Can Pump.fun tell a new story next year?

TechFlow Selected TechFlow Selected

Can Pump.fun tell a new story next year?

Despite the uncertainty, Pump remains one of the most resilient consumer applications in this cycle.

Author: Simon

Translation: TechFlow

The following is excerpted from Delphi's upcoming "2026 Application Outlook Report," focusing on Pump(.)fun — one of the consumer applications we are most excited about next year.

Since we published our initial Pump report (pre-funding), many things have changed. Many of the dynamics we predicted have been validated, but some areas have fallen short of expectations, disappointing both users and investors. However, the core challenges facing Pump remain unchanged.

To realize its ambitious vision, the team must balance the short-term profit-driven nature of the crypto industry with their long-term platform aspirations. Notably, once a project launches its token, the operating environment shifts; the token itself becomes a standalone product with inherent reflexivity, continuously shaping user expectations — and Pump is no exception.

Since raising funds, the Pump team has increased investment in crypto-native streaming, but progress in this area has not gone as smoothly as we anticipated — at least not yet.

Pump has yet to successfully attract core creators outside the crypto ecosystem, and the CCM meta-universe that emerged on the platform was fleeting. The most notable moment came from the “Bagwork” campaign, which showcased both the potential of creator-driven tokens and the structural issues hindering this model’s development.

This viral phenomenon was led by a group of teenagers who, with partial support from Pump, orchestrated several attention-grabbing stunts: snatching Bradley Martyn’s hat, invading a Dodgers game, storming onto a Knicks court, and even getting tattoos of Pumpfun and Bagwork.

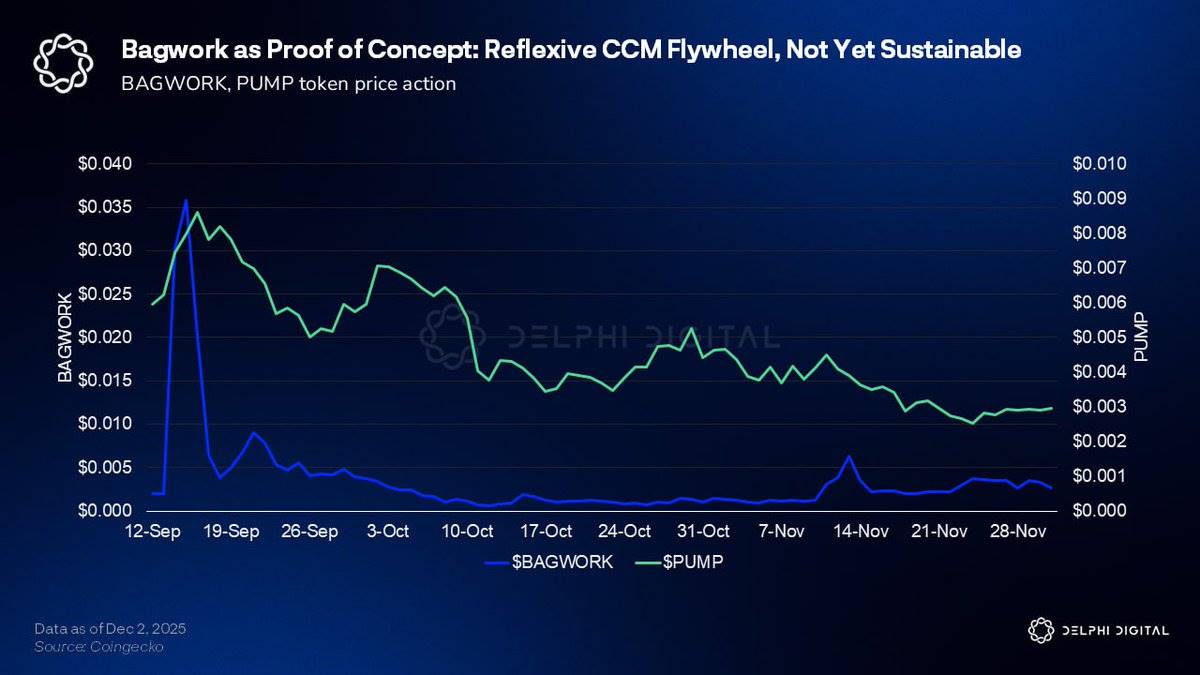

@onlybagwork ramped up almost perfectly in sync with Pump.fun’s peak hype around mid-September. At that time, $PUMP’s fully diluted valuation (FDV) reached approximately $8.5 billion, while Bagwork’s market cap briefly surpassed $50 million.

However, since then, no other creator token has come close to achieving similar organic momentum or valuation highs.

The Knicks court incident happened more recently, well past the initial hype cycle, and today Bagwork’s market cap stands just above $2 million.

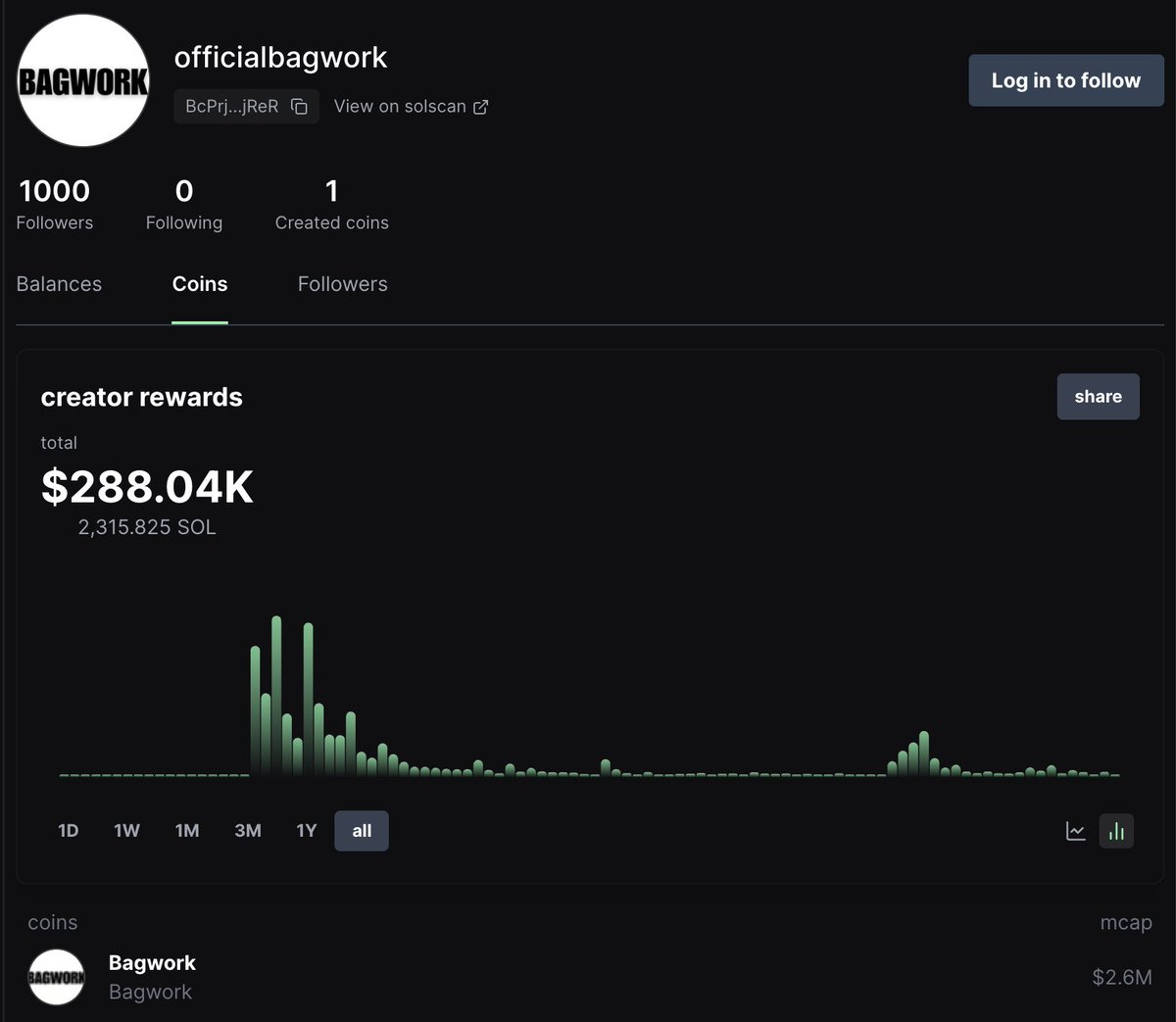

Bagwork was one of the few real cases in Pump’s streaming experiment that functioned largely as intended. The Bagwork team earned over 2,300 SOL in creator revenue from $BAGWORK trading fees (worth around $300,000 at current prices).

Notably, this was achieved without the team selling any of their holdings. Viral events directly translated into attention, trading volume, and fee income — creating the closest case yet to a true creator token flywheel effect on Pump.

Yet beyond Bagwork, Pump continues to struggle in realizing its streaming vision. Creator tokens consistently fail to maintain value. This traces back to a fundamental issue: the token itself is part of the product.

Currently, the economic rationale for owning or supporting a streamer’s token remains unclear. Bagwork’s early success quickly faded, and since then, every major streamer token has failed to gain comparable traction, ultimately trending toward zero.

Creators can earn short-term gains through CCM’s fee structure, but the reputational risk associated with pump-and-dump tokens makes this model unattractive to bigger, more established creators who could help the platform reach broader audiences. From a trader’s perspective, these tokens still operate in a zero-sum environment rather than fostering genuine communities.

This is the most critical issue Pump must address as it enters 2026.

So far, the team has not made meaningful attempts at deeper creator incentive mechanisms, and the airdrop allocation remains untouched. Beyond informal support during the Bagwork hype, Pump has taken no coordinated actions — such as targeted airdrops, creator rewards, or other incentives — that could have kickstarted early activity, created more PvE-style (player-versus-environment) motivations, and provided creators with experimental space without immediately damaging their community dynamics.

The good news is that this gives Pump significant flexibility.

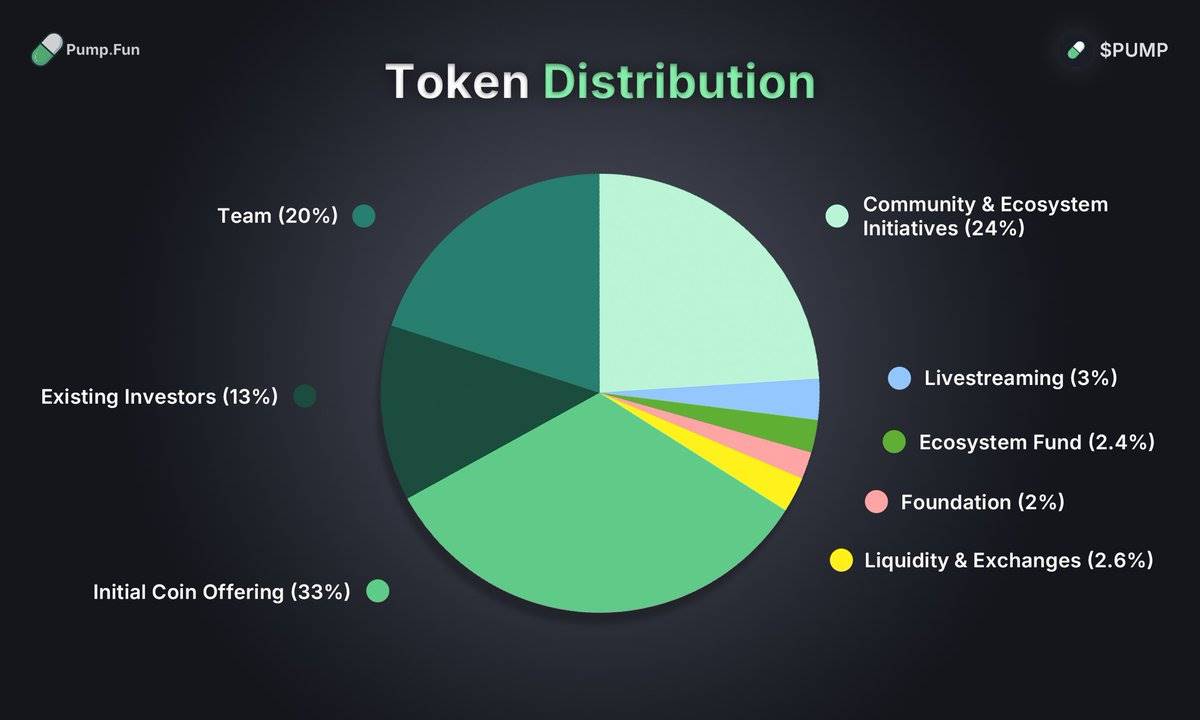

The unused Community & Ecosystem Initiatives fund remains a powerful lever the team can deploy once the model matures. If Pump can design a sustainable creator token incentive structure, it could unlock an entirely new economic category for creators seeking to monetize via crypto mechanisms and expand their audience.

While the potential upside here is substantial, until then, streaming will continue to manifest as a series of fleeting hype cycles rather than a durable, repeatable vertical.

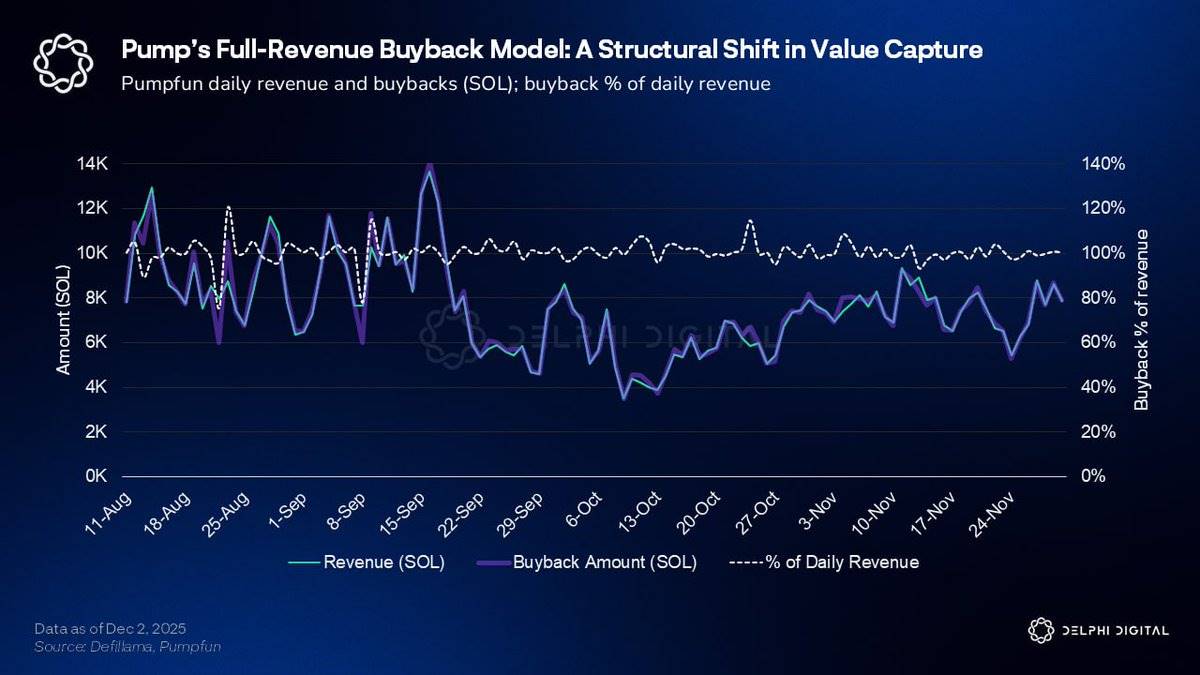

On the token side, the main catalyst pushing $PUMP from ~$0.025 to $0.085 was the team’s decision to allocate 100% of net revenue to buybacks.

Pump shifted from an initial plan to use roughly a quarter of revenue for buybacks to nearly full adoption of a Hyperliquid-style buyback model. This pivot came after the market made clear that partial buyback models wouldn’t be rewarded. This change ignited one of the strongest large-cap token rallies in a liquidity-starved and challenging altcoin market this year.

In terms of buyback-to-market-cap ratio, no major token currently trades at a lower multiple.

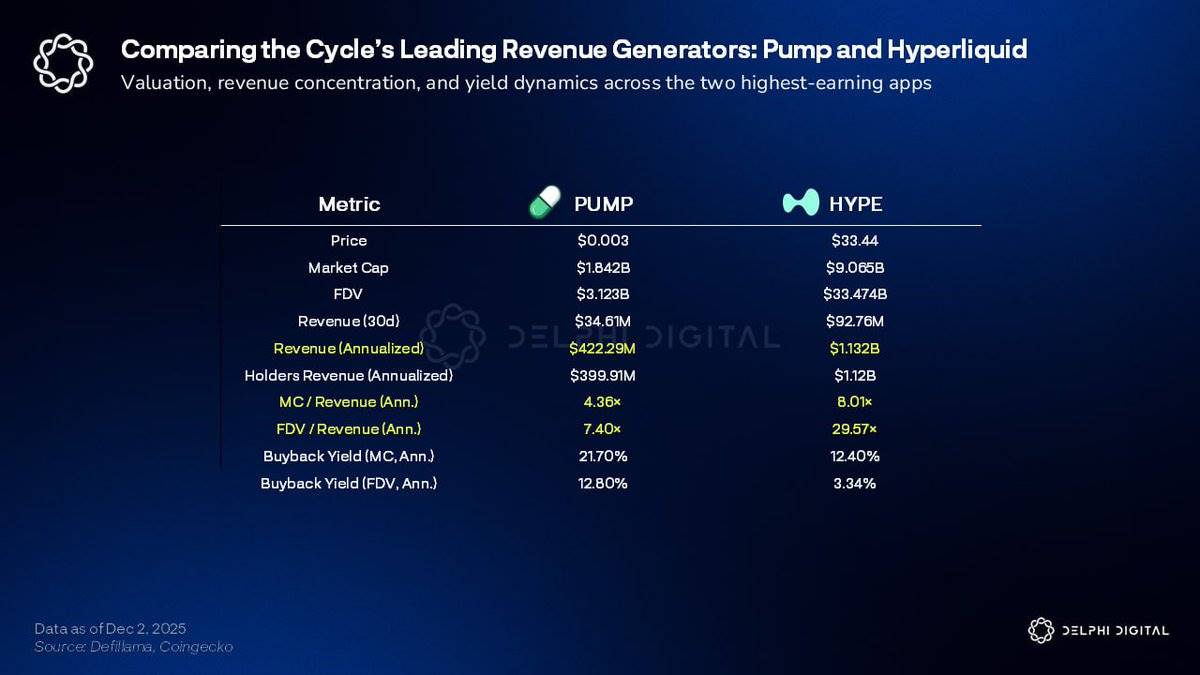

Based on current data, Pump generates $422 million in annualized revenue with an $1.84 billion market cap, implying a market-cap-to-revenue (MC/Rev) ratio of 4.36x and an annualized buyback yield of approximately 12.8%. This is significantly lower than other large-cap tokens, including Hyperliquid’s ~8.01x MC/Rev and ~3.34% yield.

Even so, the market remains skeptical of Pump’s long-term business prospects.

Market concerns may include whether the team can consistently launch meaningful products; the impact of future unlocks given that about 40% of the token supply remains locked; uncertainty around the final distribution of airdrops and creator incentives; and broader questions about shrinking meme coin activity, declining end-user engagement, and the sustainability of Pump’s revenue base.

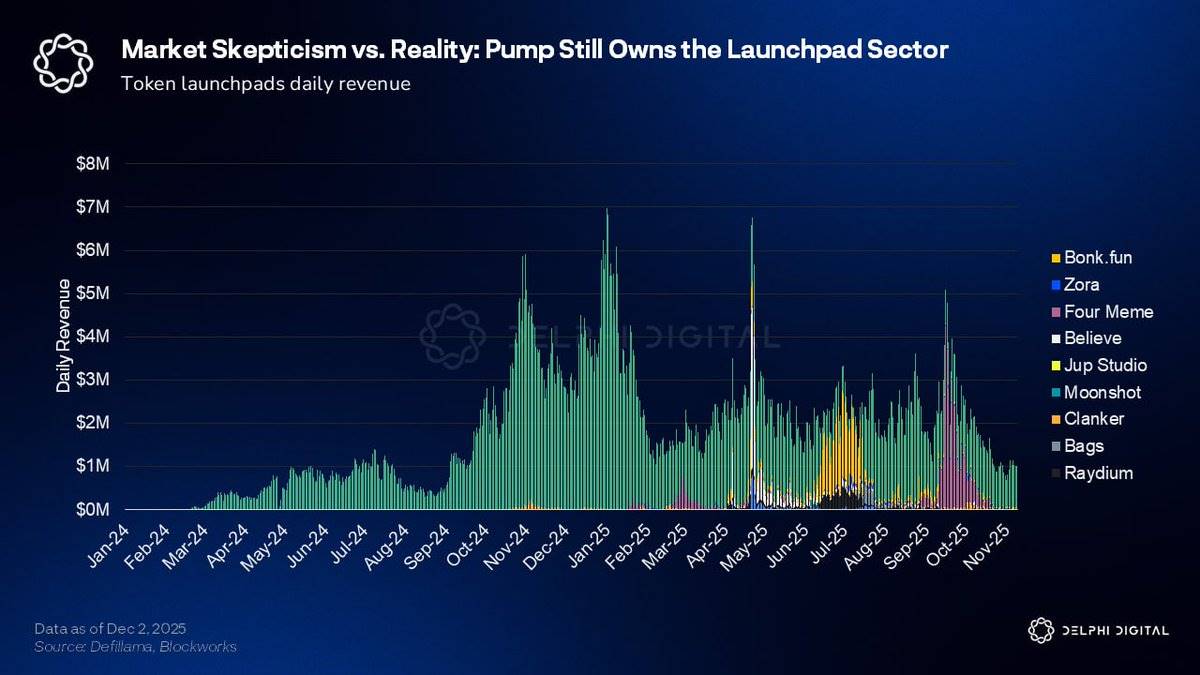

Despite these concerns, Pump remains dominant in the meme coin launchpad space, continuing to earn (and buy back) around $1 million per day even in the current extremely difficult market conditions.

Pump’s daily launchpad revenue has declined nearly 85% from a peak of nearly $14 million at the start of the year to around $2 million today. Yet competitors have only briefly threatened Pump’s position, failing to mount any substantive challenge. This aligns with our earlier prediction of temporary competitive phases from Bonk and Raydium: even amid cyclical volume contraction, Pump has maintained structural advantages and dominated industry activity share.

The acquisition of Padre supports the view that Pump intends to expand beyond Solana into a multi-chain ecosystem, with Padre’s frontend already enabling support for BNB chain assets. This also matches our earlier prediction that Pump would eventually acquire a terminal or terminal-adjacent asset to strengthen user acquisition and integrate more of the user journey.

Beyond these moves, the team has remained relatively low-key recently. An investor call is planned but hasn’t occurred as of writing, so further details may emerge later.

The leadership team has also expressed interest in the broader ICM (Initial Community Offering) category, though we believe this is not central to Pump’s current brand positioning or product strengths. Pump initially experimented with the Believe model but failed to gain real market attention. MetaDAO has since become the leader in the “high-quality founders + community” fundraising space.

Moreover, the culture and structure of ICM seem misaligned with Pump’s brand identity. Pump’s core revolves around speculation, speed, and creator meme culture, not long-term governance or futarchy-based systems. For Pump to succeed in ICM, they would need to adopt more governance-oriented structures and attract non-crypto teams interested in on-chain operations — which doesn’t fully align with the needs and positioning of Pump’s current user and creator base. While there may be theoretical upside if the team takes concrete action, we see this as more of a secondary or optional path rather than a natural extension of Pump’s existing flywheel in 2026.

Looking ahead to 2026, Pump’s key questions revolve around: whether it can finally build an incentive-compatible creator token model; whether it can achieve meaningful multi-chain expansion via Padre; how it will manage risks from token unlocks and declining revenue visibility; and which product vertical to prioritize. Currently, Pump’s strategy appears scattered across multiple directions, including streaming, ICM, and mobile.

At some point, the team may need to focus clearly on one core breakthrough. For much of 2025, that appeared to be streaming — but now it’s less clear.

The bigger question is whether Pump can attract larger creators from outside the crypto world. This might require rethinking the creator token flywheel, offering stronger, longer-term incentives to support virality beyond crypto-native user bases. Pump has the basic ingredients to achieve this. The 2025 Bagwork craze briefly showed the potential for this model to succeed, when Pump seemed close to crossing the chasm.

Additionally, Pump has ample room to expand its product suite. One strategic direction worth serious consideration is entering the iGaming or casino-related vertical. A model similar to Kick or Stake would naturally align with Pump’s speculation-driven user base. This move would deeply synergize with its meme coin and streaming strategies, and the profitability of this space is already proven.

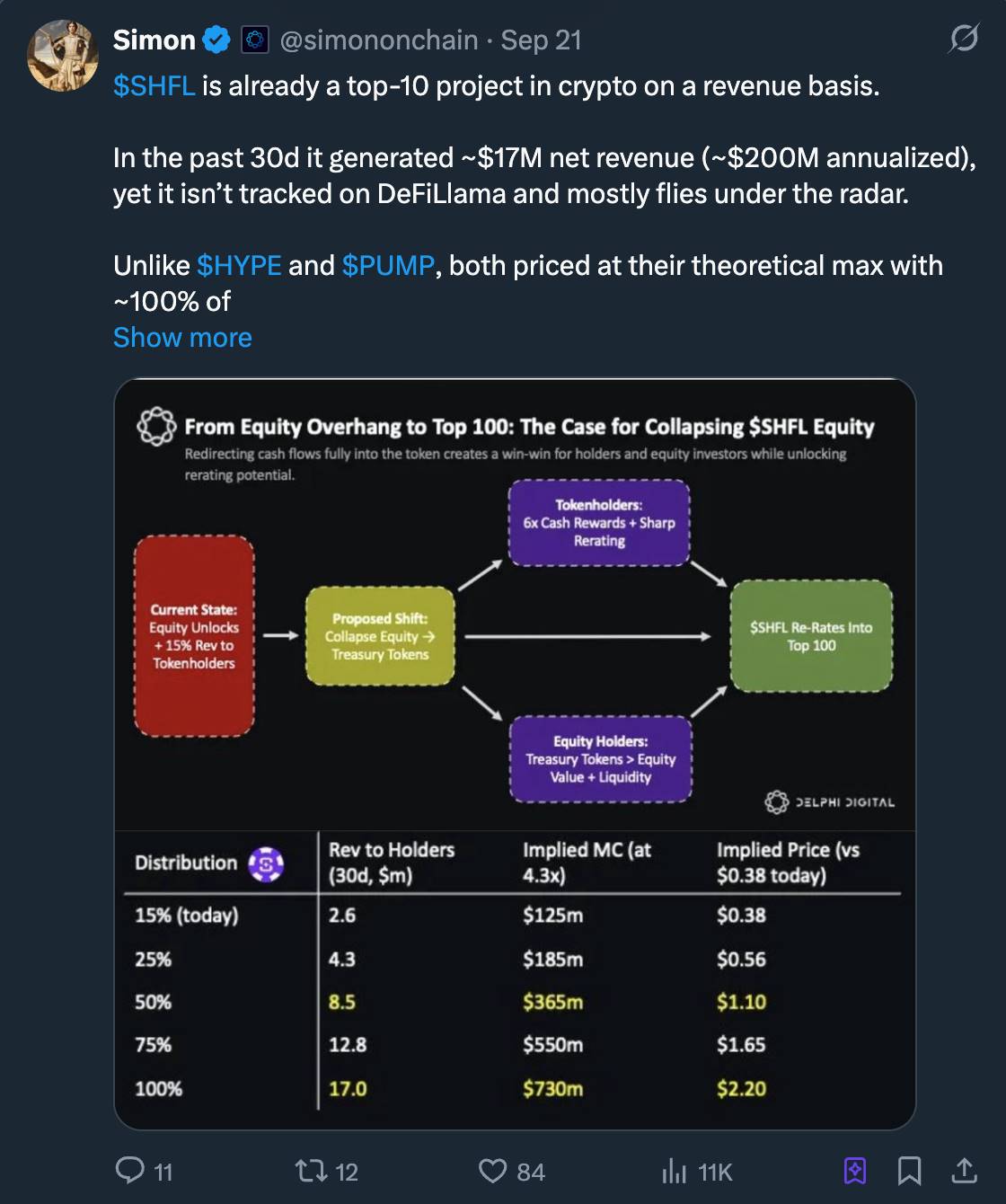

Shuffle’s net gaming revenue and weekly lottery payouts demonstrate the massive potential of this sector when executed well.

Pump’s mobile app is another underutilized advantage. Deeper mobile integration could expand user acquisition, make the product more accessible to mainstream users, and open additional monetization scenarios for creators. Combined with iGaming, this could significantly broaden Pump’s potential audience while reinforcing its existing strengths.

Despite uncertainties, Pump remains one of the most resilient consumer applications in this cycle, maintaining dominance even as the broader market landscape evolves. Meaningful progress in any key direction could shift market sentiment dramatically and help Pump break through to attract a wider, non-crypto-native user base.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News