The Next Trillion-Dollar Battleground for RWAs: How the Founder of Booking.com, Partnering with Staynex, Is Restructuring Liquidity for Hospitality Assets via a “Blockchain-Based Travel Platform”

TechFlow Selected TechFlow Selected

The Next Trillion-Dollar Battleground for RWAs: How the Founder of Booking.com, Partnering with Staynex, Is Restructuring Liquidity for Hospitality Assets via a “Blockchain-Based Travel Platform”

Staynex’s solution may well be the best example of how RWAs can achieve mass adoption.

In the RWA (Real-World Assets) sector, the U.S. Treasury story has already been thoroughly told. The market is now searching for the next asset class capable of absorbing large-scale liquidity while supporting high-frequency consumption use cases. When the trillion-dollar global travel market meets Web3’s asset allocation demands, a paradigm shift toward “consumer finance” is underway. Staynex’s answer may well be the best-case example of RWA achieving mass adoption.

Breaking Through: From “Consumptive Travel” to “Asset-Based Travel”

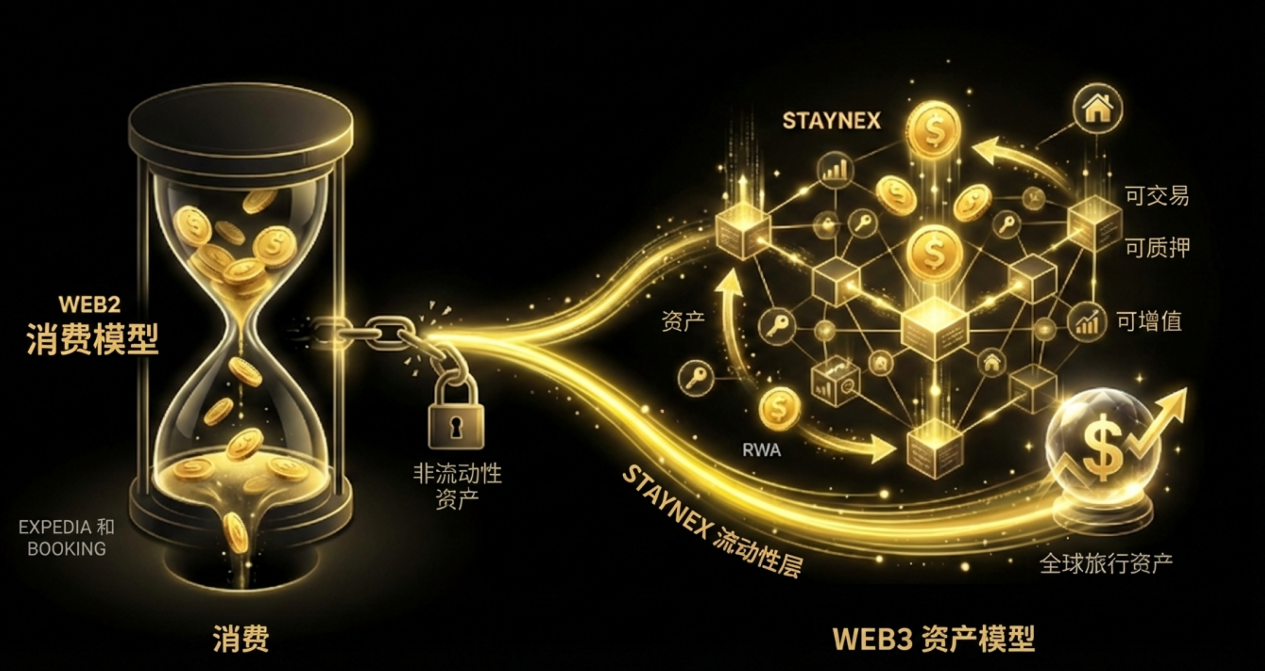

Over the past two decades, Expedia and Booking have dominated the global travel market, building a linear “book-consume-end” model. In this model, users’ funds are purely consumptive, while hotels’ forward room rights sell at a discount due to illiquidity.

This structural gap represents precisely the opportunity where Web3 can intervene.

Staynex does not aim to build a “decentralized Ctrip.” Its ambition is to construct a Liquidity Layer for global travel assets. By tokenizing “travel rights,” Staynex breaks open the walled gardens of traditional OTAs. Here, a hotel booking is no longer merely a consumption act—it becomes an RWA asset certificate that is tradable, stakable, and appreciable.

This marks travel’s formal transition from Web2’s “information-matching” era into Web3’s “asset-interaction” era.

Deconstructing Staynex: A Commercial Closed Loop Built on RWA + DeFi

Most “Web3 travel” projects in the market have failed due to lack of organic revenue generation. Staynex stands apart thanks to its robust underlying assets and the StayLP mechanism.

- Hard-Connected Asset Side: Unlike vaporware projects, Staynex has already mapped resources across more than 2.65 million hotels worldwide. This means its on-chain assets are backed by real-world fulfillment value (Book Value).

- StayLP Transforms Consumers into Network Shareholders: This is the core of Staynex’s economic model. Traditional hotel loyalty points are dead assets—redeemable only, non-monetizable. StayLP, by contrast, assets those rights. Participating in StayLP makes users “liquidity providers” for this global travel network. In return, they earn not just discounts—but also platform growth dividends and passive yield.

This model skillfully transforms “travelers” into “shareholders,” solving the persistent pain point of high customer acquisition costs for traditional platforms—and providing users with stable RWA returns.

The Anchor of Trust: Booking’s Co-Founder Joins

In the crypto industry, team background often defines a project’s ceiling.

Staynex’s most striking endorsement comes from its Chairman, Jeff Hoffman. As co-founder of Priceline (Booking.com’s parent company), Jeff is a godfather figure in the global online travel industry. His involvement sends a powerful signal: top-tier Web2 executives are stepping directly into the arena—rebuilding, with Web3 technology, the very industries they once created.

Additionally, technical infrastructure support from Huawei and Tencent Cloud, alongside participation from top-tier market maker Wintermute, has built institutional-grade security and liquidity moats around Staynex. This is no longer a scrappy startup story—it’s a systematic, high-caliber offensive.

Why Staynex May Be Web3’s Breakout Catalyst

What is Web3’s biggest pain point today? It’s internal cannibalization. If this bull run consists solely of insiders trading among themselves, the industry’s ceiling will remain capped. For Web3 to achieve true breakout growth, it must accomplish one critical task: onboard new users and new capital from outside the ecosystem.

This is Staynex’s true strategic value.

1. You cannot onboard someone who has never touched crypto through complex DeFi protocols. But everyone travels. Staynex chose a trillion-dollar sector—one that 99% of people globally understand and willingly pay for: travel. Leveraging AI assistants and seamless blockchain infrastructure, it dramatically lowers the barrier to entry.

2. Unlocking the pipeline for trillion-dollar inflows. Traditional crypto projects often lack external revenue generation. Staynex, however, connects to the hospitality and travel market—the most cash-rich segment of the real economy. When ordinary users pay fiat via Staynex to book hotels or purchase memberships, these funds—previously circulating only in Web2—are injected into the Web3 ecosystem as RWAs.

In the fast-paced, ever-shifting crypto market, projects that endure cycles must possess two qualities: first, solving genuine real-world problems; second, sustaining a commercially viable closed loop.

Staynex stands precisely at the intersection of RWA and consumer internet. It demonstrates to the market that travel need not be mere wealth consumption—it can also be wealth extension. With the global travel market recovering and the RWA narrative gaining momentum, Staynex is opening a trillion-dollar door to “financialized travel.”

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News