Behind the CRCL Callback, Who Captured the Economic Value of USDC?

TechFlow Selected TechFlow Selected

Behind the CRCL Callback, Who Captured the Economic Value of USDC?

Long-term growth prospects still depend on the expansion of USDC supply, market share gains, and diversification of revenue streams toward non-reserve sources.

By Tanay Ved

Translation: johyyn, BlockBeats

Editor's Note: This analysis is based on recent market fluctuations in Circle’s valuation, USDC yield structure, and strategic partnerships. The context was shaped by the passage of the GENIUS Act, which renewed market attention on the stablecoin sector—prompting Circle’s market cap to briefly surpass $63 billion, exceeding the total value of its issued USDC. Drawing from on-chain data and public filings, the author examines Circle’s current revenue model, its partnership with Coinbase, cost structure, and highlights sustainability pressures and growth concerns behind its high valuation—particularly amid declining interest rates and intensifying competition—urging diversification of its business model.

Below is the original content (slightly edited for clarity):

Key Takeaways:

- Circle’s soaring market cap reflects stretched valuations: The passage of the GENIUS Act propelled Circle’s market capitalization to $63 billion—surpassing the value of all circulating USDC. However, trading at approximately 37x trailing twelve-month revenue and 401x net profit, its valuation increasingly diverges from fundamentals.

- Coinbase is both key partner and major cost center: In 2024, Coinbase captured about 56% of USDC reserve income—a significant distribution cost for Circle. Nevertheless, the partnership remains vital for expanding USDC scale through Coinbase’s products and ecosystem.

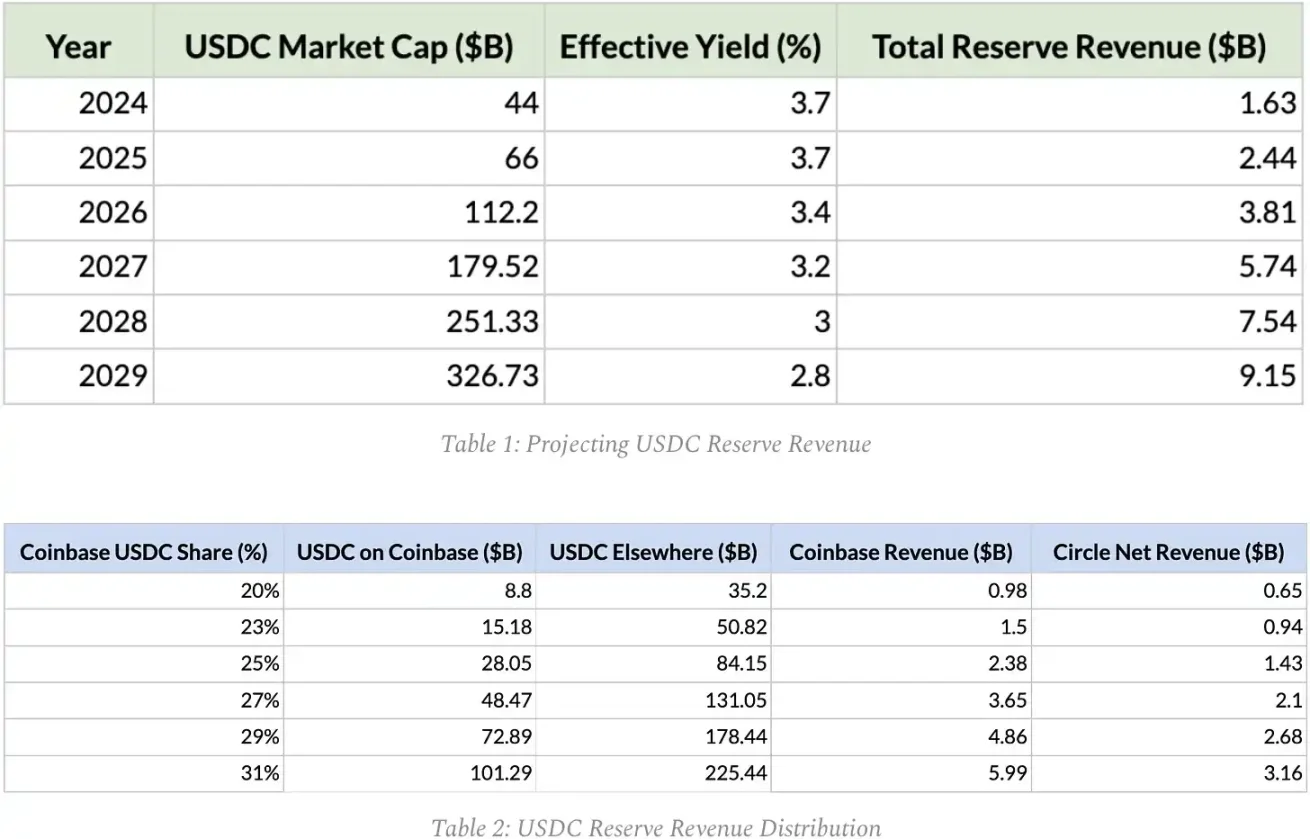

- Reserve income may grow but split terms limit upside: Based on on-chain data and public documents, Circle’s USDC reserve income could rise from $1.6 billion in 2024 to over $9 billion by 2029. Yet under current revenue-sharing agreements, Circle may retain less than half—highlighting the urgency of developing non-reserve revenue streams.

- Growth hinges on scale and share gains as rates fall: With anticipated rate declines, Circle’s long-term revenue potential depends critically on growing USDC supply and capturing market share amid rising competition from newly approved issuers.

Introduction

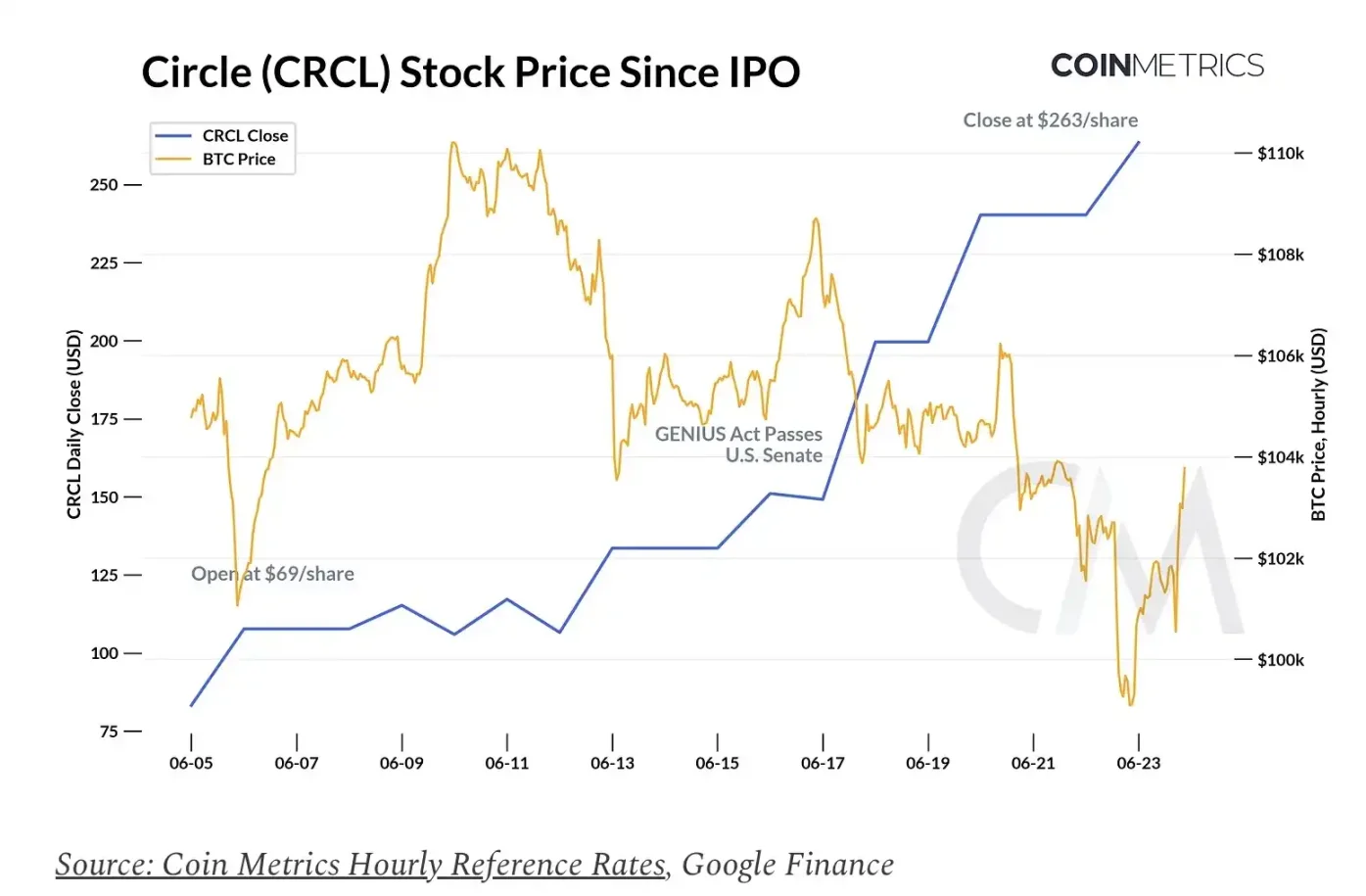

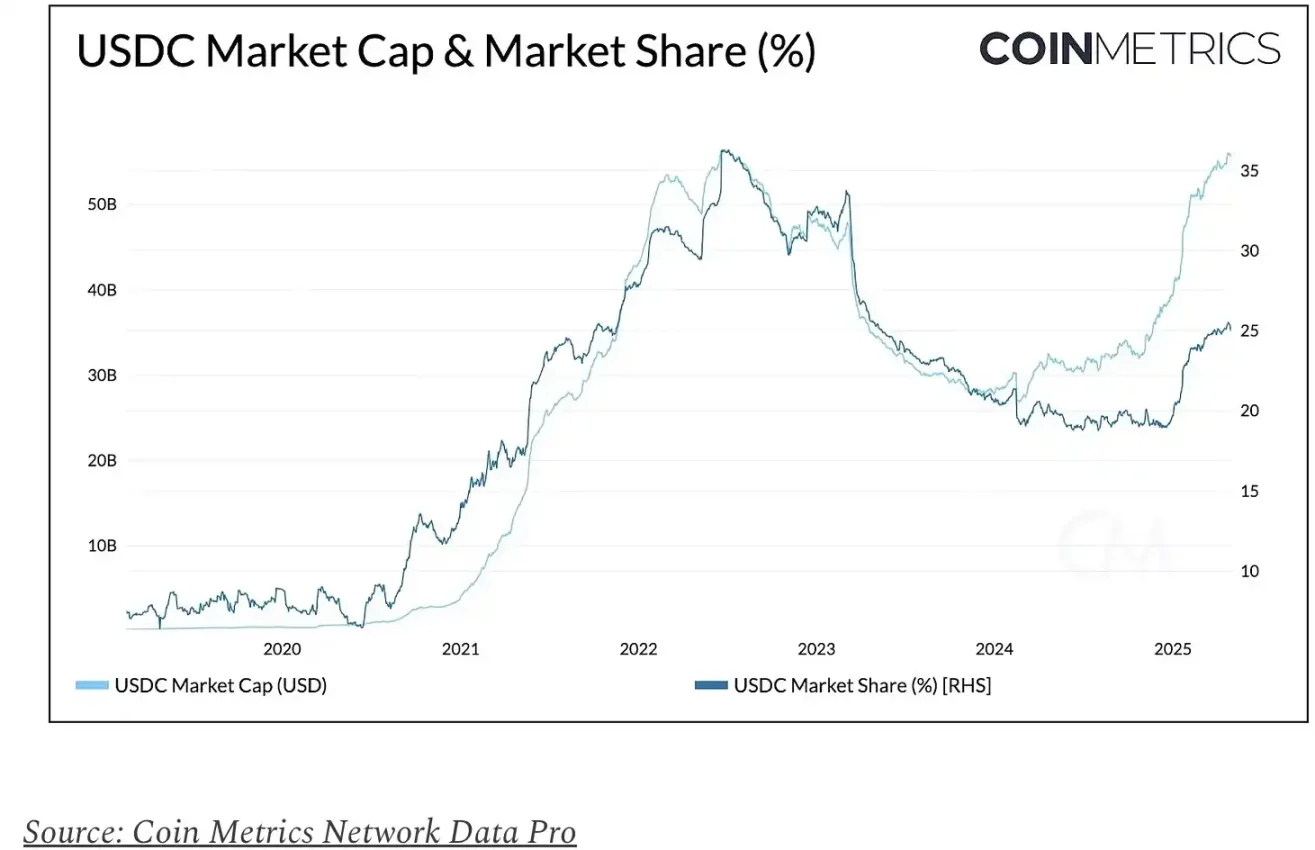

Stablecoins are experiencing a breakout moment—and so is Circle. Circle Internet Financial, the issuer of USDC (the second-largest stablecoin, valued at around $61 billion with ~25% market share), went public on the New York Stock Exchange (NYSE) on June 5. Since then, CRCL shares have surged more than 700%, climbing from their $31 IPO price to roughly $263 per share. With a $63 billion market cap, Circle now trades above the size of its own USDC reserves.

Circle’s IPO arrived at an opportune time, boosted by the U.S. Senate’s passage of the GENIUS Act. Combined with growing demand for compliant digital dollars, Circle is capitalizing on strong investor appetite for pure-play exposure to stablecoins. Its impressive debut has also sparked renewed interest in IPOs among other crypto firms like Bullish and Gemini, while invigorating broader public market activity and rekindling focus on stablecoin economics.

In this edition of the Coin Metrics Network State Report, we analyze Circle’s post-IPO performance and valuation, examine who captures the economic value of USDC, and project Circle’s future revenue potential based on interest rates, USDC adoption, and competitive dynamics in the stablecoin market.

Circle (CRCL) Performance

Circle’s IPO stands out as one of the most notable tech listings in the U.S. in recent years. It attracted over 25x oversubscription, with shares opening well above the $31 IPO price. Even as broader crypto markets pulled back, CRCL continued to climb, pushing Circle’s market cap to $63 billion.

Valuation Metrics

But does such a high valuation align with fundamentals? Based on Circle’s 2024 revenue of $1.67 billion and net income of $157 million, $CRCL currently trades at approximately 37x trailing revenue (price-to-sales ratio, P/S) and 401x net earnings (P/E). These multiples far exceed those of comparable fintech companies—such as NuBank (~27x), Robinhood (~45x), and even Coinbase (~57x), despite the latter having more diversified revenue streams and higher margins.

Several factors appear to be driving this premium. Circle offers investors direct access to the growth of digital dollars—an opportunity amplified by the GENIUS Act and enhanced by its first-mover advantage in regulated markets. As the addressable market expands, both USDC and Circle are well-positioned to benefit. Yet, with a $65 billion market cap, narrative-driven enthusiasm appears to have outpaced underlying fundamentals. Key risks include heavy reliance on interest income (which could shrink if U.S. rates decline) and intensifying competition from banks and fintech firms—the GENIUS Act has paved the way for more regulated stablecoin issuers using similar business models.

Who Captures the Economic Value of USDC?

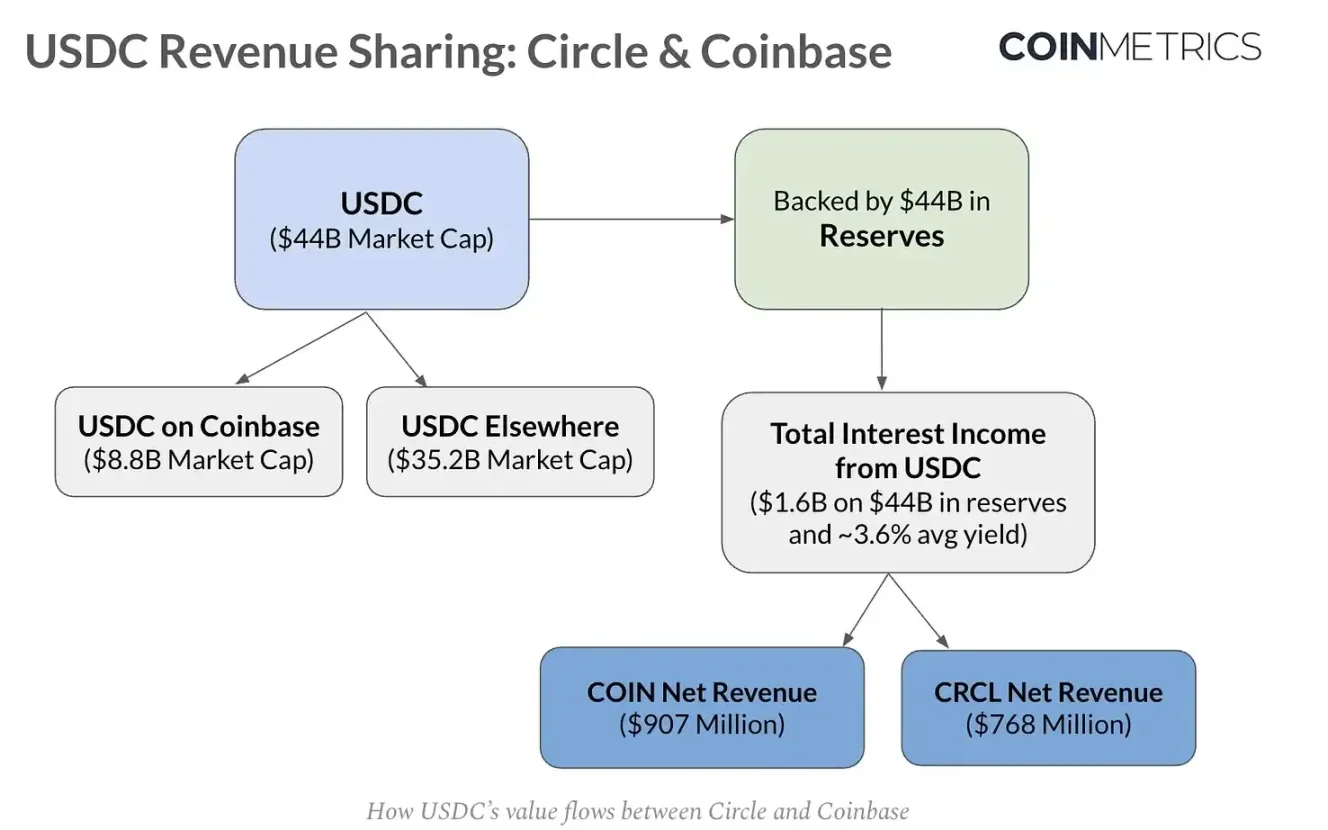

Almost all of Circle’s revenue comes from interest earned on USDC reserves. These reserves are held in cash at banks and in the Circle Reserve Fund managed by BlackRock, which invests in short-term U.S. Treasuries. By the end of 2024, the $44 billion in reserves generated $1.6 billion in gross revenue—implying an effective yield of about 3.6%. After paying over $900 million in distribution costs (primarily to Coinbase), Circle retained $768 million in net income from its USDC operations.

Circle and Coinbase Revenue Sharing

Although Circle remains the sole issuer of USDC, it does not capture all of its economic value. Thanks to its equity stake in Circle and a revenue-sharing agreement, Coinbase earns:

- 100% of the interest income from USDC held by customers on Coinbase platforms;

- 50% of the interest income from USDC held elsewhere.

This arrangement incentivizes both parties to expand USDC adoption. Coinbase has played a pivotal role in driving growth, significantly boosting USDC distribution via its exchange, the Base Layer-2 network (which currently holds $37 billion in USDC), and new offerings like Coinbase Payments. According to Circle’s S-1 filing, Coinbase’s share of outstanding USDC has steadily increased—from about 5% in 2022 to 12% in 2023, 20% in 2024, and reaching 22% by Q1 2025, equivalent to $12 billion in USDC across its platforms.

The diagram below illustrates the flow of USDC-generated revenue between Circle and Coinbase in 2024. Treating Coinbase’s portion of USDC reserve income as a cost to Circle clarifies how value flows from USDC reserves to Circle and is then redistributed to Coinbase under their revenue-sharing agreement.

Based on these projections, Coinbase captures over 50% of Circle’s total USDC-related revenue, driven by its growing platform share. While stablecoin revenue accounts for only about 23% of Coinbase’s total revenue—and some of that is passed back to users via “USDC Rewards”—the company still retains substantial upside. This interdependent economic relationship raises an important question: Given that Circle’s market cap now reaches 82% of Coinbase’s, how should investors relatively value these two entities?

Projecting Future USDC Interest Income

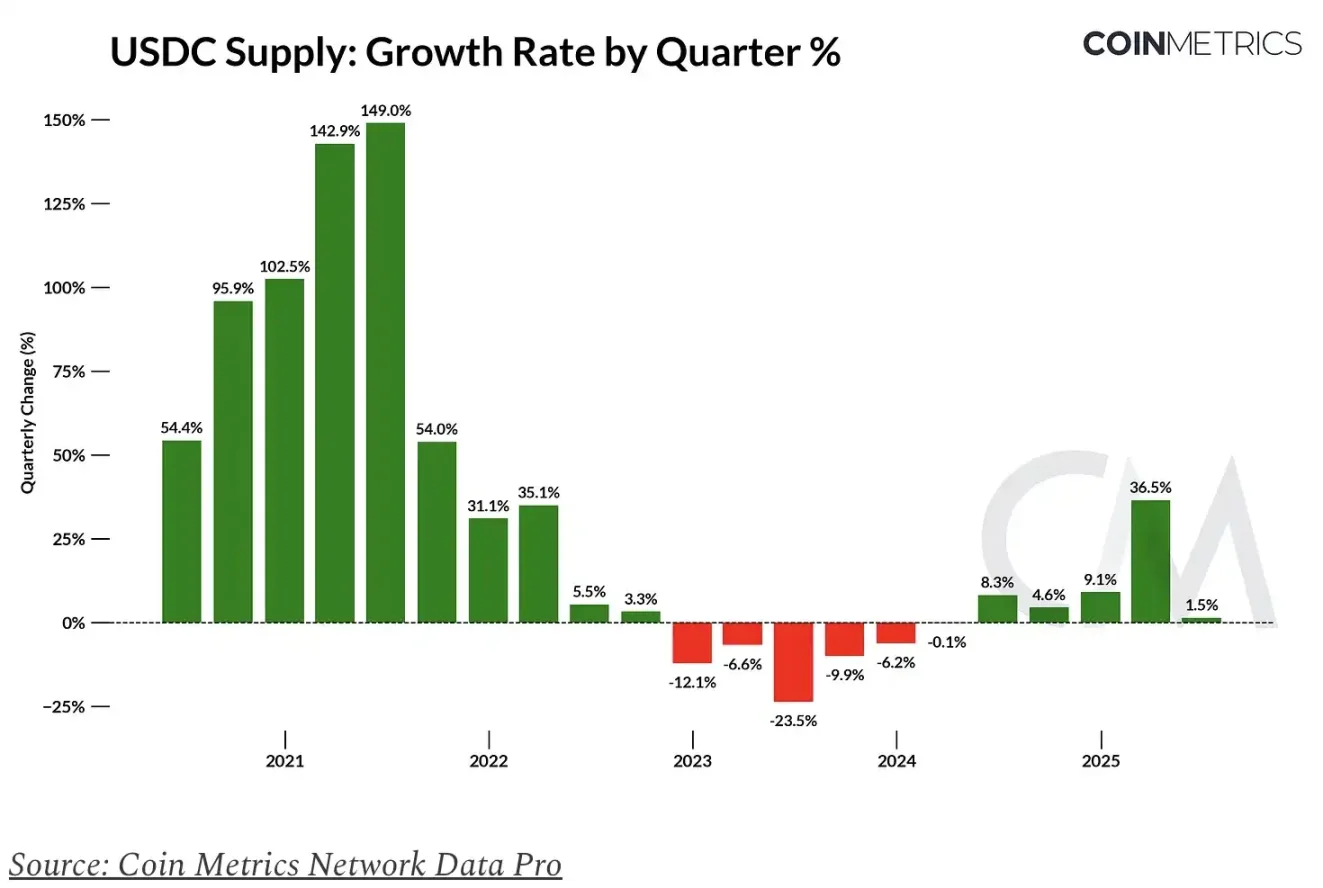

Looking ahead, Circle’s revenue trajectory hinges on three key variables: the supply of circulating USDC (influenced by overall stablecoin market growth and its market share), prevailing interest rates, and the proportion of USDC held on Coinbase platforms.

While historical USDC supply growth provides a useful benchmark, forecasting future expansion involves inherent uncertainty. The real-world impact of regulatory clarity, evolving competition, and macroeconomic conditions could significantly affect adoption and market share. To account for this, we built a gradually decelerating growth model—incorporating near-term tailwinds (e.g., stablecoin legislation) alongside long-term headwinds from increasing competition and falling yields.

To better understand USDC’s long-term economic model, we projected net income for both Circle and Coinbase through 2029 based on these core drivers.

In summary, the long-term revenue potential for both Circle and Coinbase is closely tied to USDC supply growth and market share retention—key to offsetting downward pressure from falling yields. By the end of 2025, total reserve income generated by USDC is projected to reach $2.44 billion, with Coinbase capturing ~$1.5 billion and Circle retaining ~$940 million.

If current market dynamics persist, this figure could grow to $9.15 billion by 2029—$5.99 billion for Coinbase and $3.16 billion for Circle.

It should be noted that these estimates cover only USDC reserve income, which constitutes the vast majority of Circle’s current revenue, and do not include potential upside from emerging business lines such as the Circle Payments Network—which may play an increasingly important role in revenue diversification in the future.

Conclusion

Circle’s IPO marks a significant milestone for the stablecoin industry, offering investors direct exposure to the growth of “digital dollars.” In the short term, regulatory momentum and Circle’s positioning in regulated markets provide strong tailwinds. However, its long-term success will depend on expanding USDC supply, gaining market share, and diversifying revenue beyond reserve assets.

Currently, CRCL’s valuation multiples are substantially higher than its fundamentals suggest. Whether Circle can translate regulatory clarity, institutional partnerships, and distribution strength into durable, sustainable growth will be the critical test going forward.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News