To All HODLers Questioning Their Life Choices: Navigating the Darkest Hour—Crypto Remains at Its Chaotic Starting Point

TechFlow Selected TechFlow Selected

To All HODLers Questioning Their Life Choices: Navigating the Darkest Hour—Crypto Remains at Its Chaotic Starting Point

An internet-based financial system will appear inevitable, and this period will be regarded as the beginning of chaos.

Author: Connor Dempsey

Translated by: TechFlow

TechFlow Intro: This article traces the dramatic arc from the extreme optimism triggered by Trump’s election victory in early 2025—through the ensuing epic crash caused by the “First Family’s” token launches, tariff policies, Binance’s unexpected outage, and a broad-based U.S. equity selloff. Drawing on eight years of industry experience, the author offers a deep analysis of how the crypto market has evolved from operating as an independent asset class to becoming deeply intertwined—and thus doubly vulnerable—with Wall Street. Though the current landscape is littered with wreckage, the author argues that, amid macro expectations of rate cuts and a weak dollar, and under the broader trend of financial infrastructure migrating onto blockchains, we remain at the “chaotic beginning” of this internet-based financial revolution.

Full Text Below:

I’ve been navigating the crypto markets for eight years, and every so often, I encounter days like the ones we’ve just lived through.

February 5th was one of those days. But none of this happened overnight. Here’s how we got here.

Looking Back

Entering 2025, expectations for cryptocurrency were sky-high. The moment Trump’s victory was confirmed at the end of 2024, Bitcoin (BTC) began breaking new all-time highs. We were shifting from a Biden administration actively seeking to stifle the U.S. crypto industry, to a Trump administration pledging to make America the “world’s crypto capital.” Clear regulation was imminent, Bitcoin had acquired a powerful new institutional narrative, and exchange-traded funds (ETFs) stood ready to give large capital easy exposure.

An Abrupt Screech to a Halt

The world’s largest economy was finally embracing the technology we’d spent 16 years building. Sentiment was soaring. Then came the dumbest thing I’ve witnessed in my eight years in crypto: Donald J. Trump—the President of the United States—launched his own shitcoin. And then his wife launched one too.

Overnight, the narrative flipped—from “cryptocurrency will modernize finance” to “the President is running a pump-and-dump scheme.” A flood of retail investors rushed into $TRUMP. Most got rekt. And just like that, those who had long despised the industry gained yet another reason to call the entire project a scam.

Source: @messaricrypto

Staying Positive

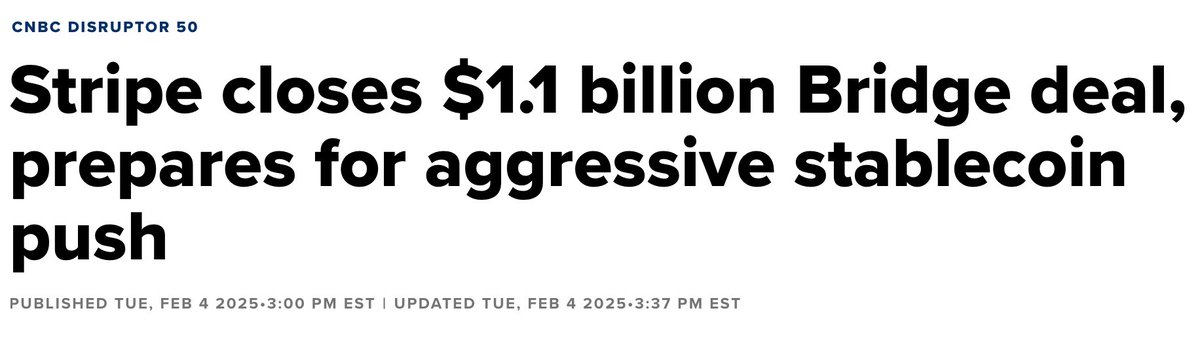

Crypto had weathered awkward moments before—and there remained plenty to be optimistic about. Billions of dollars were flowing into BlackRock’s Bitcoin ETF. Stripe, Visa, and even century-old firms like MoneyGram were going all-in on stablecoins. The Trump administration finalized federal stablecoin regulations, and the Market Structure Bill (“Clarity”)—designed to establish clear rules for the entire industry—followed closely behind. The race was still on.

October 10 (10/10)

Most market participants—including myself—expected the year to close at all-time highs (ATHs). The Fed was cutting rates, Bitcoin was retesting its $125,000 ATH, and experts were forecasting $250,000 for BTC and $12,000 for ETH—while equities and gold also surged to record highs.

Then, on October 10, Trump announced 100% tariffs on China, and MSCI proposed removing companies with high crypto exposure from pension fund and ETF-tracking indices. The latter threatened to sever one of Bitcoin’s largest sources of demand.

The market began selling off—and then crypto’s true catastrophe unfolded. Crypto investors were over-leveraged—as always—and then the world’s largest exchange, Binance, suffered a technical failure, triggering the largest single-day liquidation event in crypto history: $30–40 billion in forced sales, with some altcoins plunging 70% in a day.

It’s widely believed this event temporarily shattered crypto’s momentum—and since then, we’ve decoupled from rising equities and commodities.

Caption: Brilliant chart courtesy of @ceterispar1bus

A Long Descent

What followed was real pain. While other assets soared, crypto bled quietly. All the ingredients predicted by Fundstrat to carry us to “Valhalla”—rate cuts, a weakening dollar, and rising global risk-on sentiment—were in place. The S&P 500 closed at an all-time high. Gold and silver entered an epic rally. Peter Schiff danced on our graves. And crypto just sat there, bleeding.

Re-Coupling

By 2026, other markets started falling—and crypto tumbled alongside them. The S&P began giving back trillions in gains; gold and silver suffered their worst selloff in over 40 years. On February 4, hedge funds got hammered. Many blamed a tech-stock selloff driven by fears that AI would render software companies obsolete. Regardless, risk managers stepped in and cut positions—including massive Bitcoin holdings now held via ETFs and options. The sell-off pushed Bitcoin lower, triggering further mechanical liquidations, which then cascaded into native crypto funds. Reports indicate Trend Research had a $2 billion Ethereum position on Aave that was liquidated—exacerbating the crisis.

Traditional finance (TradFi) selloffs triggered crypto selloffs—not the other way around. The institutional adoption we fought so hard for ultimately became a double-edged sword. And that brings us to where we stand today.

Crypto Is Dead

As expected, those who’ve been wrong about crypto for over a decade crawled out of their holes once again—to dance on our graves.

“The ‘digital gold’ thesis is dead. Crypto isn’t a hedge against currency debasement. Worse still, the miner death spiral is coming—and everything will go to zero. This was a scam from start to finish.” An Elizabeth Warren tweet about Bitcoin causing cancer can’t be far off.

Long Live Crypto

The critics are right: Bitcoin and the broader market were indeed disappointing in 2025. The reality is, this remains an immature market—just 17 years old. It still trades largely like a tech stock, and last week’s performance showed it’s more deeply entwined with Wall Street than ever before. The bright side? The very same Wall Street that dragged crypto down last week can—and likely will—pull it back up.

And the environment is already set. Both the Trump administration and the incoming Fed Chair have signaled plans to resolve the debt crisis by overheating the economy—via low rates and a weak dollar. That’s the macro recipe for risk-asset rallies—and crypto is included.

Moreover, don’t forget the bigger story. Even our longest-standing critics no longer deny the reality of what we’ve built. Stablecoins are upgrading how money flows globally. The Market Structure Bill will pass, paving the way for blockchain-backed infrastructure across all financial services. The entire financial system is undergoing an upgrade—we’re just finalizing the details.

Have we permanently escaped the woods? No. Macro risks could still drag us down. Quantum computing poses a real threat to Bitcoin. Trump’s erratic behavior gives Democrats fresh justification to attack the industry if they regain power.

But in a hundred years, all of this will just be noise. An internet-native financial system will look inevitable—and this period will be remembered as its chaotic beginning. There’s one genuine wildcard: the convergence of crypto and AI is unavoidable. We just don’t yet know what form it will take. In short, we’re still early.

AI-Slop Free Guarantee: This article contains zero AI-generated content. Every word was typed by a human. That said, I did use Claude Opus 4.6 as an editing and research partner—feeding it content written by people far smarter than me.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News