Opinion: It's not advisable to "buy the dip" right now—wait quietly for these three scenarios to emerge

TechFlow Selected TechFlow Selected

Opinion: It's not advisable to "buy the dip" right now—wait quietly for these three scenarios to emerge

Although the White House crypto summit and Bitcoin reserve news did not meet market expectations, current macro uncertainty remains the primary cause of the recent market downturn.

Author: The DeFi Investor

Translation: Felix, PANews

Right now, almost every token has been declining for several weeks.

If you've lost a significant amount of money recently, I personally recommend pausing trading, creating a new plan, and doing everything possible to avoid revenge trading.

The current goal is survival and preserving remaining capital.

As long as you haven't lost everything and remain at the table, opportunities will come again.

Why is the market continuing to fall?

In my view, there are two main reasons:

1. Significant macro uncertainty: The stock market has also been crashing, and crypto has remained closely correlated with equities.

It might sound crazy, but this uncertainty could be deliberately created by the U.S. government.

Why?

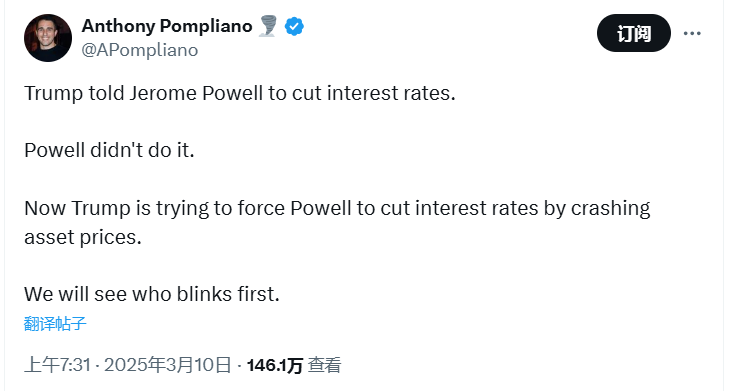

Because Trump wants to force the Federal Reserve Chair to cut interest rates.

The Trump administration continuously threatens new tariffs and then makes last-minute changes, creating widespread panic in markets.

They're using this approach to damage markets and pressure Fed Chair Jerome Powell into cutting rates—because Powell becomes more likely to ease policy when market conditions deteriorate.

Unfortunately, financial markets will continue to suffer unless the Trump administration stops manufacturing fear or Powell agrees to lower rates.

Crypto, classified as a high-risk asset class, is especially vulnerable to such developments.

2. The White House’s first-ever crypto summit and the national Bitcoin reserve failed to generate the expected “hype.”

(Don’t get me wrong—establishing a national Bitcoin reserve in the U.S. still carries major long-term implications.)

This positive news was already priced into the market long ago—Trump first stated that the U.S. would store its existing Bitcoin holdings in a national reserve quite some time back.

However, many expected Trump to announce a concrete strategy for the U.S. government to gradually accumulate more Bitcoin over time.

No such strategic move was announced; the administration merely declared it wouldn't sell seized Bitcoin. That’s why the launch of the U.S. Bitcoin reserve ultimately turned into a sell-off event.

Still, current macro uncertainty remains the primary driver behind the recent market crash.

When to Buy the Dip?

Before aggressively buying the dip, I’d like to see the following scenarios unfold (not investment advice):

- Fed rate cuts — Historically, rate cuts are bullish for financial markets. Additionally, once things settle, the Trump administration may stop generating so much market uncertainty.

- A new major crypto catalyst on the horizon — The biggest rallies in this cycle were driven by two key events: the approval of spot Bitcoin ETFs and Trump’s election victory.

- BTC and altcoins show strength even amid negative news — This would indicate that sellers are nearly out of tokens.

Until then, I'd rather use idle funds for yield farming and airdrop hunting. The market has been "bleeding" for weeks; waiting for signs of recovery before buying is wise.

I remain highly confident in crypto’s eventual comeback.

If the collapses of FTX, Three Arrows Capital, and Terra Luna weren't enough to destroy crypto, what could?

Sometimes taking high risks makes sense—but sometimes the best move is to wait and protect your hard-earned money.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News