A Brief Analysis of the Current State and Future Outlook of the LSDFi Ecosystem

TechFlow Selected TechFlow Selected

A Brief Analysis of the Current State and Future Outlook of the LSDFi Ecosystem

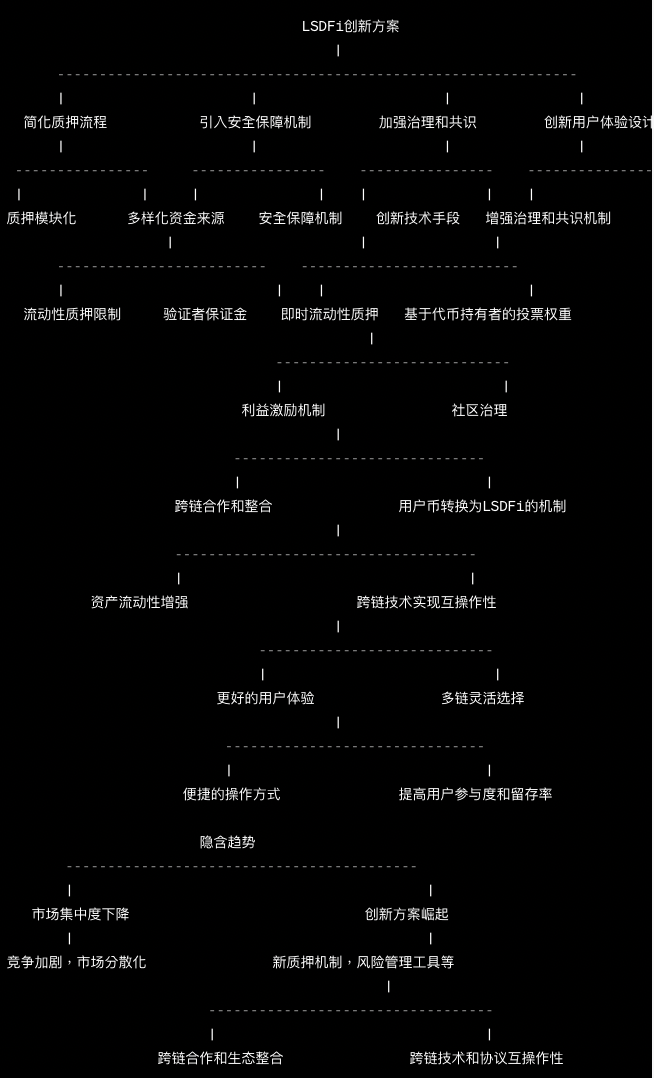

As an important component of the public chain ecosystem, the future development of LSDFi needs to achieve long-term healthy empowerment by simplifying the staking process, introducing security safeguards, and strengthening governance and consensus.

Author: Kyle Liu, Investment Manager at Bing Ventures

Introduction

LSDFi fundamentally combines the LSD market with DeFi products and protocols, offering users more unique staking and lending opportunities. Building upon LSD, LSDFi continues to innovate and explore increasingly niche application areas.

Currently, ETH's staking ratio remains relatively low, significantly below the average level of other PoS chains. This indicates substantial growth potential for the LSDFi (Liquid Staking Derivatives Finance) market—especially as staking ratios rise and more institutional capital flows in, driving market expansion. The influx of institutional funds brings new development opportunities to LSDFi. Involvement and support from top-tier institutions bolster confidence in the LSDFi market. Institutional participation not only deepens market liquidity but also fosters further innovation, expanding options within LSDFi.

Yield competition is one of the key characteristics of the LSDFi market. LSDFi protocols attract user participation by offering higher yields, resulting in an ongoing yield race. Protocols such as Pendle Finance and Lybra Finance have drawn significant attention through their unique yield models and strategies. This competitive environment drives continuous innovation in LSDFi, delivering more efficient and sustainable yield opportunities.

The Essence of LSDFi

The essence of LSDFi lies in integrating the LSD market with DeFi products and protocols, providing users with more specialized staking and lending opportunities. The development of LSDFi is driven by multiple factors, including rising staking ratios, infrastructure upgrades, restaking mechanisms, institutional capital inflows, and yield competition. As LSDFi continues to innovate, we can expect a growing number of attractive LSDFi products and protocols to emerge.

Several factors drive LSDFi’s evolution. First, ETH’s current staking ratio is relatively low compared to other blockchains, indicating significant room for growth. As staking adoption increases, the LSD market will expand accordingly, creating greater opportunities for LSDFi. Additionally, advancements in infrastructure positively impact LSDFi. With technological progress and improved infrastructure, LSDFi can execute staking and lending operations more efficiently, enhancing user experience.

Restaking is another crucial driver of LSDFi growth. By introducing restaking mechanisms, LSDFi incentivizes participants to redeploy their staked assets back into the market, increasing liquidity and market activity. This mechanism lowers barriers to entry while creating additional yield opportunities, attracting more users and capital into the LSDFi ecosystem.

Competition in LSDFi

At the core of today’s LSD competition is the battle among institutions to capture ETH held by borrowers. Both centralized and decentralized entities play important roles in this landscape, offering different staking and lending solutions to attract users and gain market share.

On the centralized side, exchanges like Coinbase, Binance, and Kraken offer well-known LSD services. These platforms hold notable market shares and attract large numbers of users. Centralized providers typically deliver user-friendly interfaces and streamlined processes, appealing to users unfamiliar with or preferring traditional financial models over decentralized alternatives.

Decentralized players also demonstrate strong competitiveness in the LSD market. Projects such as Lido, Rocket Pool, Ankr, Frax Finance, Stader Labs, and StakeWise offer decentralized LSDFi solutions. Through decentralized architecture and smart contract execution, these projects provide enhanced security and trustworthiness, helping users achieve better returns within the LSD market.

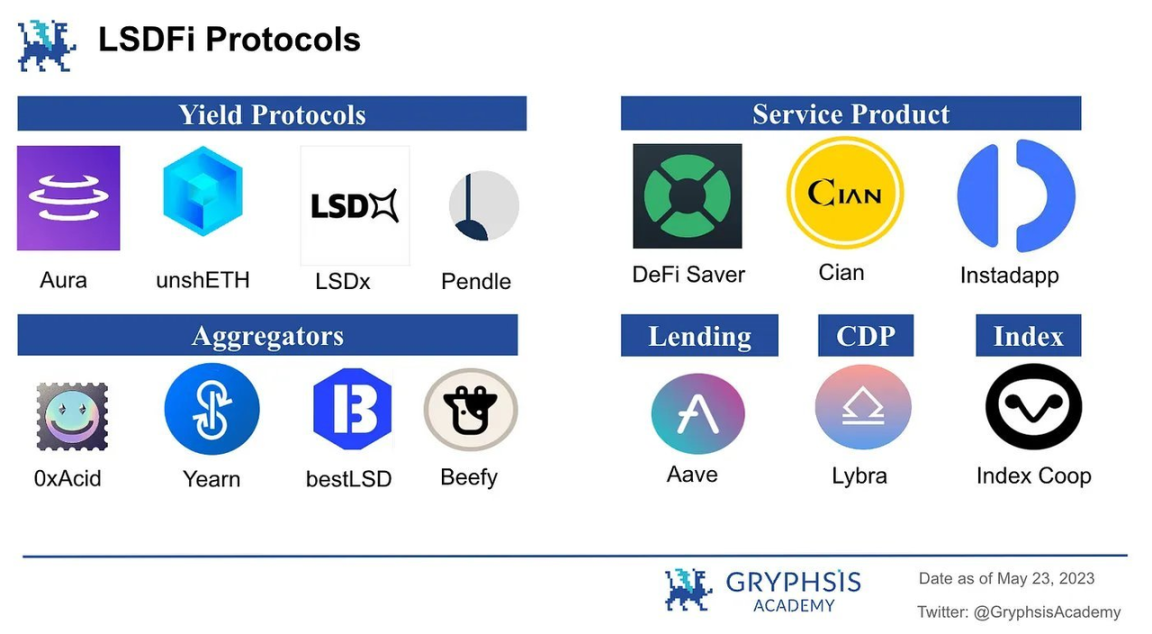

Beyond centralized and decentralized institutions, the LSDFi market spans multiple domains and initiatives. It includes protocols that use LSD as collateral to mint stablecoins (e.g., Curve, Lybra Finance, Raft, and Prisma), index protocols issuing tokens representing baskets of LSDs (e.g., Index Coop and unshETH), and protocols offering automated yield strategies (e.g., Instadapp, Pendle, Flashstake, Swell, and Asymetrix). The LSDFi market thus delivers diverse functionalities.

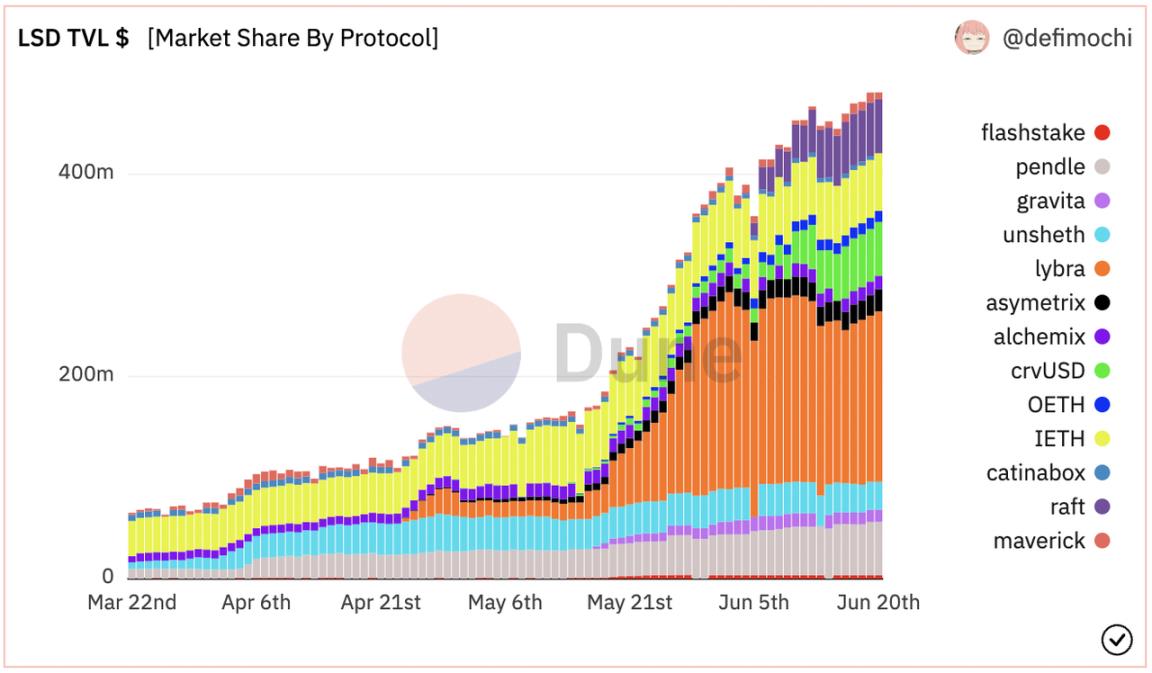

In this competitive arena, market share and total value locked (TVL) are key metrics for assessing the strength of various solutions. Currently, the LSDFi market is relatively concentrated, with the top five players accounting for over 80% of TVL—highlighting the dominant influence of a few major projects. However, as time progresses and the market evolves, new entrants and innovative solutions will continue to emerge, reshaping the competitive landscape.

Future Outlook for LSDFi

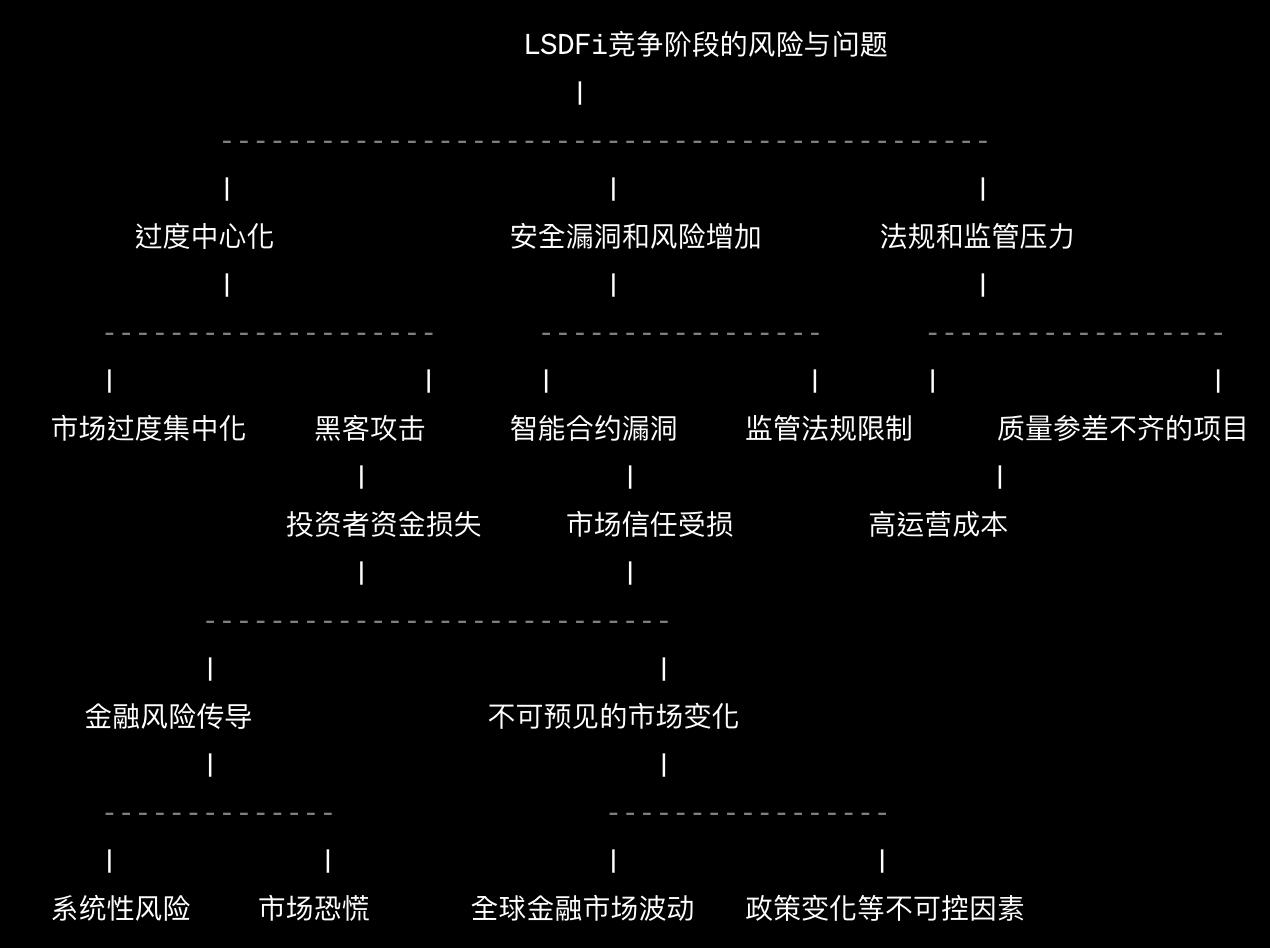

Looking ahead, how LSDFi can truly leverage staking mechanisms to sustainably empower public blockchain ecosystems without triggering systemic risks—and how its competitive dynamics will evolve—are critical questions worth deep exploration.

To ensure long-term healthy development of LSDFi, it is essential first to design simplified staking processes that lower user entry barriers and improve overall experience. Streamlined staking procedures will attract more participants to the LSDFi market, boosting liquidity provision and capital inflow. At the same time, implementing robust security measures—such as validator deposits, liquidity caps, and self-collateralization mechanisms—is crucial to effectively prevent malicious behavior and systemic risks. These safeguards will build user confidence and enhance market stability and reliability.

Furthermore, strengthening governance and consensus mechanisms is key to ensuring LSDFi’s sustainable growth. Community-driven governance and sound consensus frameworks help protect the rights of stakers and validators, minimizing potential disputes. A healthy public chain ecosystem requires balanced coordination among stakeholders; effective governance and consensus systems will provide LSDFi with a stable operating environment.

Based on this understanding, I believe future LSDFi competition will center on two key opportunities: secure pooled mining and the development of "LSDFi+". By combining these two aspects, we can create a safer, more efficient, and value-added LSDFi ecosystem.

First, to address security concerns, we propose a secure pooled mining module. This module would integrate multiple trusted and secure staking protocols, optimizing, aggregating, and cross-chain coordinating mining opportunities across different protocols. This approach offers users safer and more diversified mining options while reducing potential systemic risks. It would foster a more stable operating environment for the LSDFi market, attracting more participants and increasing funding sources.

Second, we will advance the "LSDFi+" application layer to meet users’ demand for secondary value creation. By introducing innovative SDK-based applications, native tokens can be converted into LSD tokens without unlocking staked assets—improving user experience. Additionally, we will explore new ways to generate added value, such as establishing transparent and operationally robust Venture DAOs, launching well-managed active funds, and offering pre-listing investment opportunities and quantitative strategies. Innovations in the "LSDFi+" space will further expand the scale of the LSDFi market and unlock new avenues for growth.

In conclusion, as a vital component of public blockchain ecosystems, LSDFi’s future development must focus on simplifying staking workflows, introducing security safeguards, and enhancing governance and consensus to achieve long-term sustainability. Meanwhile, market decentralization, the emergence of innovative solutions, and cross-chain collaboration will define the evolving competitive landscape of LSDFi. These trends will drive market prosperity and offer users more choices and improved experiences.

Liquid staking derivatives are gradually gaining market attention. Both centralized and decentralized institutions exhibit distinct competitive advantages. The LSDFi market encompasses numerous domains and projects, offering rich and diverse solutions and functionalities. Market share, TVL, and staking ratios remain key indicators of competitiveness. As time passes and the market evolves, the LSDFi landscape will continue transforming, bringing new competitive dynamics and opportunities.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News