USDC Power Play: The Only Question About Coinbase Acquiring Circle Is the Price

TechFlow Selected TechFlow Selected

USDC Power Play: The Only Question About Coinbase Acquiring Circle Is the Price

Coinbase should and is very likely to acquire Circle.

Author: Ryan Y Yi

Translation: TechFlow

Background

I’ve spent years deeply involved in the crypto industry—working at early-stage fund CoinFund and later at Coinbase, helping expand its venture investment strategy. All analysis here is based on publicly available data, including Circle’s S-1 filing (April 2025) and Coinbase’s public financial documents. No insider information is used—just analysis anyone could perform, but most haven’t.

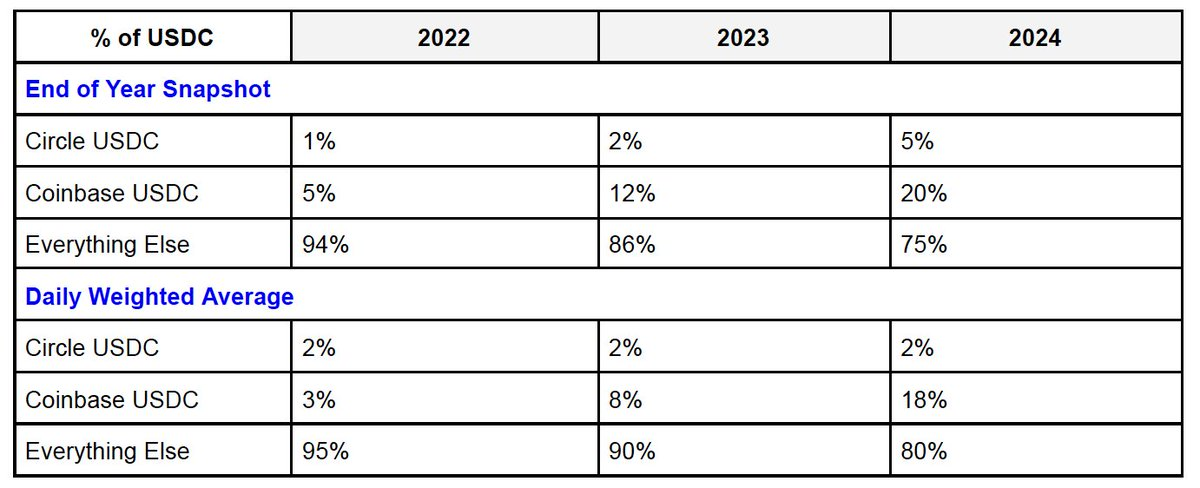

USDC Supply Structure Breakdown

The total USDC supply can be divided into three parts: Coinbase’s USDC, Circle’s USDC, and USDC on other platforms. According to Circle’s S-1 filing, “platform USDC” refers to “the portion of stablecoins held through a party’s custodial products or managed wallet services.” Specifically:

-

Coinbase: Includes USDC held by Coinbase Prime and the exchange.

-

Circle: Includes USDC held via Circle Mint.

-

Other platforms: USDC held on decentralized platforms such as Uniswap, Morpho, Phantom, etc.

Coinbase’s share of the total USDC supply is growing rapidly, reaching approximately 23% in the first quarter of 2025, according to Coinbase’s shareholder letter. In contrast, Circle’s share has remained stable. This trend reflects Coinbase’s increasing influence across consumer, developer, and institutional markets.

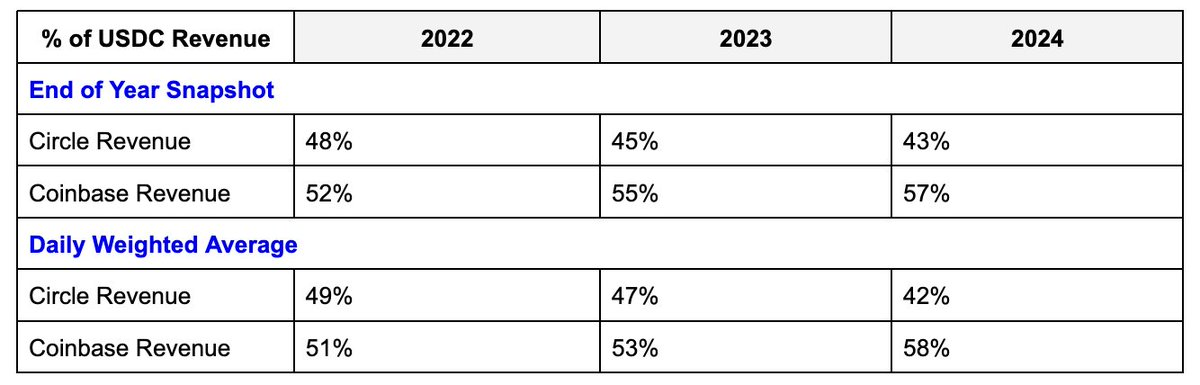

USDC Revenue Distribution

For USDC on their respective platforms, both Circle and Coinbase retain 100% of reserve income. For USDC held off-platform (i.e., the “other platforms” segment), revenue is split 50/50 between the two.

However, there's a key nuance: Circle benefits disproportionately from the off-platform USDC pool. Despite Coinbase holding roughly four times more platform USDC than Circle, its revenue advantage is only about 1.3x that of Circle.

Rough revenue estimates based on the 50-50 split for the “other” segment are shown below:

Circle: Betting on Market Size Over Control

Circle’s motivation is clear: grow the total circulation of USDC, even if it’s not held on Circle’s own platform. For Circle, the ideal outcome is for USDC to become the dominant dollar-pegged stablecoin—a result that would be inherently defensible and competitive.

As the underlying protocol provider for USDC, Circle holds advantages in:

-

Deploying and maintaining USDC smart contracts across more than 19 blockchains.

-

Controlling the native bridge and mint/burn processes of the Cross-Chain Transfer Protocol (CCTP).

While on-platform USDC is more profitable, its growth is limited. In high-stakes business development, Circle often lags behind Coinbase. But if USDC ultimately becomes the #1 dollar stablecoin, Circle still wins. This is a play for total addressable market (TAM), not margin competition.

The potential scale of USDC may render these details insignificant—most of Circle’s projected revenue growth is expected to come from the “other platforms” segment (which isn’t a bad outcome). This aligns with Circle’s capabilities, as it controls USDC’s governance, infrastructure, and technical roadmap.

Coinbase: Must Fully Control USDC

Macro View

USDC is Coinbase’s second-largest revenue source, accounting for about 15% of Q1 2025 revenue—surpassing staking income. It is also one of Coinbase’s most stable and scalable infrastructure-based revenue streams. As USDC expands globally, its potential upside is asymmetric.

In the future, USDC will become central to Coinbase’s business and a core competitive moat. While Coinbase’s primary revenue still comes from centralized exchange (CEX) trading volume—and will continue growing with the market—USDC revenue is more stable and grows steadily with the broader crypto economy.

USDC is poised to rank among the top three dollar-pegged stablecoins and serve as a technology-driven vehicle for global dollar distribution. Leading players in fintech and traditional finance already recognize this, which is why they’re acting. Yet, thanks to its early market lead and support from the crypto ecosystem, USDC is well-positioned to survive and grow amid competition. From infrastructure and regulatory standpoints, full control over USDC tells a compelling story.

Micro View: Coinbase’s Profitability Dilemma

Coinbase is the main driver of USDC growth, yet faces structural limitations. USDC has now become Coinbase’s second-largest revenue source after trading, surpassing staking. Thus, every product decision must be weighed against revenue and profit implications. The core issue: while Coinbase expands the overall market (TAM), it doesn’t fully capture the revenue. When the market grows, it must share profits with Circle—earning only 50% on off-platform revenue.

Ironically, Coinbase is actively growing the USDC ecosystem—onboarding users, building infrastructure, improving transaction speed—yet is structurally capped on returns. Its consumer and developer products are effectively “weakened” from the start.

Coinbase’s natural response is to convert market growth into “Coinbase USDC”—fully monetizable balances held in custodial products where it captures 100% of reserve income. This strategy has worked: over the past two years, the share of USDC on Coinbase’s platform has grown fourfold. However, this only applies to custodial USDC, such as exchange and Prime offerings.

The problem arises in the gray areas of custody—where growth happens, but revenue attribution becomes ambiguous.

For example:

-

Coinbase Wallet: By definition, it’s a non-custodial wallet. Even though its smart wallet improves UX and might introduce shared-key models, it likely fails to meet the S-1 definition of “platform USDC.” If most users interact with on-chain products this way, a large portion of consumer-held USDC falls into a revenue gray zone between Coinbase and Circle.

-

Base (Coinbase’s Layer 2 network): Its architecture is non-custodial—users can independently exit to Ethereum L1, and Coinbase does not hold keys. Any USDC on Base may not count as “Coinbase USDC” under the S-1 definition, even though Coinbase is the primary gateway to Base.

Key takeaway: Growth in Coinbase’s consumer and developer products drives USDC usage but comes with a built-in “weakening system.” Unless Coinbase gains control over the USDC protocol layer, it will always face revenue uncertainty. The only complete solution is to directly acquire Circle and redefine the rules.

Core Benefits of Acquiring Circle

-

100% Revenue Capture

After acquiring Circle, Coinbase would no longer be constrained by legal disputes over custodial vs. non-custodial definitions. It could claim full rights to all interest income generated by USDC—regardless of where USDC is held—capturing the full yield from ~$60 billion in USDC reserves. The debate over custodial definitions would vanish, and Coinbase would fully own all USDC interest revenue.

-

Protocol Control

USDC’s smart contracts, multi-chain integrations, and Cross-Chain Transfer Protocol (CCTP) would become internal assets of Coinbase. This means Coinbase would have full control over USDC’s technical infrastructure.

-

Strategic Product Advantage

Post-acquisition, Coinbase could natively monetize USDC within its wallet, Base (L2), and future on-chain user experiences without third-party coordination. USDC could serve as an abstraction layer for future on-chain interactions—all integrated without needing third-party permission.

-

Regulatory Leverage

As a leader in crypto policy, Coinbase could shape stablecoin regulations from the top down by controlling USDC. Owning the core technology and operations of a major stablecoin would give Coinbase significantly greater influence in regulatory negotiations.

Unknowns and Open Questions

-

Growth Potential

USDC’s current market cap is around $60 billion, but could reach $500 billion—generating roughly $20 billion in annual reserve income. This would make USDC a core driver for Coinbase to achieve “Mag7” status (revenue levels comparable to the world’s top tech companies).

-

Regulatory Factors

The U.S. is advancing stablecoin legislation (GENIUS Act), which macroscopically supports top-line growth by deeply integrating stablecoins into the existing financial system. Stablecoins may also become tools for reinforcing global dollar dominance.

However, this could invite traditional financial institutions (TradFi) and fintech firms to enter the space as stablecoin issuers.

Additionally, regulations might restrict how platforms market yield or savings products. Acquiring Circle would give Coinbase the flexibility to adapt its positioning and marketing strategies in response to evolving regulatory landscapes.

-

Operational Challenges

USDC was originally designed as a consortium model, likely due to legal and regulatory considerations at the time. While these barriers should be surmountable under a single corporate structure, the exact red lines of the current complex mechanisms remain unclear. Deconstructing the existing legal framework may pose edge-case risks, but these appear manageable.

Pricing

Market outcomes are never perfectly predictable, but we can reference some disclosed figures:

-

Circle is seeking a $5 billion valuation for its IPO.

-

Ripple is targeting a $10 billion IPO valuation.

-

Coinbase’s current market cap is approximately $70 billion.

-

USDC currently accounts for about 15% of Coinbase’s revenue; with full integration, this could exceed 30%.

Personal interpretation:

-

Based on the above, Circle is a natural acquisition target for Coinbase—and Coinbase knows it.

-

Circle wants the market to price it via IPO (target: $5 billion).

-

Coinbase wants to observe how the market values Circle.

-

Coinbase likely already recognizes the following:

-

For the reasons outlined, Coinbase needs full-stack control over USDC.

-

Full ownership could increase USDC’s contribution to annual revenue from 15% to between 15% and 30%.

-

Based on a 1:1 revenue multiple, USDC ownership could be valued between $10 billion and $20 billion.

-

Circle likely understands this too—they know that if the market prices them high enough and USDC continues growing, Coinbase will have stronger incentive to acquire Circle outright, eliminating the complexities of operating, building products, and governing alongside a third-party partner, and bringing it fully under the Coinbase umbrella.

Final Conclusion

Coinbase should and likely will acquire Circle.

While the current partnership works well, long-term conflicts in platform, product, and governance are too significant to ignore. The market will set Circle’s price, but both parties already have a clear understanding of their mutual value.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News