Data Analysis of the LSDFi Sector: Current Landscape and Future Trends

TechFlow Selected TechFlow Selected

Data Analysis of the LSDFi Sector: Current Landscape and Future Trends

This article starts with data to clarify the current state of the LSDFi sector, and explores where LSDFi is headed in the future through analysis of specific projects.

Written by: @Yuki, PSE Trading Analyst

Since Ethereum's transition to PoS, LSDFi has emerged as a compelling new sector. The reason LSDFi captured market attention lies in its innovative use of yield-bearing liquid staking tokens (LSTs). However, as ETH staking rates continue to rise and staking yields decline, the available market space is shrinking, causing LSDFi’s development to stall.

Looking back, we have already gone through three stages of LSDFi evolution: competition among liquid staking protocols, LSTs becoming widely accepted consensus assets within DeFi, and the diversification and large-scale application of LSTs. Now, however, we are clearly entering a period of developmental stagnation. This article aims to clarify the current state of the LSDFi landscape from data analysis and explore where the sector might head in the future through case studies of specific projects.

1. The Current State of LSDFi from Data

1.1 Growth红利 Period Over: Sector Stagnation and Declining Yields Drive Capital Outflows

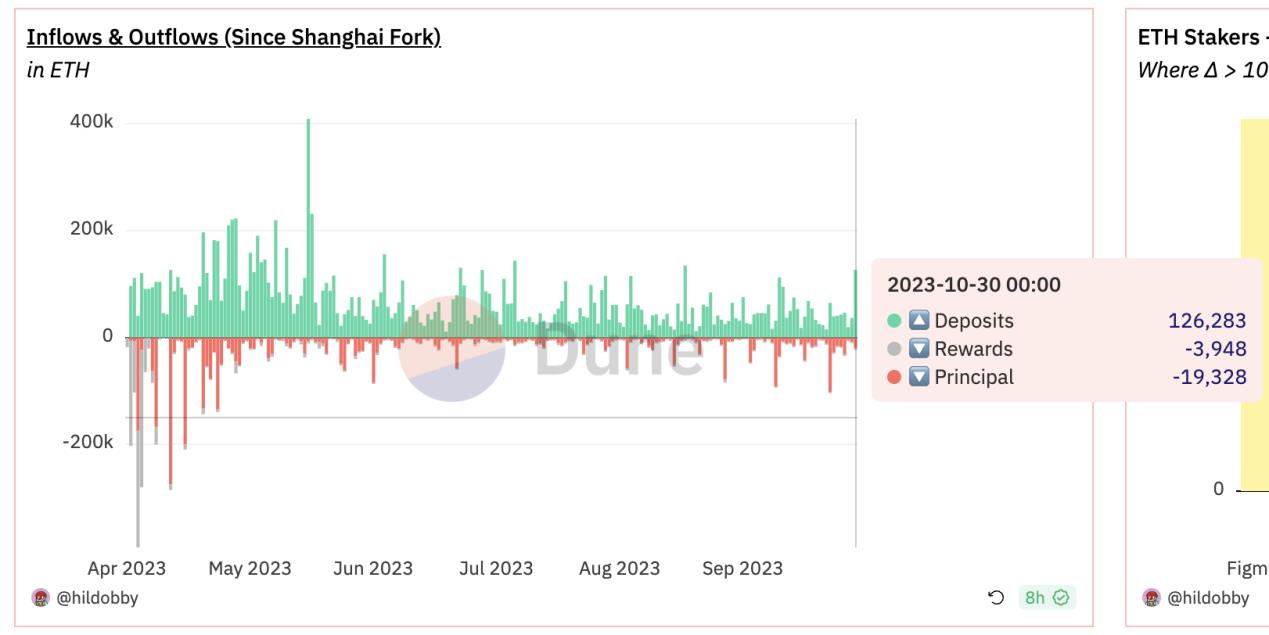

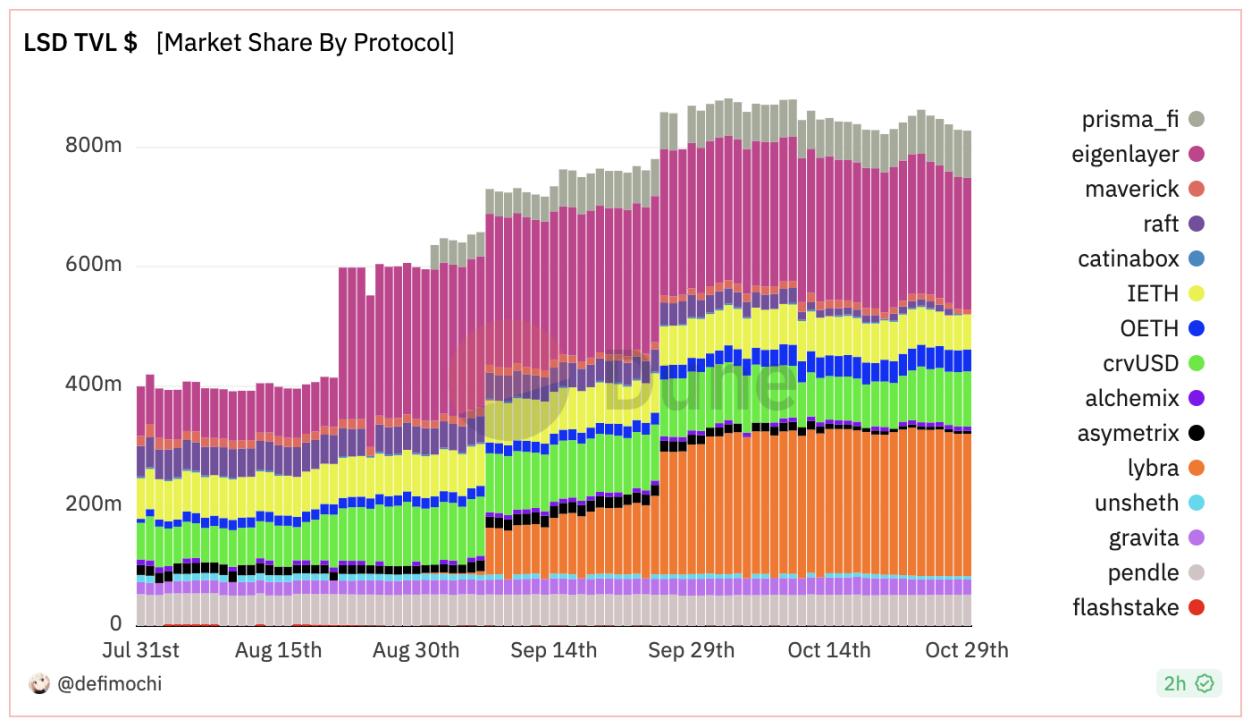

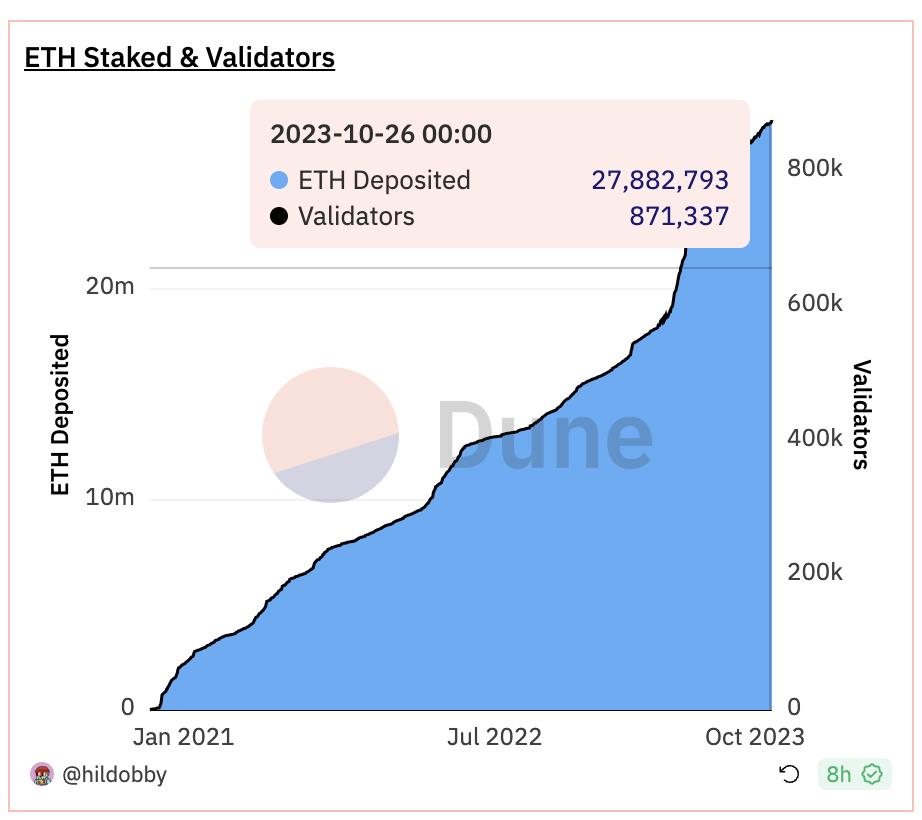

According to data from Dune, net staked ETH has flattened out, and the number of validators waiting in queue continues to decrease—indicating that the explosive growth phase of staking is over. Correspondingly, total TVL in the LSDFi sector (currently at $839M) has seen significantly slowed growth since September 26, even showing signs of negative growth. Without paradigm innovation, it is unlikely that the LSDFi sector will experience substantial expansion in the near future.

There are likely two reasons behind this situation. First, internal growth within Ethereum’s ecosystem has weakened—the rising staking rate on Ethereum leads to declining staking yields (as shown below, base yield now only ~3%+), putting LSDFi protocols into a yield bottleneck and reducing their attractiveness to capital, resulting in fund outflows. Second, external macroeconomic pressures, particularly the rising U.S. Treasury yields under high interest rates in America, are creating a "magnet effect" pulling capital away from crypto into higher-yielding instruments like U.S. Treasuries and DeFi-based synthetic versions of them.

1.2 Severe Homogenization, Intense Competition with Insufficient Innovation

To date, two core components remain shining pillars supporting the entire DeFi system: lending and stablecoins. In the context of LST usage, these two also represent the most fundamental and viable operational models. Based on the yield-generating nature of LSTs, LSDFi projects can be broadly categorized into two types:

-

Using LSTs as collateral in lending or stablecoin protocols (represented by Lybra, Prisma, Raft);

-

Principal-yield separation of LSTs (represented by Pendle);

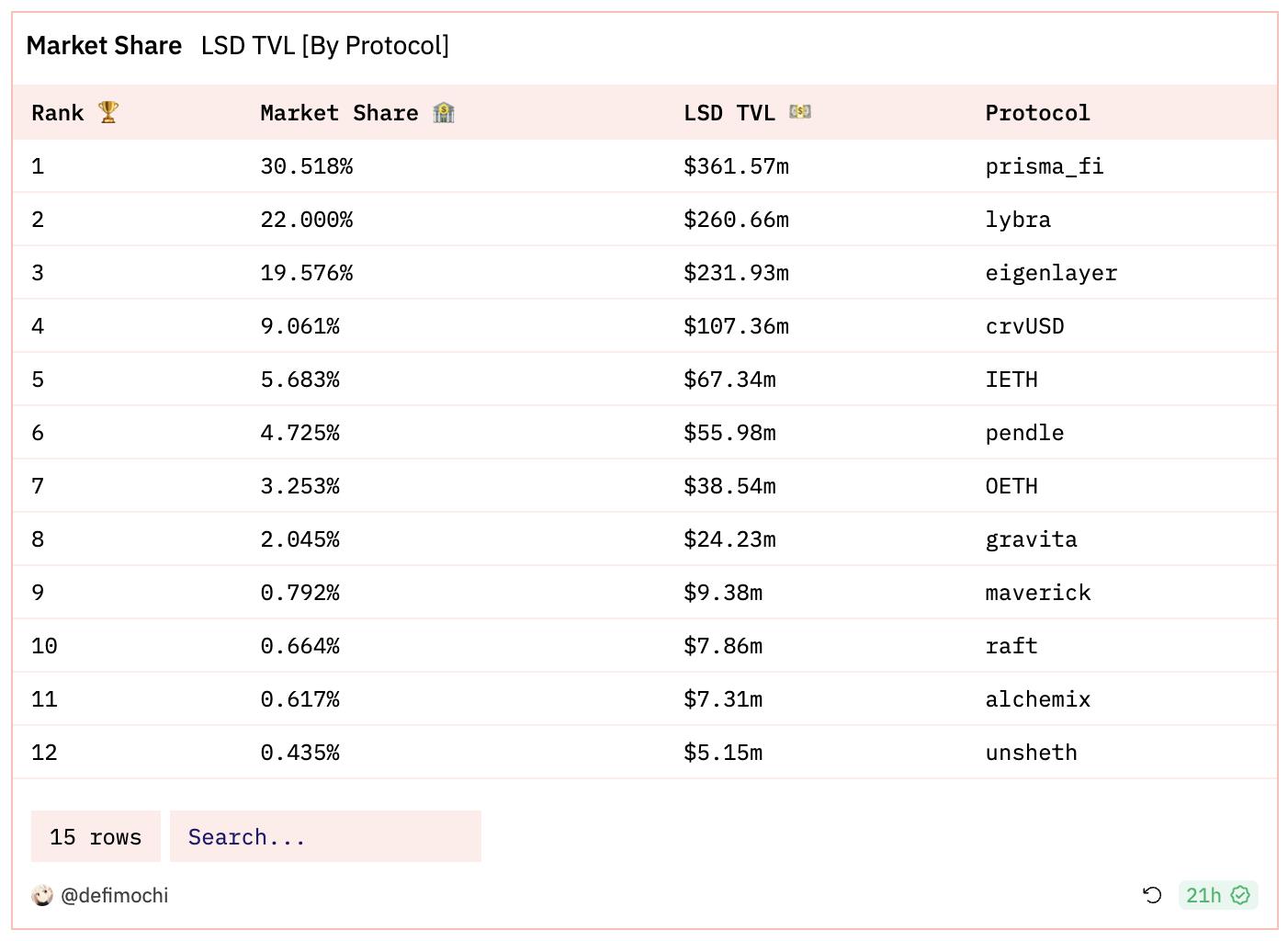

Data from Dune shows that among the top 12 LSDFi projects by TVL, five are stablecoin protocols based on LSTs. Their mechanisms are nearly identical: users deposit LSTs as collateral to mint or borrow stablecoins, and when the value of the collateral drops, it gets liquidated. The few differences lie in the type of stablecoin issued, Loan-to-Value (LTV) ratios, and supported collateral types.

After Terra’s collapse and BUSD was delisted due to regulatory risks, gaps appeared in the stablecoin market. The emergence of yield-bearing LSTs offered an opportunity to build more decentralized alternatives. But after the initial wave, the sector showed weak innovation, merely competing on LTVs, collateral types, and stablecoin yields (mostly subsidized via project tokens—an essentially artificial boost). Latecomers without distinctive advantages face immediate obsolescence upon launch.

Pendle stands out as a unique player in the LSDFi space. Its fixed-rate products are naturally suited for yield-bearing LSTs (e.g., splitting stETH into ETH principal and staking yield components), which explains why Pendle regained center stage post-Ethereum PoS. Currently, through continuous product iteration, Pendle maintains strong market share, with no equally powerful competitor yet emerging.

1.3 Lack of Pricing Power Among Leaders, Long-Term Growth Unsecured

In DeFi, we can say Aave dominates lending, Curve leads in stablecoin DEXes, and Lido leads in Ethereum liquid staking. These projects have achieved pricing power in their respective domains. By “pricing power,” I mean a barrier formed by a combination of monopoly and essential demand—creating dominance and brand recognition in markets with strong underlying needs (with far-leading market share).

What does having pricing power imply? At minimum, it suggests two key advantages: superior business model and secured long-term growth. In short, true moats are those backed by real pricing power.

Yet looking at LSDFi projects today—even market leader Lybra Finance—none have established such pricing power. In V1, Lybra surged ahead with an exceptionally high yield (>8%), much higher than base Ethereum staking returns, quickly attracting significant TVL. However, its V2 upgrade failed to drive further growth and instead saw its market share eroded by newer entrants like Prisma and EigenLayer.

The root cause of this awkward situation is threefold: first, technical barriers at the protocol layer are low—many LSD stablecoin protocols are direct forks of Liquity, meaning fierce competition is inevitable. Second, LSDFi projects are not issuers of LSTs themselves—they rely fundamentally on ETH's own staking yield for liquidity redistribution. Third, minimal differentiation exists between projects, so market share often shifts based on yield fluctuations, while leading projects have yet to establish self-sustaining ecosystems with absolute internal pricing authority.

The absence of pricing power implies that any current success may be temporary—no one has found the key to sustainable long-term growth.

1.4 Unsustainable Token Subsidies, Weak Stablecoin Liquidity

LSDFi initially attracted massive TVL through high yields, but a closer look reveals these yields were largely funded by token subsidies—effectively pre-diluting governance token value, making such high returns unsustainable.

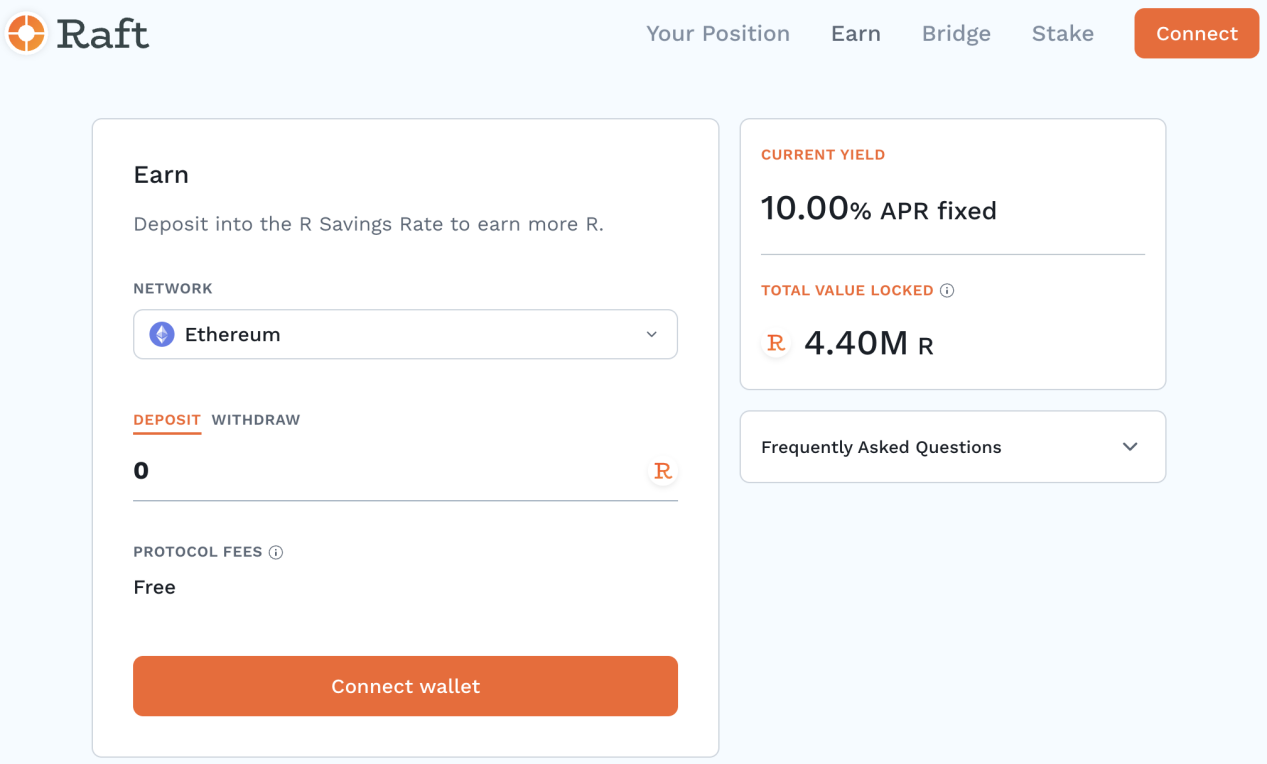

Take Raft as an example. With its V2 launch, Raft introduced a Savings Module offering a 10% fixed APR to $R holders who deposit funds, but did not disclose the source of this yield (officially stating only that it comes from protocol revenue). Across all of DeFi, very few projects offer 10% low-risk yields, raising suspicions that Raft may be minting $R out of thin air to create this seemingly attractive APR narrative.

Notably, Raft’s borrowing interest rate is currently 3.5%, meaning users who mint $R and deposit it into RSM can earn at least a 6.5% arbitrage profit.

For decentralized stablecoins, liquidity remains the biggest factor limiting scale. Liquity failed to break out during the last bull run because its liquidity couldn’t meet user demand. Today, DAI remains the most liquid decentralized stablecoin. Similarly, current LSD-backed stablecoins face similar issues—shallow liquidity pools, limited use cases, and insufficient real user demand.

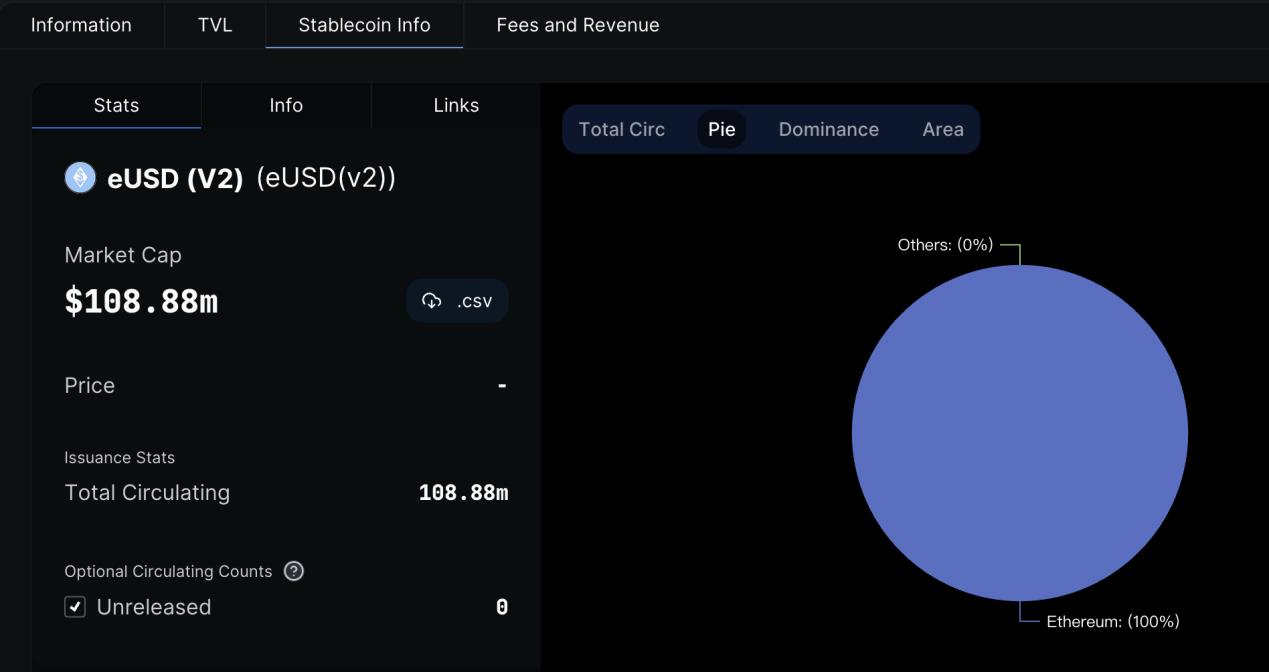

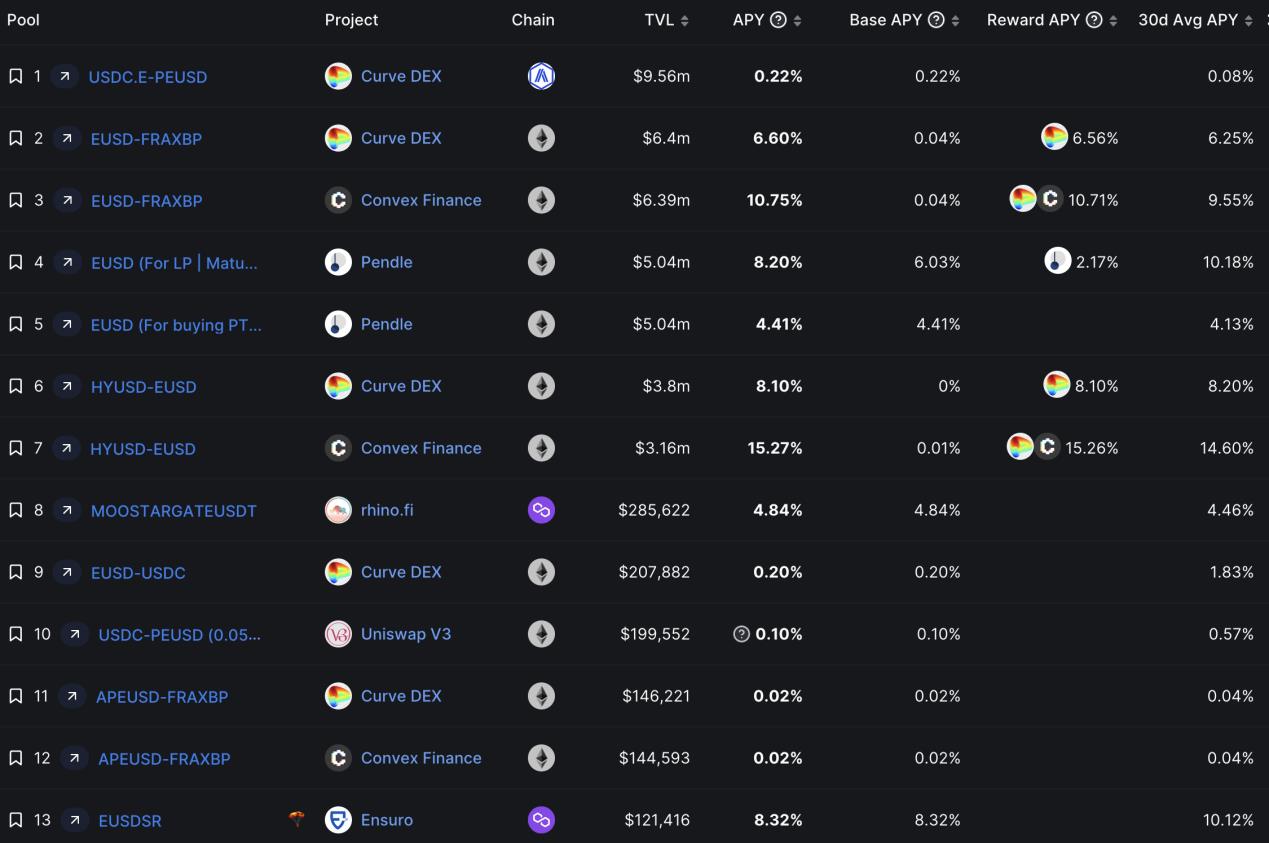

Take eUSD launched by Lybra: it currently has a supply of $108M, but its deepest pool is only the peUSD pool on Arbitrum (peUSD being the cross-chain version of eUSD). On Curve, the eUSD-USDC pool depth is just $207K, indicating inconvenient exchange with centralized stablecoins, which negatively impacts user experience.

2. Case Studies: Seeking Breakthroughs in LSDFi’s Development Dilemma

Although the LSDFi sector as a whole faces a development bottleneck, some projects are actively seeking change. From these efforts, we may draw insights and inspiration for overcoming current challenges.

2.1 Building Ecosystems to Compensate for Economic Model Weakness and Establish Pricing Power: Examples from Pendle and Lybra V2

A shared, seemingly unsolvable issue across LSDFi projects today is subsidizing user yields with governance tokens, which dilutes token value and ultimately turns them into worthless “mining coins.”

A viable and instructive solution is building an ecosystem around the protocol—leveraging ecosystem projects to strengthen economic sustainability and establish internal pricing dominance.

2.1.1 Pendle

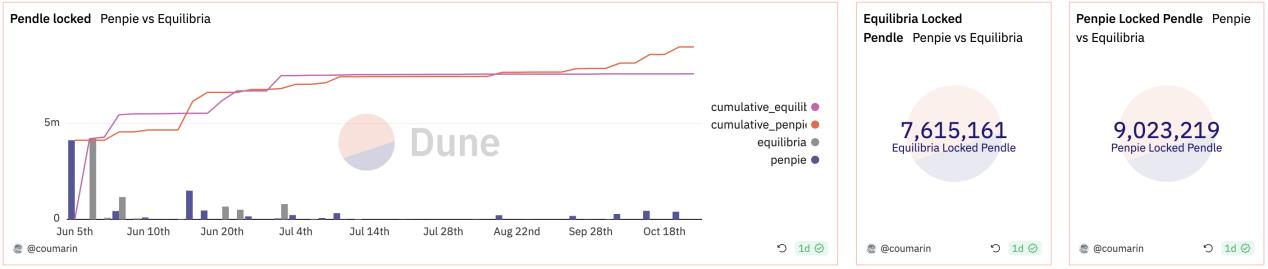

Pendle is currently the most successful example implementing this strategy. Penpie and Equilibria are auxiliary protocols built atop Pendle’s veTokenomics to boost PENDLE LP rewards. LPs don’t need to stake PENDLE directly but still benefit from boosted mining yields. While their business models are similar, both primarily help absorb selling pressure on PENDLE’s governance token, contributing to healthier overall development.

2.1.2 Lybra Finance

After failing to achieve meaningful growth following its V2 launch, Lybra began intentionally cultivating its own ecosystem. On October 13, Lybra officially announced the start of “Lybra War” as its next strategic focus.

Lybra openly launching Lybra War reflects its awareness of several critical issues:

1) High inflation of governance token LBR due to sustained high APRs, with V2 mining events causing heavy short-term sell-offs;

2) Fierce competition from peers (e.g., Prisma, Gravita, Raft) amid lack of investor backing;

3) Insufficient eUSD liquidity, with slower-than-expected adoption of peUSD;

4) Weakened community trust—questions arose over handling of un-migrated tokens during V1-to-V2 transition (one individual effectively decided voting outcomes).

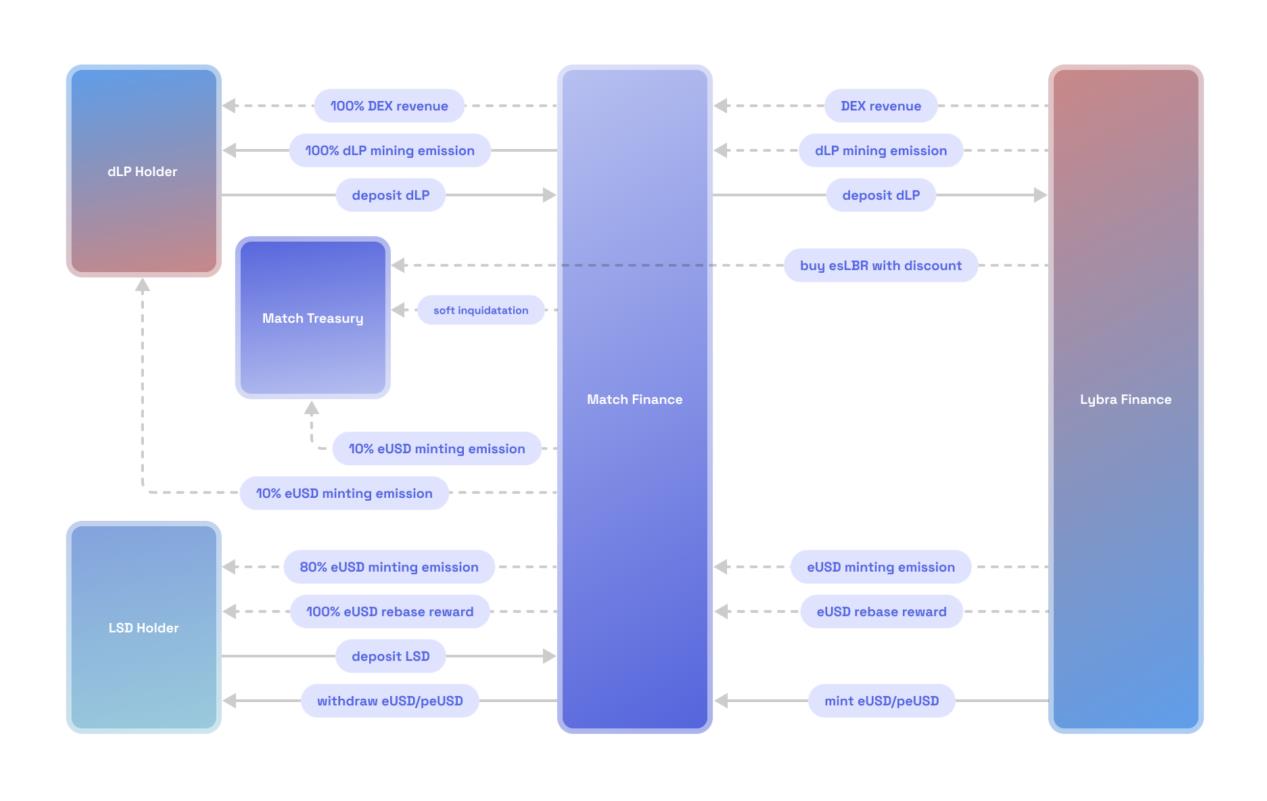

The core of Lybra War lies in accumulating dLPs and achieving dynamic matching between dLPs and eUSD. Under Lybra V2, users must stake at least 2.5% of their eUSD value in LBR/ETH dLP to receive esLBR emissions. Thus, second-layer protocols in Lybra’s ecosystem must boost esLBR and dLP yields to capture more esLBR. Additionally, allocation rights depend on esLBR emissions across LSD pools, with primary demand coming from LST issuers and large eUSD minter. Smaller LST issuers may find shallower LSD pools favorable for accumulating esLBR and increasing voting power.

Currently, only Match Finance participates deeply in Lybra War, with no effective competitive dynamics yet formed. Match Finance addresses two main issues (mechanics not elaborated here):

1) Users unable to earn esLBR incentives when minting eUSD without holding dLP;

2) Yield boosting for esLBR and exit liquidity solutions.

As protocol-layer players in LSDFi, neither Lybra nor Pendle are LST issuers. While they accumulated significant TVL early via high APRs, this also planted a seed of instability. For sustainable growth, both chose to develop ecosystems that continuously support their core protocols. Any ambitious top-tier LSDFi project will likely follow this path.

2.2 Micro-Innovations for Differentiated User Experience

For non-leader projects, surviving in a fiercely competitive sector hinges on finding a distinct niche. Even micro-innovations can attract specific vertical users—if retention is high enough, survival becomes possible.

2.2.1 No Liquidation: Example from CruiseFi

While most projects compete on LTV and collateral types, some have introduced “no-liquidation” mechanisms to attract attention.

Take CruiseFi: users deposit stETH to mint stablecoin USDx, then swap USDx for USDC via Curve’s USDC-USDx pool. Lenders providing USDC to Curve’s stablecoin pool receive stETH staking yield during the period.

How is perpetual non-liquidation ensured? When liquidation would occur:

1) The protocol locks part of the collateral (stETH), allocating its staking yield to borrowers;

2) Positions exceeding stETH yield are paused, ensuring yield always covers borrowing cost—effectively preventing borrower liquidation. However, downside: stETH yield declines as overall ETH staking rate rises;

3) For paused positions, corresponding Price Recovery Tokens (PRT) are issued. PRT can be redeemed 1:1 for ETH (only above liquidation threshold) and traded freely on secondary markets.

Benefits include extended solvency for borrowers, lenders earning staking yield, and PRT holders gaining upside from future ETH price appreciation. “No liquidation” holds appeal for risk-tolerant users in bull markets.

2.2.2 Composite Yield Generation: Example from Origin Ether

In DeFi, yield remains the most compelling narrative—and this rule still applies in LSDFi.

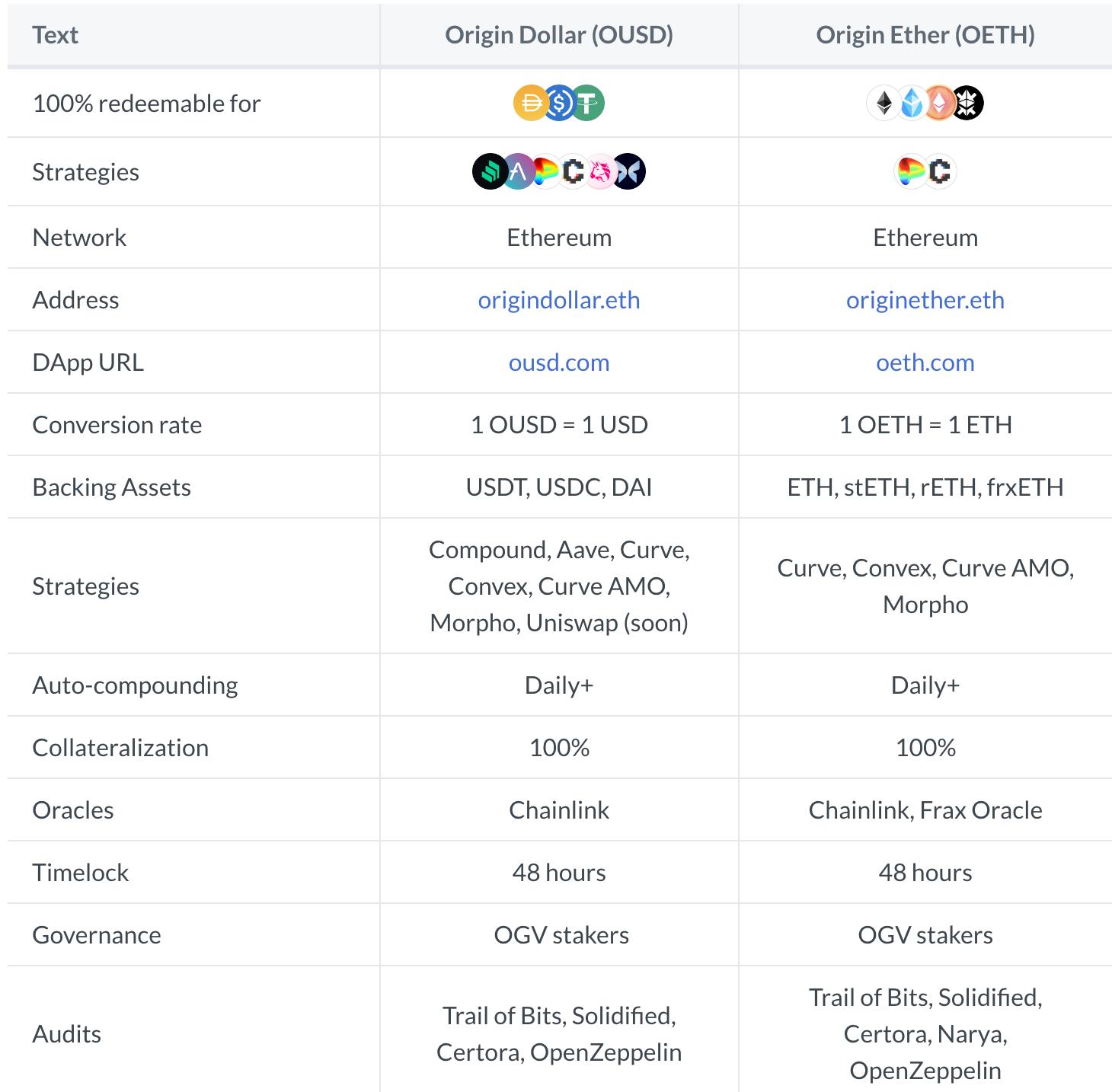

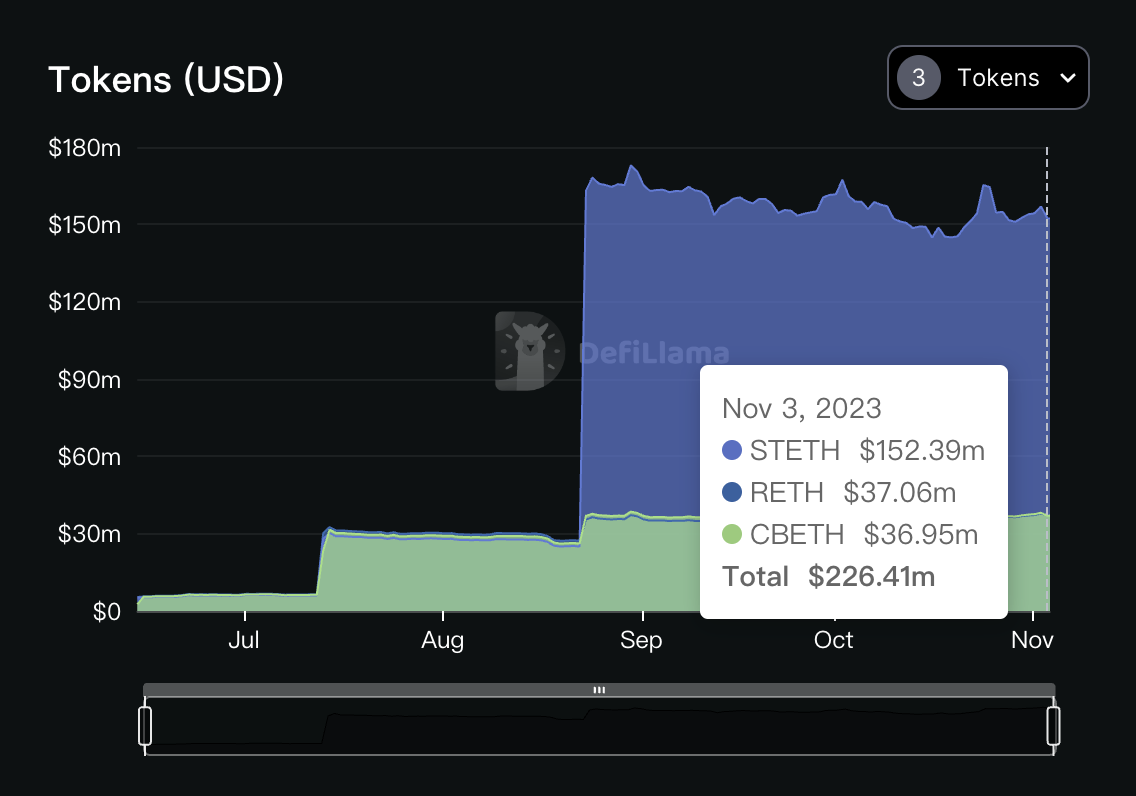

Origin Ether launched in May 2023, accepting ETH and other LSTs as collateral, with 1 OETH always valued at 1 ETH.

Origin Ether differs from others by drawing yield from a basket of LST assets including stETH, rETH, and sfrxETH. Furthermore, OETH employs AMO strategies via OETH-ETH pools on Curve and Convex, and supports additional strategies on Balancer, Morpho, and other ETH-denominated Curve pools. Through optimized liquidity strategies, Origin Ether delivers APY above market average—explaining its rapid TVL accumulation in recent months (OETH currently ranks seventh in sector market share).

2.2.3 Recursive Composability: LRTFi Built on Eigenlayer

LSDFi, as a recursive layer atop LSD, has reached a bottleneck. However, Eigenlayer’s emergence could trigger another level of recursion—LRTFi—which represents not only further leverage but also a chance for LSDFi to re-center itself and expand outward.

Though Eigenlayer remains in closed testing and hasn’t opened to all users, previous test staking rounds generated immense market enthusiasm.

Meanwhile, numerous projects based on LRT (Liquid Restaking Token) have emerged, such as Astrid Finance and Inception. These lack fundamental innovation but extend LSDFi logic by adding LRTs as acceptable collateral. Competition among them is expected to intensify once Eigenlayer fully launches—still early days.

2.3 Backed by Capital, Tied to Established Projects, Riding Other Ecosystem Waves: Example from Prisma

If a latecomer wants to surpass rivals in a volatile sector without achieving paradigm innovation, securing strong backing and leveraging existing ecosystem momentum becomes an effective shortcut—call it “cheating the system” or “finding a daddy.”

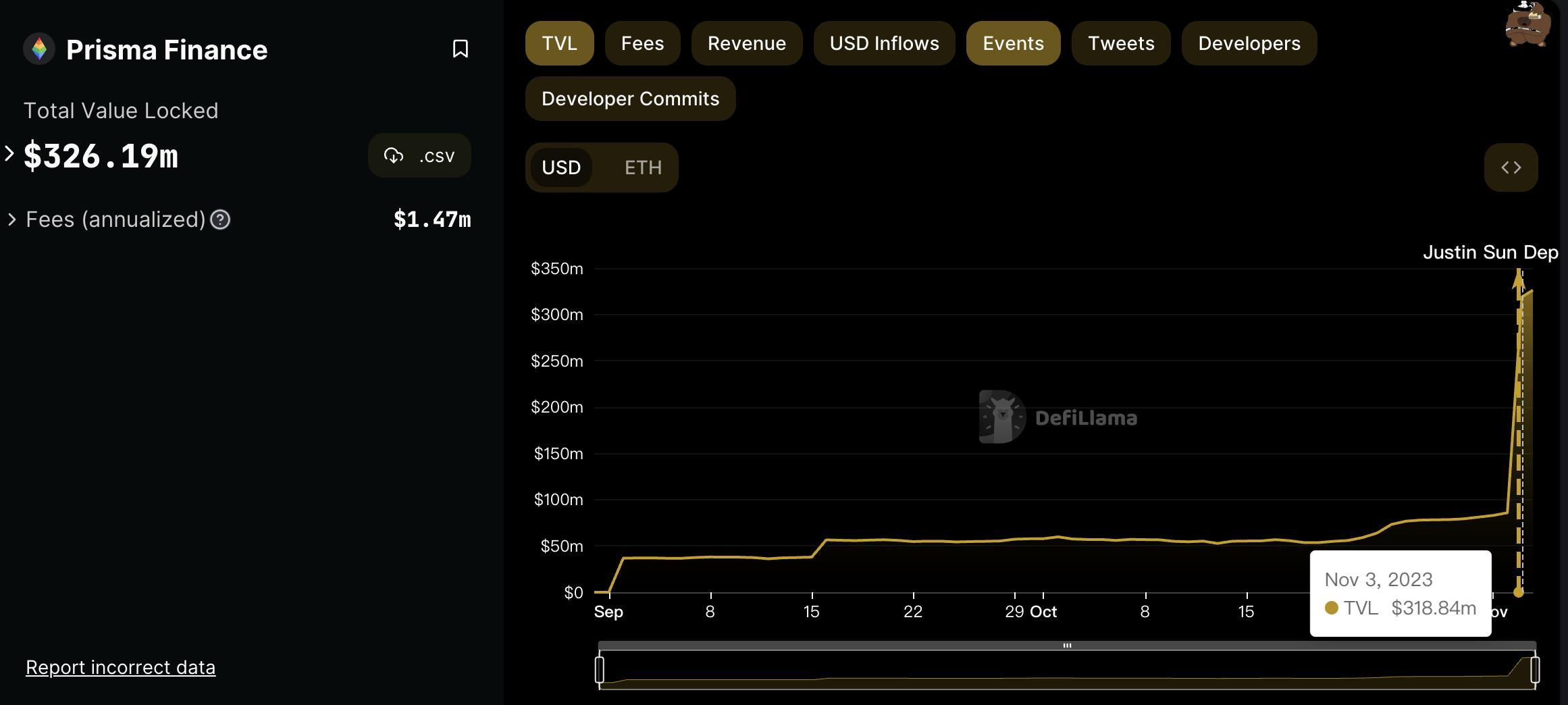

Prisma Finance exemplifies this success story. Unlike grassroots projects like Lybra Finance (community-launched, no private funding), Prisma was born privileged. Before launching any product, it captured market attention with a polished press release—not due to novel mechanics, but thanks to its investor list featuring DeFi OGs like Curve and Convex, plus major institutions like OKX and The Block.

Subsequently, Prisma followed through—tying closely to Curve and Convex, receiving their support in the form of extra rewards for native stablecoin mkUSD (paid in CRV/CVX), and leveraging veTokenomics (control over protocol parameters) to create a flywheel effect.

By its third month post-launch, Prisma achieved an all-time-high TVL, surpassing Lybra as the new sector leader, fueled by Justin Sun’s $100 million wstETH backing.

2.4 True Paradigm Innovation

Whether industry-wide or sector-specific, after periods of unchecked growth, bottlenecks inevitably arise. The ultimate solution? Nothing less than “paradigm innovation.” While LSDFi hasn’t seen transformative breakthroughs yet, I firmly believe that as long as Ethereum’s value remains a strong consensus, a paradigm-shifting innovation will eventually emerge—reigniting the flames of LSDFi once again.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News