January Crypto Market Analysis: Prices Decline, but Institutional Infrastructure Accelerates

TechFlow Selected TechFlow Selected

January Crypto Market Analysis: Prices Decline, but Institutional Infrastructure Accelerates

The drawdown in January–February 2026 is not a rejection of digital assets, but rather a repricing within an evolving global monetary system.

Author: Dhruvang Choudhari (AMINA Bank)

Translation & Editing: TechFlow

TechFlow Insight: January 2026 presents a paradox: crypto prices fell by 25%, yet infrastructure supporting institutional adoption accelerated. While Bitcoin dropped to a ten-month low near $73,000, BlackRock named digital assets the defining investment theme for 2026.

Although leveraged traders liquidated $2.2 billion in positions, the Depository Trust & Clearing Corporation (DTCC) launched production-grade tokenization for U.S. Treasuries and equities. Although sentiment indices plunged into extreme pessimism, Y Combinator announced it would begin funding startups in USDC.

AMINA Bank analysis suggests this is not a rejection of digital assets but a repricing within an evolving global monetary system. The divergence between price action and structural progress defines the current phase of the cycle.

Full Text Below:

Introduction

January 2026 presents a paradox: crypto prices fell by 25%, yet infrastructure supporting institutional adoption accelerated.

While Bitcoin dropped to a ten-month low near $73,000, BlackRock named digital assets the defining investment theme for 2026. Although leveraged traders liquidated $2.2 billion in positions, the Depository Trust & Clearing Corporation (DTCC) launched production-grade tokenization for U.S. Treasuries and equities. Although sentiment indices plunged into extreme pessimism, Y Combinator announced it would begin funding startups in USDC.

The first two months of 2026 marked a decisive shift in the digital asset market. What initially appeared as chaotic selling was in fact a broad macro-level repricing driven by sovereign risk, shifts in the monetary system, and forced global deleveraging. Unlike prior crypto downturns, this event did not originate from within the digital asset ecosystem itself—it emerged externally.

January and February revealed a paradox now central to the institutional crypto era: market prices deteriorated sharply, yet regulatory clarity, infrastructure deployment, and institutional commitment advanced at an unprecedented pace. This divergence between price action and structural progress defines the current phase of the cycle.

This update analyzes how macroeconomic shocks disrupted crypto market structure, why Bitcoin—as a macro asset—faces an identity crisis, and how institutional capital continues building rather than retreating amid volatility.

Institutional Expansion Amid Market Weakness

Despite deteriorating spot prices, institutional participation accelerated—not slowed. This acceleration reveals a fundamental shift in how mature allocators approach digital assets: infrastructure maturity now matters more than price momentum.

Tokenization Becomes a Core Strategy

BlackRock formally designated digital assets and tokenization as the defining investment theme for 2026—alongside artificial intelligence—as structural drivers of capital markets.

At Franklin Templeton, innovation leadership described 2026 as the dawn of wallet-native financial systems, where stocks, bonds, and funds reside directly in digital wallets—not via traditional custodial frameworks.

Y Combinator sent a critical signal, announcing that startups in its Spring 2026 cohort may receive funding in USDC on Ethereum, Base, and Solana. Stablecoin settlement now typically clears in under one second, at costs below $0.01—offering clear advantages over cross-border fiat rails.

Reduced Regulatory Friction

Regulatory developments quietly removed long-standing structural barriers. The SEC withdrew prior accounting guidance that had hindered banks from offering digital asset custody services. Meanwhile, the Depository Trust & Clearing Corporation (DTCC) launched production-grade tokenization programs for U.S. Treasuries, large-cap equities, and ETFs—affirming legal equivalence between tokenized securities and traditional securities.

This marks a transition from experimental adoption to internal financial infrastructure upgrades.

Regional Competition for Crypto Capital

Jurisdictions are increasingly deploying policy as a competitive lever.

Hong Kong announced zero-tax incentives on qualified digital asset returns for funds and family offices, positioning itself as Asia’s premier institutional crypto hub. As of January 2026, 11 licensed virtual asset trading platforms were operational.

Meanwhile, Dubai continues executing its blockchain-first government strategy, targeting on-chain processing for 50% of public-sector transactions by end-2026. The UAE’s crypto penetration rate has reached ~39%, representing over 3.7 million users.

Macroeconomic Shocks Disrupting Calm

Understanding why institutions continue building requires understanding what drove the sell-off. Relative stability in 2025 fostered expectations that crypto had entered a low-volatility, institutionally anchored phase. These assumptions were shattered in January.

Japan and Global Leverage Unwinding

On January 20, 2026, the Japanese Government Bond (JGB) market entered acute stress. The 30-year JGB yield surged over 30 basis points to 3.91%—its highest level in 27 years—following fiscal remarks by Prime Minister Sanae Kishida that heightened concerns about debt sustainability. Japan’s debt-to-GDP ratio has surpassed 250%, making it a focal point for global bond markets.

Figure 1: Japan 30-Year Government Bond Yield (Historical)

Source: TradingView

The direct consequence was rapid unwinding of yen carry trades—one of the largest sources of cheap global leverage. As yen funding costs rose, investors were forced to liquidate risk assets to meet margin requirements. Bitcoin broke below $91,000—not due to crypto-specific weakness—but because it served as a liquidity proxy for balance-sheet repair.

Warsh Nomination and Monetary Repricing

This pressure intensified on January 30 with Kevin Warsh’s nomination as the next Federal Reserve Chair. Warsh’s longstanding preference for higher real interest rates and substantial reduction of the Fed’s balance sheet was interpreted as a definitive pivot away from accommodative monetary policy.

Within 24 hours, the total cryptocurrency market cap declined by approximately $430 billion. Bitcoin fell roughly 7% in a single day, while Ethereum and high-beta altcoins suffered double-digit percentage drawdowns. This move reflected a repricing of expectations around global dollar liquidity—not speculative panic.

Price Action and Bitcoin’s Identity Crisis

The macro shock exposed an unsettling truth about Bitcoin’s evolution as an institutional asset. The final week of January produced one of the most severe daily misalignments in the institutional era.

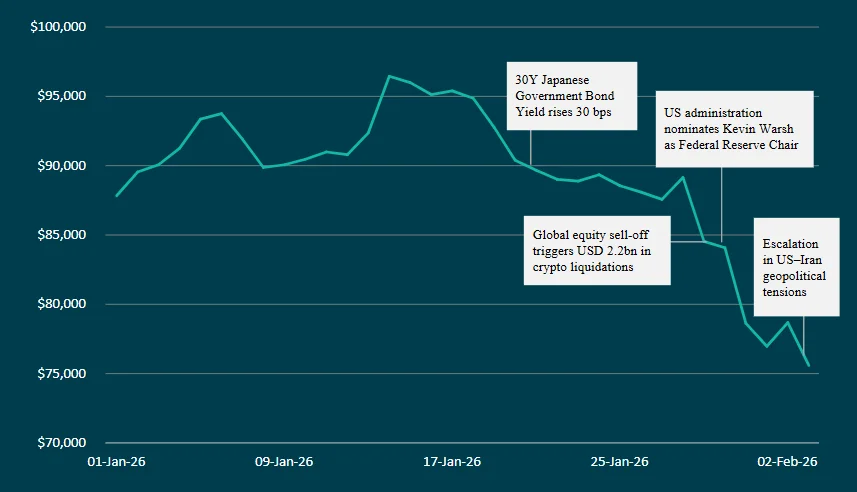

On January 29, Bitcoin fell from $96,000 to $80,000—a ~15% single-day drop. Crypto derivatives markets liquidated over $2.2 billion in leveraged positions. The significance of this move lies not in its magnitude, but in its correlation profile.

Bitcoin failed to decouple from equities and instead traded in lockstep with high-beta tech stocks. During this global deleveraging event, it did not act as a defensive asset—but as a liquidity-sensitive risk instrument.

By early February, sentiment indicators reflected extreme pessimism. The Crypto Fear & Greed Index fell to 19, while key technical levels—including the 0.786 Fibonacci retracement at $85,400—were decisively breached. The upper $70,000 range became the market’s primary structural support zone.

Figure 2: Bitcoin Price Decline Driven by Global Macro Events (Jan–Feb 2026)

Source: AMINA Bank

This correlation profile raises fundamental questions about Bitcoin’s role in institutional portfolios. If it behaves as a high-beta tech proxy—not a defensive hedge—during stress, allocation arguments must be adjusted accordingly. Yet institutional commitment continues regardless—suggesting mature allocators are pricing Bitcoin’s long-term structural role, not its short-term correlation behavior.

Protocol Evolution and Competitive Differentiation

Even amid falling prices and deteriorating macro conditions, base-layer development continued uninterrupted. This illustrates a key feature of the current cycle: infrastructure development has decoupled from price momentum.

Ethereum remains focused on scaling through execution efficiency, censorship resistance, and MEV mitigation. The upcoming Glamsterdam upgrade aims to raise the gas limit to 200 million, achieving theoretical throughput approaching 10,000 TPS.

Solana pursues aggressive performance enhancements. Its Alpenglow upgrade targets reducing transaction finality from 12.8 seconds to ~100–150 milliseconds—positioning it among the fastest production settlement layers.

These technological advances continue regardless of market sentiment—reflecting long-term capital commitments and engineering progress independent of price action.

Security Losses Highlight Operational Risk

Even as institutional infrastructure matures, security incidents highlight persistent operational vulnerabilities. January 2026 recorded over $370 million stolen—the highest monthly total in nearly a year. Over $311 million in losses stemmed from phishing and social engineering attacks—not smart contract failures.

The largest single incident exceeded $280 million and involved AI-generated voice impersonation targeting hardware wallet users. These events underscore a structural shift in risk: human and operational vulnerabilities now represent the primary attack surface for institutional crypto participants.

This pattern reinforces why custodial frameworks operating under regulatory oversight provide a competitive advantage beyond compliance. Operational security protocols, institutional-grade key management, and insurance frameworks have become table stakes.

Conclusion

The January–February 2026 pullback is not a rejection of digital assets—but a repricing within an evolving global monetary system. Crypto now reacts directly to sovereign bond markets, central bank leadership, and geopolitical escalation. This sensitivity introduces volatility—but also confirms integration.

Meanwhile, institutional adoption, regulatory clarity, and protocol development advanced through the sell-off. Tokenization shifted from narrative to deployed infrastructure; wallet-native finance moved from theory to implementation.

Early 2026 did not mark the collapse of the crypto market. It marked the first true stress test of its institutional maturity. While prices failed the test, underlying infrastructure passed with distinction.

The divergence between price action and structural progress cannot persist indefinitely—because institutional deployment, regulatory clarification, and infrastructure maturity will ultimately reflect in market valuations.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News