Crypto Predictions Review 2025: 10 Firms, Who Was Proven Wrong and Who Became Legendary?

TechFlow Selected TechFlow Selected

Crypto Predictions Review 2025: 10 Firms, Who Was Proven Wrong and Who Became Legendary?

No one can predict the future.

By: TechFlow

It's year-end again, and we can expect various institutions' 2026 crypto predictions and outlooks to roll out over the next month.

But before looking at new forecasts, it’s worth reviewing what these institutions predicted last year—after all, anyone can make predictions; accuracy is what truly matters.

Recall the end of 2024, when market sentiment was high and BTC had just broken $100,000, leading to generally optimistic projections:

For example, BTC would surge toward $200,000, stablecoin market cap would double, AI agents would ignite on-chain activity, and crypto unicorns would go public in clusters... Now, one year later, how many of those predictions actually came true?

We’ve selected several representative institutional and individual forecasts from last year and reviewed them one by one to see whose predictions were most accurate.

1. VanEck: 10% accuracy rate, only correct prediction was Bitcoin strategic reserve

VanEck made 10 predictions at the end of 2024, with only the Bitcoin strategic reserve call being correct.

The other nine were entirely off, and most weren’t slightly inaccurate but wrong by orders of magnitude—for instance, predicting crypto would peak in Q1 with Bitcoin reaching $180k and hitting new highs by year-end; in reality, both timing and price targets were completely reversed.

Additionally, their market size estimates were overly optimistic. Tokenized securities were forecasted at $50 billion, but actual figures were around $30–35 billion; DeFi TVL was projected at $200 billion, while real numbers reached about $120–130 billion; NFT trading volume was expected at $30 billion, whereas actual estimates are $5–6.5 billion.

Overall, VanEck accurately judged policy trends but systematically overestimated the scale of the on-chain economy.

Related reading: VanEck's Top 10 Crypto Predictions for 2025: Bull Market Will Reach New Highs by Year-End, US Supports Bitcoin via Strategic Reserve Policy

2. Bitwise: 50% accuracy rate, broadly right on direction but wrong on prices

Bitwise issued 10 predictions, getting 5 correct—mainly in regulation and institutional adoption. Price and scale forecasts were again systematically too high.

-

Policies and institutional adoption fully validated. Coinbase and MicroStrategy joining stock indices came true; the "IPO year" for crypto materialized as multiple crypto firms went public; countries holding BTC increased from 9 to nearly 30.

-

All price targets missed: Predicted prices for BTC, ETH, and SOL were far above their actual performance this year. Coinbase stock was forecasted at $250, missing its $700 target by 65%. RWA tokenization estimated at $50 billion clearly falls into overestimation territory.

Overall, Bitwise demonstrated sharp policy instincts and accurately gauged the pace of regulatory shifts and institutional adoption.

Related reading: Bitwise's Top 10 Cryptocurrency Predictions for 2025

3. Coinbase: Nearly 100% accuracy rate—focused on direction, not price points

Coinbase's predictions were divided into two categories—"macro" and "disruption"—mostly directional rather than precise numerical claims, making them trend-oriented.

Some core verifiable predictions include:

Other predictions were roughly correct but difficult to quantify:

You’ll notice this firm clearly avoided specific price targets, focusing instead on regulatory turning points and industry trends. As a result, all key directional calls were spot-on.

-

All regulatory shift predictions verified: Forecasting that the “most crypto-friendly Congress in history” would bring favorable outcomes and more asset ETF approvals—exactly what happened.

-

Stablecoins and DeFi broadly correct: Predicted “explosive growth and expansion into commercial payments”; indeed, Mastercard announced support for USDC/PYUSD/USDG in June, Coinbase’s own payment platform integrated Shopify, and Stripe launched USDC subscription payments;

DeFi recovery was also predicted, and reality saw DeFi TVL reach $120 billion—close to a three-year high since May 2022.

This “direction without specific levels” approach may lack sensationalism, but in hindsight proves the most robust—and least likely to backfire.

Related reading: Coinbase 2025 Outlook: New Technologies, New Landscape, New Opportunities—Crypto Market Set for Transformative Growth

4. Galaxy Research: 26% accuracy rate, almost all data-based predictions wrong

Galaxy researchers collectively made 23 predictions—the most quantified and detailed among all institutions.

In retrospect, the policy forecasting team performed exceptionally well (100% hit rate), while price and market size predictions were almost entirely incorrect. Notably, the prediction that DOGE would break $1 now appears excessively optimistic.

That said, Galaxy made reasonable calls on ecosystem developments—such as most mining companies transitioning to AI and high-performance computing, which did become a notable trend amid this year’s AI boom.

When predictions are numerous and highly granular, even professional research firms cannot get everything right; markets simply don’t follow expectations.

Related reading: Galaxy Research 2025 Prediction: Bitcoin Hits $185,000, Ethereum Surpasses $5,500

5. Hashkey: 70% accuracy rate, price forecasts overly optimistic

HashKey’s overall predictions showed strong judgment on regulatory compliance progress (ETFs, stablecoin legislation) and ecosystem changes (DEX rise, L2 divergence), though still overly bullish on price cycles.

Interestingly, this forecast also reflected the prevailing mood within the crypto community at the time.

After HashKey Group released its "Top 10 Market Predictions for 2025", nearly 50,000 community users voted on sixteen popular forecasts summarized by HashKey researchers, analysts, and traders.

The results showed that 50% of voters supported the prediction: “Bitcoin breaks $300,000, Ethereum exceeds $8,000, total crypto market cap reaches $10 trillion.”

Yet ironically, this most-voted scenario now appears the least likely from today’s vantage point at year-end.

Related reading: HashKey Group 2025 Top 10 Market Predictions: USD Stablecoin Market Cap to Exceed $300 Billion, Bitcoin Breaks $300,000

6. Delphi Digital: 40% accuracy rate, consumer-grade DeFi prediction stands out

Delphi Digital’s forecasts on technical infrastructure and consumer-facing applications were relatively accurate. Their original statement on consumer-grade applications read:

“2025 will be a pivotal development node for consumer-grade DeFi, with increasing numbers of crypto users fully embracing on-chain financial services.”

This year, we indeed witnessed the emergence of various USD-denominated cards and tokenized stocks, along with traditional finance apps like Robinhood gradually integrating on-chain features.

Related reading: Delphi Digital 2025 Top 10 Predictions: BTC to Rise Further, AI Agents Could Become Top VC

7. Messari: 55% accuracy rate, no specific price levels cited

Although Messari is a data analytics platform, its predictions leaned toward “trend directions” rather than exact numbers, and its broad trend assessments proved relatively accurate in hindsight.

8. Framework Co-founder: 25% accuracy rate, showing confidence in portfolio projects

Next, we review some representative individual forecasts from last year to assess their accuracy.

First up is the prediction set by Framework co-founder Vance Spencer, focusing on his crypto-related views:

Clearly, Vance held high expectations for his invested projects such as Glow, Daylight, and Berachain—representing energy and public chain sectors.

Moreover, some quantitative targets were overly aggressive—e.g., daily ETH ETF inflows reaching $1 billion.

Related reading: Framework Co-founder 2025 Prediction: Fed Will Continue Rate Cuts, ETH ETF Inflows Will Persist

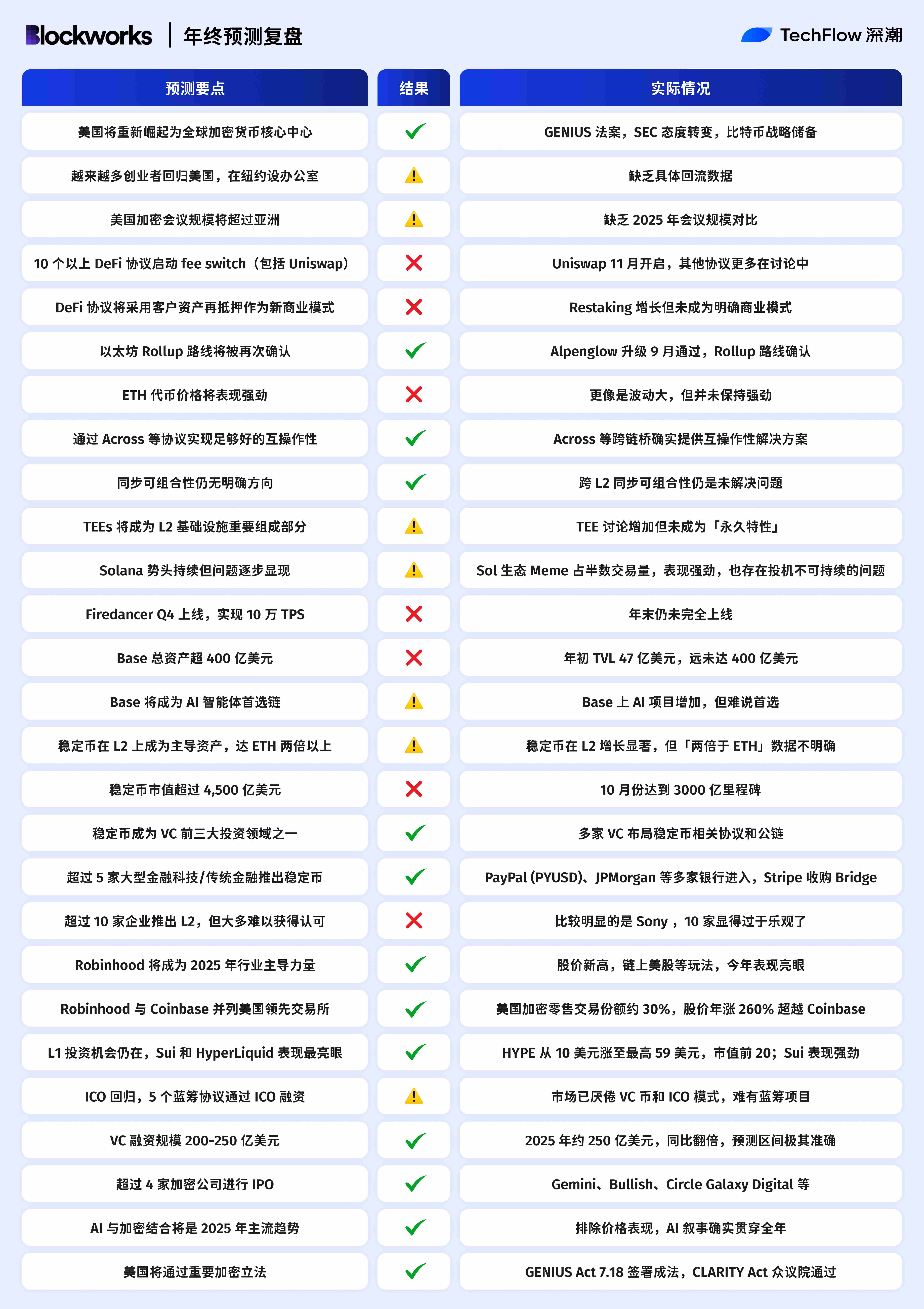

9. Blockworks Co-founder: 48% accuracy rate, highest number of predictions

Mippo (X: @MikeIppolito_), co-founder of Blockworks, made the largest number of predictions among all individuals and institutions reviewed—but achieved a solid accuracy rate, nearly half correct.

Highlights include an accurate call on Robinhood’s rise and smart positioning on L1 investments such as Hyperliquid and SUI, both of whose tokens delivered strong performances this year.

Related reading: Blockworks Co-founder's 27 Predictions for 2025: US Becomes Crypto Hub, Base Emerges as Solana's Main Competitor

10. Alliance DAO Wang Qiao & Imran: 50% accuracy rate, overly optimistic on BTC price

Alliance DAO’s two founders, WangQiao and Imran, shared their outlook for 2025 during a podcast discussion.

Related reading: Alliance DAO 2024 Crypto Market Review and 2025 Outlook: $250K Bitcoin Is Market Consensus

We’ve compiled their crypto-related views below:

As seen, both founders were overly optimistic about BTC’s performance—even the lowest forecast of $150K remains well above BTC’s peak price this year.

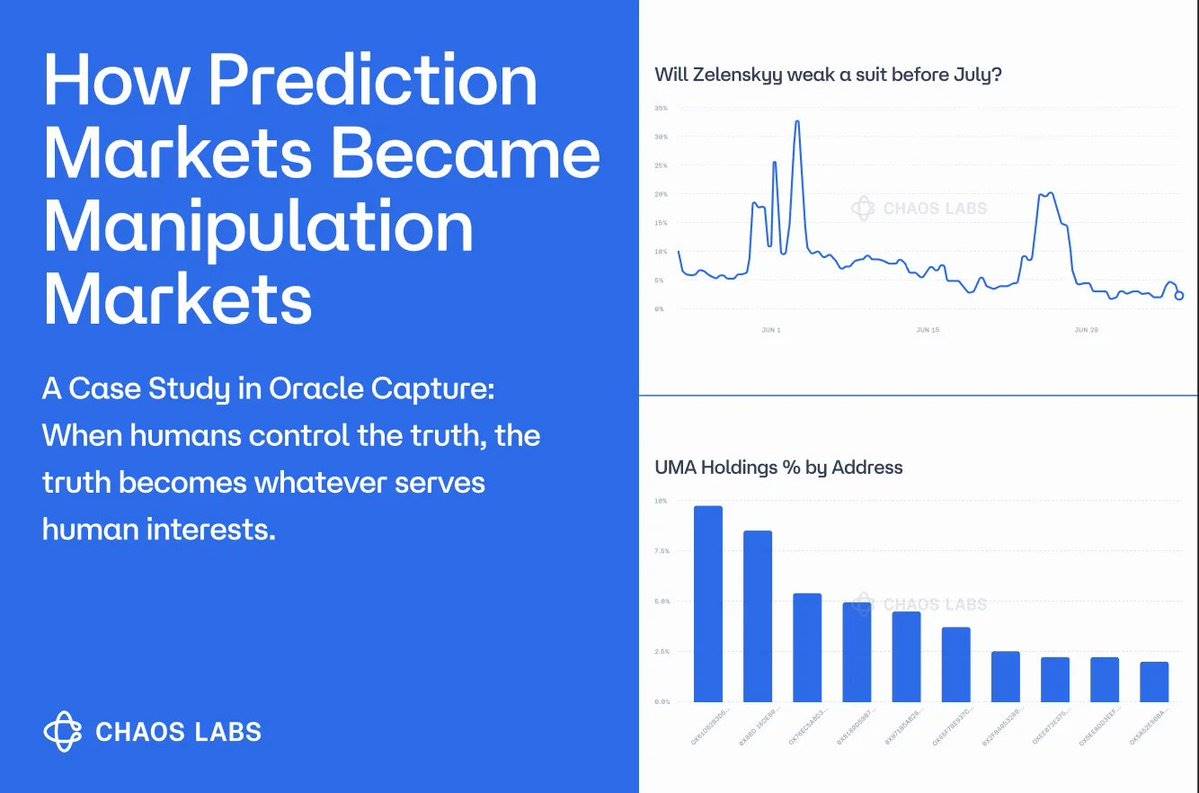

However, their judgment on prediction markets was extremely accurate, essentially spotting this key trend a full year in advance.

Summary

After reviewing last year’s predictions, several clear patterns emerge:

-

The number of predictions is largely negatively correlated with accuracy—the more you predict, the more you tend to get wrong.

-

Attempting to forecast specific price points or figures almost always backfires.

-

Predictions about policy shifts proved highly reliable—nearly every institution and individual correctly foresaw improved regulatory environments and increasing US friendliness toward crypto.

In conclusion, I believe the value of annual institutional forecasts does not lie in “telling you what to buy,” but in “revealing what the industry is thinking.” We should treat these forecasts as sentiment indicators. Using them as investment guides, however, could lead to painful outcomes.

Also, cultivate a healthy habit: remain skeptical of any forecast containing specific numbers, regardless of whether it comes from a KOL, institution, or industry leader.

This isn't about criticizing industry experts—it's recognizing that even flawed predictions carry value.

They reveal what the market once believed—and remind us that no one can foresee the future.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News