Silicon Valley vs Washington: Polymarket and Kalshi Fight for Survival

TechFlow Selected TechFlow Selected

Silicon Valley vs Washington: Polymarket and Kalshi Fight for Survival

Capital Bets on Prediction Markets: Who Will Come Out on Top?

By kkk, Ryo, BlockBeats

Recently, Kalshi announced an $185 million Series C funding round led by Paradigm, boosting its valuation to $2 billion. At the same time, Polymarket is preparing to close a nearly $200 million round, pushing its valuation past $1 billion.

Frequent fundraising news in the prediction market space inevitably hints at the underlying tensions and competition between platforms. A battle for future information pricing power is quietly unfolding.

The Love and Hate of Prediction Markets

Kalshi, founded in 2020 and headquartered in New York, is currently the only prediction market platform officially approved by the U.S. Commodity Futures Trading Commission (CFTC). Backed by Y Combinator, former Charles Schwab CEO David Pottruck, and crypto-focused fund Paradigm, Kalshi reached a $1 billion valuation in its latest funding round.

Polymarket represents the decentralized prediction market model. The platform enables users to trade event predictions using the USDC stablecoin on blockchain, with fully on-chain settlement and strong liquidity. Its investor list is equally impressive, including Founders Fund, Polychain Capital, Naval Ravikant, and Balaji Srinivasan. Polymarket's upcoming funding round is expected to raise $200 million, with a pre-funding valuation nearing $1 billion, led by Founders Fund.

In June this year, Polymarket announced a partnership with X—the social platform led by Elon Musk—to integrate its prediction data with xAI’s AI tool Grok, creating a “real-time predictive news feed.” Previously, Kalshi had been in talks with X for a similar collaboration and even briefly announced it publicly—only to retract the announcement within 24 hours.

This sudden reversal was widely interpreted as politically motivated—Donald Trump Jr., eldest son of Donald Trump, serves as a senior advisor to Kalshi. Amid escalating political friction between Musk and Trump, X’s decision to abandon Kalshi and embrace the unregulated Polymarket was seen as a strategic political move, reflecting Musk’s dissatisfaction with traditional regulatory frameworks.

Related reading: "X Partners with Polymarket: Musk Takes Another Step Toward an 'Everything App'"

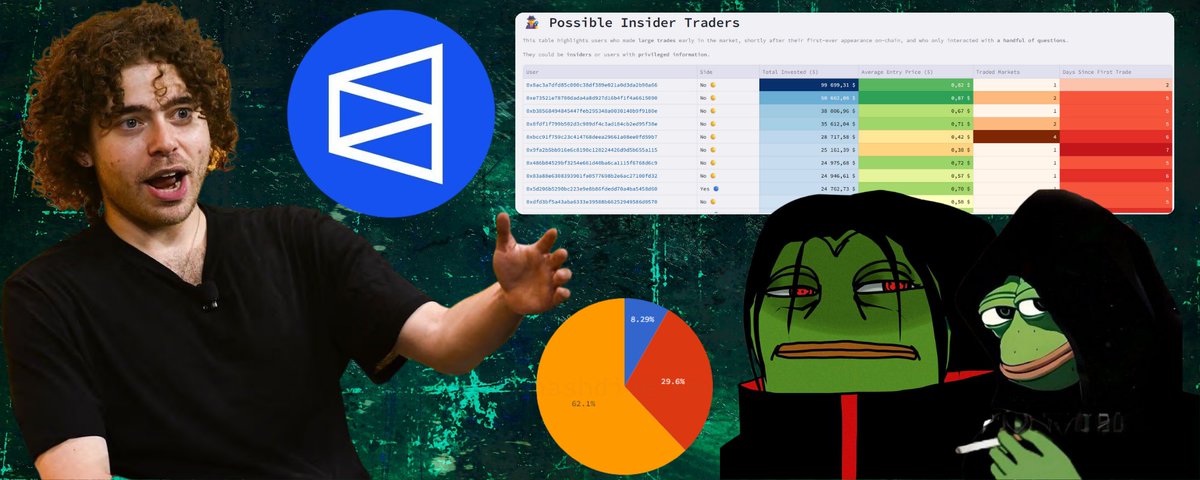

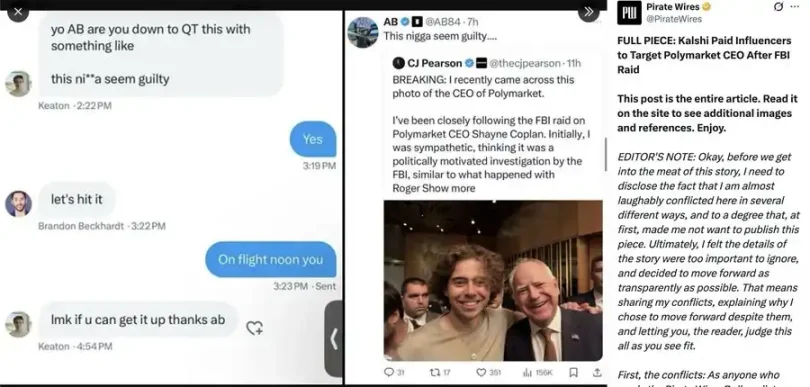

Recently, crypto investor Tom Schmidt revealed that Kalshi may have secretly coordinated former NFL player Antonio Brown (AB) to launch an organized smear campaign against Polymarket.

According to screenshots disclosed by Pirate Wires, Keaton, a growth team employee at Kalshi, was caught privately messaging AB, urging him to retweet with the caption “This guy looks guilty,” implying Polymarket CEO Coplan was involved in criminal activity. AB then posted the tweet as instructed, confirming Kalshi orchestrated a disinformation campaign leveraging social influencers.

Besides Antonio Brown, Pirate Wires identified several other high-following KOLs who published negative content about Polymarket shortly after the FBI raid on its CEO. For instance, meme account Clown World mocked Polymarket CEO Coplan as the “illegal gambling version of SBF” just one day after the raid—and has a paid partnership with Kalshi. The account also frequently promoted Kalshi-related content during the election season.

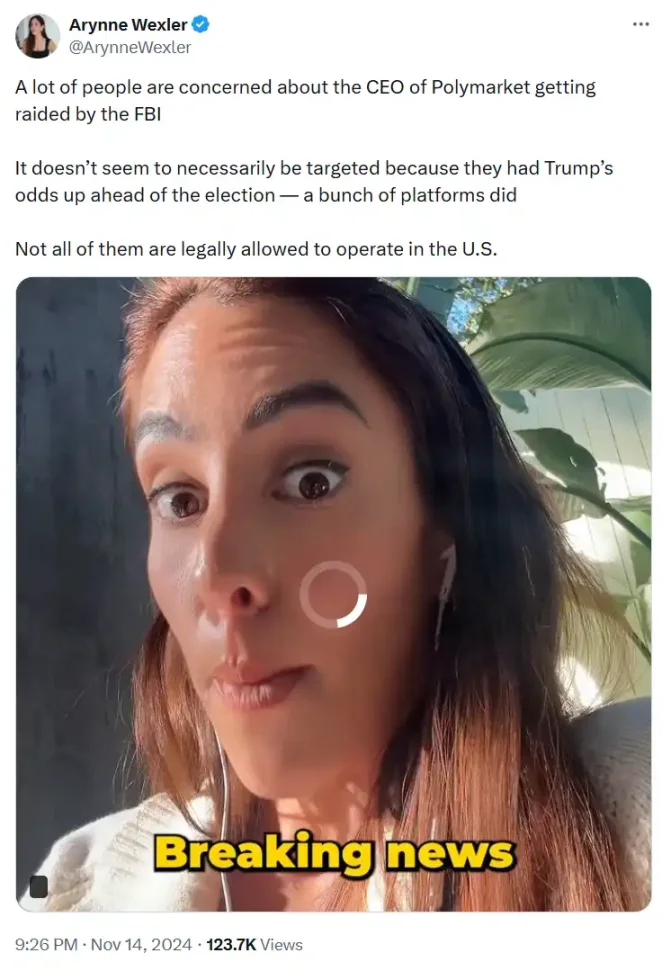

Miami influencer Arynne Wexler released a video emphasizing Polymarket’s illegality in the U.S., repeatedly recommending Kalshi and advising viewers to “choose a compliant platform.” Screenshots show she had already entered into a private collaboration with Kalshi.

Kalshi vs. Polymarket: Who Leads?

Funding: Top-Tier Capital Support

Both Kalshi and Polymarket have attracted significant attention from top-tier investors, signaling the evolution of prediction markets from niche speculation toward becoming foundational infrastructure.

Kalshi emerged from Y Combinator’s winter cohort in 2019. In February 2021, it raised $30 million in a Series A round led by Sequoia Capital, reaching a $120 million valuation. Investors included SV Angel, Charles Schwab (chairman of Charles Schwab), and Henry Kravis (co-founder of KKR). In October 2024, Kalshi secured another $50 million, backed by Sequoia, Mantis VC, Neo, and others, aimed at expanding its range of event contracts and enhancing platform capabilities. On June 26, 2025, Kalshi closed an $185 million Series C round led by Paradigm at a $2 billion valuation.

Polymarket followed a more Web3-native funding path: In its founding year of 2020, it raised $4 million in a seed round led by Polychain, with angel investors including Balaji (former a16z partner and Coinbase CTO), Jack Herrick (founder of wikiHow), and Robert Leshner (founder of Compound)—all prominent figures in the Web3 community. In 2022, it raised $25 million in a Series A led by General Catalyst, with continued backing from Airbnb co-founder Joe Gebbia and Polychain. In May 2024, Polymarket completed a $45 million Series B led by Peter Thiel’s Founders Fund, with direct participation from Ethereum founder Vitalik Buterin. It is now preparing for another $200 million round, with a post-money valuation expected to exceed $1 billion.

Notably, Polymarket enjoys deep support not only from major crypto investors but also from Silicon Valley legend Peter Thiel. His Founders Fund led Polymarket’s Series B and was also an early backer of Musk’s X. Meanwhile, Kalshi benefits from indirect endorsement by members of the Trump family. Amid regulatory scrutiny over election markets, the Trump camp’s support for Kalshi has often been interpreted as a policy signal. In this highly politicized arena, the interplay between capital and power extends far beyond the prediction market itself.

Operating Model: Centralized vs. Decentralized

The core difference between Polymarket and Kalshi lies in their operational models: centralization versus decentralization.

Kalshi follows a centralized approach, using a traditional order book system where the platform acts as both matchmaker and custodian. All trading, result sourcing, and settlement occur within its closed ecosystem, offering an experience closer to U.S. options markets—making it more accessible for institutional players and easier to integrate with regulators.

In contrast, Polymarket fully embraces decentralization: automated market makers (AMMs), fully on-chain settlements via smart contracts, and oracles determining outcomes eliminate the need for trust in a central entity. No registration or KYC is required—just connect your wallet and trade. The principles of “freedom, fairness, and censorship resistance” are embedded directly into its code, aligning closely with crypto-native values.

Regulation: Compliance First vs. Regulatory Red Lines

The regulatory gray area surrounding prediction markets is no secret. The divergent fates of Kalshi and Polymarket highlight the strengths and weaknesses of centralized versus decentralized approaches.

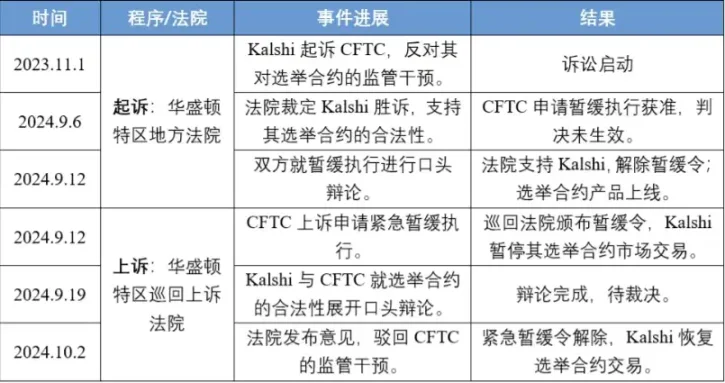

Kalshi broke through multiple regulatory barriers to become an officially recognized platform. In June 2023, its election-related contracts drew scrutiny from the CFTC. Kalshi self-certified on June 12, faced formal review on June 23, and was ultimately rejected on September 22 due to concerns over illegal gambling. Undeterred, Kalshi initiated a prolonged legal battle against the CFTC in the D.C. Circuit Court of Appeals, ultimately winning in October 2024 and becoming the first U.S. platform legally authorized to offer election prediction markets.

In stark contrast, Polymarket has faced relentless regulatory pressure. In 2022, it was sued by the CFTC for offering unregistered off-exchange binary options, resulting in a $1.4 million fine and a commitment to exit the U.S. market. However, blockchain traffic data shows around 25% of visits still originate from the U.S., largely via VPNs. After the 2024 U.S. election, Polymarket reignited regulatory backlash: the Department of Justice launched an investigation, and the FBI raided the home of founder Shayne Coplan, seizing electronic devices. Authorities suspect possible manipulation of election sentiment and facilitation of illegal trading by U.S. residents. To date, Polymarket remains classified by the CFTC as an “illegal platform,” operating under persistent regulatory threat.

Influence: Polymarket Breaks Into the Mainstream

If Kalshi wins within the rules, Polymarket wins in public visibility.

During the 2024 U.S. presidential election, Polymarket accurately predicted Trump’s victory well in advance, positioning itself as the definitive challenger to flawed traditional polls. Bloomberg Terminal integrated its odds data, while mainstream outlets like The New York Times, The Economist, and The Wall Street Journal collectively cited on-chain prediction data for the first time—breaking through Web2 media barriers. Even Donald Trump himself referenced Polymarket during campaign rallies, marking its penetration from crypto circles into national public discourse.

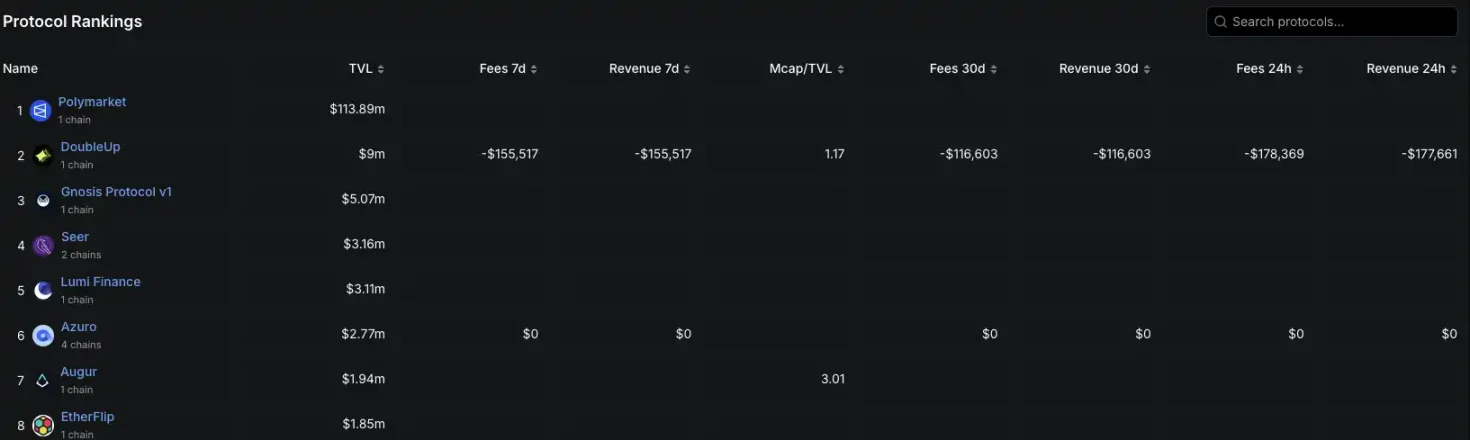

In terms of scale, Polymarket has pulled far ahead. Its current total value locked (TVL) stands at $113 million—surpassing the combined TVL of the next nine largest platforms in the sector. During the 2024 U.S. election cycle, cumulative trading volume exceeded $3 billion, with over $4 billion wagered. In comparison, Kalshi recorded $875 million in election market trading volume and approximately $230 million in wagers. Across user engagement, trading depth, and market热度, Polymarket is undoubtedly the breakout phenomenon in today’s prediction market landscape.

Conclusion

Whether it’s Kalshi’s centralized, compliance-first approach or Polymarket’s decentralized, autonomous ethos, both represent distinct visions for how society prices the future in the information age. Whether these two paths will eventually converge remains to be seen. But one thing is certain: prediction markets are moving from the fringes to the center. They are no longer just speculative games for a few, but emerging as a new way to understand and interpret the world. The question of who will lead this transformation is one worth betting on.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News