Streaming enters the speculation era, Pump.fun creates hyper-financialized live streaming for the younger generation

TechFlow Selected TechFlow Selected

Streaming enters the speculation era, Pump.fun creates hyper-financialized live streaming for the younger generation

Pump.fun offers creators a new monetization model by combining live streaming with token speculation, eliminating reliance on traditional platforms' subscriptions or ad revenue sharing.

Author: VelvetMilkman, Crypto KOL

Translation: Felix, PANews

When Facebook first launched, it seemed trivial—a digitized college yearbook with no clear business model. Older generations dismissed it as a toy, unable to foresee how the company would later monetize attention globally. Twitter faced similar skepticism. It was once derided as a platform for people to announce what they had for lunch, yet eventually evolved into the nervous system of global politics and media. Even Roblox appeared to many as just a children's video game. However, the platform later proved itself a laboratory for virtual economies and user-generated worlds. Again and again, platforms initially seen as absurdities have become foundational cultural infrastructure and sources of immense wealth.

Pump.fun is at a similar inflection point. To many, the team’s move into live streaming appears impractical, even ridiculous. Pump has long been dismissed as a fleeting "meme coin" farce. But viewing it this way overlooks its staying power and the fact that it has repeatedly outperformed competitors within mere weeks. Pump is laying the groundwork for a new generation of internet-native economic life—an environment where culture and speculation aren't separated but fused. With streaming now back in their product mix, they are positioning themselves as an entertainment gateway for audience financial engagement.

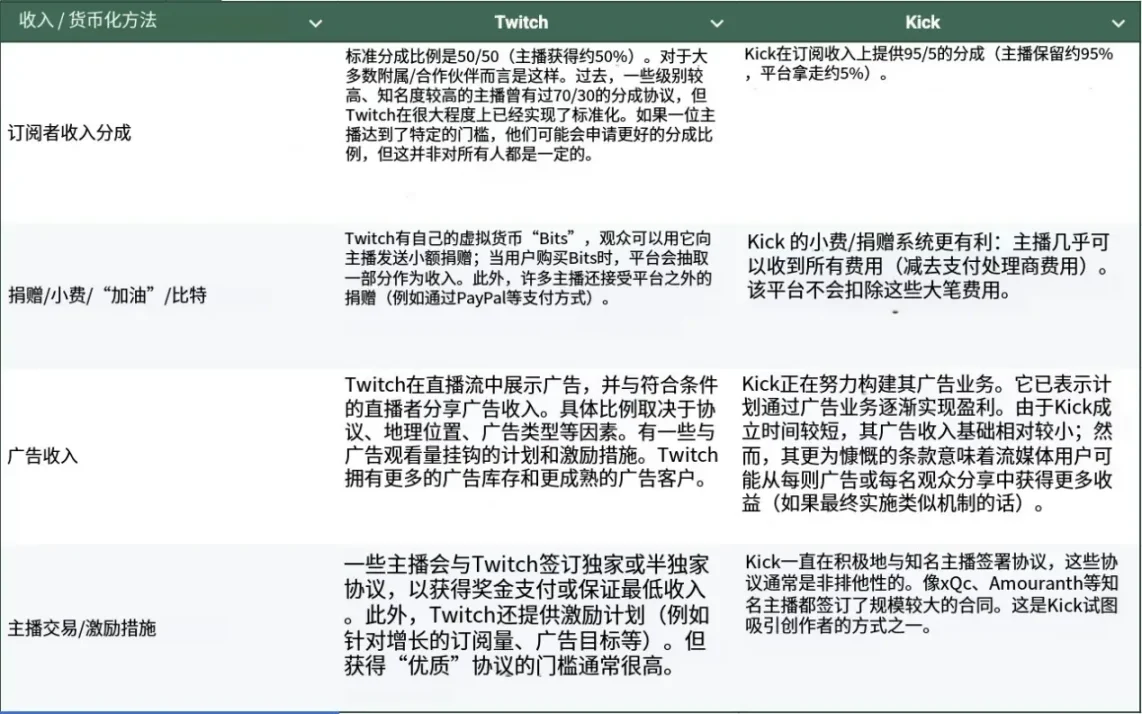

The streaming economy reveals the limitations of existing models and the opportunity for new entrants to disrupt established players like Twitch and Kick. Twitch, a wholly owned subsidiary of Amazon, takes a 50% cut from every subscription, leaving a mid-tier creator with 1,000 concurrent viewers earning roughly $600 per month—even after accounting for subscriptions, ads, and tips. Kick, backed by gambling platform Stake, offers a 95% revenue share. Kick’s generosity is subsidized. Eligible streamers under Kick’s incentive program can earn over $6,000 monthly—nearly ten times Twitch—with the same viewer count. Yet this economic model is artificial. It depends on funding from Stake, which hopes to lure users into its online casino. These models aren’t economically sustainable on their own.

Revenue sharing models between existing platforms and creators

Pump’s incentive model directly addresses these contradictions, offering creators an immediate path to profitability. Streamers launching tokens no longer rely on subscriptions or advertisers; creators can now generate demand directly through live streams. The flywheel is simple: streaming sparks speculation, speculation drives fee revenue, creators can opt to execute buybacks, buybacks create narrative, and narratives feed back into new streams. For the next wave of innovative streamers, this is a unique selling point. Revenue is no longer limited solely by audience size, but by the audience’s willingness to participate.

This isn’t a minor tweak to creator incentives. Pump redefines what live streaming means. A creator who earns $10 million annually from sponsorships could allocate a relatively small portion toward token buybacks, and suddenly the token tied to their online persona functions like an investment with built-in recurring demand. Communities are no longer passive—they actively invest, both financially and emotionally, in creators.

Younger generations increasingly turn to new media formats for daily news and current events. Once familiar with these consumption habits, it’s easy to imagine them buying tokens from their favorite streamers (even if not immediately, they may do so once able or once they realize token ownership creates value). Under this new incentive structure, the token valuations of top creators could surpass those of established tech companies. Investors and traders aren’t just buying simple cash flows—they’re purchasing access to culture, identity, and community.

This scenario isn’t purely hypothetical. Earlier this year, President Trump launched his $TRUMP meme coin shortly after winning the election, inviting the top 220 holders to a dinner, with the top 25 receiving special White House tours and private receptions hosted by the president. These holders collectively spent nearly $150 million to secure their status. Just this announcement alone drove the token price up over 50%. While this may sound absurd, it’s real—and it demonstrates that token ownership delivers both financial returns and tangible social opportunities. In other words, Pump’s vision of making streaming tokens a cultural norm is already taking shape among celebrities and political elites.

What critics miss is that Pump is professionalizing financial spectacle, just as sports professionalized physical prowess and esports professionalized digital mastery. In an era of high financialization, trading mimics art, just as art mimics trading. Crashes are no longer career-ending; they’re narrative climaxes. Rug pulls don’t mean the end of someone’s career; they’re rituals that cement anti-hero legends. Risk and loss are no longer flaws in the system—they’re repackaged as content for cultural creation and sharing.

Tokens won’t remain speculative forever. They’ll evolve into loyalty tools that govern access, commerce, and community. Just as TikTok integrated shopping into entertainment, Pump will embed spectacle into speculation. The line between financial participation and cultural participation will vanish. Audiences won’t feel like spectators in the stands—they’ll be cheering from the sidelines. Viewer identities will evolve into their own micro-economies: organizing treasuries, coordinating buybacks, and managing collective assets.

Humans have always performed to demonstrate value. Rome had gladiators, the industrial age had athletes, the digital age has gamers, and the financial age will continue elevating traders. In this latest arena, the boundary between audience and participant disappears. Watching a trader operate, you can join with a single click. Highlight moments won’t just be dunks or Oscar-worthy performances—they’ll include parabolic charts, liquidation waves, or dramatic real-time token buybacks. Finance is no longer backstage—it’s moving front and center.

Outrageous and vulgar are entirely subjective concepts. The longer something exists, the more widely accepted it becomes. History teaches us that things once seen as trivial often contain seeds of transformation. Social networks were once toys before becoming cultural infrastructure; online dating was once mocked, now it’s commonplace. To some, creator tokens may seem meaningless noise. But skeptics will soon wonder why they didn’t spot the opportunity earlier.

Pump isn’t simply attaching speculation to streaming. It has the potential to reshape the relationship between creators, audiences, and capital into a self-sustaining, scalable system. Content generates demand. Demand fuels buybacks. Buybacks create culture. Culture generates more content. The cycle completes. We’ve created a flywheel.

Money itself is a culture. Pump is the first platform to openly acknowledge this and build the rails for its expansion. The defining highlight of the next decade will be a chart.

It’s easy to dismiss Pump’s streaming as a flash in the pan, unlikely to last. But looking at Pump’s data—revenue, distribution across streaming categories, growing daily active viewers—it’s hard to conclude it doesn’t deserve close attention. To readers who’ve made it this far yet still hold that view, try setting aside doubt, shedding preconceptions, and consider what the future might look like years from now. CT won’t stop talking about hyper-financialization. They’ll keep repeating it until it feels inevitable.

This is precisely what hyper-financialization looks like. With recent massive success, the tide of opinion has shifted. It’s hard to imagine a future where streamers must still kneel to platforms like Twitch or Kick for distribution. More likely, the first generation of entrepreneurs will seize the moment, merging streaming and creator tokens into an engine of both cultural influence and economic return. We’re witnessing an accelerated form of capitalism: entertainment and investment fused on the same stage.

The line between audience and stakeholder has already begun to blur. Things that seem absurd today achieve stunning results within just one week in the spotlight. Over time, this will feel increasingly natural. Pump didn’t invent streaming, but it will push the format to its logical extreme. The team’s move into live streaming could propel Pump to the cultural forefront.

You might disagree, you might choose not to participate—but Pump is revealing an inevitable future. Don’t let personal discomfort blind you to how rapidly the current landscape could change. Such shifts usually arrive much faster than anyone expects.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News