IOSG: Exploring prediction markets and their competitive landscape through Kalshi

TechFlow Selected TechFlow Selected

IOSG: Exploring prediction markets and their competitive landscape through Kalshi

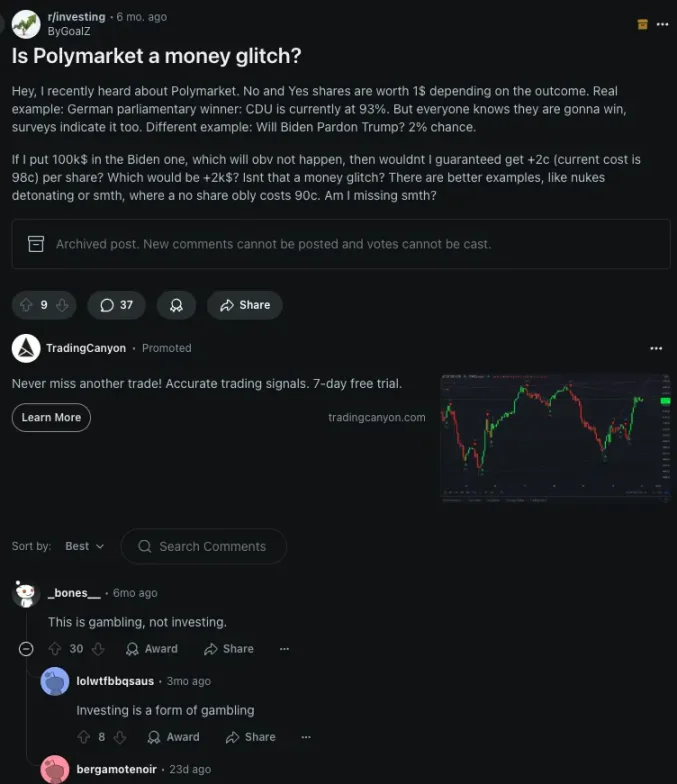

Crypto retail investors are not only similar to gamblers—they are often the same group of people.

Author: Mario @IOSG

Background Introduction

Prediction markets are speculative markets that trade based on the outcomes of future events, with their core function being aggregating dispersed information through contract prices. Under certain conditions, the price of a contract can be interpreted as the probability forecast of the event occurring. Since the 1980s, extensive research has shown that prediction markets are highly accurate, often outperforming traditional forecasting methods such as polls or expert opinions. This predictive power stems from the "wisdom of crowds": anyone can participate in the market, and traders with better information have economic incentives to trade, thereby pushing prices toward the true probability. In short, a well-designed prediction market can efficiently consolidate numerous individual beliefs into a consensus estimate about future outcomes.

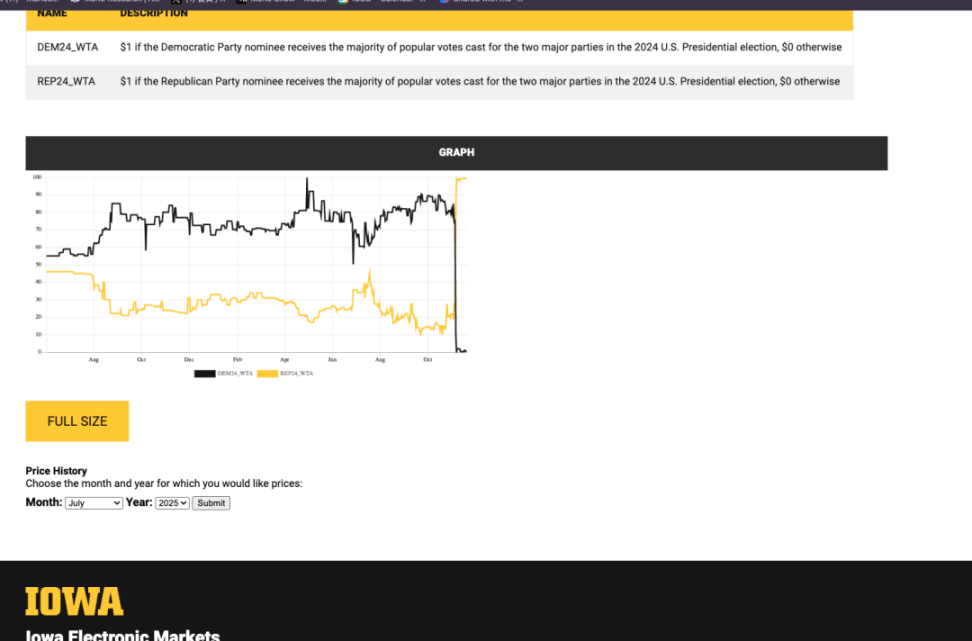

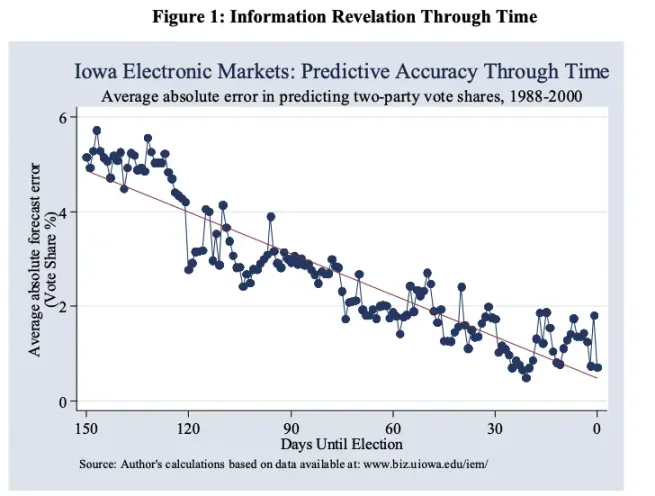

The modern origins of prediction markets can be traced back to pioneering experiments in the late 1980s. The first academic prediction market was the Iowa Electronic Markets (IEM), established at the University of Iowa in 1988.

IEM is a small-scale real-money market (individual betting amounts limited by regulators to around $500), primarily focused on U.S. election results. Despite its limited scale, IEM has long demonstrated impressive predictive accuracy. One week before elections, the market’s average absolute error in predicting vote shares for Democratic and Republican candidates was 1.5 percentage points, compared to 2.1 percentage points for Gallup’s final pre-election poll. The chart below also shows that as Election Day approaches and more information is absorbed by the market, prediction accuracy continues to improve.

At the same time, forward-looking concepts about using markets to predict uncertain events were gradually taking shape. Economist Robin Hanson proposed the concept of "Idea Futures" in 1990—a system where people could bet on scientific or social propositions. He believed this would create a "visible expert consensus," incentivizing honest contributions by rewarding accurate predictions and penalizing incorrect judgments. Essentially, he viewed prediction markets as mechanisms resistant to bias and conducive to truth discovery, applicable in areas like scientific research and public policy. This idea—known as the "market for ideas"—was extremely ahead of its time and laid the theoretical foundation for the expansion of prediction markets.

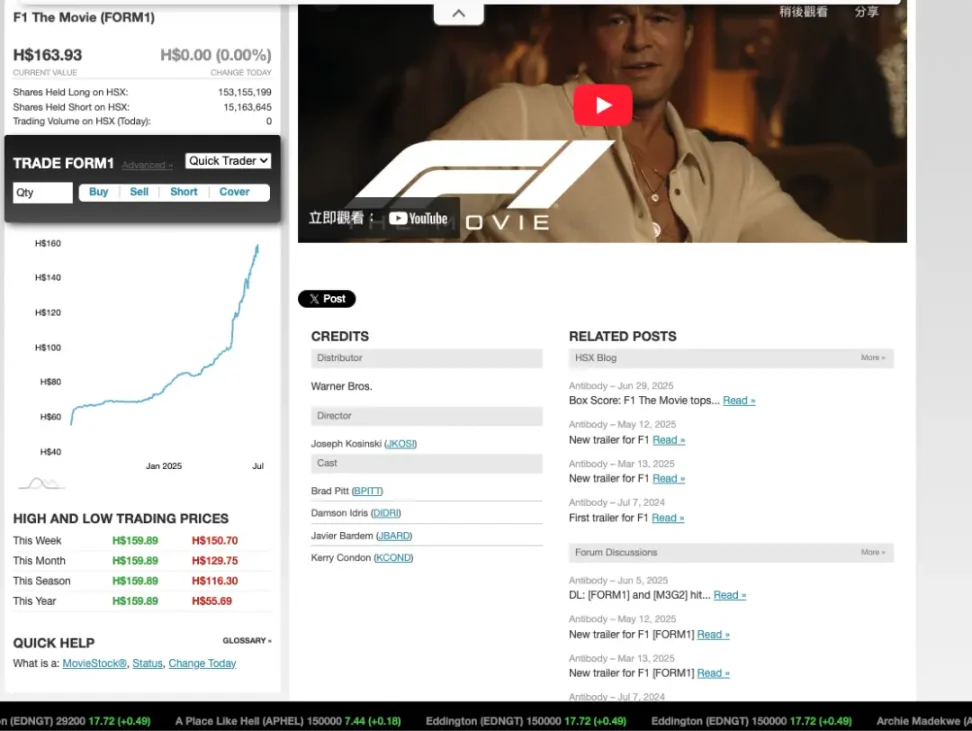

In the 1990s, some online prediction markets began to emerge, including both real-money and "virtual currency" markets. The academic market at the University of Iowa continued operating, while virtual-currency markets gained greater attention among the general public. For example, the Hollywood Stock Exchange (HSX) was launched in 1996 as an entertainment prediction market where users traded movie and actor "stocks" using virtual currency.

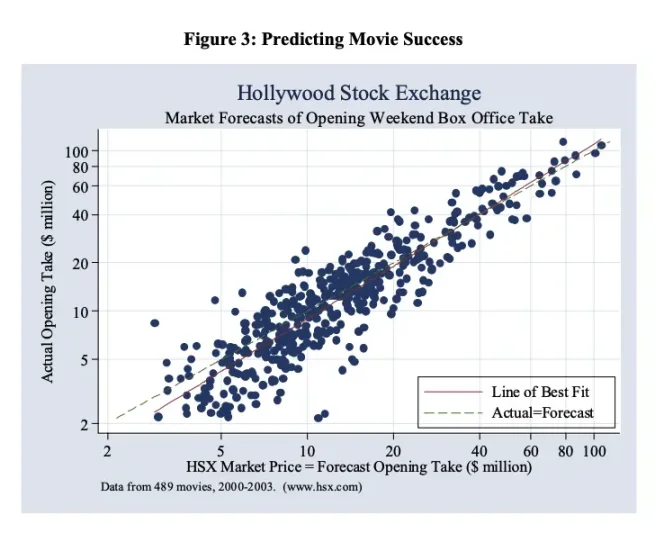

HSX proved highly adept at predicting movie opening weekend box office performance and even Oscar winners, sometimes surpassing professional film critics in accuracy. In 2007, HSX players correctly predicted 32 out of 39 major Oscar nominations and identified 7 out of 8 winners. HSX is regarded as a classic case study in prediction markets.

Theoretical Foundations and Market Mechanism Design

The fundamental mechanism of prediction markets lies in creating an incentive-compatible structure that motivates participants to reveal their private information. Because traders must wager real money (or virtual currency), they tend to act according to their genuine beliefs and private knowledge.

From an economics perspective, a well-designed market should allow traders to maximize expected returns by quoting prices aligned with their subjective probabilities.

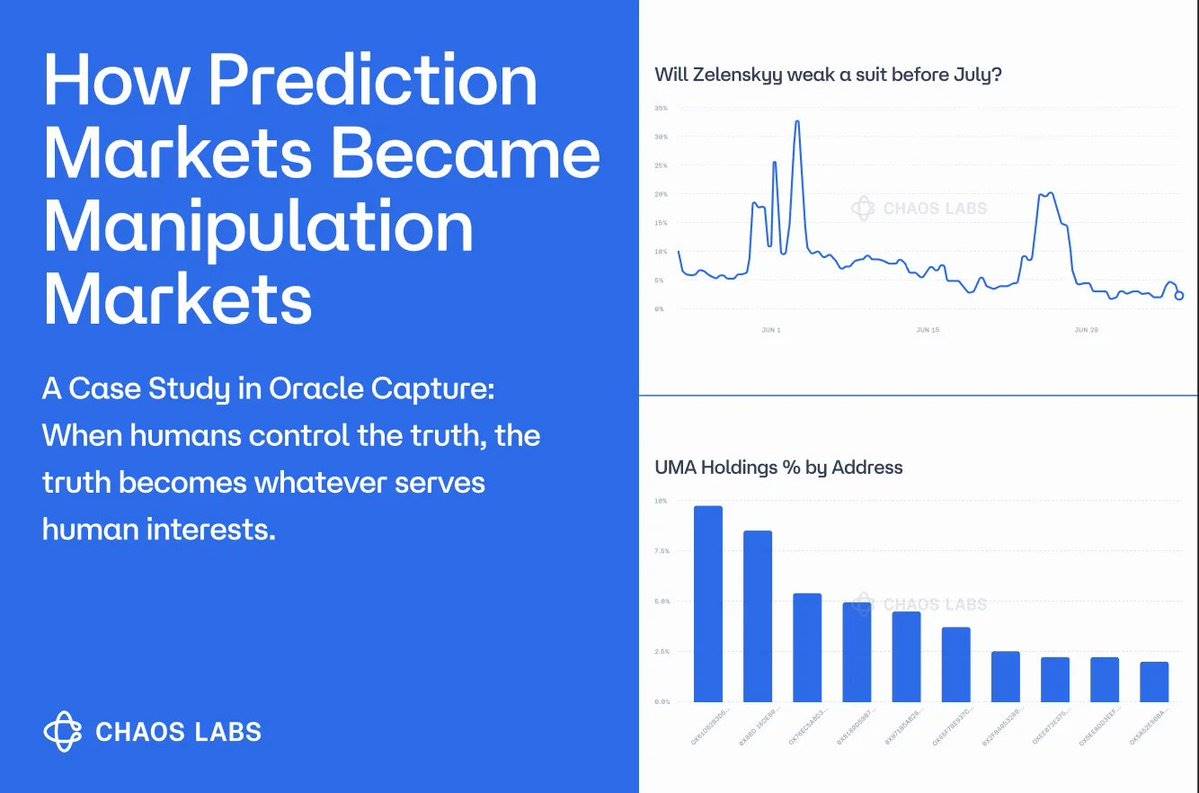

Regarding manipulation resistance, academic research has found that prediction markets are resilient against price manipulation. Attempts to move prices away from fundamentals typically create arbitrage opportunities for more rational traders, who then take offsetting positions, pulling the price back to a more reasonable level. Empirical data show that manipulative actions are usually quickly corrected—and may even enhance market liquidity. In other words, those attempting to manipulate the market often end up becoming "subsidies" for smarter traders, while market prices ultimately reflect true informational states.

Kalshi

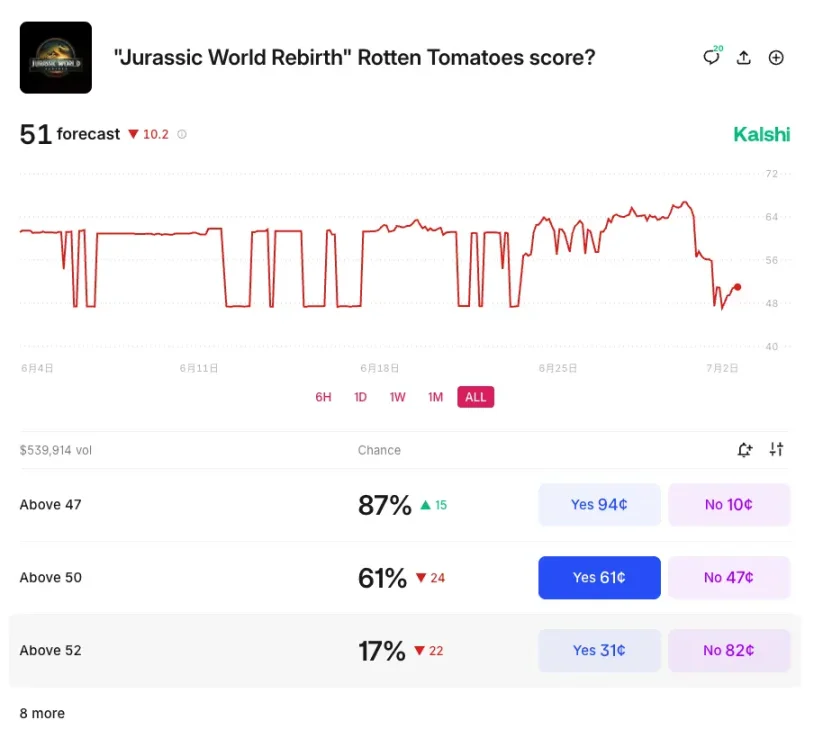

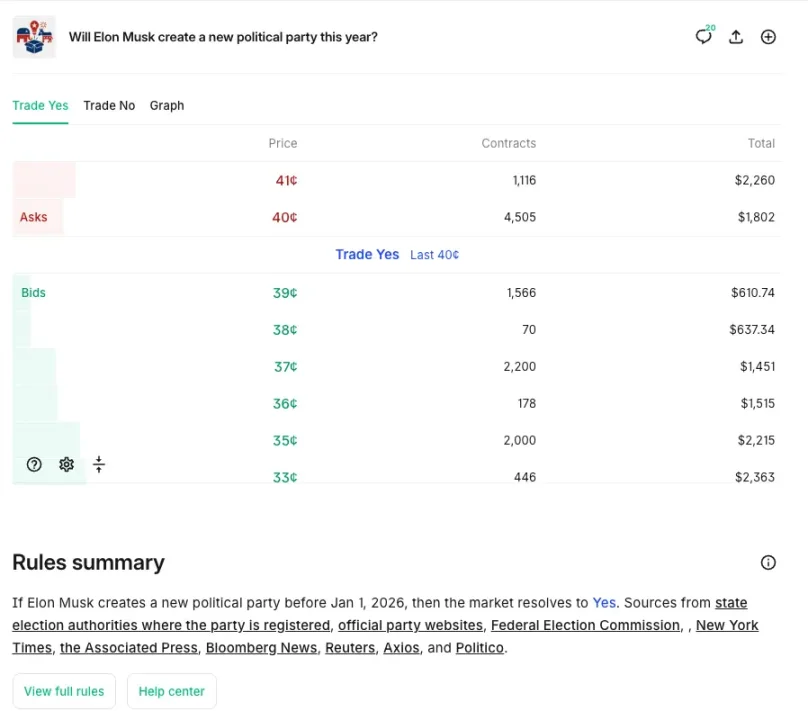

Kalshi is a federally regulated prediction market exchange where users can trade on real-world event outcomes. It is the first exchange approved by the U.S. Commodity Futures Trading Commission (CFTC) to offer Event Contracts. These contracts are binary futures (Yes/No): if the event occurs, the contract is worth $1; otherwise, it is worth $0.

Users can buy or sell “Yes” / “No” contracts priced between $0.01 and $0.99, with the price representing the market’s implied expectation of the event's probability.

If the prediction is correct, the contract settles at $1, allowing the trader to profit. Kalshi itself does not take positions (unlike bookmakers, it does not act as a counterparty); instead, it acts solely as a matching platform connecting buyers and sellers, earning revenue through transaction fees.

Market Creation Process

Proposal and Approval

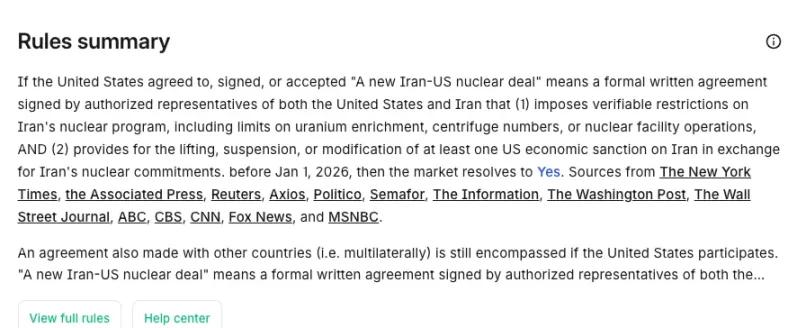

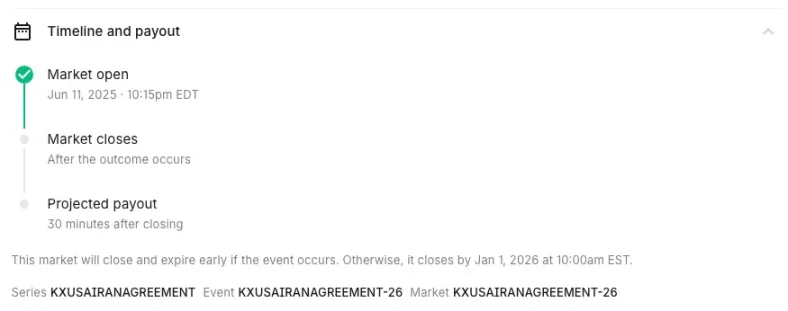

New event markets (binary Yes/No contracts) can be proposed by either the Kalshi team or users via “Kalshi Ideas.” Each proposal undergoes internal review and must meet CFTC regulatory standards, including clear event definitions, objective settlement criteria, and permissible event categories.

Contract Certification

Once approved, the event officially launches under Kalshi’s Designated Contract Market (DCM) framework, with documentation specifying contract terms, trading rules, and settlement standards.

Launch and Trading

After launch, U.S. users can trade on the event market through Kalshi’s app, website, or integrated platforms such as Robinhood and Webull.

Initial Liquidity and Pricing

Order Book Mechanism

When a new market launches, the order book starts empty. Any user (market makers or regular traders) can place limit orders (e.g., buying “Yes” at $0.39 or selling “No” at $0.61).

Market-Making Incentives

To encourage liquidity, makers (order placers) are typically fee-exempt, though minimal fees may apply in select specialty markets.

Price Discovery

Prices dynamically adjust according to supply and demand, reflecting the market’s consensus on event probability. For instance, if someone buys “Yes” at $0.60 and another sells “No” at $0.40, the system matches them: a contract is created, each party contributes $0.60 and $0.40 respectively, totaling $1.

Market Settlement Mechanism

Result Verification

Event outcomes are determined based on pre-specified authoritative data sources (e.g., government reports, official sports results).

Automatic Settlement

If the event occurs, holders of “Yes” contracts automatically receive $1 per contract; otherwise, “No” holders win, and losing contracts expire worthless. There are no additional settlement fees.

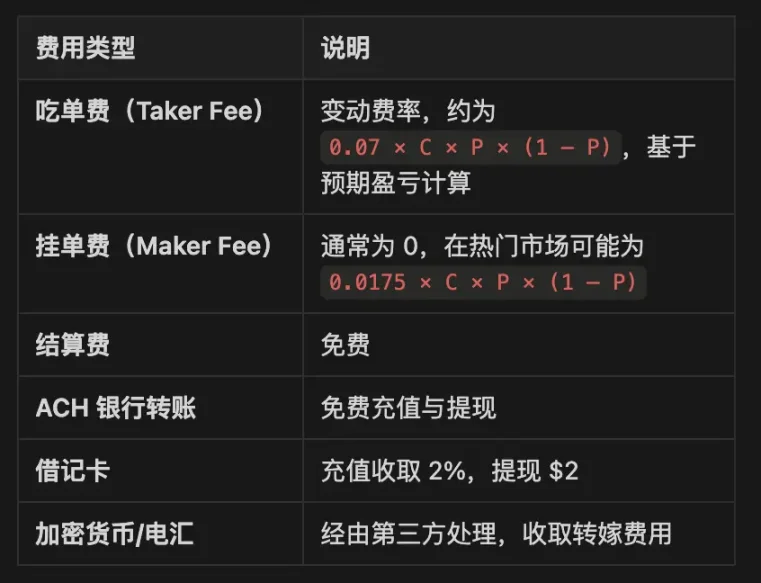

Fee Structure

Definitions: P = contract price, C = number of contracts

Polymarket

Polymarket Overview: Polymarket is a decentralized prediction market platform built on Polygon, where users trade binary outcome tokens (Yes/No Tokens) corresponding to event results. It uses the Conditional Token Framework (CTF), fully collateralizing each pair of outcome tokens with stablecoins (USDC), and employs a hybrid centralized limit order book (CLOB) for efficient trading. Market settlement is completed via UMA’s Optimistic Oracle, a disputeable decentralized resolution system.

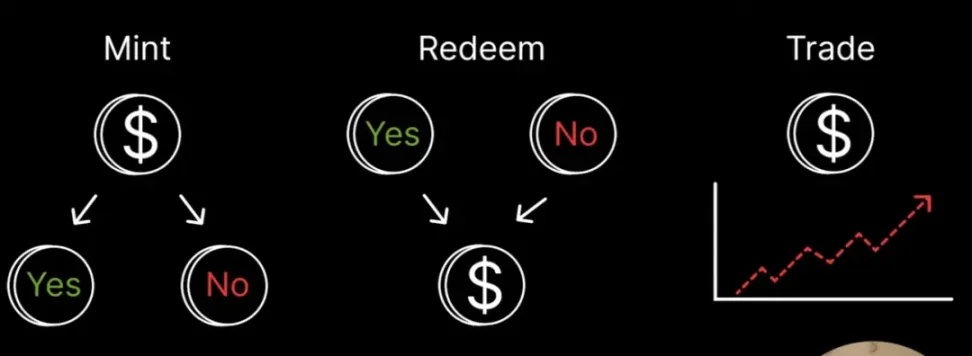

Conditional Token Framework (CTF) and Outcome Tokens

Polymarket uses Gnosis’s Conditional Token Framework to represent each market outcome as a conditional token deployed on the Polygon blockchain. For a binary market, two ERC-1155 tokens are generated—such as a Yes Token and a No Token—each backed by an equal amount of USDC.

Splitting 1 USDC generates 1 Yes + 1 No Token; combining Yes/No Tokens unlocks and returns 1 USDC, ensuring every token pair is fully collateralized. When the event concludes, only the token corresponding to the correct outcome is worth $1, while the incorrect one becomes worthless.

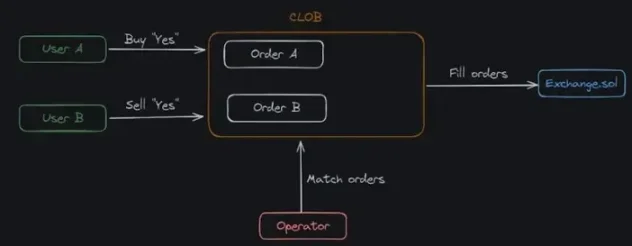

Mixed Order Book Architecture (CLOB/BLOB)

Polymarket adopts a hybrid architecture called Binary Limit Order Book (BLOB), combining off-chain order management with on-chain transaction settlement. Users sign orders off-chain; operator nodes search for matching orders, and when found, submit matches to a smart contract for on-chain value exchange.

Order Lifecycle

-

User signs an EIP-712 order off-chain (e.g., Buy YES @$0.62)

-

Operator node maintains the off-chain order book

-

When a match is found, the operator submits the result to the Exchange.sol contract

-

Atomic swap executed on-chain to complete settlement

Atomic Swap Examples

-

Buy vs Sell: One person buys Yes at $0.40, another sells Yes at $0.40; the contract swaps USDC and Yes tokens

-

Buy vs Buy: Two users buy Yes/No respectively; the contract collects a total of $1, splits into Yes/No tokens and distributes to both users

-

Sell vs Sell: Two users sell Yes/No; tokens are combined to redeem collateral

-

Supports partial fills, multi-order matching, price-time priority, and atomic execution

UMA Optimistic Oracle

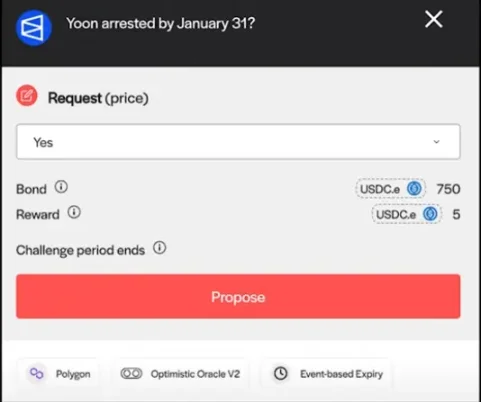

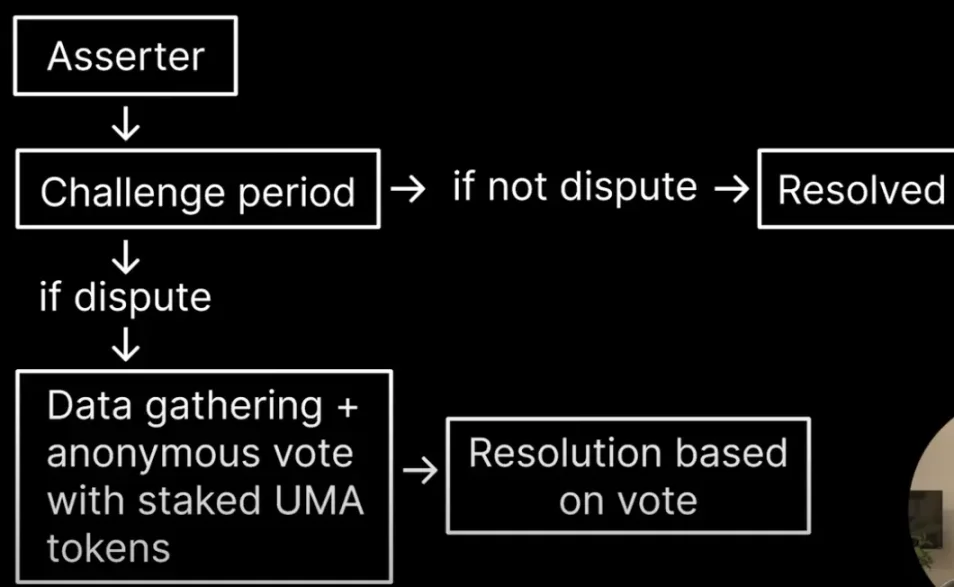

Unlike traditional exchanges that use internal adjudication or data sources, Polymarket reaches consensus via UMA’s Optimistic Oracle through community participation.

After an event ends, anyone can submit a result proposal for the market, staking a bond, which then enters a challenge period.

If unchallenged, the result stands; if challenged, resolution proceeds via UMA community voting.

Kalshi vs Polymarket: Structural and Technical Comparison

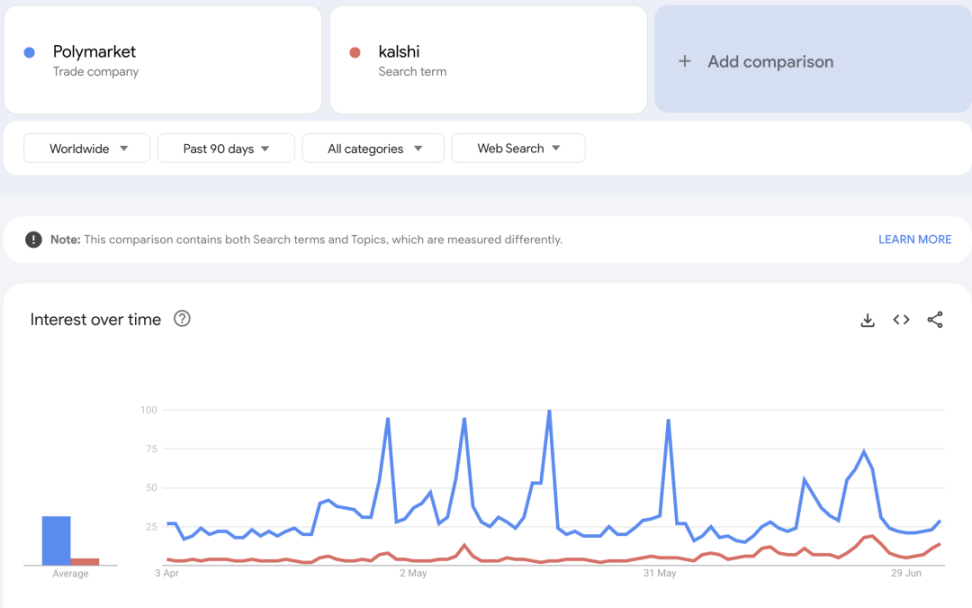

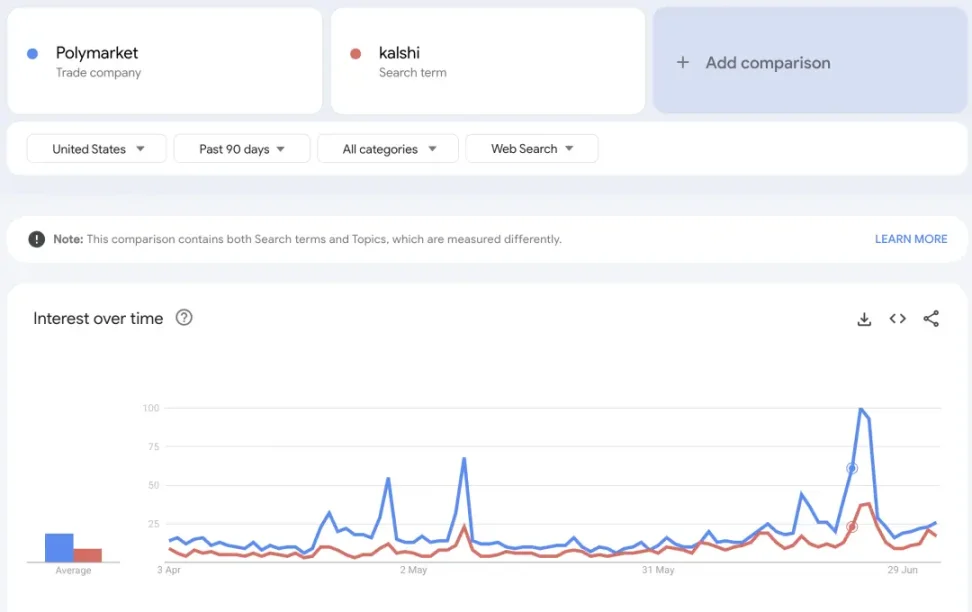

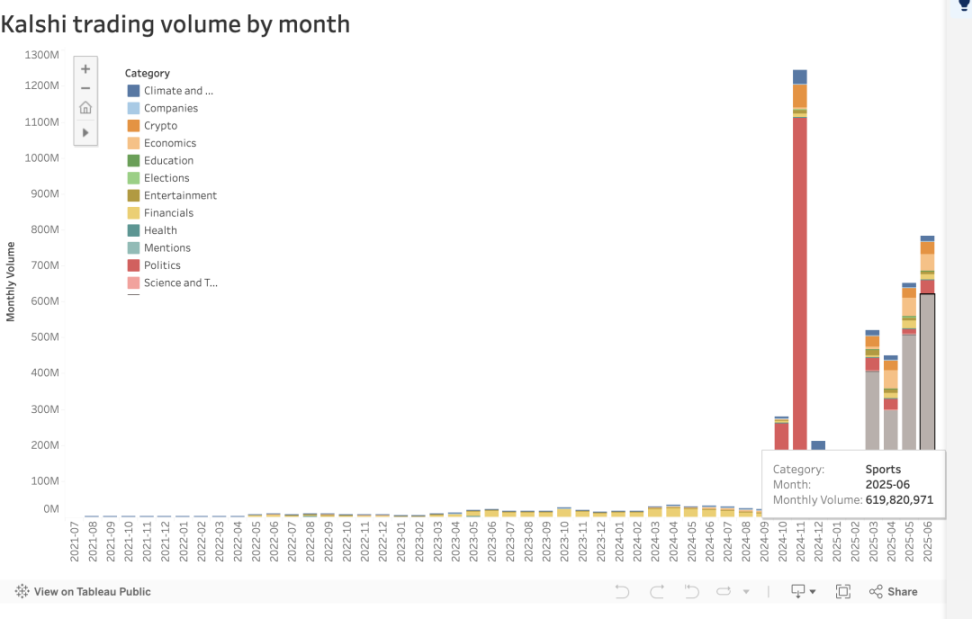

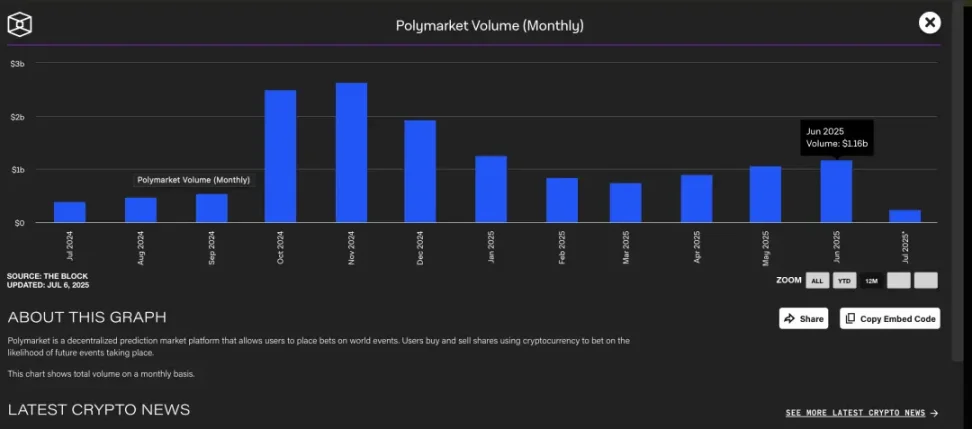

In June, Polymarket’s total platform volume (including political, tech, entertainment markets) reached $1.16 billion, slightly exceeding Kalshi’s approximately $800 million.

Market Expansion Strategy / Growth Drivers

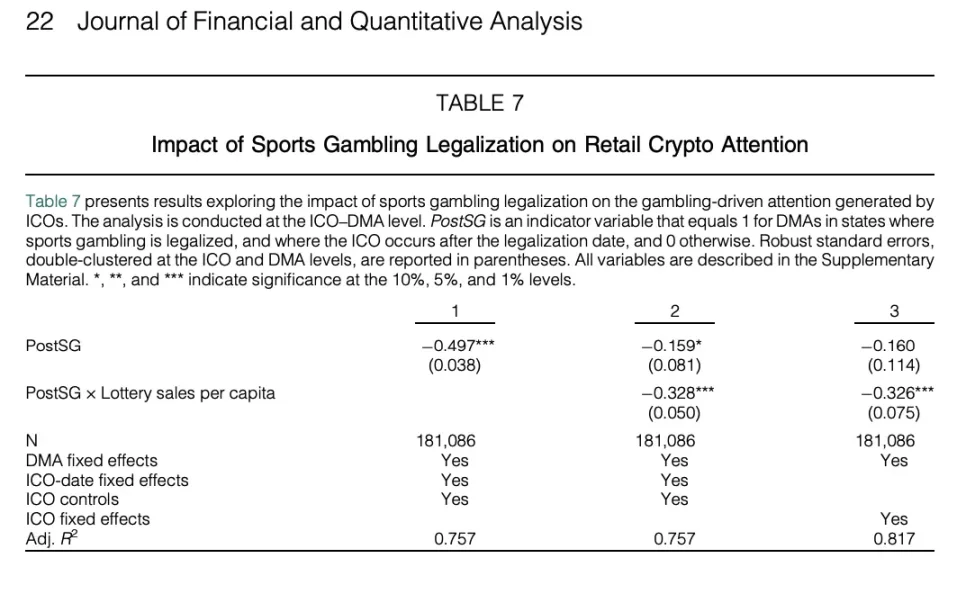

Academic Insight: “Gambling Propensity in Crypto Tokens”

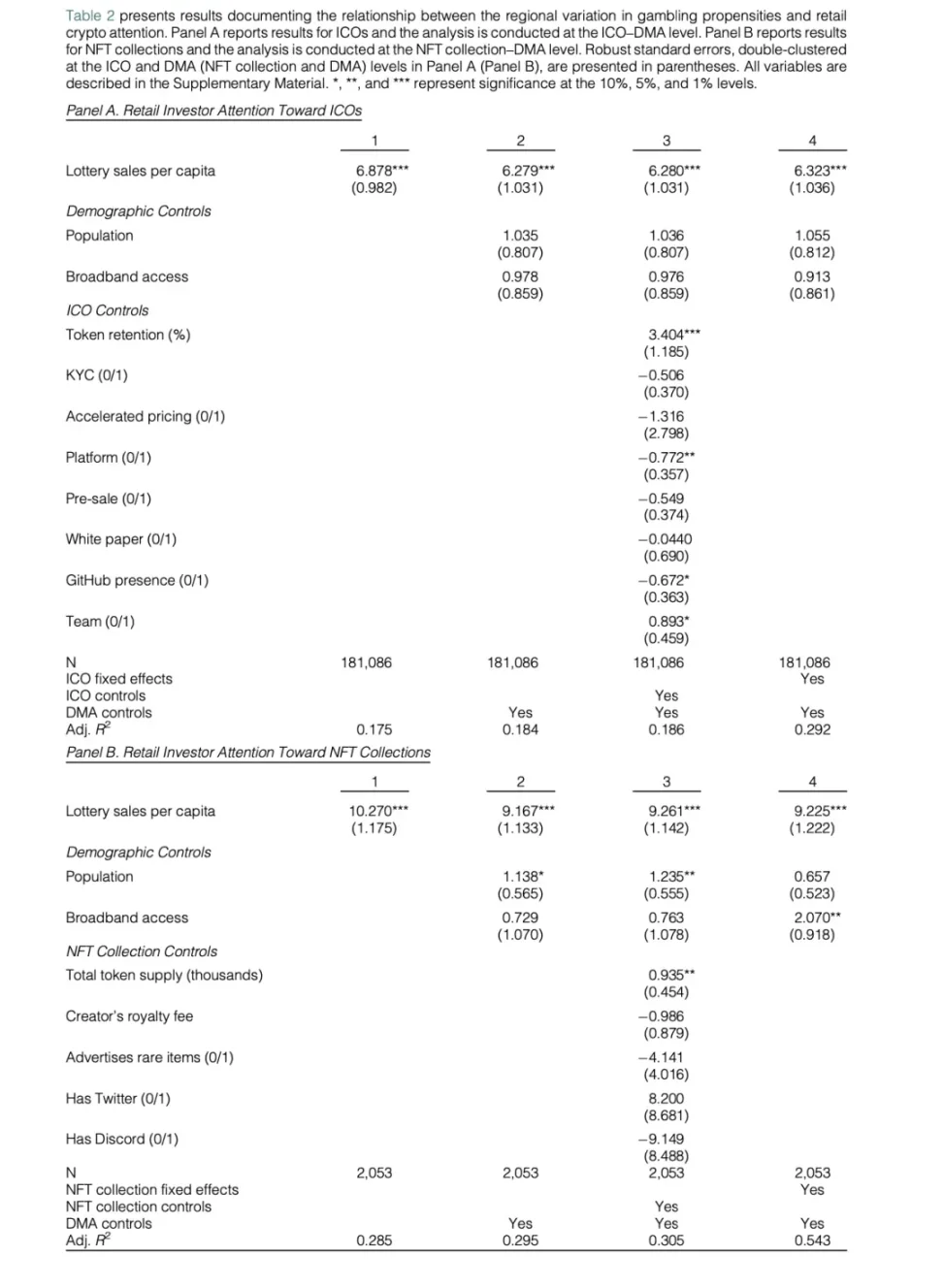

A recent peer-reviewed study titled “Gambling on Crypto Tokens?” provides strong evidence linking cryptocurrency assets and gambling behavior. Researchers used Google Trends to proxy retail investor attention, revealing several significant patterns:

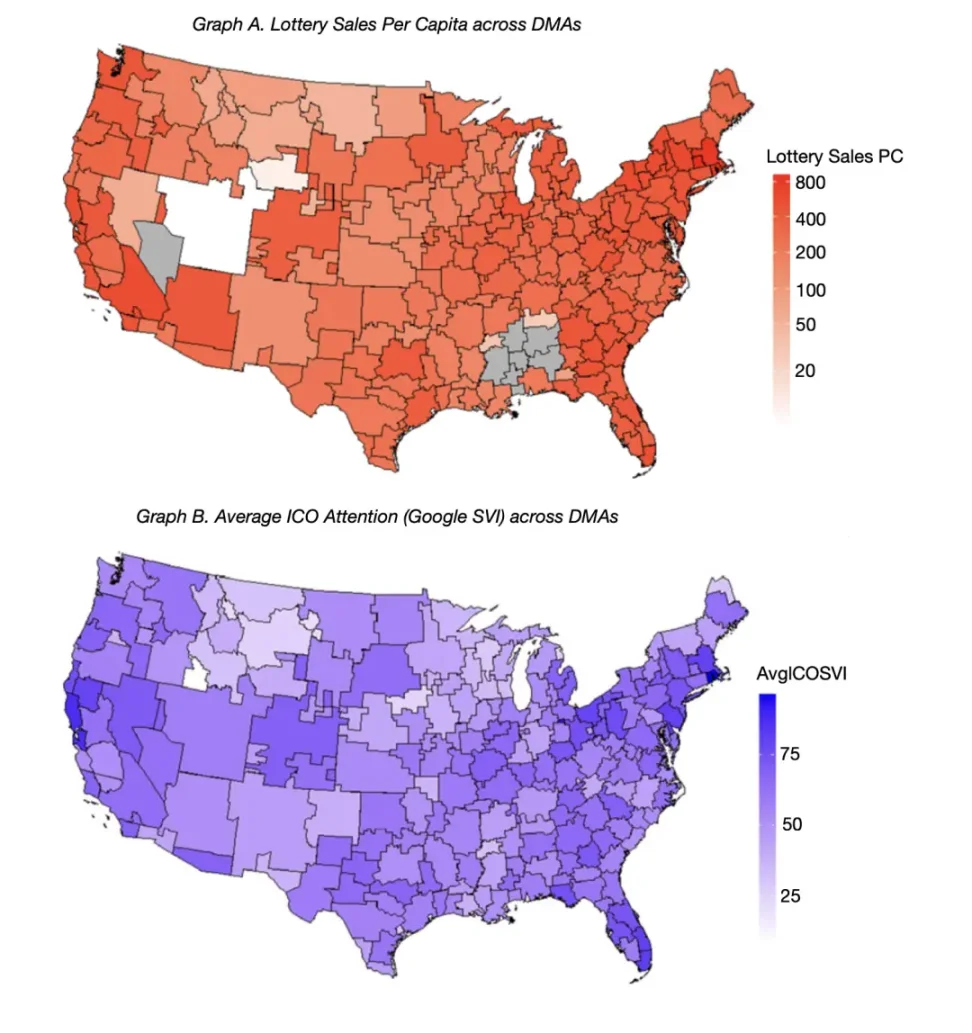

1. Per-capita lottery sales predict interest in crypto tokens

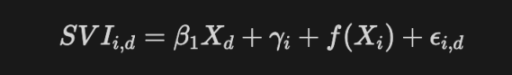

The Google Search Volume Index (SVI_{i,d}) represents the level of attention received by a specific initial coin offering (ICO) or NFT project i upon launch within a designated market area (DMA) d. The key coefficient β ₁ in the regression model measures the impact of regional gambling propensity on attention to crypto assets. f(X_d) denotes regional control variables that might affect ICO or NFT interest.

The primary explanatory variable in X_d is per-capita lottery sales, including interaction terms with token characteristics.

Regression results show that in U.S. regions (DMAs) with higher per-capita lottery sales, Google search activity is significantly higher for:

Initial Coin Offerings (ICOs): Regression coefficients range from 6.28 to 6.88, p-value < 0.01, statistically significant.

This indicates substantial behavioral overlap between gamblers and retail crypto investors.

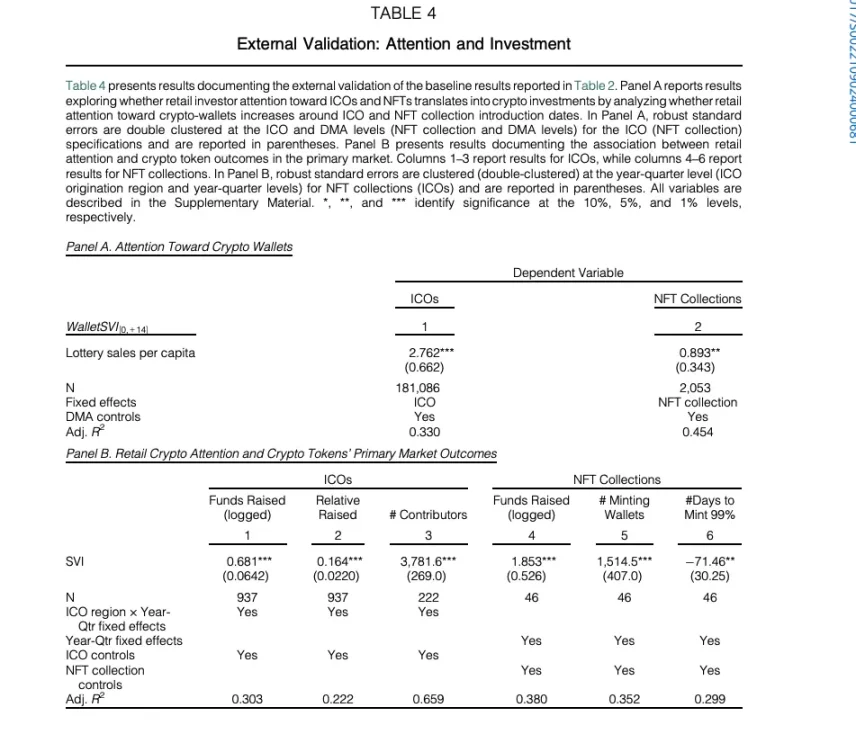

2. Wallet attention and investment outcomes

In regions with high per-capita lottery sales, wallet activity surges rapidly after ICO or NFT launches.

-

During ICO/NFT launches, searches related to wallets (Wallet SVI)—such as MetaMask, Coinbase Wallet—show sharper increases in high-lottery-sales areas.

-

These regions also exhibit higher fundraising amounts, more participants, and faster NFT minting speeds.

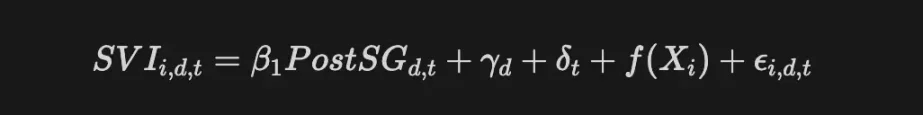

3. Legalization of gambling as a natural experiment

Table 7 of the paper leverages variation across U.S. states in the timing of sports betting legalization as a natural experiment. Results show that once gambling becomes legal in a state, crypto-related attention significantly declines in high-lottery-sales regions:

The interaction term (PostSG × Lottery Sales) in the regression model shows a strong negative relationship and is highly significant.

This implies a “substitution effect” between crypto tokens and gambling behavior—once legal gambling channels become available, speculative interest in crypto assets decreases.

The paper’s conclusion is clear: “Gambling preferences strongly predict retail investor interest in crypto markets.”

Crypto trading is not just “like gambling”—for many users, it is gambling.

These findings further validate the comparison and highlight the existence of users who have high risk tolerance and seek speculative thrills on platforms ranging from casinos to Coinbase.

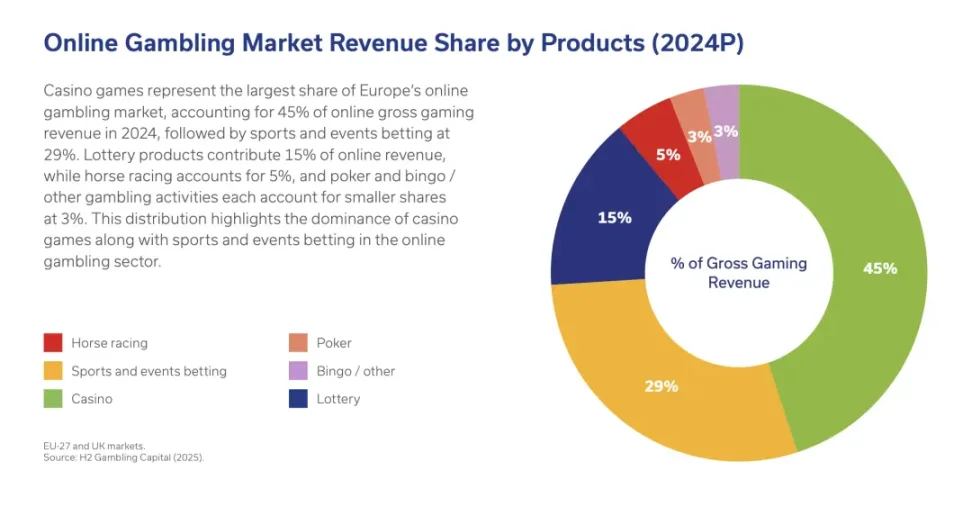

Crypto Gambling Market: Stake.com as a Representative Example

To gauge market size, consider the rise of native crypto gambling platforms (accepting only crypto deposits) such as Stake.com.

In just a few years, Stake captured massive global demand for high-risk, high-reward entertainment, achieving explosive growth:

-

Remarkable revenue scale: Stake generated approximately $2.6 billion in gross gaming revenue in 2022 (up from $105 million in 2020), placing it among the world’s largest gambling companies. Growth continues—Stake’s revenue reached about $4.7 billion in 2024, an ~80% increase from 2022. By comparison, traditional giant Entain reported ~$5 billion in 2024, and Flutter ~$14 billion—Stake is now in the same league.

-

User scale and reach: As of 2023, the platform had over 600,000 active users, despite being blocked in markets like the U.S. and UK. Its user base is concentrated in Southeast Asia, Japan, Brazil, and other regions with relaxed online gambling regulations. Hundreds of thousands globally bypass geographic restrictions to access this crypto gambling platform, indicating a vast suppressed demand.

-

Global top-tier player: Stake’s explosive growth has made it the seventh-largest gambling company globally (by revenue), surpassing many traditional sports betting firms. Notably, U.S.-based DraftKings’ revenue now trails behind Stake, showing that crypto-driven gambling models are opening a new total addressable market (TAM) unreachable by traditional operators.

Why prediction markets have advantages over traditional bookmakers:

Tradable during events (early cash-out / profit-taking)

Prediction markets like Kalshi allow users to buy or sell positions before an event concludes, locking in profits or losses early (similar to Hong Kong Jockey Club’s “Quick Payout” feature), offering the following benefits:

-

Actively hedge risk amid uncertainty

-

Dynamically adjust portfolio exposure

-

Make more flexible speculative decisions

Traditional bookmakers (Stake, Bet365, etc.)

Although some modern bookmakers offer early cash-out features, they face limitations:

-

Control rests with the bookmaker, leaving users without agency

-

Potential slippage or fees

Overall industry scale

Stake is merely a representative of the broader crypto gambling market. According to industry reports, total gross gaming revenue from crypto casinos exceeded $81 billion in 2024, and growth persists despite tightening regulations in many countries.

This figure represents gross revenue generated from crypto-denominated bets, indicating that the intersection of “crypto × gambling” has formed an enormous user and capital pool, currently flowing mostly to offshore or unregulated platforms.

Stake.com’s success clearly demonstrates:

There exists a large market segment that:

-

Routinely uses cryptocurrencies for transactions;

-

Enjoys speculation and high-volatility events;

-

Seeks to participate in “betting” outside traditional channels.

These individuals are essentially the core user base of prediction markets—currently concentrated on non-regulated platforms like Stake.

A regulated exchange like Kalshi, with robust market infrastructure and compliance oversight, has the potential to attract part of this user base by offering a compliant yet stimulating experience. Stake’s growth trajectory suggests that if these users migrate to legitimate platforms, the annual total addressable market (TAM) for “crypto-flavored” betting activities in the U.S. could reach tens of billions of dollars.

User Overlap: Demographic and Behavioral Consistency

This is not merely theoretical overlap—multiple studies and surveys confirm that cryptocurrency traders and gamblers share highly similar demographic and behavioral traits.

In many cases, they are the same people—or even literally the same individual. Key overlaps include:

Young, male, risk-seeking: Both crypto trading and sports/casino gambling skew heavily toward young adult males with high risk tolerance. They pursue volatile assets and large payoffs. A Rutgers University study found that over 50% of monthly gamblers had engaged in cryptocurrency trading in the past year; over 75% of high-risk stock traders also participated in crypto. Researchers noted: “Crypto trading is particularly attractive to individuals who struggle to control gambling behaviors.” In other words, a typical Robinhood-based crypto day trader (young, thrill-seeking, intuitively buying meme coins all-in) closely resembles a sports bettor or poker player chasing victory.

Always online: Crypto markets operate 24/7, running continuously worldwide; online gambling is similarly accessible anytime, delivering constant dopamine hits. Many who transitioned from gambling to crypto trading say they were drawn by the ability to trade anytime—especially on weekends or late at night. For internet-heavy, impulsive individuals, both crypto and gambling provide relentless stimulation—there’s always a game to bet on, always a coin fluctuating.

Thus, Kalshi’s target audience precisely includes these speculative retail users who straddle both crypto trading and gambling communities. These users are already engaging in similar behaviors; the key is providing a product that delivers comparable excitement within a compliant and secure framework. The behavioral overlap also means Kalshi’s marketing must emphasize both the thrill of prediction markets (to appeal to gamblers) and its financial, rational-trading attributes (to appeal to users’ self-image as investors).

Evolution of Crypto Narrative: Toward Compliance

In recent years, the overarching narrative in crypto has shifted dramatically—from “unregulated” free innovation toward institutional dominance and regulatory compliance. This shift creates favorable competitive conditions for regulated platforms like Kalshi and highlights the strategic value of its regulatory moat (CFTC approval).

Alignment with traditional institutions: The current trend sees major traditional financial institutions and governments actively participating in crypto, bringing credibility and standardization. For example, in 2023, BlackRock, the world’s largest asset manager, filed for a Bitcoin ETF, fueling market optimism about SEC approval of spot ETFs. In June 2025, the U.S. Senate passed the stablecoin regulation bill (GENIUS Act), establishing federal-level crypto regulations. Geopolitically, former U.S. President Trump’s team proposed crypto-friendly policies such as a “National Bitcoin Reserve.” All signs indicate that crypto is no longer a fringe space but is being integrated into compliant and mainstream finance.

Compliance as moat: In this new environment, compliance equals competitiveness. The industry has shifted from “move fast and break things” to “compliant and stable.” Kalshi spent six years obtaining CFTC approval, becoming a nationally recognized compliant exchange (Designated Contract Market, DCM), legally offering event contracts across all 50 states—even in California or Texas, where sports betting is banned. This status is extremely difficult to replicate. In contrast, Kalshi’s crypto-native competitor Polymarket remains in regulatory gray territory, unable to operate legally in the U.S. and vulnerable to policy crackdowns. Amid the broader trend of “institutional crypto,” Kalshi’s federal compliance is itself a selling point, offering trust, legal clarity, and nationwide access—the very direction the industry is heading. Simply put, Kalshi has taken an early lead in the compliance race, while others are still catching up.

Kalshi’s strategy: Positioning as “trading” rather than “gambling” + distribution via Robinhood

Kalshi is highly cautious in brand positioning, deliberately avoiding the label “gambling,” instead framing itself as a novel trading platform: offering investment tools in the form of “event contracts” with regulated exchange credentials. This strategy is highly forward-looking:

“We’re not a gambling site”—linguistic and model distinction: Kalshi’s founders and executives repeatedly emphasize that the platform is a matching exchange, not a bookmaker. Unlike gambling sites that profit when users lose, Kalshi simply matches orders and earns fees (similar to stock trading commissions). A Kalshi representative stated: “We’re just an exchange… we don’t make money from whether people win or lose.”

CEO Tarek Mansour went further: “If we’re considered gambling, then the entire financial market should be considered gambling.”

This statement encapsulates Kalshi’s positioning logic: treating event contracts as financial derivatives—for example, buying a contract on whether July will set a record high temperature—is akin to trading crude oil futures or earnings options, not rolling dice. This linguistic reframing is highly effective, improving regulatory perception and making users more willing to view it as “investing” rather than “betting.”

Integration with Robinhood: In early 2025, Kalshi announced a partnership with Robinhood. With over 15 million active users, Robinhood is a hub for young retail traders. This collaboration introduced a “Prediction Markets” section within the Robinhood app, enabling users to directly trade Kalshi’s event contracts (such as economic data forecasts or even sports outcomes). This greatly enhanced Kalshi’s reach. Robinhood’s stock even rose approximately 8% following the integration, as investors recognized its added value. By embedding into Robinhood’s ecosystem, Kalshi avoids costly customer acquisition and naturally integrates prediction markets into users’ existing asset classes (stocks, options, crypto), normalizing the product.

Avoiding “gambling”: Kalshi deliberately avoids the word “gambling” in marketing and media materials. For instance, it refers to contracts as “Yes/No Event Contracts,” and its blog and educational content emphasize predictive functions and information value rather than gambling thrills.

Even in its Robinhood collaboration, promotional language focuses on “bringing event trading to the masses,” avoiding any gambling terminology. This carefully crafted branding serves both regulatory navigation and alleviating users’ stigma around gambling. By packaging prediction markets as a “trading experience,” Kalshi attracts a broader audience—including those who enjoy speculation but wish to see themselves as “rational investors.”

The line between gambling and trading has always been blurry. As a student of quantitative finance, we are often taught that market movements follow random walks and Brownian motion. But this raises a question: if trading is driven by volatility, speculative psychology, and emotion, is it truly different from gambling? If you bet on a high-risk event with positive expected value, is it still gambling? According to the “gambler’s ruin” theory, a gambler who keeps increasing bets without reducing stakes during losses will eventually go bankrupt—even if each bet has positive expected value. Then again, are we all just “sophisticated gamblers”?

The data is clear: retail crypto users and gamblers are not only similar—they are often the exact same people.

Kalshi doesn’t need to choose between these two user types; it can serve both. Whether it’s a “smart trader” executing arbitrage strategies or an “entertainment player” predicting sports results, Kalshi offers a regulated, legal market environment where both behaviors coexist.

By abstracting away the label of “gambling” and embracing the language of “markets,” Kalshi is connecting two massive user groups: those who want to play and those who want to trade. In doing so, it doesn’t sacrifice either identity—it strengthens the value and legitimacy of both.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News