eUSD and DAI Design Differences: How Will Lybra Evolve in the Future?

TechFlow Selected TechFlow Selected

eUSD and DAI Design Differences: How Will Lybra Evolve in the Future?

It's always right to remain cautious and vigilant in the market, but we should also set aside biases and encourage innovation from projects like Lybra and their product $eUSD.

Written by: CryptoDocto

Compiled by: TechFlow

Recently, Lybra's $eUSD design model has sparked intense discussions on crypto Twitter. Some pointed out: "Compared to DAI, eUSD lacks functionality and scalability." In response, analyst CryptoDocto spent a week comparing $DAI and $eUSD. Here are his findings:

eUSD is an interest-bearing, over-collateralized stablecoin backed by $ETH/$stETH.

Minting eUSD is simple—just deposit your $ETH/$stETH into Lybra, and you’ll earn approximately 8% yield by holding it. There’s no interest charged for minting eUSD; Lybra stakes all received ETH via Lido (converting it to stETH), and the staking rewards generated by $stETH are converted into eUSD.

A portion of the converted $eUSD is then distributed as yield to $eUSD holders.

However, if you swap, transfer, or spend your generated eUSD, you forfeit these rewards.

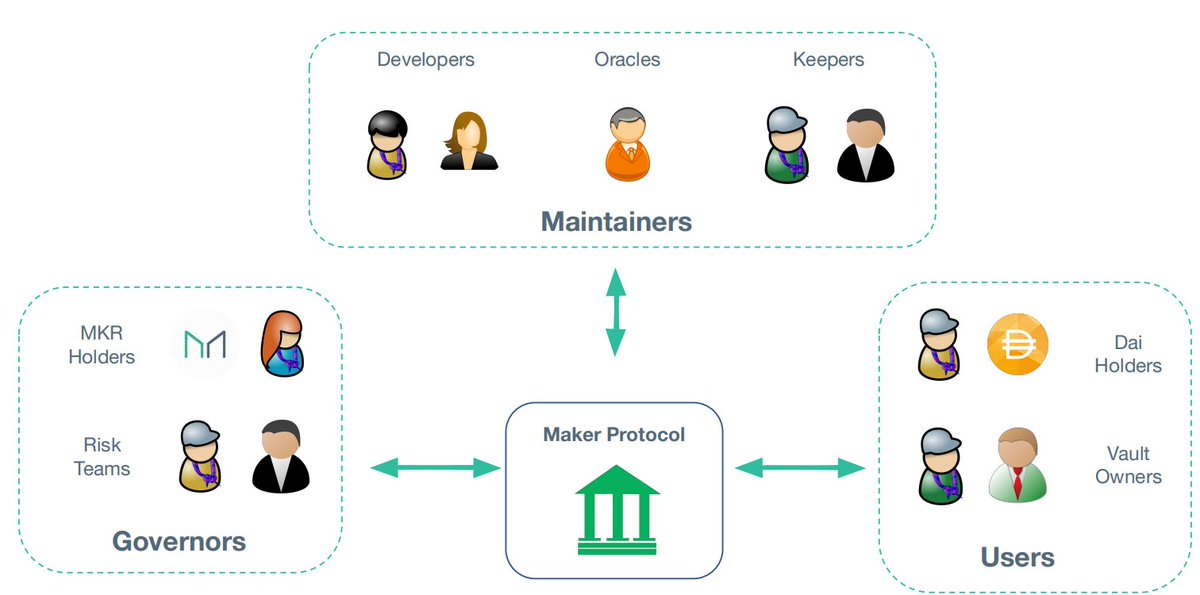

$DAI operates differently.

$DAI is MakerDAO’s flagship product. It is also an over-collateralized stablecoin, backed by a basket of low-risk assets (wBTC, ETH). $DAI itself does not generate yield, but users can choose to deploy $DAI in other DeFi protocols to maximize returns.

Unlike $eUSD, users must pay interest when repaying debt.

We can easily identify the following differences:

$eUSD:

-

Does not accrue interest on transfers.

-

Yield-bearing token.

-

Backed solely by stETH.

-

Limited DeFi integration.

$DAI:

-

Interest must be paid to repay debt.

-

No rewards for simply holding $DAI.

-

Widely used across DeFi.

-

Supported by multiple asset types.

Based on my research, I find it more appropriate to compare $eUSD with Liquity’s flagship product $LUSD, as both are backed exclusively by $ETH, although $LUSD is not a yield-bearing token.

Liquity designed another incentive mechanism—the Stability Pool—where holders can deposit their $LUSD to earn additional rewards. Thus, even though $LUSD itself doesn’t bear yield, the Liquity protocol created an incentive pool for $LUSD.

From previous discussions on Discord, the main concerns about $eUSD include:

(1) Lack of $eUSD integrations;

(2) Users lose accrued interest when $eUSD is transferred, spent, or swapped → inefficient capital utilization.

So how does Lybra plan to address these issues?

The concerns raised about $eUSD are valid, but I believe the Lybra team clearly understands the next steps for $eUSD. I carefully reviewed their roadmap for $eUSD’s future development.

In Q2/Q3, Lybra aims to achieve the following:

(1) Expand collateral options (other LSDs, especially top 5 TVL projects on Defi Llama).

(2) Launch weUSD (Wrapped eUSD) to further collaborate with other DeFi projects.

(3) Build a lending market for eUSD.

Lybra also plans to launch on Arbitrum (seeking integration with other dApps, not limited to eUSD but including LBR), and a potential collaboration with LayerZero Labs would be a significant step toward achieving omnichain functionality for future eUSD and LBR.

Lybra mentioned they’ve received substantial interest from other protocols and projects. However, out of responsibility to the community and the protocol itself, Lybra is still reviewing partnership requests.

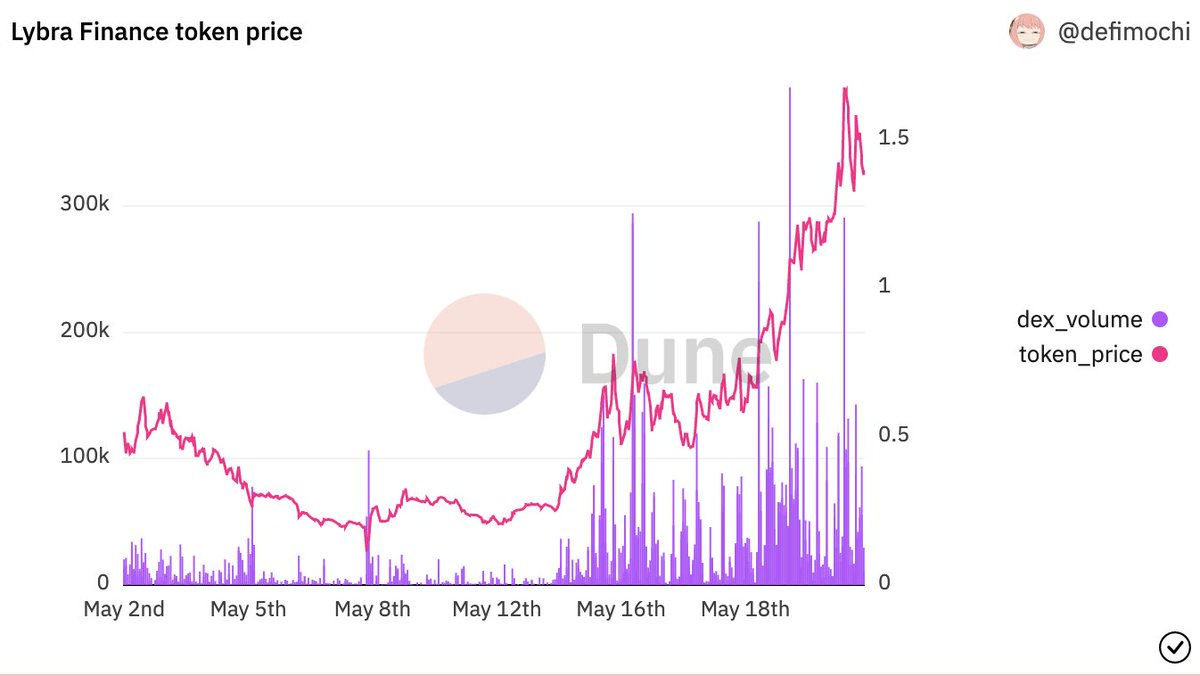

It’s clear that Lybra has a clear strategy to address potential concerns around $eUSD. From a data perspective, market confidence in Lybra appears to be steadily increasing.

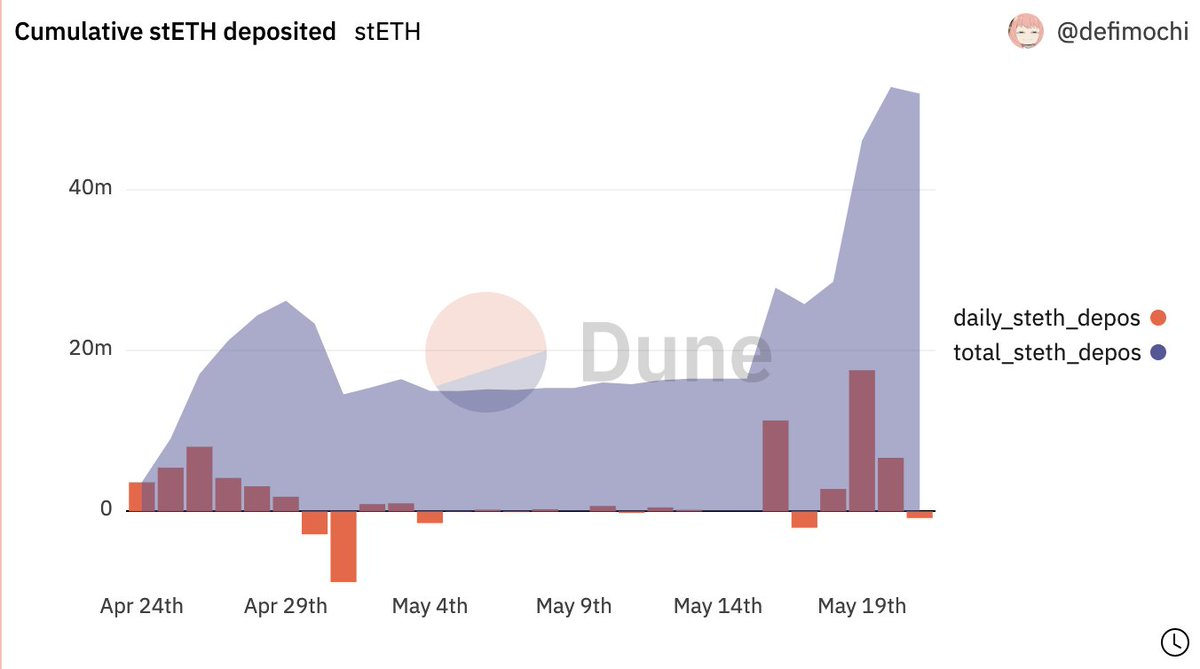

We can observe remarkable growth in all on-chain data and prices for $LBR and $eUSD over the past week:

(1) $LBR breaking its all-time high;

(2) Maximum supply of eUSD reached;

(3) Cumulative stETH deposits continue to rise.

Personal View

Frankly, I think the criticism against Lybra and $eUSD is entirely unfair. I understand some concerns regarding the new stablecoin $eUSD, as stablecoins represent one of the broadest yet most challenging narratives in crypto. But Lybra is still an early-stage project—it will have V2, V3 versions of both LBR and $eUSD in the future.

Remaining cautious and vigilant in the market is always wise, but we should also set aside biases and encourage innovation from projects like Lybra and their product $eUSD.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News