Introducing Haedal Hae3: Sui's Liquid Staking Protocol that Reimagines the Glory of LSD and DAO

TechFlow Selected TechFlow Selected

Introducing Haedal Hae3: Sui's Liquid Staking Protocol that Reimagines the Glory of LSD and DAO

Hae3 will directly extract value from transaction fees generated through the trading process.

Author: Haedal Protocol

Translation: TechFlow

1. Why Do We Need LSD?

LSD (Liquid Staking Derivatives) is one of the most classic and foundational protocols in the DeFi market. Today, most blockchains rely on staking their native tokens to secure network safety and incentivize participation through staking rewards. This model, together with transaction fee income and lending fee income, forms one of the most fundamental yield mechanisms in the entire crypto space—and a core component of DeFi.

However, simple token staking is not capital-efficient. This is where Lido introduced an innovative solution: Liquid Staking Tokens (LST). In this system, staked tokens are wrapped into "voucher tokens" that can freely circulate within DeFi markets. Essentially, it decouples the functional utility of native tokens from their financial value, allowing both aspects to coexist.

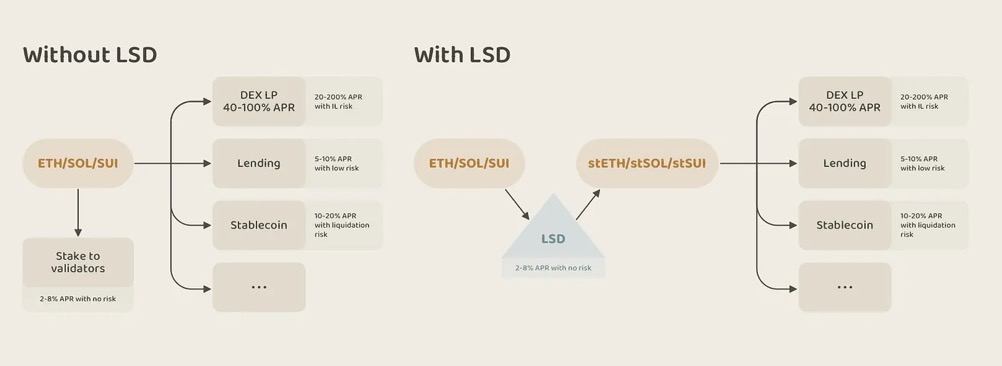

This model unlocks tremendous potential for crypto users. By staking ETH, SOL, or SUI on their respective native chains, users can earn staking rewards while simultaneously receiving 1:1 equivalent LSTs. These LSTs can then be used across various DeFi applications such as decentralized exchanges (DEX), lending platforms, and stablecoin collateralized debt positions (CDPs). This enables numerous “single-asset, multiple-yield” and compound yield strategies, attracting more capital and holders.

Figure: LSD allows users to simultaneously earn staking yields and DeFi yields, combining both in a composable way

For every ecosystem, its native token is its most unique and valuable asset. Unlocking the massive financial value locked by validators—while ensuring network security—is critical for any ecosystem’s growth.

2. The Current State and Challenges of LSD in the Sui Ecosystem

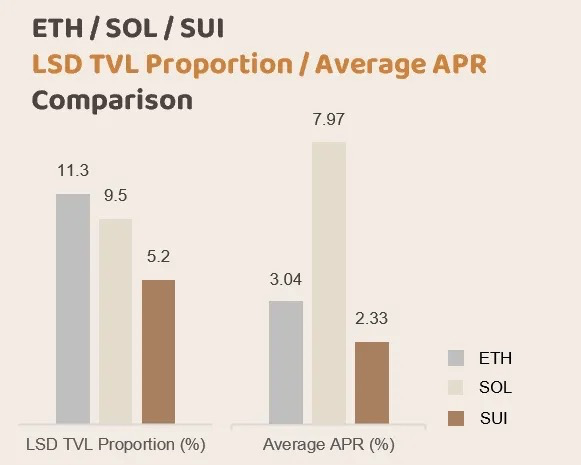

As a relatively new ecosystem, Sui's development of LSD has been short. From the statistics below, we can see that the LST staking ratio in Sui remains low relative to its market cap—especially when compared to ETH and SOL. The root cause lies in Sui’s currently low annual percentage rate (APR) for staking.

Currently, the average APR for LSTs in the Sui ecosystem is about 2.33%, and many direct validator stakings fall below this figure. In contrast, Lido offers around 3.1% APR, while Jito achieves as high as 7.85%. For holders of Sui’s native token, these returns are insufficient to incentivize moving their tokens from centralized exchanges (CEX) onto the Sui chain.

In the fierce competition among public blockchains, on-chain liquidity is crucial. As demonstrated by the success of ETH and SOL, high-yield, low-risk LSTs combined with rich DeFi use cases are essential prerequisites for any thriving DeFi ecosystem. Therefore, we emphasize that the top priority for any LSD protocol should be increasing the APR of LSTs within the Sui ecosystem.

3. Evolution of LSD Product Strategies

To improve APR, LSD protocols must focus on both cost reduction and revenue generation.

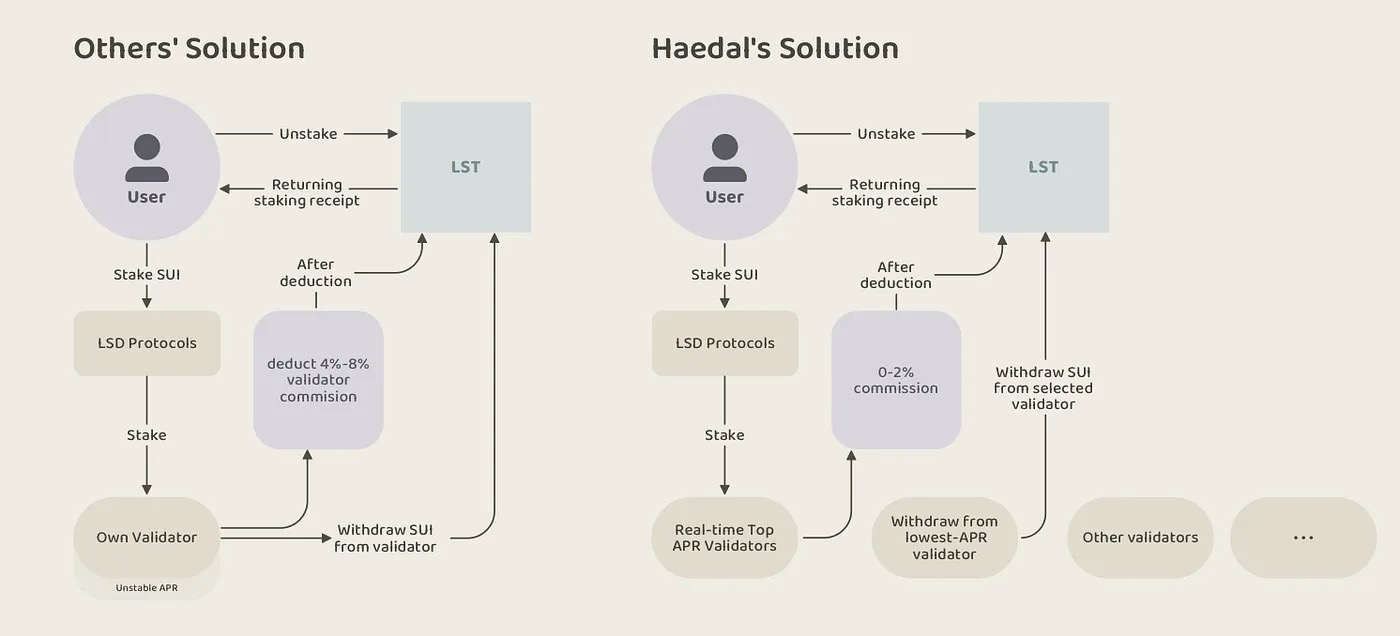

Cost reduction is a straightforward strategy. We need to become “smart stakers” by selecting the most cost-effective validators—the ones offering the highest returns. This primarily depends on two factors: the validator’s APR and its commission rate. The net APR is typically determined by these two dynamic variables.

Currently, most LSTs on Sui are validator-based, meaning each LST token is tied to a specific validator. While not inherently problematic, this setup does not guarantee the selected validator has the highest APR. Additionally, most validators charge commissions between 4% and 8%, further reducing the final APR received by LST holders.

The Haedal protocol, however, features dynamic validator selection. It continuously monitors all validators on the network and selects those with the highest net APR during staking—typically validators charging only 0%-2% commission. Similarly, when users unstake, Haedal selects validators with the lowest APR for withdrawal. This dynamic approach ensures haSUI consistently maintains the highest native APR across the ecosystem.

While cost reduction helps achieve higher APR under existing system constraints, it cannot overcome issuance limits imposed by economic models. On the other hand, increasing revenue means identifying additional income streams—particularly through integration with the broader DeFi ecosystem.

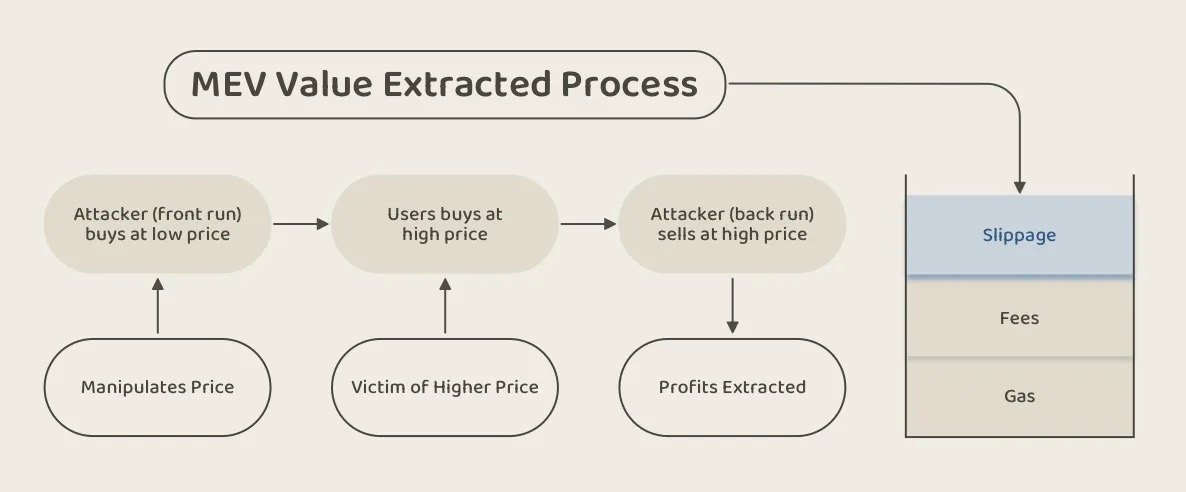

As previously mentioned, there are almost only three stable and sustainable sources of income in the crypto world: staking, lending, and trading. LSD protocols are naturally positioned to leverage trading for added revenue. For example, Jito, a leading LSD project on Solana, boosts income via MEV (Maximal Extractable Value) optimization from transaction ordering.

On-chain transaction costs are high. Users face slippage, transaction fees, and gas costs with every trade. MEV services (such as those provided by Jito) profit from user slippage. Jito provides efficient MEV infrastructure for Solana validators, optimizing transaction ordering to capture MEV opportunities and distributing the resulting profits.

Figure: Sandwich attacks severely degrade trading experience and outcomes

However, we believe MEV is a product of DeFi immaturity. If MEV becomes normalized as a fixed transaction cost, on-chain trading could end up being ten or even a hundred times more expensive than on centralized exchanges, making it hard to compete. Moreover, the slippage costs caused by MEV are burdens users neither want nor accept.

Given recent community and developer discussions around MEV on Sui, it's clear the focus is shifting toward anti-MEV solutions. We fully agree and view MEV as a systemic challenge—not a solution. Hence, we propose a new alternative: extracting value directly from transaction fees generated through the trading process. We call this product Hae3.

4. Hae3: Capturing Value from Ecological Transaction Flows

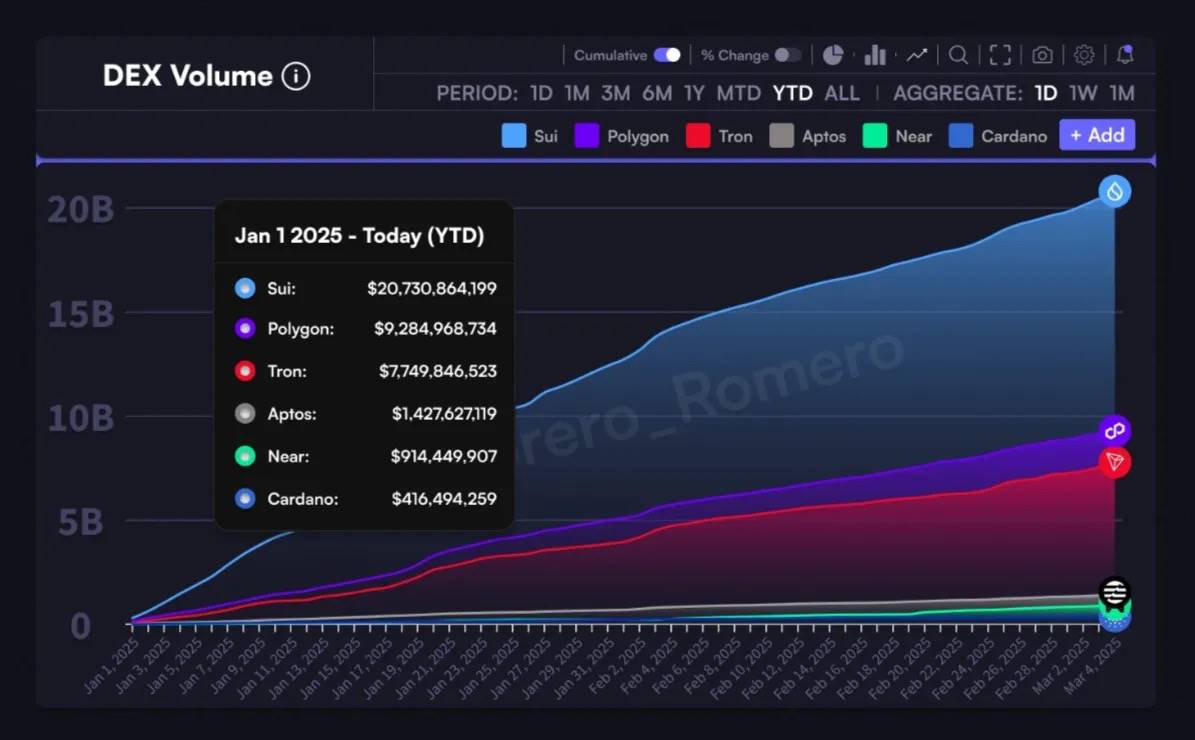

In recent years, transaction volume on the Sui chain has grown rapidly. According to DefiLlama data, since Q4 2024, Sui’s DEX trading volume has far surpassed established ecosystems like Polygon, Tron, and Avalanche.

Credit: https://x.com/Torero_Romero

This surge in trading volume translates into substantial fee income—a healthier and more sustainable revenue model. We believe this represents the true “dividend” of the blockchain world.

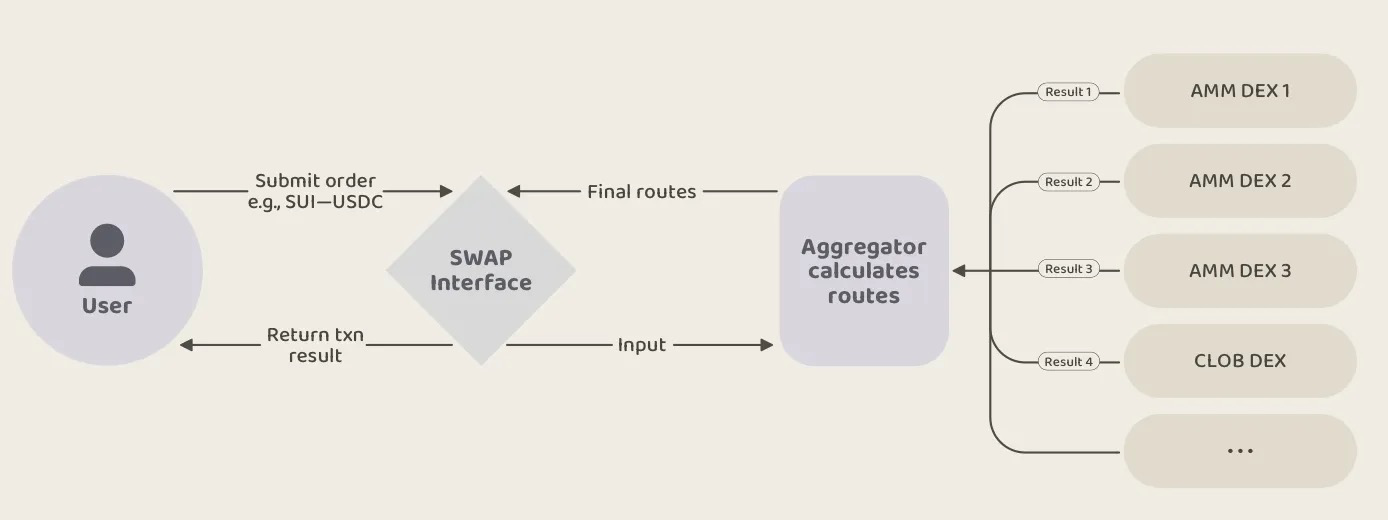

Currently, most transactions on Sui are initiated through aggregators (as is common in most ecosystems). After a user initiates a trade, various AMM DEXes (e.g., Cetus) and CLOB DEXes (e.g., Deepbook) provide quotes based on pool or order book states. Routing systems compute optimal paths and execute trades.

In this context, how can we capture transaction flows and extract profits? Haedal proposes two strategies:

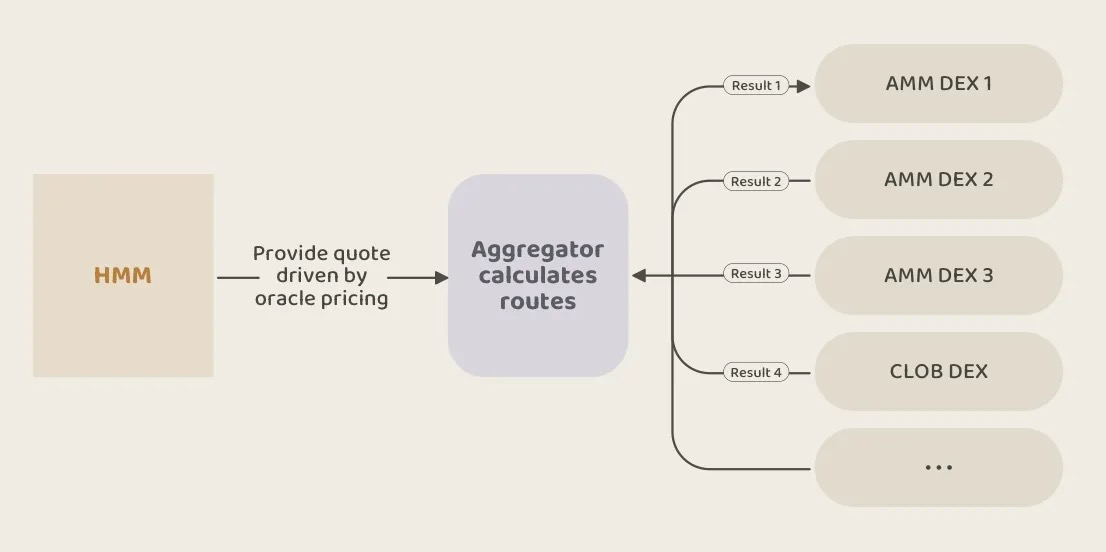

4.1 Haedal Market Maker (HMM): Oracle-Based Market Making Algorithm

In previous articles, we introduced the Haedal Market Maker (HMM). The core idea is that pricing for the top 200 mainstream market assets is still dominated by centralized exchanges (CEX), while prices in decentralized exchange (DEX) pools often lag behind real-time market prices. During price aggregation and routing, using oracle-generated fair market prices from multiple data sources gives us a competitive edge in quoting.

Built on this principle, we developed HMM—an oracle-based market making algorithm—integrated directly into aggregators. HMM offers three key features:

-

Centralized Liquidity Based on Oracle Pricing: Unlike traditional DEXes that set prices based on pool reserves, HMM always prices according to oracle feeds. With frequent updates (every 0.25 seconds), liquidity in the aggregator stays aligned with the “fair market price.”

-

Automatic Rebalancing and Market Making: HMM automatically rebalances its liquidity based on asset conditions, capturing market volatility and potentially turning impermanent loss into “impermanent profit” through low-buy, high-sell cycles.

-

Anti-MEV: HMM is naturally resistant to MEV attacks, ensuring trading profits aren’t eroded by front-running or sandwich attacks.

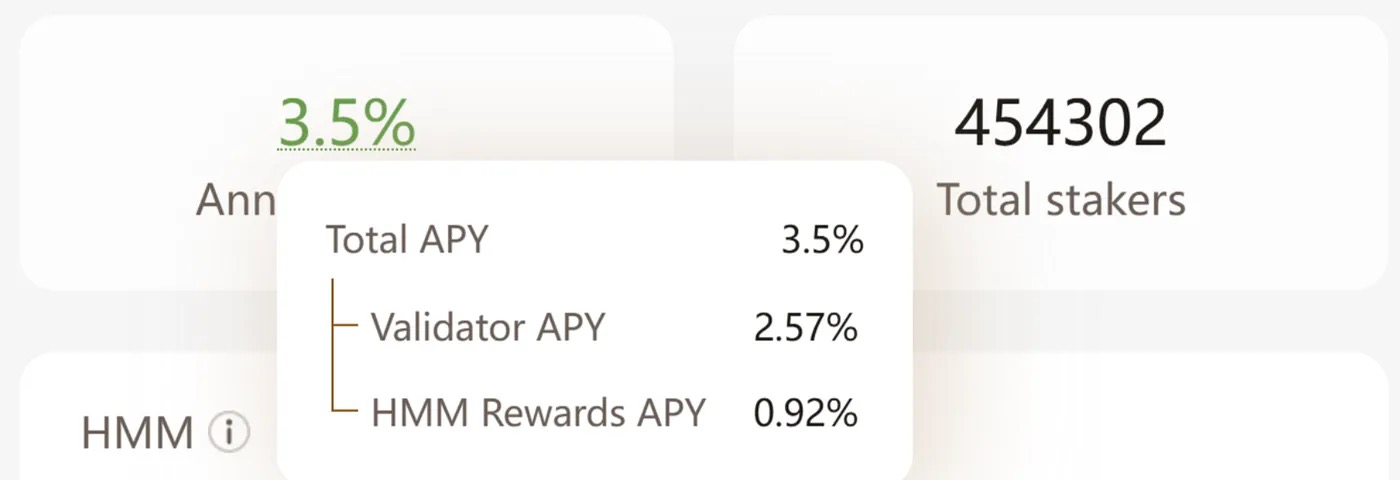

After two months of beta testing, HMM has captured approximately 10–15% of total DEX trading volume on Sui, despite having a TVL of only around $850,000. This performance has significantly boosted haSUI’s APR, which now stabilizes at 3.5%—far exceeding other LSTs in the Sui ecosystem. Notably, HMM alone contributed an additional 0.92% APR uplift to haSUI.

4.2 haeVault: Enabling Ordinary Users to Participate in Liquidity Provision Like CEX Market Makers

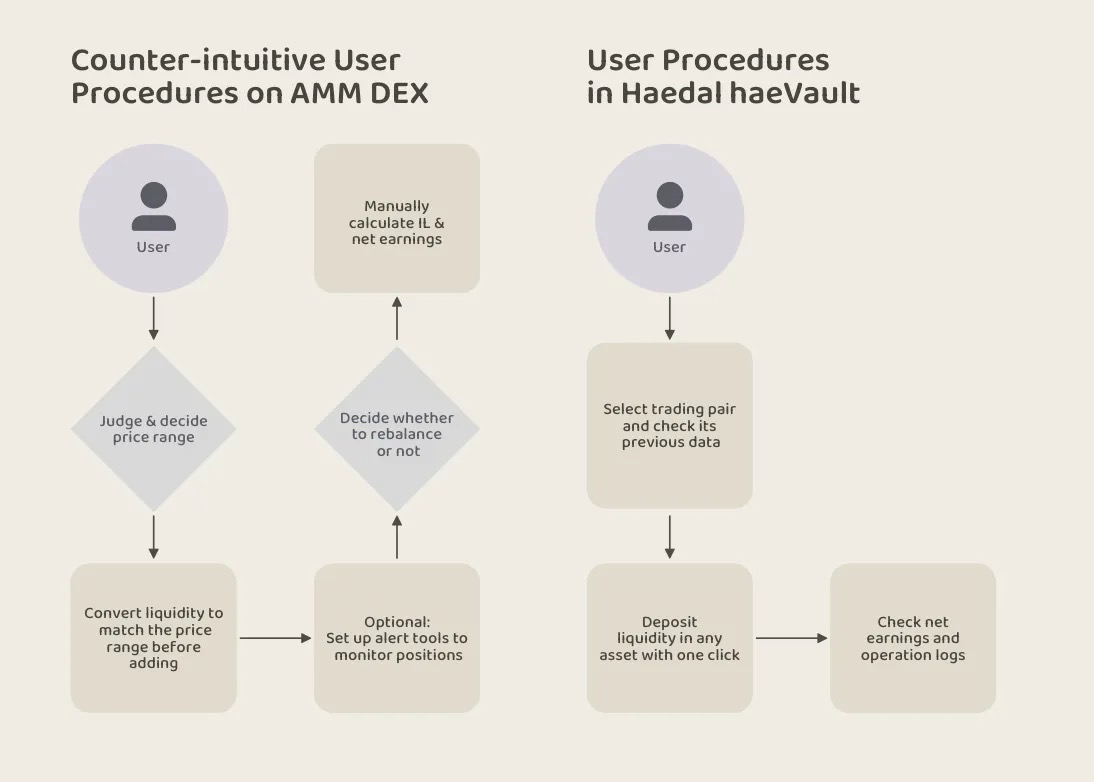

A major issue with current DEX products is the high barrier to entry for ordinary users becoming liquidity providers (LPs). In mainstream CLAMM algorithms (the most commonly used AMM design on Sui), if a user wants to provide liquidity to the SUI-USDC pool, they must handle several complex tasks:

-

Determine Price Ranges: Users must make subjective judgments about acceptable price ranges.

-

Adjust Liquidity: Dynamically manage liquidity within the chosen price range.

-

Monitor Position Status: Continuously check whether their liquidity has gone “out of range.”

-

Decide on Rebalancing: Judge whether to rebalance their position.

For most users, this entire process feels unnatural and inefficient, creating a significant participation barrier. Due to concerns over impermanent loss and poor decision-making, many avoid committing large amounts of capital to DEXes for high yields—or only provide liquidity in extremely conservative ranges, which often drastically reduces returns. For reference, while the SUI-USDC pool on Sui offers an average APR of about 150%, LPs providing full-range or ultra-wide-range liquidity may only achieve 10%-20% APR. Some users, obsessed with minimizing or eliminating impermanent loss risk, prefer lending or staking instead—despite their single-digit APRs.

So who is actually earning these high DEX yields? The answer is professional on-chain LPs. By simulating CEX-style market making strategies, these professionals typically provide liquidity within very narrow ranges and use custom monitoring bots and programs to automate rebalancing and hedging. They have long enjoyed outsized returns inaccessible to ordinary users.

Is there a way for regular users to easily participate in liquidity provision and enjoy similar professional-grade strategies? This is exactly the mission of haeVault.

haeVault builds an automated liquidity management layer atop AMM DEXes. It automatically adjusts liquidity based on price fluctuations and repositions positions using key metrics. haeVault mimics the sophisticated strategies of CEX market makers—but designed specifically for DEX LPs. Just as CEX market makers profit from “buying low and selling high,” haeVault continuously earns trading fees through active liquidity provision on DEXes.

Core Features of haeVault:

-

Simplicity: Users simply deposit any supported asset with one click.

-

Transparency: Users can clearly view their profit and loss (PnL).

-

Fully Automated Management: No actions required beyond deposits and withdrawals.

-

High Returns: Leverages professional strategies to deliver competitive yields compared to other LPs.

Unlike HMM, haeVault will be open to all users and is inherently designed to attract large-scale capital. Once haeVault accumulates sufficient TVL, it has the potential to capture a significant portion of transaction fee revenue from major asset pairs on DEXes.

We plan to launch the Alpha version of haeVault in a few weeks—stay tuned.

4.3 haeDAO: Community and Protocol-Controlled Liquidity

HMM and haeVault will deeply integrate with existing aggregators and DEX systems, enhancing liquidity depth and reducing slippage for trades on Sui. As the TVL of these two products continues to grow, we are confident Haedal will capture a substantial share of transaction fee revenue within the Sui ecosystem.

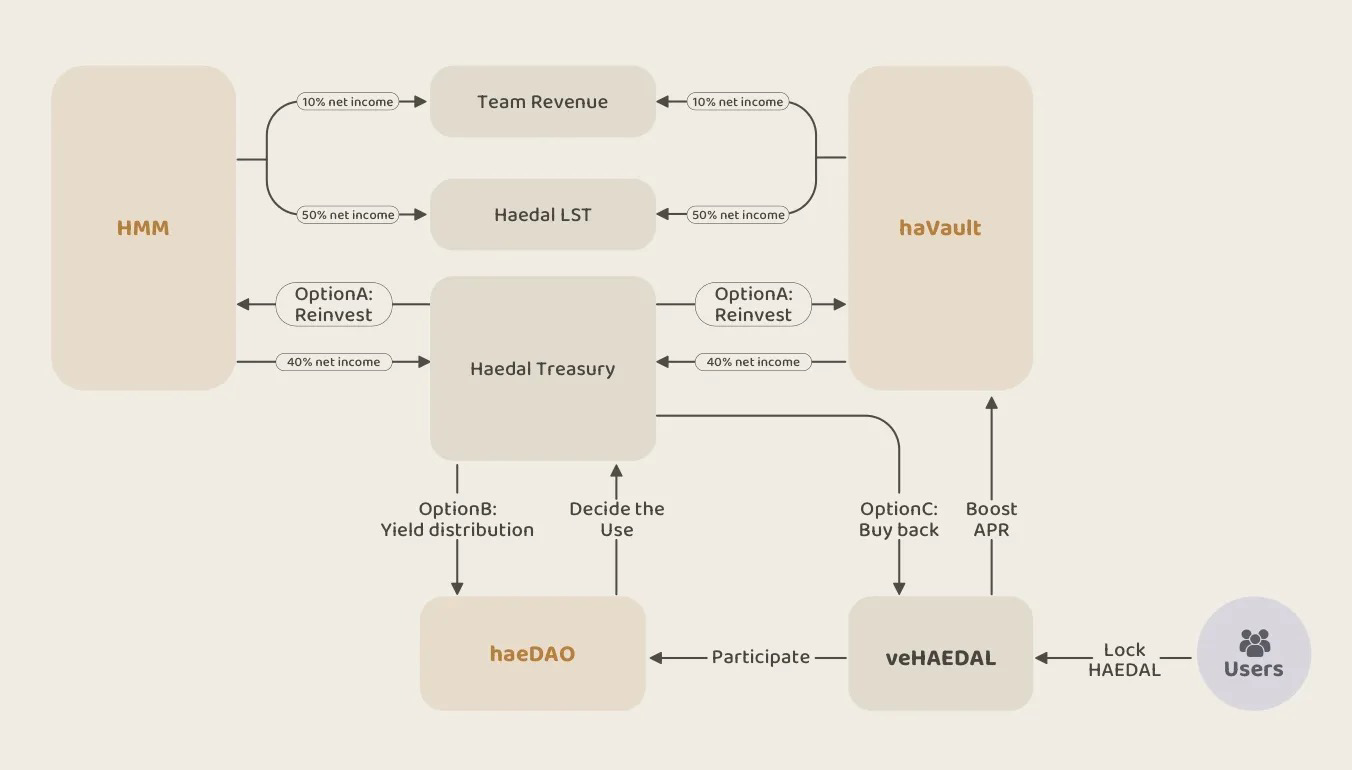

Profit Distribution Mechanism:

-

50%: Used to boost APR for Haedal LSTs.

-

10%: Allocated to the team to ensure long-term protocol sustainability.

-

40%: Directed to the Haedal treasury as Protocol-Owned Liquidity (POL).

In the early stages, treasury funds will be reinvested into Haedal products to expand liquidity. As the products mature, we will introduce haeDAO to govern the treasury, empowering both the Haedal token and its community.

Haedal tokens (HAEDAL) can be locked into veHAEDAL (name tentative) to gain full rights within haeDAO, including:

- Treasury Governance: Deciding asset allocations, liquidity distribution across modules or protocols, and reward structures.

- Boosted haeVault Yields: Increasing user weight in haeVault to access higher APRs.

- Proposal and Voting Rights: Major protocol decisions—including key product directions and treasury usage—will be made via DAO voting.

We plan to launch haeDAO in Q2, completing the final piece of the Hae3 product suite. Hae3 will provide a perfect supporting ecosystem for Haedal LSTs, featuring two powerful yield-enhancing products, a growing treasury, and a mature DAO community. We believe the Hae3 economy will generate a sustainable and ever-expanding treasury, enabling Haedal to achieve long-term growth amid the rapid expansion of the Sui ecosystem.

5. A Few More Words

Haedal will soon support Walrus’s LST (called haWAL), launching after Walrus’s TGE (Token Generation Event). Smart contract development is complete and undergoing third-party audits. haWAL will also be integrated into the Hae3 empowerment ecosystem, offering users attractive staking and yield opportunities.

Just as we believe in Sui, we also believe Walrus will become a key player in Web3, reshaping decentralized storage and serving as critical infrastructure for next-generation dApps. Haedal is ready to partner with Walrus for mutual success.

6. Final Thoughts

The current 3.5% APR for haSUI is just the beginning for Haedal. Inspired by pioneers like Jito, whose staking page boldly states: “Earn 15% more when you stake.” We deeply respect such innovators. Haedal aims to bring this vision to the Sui ecosystem—and go even further. Let’s Haedal together!

Follow our social channels for the latest updates 🌍

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News