2026 Institutional-Grade RWA Infrastructure Review: Market Nears $20 Billion Mark, Sub-Sectors Showcase Strength

TechFlow Selected TechFlow Selected

2026 Institutional-Grade RWA Infrastructure Review: Market Nears $20 Billion Mark, Sub-Sectors Showcase Strength

The institutional RWA landscape at the beginning of 2026 reveals an unexpected trend: there is no single winner, because there is no single market.

Author: Mesh

Translation: TechFlow

To be honest, the development of institutional-grade RWA (real-world asset) tokenization over the past six months deserves close attention. The market size is approaching $20 billion. This isn't hype—it's real institutional capital being deployed on-chain.

I've been following this space for a while, and the pace of recent developments is astonishing. From government bonds and private credit to tokenized stocks, these assets are moving onto blockchain infrastructure faster than the market anticipated.

Currently, five protocols have emerged as foundational players in this domain: Rayls Labs, Ondo Finance, Centrifuge, Canton Network, and Polymesh. They aren’t competing for the same clients but instead address different institutional needs: banks require privacy, asset managers seek efficiency, and Wall Street firms demand compliance-ready infrastructure.

This isn’t about who “wins,” but rather which infrastructure institutions choose—and how trillions of dollars in traditional assets will migrate through these tools.

The Overlooked Market Is Nearing the $20 Billion Mark

Three years ago, tokenized RWAs barely qualified as a category. Today, on-chain assets including treasury bonds, private credit, and public equities are nearing $20 billion—up significantly from the $6–8 billion range at the beginning of 2024.

To be frank, the breakdown by segment is even more interesting than the total figure.

According to an early-January 2026 market snapshot provided by rwa.xyz:

- Treasury bonds and money market funds: ~$8–9 billion, accounting for 45%–50% of the market

- Private credit: $2–6 billion (smaller base but fastest-growing, 20%–30% share)

- Public stocks: over $400 million (rapid growth, primarily driven by Ondo Finance)

Three Key Drivers Accelerating RWA Adoption:

- Yield arbitrage appeal: Tokenized treasury products offer 4%–6% returns with 24/7 access, compared to T+2 settlement cycles in traditional markets. Private credit instruments yield 8%–12%. For corporate treasurers managing billions in idle capital, the math is compelling.

- Regulatory frameworks maturing: The EU’s Markets in Crypto-Assets Regulation (MiCA) is now enforceable across all 27 member states. The SEC’s Project Crypto is advancing an on-chain securities framework. Meanwhile, No-Action Letters allow infrastructure providers like DTCC to tokenize assets.

- Maturity of custody and oracle infrastructure: Chronicle Labs has processed over $20 billion in total value secured, and Halborn has completed security audits for major RWA protocols. These systems are now robust enough to meet fiduciary standards.

Nonetheless, the industry still faces significant challenges. Cross-chain transaction costs are estimated at up to $1.3 billion annually. Price spreads of 1%–3% persist across blockchains due to higher capital transfer costs than arbitrage gains. The tension between privacy needs and regulatory transparency demands remains unresolved.

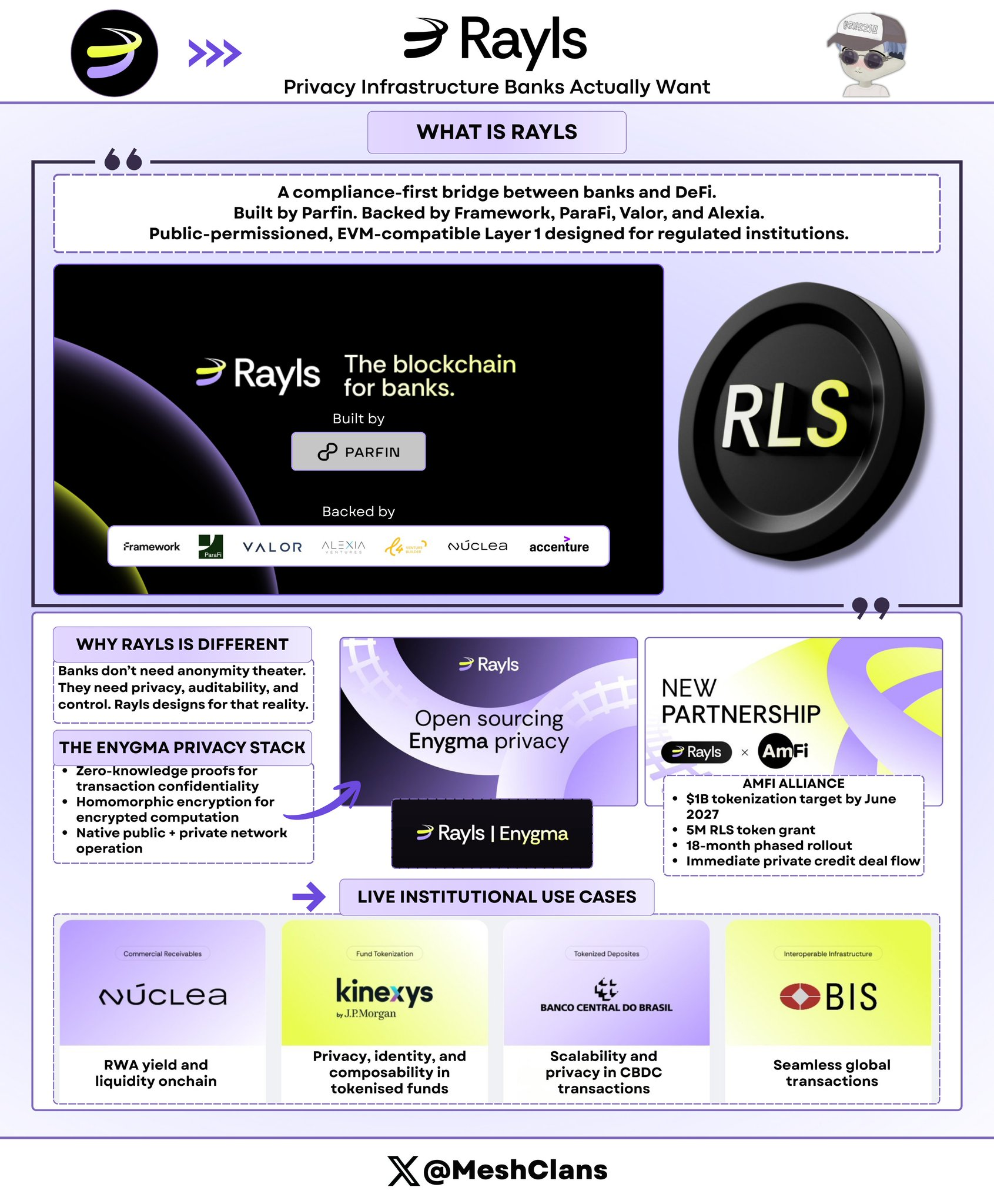

Rayls Labs: The Privacy Infrastructure Banks Actually Need

@RaylsLabs positions itself as a compliance-first bridge connecting banks to decentralized finance (DeFi). Developed by Brazilian fintech Parfin and backed by Framework Ventures, ParaFi Capital, Valor Capital, and Alexia Ventures, its architecture is a public-permissioned, EVM-compatible Layer 1 blockchain designed specifically for regulated institutions.

I’ve been tracking the development of its Enygma privacy tech stack for some time. The key isn’t technical specs, but methodology. Rayls is solving real problems that banks face—not imagined needs shaped by DeFi community assumptions.

Core Features of the Enygma Privacy Stack:

- Zero-Knowledge Proofs: Ensure transaction confidentiality

- Homomorphic Encryption: Enable computation on encrypted data

- Native operations across public chains and private institutional networks

- Confidential Payments: Support atomic swaps and embedded Delivery-versus-Payment (DvP)

- Programmable Compliance: Selective data disclosure to designated auditors

Real-World Use Cases:

- Banco Central do Brasil (Central Bank of Brazil): Pilot for cross-border CBDC settlements

- Núclea: Regulated accounts receivable tokenization

- Multiple undisclosed node clients: Private DvP workflows

Latest Developments

On January 8, 2026, Rayls announced successful completion of a security audit by Halborn. This provides institutional-grade validation of its RWA infrastructure—an important signal for banks evaluating production deployment.

In addition, the AmFi Consortium has set a goal to tokenize $1 billion in assets on Rayls by June 2027, supported by a 5 million RLS token incentive program. AmFi, Brazil’s largest private credit tokenization platform, brings immediate transaction volume and sets concrete 18-month milestones. This represents one of the largest institutional RWA commitments in any blockchain ecosystem to date.

Target Market & Challenges

Rayls targets banks, central banks, and asset managers requiring institutional-grade privacy. Its public-permissioned model restricts validator participation to licensed financial institutions while ensuring transactional confidentiality.

However, Rayls’ challenge lies in proving market traction. Without public TVL (total value locked) data or announced client deployments beyond pilots, the AmFi $1 billion target by mid-2027 becomes a critical benchmark.

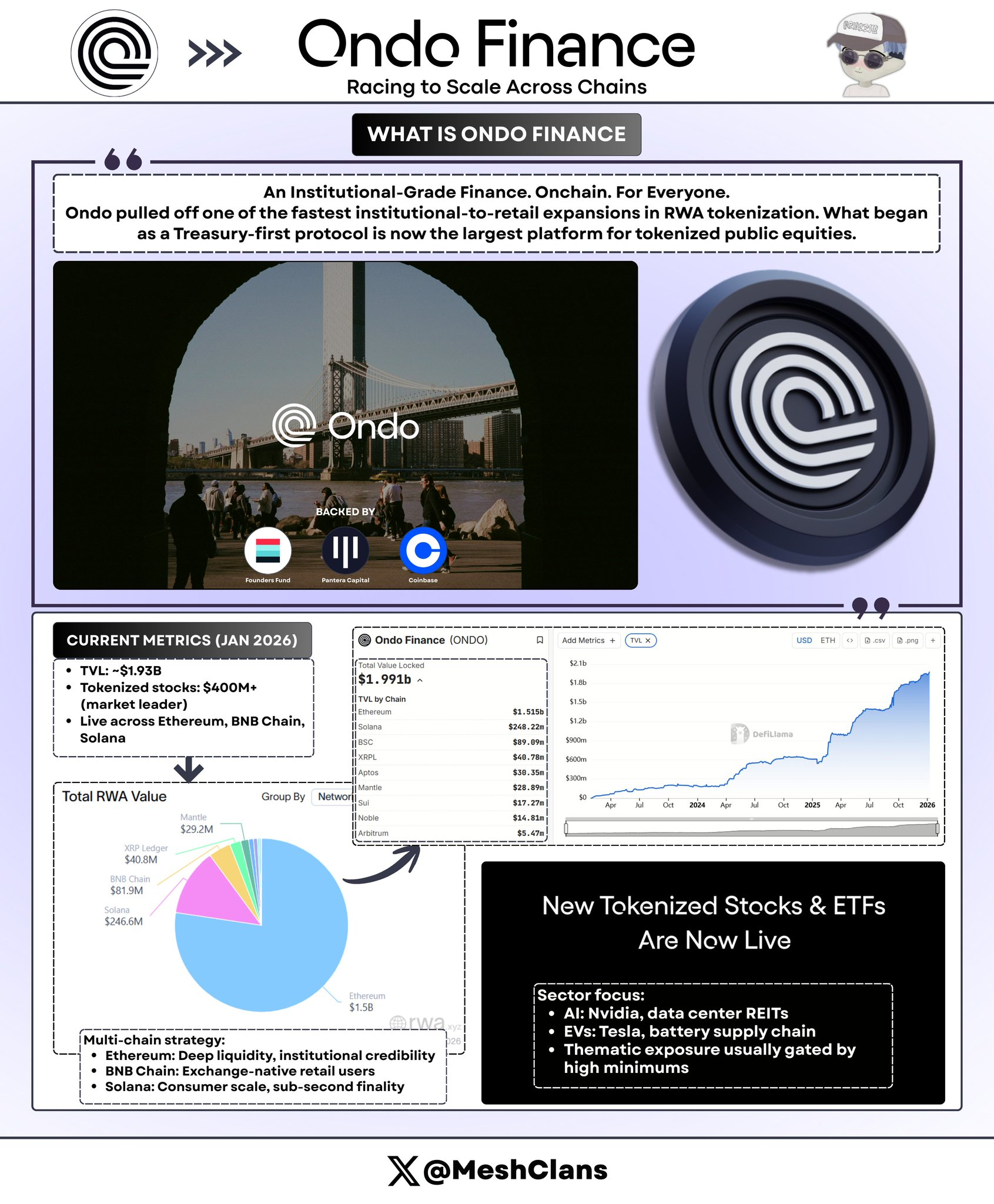

Ondo Finance: The Race for Cross-Chain Expansion

@OndoFinance has achieved the fastest expansion from institutional to retail adoption in the RWA tokenization space. Starting as a treasury-focused protocol, it is now the leading platform in tokenized public equities.

Latest Data as of January 2026:

- Total Value Locked (TVL): $1.93 billion

- Tokenized Stocks: Over $400 million, capturing 53% market share

- USDY holdings on Solana: ~$176 million

I personally tested the USDY product on Solana—the user experience was seamless. Combining institutional-grade treasuries with DeFi convenience is exactly the right formula.

Recent Updates

On January 8, 2026, Ondo launched 98 new tokenized assets simultaneously, covering stocks and ETFs in AI, EV, and thematic investing. This is not a small test—it’s full-speed execution.

Ondo plans to launch tokenized U.S. stocks and ETFs on Solana in Q1 2026—the most aggressive move yet into retail-friendly infrastructure. According to its roadmap, it aims to list over 1,000 tokenized assets as expansion continues.

Focus Areas:

- Artificial Intelligence: Nvidia, data center REITs

- Electric Vehicles: Tesla, lithium battery manufacturers

- Thematic Investing: Niche sectors previously limited by high minimum investments

Multi-Chain Deployment Strategy

- Ethereum: DeFi liquidity and institutional legitimacy

- BNB Chain: Access to exchange-native users

- Solana: Scalability for mass consumer use, sub-second finality

To be clear, Ondo’s TVL reaching $1.93 billion despite a falling token price is the most important signal: protocol growth is outpacing speculation. This growth is driven by institutional demand for treasury yields and DeFi protocols seeking yield on idle stablecoins. TVL increases during Q4 2025 market consolidation indicate real demand—not just chasing trends.

Through custodial partnerships with broker-dealers, passing Halborn audits, and launching products across three major blockchains within six months, Ondo has built a lead competitors struggle to match. For example, rival Backed Finance has only around $162 million in tokenized assets.

Still, Ondo faces challenges:

- Price volatility outside trading hours: While tokens can be transferred anytime, pricing still references exchange hours, potentially creating arbitrage gaps during overnight U.S. trading sessions.

- Compliance constraints: Securities laws require strict KYC and accreditation checks, limiting the "permissionless" narrative.

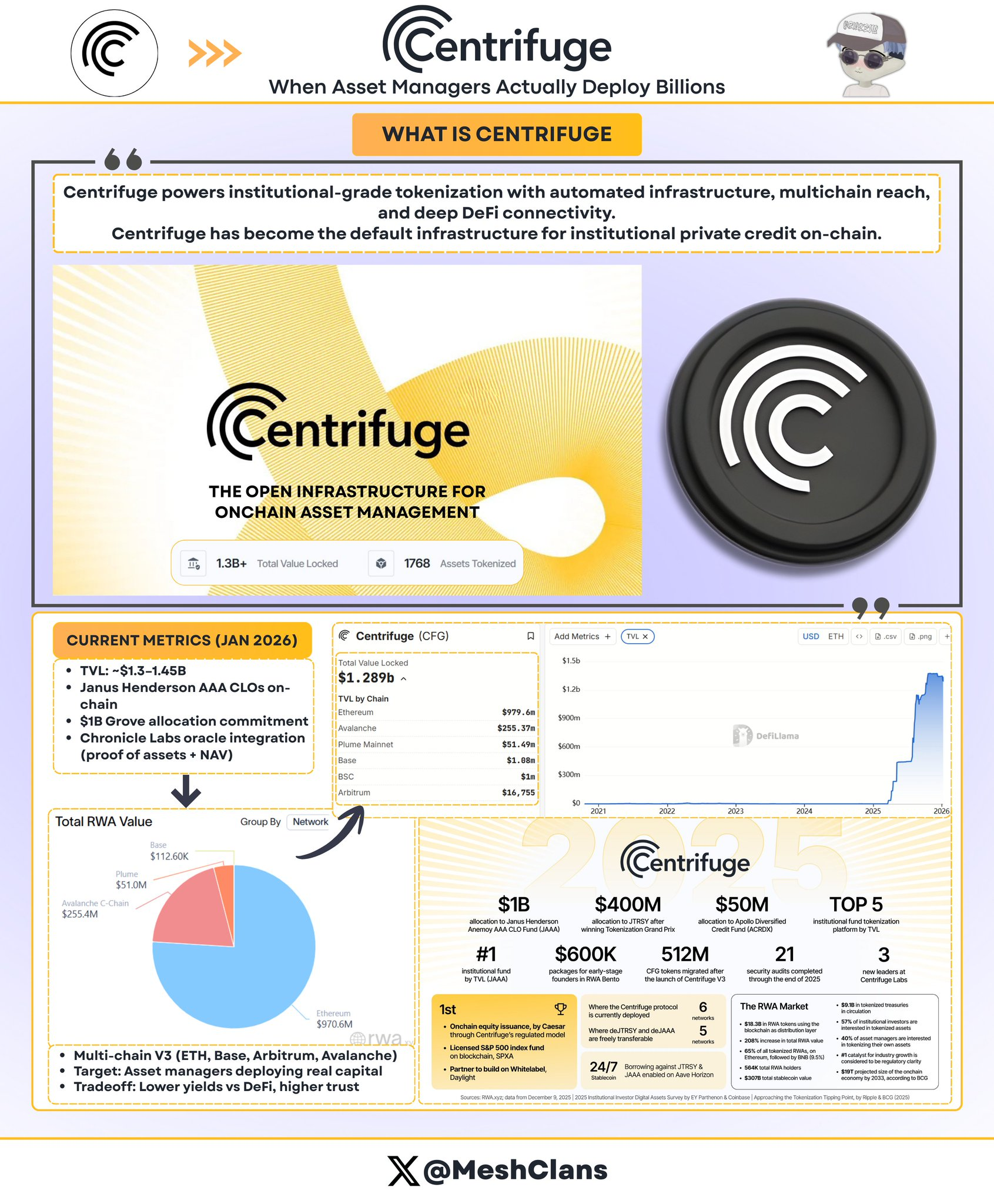

Centrifuge: How Asset Managers Deploy Billions for Real

@centrifuge has become the de facto infrastructure standard for institutional private credit tokenization. As of December 2025, the protocol’s TVL surged to $1.3–1.45 billion, driven by actual institutional capital deployment.

Major Institutional Deployments

- Partnership with Janus Henderson (global asset manager with $373B AUM)

- Anemoy AAA CLO Fund: Fully on-chain AAA-rated Collateralized Loan Obligation

- Managed by the same portfolio team overseeing their $21.4B AAA CLO ETF

- Expansion plan announced in July 2025 to add $250M on Avalanche

- Grove capital allocation (institutional credit protocol within Sky ecosystem)

- Capital commitment strategy up to $1 billion

- Initial deployment capital: $50 million

- Founding team from Deloitte, Citigroup, BlockTower Capital, Hildene Capital Management

- Chronicle Labs oracle partnership (announced January 8, 2026)

- Proof of Asset framework: Cryptographically verified position data

- Supports transparent NAV calculation, custody verification, and compliance reporting

- Dashboard access for LPs and auditors

I’ve long tracked oracle issues in blockchain, and Chronicle Labs’ approach is the first capable of meeting institutional needs: verifiable data without sacrificing on-chain efficiency. The January 8 announcement included a video demo showing live implementation—not just future promises.

Centrifuge’s Unique Operating Model:

Unlike competitors that simply wrap off-chain products, Centrifuge tokenizes credit strategies directly at issuance. The process:

- Issuers design and manage funds via a single transparent workflow;

- Institutional investors allocate stablecoins;

- Funds flow to borrowers after credit approval;

- Repayments are distributed proportionally to token holders via smart contracts;

- AAA-rated assets yield 3.3%–4.6% APY, fully transparent.

Multi-chain V3 network support: Ethereum; Base; Arbitrum; Celo; Avalanche

The point is, asset managers need proof that on-chain credit can handle multi-billion dollar deployments—and Centrifuge has delivered. The Janus Henderson partnership alone provides multi-billion dollar capacity.

Moreover, Centrifuge’s leadership in setting industry standards (co-founding the Tokenized Asset Coalition and Real-World Asset Summit) reinforces its role as infrastructure, not just a product.

While $1.45B TVL proves institutional demand, the 3.8% target APY lags behind historically riskier, higher-return opportunities in DeFi. Attracting native DeFi liquidity beyond the Sky ecosystem allocations is Centrifuge’s next hurdle.

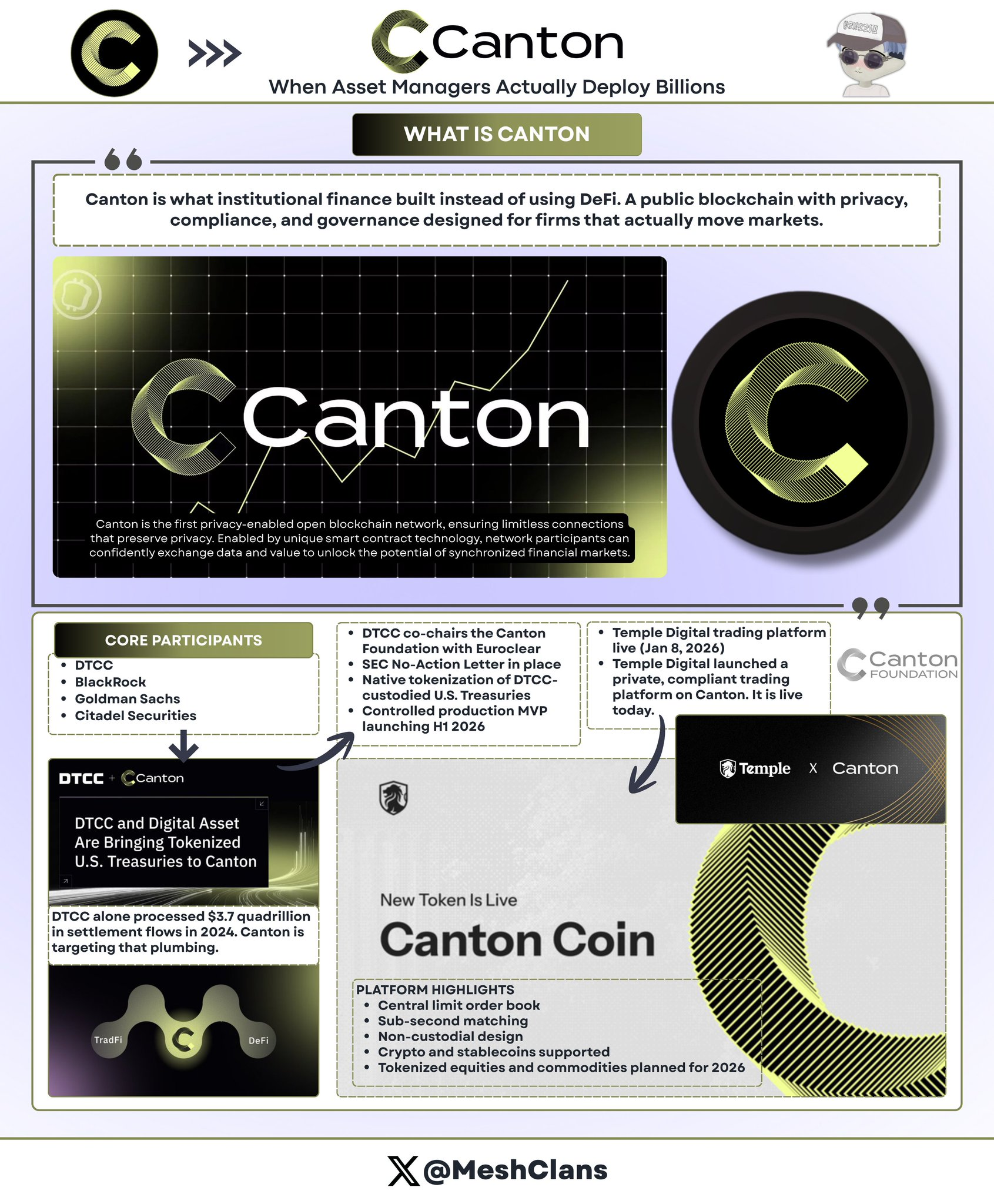

Canton Network: Wall Street’s Blockchain Infrastructure

@CantonNetwork represents institutional blockchain’s answer to DeFi’s permissionless ethos: a privacy-preserving public network backed by top Wall Street firms.

Participating Institutions

- DTCC (Depository Trust & Clearing Corporation)

- BlackRock

- Goldman Sachs

- Citadel Securities

Canton aims to capture $370 trillion in annual settlement volume processed by DTCC in 2024. Yes, that number is correct.

DTCC Partnership (December 2025)

The DTCC partnership is pivotal. It’s not just a pilot, but a core commitment to rebuild U.S. securities settlement infrastructure. With SEC No-Action Letter approval, this enables select U.S. Treasuries held by DTCC to be natively tokenized on Canton, with a controlled production MVP planned for H1 2026.

Key Details:

- DTCC and Euroclear jointly chair the Canton Foundation;

- Not just participants, but governance leaders;

- Initially focused on Treasuries (lowest credit risk, high liquidity, clear regulation);

- Potential expansion post-MVP to corporate bonds, equities, structured products.

Initially, I was skeptical of permissioned blockchains. But the DTCC partnership changed my mind. Not because of technical superiority, but because this is the kind of infrastructure traditional finance will actually adopt.

Temple Digital Platform Launch (January 8, 2026)

Canton’s institutional value proposition was further clarified with Temple Digital Group’s launch of a private trading platform on January 8, 2026. This platform is live—not “coming soon.”

Canton Network offers a Central Limit Order Book (CLOB) with sub-second matching speed and non-custodial architecture. Currently supports crypto and stablecoin trading, with plans to add tokenized stocks and commodities in 2026.

Ecosystem Partners

- Franklin Templeton: Manages an $828 million money market fund

- JPMorgan: Uses JPM Coin for DvP settlement

Canton’s Privacy Architecture

Canton implements privacy at the smart contract level using Daml (Digital Asset Modeling Language):

- Contracts define precisely which parties see what data;

- Regulators have full audit trail access;

- Counterparties view transaction details;

- Competitors and the public see nothing;

- State updates propagate atomically across the network.

For institutions accustomed to Bloomberg terminals and dark pools for confidential trading, Canton’s architecture offers blockchain efficiency without exposing trading strategies—a rational design. After all, Wall Street will never expose proprietary trading activity on a transparent public ledger.

Canton’s 300+ participating institutions demonstrate strong institutional appeal. However, much of the reported transaction volume may stem from simulated pilots rather than real production traffic.

The current limitation is development speed: The MVP scheduled for H1 2026 reflects multi-quarter planning cycles—unlike DeFi protocols that often launch new products in weeks.

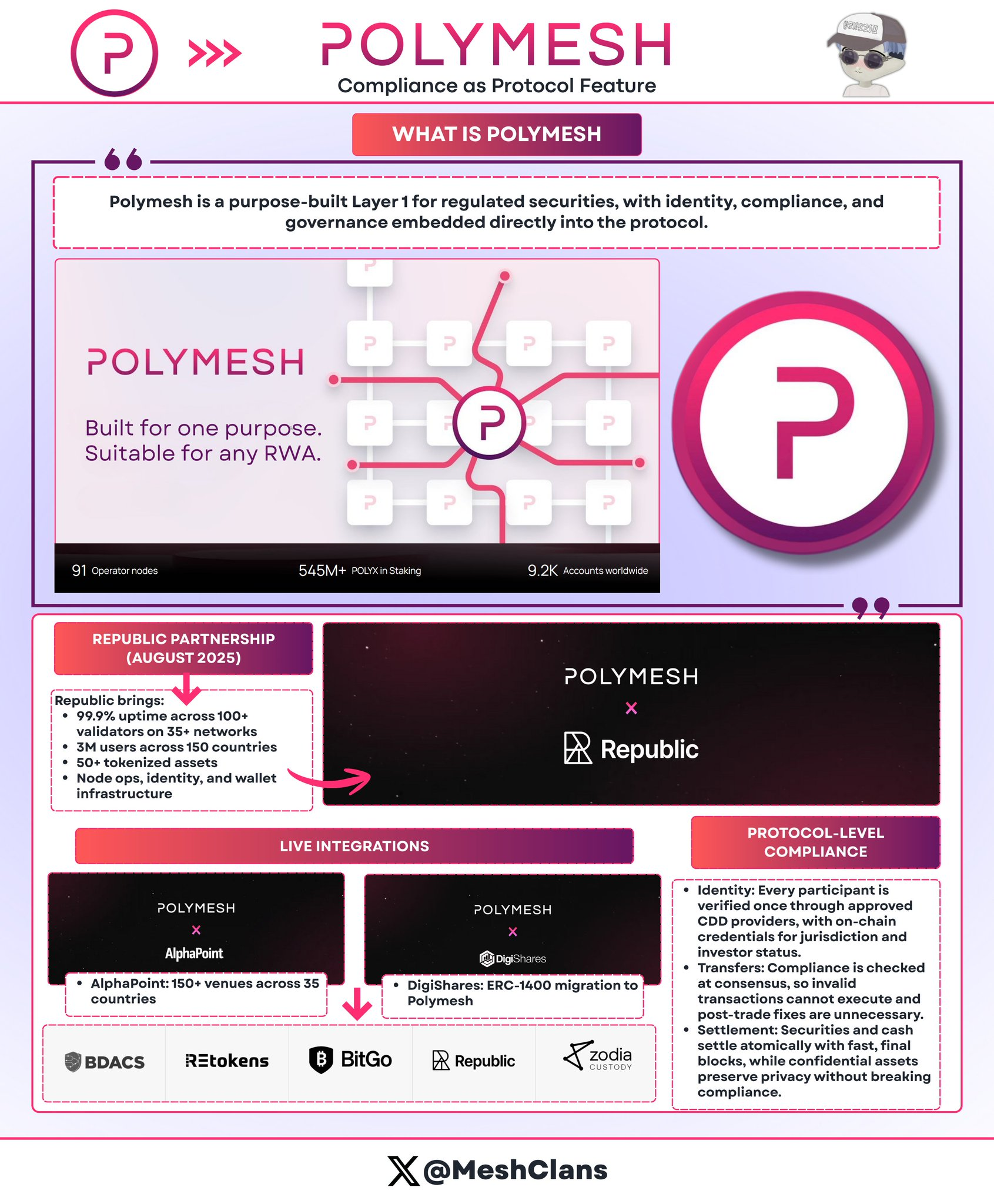

Polymesh: The Security Blockchain Built for Compliance

@PolymeshNetwork stands out by embedding compliance at the protocol layer rather than relying on complex smart contracts. Designed specifically for regulated securities, Polymesh performs compliance validation at consensus—no custom code required.

Core Features

- Protocol-level identity verification: Through licensed CDD (Customer Due Diligence) providers;

- Embedded transfer rules: Non-compliant transactions fail at consensus;

- Atomic DvP (Delivery vs. Payment): Final settlement in under 6 seconds.

Production Integrations

- Republic (August 2025): Supports private securities issuance;

- AlphaPoint: Reaches 150+ venues across 35 countries;

- Target sectors: Regulated funds, real estate, private equity.

Advantages

- No need for custom smart contract audits;

- Protocol automatically adapts to regulatory changes;

- Non-compliant transfers cannot be executed.

Challenges & Road Ahead

Polymesh currently operates as a standalone chain, isolating it from DeFi liquidity. To address this, an Ethereum bridge is planned for Q2 2026. Whether it launches on schedule remains to be seen.

To be honest, I underestimated the potential of this “compliance-native” architecture. For issuers frustrated by the complexity of ERC-1400, Polymesh’s approach is far more attractive: bake compliance into the protocol, not the smart contract.

How Do These Protocols Divide the Market?

These five protocols don’t compete directly—they solve different problems:

Privacy Solutions:

- Canton: Daml-based, focused on Wall Street counterparty relationships;

- Rayls: Zero-Knowledge Proofs, offering bank-grade mathematical privacy;

- Polymesh: Protocol-level identity, providing turnkey compliance.

Expansion Strategies:

- Ondo: Managing $1.93B across three chains, prioritizing liquidity velocity over depth;

- Centrifuge: Focused on $1.3–1.45B institutional credit market, depth over speed.

Target Markets:

- Banks/CBDC → Rayls

- Retail/DeFi → Ondo

- Asset Managers → Centrifuge

- Wall Street → Canton

- Security Tokens → Polymesh

In my view, this segmentation is more important than many realize. Institutions won’t pick the “best blockchain”—they’ll choose infrastructure that solves their specific compliance, operational, and competitive needs.

Unresolved Issues

Liquidity Fragmentation Across Chains

The cost of fragmentation is massive: estimated at $1.3–1.5 billion annually. High cross-chain bridging fees create 1%–3% price spreads for identical assets across chains. If unresolved by 2030, annual losses could exceed $75 billion.

This is one of my biggest concerns. Even if you build cutting-edge tokenization infrastructure, efficiency gains vanish when liquidity is scattered across incompatible chains.

Privacy vs. Transparency Conflict

Institutions need transaction confidentiality, regulators demand auditability. In multi-party scenarios (issuers, investors, rating agencies, regulators, auditors), each party requires different visibility levels. No perfect solution exists today.

Regulatory Fragmentation

- EU passed MiCA, applicable across 27 countries;

- U.S. requires case-by-case No-Action Letters, taking months;

- Cross-border flows face jurisdictional conflicts.

Oracle Risk

Tokenized assets depend on off-chain data. If data providers are compromised, on-chain representations may reflect false realities. While Chronicle’s Proof of Asset framework helps, risks remain.

The Path to Trillions: Key Catalysts in 2026

Key Catalysts to Watch in 2026:

Ondo’s Solana Launch (Q1 2026)

- Test whether retail-scale distribution can generate sustainable liquidity;

- Success metric: Over 100,000 holders, proving real demand.

Canton’s DTCC MVP (H1 2026)

- Validate blockchain feasibility for U.S. Treasury settlements;

- If successful: Could shift trillions in capital flows to on-chain infrastructure.

Passage of the U.S. CLARITY Act

- Provides clear regulatory framework;

- Enables currently观望 institutions to deploy capital.

Centrifuge’s Grove Deployment

- Completion of $1 billion allocation throughout 2026;

- Test real-capital operation of institutional credit tokenization;

- Successful execution without credit events would boost confidence among asset managers.

Market Outlook

- 2030 Target: $2–4 trillion in tokenized assets;

- Growth Required: 50–100x increase from current $19.7B;

- Assumptions: Regulatory stability, ready cross-chain interoperability, no major institutional failures.

Industry Growth Projections:

- Private Credit: Grow from $2–6B to $150–200B (highest growth rate due to small base);

- Tokenized Treasuries: Potential exceeds $5T+ if money market funds migrate on-chain;

- Real Estate: Projected to reach $3–4T (dependent on blockchain-compatible land registry adoption).

Hundred-Billion-Dollar Milestone:

- Expected Timeline: 2027–2028;

- Projected Distribution:

- Institutional Credit: $30–40B;

- Treasuries: $30–40B;

- Tokenized Stocks: $20–30B;

- Real Estate/Commodities: $10–20B.

This requires a 5x increase from current levels. Though ambitious, given institutional momentum in Q4 2025 and upcoming regulatory clarity, it’s not out of reach.

Why These Five Protocols Matter

The institutional RWA landscape in early 2026 reveals an unexpected trend: no single winner, because there is no single market.

Frankly, this is exactly how infrastructure should evolve.

Each protocol solves a distinct problem:

- Rayls → Banking privacy;

- Ondo → Tokenized stock distribution;

- Centrifuge → On-chain deployment for asset managers;

- Canton → Wall Street infrastructure migration;

- Polymesh → Simplified securities compliance.

The market’s growth from $8.5B in early 2024 to $19.7B shows demand has moved beyond speculation.

Core Needs of Institutional Players:

- Treasurers: Yield and operational efficiency;

- Asset Managers: Lower distribution costs, broader investor base;

- Banks: Compliant infrastructure.

The Next 18 Months Are Critical

- Ondo’s Solana Launch → Test scalability in retail markets;

- Canton’s DTCC MVP → Test institutional settlement capability;

- Centrifuge’s Grove Deployment → Test credit tokenization with real capital;

- Rayls’ $1B AmFi Goal → Test adoption of privacy infrastructure.

Execution beats architecture. Results beat blueprints. That’s what matters now.

Traditional finance is entering a long-term shift toward on-chain migration. These five protocols provide the necessary infrastructure: privacy layers, compliance frameworks, and settlement rails. Their success will determine the future of tokenization—whether it becomes an efficiency upgrade to existing structures or a new system replacing traditional financial intermediaries.

The infrastructure choices institutions make in 2026 will define the industry landscape for the next decade.

Key 2026 Milestones

- Q1: Ondo’s Solana launch (98+ stocks go live);

- H1: Canton’s DTCC MVP (treasury tokenization on Wall Street infrastructure);

- Ongoing: Centrifuge’s $1B Grove deployment; Rayls’ AmFi ecosystem buildout.

Trillions in assets are coming.

NFA.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News