Bitget Wallet Research|Tokenization of Private Company Equity: The Trillion-Dollar "Besieged City" and the Attention Stolen by Perpetual Contracts

TechFlow Selected TechFlow Selected

Bitget Wallet Research|Tokenization of Private Company Equity: The Trillion-Dollar "Besieged City" and the Attention Stolen by Perpetual Contracts

The rewriting of asset structure and market structure is beginning.

1. Introduction

In the global asset landscape, private company equity—especially fast-growing unicorn companies—represents a high-value and imaginative asset class. However, for a long time, this area of value appreciation has been almost entirely monopolized by professional institutions such as private equity (PE) and venture capital (VC), accessible only to select institutions and high-net-worth individuals. Ordinary investors are often limited to passively following unicorn growth stories through news reports.

Blockchain and tokenization are changing this situation. By issuing tokens on-chain that represent private company equity or its economic rights, the market aims to build a new 7×24 trading secondary market within a compliant framework, enhancing liquidity, lowering access barriers, and connecting TradFi with DeFi at scale.

Institutions have placed extremely high expectations on this field. For example, Citigroup estimates that tokenized private equity could grow 80-fold within ten years, approaching a $4 trillion market size. Against this backdrop, tokenization of private company equity has naturally become one of the most watched sub-sectors in RWA, significant not only for technological innovation but also for deep transformations in asset participation mechanisms, exit methods, and return structures. In this article, Bitget Wallet Research will explore how equity tokenization can help private companies break through these walls.

2. The Trillion-Dollar "Walled City": High Value, Hard to Enter or Exit

From an asset perspective, private company equity spans from startups to large private groups, with holders including founding teams, employees (via ESOP/RSU), angel investors, VC/PE funds, and some long-term institutional investors. From a capital perspective, public data shows that global PE assets under management (AUM) are close to $6 trillion, while VC AUM is around $3 trillion, totaling approximately $8.9 trillion. Meanwhile, as of mid-2025, the total valuation of global unicorns hovers between $4.8–5.6 trillion—this figure represents only the top few thousand elite firms at the pyramid’s tip, with tens of thousands of mature private companies below the “unicorn threshold” remaining uncounted.

When combining these figures, a clear picture emerges: this is a multi-trillion-dollar asset pool with extremely poor liquidity—a walled city. On one hand, the market is largely inaccessible to most people. Major jurisdictions typically restrict primary private investment opportunities to accredited and institutional investors, with minimum investments often starting at hundreds of thousands or even millions of dollars. Combined wealth and regulatory barriers make it nearly impossible for ordinary investors to access this asset class. On the other hand, those inside the city often struggle to exit. For employees, angels, and VC/PE holders, the main exit routes remain limited to IPOs or acquisitions. Unicorn companies commonly delay going public, making ten-year lock-up periods standard, leaving paper wealth illiquid for extended periods. While off-chain private equity secondary markets exist, they heavily rely on intermediaries, feature opaque processes, high costs, and long cycles, making them inadequate as scalable liquidity outlets.

The asymmetry between high-value assets and inefficient liquidity mechanisms provides a clear demand case for private company equity tokenization: creating a new path for participation and exit without disrupting regulatory frameworks or corporate governance.

3. What Tokenization Truly Changes

Under compliance conditions, the value brought by tokenization goes beyond merely moving equity onto the blockchain—it fundamentally reshapes three core mechanisms.

First is continuous secondary market liquidity. Through tokenization and fractionalization, high-value equity can be divided into smaller units, enabling more compliant investors to participate in PE/VC-grade assets with lower capital requirements. From external investors' perspectives, this marks the beginning of allowing average individuals to own a small stake in companies like OpenAI or SpaceX; for internal holders, it offers employees, early shareholders, and certain LPs an alternative exit beyond IPO/M&A, enabling phased realization of value via 7×24 on-chain markets under controlled thresholds.

Second is more continuous price discovery and market capitalization management. Traditional valuations of private equity depend heavily on funding rounds, resulting in discrete, lagging prices—almost akin to intermittent quotations. If portions of equity or economic rights are tokenized and enter continuous trading under a compliant framework, both target companies and primary investors can leverage more frequent market pricing signals to inform future fundraising, actively manage “quasi-public market” valuations, and reduce valuation gaps between private and public markets.

Third is access to new financing channels. For some high-growth companies, tokenization is not just a tool for circulating existing equity, but also a mechanism for raising incremental capital. Through paths like Security Token Offerings (STOs), companies may bypass costly underwriting and lengthy IPO queues, directly raising funds from global compliant investors. For firms without short-term listing plans but seeking optimized capital structures and improved employee liquidity, this path holds practical appeal.

4. Three Models: Native Equity-on-Chain, Synthetic Derivatives, and SPV Structures

Regarding the tokenization of private company equity, the market has broadly developed three implementation approaches, differing fundamentally in legal nature, investor rights, and compliance pathways.

The first model is native collaborative equity-on-chain. This approach involves active authorization and participation by the underlying company, with share registration, token issuance, and shareholder registry maintenance all conducted within regulatory frameworks. On-chain tokens represent legally recognized equity, granting holders full shareholder rights such as voting and dividend entitlements. Securitize is a typical example, having helped companies like Exodus and Curzio Research tokenize their equity and list them on ATS platforms—and eventually even on the NYSE. The advantage lies in clear compliance and well-defined rights, though it requires strong issuer cooperation and tends to progress slowly.

The second model is synthetic mirror derivatives. These projects do not hold actual equity but instead index the valuation of target companies via contracts or notes, then issue perpetual contracts or debt-like tokens. Legally, investors form creditor or contractual relationships with the platform rather than being registered as shareholders of the target company, with returns fully dependent on contract settlements. Ventuals exemplifies this model, leveraging Hyperliquid’s perpetual contract infrastructure to break down valuations of non-listed firms like OpenAI into tradable units for long and short positions.

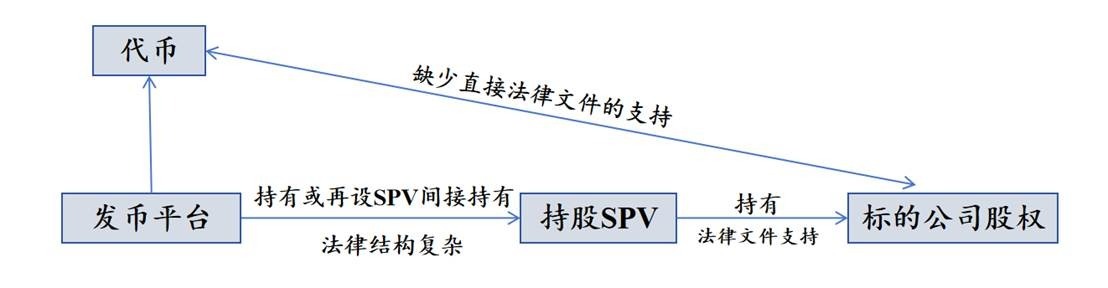

The third model—the most common in today's crypto context—is indirect holding via SPV structure. The issuing platform establishes a Special Purpose Vehicle (SPV), which acquires a small portion of the target company’s equity through traditional private secondary markets, then tokenizes the SPV’s beneficial ownership for public sale. Investors hold contractual economic rights to the SPV, not direct equity on the target company’s shareholder register. This model’s strength is practical feasibility—enabling a link between real equity and on-chain capital even without issuer cooperation. However, it inherently faces dual pressure from regulators and the target company’s legal team, with potential future disputes arising from transfer restrictions in shareholder agreements, SPV information opacity, and unclear liquidation arrangements.

5. Derivatives Counterparty: When OpenAI Gets "On-Chain" via Perpetual Contracts

Recently, a new signal is reshaping market perceptions of Pre-IPO RWA: many users don’t actually want shareholder status—they simply want the ability to bet on the rise or fall of unicorns like OpenAI and SpaceX at any time.

Hyperliquid has amplified this demand to the extreme. Through its HIP-3 programmable perpetual contract layer, any team can create a new perp market by staking sufficient HYPE. To ease cold-start challenges, Hyperliquid introduced Growth Mode, offering new markets about 90% taker fee rebates, enabling long-tail assets to quickly accumulate depth and activity in early stages.

Last week, Hyperliquid launched the OPENAI-USDH trading pair. This means a company not yet publicly listed, whose valuation is entirely driven by private markets, has been pulled into a 7×24, leveraged, globally accessible on-chain market—delivering a disruptive blow to Pre-IPO RWA.

The impact on expectations is stark: Pre-IPO equity tokens lacking liquidity are being marginalized before they even mature, overtaken by the depth and speed of perp markets. If this trend continues, primary market participants may eventually have to reference perp market on-chain prices when negotiating valuations—fundamentally altering the price discovery logic for private assets.

Naturally, questions arise: what exactly does the OPENAI-USDH price anchor to? Private company valuations lack continuous quotes off-chain, yet the on-chain perpetual contract runs 7×24, relying instead on a “soft anchoring” system built from oracles, long-term valuation expectations, funding rates, and market sentiment.

For the Pre-IPO RWA sector, there are two immediate impacts:

One is demand-side pressure. When ordinary investors care only about price speculation—not shareholder rights, dividends, or voting—perpetual DEXs like Hyperliquid offer simpler access, deeper liquidity, and richer leverage tools. In comparison, if Pre-IPO equity tokenization products only provide price exposure, they will struggle to compete with perp DEXs in terms of user experience and efficiency.

Two is the contrast in narrative and regulatory logic. Equity tokenization must repeatedly negotiate with regulators like the SEC and issuers’ legal departments, whereas perp DEXs currently operate largely in regulatory gray zones, using lightweight contract structures and global accessibility to capture mindshare and trading volume. For average users, “launching perpetual contracts first, worrying about real equity later” is becoming a more natural path.

This doesn't mean the Pre-IPO RWA narrative fails—but it serves as a wake-up call. For this sector to advance further, it must find its own differentiated positioning between “real shareholder rights, long-term capital allocation, cash flow distribution” and “on-chain native liquidity.”

6. Conclusion: Rewriting Asset and Market Structures Has Begun

The significance of private company equity tokenization lies not merely in enabling more people to own a piece of a unicorn, but in addressing the fundamental pain points of private assets: excessively high entry barriers, narrow exit paths, and delayed price discovery. Tokenization offers the first real glimpse that these structural constraints can be redefined.

In this process, Pre-IPO RWA presents both opportunity and stress test. It reveals genuine demand—employees, early shareholders, and investors alike are seeking more flexible ways to transfer value—while also exposing real-world constraints like regulatory friction, price anchoring difficulties, and insufficient market depth. Especially under the disruptive force of perp DEXs, the industry now clearly sees the speed and power of on-chain native liquidity.

Yet this doesn’t mean tokenization will stall. Transformations in asset, transaction, and market structures rarely hinge on one model dominating, but rather on issuers and infrastructure finding sustainable compromises between regulation and efficiency. Hybrid models are more likely to emerge—preserving shareholder rights and governance under compliant frameworks while also supporting continuous on-chain liquidity and global accessibility.

As more assets come on-chain in composable, tradable forms, the boundaries of private equity will be redefined: no longer scarce assets locked in closed markets, but fluid nodes within a global capital network.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News