2026 Investment Framework: The End of Globalization, AI Supply-Demand Mismatch, and the Silver Frenzy

TechFlow Selected TechFlow Selected

2026 Investment Framework: The End of Globalization, AI Supply-Demand Mismatch, and the Silver Frenzy

When agent-based AI can truly deliver on its promise, usage will grow exponentially.

Author: Campbell

Translation: TechFlow

Yes, we're a bit late with the update. New Year's Eve was spent entirely on trading—rebalancing portfolios for 2026 and cleaning up the books. I thought there'd still be time to analyze more before hitting publish.

"What major events could possibly happen in the first week of the year?"

Our first wrong call of 2026.

Silver surged. Maduro (President of Venezuela) was seized like a nighttime thief. Is Iran on shaky ground? Is Greenland back on the negotiating table? Were Russian, Iranian, and Venezuelan ships detained by special forces? Today, Trump banned defense contractors from paying dividends or buying back stock while working with the government, and prohibited institutional investors from entering the single-family home sector.

While our blog post is delayed, it seems the world is gradually embracing the framework we've been preaching all along: the end of globalization, resource nationalism, silver’s remonetization, China's gold reserves, the "horseshoe theory" of the political spectrum becoming reality, and the urgent need for a “New New Deal” amid machine-driven inequality.

Clearly, markets agree—our portfolio ended the year with a 131% return. This was largely driven by our oversized positions in silver and gold.

Keep in mind: we are small players, not in the same league as the big institutions. Part of our advantage comes from operating a relatively small portfolio, whereas those managing pensions and endowments face transaction, liquidity, and institutional costs that may be 10 or even 1,000 times higher than ours. It’s simply not the same game—we’re amateurs, they’re professionals. Our portfolio was designed primarily to hedge my less liquid startup equity while capturing returns aligned with our broader Stoic macro framework.

Read more: The Stoic Macro Investment Framework

The State of Silver

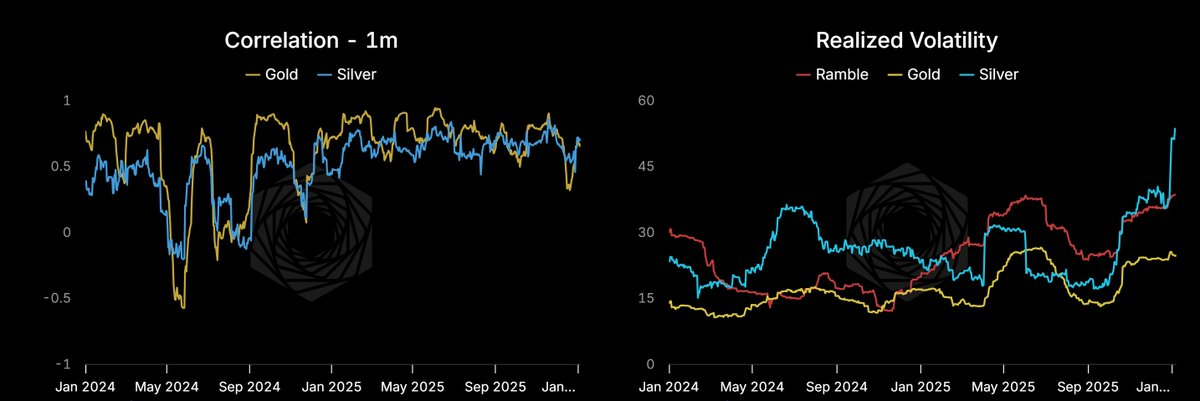

Rather than focusing solely on returns, let’s examine the actual composition of the portfolio. You can see our correlation with silver has increased, and our volatility target remains around 30.

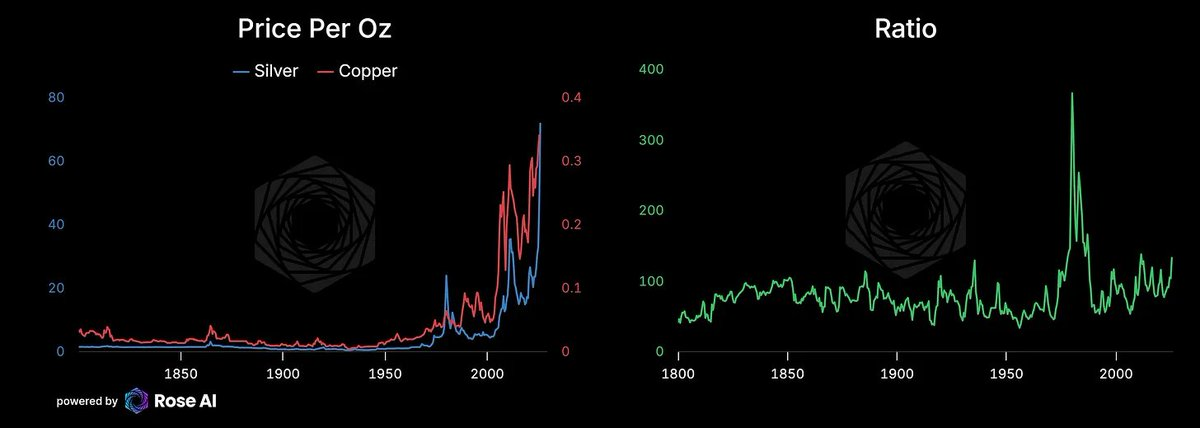

Note that after previous squeezes, silver experienced sharp pullbacks—volatility patterns clearly visible decades later. We know this wave will eventually end similarly. The question is: at $85, $200, or $1,000? And how long will it take?

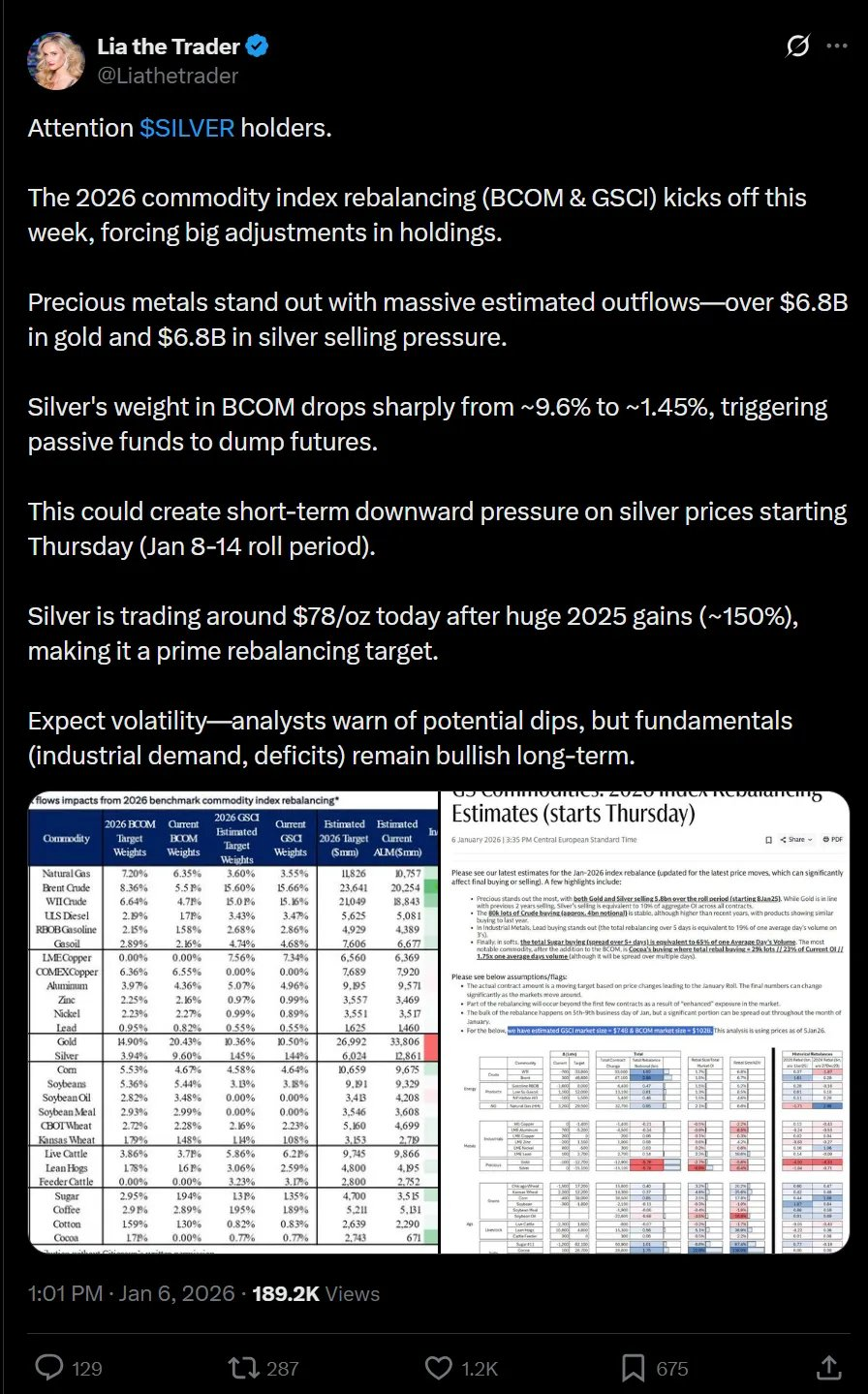

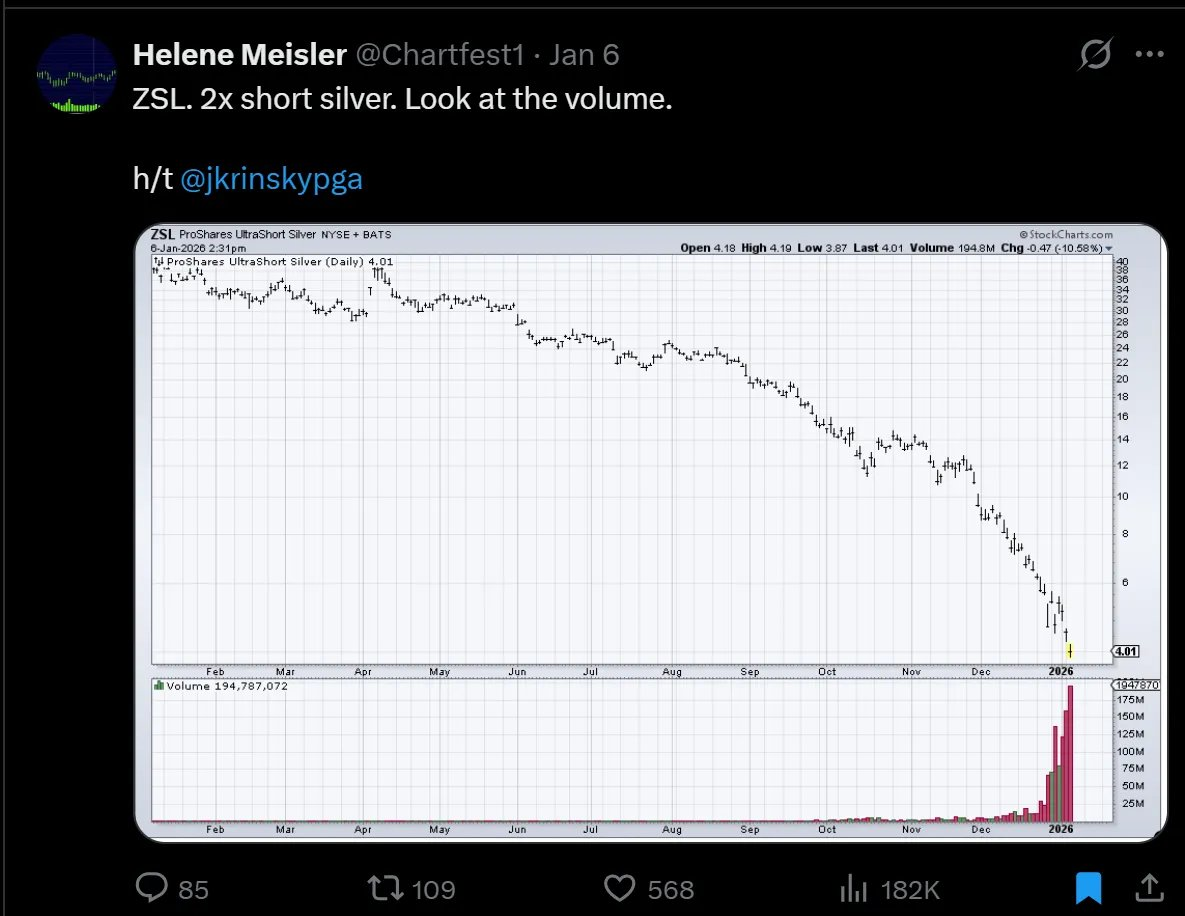

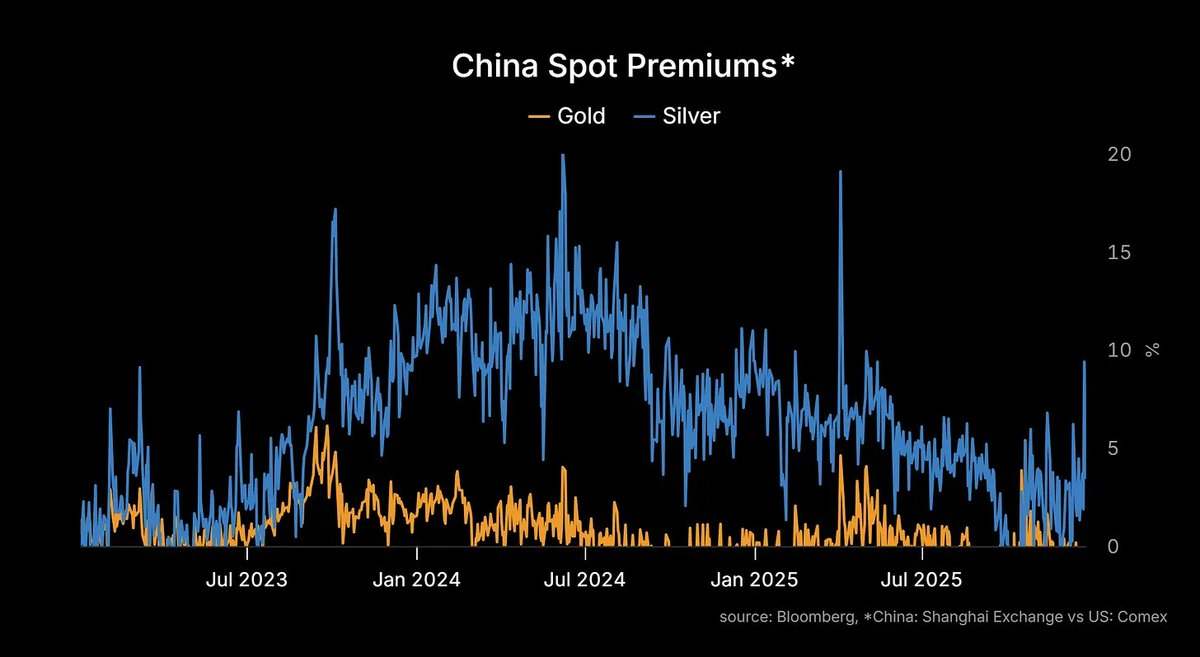

Bears are mobilizing. A notable observation: index rebalancing is approaching—silver’s weight in certain commodity baskets will drop from nearly 10% back to its historical average of 2%. I believe the final outcome will be a structurally higher weighting for silver, but the bears aren’t wrong: this will indeed create selling pressure in Western markets.

What we’re seeing in the silver market reminds me of my days trading crude oil.

When training interns, I’d always start with one question: “What’s the price of oil?” Just to see what answers I’d get. The point is, there isn’t a single price for crude oil. When people say “oil price,” they’re using an abstract concept referring to a complex basket of prices across different markets—each with its own pricing, tied together through odd formulas to dollar-denominated futures.

So “what’s the price of oil?” actually leads to many more questions:

- WTI in the U.S. vs Brent in Europe? — Different geography.

- Today’s price, tomorrow’s, or five years out?

- Type of oil? Dubai crude?

- Product type? Gasoline, naphtha, fuel oil?

- Pricing currency? Crude traded in Shanghai?

This brings us directly to the silver market.

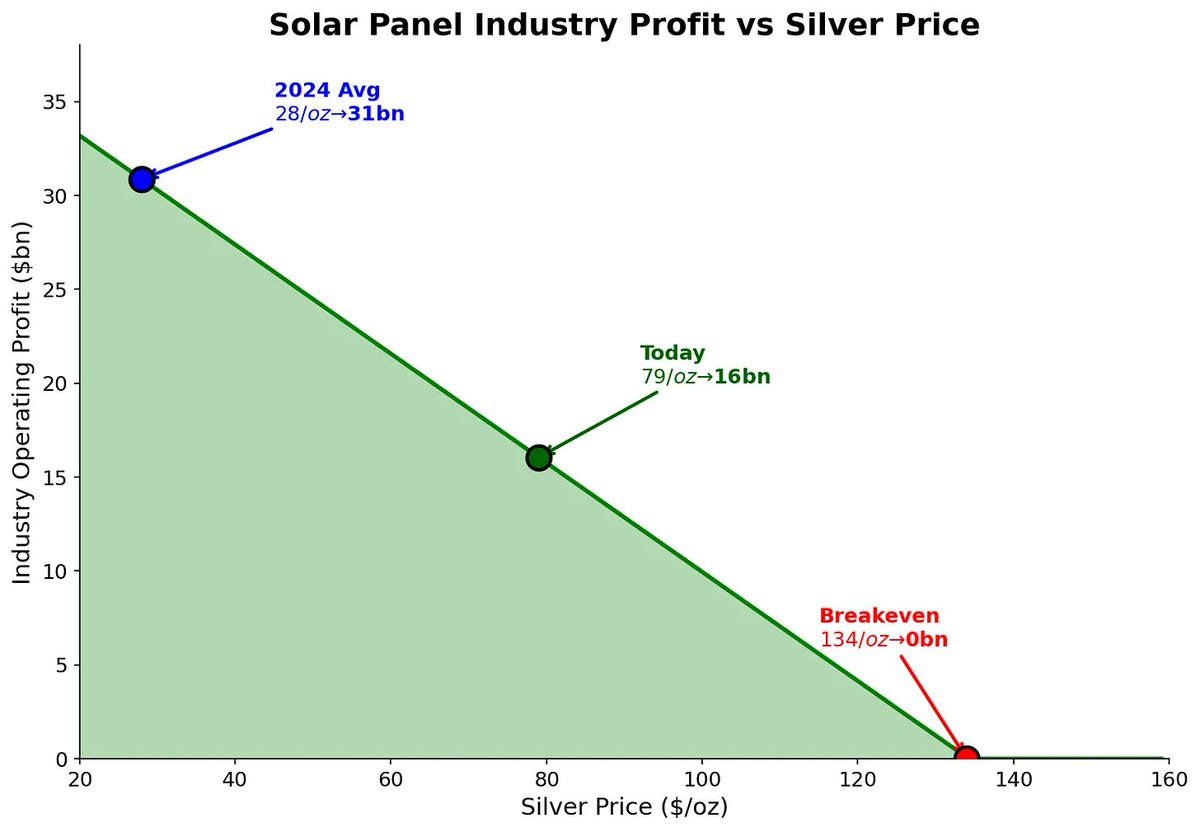

The bear case holds: indexes need adjustment, current momentum is unsustainable, and if silver exceeds $100/oz, producers will accelerate substitution of silver with base metals.

But medium-term, these bearish pressures will ease and turn into buying. Index rebalancing will end, record short positions will eventually be covered—and that very liquidity becomes supportive for silver prices.

Some impact shows up in positioning, some directly in price.

Yet when we zoom out, these details seem to fade. Why?

First, copper substitution takes time.

My rough estimate: over four years and ~$16 billion in capex required. Alternative models welcome.

This means we have time before the so-called “short squeeze” forces solar manufacturers into substitution—and silver may still have 50% upside before then.

Alternatively, high-efficiency frontier solar developers might produce panels that dramatically improve energy capture—panels that require more silver. In fact, this is already the trend (even if names like TopCon and HJT sound forgettable).

Second, answering “what’s the price of silver?” requires grounding in real-world markets:

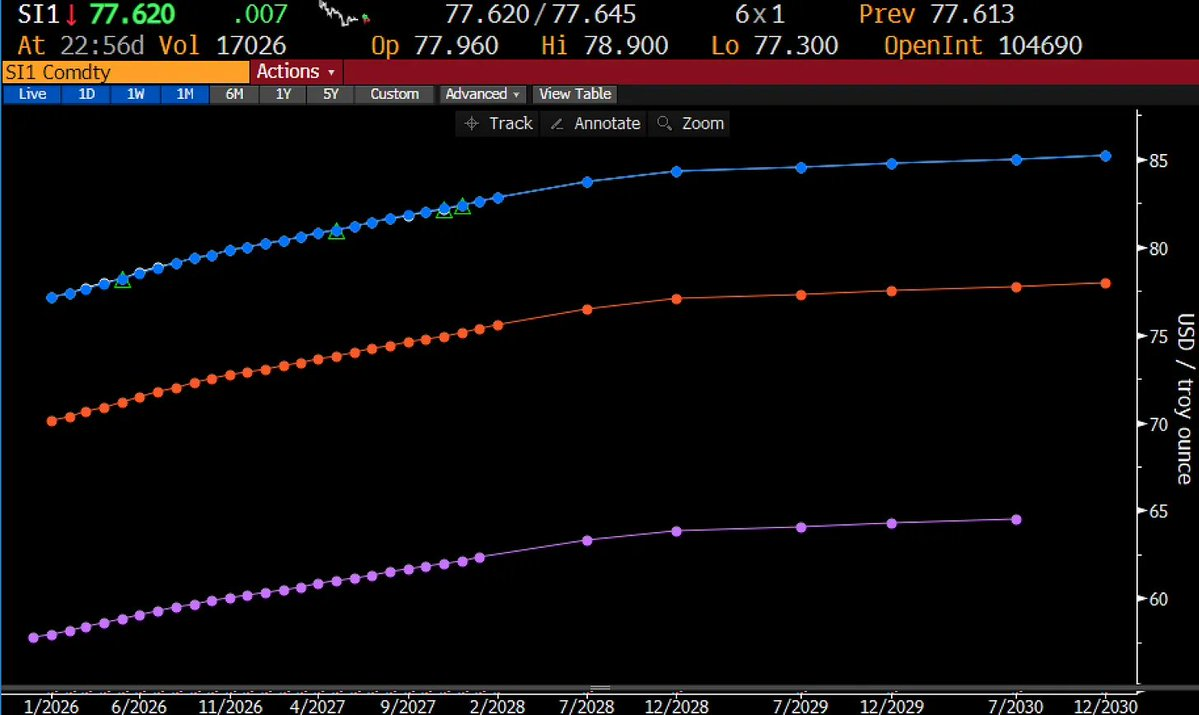

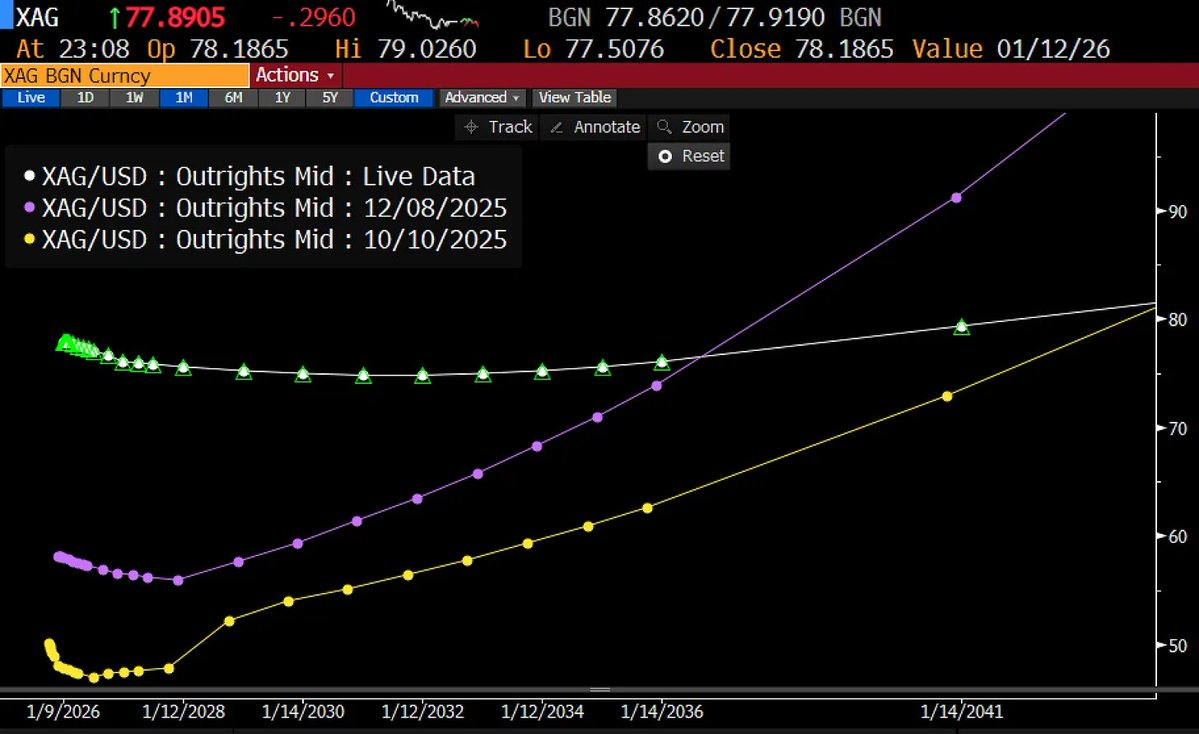

New York (COMEX): Current price: $76.93. Inventory ample. Futures curve in classic contango—near-term below forward due to carrying cost premiums.

London (LBMA): Silver’s “old world home.” Inventory tight. Near-term above forward—backwardation.

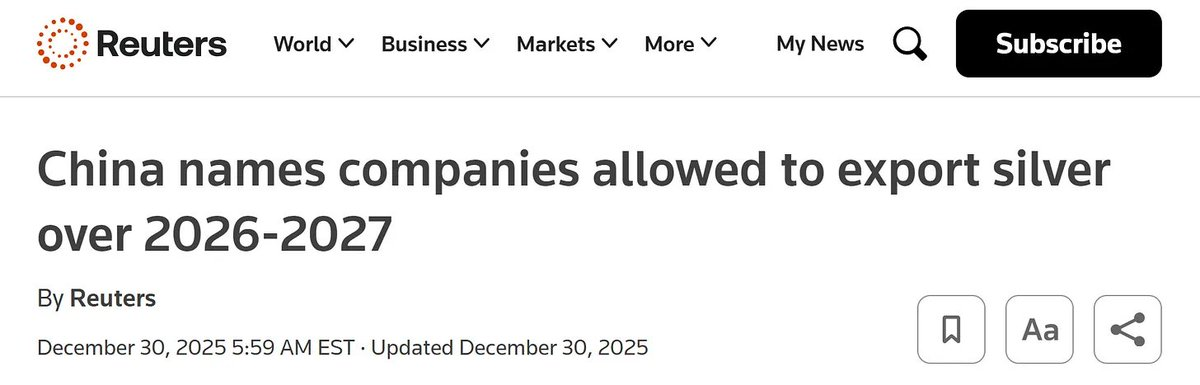

Shanghai/Mumbai/Dubai: Now the ultimate destination for physical silver. These markets trade at premium. Governments recently banned—or severely restricted via administrative measures—silver exports. Now your silver in Asia needs a “passport” to leave.

This is why we love this market.

Silver’s long-term story is so dynamic you enjoy tracking daily developments. That feeling of deep market understanding—not predicting where it goes (even top forecasters hit only 55%-60%), but grasping its behavior: curve shapes, volatility characteristics.

Investment Strategy:

We’ve shifted our silver exposure from >30% direct longs and 15% derivatives to the following:

- Calendar Spread:

- Capture COMEX shift from contango to backwardation.

- Long March contract, short June.

- Since September, COMEX inventory down 81 million oz.

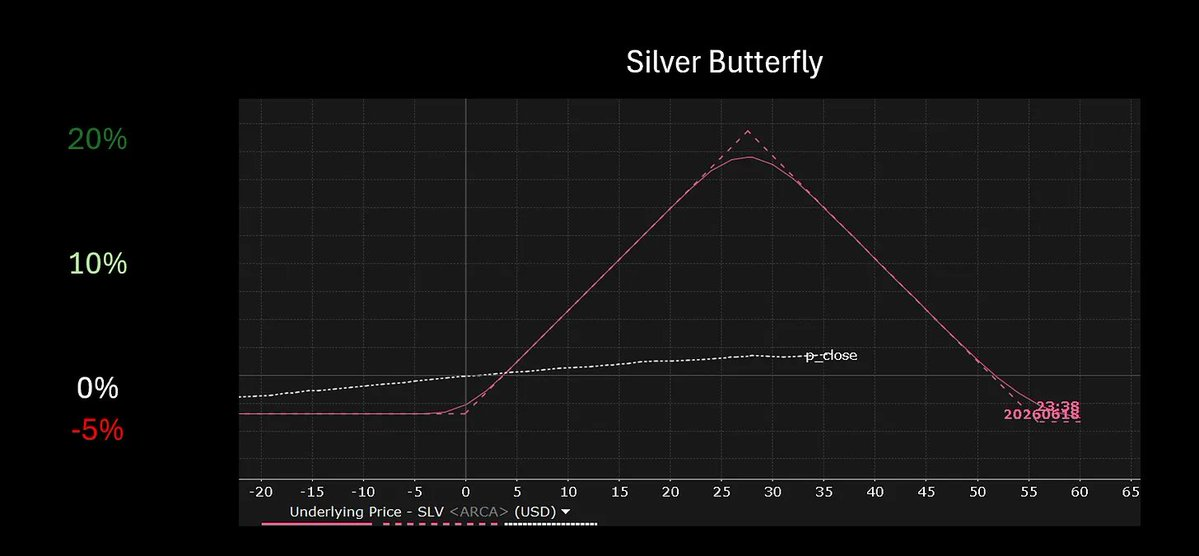

- Butterfly Options:

- For markets with expensive upside skew and acceptable downside risk, use at-the-money butterfly strategies.

- Allocate 5% to SLV (iShares Silver Trust ETF) 70-90-110 June butterfly, cost ~$2.50.

- Target gain ~$10, max gain ~$20, potential return ~7x.

We’ll roll or exit near the middle strike (~$100/oz futures) or 1–2 months before expiry.

Other Adjustments:

Shorten duration, increase crash protection:

- Switched intermediate Treasuries into SPY (S&P 500 ETF) puts—better margin efficiency and higher convexity on downside.

Short student loan servicers:

- U.S. student debt: $1.7 trillion. Future of SAVE (government repayment relief program) uncertain. Defaults rising. When the system breaks, servicers go first.

Long tin miners:

- Small allocation, lottery-ticket logic. Every chip needs solder, which is 50% tin. Tin supply chains are chaotic.

Long Japanese banks:

- BOJ finally normalizing policy. 30-year ZIRP ends. Net interest margins (NIM) set for real recovery.

Result: a clearer portfolio, better margin efficiency, and positioning aligned with our core framework.

Three forces drove 2025. Three will define 2026.

The End of Globalization:

Both sides of Cold War 2.0 now realize old balances are unsustainable. Resource nationalism, gray-zone conflicts, and sphere-of-influence divisions are the new norm.

Acceleration Is Real:

Public and private sectors race to secure critical minerals, energy, and talent to feed growing demand.

Horseshoe Theory Comes True:

The unraveling of neoliberal consensus accelerates. Zero-sum thinking across generations and genders intensifies. A new political reality emerges.

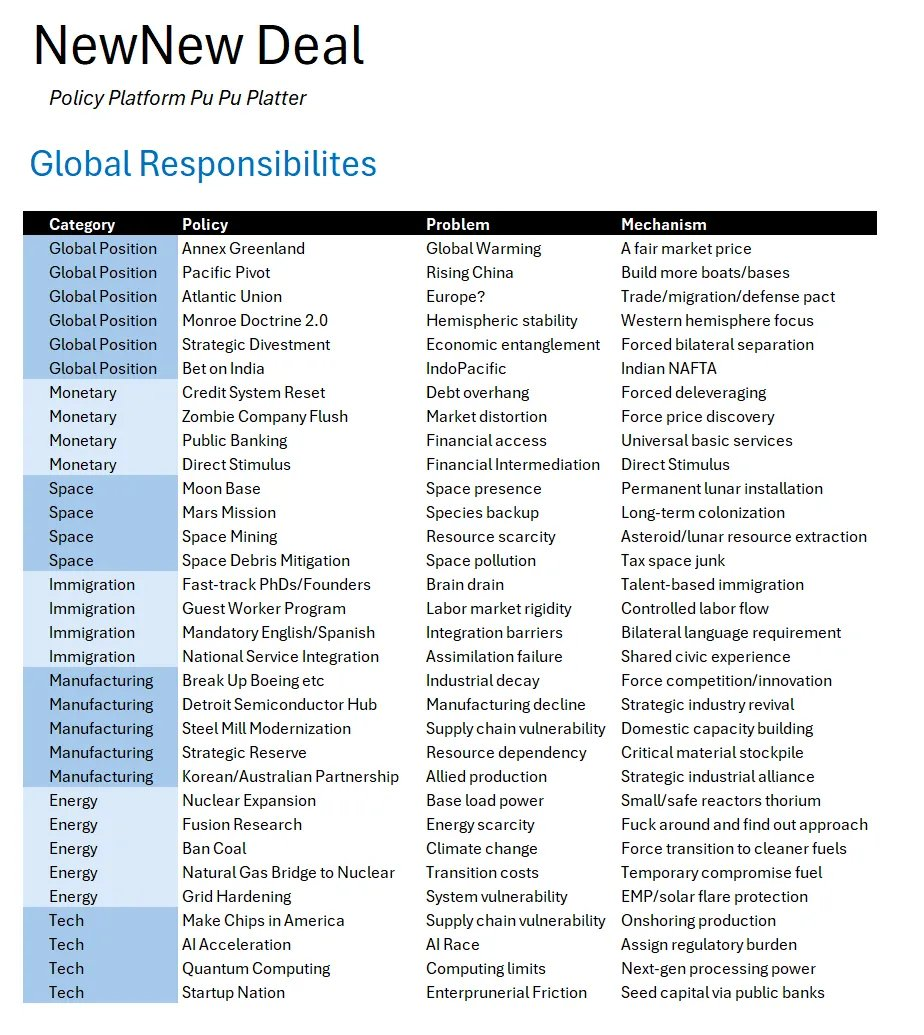

Many ideas once deemed crazy on our “New New Deal” platform—especially regarding global portfolios—are now firmly within the Overton Window.

Greenland, Monroe Doctrine 2.0, betting on India, lunar bases, strategic reserves, Korea-U.S. cooperation, nuclear expansion, fusion, natural gas, U.S. chip manufacturing, AI acceleration—these are now mainstream trends.

Domestic U.S. implications may take another 1–2 years to fully emerge.

Detailed analysis coming soon.

But you’re not here for philosophy.

Longtime readers want to see if we can maintain ~80% hit rate. New readers want latest silver updates (just covered).

Let’s go straight to the views.

Views

The End of Globalization

Resource Nationalism Accelerates:

Nations hoard resources. Indonesia restricts tin exports. Chile tightens lithium control. China dominates gallium and germanium exports.

The end of globalization isn't just about tariffs on finished goods—it’s about control over critical raw materials.

Monroe Doctrine 2.0:

Greenland, Panama, Venezuela in focus.

Maduro may fall. Trump revives idea of “buying Greenland.” Western Hemisphere nations secure strategic resources. Seemed absurd last November. Now policy agenda.

Conflict Fuels Metal Inflation, Not Oil:

Old rules no longer apply.

Venezuelan and Iranian oil re-entering market causes crude oversupply. OPEC’s pricing power likely gone within decade.

Yet metals used in energy infrastructure (copper, silver, tin) rise. Supply chains disrupted. Export bans spread. Demand surges.

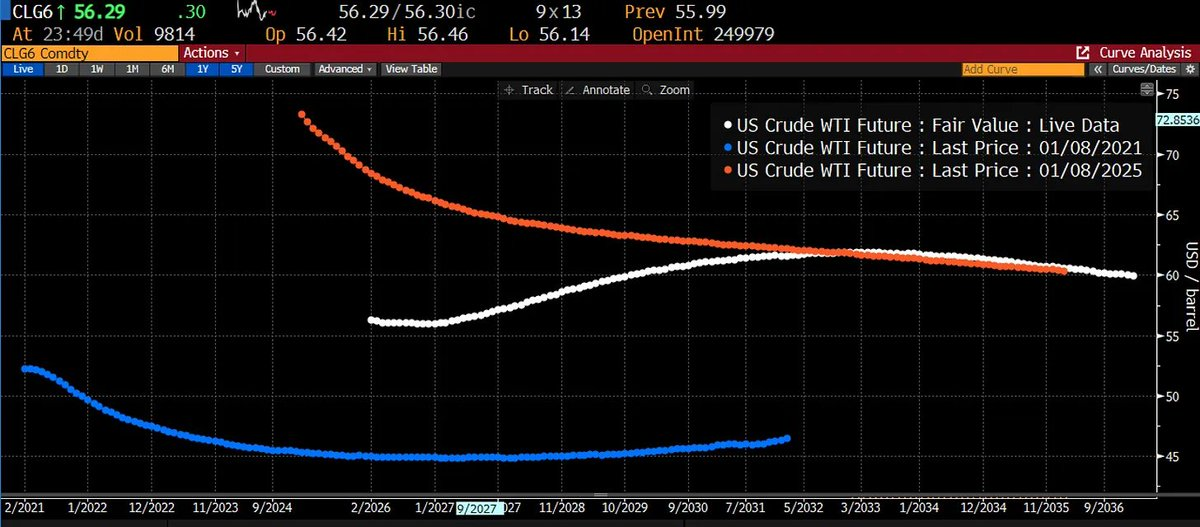

- WTI (West Texas Intermediate) curve collapses from $75 backwardation to $60 flat. Mid-term 2027–28 curve still humped—but likely flattening via arbitrage.

- Recommendation: Long metals. Oil neutral or short.

China’s Challenges

Banking Sector “Zombification”:

No real restructuring. Losses hidden. “Delay and pretend” persists.

Real estate sector hides $5–10 trillion in losses, still carried at par. Facing Sophie’s choice: structural reform or devaluation? No decision yet—only enduring slow bleed.

LGFV Default Goes Public:

First LGFV (Local Government Financing Vehicle) default surfaces, quickly buried.

Over $9 trillion in such debt. Implicit guarantees never stress-tested. If system cracks, government will try containment—but no precedent for multi-trillion scale.

Religious Revival:

Underground churches spreading triggers tighter controls.

As economic performance disappoints, more seek spiritual meaning outside the Party. Faith rising.

III. The Age of Acceleration

The Air Gap:

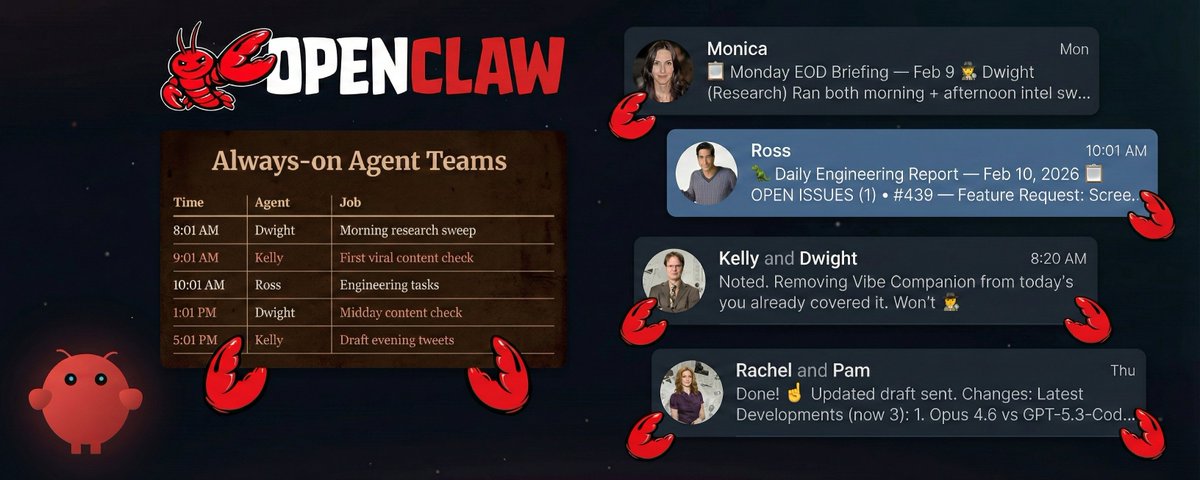

During holidays, I consumed more compute than past six months combined. Using desktop Claude Code, orchestrating five distinct agents talking to each other on Slack, continuously creating, storing, updating context from developer, quant, analyst perspectives. I saw the future—and it’s already here. Acceleration has arrived.

Demand is real—I lived it. When infrastructure, permissions, models, and local compute integrate seamlessly, anyone can do what I did. Now, many developers—including me—are coding their own “orchestration environments” to stitch it all together. First one to nail it may trigger an OS-level revolution in personal computing interaction.

The problem: infrastructure always precedes demand. Repeated throughout history—railroads, fiber optics, highways. Infrastructure builds first. Society benefits long-term. But companies investing often become victims of financial panic due to over-leverage—consistent with our 2018 framework on origins of financial panic.

By 2035, compute capacity will be short 8x to 50x. Tokens will be the “kWh” of knowledge work. Today’s capex will look visionary in hindsight.

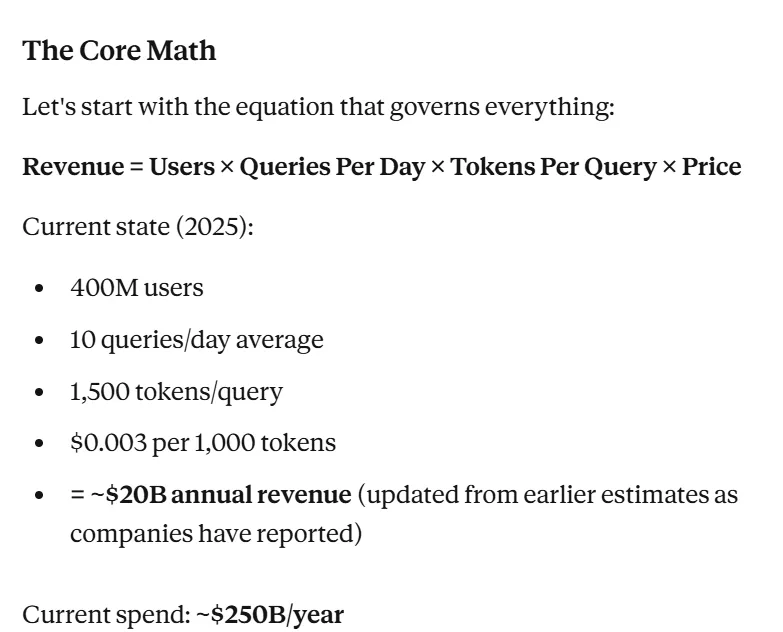

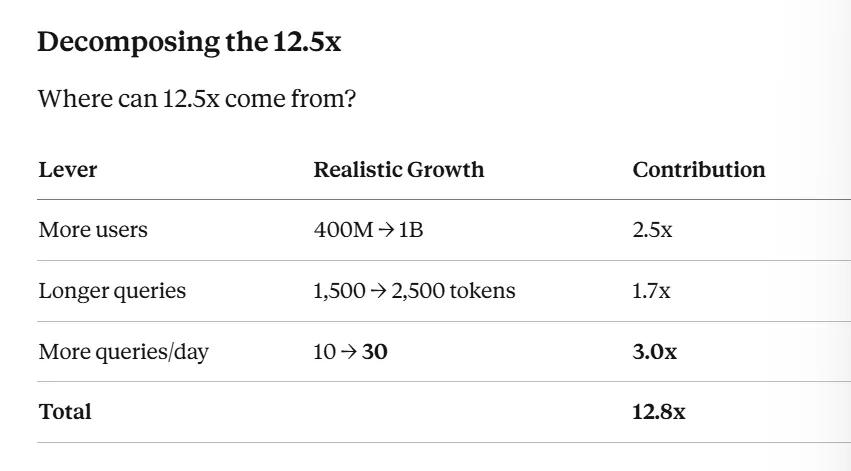

Yet bears may be right today. Preliminary estimates suggest current investment is ~12x revenue of relevant firms.

This gap can only close via one of three paths:

- More users;

- More queries per day;

- More tokens per query (i.e., compute).

If we limit token-per-query growth to 2x (estimate may be off by order of magnitude, but aligns with expected token/compute efficiency gains), then average daily queries must rise from 10 to 30.

For manual users, this growth seems unrealistic. But for AI agents acting on your behalf? Entirely plausible—they may trigger an order of magnitude more subqueries per task.

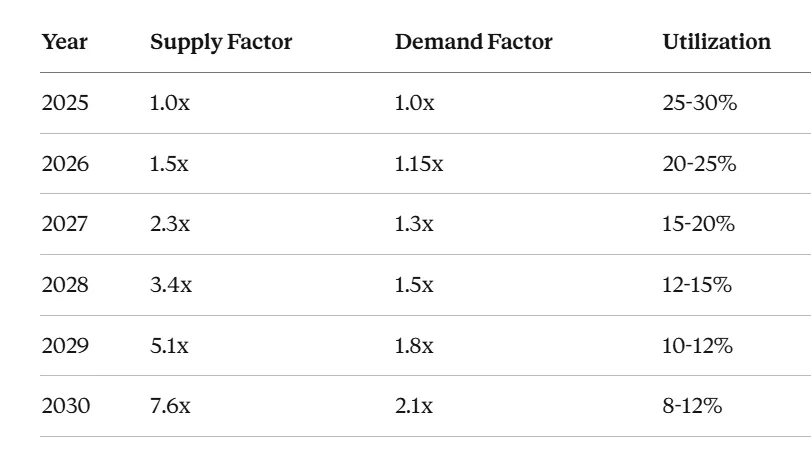

Thus, we expect the compute air gap to peak in 2027, with markets reflecting this by mid-year. Equity and credit markets will repricing.

Supply-demand analysis & forecasts:

- Supply: Compounding ~50% annually (massive data centers expanding rapidly).

- Demand: Growing slowly ~15% annually until capability threshold crossed.

- Utilization: Trending from today’s 25–30% down to 10–15% by 2027–2029.

Google’s “1000x in 5 years” is a planning scenario, not demand forecast. More supply doesn’t create demand. Without widespread adoption of agentic AI, compute sits idle until tech crosses critical thresholds.

Two Phases:

Phase One (2025–2027): Supply Glut

- Infrastructure builds faster than demand grows.

- Compute utilization plummets. Economic losses mount.

- We are here now.

Phase Two (2028–2030+): Demand Explosion

- Tech crosses key thresholds. Demand explodes.

- Compute capacity hits limits.

- This is what bulls anticipate.

Both are right—but sequentially, not simultaneously. The key question: Can investors survive Phase One to reap rewards in Phase Two?

- Short-term: Supply-demand gap suppresses equity performance.

- Long-term: Investment thesis validated. Returns could surge.

Agentic AI Going Live

LLMs embedded in environment, connected to local data, doing real work.

This marks arrival of Phase Two. Per-user token demand jumps 10x–100x. Market not just wider, but deeper.

Yet AI adoption ≠ technical maturity. Adoption = capability × tools × organizational readiness.

Even if models autonomously complete 4-hour tasks, key thresholds remain:

- Legal: Integration with document management systems (expected 2029–2030).

- Finance: ERP integration + regulatory approval (2031–2032).

- Robotics: Safety validation + physical infrastructure (2030–2035).

Technical capability is necessary—but insufficient. Hence, demand typically lags supply by 3–5 years—the core logic behind our “three-threshold model of demand lag.”

Claude Gains Market Share

Currently, Claude Code is best tool for building persistent, single-thread chats. Eliminates hassle of managing multiple chat windows and contexts before resuming work.

Hackers (including me) already integrating it into products. For example, many charts in this article were built with Claude’s help during holidays: I spent 100 hours building an environment where bots create, store, index, retrieve, and share data across web—developers, front-end, architects, quants, analysts collaborate in one channel.

Still, whether Claude’s valuation can grow beyond $350B remains to be seen, depending on many factors.

Others may catch up, but Claude demonstrates leading culture in pushing agentic AI frontier. We believe it will exert growing influence—and may even allow Anthropic to surpass Perplexity (essentially a wrapper around Claude).

Rise of Local AI

As people integrate AI into work, they also bring it onto their devices. Hosting and owning models makes integration simpler and more intuitive:

You can tune models to needs. Dive deep into operations. No fear of server downtime or hacking.

Cloud remains home for frontier models (due to massive memory demands), but mid-sized models are now smart enough to perform real tasks on consumer hardware.

E.g., NVIDIA 5090 GPU with 32GB VRAM; SGX desktop units with 100GB VRAM (though CPU/memory reportedly weak, inference speed mediocre).

Western Open-Source Renaissance? Doomers and China’s alignment strategy have impacted Western open-source development. But we’re more confident doomers won’t admit error than in lack of future open-source vitality.

LLMs in Gaming

Game NPCs no longer scripted—they’ll have real theory of mind.

AI will shape dialogue, characters, environments—creating deeper immersion.

As longtime GTA series player (and investor), we suspect TakeTwo delayed release by a year to achieve this vision. Either way, we expect indie devs or mod teams to launch breakout games with LLM-integrated engines this year.

Peak Data Center Buildout

Even executing current plans, data center construction remains massive. From planning to legal approvals to funding, it takes two years. Whether exponential growth in compute, energy, and data can sustain these builds remains uncertain.

IV. Go Long Resources

COMEX vs LBMA Arbitrage

Refer to earlier discussion: would be ideal to have an ISDA agreement and a ship to transport silver to London and mint it.

Long backwardation in New York, short in London.

Go Long Copper

- Data centers need 20–40 tons each.

- EVs, grids, solar drive huge demand.

- Demand up 35–40% by 2030, supply growing only ~3% annually, with 5–7 year supply-demand lag.

Go Long Tin

- Every chip needs solder—50% tin.

- AI boom → more semiconductors → more tin demand.

- Myanmar civil war disrupts 10% of global tin supply. Indonesia restricting exports. West lacks aligned production base.

Go Long Laser/Photonics

Holy photonics, Batman! These stocks have performed exceptionally well lately—wish we’d bought more last year!

- Optical interconnects shifting copper to fiber. Co-packaged optics in data centers advancing fast.

- Defense: Drone economics broken. $50K Shahed drone shot down by $10M Patriot missile—unsustainable asymmetry. Lasers solve this—cents per shot, infinite ammo.

IV. Energy & Compute Infrastructure Opportunities

Go Long Nuclear

AI needs stable baseload power, weather-independent. Bottleneck today is workforce—not technology. Nuclear workforce gutted over past 30 years. Urgent need to rebuild.

Go Long Natural Gas

Gas as transition fuel helps Europe phase out Russian energy.

Also, AI’s need for dispatchable power (to handle peak loads) makes gas essential.

Go Long Compute Stack

We need more compute: Korean memory chips, U.S. processors, hard drives, networking gear, gaming hardware.

Even without new mega data centers, existing data centers and local AI already strain supply chains for memory, CPUs, and components.

V. U.S. Domestic Dynamics

Government Shutdown Risk

Polymarket implies 20–30% chance of shutdown. MAGA faction vs Congress standoff continues. December’s political deadlock didn’t vanish—CR bill only kicked the can.

Zero-sum politics turning negative-sum. Hope it doesn’t last long.

Student Loan Stress Mounts

U.S. student debt: $1.7 trillion. SAVE plan facing litigation.

Government accounting fiction harder to maintain. Defaults rising. Servicers feel pressure first.

GLP-1 Drugs Go Mainstream

Peptide drugs (e.g., GLP-1) going mass-market, possibly covered by insurance.

Used not just for weight loss, but potentially heart, kidney disease, addiction, even Alzheimer’s. Positive trial results could make it most-prescribed drug in history.

Horseshoe Theory Meets Robotics

AI adoption transforms labor markets—rare left-right consensus on inequality emerging.

$150K programming jobs disappearing. $45K care aide jobs growing. Could spark “New New Deal”-style policies to address new economic realities.

VI. Markets

Japan Policy Normalization

BOJ exits YCC. 10-year JGBs trade freely. Japanese investors hold over $1 trillion in U.S. Treasuries. If domestic yields rise, capital may repatriate. August 2024 market move may have been a preview.

Private Credit Under Pressure

Private credit exceeds $2 trillion. Pension funds chasing yield invest in illiquid loans not marked-to-market.

CRE market fragile. 2021 LBOs face high-rate rollover stress. If equities begin pricing in cash flow gaps, credit markets won’t escape similar repricing.

Arbitrage Opportunity in GPU-as-a-Service Companies:

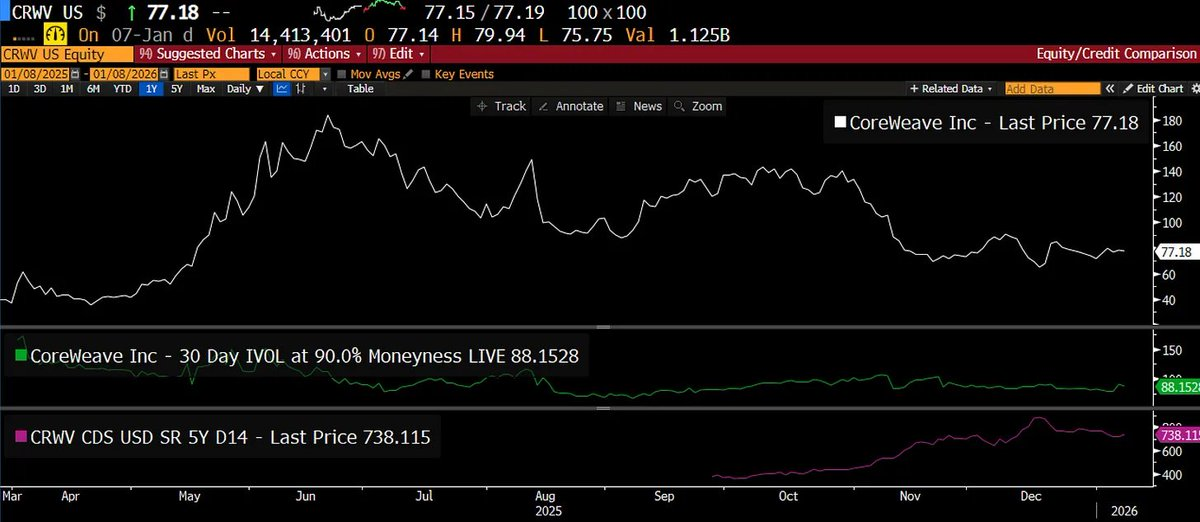

Credit spreads over 700bps, stock volatility only ~80. Applying Merton model to Coreweave’s credit spread (700bp) and leverage, what should 5-year debt volatility be? Offers fresh market perspective.

One company projects $26B capex vs $12B revenue, $8B EBITDA → -$18B cash flow, with only $2B cash on hand.

No wonder someone chose a straddle. We can’t predict direction—but status quo is unsustainable.

Oil Curve Flattens

We’re not positioned in oil, but charts tell the story:

WTI collapses from $75 backwardation to $60 flat.

Venezuelan and Iranian crude returning to market confirms prior thesis. Mid-curve “hump” likely arbitraged away.

Core Logic Across All Themes

AI Demand Is Real: Infrastructure building. When agentic AI delivers real work, usage will explode.

Energy Supply Shift: Metals up, oil down. Resource nationalism rises, crude oversupplied.

Policy Shift: Greenland now policy priority. Monroe Doctrine revived.

Short-Term Cash Flow Shock: Near-term cash flow gaps pressure markets. Long-term, investment thesis holds.

Investment Strategy: Rebalance portfolio accordingly.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News