FOLD's 100% Surge in 7 Days: An Overlooked Disruptor in the LSD Sector Fueled by MEV Yield Expectations?

TechFlow Selected TechFlow Selected

FOLD's 100% Surge in 7 Days: An Overlooked Disruptor in the LSD Sector Fueled by MEV Yield Expectations?

When liquid staking gains MEV revenue, will FOLD token acquire new utility? And what transformations might the entire LSD sector undergo?

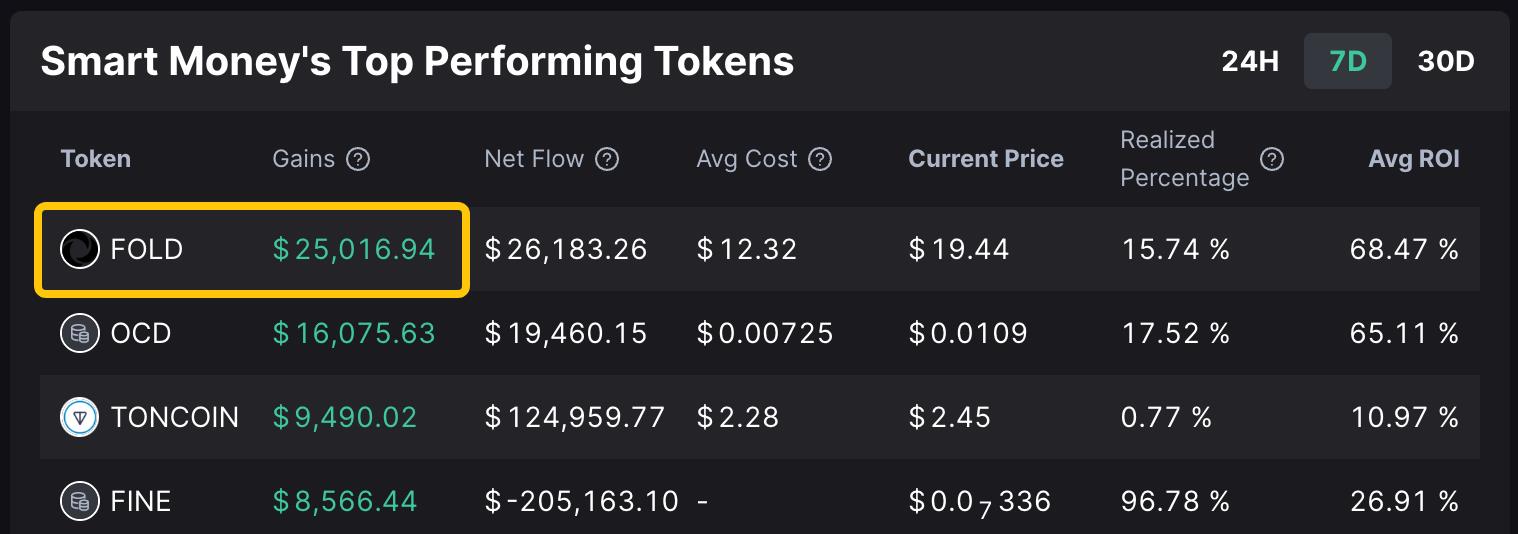

Meanwhile, FOLD has also climbed to the top position in rankings of tokens held by smart money based on returns.

Meanwhile, FOLD has also climbed to the top position in rankings of tokens held by smart money based on returns.

However, since the FOLD token lacks liquidity on major centralized exchanges (CEX), and Manifold Finance operates in the technically complex MEV space—which isn't easily understandable—there has been little in-depth research or coverage about it within Chinese-speaking communities.

Still, we all know that rapid price movements are often driven by expectations and narratives.

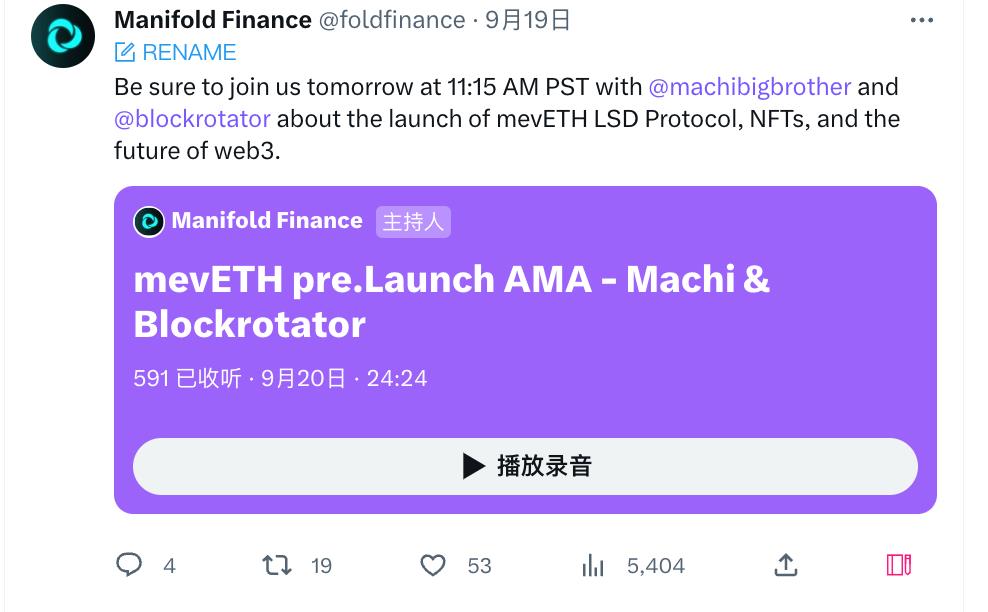

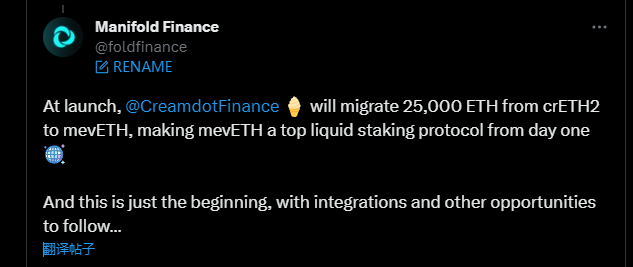

Manifold Finance recently announced on Twitter the upcoming launch of mevETH, an MEV-related LSD protocol, and invited prominent figures such as Maji Brother to host an AMA for promotional purposes.

However, since the FOLD token lacks liquidity on major centralized exchanges (CEX), and Manifold Finance operates in the technically complex MEV space—which isn't easily understandable—there has been little in-depth research or coverage about it within Chinese-speaking communities.

Still, we all know that rapid price movements are often driven by expectations and narratives.

Manifold Finance recently announced on Twitter the upcoming launch of mevETH, an MEV-related LSD protocol, and invited prominent figures such as Maji Brother to host an AMA for promotional purposes.

The prefix "mevETH" alone signals a convergence of multiple concepts—MEV, liquid staking, and yield optimization—that have fueled speculative anticipation, acting as a catalyst for FOLD’s recent surge.

Currently, as the LSD sector becomes increasingly competitive, Manifold’s mevETH may offer a unique solution to boost yields.

If Manifold builds its own LSD staking protocol, the higher returns could make it a disruptive force in the sector. Alternatively, if other staking providers choose to integrate mevETH into their offerings, this would represent a significant positive development for the protocol itself.

When liquid staking is enhanced with MEV yield, will FOLD gain new utility? And how might the broader LSD landscape evolve?

The prefix "mevETH" alone signals a convergence of multiple concepts—MEV, liquid staking, and yield optimization—that have fueled speculative anticipation, acting as a catalyst for FOLD’s recent surge.

Currently, as the LSD sector becomes increasingly competitive, Manifold’s mevETH may offer a unique solution to boost yields.

If Manifold builds its own LSD staking protocol, the higher returns could make it a disruptive force in the sector. Alternatively, if other staking providers choose to integrate mevETH into their offerings, this would represent a significant positive development for the protocol itself.

When liquid staking is enhanced with MEV yield, will FOLD gain new utility? And how might the broader LSD landscape evolve?

Manifold's Existing Business: Building High-Value Blocks and SecureRPC

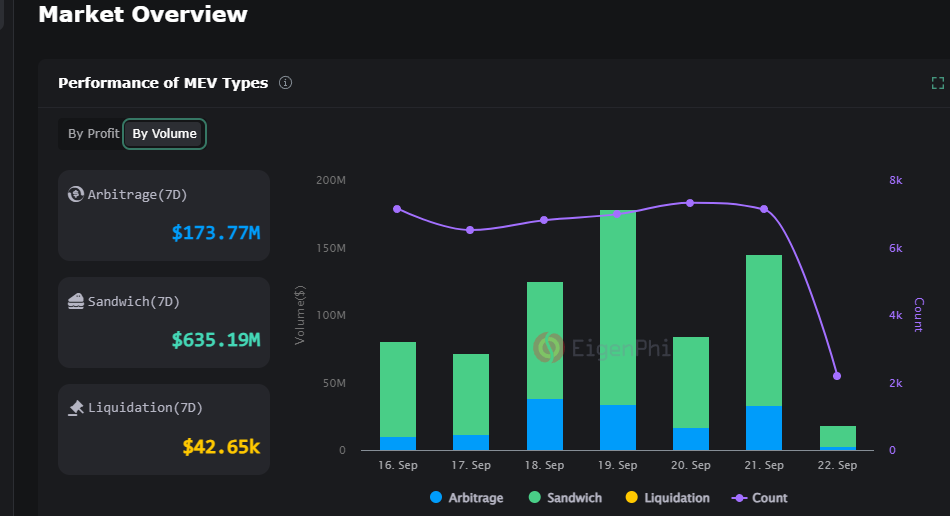

Following Ethereum's transition from Proof-of-Work (PoW) to Proof-of-Stake (PoS), Miner Extractable Value (MEV) has drawn growing attention. MEV leads to undesirable behaviors like sandwich attacks and front-running, which degrade user experience and increase transaction costs. Worse, it heightens centralization risks, as nodes with greater resources can extract more MEV profits.

Manifold's Role and Value

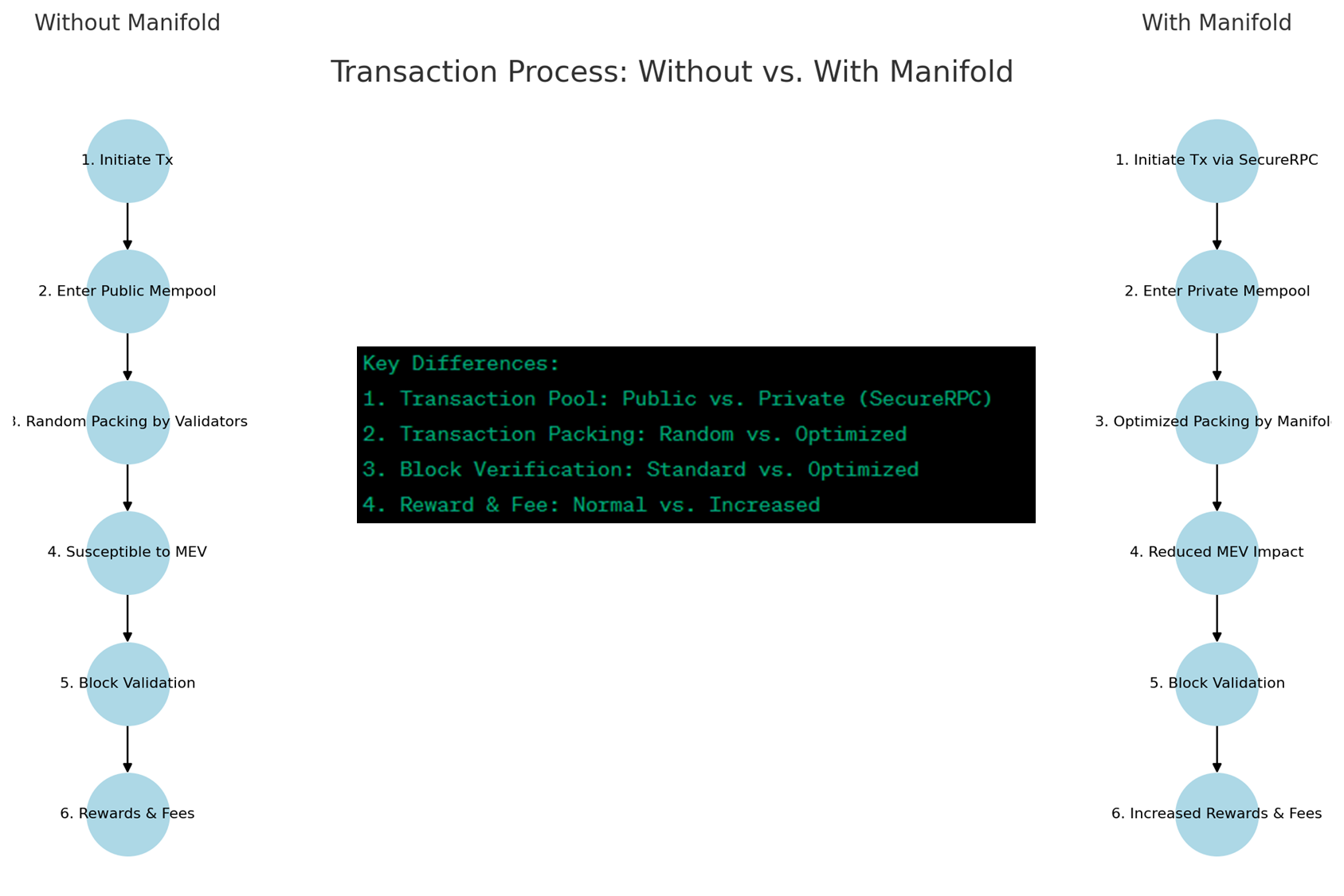

Manifold Finance is a pioneer addressing MEV issues, gaining increasing attention especially after Ethereum’s Shanghai upgrade. As a block builder, Manifold has the ability to sequence and optimize transactions before they enter the blockchain—a critical capability directly impacting validators’ rewards and fee income. Through partnerships with major validators and DeFi protocols like Sushiswap, Manifold uses its proprietary SecureRPC private node to access more private order flow. This allows Manifold to optimize transaction ordering and construct higher-value blocks. Higher-value blocks mean increased transaction fees, directly boosting validator earnings. Validators earn income from two sources: newly minted block rewards and transaction fees. By efficiently including high-value, high-fee transactions in new blocks, Manifold increases overall block value and enhances fee revenue for validators. This creates strong incentives for validators to select Manifold as their block builder, forming a virtuous cycle.Before and After Manifold

-

Without Manifold: Transactions enter blocks randomly, vulnerable to MEV bots, leading to higher transaction costs and degraded user experience.

-

With Manifold: Through SecureRPC and partner order flows, Manifold optimizes transaction sequencing, reducing negative MEV impacts and improving network efficiency and security.

In summary, Manifold not only mitigates various problems caused by MEV but also delivers direct economic benefits to both validators and users through optimized transactions and higher block values.

In summary, Manifold not only mitigates various problems caused by MEV but also delivers direct economic benefits to both validators and users through optimized transactions and higher block values.

Moving Into LSD Protocols: From Behind the Scenes to the Spotlight

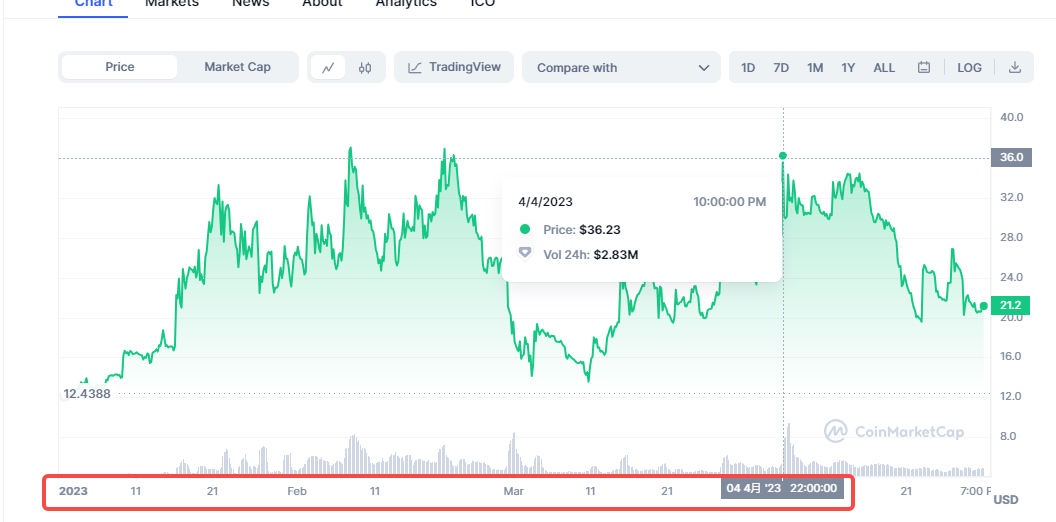

After the Shanghai upgrade allowed users to withdraw staked ETH under the PoS consensus, maximizing staking yields became a key concern. Helping more protocols capture MEV profits to increase revenue—this expectation around Manifold was previously tied to the timeline of Ethereum’s Shanghai upgrade. As seen in the price chart of its token FOLD, from early this year until just before the Shanghai upgrade, FOLD experienced a massive rally. Afterward, with the upgrade complete, we witnessed surging popularity in liquid staking protocols like Lido and Rocket Pool (RPL). The LSD sector gained further attention and spawned new innovations such as LSTs.

Rather than merely providing backend support to other protocols, Manifold now aims to enter this space directly, leveraging its expertise in MEV and transaction optimization.

For Manifold itself, given its proven ability to enhance profitability for other protocols via MEV solutions, stepping into the LSD arena when demand is high is not only logical but technically feasible.

Thus, Manifold Finance is positioning mevETH as a major player in this domain. Unlike traditional wrapped ETH, mevETH offers an end-to-end LSD solution that provides liquidity while optimizing MEV yield—an immense value proposition for liquidity providers and end users alike.

Afterward, with the upgrade complete, we witnessed surging popularity in liquid staking protocols like Lido and Rocket Pool (RPL). The LSD sector gained further attention and spawned new innovations such as LSTs.

Rather than merely providing backend support to other protocols, Manifold now aims to enter this space directly, leveraging its expertise in MEV and transaction optimization.

For Manifold itself, given its proven ability to enhance profitability for other protocols via MEV solutions, stepping into the LSD arena when demand is high is not only logical but technically feasible.

Thus, Manifold Finance is positioning mevETH as a major player in this domain. Unlike traditional wrapped ETH, mevETH offers an end-to-end LSD solution that provides liquidity while optimizing MEV yield—an immense value proposition for liquidity providers and end users alike.

From a technical standpoint, it’s easier for an MEV-focused protocol to build an LSD than vice versa. Manifold already operates as a block builder with mature solutions like SecureRPC, making an LSD extension natural. In contrast, it would be inefficient for LSD protocols like Lido to develop their own RPC infrastructure; instead, integrating established MEV optimization services makes more sense.

From a technical standpoint, it’s easier for an MEV-focused protocol to build an LSD than vice versa. Manifold already operates as a block builder with mature solutions like SecureRPC, making an LSD extension natural. In contrast, it would be inefficient for LSD protocols like Lido to develop their own RPC infrastructure; instead, integrating established MEV optimization services makes more sense.

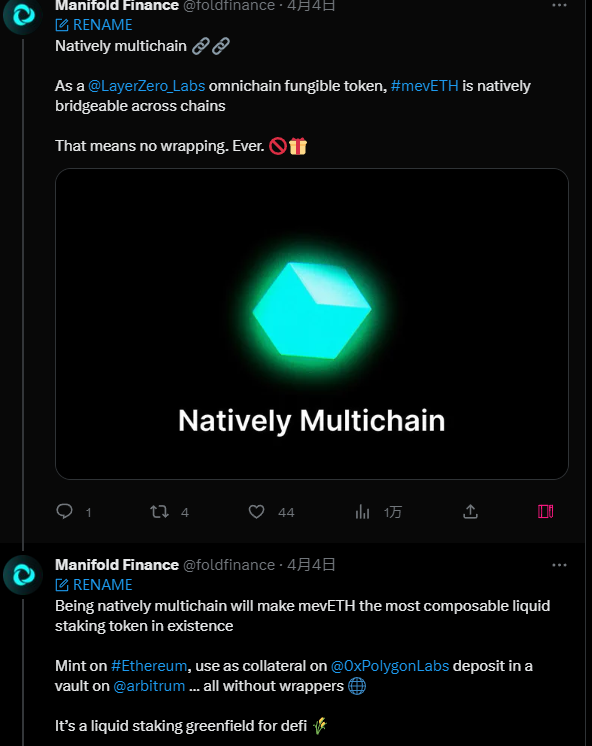

mevETH: Higher-Yield, More Convenient Staking

mevETH is Manifold Finance’s upcoming end-to-end LSD solution specifically designed to address MEV (Miner Extractable Value). It enables higher staking yields and improved transaction efficiency. mevETH leverages Manifold’s role as a block builder to reorder transactions for maximum block value and captures additional MEV opportunities via its private RPC (SecureRPC). Manifold has already partnered with Sushiswap, and collaborations with Balancer and LayerZero are underway. mevETH adopts LayerZero’s Omni solution, simplifying cross-chain functionality. On its official Twitter, a simplified example illustrates the concept: mint mevETH on Ethereum, use it as collateral on Polygon, then deposit it into a protocol on Arbitrum—all without converting assets. mevETH remains unchanged throughout, eliminating the need for additional layers of wrapped tokens. If successfully implemented, this design could significantly boost LST liquidity and enable deeper composability across DeFi protocols. However, note that mevETH has not yet launched—the excitement stems solely from discussions in official communities and social media. Actual product details remain to be seen. The expectation of higher-yielding, more liquid staking powered by mevETH has driven FOLD’s remarkable gains over the past week.

Yet once the product launches and speculation fades, a sharp pullback could follow.

However, note that mevETH has not yet launched—the excitement stems solely from discussions in official communities and social media. Actual product details remain to be seen. The expectation of higher-yielding, more liquid staking powered by mevETH has driven FOLD’s remarkable gains over the past week.

Yet once the product launches and speculation fades, a sharp pullback could follow.

Potential Impact of mevETH

Summarizing the above, potential impacts of mevETH include:-

Higher Staking Yields: Thanks to MEV optimization, partners and end users can earn higher returns by staking mevETH.

-

Cross-Chain Capability: mevETH is not limited to Ethereum—it can be used on other chains like BSC and Polkadot, greatly enhancing flexibility and use cases.

-

Impact on Other LSD Protocols: mevETH could threaten existing LSDs like LDO and RPL by offering superior yields and flexibility. Competitors must either integrate similar MEV solutions or risk falling behind in yield competition—an inevitable race for yield and technological upgrades may soon begin.

Following this collaboration model, more LST-based protocols may join after seeing the benefits, integrating with mevETH.

This reflects a new strategy for breaking through saturated markets—not competing head-on with dominant players for market share, but leveraging a profit-enhancing necessity to form ecosystem partnerships and disrupt from the periphery.

Following this collaboration model, more LST-based protocols may join after seeing the benefits, integrating with mevETH.

This reflects a new strategy for breaking through saturated markets—not competing head-on with dominant players for market share, but leveraging a profit-enhancing necessity to form ecosystem partnerships and disrupt from the periphery.

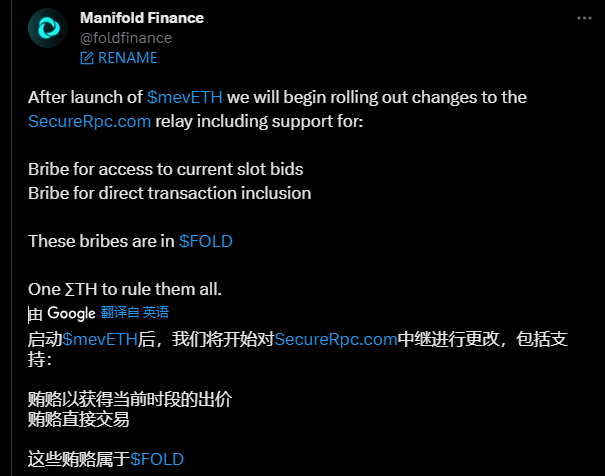

Will FOLD Get a New Catalyst?

As a protocol and feature, mevETH directly benefits its native token. While FOLD’s 100% surge is a short-term phenomenon, could entering the LSD space grant the token additional utility and long-term value? The answer is likely yes—with the most notable addition being the bribe mechanism, where FOLD serves as the intermediary.Bribe Mechanism

Within the mevETH protocol, the bribe mechanism allows users to pay FOLD tokens to prioritize their transactions in SecureRPC. This gives FOLD tangible utility and demand, creating a direct incentive for users and validators to hold and use the token. Though specific details haven’t been disclosed, we can reasonably infer how it works:

Suppose Alice is a DeFi user who wants to execute a high-value trade in a specific Ethereum block. Bob is a validator responsible for confirming transactions in that block.

Without Manifold and FOLD, Alice’s transaction might fall victim to MEV bots, forcing her to pay higher gas fees or suffer adverse outcomes.

But with Manifold’s SecureRPC relay and FOLD tokens, the situation changes:

Though specific details haven’t been disclosed, we can reasonably infer how it works:

Suppose Alice is a DeFi user who wants to execute a high-value trade in a specific Ethereum block. Bob is a validator responsible for confirming transactions in that block.

Without Manifold and FOLD, Alice’s transaction might fall victim to MEV bots, forcing her to pay higher gas fees or suffer adverse outcomes.

But with Manifold’s SecureRPC relay and FOLD tokens, the situation changes:

-

Alice uses FOLD tokens as a “bribe”: She pays a certain amount of FOLD to ensure her transaction is prioritized in the block.

-

Submission via SecureRPC relay: Alice submits her transaction along with the FOLD payment through Manifold’s SecureRPC.

-

Priority processing: Due to the FOLD bribe, her transaction receives priority in the SecureRPC relay and is forwarded to cooperating validators like Bob.

-

Bob selects the highest-value block: As a validator, Bob receives several potential high-value block options from Manifold, one containing Alice’s transaction. Because of the bribe, this block offers higher value to Bob.

-

Successful execution: Bob selects this high-value block and adds it to the Ethereum chain. Alice’s transaction executes smoothly, while Bob and Manifold receive additional FOLD tokens as reward.

Data Perspective

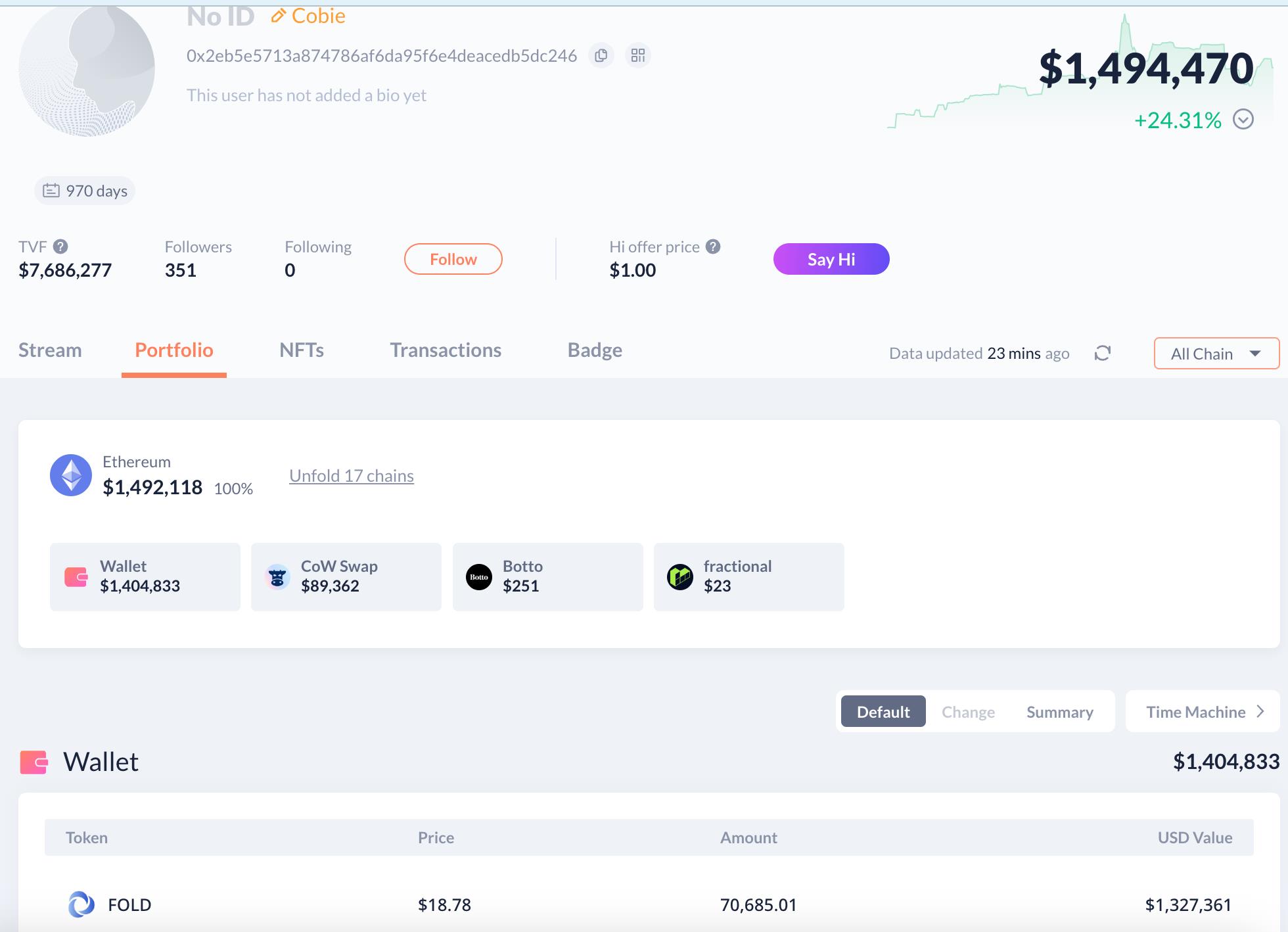

After examining functional updates to the token, let’s look at some data points. First, based on current market cap estimates, using FXS as a benchmark, FOLD still has room for a 16x increase (theoretical reference only, NFA). Additionally, cobie—a well-known crypto figure—still holds $1.5 million worth of FOLD in his publicly known wallet mamoca.eth. Historical records show he transferred FOLD to other addresses multiple times this year but maintains a core holding.

Additionally, cobie—a well-known crypto figure—still holds $1.5 million worth of FOLD in his publicly known wallet mamoca.eth. Historical records show he transferred FOLD to other addresses multiple times this year but maintains a core holding.

Regarding circulating supply, FOLD has a relatively small total supply, with over 80% already in circulation. Considering a portion of FOLD is staked within Manifold’s protocol, and unlike many tokens with large unvested VC allocations, there is theoretically less unlock pressure.

Given its relatively low market cap, current price volatility is understandable. However, future performance remains uncertain and depends on whether the market embraces the mevETH concept.

Regarding circulating supply, FOLD has a relatively small total supply, with over 80% already in circulation. Considering a portion of FOLD is staked within Manifold’s protocol, and unlike many tokens with large unvested VC allocations, there is theoretically less unlock pressure.

Given its relatively low market cap, current price volatility is understandable. However, future performance remains uncertain and depends on whether the market embraces the mevETH concept.

The good news is that mevETH hasn’t launched yet—whether Manifold will be a game-changer or just another passerby in the LSD space still remains to be seen.

Finally, here are some concerns worth noting:

The good news is that mevETH hasn’t launched yet—whether Manifold will be a game-changer or just another passerby in the LSD space still remains to be seen.

Finally, here are some concerns worth noting:

- Slow rollout: mevETH was first announced in April but has yet to launch;

- Limited documentation: Full design details of mevETH are scarce, with marketing relying heavily on social media hype;

- Past controversy: FOLD staking previously faced criticism over lack of transparency.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News