Interpreting Lybra Finance: A New Stablecoin in the LSD Sector—Will Yield-Bearing Derivatives Be a Good Design?

TechFlow Selected TechFlow Selected

Interpreting Lybra Finance: A New Stablecoin in the LSD Sector—Will Yield-Bearing Derivatives Be a Good Design?

After the Ethereum upgrade is completed, what new opportunities and highlights are there to participate in the LSD sector?

Written by: Hercules

Translated by: TechFlow

After the Ethereum upgrade, what new opportunities and highlights remain in the LSD sector? One potential area is new stablecoins.

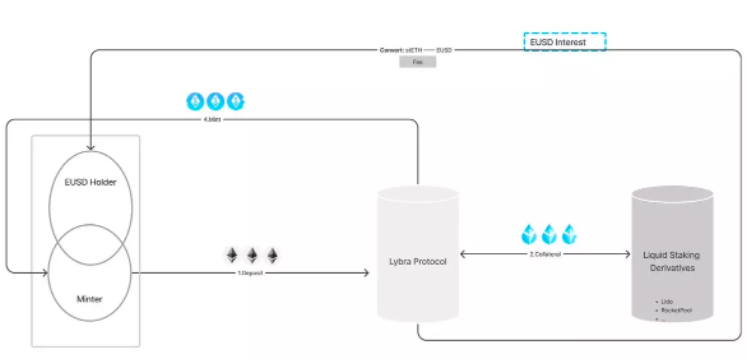

Lybra Protocol is a protocol that allows users to generate a stablecoin through over-collateralized ETH deposits, converting deposited ETH into stETH to earn yield.

It maintains stability through over-collateralization, liquidation mechanisms, and arbitrage opportunities. Additionally, it features a native token, LBR, used for governance and voting.

Currently, its testnet is live. Before interacting, take time to understand Lybra Protocol’s various mechanisms and features through this article.

Introduction to Lybra Finance

Lybra Finance is a DeFi protocol that allows you to deposit ETH and mint the stablecoin eUSD without paying any fees or borrowing interest. The eUSD held in your account earns a stable rate of return.

The protocol is currently on testnet and will soon launch on the Ethereum mainnet.

Testnet link: https://beta.lybra.finance/

How Lybra Finance works:

1. Deposit ETH/stETH as collateral into Lybra;

2. Mint eUSD;

3. Your held eUSD earns a 7.2% APY.

The minted eUSD can also be used across other protocols.

eUSD: The Protocol's Stablecoin

eUSD is a dollar-pegged stablecoin backed by over-collateralized ETH. Simply holding eUSD generates stable income, with an APY of approximately 7.2%.

How Does eUSD Earn Interest?

Deposited ETH is automatically converted into stETH via the Lybra protocol. Over time, stETH appreciates in value. The yield generated from stETH is converted into eUSD and distributed to eUSD holders, currently offering a base APY of 7.2%.

How Is eUSD Stability Ensured?

Lybra maintains eUSD stability through three mechanisms—common design principles among most over-collateralized stablecoins:

1. Over-collateralization;

2. Liquidation mechanism;

3. Arbitrage opportunities.

Over-Collateralization

Each eUSD is backed by at least $1.50 worth of stETH collateral.

Liquidation Mechanism

If a user's collateral ratio falls below the safe threshold, any user can voluntarily act as a liquidator. They can use their eUSD to purchase the liquidated portion of the borrower’s stETH. This mechanism ensures eUSD stability.

Arbitrage Opportunities

When the price of eUSD deviates from its $1 peg, arbitrage opportunities arise, allowing users to profit from these price discrepancies.

LBR: The Protocol's Native Token

LBR is the native token of the Lybra protocol. Holders of stLBR can participate in governance and voting, while also sharing in protocol revenues.

Users can obtain LBR tokens through the following methods:

- Participating in the Lybra LBR IDO;

- Earning rewards by minting eUSD;

- Providing liquidity for eUSD/ETH pairs.

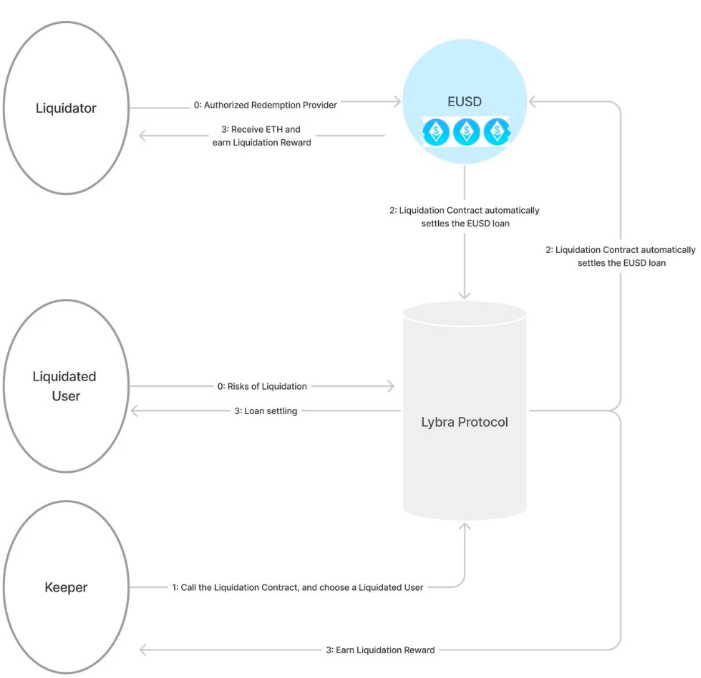

Protocol Mechanics and User Roles

Within the Lybra protocol, users can play the following roles:

- Minters;

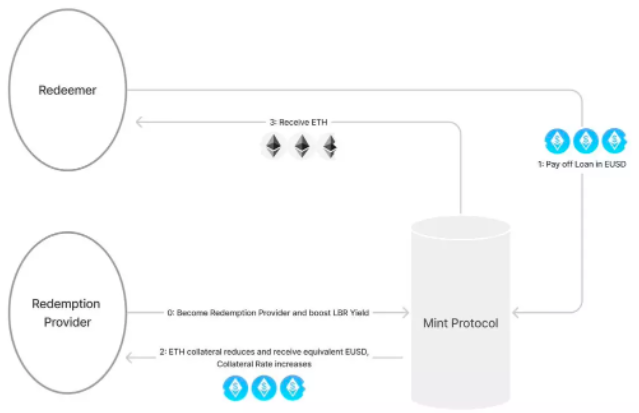

- Redemption Providers;

- Liquidators;

- Keepers.

Minters

Users can use their ETH or stETH as collateral to borrow eUSD, earn yield, and repay debt later. A user's collateral ratio must remain above the safety threshold of 160%.

Rigid Redemption

Rigid redemption refers to the process of redeeming eUSD for ETH at face value—similar to 1 eUSD being exactly equal to $1. Users can exchange their eUSD for ETH at any time with a 0.05% fee.

Liquidators

Liquidators are the first line of defense in maintaining system viability. By acting as a liquidator, users can settle any borrower’s (Minter’s) debt using their eUSD. They help maintain eUSD stability and overall supply integrity.

Keepers

Any third party can run Keepers to monitor the status of each liquidator and minter. When a borrower becomes eligible for liquidation, Keepers can immediately execute the liquidation using eUSD.

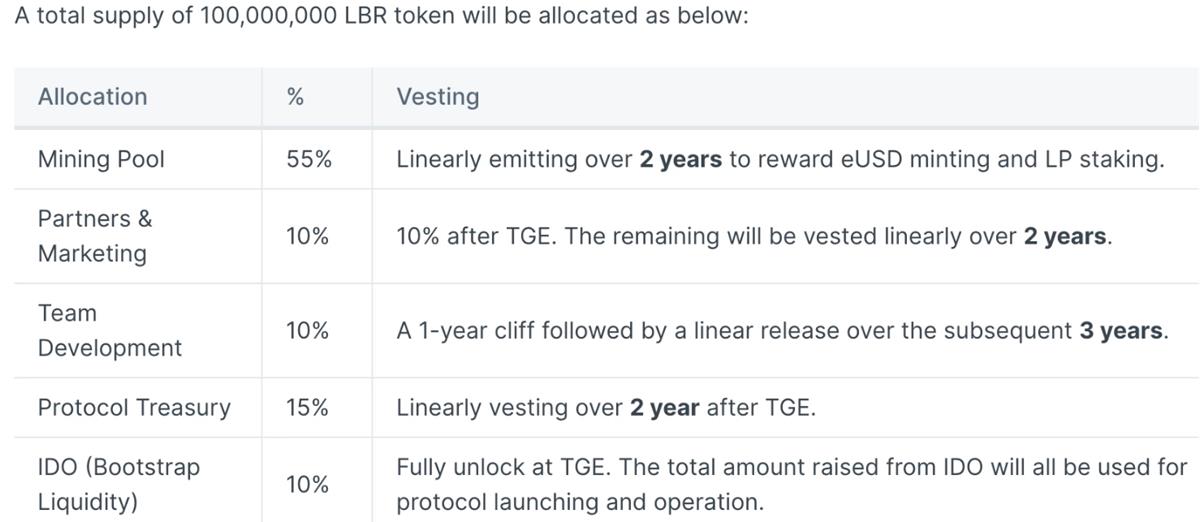

Tokenomics

LBR is an ERC-20 governance token with a maximum supply of 1 billion. The token distribution is as follows:

-

Mining Pool: 55%

-

Partnerships and Marketing: 10%

-

Team and Development: 10%

-

Treasury: 15%

-

IDO: 10%

Except for the IDO portion, which unlocks fully at launch, all other allocations have linear vesting periods exceeding two years. Details are shown below:

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News