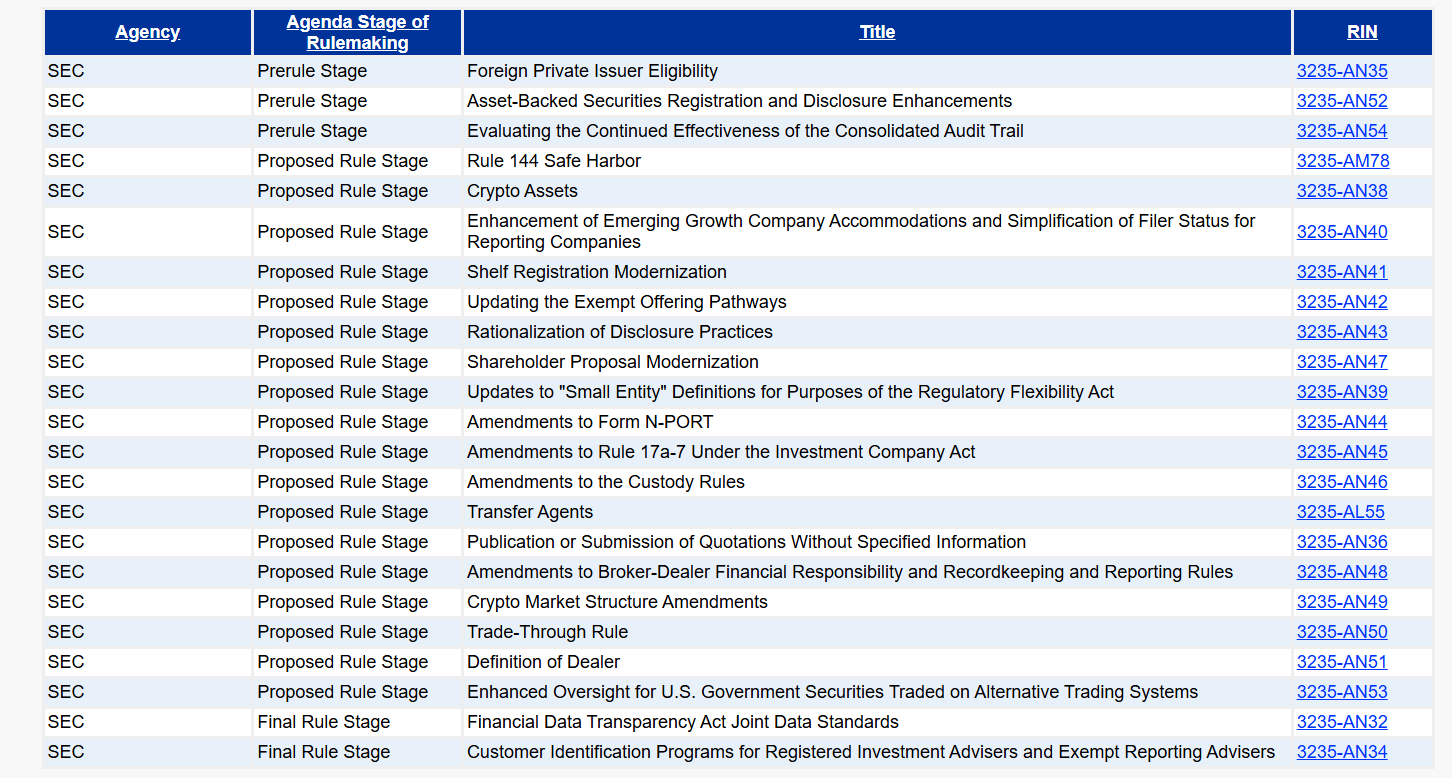

Interestingly, just days before Nasdaq submitted its application (on September 4), the SEC released its annual agenda, explicitly calling for reforms in crypto policy, including “restructuring crypto regulation” and “reducing overly complex rules criticized by Wall Street.”

This timing coincidence makes it hard not to suspect Nasdaq timed its move precisely, sensing subtle shifts in regulatory winds—perhaps even demonstrating a clear grasp of the SEC’s boundaries, thereby skillfully balancing “innovation” and “stability” in its design.

Chuck Mack, Senior Vice President of Nasdaq North America, captured the essence of this hybrid model in an interview: “We’re not trying to replace the current system, but to offer the market another more efficient and transparent technological option. Tokenized securities are simply the same assets expressed in a new form on the blockchain.”

Ultimately, in Nasdaq’s vision, tokenization isn’t about starting from scratch—it’s a mild yet firm upgrade to foundational infrastructure—one that leverages existing market structures and trading systems while positioning blockchain as the next-generation custody and settlement tool.

According to plans, once DTC’s infrastructure is ready, U.S. investors could see the first Nasdaq-settled tokenized stock trades by the end of Q3 2026.

At that point, Wall Street’s ledger may turn a completely new page.

II. Why Is Wall Street Acting So Boldly—And Why Now?

In fact, Nasdaq is not the first mover, but its entry marks the beginning of the decisive phase in this race.

Across Wall Street, a quiet onboarding movement has already begun: JPMorgan launched its Onyx platform for interbank settlements, BlackRock issued its tokenized U.S. Treasury fund BUIDL on Ethereum, and Citigroup is exploring cross-border payments and custodial tokenized assets.

Still, why is Nasdaq choosing to lead the charge right now?

A quote from BlackRock CEO Larry Fink might hint at the answer: “Since the invention of double-entry bookkeeping, ledgers have never been this exciting.” Indeed, the history of finance over the past centuries can essentially be seen as an evolution of “accounting technology”:

-

1602: The Amsterdam Stock Exchange was founded—the world’s first stock market—with paper certificates forming the basis of trust;

-

1792: The Buttonwood Agreement established the NYSE, ushering Wall Street into the era of paper contracts and open outcry trading;

-

1971: Nasdaq was founded, creating the world’s first electronic stock market;

-

1996: The Direct Registration System (DRS) was introduced, marking the start of the dematerialization era for U.S. equities;

Today, blockchain has become the latest bearer of this baton—when technological accumulation reaches a tipping point, transformation naturally follows.

Even more telling, regulatory attitudes are also shifting subtly. On November 12, the SEC website published the full text of a speech by Chairman Paul S. Atkins, which included a passage widely interpreted as a “pre-approval” for U.S. stock tokenization:

“Whether a stock is represented by a paper certificate, an account at the Depository Trust & Clearing Corporation (DTCC), or a token on a public blockchain, it remains fundamentally a stock; a bond does not cease to be a bond simply because its cash flows are tracked via smart contracts. Regardless of form, securities remain securities—and that’s straightforward to understand.”

Source: U.S. SEC official website

In essence, from the regulator’s perspective, a tokenized security is still a security—as long as the legal nature of the security remains unchanged, technical upgrades are no longer off-limits.

With both technological maturity and evolving regulations aligning, Nasdaq is moving swiftly to address three fundamental pain points in capital markets that cannot be solved under the traditional architecture:

-

Settlement efficiency: Moving from T+1 or longer to T+0 (real-time clearing), eliminating counterparty risk entirely—potentially saving global infrastructure tens of billions in operational costs annually;

-

24/7 trading: Breaking free from the 6.5-hour trading day, enabling 7×24 global liquidity and solving severe liquidity fragmentation;

-

Asset programmability: Embedding dividends, voting, and compliance checks into smart contracts, unlocking automated governance and greater composability;

Beyond technological progress, however, there is an even more crucial factor: this is fundamentally a restructuring of the profit distribution model. Within the current TradFi system, Nasdaq actually occupies a lower tier in the value chain:

Investors trade through brokers or dealers, who capture the bulk of transaction fees, margin interest, and funding flows (2C business). As an exchange, Nasdaq primarily earns revenue from matching, clearing, settlement, and listing services (2B business).

To put it bluntly, brokers are eating the meat, while Nasdaq is left with the soup.

But once U.S. equities become tokenized—issued and circulated directly on Nasdaq’s own chain or a permissioned chain—the situation would instantly reverse. Nasdaq could then capture data and revenue across the entire lifecycle—from issuance and circulation to settlement. It would no longer be just a matching platform; its value capture model would shift from simple fees to a combination of “direct commissions + value-added services + network effects.”

If Nasdaq further launches its own on-chain trading venue (a permissioned-chain DEX), it could nearly replicate the perfect closed loop of a top-tier crypto CEX: users place orders → matching → on-chain recording → clearing and settlement → asset custody—all in one seamless flow.

This means the massive pie currently fragmented among “bank-broker custody funds + clearinghouse settlement + broker front-end client services” could all be consolidated onto a single chain. For major existing TradFi players (brokers, custodians), this would be profoundly disruptive—but for Nasdaq, it represents a historic opportunity to keep the meat in its own pot.

III. What Comes Next—Where Will the Storm Strike?

Objectively speaking, U.S. stock tokenization is no longer just a narrative—it has become a powerful historical tide.

Slogans can deceive, but actions cannot. As Nasdaq accelerates, many others have already entered the field: Robinhood launching tokenized private equity, Kraken offering tokenized U.S. stocks via XStocks, Galaxy Digital listing its own shares on public blockchains, and SBI Holdings building on-chain trading in Japan. Whether native crypto firms or traditional financial giants, all are racing to gain first-mover advantage in this emerging space.

Yet ironically, just as Nasdaq surges ahead, resistance from the native crypto world has emerged. On October 16, Ondo Finance, a leading RWA issuance protocol, sent an open letter to the SEC urging it to delay approval of Nasdaq’s rule change, citing “lack of transparency” and criticizing Nasdaq’s vague description of the settlement process.

Source: Ondo Finance

It’s hard not to interpret this as more than just a compliance debate—it likely reflects Ondo’s competitive anxiety over being squeezed out. If Nasdaq directly issues the most credible, highest-liquidity native tokenized stocks (e.g., Tokenized-AAPL), then protocols like Ondo, which focus on “middle-layer issuance and underwriting,” will see their survival space drastically reduced.

Put plainly, why would investors buy assets packaged by intermediaries when they can get Nasdaq-native tokenized stocks directly?

As institutional players like Nasdaq enter, the barrier to upstream asset issuance collapses. All RWA issuance protocols will face a similar “disintermediation” blow—a deeper crisis facing the RWA sector in its second half, where mere tokenized stock issuance is no longer attractive.

Especially as DEXs like Hyperliquid use HIP3 perpetual contracts to capture U.S. stock liquidity, the appeal of simply holding tokenized stocks is diminishing. Yet this is not the end of the U.S. stock tokenization赛道—rather, it’s the dawn of a historic opportunity for “downstream protocols.”

Nasdaq handles “asset creation” (issuance and settlement), but it cannot monopolize all “asset utilization” (trading and applications). Even if some fear Nasdaq might launch an official DEX to squeeze out other protocols, just as Uniswap and Hyperliquid coexist on-chain, the ecosystem of trading, derivatives, lending, and market-making built around Nasdaq’s tokenized U.S. stocks will become a blue ocean of innovation.

Decentralized protocols and compliant trading platforms near the traffic gateway—those building trading capabilities around on-chain composability—are more likely to truly capture this wave of opportunity. Of course, no one can guarantee MSX will be the winner, but the overarching idea of “downstream dominance” is sound.

Final Thoughts

Interestingly, on December 1, The Economist published an article discussing “How RWA Tokenization Is Changing Finance,” drawing a symbolic analogy:

If history is any guide, tokenization today is roughly at the same stage as the internet in 1996—when Amazon had sold only $16 million worth of books, and three of today’s dominant “Magnificent Seven” tech giants hadn’t even been born.

From yellowed paper certificates to SWIFT’s digitization in 1977, and now to blockchain’s atomic settlement, the evolution curve of financial infrastructure is not only mirroring the internet’s pace—but possibly surpassing it.

For Nasdaq, this is a high-stakes bet of “revolutionize or be revolutionized”; for the crypto industry and new RWA entrants, this is not just a brutal shakeout of winners and losers, but a once-in-a-generation opportunity comparable to betting on the next Amazon or NVIDIA in the 1990s.

The future is still early—the arrow has just been released.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News