Looking back and looking forward: Why is shorting considered low value for money?

TechFlow Selected TechFlow Selected

Looking back and looking forward: Why is shorting considered low value for money?

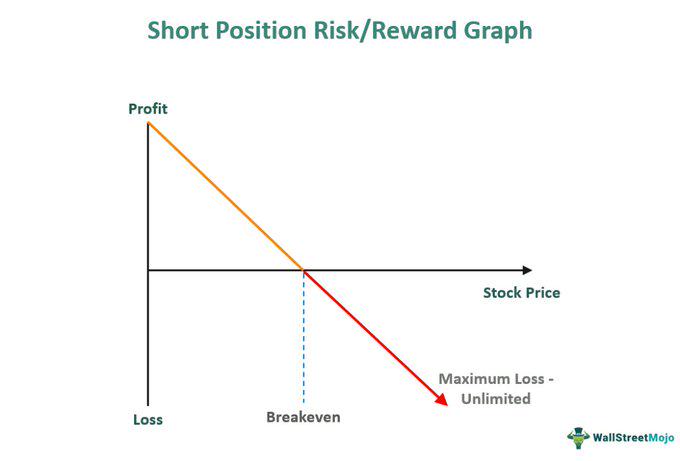

In theory, short selling can yield a maximum profit of 1x but carries the risk of infinite losses.

Author: 0xTodd

1. Why is shorting not cost-effective?

Theoretically, shorting has a maximum profit of 1x but unlimited downside risk;

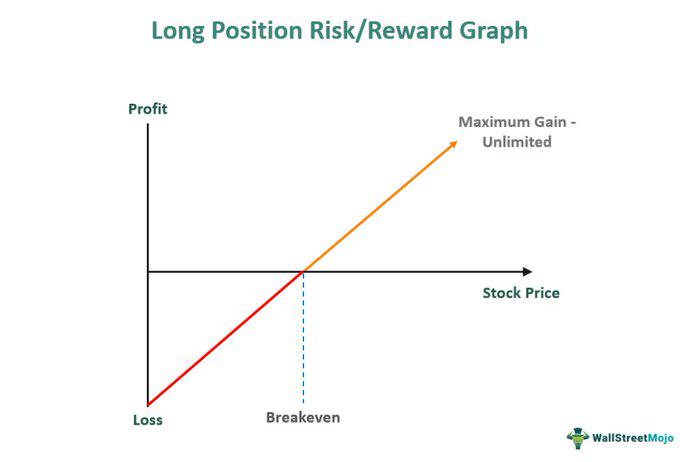

Going long risks losing 1x at most, but offers unlimited upside potential.

Although some argue that since all altcoins in the crypto space have strong gravitational pull (team dumping), shorting isn't as bad as imagined.

Still, I rarely short (except for hedging), and a deeper reason is:

Shorting warps your mindset and makes you start hating this industry (seeing only the dark side reinforces itself).

Once hatred takes over (it will), and faith is lost, one day you'll inevitably try shorting Bitcoin—but the consequences, you know, are terrifying.

You need to understand:

Humanity prints money forever √

Bitcoin remains in a perpetual bull market √

--------分割线--------

2. How much did the $Luna crash make for bears?

In 2022, I criticized the Luna scam daily on Twitter, so much so that for a while, Luna fanatics chased me around cursing nonstop—so I have the right to speak.

The $Luna collapse was essentially:

Wealth from Luna longs

↓ transferred to ↓

Luna shorts + CEXs.

Given it was once a top 10 market cap project, this wealth transfer was massive, so bears made big profits.

But don't just see the thief eating meat without seeing him getting beaten.

When Luna surged from $0.3 to $120, countless shorts had already fed their capital into the hands of longs—so shorting still isn't worthwhile.

I opened a rare short position back then—I didn’t short Luna itself, but $UST (Luna’s stablecoin).

To this day, I still think it was an excellent decision. As a stablecoin, I started shorting UST around $0.9, theoretically risking less than 10% while gaining up to 90%.

However, such shorting opportunities come only once every few years.

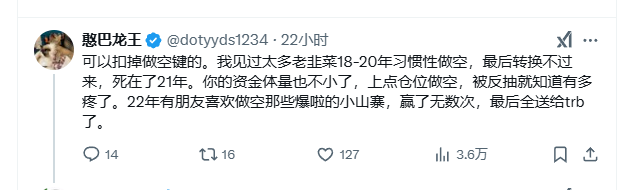

Plus, every now and then you encounter something like $TRB, which nukes from the ground up (no fundamentals, yet jumps from $10 to $550 in months). Even with god-tier margin, your entire bearish arsenal gets wiped out instantly.

As referenced by @dotyyds1234

So the conclusion is:

Don't habitually short (except for hedging)

Sometimes it's better not to earn certain money

It's better to rest during bear markets

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News