The Dollar on the Internet of Value: 2025 USDC Macroeconomic Report

TechFlow Selected TechFlow Selected

The Dollar on the Internet of Value: 2025 USDC Macroeconomic Report

Circle is building an open technology platform centered on USDC, aiming to achieve similar network effects and utility for financial services.

Written by: Circle

Translated by: Will Awang

We have already seen enough cases in 2024 to establish consensus that stablecoins are a "killer app." Stripe even used real money to acquire Bridge, a stablecoin service provider, setting the industry's highest acquisition amount. With the U.S. government now sending clear regulatory signals, 2025 will undoubtedly be a landmark year for the stablecoin market. Multiple stablecoin issuers, various types of stablecoins, and an ever-expanding range of use cases will emerge one after another.

As the issuer of USDC, the compliant stablecoin, financial technology company Circle is one of today’s most successful projects. As a pre-IPO project taking the traditional capital markets route, how to craft narratives for traditional finance and expand its application scenarios is something every stablecoin issuer—and every project claiming to achieve mass adoption—must learn from and emulate.

-

First-level narrative: The Internet's Financial Upgrade. Circle is building a value-interconnected network based on stablecoins, upgrading the global financial system. Blockchain brings internet speed and scale to the transfer of value. Note that this story extends “Internet+” rather than expanding “Blockchain+,” as all current applications are built upon the internet.

-

Second-level narrative: Upgrading the Interconnected Network via USDC. USDC digital dollars are tokenized versions of fiat currency loaded onto the internet, enabling individuals and businesses to transfer, spend, save, and store value with the same efficiency and scale we use to transmit data online today.

-

Due to limitations in financial infrastructure, information transmission and fund transfers remain separated worldwide. Web3’s blockchain-based value internet directly embeds value into the traditional internet architecture, allowing users to own their data and other technological assets—including money—and facilitating value exchange. In this Web3 value internet, USDC is the dollar on the internet. USDC can leverage innovations in blockchain networks to bridge and strengthen the global banking and financial system.

-

Third-level narrative: Expanding Use Cases Through Network Effects. The U.S. dollar and the internet both possess powerful network effects. In the real world and online, the dollar functions as a currency with strong network effects. Blockchain technology gives USDC enhanced functionality and new application potential beyond traditional dollars, while leveraging existing internet infrastructure for deployment. Circle is building an open technical platform centered around USDC, capitalizing on the dollar’s current strength and widespread usage, along with the internet’s advantages in scale, speed, and cost, to deliver similar network effects and utility to financial services.

The establishment of these narratives and the expansion of practical applications have driven Circle USDC’s success. Therefore, we have translated Circle’s recently released 2025 State of the USDC Economy report for collective learning and reference.

The full text spans 18,000 words. Enjoy:

1. Jeremy Allaire’s Executive Summary

The past year marked significant progress for USDC in economic growth and application maturity. Globally, the trend has gained strong momentum as more individuals and enterprises experience the power of digital dollars on blockchain networks. Developers continue discovering ways to build application platforms using USDC and Circle’s technologies, making global commerce and finance more efficient, faster, and inclusive.

Let’s look at USDC’s specific data for 2024:

-

In 2024, the circulating supply of USDC grew over 78% year-on-year—faster than any other major stablecoin. Meanwhile, monthly transaction volume reached $1 trillion in November 2024 alone, with historical transaction volume exceeding $18 trillion.

-

The USDC user base is also robust and becoming mainstream. By expanding partnerships with leading digital asset exchanges, banks, and wallets, USDC is now accessible through wallet products serving over 500 million end users, supporting use cases ranging from digital capital market activities and dollar value storage to an increasing wave of global payment applications.

USDC is a dollar-backed stablecoin. Beyond the U.S. dollar’s dominant position in trade, payments, and global finance, three additional factors are expected to accelerate USDC adoption and utility. This mirrors the evolution in tech history—from dial-up internet and immature browsers evolving into broadband and mobile networks—after which search and e-commerce brought all the world’s knowledge and sellable goods to billions’ fingertips.

-

Legal and regulatory clarity: Emerging stablecoin regulations worldwide are establishing sound compliance standards to protect consumers and pave the way for broader institutional integration—aligning with Circle’s operating model. There are strong indications the U.S. will soon follow suit and play a key role in harmonizing these rules globally. This trend toward regulatory clarity will boost confidence in USDC among households, businesses, and financial institutions.

-

Scalability of blockchain networks: Meanwhile, blockchain infrastructure is rapidly improving—becoming faster, safer, and more flexible. Developers are simplifying user experiences and pushing complexity into the background so the technology just “works.” Blockchains that have solved major scalability issues can now enable USDC payments globally at a cost of mere cents.

-

Superior user experience: The number of connections between USDC and traditional finance is surging. Circle’s continuously expanding global banking network increases direct access to USDC across many financial centers worldwide. Growing partnerships unlock more traditional payment use cases, including global payroll, vendor payments, cross-border remittances, merchant payments, and more.

Driven by these factors, combined with the open network and ultra-high throughput of the value internet, Circle’s stablecoin network enables near-instant global value distribution. Consider video storage and streaming: in 2002, transferring video files was extremely cumbersome. Two decades later, people watch over one billion hours of video daily.

The growth of the USDC economy reflects a broader trend toward financial openness, where technological advances and API proliferation are driving a future in which instant, low-cost payments become the norm. Recent research confirms this: 65% of payment industry executives recognize the need to expand instant payment infrastructure. However, traditional payment systems have lagged behind. USDC is poised to help the rapidly evolving payment landscape fully realize its potential—especially in emerging markets quickly shifting from cash to non-cash payments.

Circle’s combination of internet-scale reach, enterprise-grade quality, and regulatory compliance isn’t just smart business strategy—it’s a necessity for becoming a thriving platform. Over a decade ago, Circle committed to building a company that leverages the best features of blockchain—high speed, low cost, inclusivity, and programmability—to rebuild global value exchange from the ground up using internet infrastructure. As demonstrated in this report, Circle is fulfilling its mission of enhancing global economic prosperity through frictionless value exchange.

Circle is more optimistic than ever about the future—not only for itself, but for everyone in the entire USDC ecosystem. — Jeremy Allaire, Circle Co-founder & CEO

2. About Circle and USDC

2.1 Circle Stablecoin Network

Interest in USDC is growing organically worldwide, as more businesses and individuals recognize that stablecoins and blockchain networks can solve long-standing problems in global payments. These problems stem primarily from outdated payment rails still relied upon by today’s commercial activity. SWIFT and ACH—just two of many rails comprising today’s fragmented global payment landscape—were established in 1977 and 1972, respectively. More recent developments, such as the Eurozone’s SEPA and national instant payment systems in several major markets, still lack global interoperability and economies of scale.

These shortcomings result in high transaction costs, delays, and other barriers, exacerbating financial inclusion challenges for those excluded from the global banking system. Collectively, these frictions impose a substantial tax on global commercial activity. We urgently need a new standard for global money movement—convenient, secure, reliable, and open to all—that addresses these pain points and unlocks massive opportunities. This vision is now materializing in the form of the Circle stablecoin network.

Circle collaborates with leading global banks, payment providers, and other institutions, connecting all participants within a comprehensive, internet-based settlement system centered around USDC—the world’s largest regulated stablecoin. USDC leverages innovations in blockchain networks to bridge and strengthen the global banking and financial system. Since its launch in 2018, Circle has facilitated over $850 billion in two-way flows between fiat currencies and supported blockchains. This stablecoin network enables banks, payment providers, businesses, and consumers to leverage USDC for real-time global settlements at extremely low cost with global accessibility.

Half a century after the creation of SWIFT and ACH, global communications have undergone a complete transformation, enabling instantaneous global connectivity. Billions can watch Hollywood movies on handheld phones during subway rides, instantly access nearly all human knowledge at almost zero cost, and buy or sell virtually any product from anywhere in the world. Circle is building a value-interconnected network based on stablecoins, delivering a network upgrade for global finance. As detailed in this report, this transformation is underway, and Circle expects accelerated progress in 2025 and beyond.

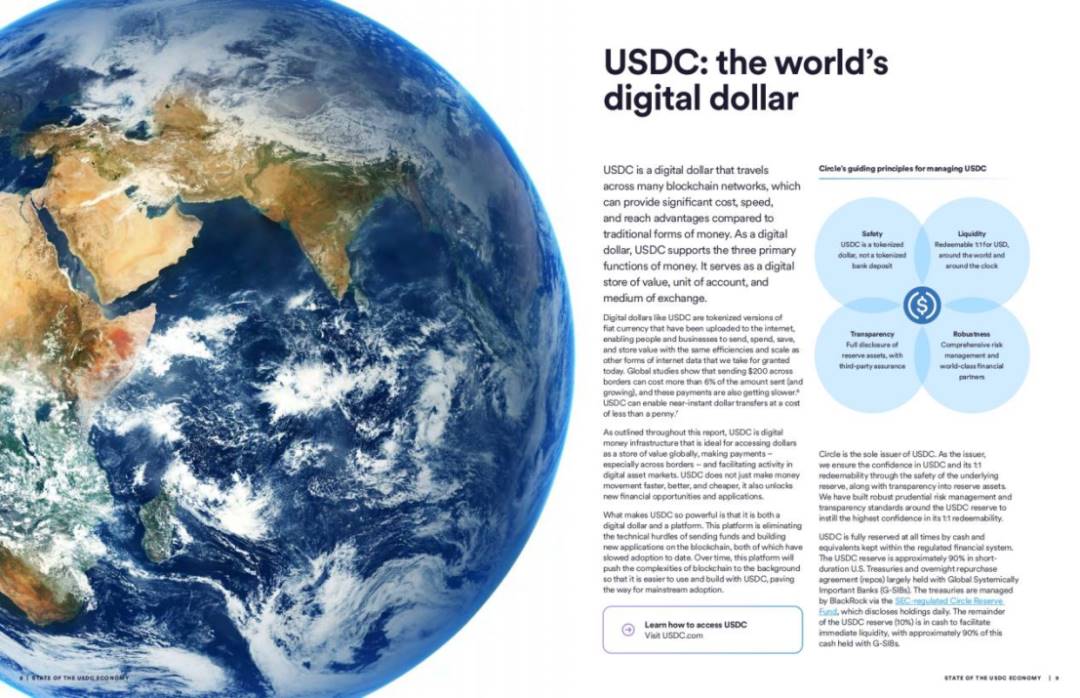

2.2 USDC Is Both Money and Platform

USDC is a digital dollar that can be transmitted across multiple blockchain networks, offering significant advantages over traditional forms of money in terms of cost, speed, and reach. USDC fulfills the three core functions of money: it serves as a digital store of value, a unit of account, and a medium of exchange.

USDC digital dollars are tokenized versions of fiat currency loaded onto the internet, enabling individuals and businesses to transfer, spend, save, and store value with the same efficiency and scale we use to transmit internet data today. Global studies show that the cost of sending a $200 cross-border remittance can exceed 6% of the amount sent (and rising), and these payments are also slowing down. USDC enables near-instant dollar transfers at a cost of less than one cent.

Meanwhile, USDC is ideal digital currency infrastructure, usable globally for value storage, payments (especially cross-border), and enabling digital asset market activities. USDC not only makes money movement faster, better, and cheaper, but also unlocks new financial opportunities and applications.

As a bridge between traditional finance and blockchain, USDC must maintain tight integration with banking systems at all times. Circle partners with several global systemically important banks (G-SIBs) to ensure USDC can always be redeemed 1:1 for U.S. dollars. These partner banks are strategically located worldwide, making USDC cost-effective and easily accessible in high-demand markets.

This year, Circle began offering USDC in certain countries through national payment systems and local currencies. As Circle pursues further bank integrations, this local availability is expected to expand. USDC is also accepted by leading card networks and payment processors as a primary settlement currency, reinforcing its role as a medium of exchange.

USDC’s strength lies in being both digital dollars and a platform. This platform removes technical barriers to moving funds and building new applications on blockchains—two factors that previously hindered adoption. Over time, this platform will push blockchain complexity into the background, making it easier to use and build with USDC, paving the way for mass adoption.

2.3 Circle’s Compliance Principles for Managing USDC

Circle’s core principles for managing USDC: 1) Security: USDC is tokenized dollars, not tokenized bank deposits; 2) Transparency: Full disclosure of reserve assets with third-party attestation; 3) Liquidity: Redeemable 1:1 for U.S. dollars anytime, anywhere globally; 4) Resilience: Comprehensive risk management and world-class financial partners.

Circle is the sole issuer of USDC. As the issuer, Circle has established sound prudential risk management and transparency standards for USDC reserves to instill maximum confidence in its 1:1 redeemability. USDC is fully backed at all times by cash and cash equivalents held within regulated financial systems. Approximately 90% of reserves consist of short-term U.S. Treasury securities and overnight repurchase agreements (Repos). These Treasuries are managed by BlackRock through the Circle Reserve Fund, a fund registered with the U.S. Securities and Exchange Commission (SEC) that discloses holdings daily. The remaining 10% of reserves are cash, providing immediate liquidity, with about 90% of this cash held at G-SIBs.

Weekly, Circle discloses reserve assets, minting, and redemption data on its transparency page at circle.com. Monthly, USDC and EURC reserve reports are published, with independent auditor Deloitte providing opinions. Circle is regulated in the U.S. and other global jurisdictions, maintaining customer identification (KYC), anti-money laundering (AML), sanctions, privacy, regulatory reporting, and other risk management programs, while conducting blockchain monitoring and screening to prevent child exploitation, sanctioned addresses, terrorist financing, and other illicit activities.

USDC also benefits from legal and regulatory clarity in Europe. Circle has become the first major global stablecoin issuer compliant with MiCA regulations—EURC, the euro-backed stablecoin, is fully issued and reserved by Circle’s regulated electronic money institution in France, meeting the European Union’s Markets in Crypto-Assets Regulation (MiCA) framework. In early October 2024, EURC became the largest euro-backed stablecoin by total circulation, with weekly transaction volumes exceeding $1 billion. EURC is available across multiple blockchains and widely supported by major EU digital asset service providers. The growth of non-dollar stablecoins brings new possibilities to blockchain-based finance, including foreign exchange (FX), local capital markets, tokenization initiatives, and regional cross-border and remittance channels.

3. The Dollar on the Internet

Circle’s mission is to enhance global economic prosperity through frictionless value exchange. Circle firmly believes that the advantages in speed, cost, and accessibility brought by blockchain-enabled commerce can significantly benefit billions of people worldwide.

USDC is already helping accelerate the evolution of traditional financial services in developed economies, but its most impactful potential may lie in assisting the 1.4 billion unbanked individuals. Many of these people live far from mobile networks, internet access, fintech, and physical banks. USDC offers a way to deliver low-cost, transparent digital dollars directly into their hands.

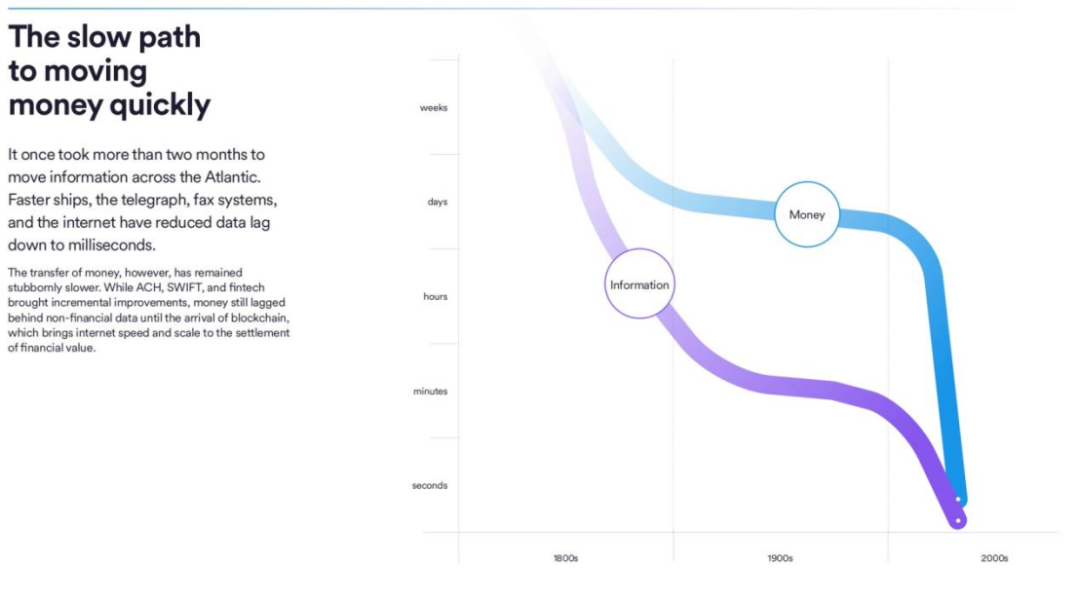

3.1 Internet Speed for Value Transfer

All of this stems from USDC’s inherent openness. USDC is built on open blockchain networks, enabling money, payments, lending, and other programmable functions to be directly embedded into the internet’s architecture. As of 2024, USDC natively supports 16 blockchains, including Ethereum—the world’s largest smart contract blockchain—as well as numerous “third-generation” blockchains designed from the ground up for near-instant, near-free payment settlements.

USDC will drive the next paradigm shift in fund transfers. In the past, it took over two months for information to cross the Atlantic; faster ships, telegraphs, fax machines, and the internet reduced data latency to milliseconds. Yet, money transfers remained slow. Despite improvements from ACH, SWIFT, and fintech, until blockchain emerged, money transfers lagged behind non-financial data. Blockchain brings internet speed and scale to the transfer of value.

3.2 Expanding USDC User Base

Worldwide, the number of USDC users continues to grow steadily. Since early 2023, the number of wallets holding at least $10 in USDC has nearly doubled to 3.9 million addresses, with most growth occurring in 2024. This is part of a larger, longer-term transformation in financial services that has been ongoing for at least two decades. From the early to mid-2000s, the rollout of mobile devices and smartphones, along with regulations like the EU’s Payment Services Directive (PSD), paved the way for tech companies to begin offering financial services.

Overall, financial digitization is driving major change. Digital wallets—including those linked to payment cards—are becoming a preferred payment method, and commercial payments are rapidly going digital.

Over the past year, Circle has formed partnerships with many enterprises that can now directly distribute USDC to millions of their own users. While these partnerships are still in early stages, Circle expects they will help drive the next phase of USDC growth by expanding access to U.S. dollars through their vast user bases.

3.3 Surging Global Corporate Interest in Circle

Interest in Circle’s business is deepening among powerful financial institutions, enterprise tech firms, and pioneering payment companies. Businesses worldwide are leveraging Circle’s platform to better serve customers, operate more efficiently, and create new connections. Borderless, always-on, and enabling near-instant payments, USDC powers the next wave of global commerce.

4. A New Internet Financial System – The Value Internet

Growth in the USDC user base is synchronizing with the rise of a new internet financial system—the value internet—creating new ways of exchanging value and enhancing and expanding traditional financial activities. Over time, Circle expects that as more people, businesses, and institutions rally around the unparalleled utility offered by open internet protocols, more traditional financial activities will migrate to this new internet financial system—the value internet. This trend has evolved from information to communication, and now to money itself—stablecoins.

4.1 The Trajectory of Internet Development

To understand this upcoming transformation and Circle’s intended role, consider the early development path of the internet. The emergence of commercial internet in the 1990s and the push for “write access” in the early 2000s gave rise to new platform business models that empowered builders and directly connected users. These platform businesses still dominate the internet today, spanning social media, ride-sharing, e-commerce, app stores, and more. By accumulating significant network effects and global scale, they created utility that enabled deep, sustained engagement with loyal user bases.

The rise of digital currencies like USDC results from the collision of money with Moore’s Law and Metcalfe’s Law. In the real world and online, the dollar is a currency with network effects. Circle is building a technology platform centered around USDC, leveraging the dollar’s current strength and widespread use, along with the internet’s scale, speed, and cost advantages, to achieve similar network effects and utility for financial services.

4.2 The Value Layer of the Internet

To this end, Circle designed USDC using open standards and smart contract blockchains so any developer can easily access the tools needed to build scalable, global digital dollar applications. This programmability and composability are game-changing: they give USDC greater functionality and new application potential beyond traditional dollars.

Circle provides developers with additional services designed to make USDC easier for their enterprises and end customers to use. These include several types of USDC-compatible wallets that enterprises can embed directly into existing customer interfaces with just a few lines of code, and a growing library of smart contract templates that eliminate much of the complexity involved in creating blockchain applications. Other services focus on simplifying the payment of network transaction fees, typically denominated in the blockchain’s native token, which adds extra steps and usage barriers. Circle is now enabling the use of USDC to pay these fees.

At the same time, as a regulated financial services firm, Circle places compliance first. Developers and enterprises building on the Circle platform gain access to tools that help ensure adherence to anti-money laundering (AML) standards, through real-time transaction screening, continuous monitoring, and Travel Rule compliance. Circle’s new compliance engine provides developers with resources to meet regulatory requirements, extending secure, resilient, responsible tools to the broader digital asset ecosystem.

Over the past two decades, leading cloud providers solved difficult problems like on-demand data storage, allowing today’s internet companies to reduce backend concerns and focus more resources and attention on innovation and customer experience. Similarly, Circle offers a comprehensive toolkit that facilitates the development of “Web3.”

Web3 embeds value directly into the internet’s architecture, enabling users to own their data and other technological assets—including money—and facilitating value exchange. Moreover, Web3 can become another new foundational layer of the internet, offering new pathways for corporate governance, value creation, and stakeholder engagement.

Just as 94% of Fortune 500 companies today rely on public cloud for operations, Circle expects that in the coming years, an increasing number of major corporations will turn to this value internet. Some studies show that over half of surveyed Fortune 500 executives say their companies are already building on blockchains. Beyond making individual app launches easier, Circle offers enhanced capabilities that transform USDC into a connective thread across a wide range of services throughout the blockchain ecosystem. The Cross-Chain Transfer Protocol (CCTP), launched in 2023, is one such example.

Email achieved global popularity partly because of its universal reach—SMTP allows seamless communication regardless of service used. Similarly, CCTP promotes USDC interoperability across supported blockchain networks. By eliminating the long-standing friction and risks of transferring value between blockchains—which inherently cannot communicate with each other—CCTP transforms increasingly large parts of the growing blockchain ecosystem into a single interconnected network where USDC can flow freely. Though still in its early lifecycle, CCTP has already become the primary method for transferring USDC from one blockchain to another. Since inception, CCTP has processed over $20 billion in USDC transfers.

4.3 Cultivating a Developer Ecosystem

Money flow touches nearly every aspect of local and global commerce. USDC and Circle’s technical solutions are built on open protocols and programmability, giving any software developer familiar tools—including APIs in standard programming languages—to create powerful applications that upgrade traditional financial systems.

Developers are already seizing this new opportunity to build the value internet. Crucially, this process proceeds both bottom-up and top-down. Entrepreneurs are using USDC and Circle’s platform to create entirely new categories of financial applications. At the same time, enterprises are integrating USDC and blockchain efficiencies into their existing operations using the same infrastructure. Every day, Circle invests in the growth of the blockchain ecosystem and developer community.

Globally, Circle hosts workshops and provides other resources to make it easier for developers to get started and harness the power of digital dollars. Circle helps developers unlock the USDC platform, equipping them to integrate enterprise-grade software into trusted applications built for the digital dollar use cases highlighted in this report.

To date, most USDC developer activity has focused on strengthening links between the blockchain ecosystem and traditional financial rails. These links act as on-ramps and off-ramps, increasing USDC’s impact on existing payment use cases. These efforts support and enhance the development of a stronger on-chain economy, where a full suite of financial activities connecting buyers, sellers, and merchants can occur natively on blockchains.

Another growing area of interest within the USDC developer community is the intersection of blockchain and AI. Though still in early stages, there are signs that autonomous payments using USDC could begin unlocking new business models for internet goods and offer people more convenient consumption methods. The Circle platform is ready to help developers build this future.

This on-chain economy is emerging across multiple blockchains, further underscoring the need for neutral, interoperable infrastructure—including USDC and CCTP—to eliminate friction in doing business across these networks. Indeed, the top six blockchains ranked by builder interest all feature native USDC availability and full CCTP integration, highlighting Circle’s central role in this growing ecosystem of builders and creators.

5. Real-World USDC Use Cases

USDC’s uses are as diverse as those of fiat dollars—and even more promising. Today, most USDC activity falls into four main categories:

5.1 Global Access to Dollars

Demand for U.S. dollars outside the United States—both for commercial and personal use—is strong. Dollars account for over 90% of cross-border trade in Latin America, 74% in Asia-Pacific, and 79% in other regions outside Europe. According to the U.S. Federal Reserve, over $1 trillion in U.S. banknotes—and more than 60% of all $100 bills—are held outside the United States.

USDC’s usage outside the U.S. benefits greatly from these factors, along with easier access compared to traditional bank-held dollars. Throughout the year, Circle partnered with established fintech firms, neobanks, and other distributors to deliver USDC directly into the hands of global customers.

5.1.1 Nubank – Latin America’s Emerging Bank

Nubank is the largest digital banking platform outside Asia, serving 105 million customers in Brazil, Mexico, and Colombia. The company leads industry transformation by leveraging data and proprietary technology to develop innovative financial products and services. Guided by its mission to “fight complexity and empower people,” Nubank supports customers throughout their full financial journey, promoting financial access and inclusion through responsible lending and transparency. Supported by an efficient and scalable business model combining low-cost services with growing returns, Nubank’s impact has earned numerous accolades, including TIME 100 Companies, Fast Company’s Most Innovative Companies, and Forbes’ Best Banks Worldwide.

In May 2024, Circle announced its launch in Nubank’s home market of Brazil. This release included a partnership with Nubank to co-develop digital asset products, enabling Nubank users to access USDC nearly instantly, at low cost, and 24/7. Beyond using dollars as value storage, Nubank users can transfer USDC to other wallets and increasingly use it in daily financial activities. At Nubank, 30% of crypto users hold USDC assets, 50% of new users enter the crypto world via USDC, and users holding USDC increased tenfold in 2024.

“As Nubank continues to expand its influence across Latin America and beyond, USDC will be a cornerstone of our strategy to deliver innovative financial solutions to our customers. Its stability, global reach, and commitment to regulatory compliance make it an ideal partner for building a more inclusive and accessible financial future.” — Thomaz Fortes, Head of Crypto

5.1.2 Lemon – Fiat and Crypto Wallet

Lemon, a Latin American company, has become a leader in the retail cryptocurrency market. With direct operations in Argentina, Peru, and Brazil, and partnerships covering users in Mexico, Colombia, Uruguay, and Ecuador, Lemon’s flagship product is a virtual wallet combining traditional finance with digital currencies. Integration with DeFi protocols enables users to earn additional crypto income weekly, further enhancing seamless conversion between local currencies and cryptocurrencies, including USDC.

An innovative Visa Lemon Card is available to users in Argentina, offering global spending with Bitcoin cashback on every purchase. Lemon and Visa have deepened their collaboration, planning to roll out the Lemon Card across the region. Additionally, Peruvians can interact with local payment systems using either fiat or crypto and send remittances via QR codes. At Lemon, users collectively hold $137 million in USDC, with new USDC users increasing by 21%.

“With over 3 million users in the region, the amount of USDC held by Lemon has grown 61% over the past 12 months. This reflects rising demand for digital dollars. This growth highlights the importance of stablecoins and our ability to deliver tailored solutions that empower individuals across Latin America to manage their finances freely and without barriers.” — Maximiliano Raimondi, CFO

5.2 Digital Asset Markets

In 2024, the digital asset market showed strong momentum and significant growth in mainstream adoption. As more jurisdictions globally enact clear regulations governing market conduct, more digital asset exchanges are becoming compliant entry points for new users seeking financial products with enhanced security and strong consumer protections.

USDC plays an increasingly vital role in these markets. As the most widely used regulated stablecoin, USDC eliminates risk for exchanges and their customers, serving as a liquid dollar foundation layer for trading, lending, value storage, and other activities.

Driven by growing public interest, the amount of USDC held by centralized exchanges globally rose steadily in 2024. Increased institutional support for USDC trading and the launch of new products pegged to USDC continued to enhance liquidity for spot and leveraged trading of USDC against Bitcoin, Ether, and other digital currencies.

USDC also plays a crucial role in decentralized finance (DeFi), where institutions often prioritize security and transparency. As digital asset prices rose, DeFi rebounded throughout 2024, with total value locked (TVL) exceeding $126 billion by November 30, 2024. Building on historically strong usage in DeFi, USDC accounted for 69% of stablecoin trading volume during the same period.

As more global jurisdictions enact digital asset market regulations, demand for regulated stablecoins will grow. This is already evident in Europe, which adopted the comprehensive MiCA framework in summer 2024. Traders in Europe are increasingly choosing regulated stablecoins like USDC and EURC, which complied with MiCA standards from day one. Throughout 2024, several exchanges in the region announced ahead of the December 31 compliance deadline that they would delist non-compliant stablecoins.

Despite lacking market structure regulation, mainstream adoption in the U.S. is accelerating, largely driven by the U.S. Securities and Exchange Commission (SEC) approving spot Bitcoin exchange-traded funds (ETFs), allowing asset managers to provide clients access to the largest digital asset by market cap. Months later, the SEC approved spot Ether ETFs. Altogether, these ETFs provided a highly regulated, transparent way for mainstream investors to access nearly $2.5 trillion in digital assets by November 30, 2024. To date, at least 11 U.S. institutions have launched ETFs linked to Bitcoin or Ether—the two largest digital assets by market cap.

While Circle is not directly involved in these ETFs, its long-standing regulatory-first stance means USDC benefits from broader trends in the digital asset market—clearer regulation and deeper integration into the global financial system. Major traditional investment platforms in the U.S. and worldwide continue expanding their digital product offerings, with USDC serving as a bridge between traditional and digital asset markets to serve customers.

5.2.1 Coinbase – Leading Global Compliant Digital Asset Exchange

Coinbase offers a trusted platform enabling individuals and institutions to easily participate in digital assets, including trading, staking, custody, spending, and fast, free global transfers. USDC plays a critical role at Coinbase, representing a large portion of trading liquidity and collateral. In 2023, Coinbase launched Base, an Ethereum Layer 2 blockchain enabling USDC transactions in under one second at a cost of less than one cent. This year, Base adoption grew significantly, with USDC—as the leading stablecoin on Base—playing a key role in this surge. Over the past few years, approximately $562 billion in USDC has flowed to Base. Coinbase also offers a range of other services making it easier for more people to access and start using USDC.

“Stablecoins are transforming the global financial landscape by enabling greater openness and inclusivity. The expanding circulation of USDC will enhance global economic freedom and set new standards for an industry built on trust and transparency. We’re excited to further drive innovation by advancing the development of the USDC ecosystem, its circulation, and global adoption.” — Shan Aggarwal, VP of Corporate and Business Development

5.2.3 Chipper Cash – Delivering Accessible Financial Services to Africa

Chipper Cash, with over 6 million registered users, is one of Africa’s largest fintech companies. The company enables Africans to send remittances easily, avoiding the hassle and fees typically associated with other payment systems. Chipper uses USDC for efficient global fund management, optimizing and reducing cross-border settlement costs.

Chipper offers a variety of products, including dollar-denominated savings (for local workers wishing to convert foreign salaries into USDC), virtual Visa cards that can be funded and used locally or globally, fractional shares for investing in foreign stocks, and remittance services. Chipper holds 49 operational licenses globally, including a recent broker-dealer license granted by Ghana’s Securities and Exchange Commission. Circle and Chipper are proud partners delivering trusted, accessible financial services across Africa and beyond.

“USDC is a key settlement layer for Chipper Cash’s technology platform and an increasing number of partners, enabling seamless 24/7 dollar transfers and broad interoperability. Using USDC on a shared ledger has dramatically improved our operational efficiency—real-time reconciliation, transparent fund tracking, and reduced transaction disputes—streamlining our internal liquidity processes. This efficiency is critical to our growth strategy and our commitment to delivering strong, reliable financial services to users across Africa and beyond.” — Maijid Moujaled, Co-founder & CEO

5.2.2 Bullish – Innovative Digital Asset Exchange

Bullish focuses on developing products and services for the institutional digital asset space, redefining traditional exchanges to benefit asset holders, empower traders, and increase market transparency. Backed by strong institutional capital, Bullish’s centralized exchange combines a high-performance central limit order book (CLOB) with proprietary automated market-making technology to deliver deep liquidity and tight spreads—all within a compliant, regulated framework. Launched in November 2021, the exchange serves over 50 specific jurisdictions across Asia-Pacific, Europe, Africa, and Latin America. Bullish operates as a full-reserve exchange, prioritizing compliance and customer asset protection through robust security measures and regulatory oversight.

The Bullish exchange is operated by Bullish (GI) Limited, regulated by the Gibraltar Financial Services Commission. Bullish launched USDC in 2021 and currently lists over 50 USDC trading pairs on its spot and derivatives markets. Daily USDC trading volume on Bullish reaches $1.3 billion, accounting for 83% of the exchange’s total trading volume.

“The global introduction of robust regulatory frameworks is opening cryptocurrency markets to the existing diverse participants in financial services. USDC not only provides an efficient, secure medium of exchange but also gives institutions a pathway to confidently engage with digital assets, while serving as an important mechanism for recycling risk capital.” — Chris Tyrer, Head of Institutional

5.2.3 dYdX – Top Decentralized Exchange

dYdX is one of the largest and most successful protocols in decentralized finance (DeFi), founded by Antonio Juliano in 2017, initially launching on the Ethereum mainnet, then building a Layer 2 scaling solution together with Starkware on Ethereum in 2020.

Recognizing the need to reduce fees and accelerate speeds, dYdX began exploring alternative infrastructure and relaunched its service on Cosmos in 2023—a highly modular ecosystem enabling services like dYdX to build and operate their own blockchains.

Every trade on dYdX settles in USDC almost immediately. Circle’s Cross-Chain Transfer Protocol (CCTP) provides users with a simple way to bring native USDC liquidity from other blockchain ecosystems to Cosmos. CCTP is a permissionless, on-chain utility that securely transfers USDC between blockchains via native burn-and-mint mechanisms. CCTP allows users to easily connect their wallets and deposit USDC from Ethereum and other supported networks. Read more about Circle, dYdX, and Cosmos.

“Circle thanks the Circle team—dYdX Chain has processed over $10 billion in transaction volume since deployment. This is a tremendous achievement, impossible without the innovation of native USDC on Cosmos and CCTP. At dYdX, we deeply appreciate Circle’s continuous innovation and commitment to ensuring user safety and reliability.” — Antonio Juliano, Founder

5.3 Payments

Blockchain networks can significantly upgrade outdated, fragmented traditional payment rails by replacing multiple intermediaries and siloed databases with streamlined, always-on, interoperable technology capable of transferring value to anyone with internet access.

USDC is advancing global payments—from merchant acquiring to remittances and B2B payments. USDC is well-suited to compete in reducing costs and increasing efficiency across the $150 trillion in cross-border transaction flows. Commercial payments, already shifting toward digital alternatives, are expected to continue growing in the coming years. USDC can help fully realize the benefits of digital payments, as it operates through open, shared blockchain ledgers without intermediaries.

This year, Circle has taken major steps to leverage this trend in key global markets with high demand for digital dollars. Enterprises in the U.S., Brazil, Mexico, the European Economic Area, Singapore, and Hong Kong can now use Circle’s banking partnerships to make USDC payments to other businesses in these markets. Recipients with accounts at Circle’s banking partners can easily convert these funds into local currency within minutes.

These markets represent some of the world’s most active global trade corridors. For example, bilateral trade between the U.S. and Mexico exceeds $800 billion annually. In Brazil, 95% of the country’s $640 billion in annual foreign trade is conducted in dollars. Circle expects additional banking partnerships will further enhance USDC’s global liquidity and payment utility, paving the way for broader use in merchant, supplier, trade, remittance, payroll, intercompany, and other payment types.

5.3.1 Worldpay – Innovative Global Payment Service Provider

Worldpay delivers payment, collection, and management services for businesses of all sizes. A global leader in fintech, it possesses unique capabilities to support entire business operations. Whether online, in-store, or via mobile, Worldpay powers exceptional commerce experiences across 146 countries and 135 currencies. It helps clients improve efficiency, enhance security, and achieve greater success.

In 2022, Worldpay became the first global merchant acquirer to offer direct USDC settlement, enabling merchants worldwide to tap into growing stablecoin payment volumes and offer new payment options to both crypto-native and traditional enterprise customers. Adopting USDC also allows businesses to implement financial strategies in their preferred operating currency. Thus, Worldpay customers are no longer limited to payment service providers confined to fiat ecosystems—they can now leverage innovative crypto payments to receive, hold, and transfer stablecoins directly, quickly, and efficiently.

This year, as the digital asset market rebounds, Worldpay is well-positioned to capitalize on rising retail interest. Beyond offering card-to-crypto purchases and crypto-to-card withdrawals for several major exchanges, it streamlines fund management via USDC settlement. Worldpay customers can receive USDC instead of fiat from their clients and settle these funds on weekends—outside traditional banking hours—helping optimize working capital.

“Partnering with Circle enables Worldpay to bring new, innovative, scalable digital payment solutions to our merchants. Our partnership improves transaction efficiency while expanding customer access to secure on-chain transactions. USDC settlement empowers our merchants to position themselves at the forefront of digital finance, where they can benefit from fast, efficient settlement. Looking ahead to 2025, Worldpay is excited about the opportunities to continue growing the ecosystem with Circle, enabling more participants to leverage the advantages offered by stablecoins.” — Nabil Manji, SVP, Head of FinTech Growth & Financial Partnerships

5.3.2 Mastercard – Global Card Network

Mastercard collaborates with businesses and governments worldwide in areas like payments to improve the lives of billions it serves. For over 60 years, Mastercard has pioneered technologies to make payments simpler, smarter, and safer. Mastercard’s global network drives progress in the payments ecosystem by using technology to build stronger connections and bring more people into the digital economy.

Mastercard’s partnership with Circle is now entering its fifth year. In 2021, Mastercard announced it would enable issuers and their crypto card partners to more easily use USDC to settle payments generated by transactions on the Mastercard network. Subsequently, the same functionality expanded to support acquirers wishing to pay merchants in USDC. Currently, millions of dollars are settled using this solution, available to both issuers and acquirers. Additionally, last year Mastercard launched a card product structure enabling USDC held in self-custody wallets to be used at over 100 million locations accepting Mastercard.

“At Mastercard, we strive to meet the needs of consumers and clients. Customers and co-brands operating in digital assets prefer transacting with stablecoins including USDC as part of their business models, and we want them to have the option to choose our network’s settlement mechanism. Our partnership with Circle will continue evolving to support our mission of making payments simpler, smarter, and safer.” — Izzy Iliev-Wollitzer, SVP, Blockchain and Digital Assets. “At MetaMask, we’re thrilled to collaborate with Mastercard and Circle. We set out to create a solution allowing users to pay directly from their MetaMask accounts anywhere Mastercard is accepted, and with these valuable partners, we achieved this goal last summer. While this is an important step toward better, faster payment services, we believe it’s only the first step into a new era of financial inclusion—we look forward to continuing to build it together.” — Daniel Lynch, Card Strategy Lead

5.3.3 Zodia Markets – Advancing Corporate Cross-Border Payments with Standard Chartered

Zodia Markets is an institution-first digital asset brokerage providing a wide range of services globally, including OTC trading and on-chain FX. Throughout the year, Zodia Markets minted $4 billion in USDC, with an average cross-border payment size of $3.5 million.

Founded by SC Ventures, Standard Chartered’s innovation division, and OSL Group, a leading Asian digital asset company, Zodia Markets supports over 50 digital assets and 20 fiat currencies. Its institutional focus and unique relationship with Standard Chartered make it central to USDC’s enterprise cross-border payment use case, especially in emerging markets. Clients include multinational commodity firms and other enterprises seeking faster, cheaper ways to move dollars across borders to accelerate growth.

Standard Chartered, a well-capitalized global bank and major shareholder in Zodia Markets, plays a key role in bridging digital assets and traditional finance. With a long history and diversified business lines, Standard Chartered deeply understands how to promote sustainable growth for global businesses and individuals. In 2023, Standard Chartered became one of the banks holding portions of the cash backing USDC reserves. It also facilitates local minting in Singapore, making USDC easier to access in high-demand markets. Circle’s partnership with Standard Chartered enables Zodia Markets to mint and burn USDC almost instantly, giving clients the opportunity to enter and exit global payment flows within minutes.

5.3.4 MoneyGram – Leading Global Fintech Company

MoneyGram is one of the world’s leading fintech companies, with 80 years of history dedicated to helping individuals and businesses worldwide send money faster and more efficiently. Today, its services span over 200 countries and regions, reaching more than 150 million consumers who can choose how to send money—online, via its highly rated mobile app, or at over 440,000 locations.

MoneyGram uses USDC on the Stellar blockchain to facilitate internet-scale dollar flows, capable of being cashed out in 180 countries and converted to USDC in over 30 countries/regions. In 2024, MoneyGram launched the MoneyGram® Wallet, a non-custodial digital wallet using USDC to simplify peer-to-peer remittances. Leveraging its global footprint and decades of expertise, MoneyGram delivers truly global—not regional—remittance solutions. MoneyGram has already connected the U.S. with Brazil and Mexico and plans to activate more payment corridors in development.

“At MoneyGram, we see immense potential in partnering with Circle and using USDC to enhance the speed, transparency, and accessibility of cross-border transactions. Our goal is to empower communities worldwide through greater financial inclusion. Open blockchain networks represent a critical step in the evolution of global money movement, enabling us to meet the growing expectations of digitally savvy customers. By leveraging blockchain technology and stablecoins like USDC, MoneyGram stands at the forefront of innovation, bridging traditional and digital financial ecosystems and enabling interoperability between digital assets and local currencies.” — Jon Lira MoneyGram Access, Head of Partnerships

5.3.5 Stripe – U.S. Payment Giant

Stripe is a technology company building financial infrastructure for the internet. Enterprises of all sizes—from startups to public companies—use Stripe’s software to accept payments and manage online businesses. In 2023, Stripe’s commercial clients processed total payments of $1 trillion. One of the world’s most innovative companies, Stripe was an early adopter of crypto payments. In 2022, it began offering USDC as a payment option for platforms, and in 2024, enabled merchants to accept stablecoin payments in USDC on the Ethereum, Solana, and Polygon blockchains.

5.4 Humanitarian Aid

In some of the world’s most remote and hard-to-reach regions, humanitarian organizations often resort to physically transporting cash across borders to facilitate payments.

This method of aid delivery is unreliable, costly, inefficient, and prone to corruption. Currently, 1.4 billion people live in areas underserved by banking. An estimated 130 million people are projected to fall into extreme poverty due to global warming trends.

USDC is beginning to change this, offering more effective and secure alternatives for some of the world’s leading humanitarian aid organizations. USDC supports 180 countries with negligible transaction costs.

By providing a fast, transparent, and efficient way to transfer value directly across the internet with just a mobile device and digital wallet, USDC can bridge this seemingly intractable gap. It enables aid organizations to support those most in need with unprecedented speed, lower costs, and high levels of auditability and trust—foundational elements of humanitarian work.

Entrepreneurs worldwide are also turning to USDC to build next-generation humanitarian services. Circle nurtures this entrepreneurial community through Unlocking Impact, a series of pitch competitions bringing together humanitarian, business, and technology sectors to design new USDC use cases addressing the UN’s Sustainable Development Goals (SDGs).

In autumn 2024, Circle hosted its fourth and fifth Unlocking Impact pitch competitions during the UN General Assembly and IMF and World Bank Annual Meetings. Winners included Kshetra and Decaf, startups using USDC to create payment and remittance services that advance financial inclusion.

5.4.1 The UN Refugee Agency – UNHCR

Today, over 120 million people worldwide are forcibly displaced—nearly the population

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News