Understanding Lybra v2: Creating Use Cases for eUSD, Attracting TVL, and Optimizing Tokenomics

TechFlow Selected TechFlow Selected

Understanding Lybra v2: Creating Use Cases for eUSD, Attracting TVL, and Optimizing Tokenomics

What are the highlights of the upcoming Lybra Finance v2?

Author: Yu Zhong Kuang Shui

$LBR has been rising steadily. I sold most of mine around 0.1x. Nearly a month later, $LBR is now up tenfold from my exit price—currently trading around $1.80. In my view, this impressive performance is largely attributable to the team’s efforts in both token economics and product development.

On the token price front, the team avoided high-inflationary emission models and instead focused on sustainable, long-term growth, which has driven consistent increases in the protocol’s TVL. On the product side, despite early successes, the team hasn’t slowed down. They are preparing to launch the v2 testnet by mid-June, following audits and bug bounty programs on Immunefi and Code4rena.

Today, I’d like to share my personal insights into Lybra Finance v2.

Here are several exciting features coming in v2:

1. Cross-chain expansion via LayerZero;

2. Support for additional LST asset types as collateral;

3. New $LBR tokenomics;

4. Protocol revenue and fee capture reforms;

5. DAO governance;

First, cross-chain expansion. The first target chain is Arbitrum. As far as I know, the team has already started discussing partnerships with protocols on Arbitrum. I suspect that Layer2s will be prioritized initially, with future plans possibly extending eUSD to alternative Layer 1 chains. A wrapped version, weUSD, will be introduced for cross-chain purposes. Beyond bridging, weUSD could see broader utility—for example, participating in other DeFi protocols.

Second, adding more LST asset types as collateral. The main challenge here lies in stETH’s auto-compounding mechanism, which currently enables eUSD to compound automatically as well. If new LST assets are introduced, how should eUSD maintain this feature? One possibility is to standardize the model by removing auto-compounding from eUSD entirely—only staked eUSD would earn ETH staking APY. After staking, users would receive a weUSD version usable across chains or in other DeFi applications. To withdraw, users would convert weUSD back to eUSD to reclaim principal plus earnings.

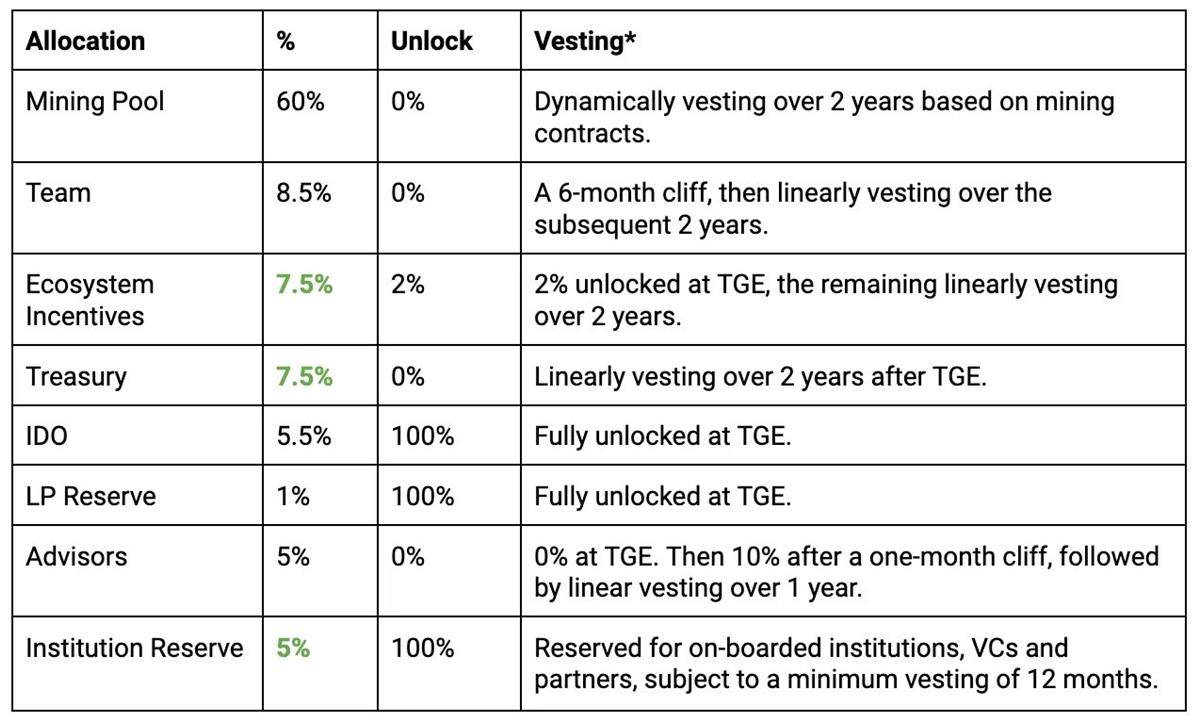

Third and fourth points: Lybra has brought in investors, with VC allocations subject to a minimum one-year vesting period. These VCs are expected to help grow Lybra’s market presence and ecosystem.

Additionally, deflationary mechanisms have been introduced for $LBR, including extending the vesting period for esLBR rewards to 60 days and allowing longer lock-up durations.

To support $LBR’s token price, v2 introduces new use cases such as the DLP (Dynamic Liquidity Provision) mechanism. To mint $LBR from the eUSD pool, users must provide DLP tokens worth at least 5% of their total staked value. This creates deflationary pressure: if a user fails to meet the 5% DLP threshold, others can purchase their esLBR rewards at a 50% discount using $LBR. When the protocol receives $LBR in such cases, 10% is burned and 90% is recycled back into the reward pool.

Fifth, DAO governance. By integrating esLBR into governance, Lybra will enable community members to participate in key protocol decisions.

Another noteworthy point: Lybra is exploring ways to ensure eUSD maintains sufficient liquidity and stable pegging in the future. The primary strategy involves listing eUSD on Curve, though this will require time and accumulation of $CRV tokens.

Overall, I’m quite satisfied with Lybra v2’s roadmap. It directly addresses core challenges the protocol faces—such as TVL growth, tokenomics sustainability, and limited use cases for eUSD.

Looking ahead, creating abundant liquidity and diverse use cases for eUSD will be critical to the protocol’s continued success.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News