Probability Tavern: A Practitioner’s Notes on Oracles

TechFlow Selected TechFlow Selected

Probability Tavern: A Practitioner’s Notes on Oracles

Ultimately, the world will become a massive prediction game.

By Bruce

Preface

In this era of information overload, we are confronting an unprecedented form of visual deception. Just as the filtered, idyllic scenery on Xiaohongshu often turns out to be a landfill upon real-world inspection, social media traffic no longer reflects reality—and reality itself rarely generates traffic. When truth becomes scarce amid algorithmic fog, how do we cut through the haze to make sound decisions?

Imagine if every geopolitical turning point and every public spat among tech titans could be quantified into real, tradable odds. Would such a world become clearer—or more chaotic? In a recent in-depth conversation on Day1Global, guests revealed a harsh yet captivating reality: prediction markets are far more than simple betting tools; they represent a complete overhaul of existing information distribution and trading logic.

Below are five investment principles about truth distilled from that discussion.

Don’t Be Fooled by 90% Win Rates—Odds Are the Core of Asymmetric Opportunities

To the average investor, chasing “sure-win” projects with 80–90% win rates feels like risk-averse instinct. Yet to seasoned players, this zone is often where intelligence taxes are aggressively collected.

Prediction markets don’t follow a perfect normal distribution—they obey power-law or long-tail distributions. Many flock to the 90% win-rate zone, treating it as a cash-grabbing financial strategy. But Zixi offered a stark warning: the focus shouldn’t be on win rate—it should be on odds.

Projects that appear certain to win can wipe out all your prior gains in a single night if hit by a random black swan (e.g., a sudden geopolitical reversal). True professionals seek asymmetric opportunities: for example, Chess—on the UEFA Champions League stage—bought shares at extremely low odds when Manchester City played away against an obscure Norwegian club, turning $100 into $700. This logic closely mirrors early-stage VC investing: aiming for high-odds upside, not obsessing over narrow spreads.

Binary Options Victory: Prediction Markets Hedge Your Portfolio

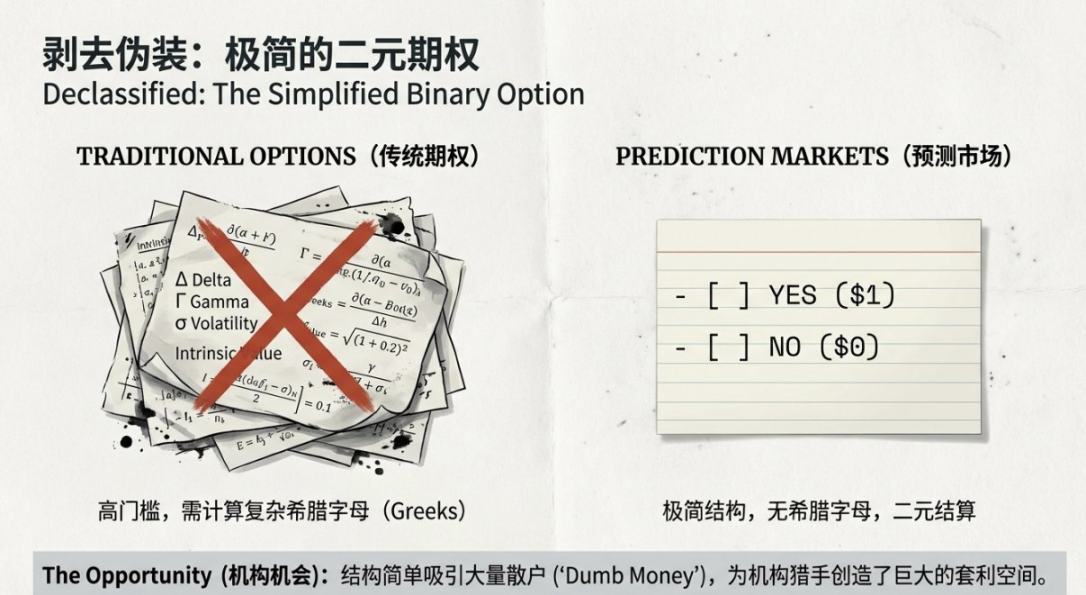

In practical finance, prediction markets function as binary options—more intuitive and with shorter reaction times than traditional options.

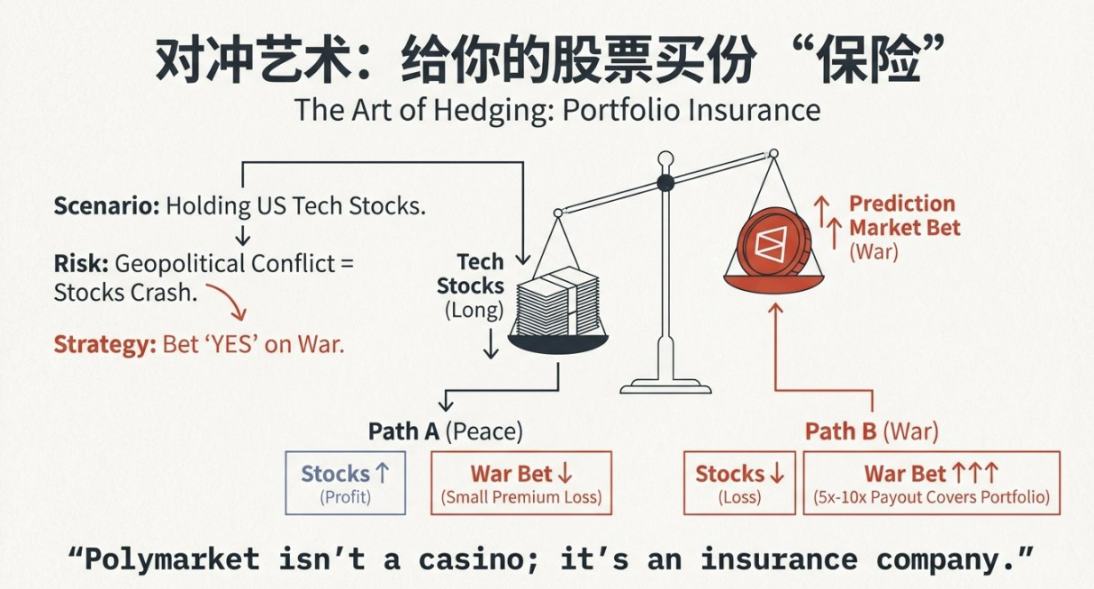

For holders of large positions in U.S. equities or digital assets, geopolitical turbulence implies substantial drawdown risk. Zixi shared a real-world case: during heightened tensions in Iran, he placed a $3,200 bet on whether the U.S. would take action. The logic wasn’t purely profit-driven—it was hedging:

- If conflict erupts: stock portfolio loses value, but the prediction market position doubles—achieving net breakeven.

- If nothing happens: the small prediction-market stake is lost (like an insurance premium), while core assets steadily appreciate in the equity market.

This win-win logic helps investors maintain composure amid volatile markets. Compared to traditional options—which require calculating implied volatility (Greeks)—prediction markets simplify complex financial models into clear-cut, binary bets, dramatically lowering the barrier for ordinary people to engage in risk management.

When Radar Becomes the Oracle: Physical Data Leads Press Releases

At its core, competition in prediction markets is an arms race over information asymmetry. While the world refreshes social feeds waiting for official press releases, professional players seek truth through physical laws.

Zixi revealed details behind his Iran-related profit: top-tier players ignored diplomatic rhetoric and instead monitored FlightRadar24 in real time. When all commercial flights suddenly vanished from Iranian airspace—or when a strange Russian military aircraft flew directly from Israel to Russia—the truth was already evident.

Even more valuable were exit signals: when Zixi observed commercial flights resuming over Iran, he recognized de-escalation and promptly closed his position. That $3,200 bet returned $8,000—netting $4,875, for a 150–250% return. In prediction markets, physical data—satellite imagery, flight paths, weather—may be the true oracle, precisely because it cannot be faked.

From JJ Lin’s App to the Cost of Faith: More Than Gambling—It’s an Emotional Outlet

Why have prediction markets become a cultural phenomenon? Because they serve as outlets for adult social catharsis and faith discovery.

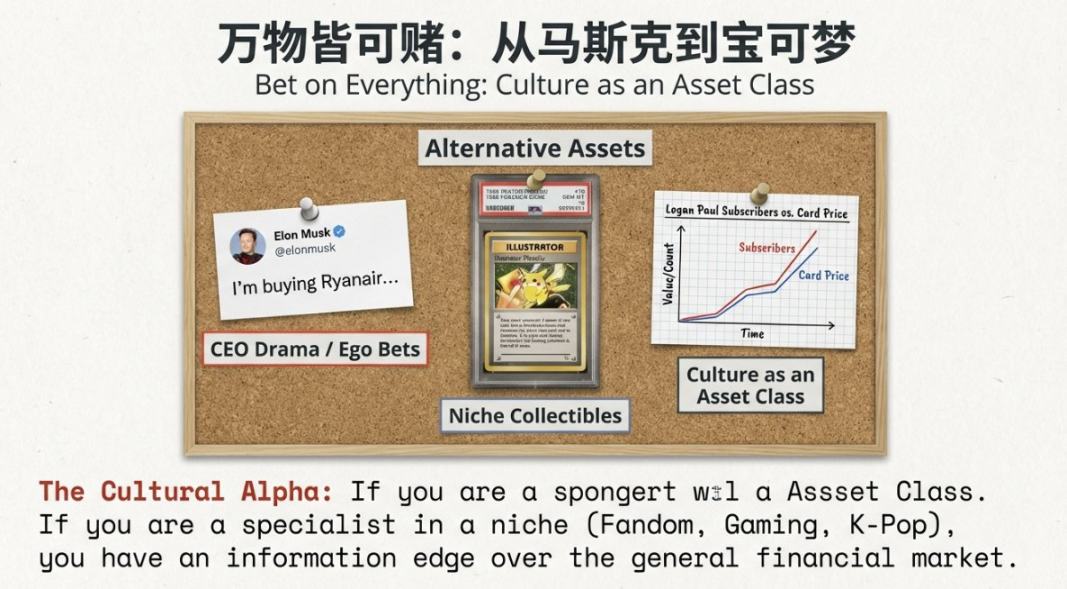

Star cited an intriguing comparison: the entry fee for JJ Lin’s fan app “Lin Distance” is ¥300 RMB—proof that people willingly pay for belief and emotion. Prediction markets channel this psychology into an information-discovery tool.

Whether it’s Taylor Swift’s chart performance, whether Elon Musk will acquire Ryanair, or who wins the Oscars, prediction markets offer low-cost participation in grand narratives or entertainment gossip. They transform fandom into real-money logical falsification: win, and you validate your judgment; lose, and you get affordable catharsis. This healthy emotional release is emerging as a new social currency for today’s highly stressed population.

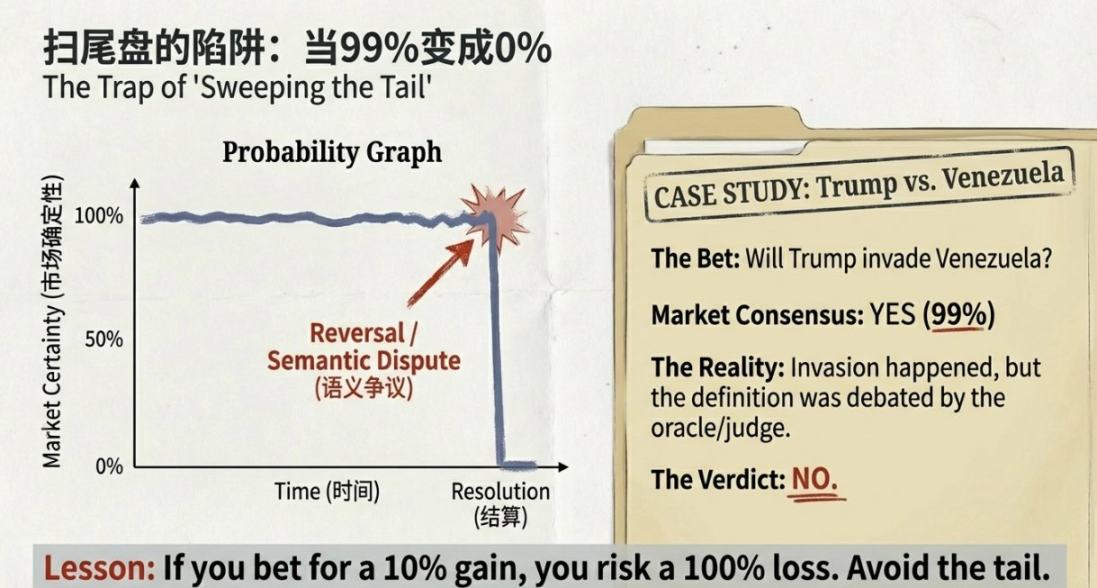

Beware the Definition Black Hole: Don’t Blindly Chase Late-Stage Bets at 99% Win Rates

In prediction markets, your most hidden risk isn’t logical error—it’s definition risk (The Power of Definition).

Professional institutions have already entered the arena. Global top-tier options market maker SIG (Susquehanna International Group) is deeply active on platforms like Polymarket. These heavily armed opponents even purchase high-resolution satellite imagery to monitor crude oil production volumes—gaining absolute control over order books.

Even more dangerous is the subjectivity inherent in outcome resolution. Zixi cited an example from the Trump era: regarding whether the U.S. would invade Venezuela, even if troops moved, the outcome could still be ruled “no” if adjudicators subjectively defined the operation as a “special military operation” rather than “invasion.” Remember: the house doesn’t just win—it defines what winning means. Never blindly chase late-stage bets at 99% win rates, because you never know how that final 1% of subjective interpretation might obliterate your position.

The World Will Ultimately Become One Giant Prediction Game

Prediction markets are reshaping how we interact with reality. They demand that every participant move from idle opinionating to putting skin in the game—paying for their cognition with real capital.

In traditional AMM (Automated Market Maker) logic, liquidity is assumed to follow a normal distribution; in prediction markets, however, we must confront the long tail of extreme events. If every view you express in the future must carry an associated wager, will you still accept news at face value?

In a world where probability coexists with mysticism, prediction markets may be the only shortcut to truth—because they understand one thing clearly: money speaks truer than traffic.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News