MakerDAO's Commitment to "Decentralization": DAI Decouples from USD, Ultimately Becoming the World Currency

TechFlow Selected TechFlow Selected

MakerDAO's Commitment to "Decentralization": DAI Decouples from USD, Ultimately Becoming the World Currency

Is it possible for Maker's DAI to scale up and eventually surpass centralized stablecoins? If so, how could it achieve that?

Written by: Ignas

Compiled by: TechFlow

By market capitalization, Maker's $DAI is the largest DeFi stablecoin and the thirteenth-largest cryptocurrency. However, DAI's $6.5 billion market cap pales in comparison to $USDT's $67.5 billion. Is it possible for DAI to scale up and eventually surpass centralized stablecoins? If so, how?

Currently, over 50% of DAI is backed by USDC, introducing centralization risks. But RuneKek’s Endgame Plan aims to make DAI as Bitcoin-like as possible:

- Decentralized;

- Inherently elastic;

- With a fixed scope and complexity of its core system.

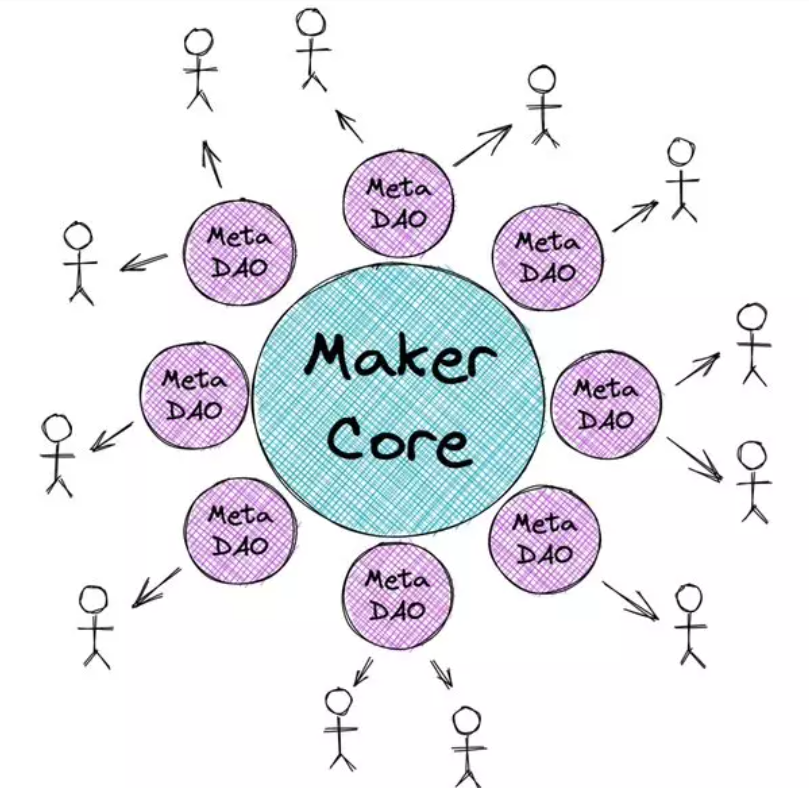

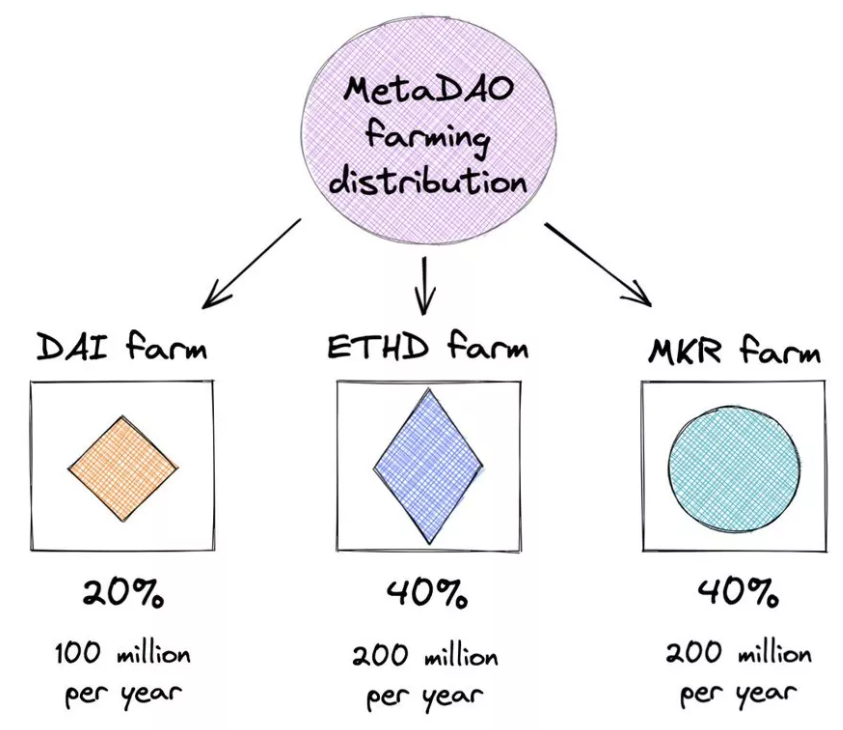

First, Maker needs to reduce governance complexity by creating self-sustaining DAOs called MetaDAOs. Think of Maker Core as Ethereum L1: slow and expensive, but secure. MetaDAOs are like L2 solutions: fast and flexible, deriving security from the L1.

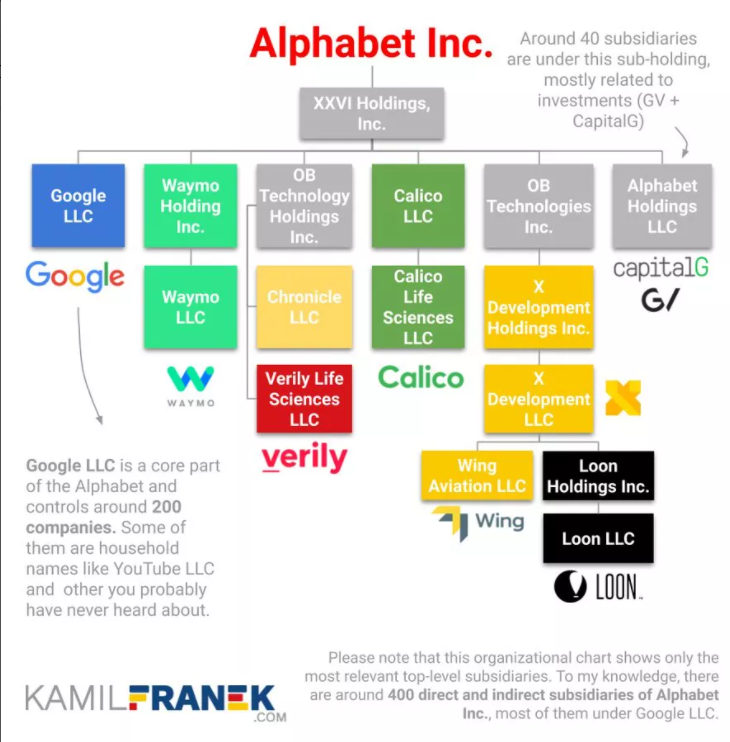

Each MetaDAO will have a specific mission. For example, a Real World Asset (RWA) DAO could develop specialized governance mechanisms to overcome current Maker limitations. Like Google’s Alphabet, Maker Core is Google, and MetaDAOs are the “Alpha Bets.”

Each MetaDAO will issue a yield-bearing token (MDAO). Two billion tokens will be allocated as staking incentives with a gradually decreasing emission rate:

- 20% to DAI holders;

- 40% to delegated MKR holders, boosting voting participation;

- 40% to synthetic $ETH (ETHD) vault debt holders;

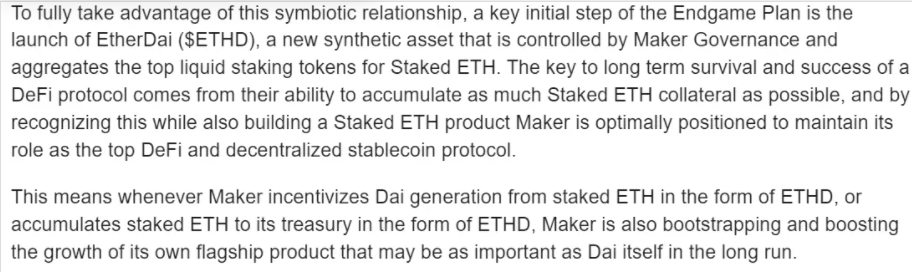

EtherDai ($ETHD) will be backed by liquid staking tokens such as Lido’s $stETH and will serve as collateral for DAI.

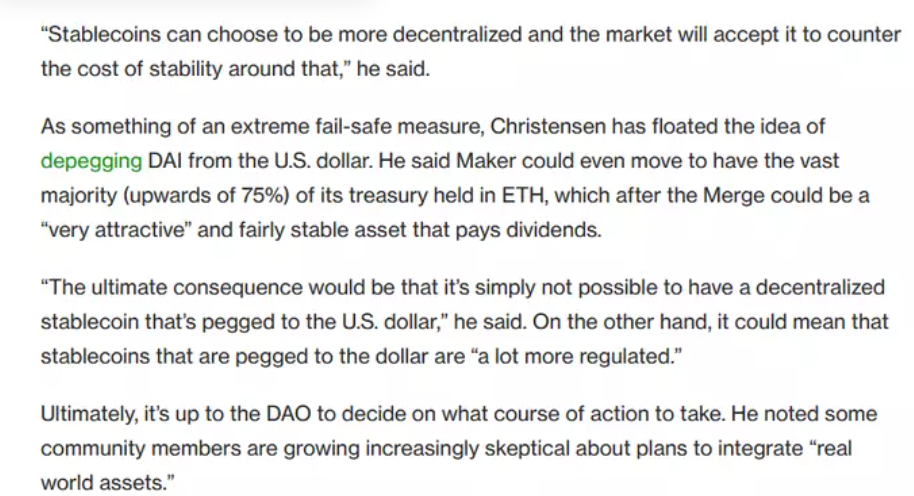

To become a world currency, Maker is willing to abandon DAI’s peg to the US dollar. Yes, this means DAI will float freely instead of maintaining a 1:1 USD peg, adjusting its price over time based on a target interest rate.

A positive target rate increases demand for DAI while reducing supply. A negative target rate has the opposite effect—reducing demand and increasing supply. This mechanism can stabilize DAI without requiring a strict 1:1 dollar peg.

Why do this? The Endgame Plan assumes regulators will eventually crack down on RWA collateral, including $USDC. Therefore, resilience against physical attacks is prioritized over maintaining a dollar peg.

Currently, $DAI serves as a decentralized alternative to $USDC or $USDT. Thus, RuneKek anticipates a highly plausible scenario where, upon initial activation of the free float, up to 50% of protocol users may leave within a short period.

Rune also proposed a Protocol-Owned Vault (POV) mechanism, similar to $FEI’s Protocol Controlled Value. POV is a Maker Vault accessible only to Maker Governance, holding ETHD and other decentralized assets as collateral, which it then uses to mint and stabilize DAI.

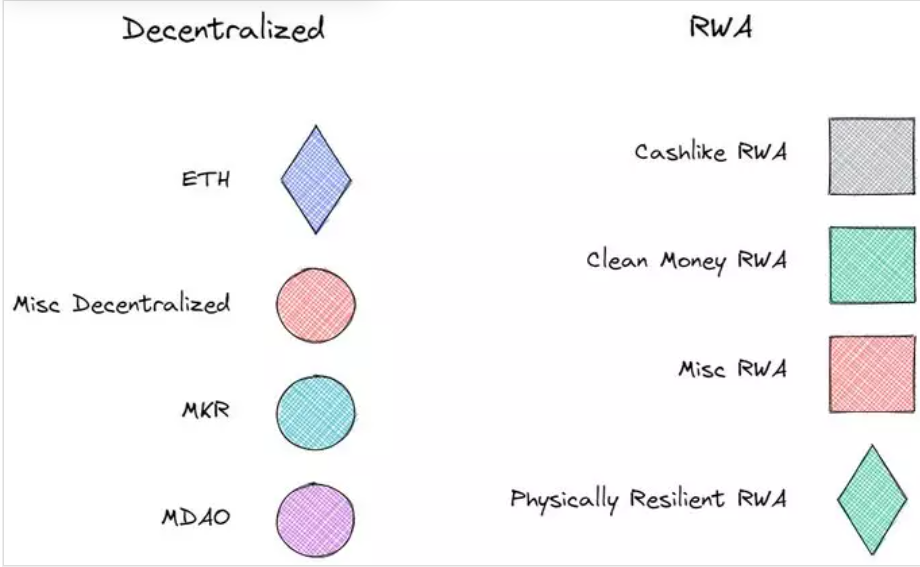

The Endgame Plan also aims to diversify collateral types, including:

- Decentralized assets: $ETH, $UNI, $MKR, etc.

- Real World Assets (RWA): centralized stablecoins, renewable energy projects, cross-chain bridged tokens, or physically resilient RWAs...

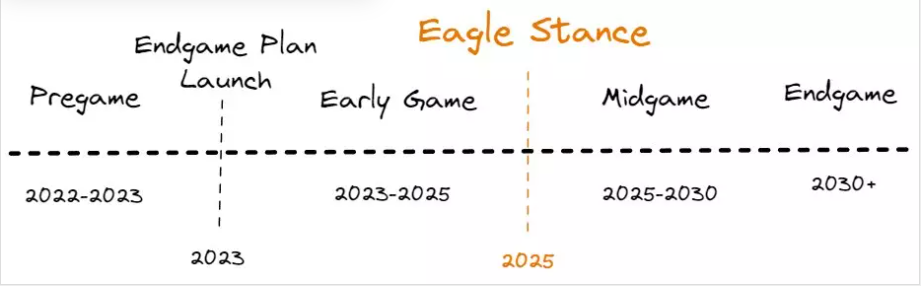

The Endgame Plan assumes that as global economic and social conditions deteriorate, regulatory safety will significantly worsen. To adapt, survive, and recover, Maker will adopt three distinct "stances."

The dovish stance imposes no limits on RWA exposure and maintains DAI’s 1:1 USD peg. This allows Maker to tolerate minimal regulatory threats and maximize revenue from RWAs.

The hawkish stance involves DAI floating freely with a negative target interest rate. This ensures Maker’s exposure to seizable RWAs is capped at 25%. If necessary, DAI may detach from the dollar to achieve this.

The final stance prohibits any RWA except physically resilient ones, meaning Maker will no longer accept easily confiscatable RWAs as collateral.

The Endgame Plan’s roadmap is divided into four major phases. The early version will launch within 12 months, building ETHD, launching six MetaDAOs, initiating liquidity mining, and more. However, the full version won’t go live until 2030 or later.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News