Top 3 Trends in the LSD Sector: Decentralization, DeFi Enhancement, and Omnichain Integration

TechFlow Selected TechFlow Selected

Top 3 Trends in the LSD Sector: Decentralization, DeFi Enhancement, and Omnichain Integration

What are the new trends and innovations in the LSD space? Where is the LSD sector headed?

It has been half a year since the Shanghai upgrade, and the LSD War continues to heat up. Due to their massive market capitalizations in the billions, LSDs have always been a fiercely competitive sector. Established players like Lido and Rocket Pool keep clashing, while newcomers such as Puffer and Stader are joining the game. What new trends and strategies are emerging in the LSD space? Where is the LSD sector headed? Which projects will gain an edge in this competition? And what might be the endgame for the LSD赛道?

Decentralization: A Flag of Political Correctness

In July this year, Lido launched criticism against Rocket Pool, pointing out that its smart contracts contain sudo permissions allowing the team to arbitrarily modify key parameters, accusing Rocket Pool of insufficient decentralization. Shortly after, in August, Rocket Pool joined forces with five other Ethereum LSD protocols including StakeWise to launch an initiative under the banner of preserving Ethereum's decentralization—proposing that no single LSD protocol should hold more than 22% of total staked ETH. This move clearly targeted industry leader Lido, the only protocol exceeding that 22% threshold.

Lido did not issue an official response, but supporters from its community argued: Lido should not be viewed as a single entity, but rather as a coordination layer.

Decentralization remains one of the core narratives for all DeFi protocols, including LSDs. In crypto, “decentralization” is a politically correct banner—whichever project can prove it is more decentralized than its rivals gains moral high ground. This "culture" indeed drives protocols to continuously improve their decentralization.

In reality, Rocket Pool was among the first protocols to implement a permissionless mechanism at the node level, while Lido has introduced its Staking Router mechanism and dual-layer voting system in version V2. Both have made notable progress toward decentralization—and continue pushing forward.

Decentralization in LSD protocols encompasses four layers:

-

First, decentralization at the node level—referring to technologies like DVT/SSV that allow multiple parties to jointly control a single validator;

-

Second, decentralization in how the protocol selects nodes—whether nodes can freely join, how many nodes are supported, and their geographical distribution;

-

Third, governance-level decentralization—who controls the protocol, who decides on upgrades and changes, and how node selection is determined. Do developers retain admin or superuser privileges?

-

Fourth, diversification across LSD protocols—for any given blockchain, it’s risky if most tokens are staked through just one protocol. Lido truly cannot be simplistically regarded as merely a coordination layer.

Regarding the rivalry between Lido and Rocket Pool, the author takes no side, but believes such competition and mutual scrutiny actually push the entire sector toward greater decentralization. Progress across all four dimensions is beneficial.

DeFi Enhancement: The Goal Is Maximizing Yield

The base yield of LSD assets depends on the staking rewards defined by the underlying blockchain and the distribution model set by the LSD protocol (the split among validators, protocol, and users). Most LSD protocols are quite similar in this regard. Some, like Frax Finance, offer subsidies to boost base yields, but these are inherently unsustainable. From the user’s perspective, what matters more than base yield is the "stacked yield"—additional returns generated via certain DeFi strategies while managing risk.

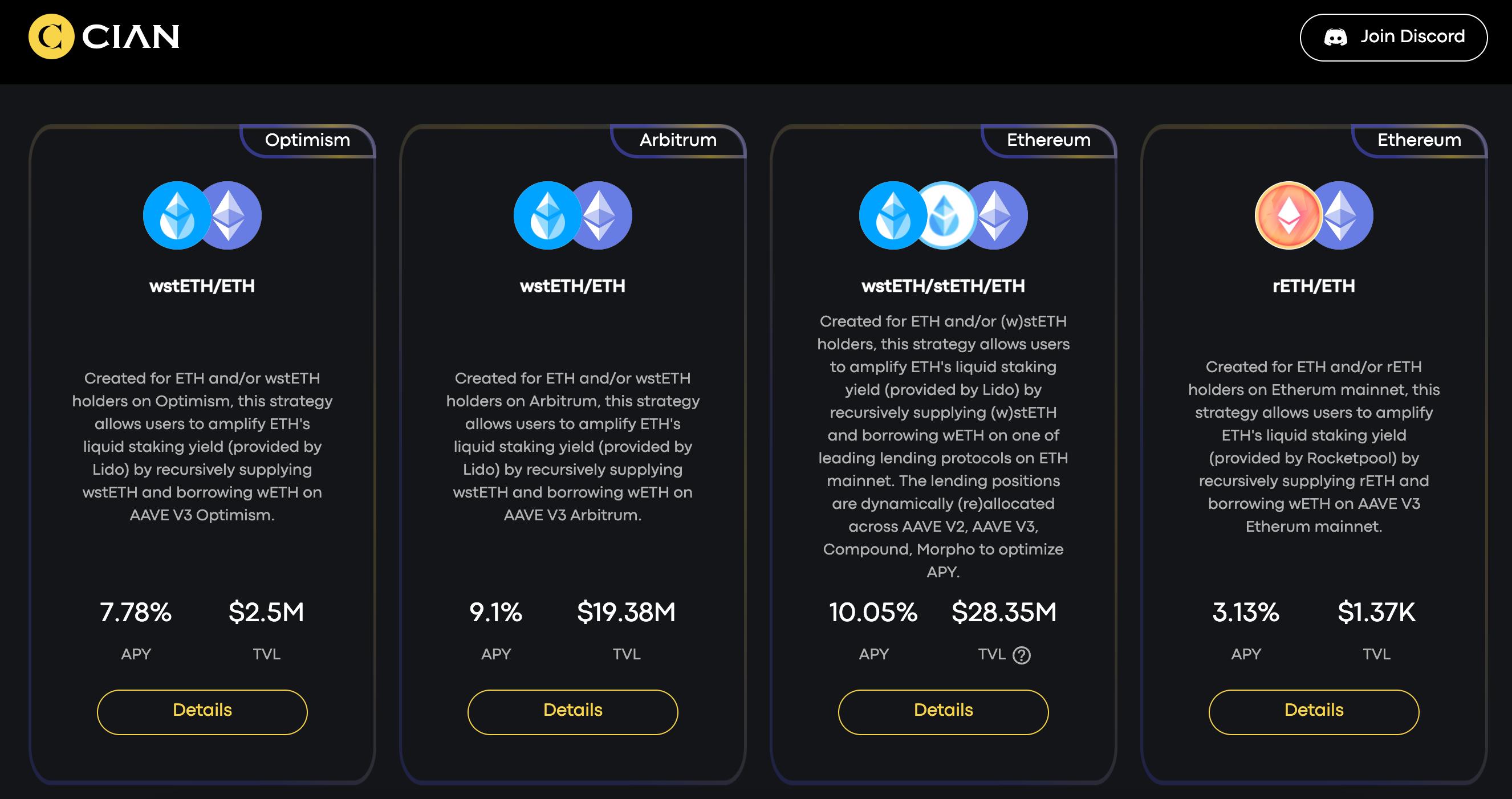

Currently, the most widely used strategy is recursive lending. For example, depositing ETH into Lido to receive stETH, then using stETH as collateral on Aave or Compound to borrow ETH, which is then restaked into Lido. This cycle can repeat multiple times until borrowing costs approach the LSD yield. Through recursion, stacked yields can far exceed base yields. At its core, this is an interest rate arbitrage and leveraging strategy. However, the risk lies in increasing liquidation exposure with each loop.

Some protocols provide LSD holders with automated tools to manage yield-maximizing strategies—including managing leverage ratios (i.e., number of loops)—so users don’t need to manually execute recursive staking. Notable examples include DeFiSaver, Cian, and Flashstake, which offer diverse DeFi enhancement strategies and leverage management tools for LSD assets.

Beyond recursive lending, users can also deploy LSD assets in other yield-generating activities—such as providing liquidity on DEXs, or depositing into index-based or yield-aggregating protocols. Readers may refer to this article: “LSD Hides Seven Layers of Yield: The APR War Ends with 10X TVL Growth”.

Protocols built atop LSD assets are sometimes referred to as LSDFi protocols. In the future, LSDFi and LSD protocols will increasingly merge and intertwine. Some LSD protocols will either launch native LSDFi offerings or integrate third-party LSDFi protocols to offer bundled yield strategies directly within their interfaces. Conversely, LSDFi protocols will embed LSD protocols, enabling users to start with base assets like ETH and one-click execute complex yield strategies.

For LSD protocols, the LSD War shouldn't be seen merely as an APR race over base yields. Instead, they should focus on getting their LSD assets listed across more LSDFi platforms, enabling higher stacked yields and better meeting the demands of yield maximizers.

Multi-Chain Evolution: From Multi-Chain Deployment to Omnichain Architecture

When discussing LSDs, we often implicitly refer to ETH LSDs—due to Ethereum’s large market cap and its shift to PoS, which catalyzed the LSD boom. Yet, LSD is actually an old concept. Earlier PoS blockchains had LSD-like products long before, though they were then called “staking derivatives.”

In fact, early LSD protocols typically support multiple chains, and even newer entrants are rapidly expanding across chains to grow their footprint.

Lido now supports not only Ethereum, but also Solana and Polygon—users can mint stSOL on Solana or stMATIC on Polygon via Lido. Stader supports seven chains: Ethereum, Polygon, Hedera, BNB Chain, Fantom, Near, and Terra 2.0. Ankr supports seven chains: Ethereum, Polygon, BNB Chain, Fantom, Avalanche, Polkadot, and Gnosis Chain. StaFi, originating from the Cosmos ecosystem, supports nine chains: Ethereum, Polygon, BNB Chain, Solana, Atom, HUAHUA, IRIS, Polkadot, and Kusama. Bifrost, rooted in the Polkadot ecosystem, supports six chains: Ethereum, Polkadot, Kusama, Filecoin, Moonbeam, and Moonriver.

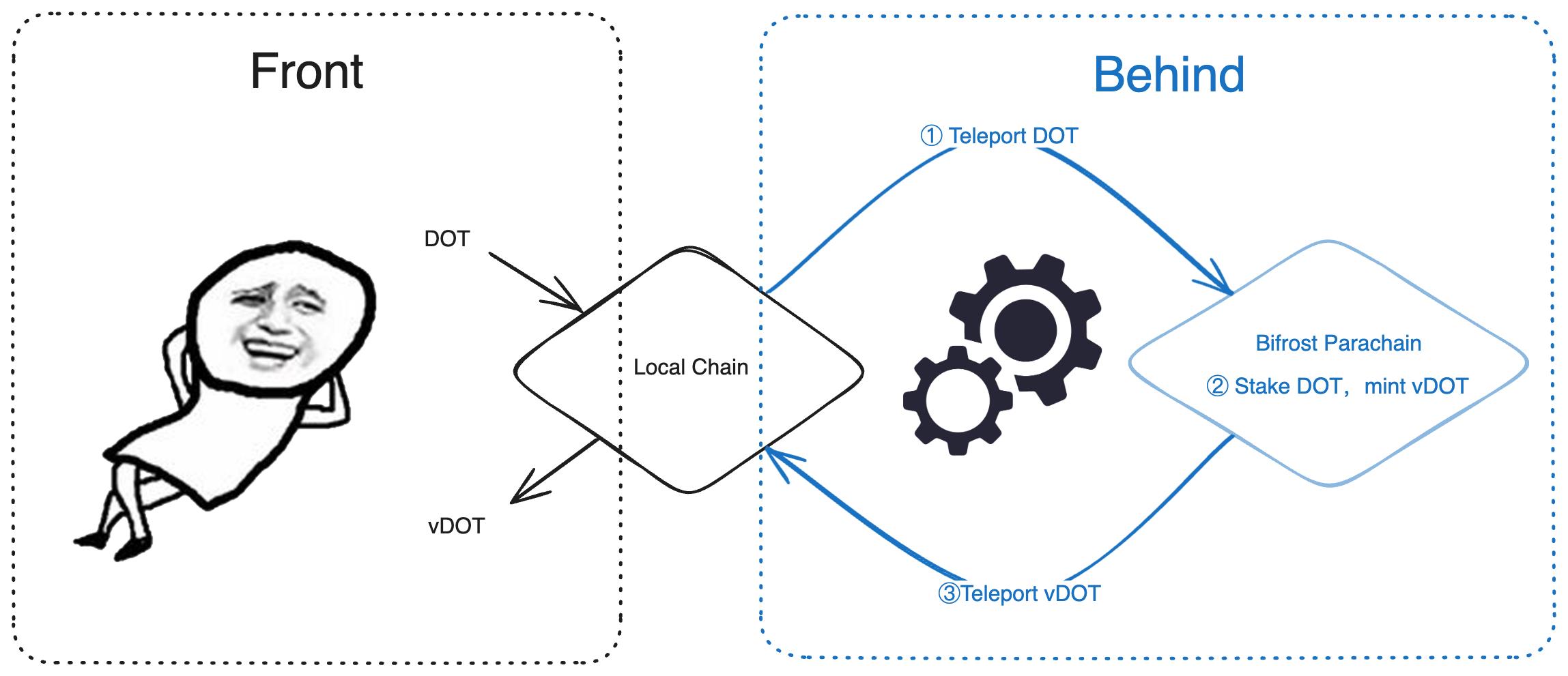

Bifrost’s multi-chain strategy is unique compared to other LSD protocols. Rather than redeploying its full protocol across multiple chains, Bifrost adopts a novel architecture.

Bifrost operates its own chain—the Bifrost Parachain—a dedicated parachain on Polkadot. It deploys its core protocol exclusively on this chain, while deploying lightweight, remotely accessible modules on other chains. The LSD tokens minted by Bifrost are called vTokens. When a user mints a vToken on another chain, the remote module triggers a cross-chain call to the main protocol on Bifrost Parachain. Once the vToken is minted, it is sent back across chains to the user’s original network.

To the user, it feels like local minting—but behind the scenes, there is a round-trip cross-chain process. According to Bifrost’s article “Taking Bifrost as an Example: Analyzing a New Paradigm for Omnichain Applications”, this design was driven by two main considerations:

-

The global state of all vTokens across all chains resides unified on Bifrost Parachain, not fragmented across separate chains. Centralized data enables superior cross-chain integrability. Any dApp on any chain can integrate all vTokens by connecting to the corresponding remote module, without needing individual integrations per chain. Users can mint any vToken on any chain—for example, minting vDOT on Ethereum;

-

All vToken liquidity is pooled on Bifrost Parachain, eliminating the need for Bifrost to bootstrap liquidity separately on each chain. Users on other chains access this central liquidity pool via remote calls when swapping vTokens. Similarly, lending dApps integrating vTokens can perform liquidations via the unified pool. With concentrated liquidity, slippage during liquidation is significantly reduced.

Bifrost refers to this model as an “omnichain architecture.” Under this framework, dApps are deployed only once—on a single chain—and are accessed remotely by users and applications on other chains, delivering an experience indistinguishable from native use. Bifrost argues this offers stronger cross-chain composability and unified liquidity advantages.

The author believes Bifrost’s “omnichain architecture” represents the right path forward for multi-chain applications and could become a dominant paradigm. It reflects a new application design philosophy—one that treats cross-chain interoperability as foundational, designing the dApp’s components across chains as a unified whole, rather than simply copying a single-chain app onto multiple chains.

Thanks to its superior cross-chain composability, Bifrost can implement more sophisticated, cross-chain DeFi yield strategies for vTokens. Does this sound familiar? Readers might detect a whiff of “Intent-Centric” architecture here.

However, this architecture places high demands on cross-chain bridge infrastructure. It requires secure, high-performance cross-chain protocols capable of supporting frequent, reliable inter-chain operations.

Summary

Driven by crypto’s cultural emphasis on “decentralization,” LSD protocols will continue advancing toward greater decentralization to strengthen their narrative and public perception;

Users’ engagement with LSD protocols goes beyond earning basic staking rewards—they increasingly employ recursive lending and other DeFi tactics to craft yield-enhancing strategies. As a result, competition among LSD protocols shifts from base APR to composability and stacked yield;

To expand their reach, LSD protocols are deploying across multiple chains. Yet innovative models like the “omnichain architecture” enable “single deployment, multi-chain access,” offering superior cross-chain composability and unified liquidity—potentially defining the future of multi-chain applications.

Competition and innovation in the LSD space remain intense. Although the top five LSD protocols currently dominate over 80% of the LSD market—with Lido alone holding over 70% of the ETH LSD share—the landscape is far from settled. Winds of change begin with subtle shifts: users’ unwavering belief in decentralization, their pursuit of stacked yields, and their desire for seamless, unified multi-chain experiences will inevitably reshape the future of LSD.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News