The people quietly making money through arbitrage on Polymarket

TechFlow Selected TechFlow Selected

The people quietly making money through arbitrage on Polymarket

After Polymarket's valuation reaches $9 billion, what other profit opportunities do we have?

Author: Jaleel

After securing $2 billion in investment, Polymarket is now valued at $9 billion—one of the largest funding rounds in the crypto space in recent years.

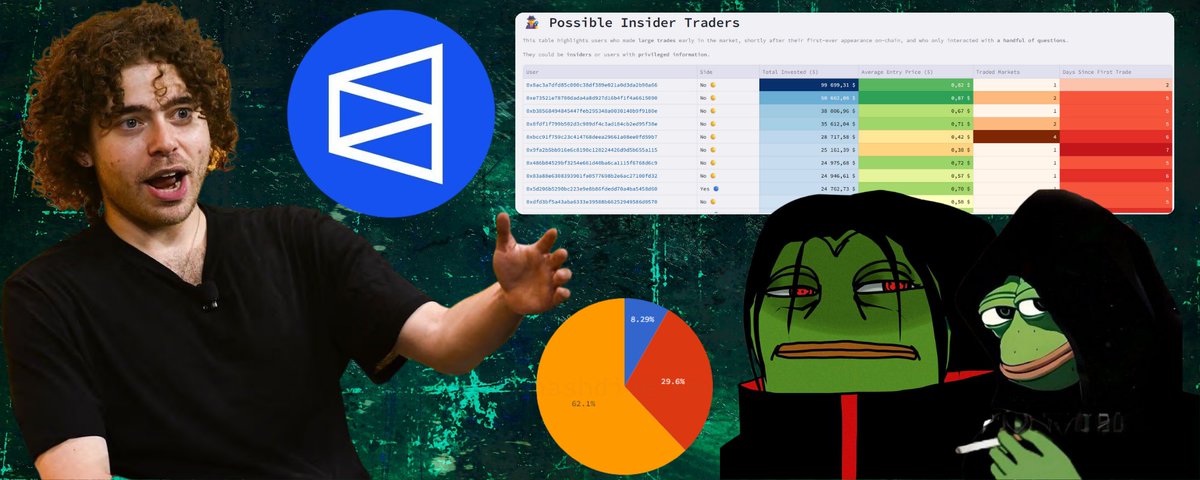

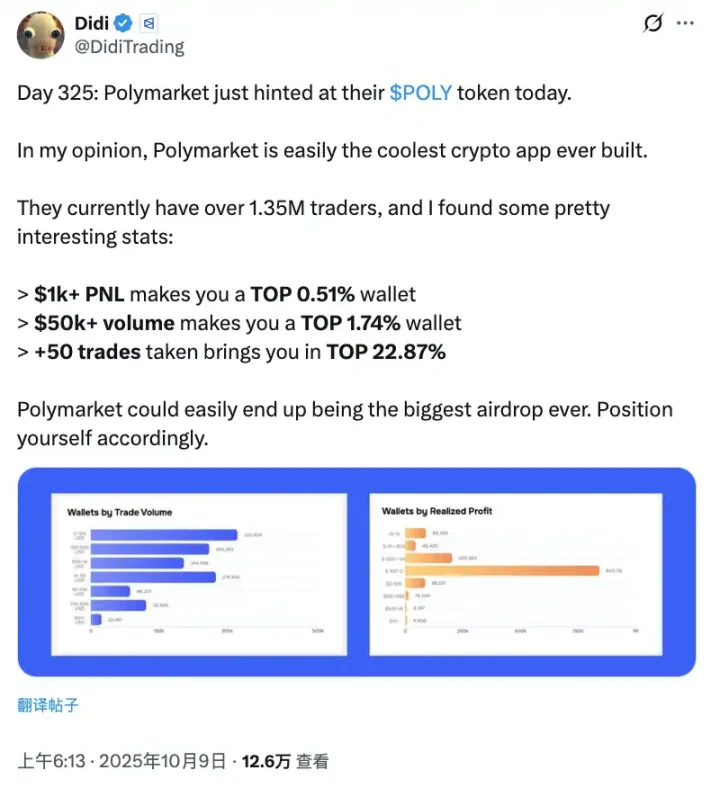

Amid growing rumors of an IPO, IDO, and airdrop, let's first look at an interesting set of data: if your PNL exceeds $1,000, you're in the top 0.51% of wallets; if your trading volume surpasses $50,000, you're among the top 1.74% of large traders; completing over 50 trades means you've outperformed 77% of users.

This data also suggests that on Polymarket—a fertile ground—only a small number of people have truly been consistently farming and harvesting profits over the past few years.

With ICE’s strategic investment now in place, Polymarket’s liquidity, user base, and market depth are rapidly expanding. More capital flowing in means more trading opportunities; increased retail participation leads to greater market imbalances; and more market types open up more arbitrage potential.

For those who know how to genuinely profit on Polymarket, this is a golden age. Most treat Polymarket as a casino, while smart money sees it as an arbitrage tool. In this long-read piece, BlockBeats interviewed three seasoned Polymarket players to break down their profit strategies.

Sweeping Tails as a New Financial Tool

"Roughly 90% of large orders worth tens of thousands of dollars or more on Polymarket trade at prices above 0.95," said veteran player fish, cutting straight to the point.

On Polymarket, a prediction market, one popular strategy known as "sweeping tails" has gained widespread traction.

The strategy is simple: when an event’s outcome is nearly certain and the market price soars above 0.95 or even approaches 0.99, you buy in at that price and patiently wait for the official settlement, capturing the last few percentage points of near-certain profit.

The core logic of tail sweeping can be summed up in four words: time for certainty.

When an event has already occurred—such as a clear election result or a concluded sports match—but the market hasn’t settled yet, prices often hover just below 1. Entering at this stage theoretically guarantees a small but secure profit upon settlement.

"Many retail traders don’t wait for settlement," fish explained to BlockBeats. "They’re eager to cash out and move on to the next trade, so they sell directly at prices between 0.997 and 0.999, leaving room for larger players to arbitrage. While each trade only yields about 0.1% profit, with sufficient capital and high frequency, these gains accumulate into significant income."

But like all investments, tail sweeping isn't risk-free "mindless investing."

"The biggest enemy of this strategy," fish continued, "isn't market volatility—it's black swan events and manipulation by whales."

Black swan risks are ones tail sweepers must constantly guard against. A black swan refers to seemingly certain outcomes suddenly reversing—like a game declared over being ruled invalid post-match, or a political result overturned due to a scandal. If such low-probability events occur, tokens bought at 0.99 instantly become worthless.

"Most so-called black swan reversals are actually orchestrated by whales," fish went on. "Their typical playbook: when the price nears 0.99, they dump a large order to crash it to 0.9, create panic, spread reversal narratives on comment sections and social media to amplify fear among retail traders, wait for panic selling, then repurchase the positions cheaply. After settlement, these whales not only pocket the difference from 0.9 to 1.00 but also steal the profits that retail traders should have earned."

This completes the full cycle of whale manipulation.

Another veteran player, Luke (@DeFiGuyLuke), added an interesting detail to this cycle: "Polymarket’s comment section is highly readable. This phenomenon is quite unique—you rarely see this elsewhere."

People write extensive arguments backing their views, and many realize they can align with others. As a result, manipulating public sentiment on Polymarket becomes relatively easy.

This insight became the foundation of Luke’s startup: "When I used Polymarket, I noticed something interesting—on Twitter, content is mostly noise and no one really wants to read it. Most people don’t speak much. But on Polymarket’s comments, even someone betting $20 or $100 will write long, detailed posts."

"I found this content incredibly engaging. That’s when I realized how unusually readable Polymarket’s comment sections are." Based on this observation, Luke launched Buzzing—a platform allowing anyone to create markets on any topic. After placing bets, users can post comments, which form a content feed that helps distribute and surface markets.

So, given the risk of manipulated black swans, is tail sweeping unplayable?

"Not necessarily. The key lies in risk control and position management. For example, I never allocate more than 1/10 of my capital to any single market," fish added. "Never bet everything on one market, even if it looks 99.9% certain to win. Prioritize markets nearing settlement (within hours) with prices above 0.997—this shortens the window for black swan events."

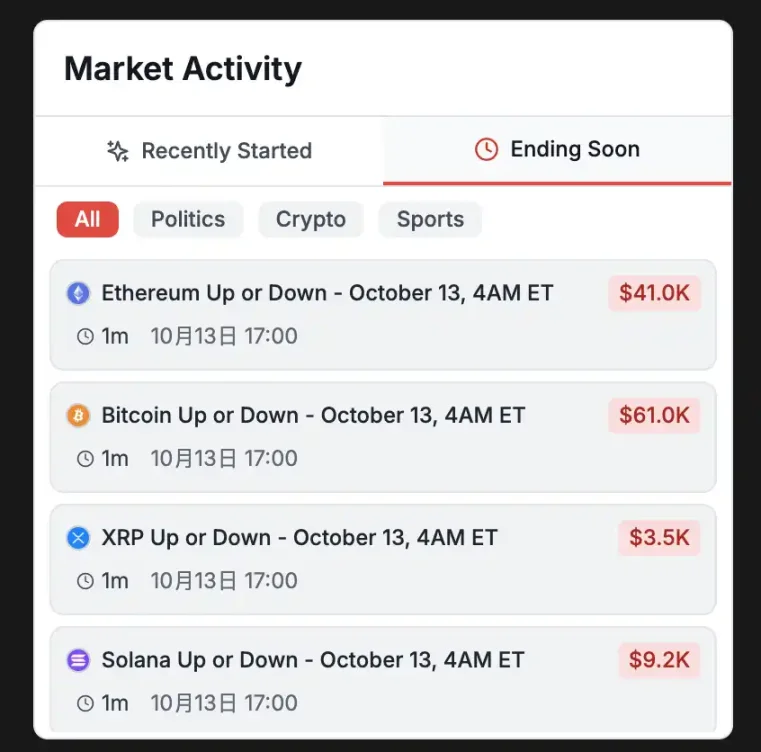

Markets nearing completion shown on polymarketanalytics

Arbitrage Opportunities When Total Probability Is Less Than 100%

There’s an address on Polymarket that turned $10,000 into $100,000 in six months by participating in over 10,000 markets.

It wasn’t through gambling or insider information, but via a seemingly simple yet technically demanding arbitrage strategy—exploiting multi-outcome markets where the total probability sums to less than 100%.

The elegance of this strategy is striking: in a multi-option market where only one outcome wins (Only 1 Winner), if the sum of all option prices is less than $1, buying one share of each option guarantees a $1 payout upon settlement. The difference between cost and payout is pure risk-free profit.

Let’s illustrate with a concrete example. Consider a market on “Will the Fed cut rates in July?” with four options:

Cut by more than 50 bps: priced at $0.001 (0.1%)

Cut by more than 25 bps: priced at $0.008 (0.8%)

No change: priced at $0.985 (98.5%)

Hike by more than 25 bps: priced at $0.001 (0.1%)

Summing these: 0.001 + 0.008 + 0.985 + 0.001 = $0.995. This means you spend $0.995 to buy one share of each, and after settlement, you receive $1 regardless of the outcome. Profit: $0.005, or a 0.5% return.

"Don’t underestimate 0.5%. With $10,000 invested, that’s $50 per trade. Do dozens daily, and the annual return becomes staggering. And since it’s risk-free arbitrage, as long as the market settles normally, profit is guaranteed," Fish said.

Why do such arbitrage opportunities exist?

In multi-option markets, each option has its own independent order book. This leads to an interesting phenomenon:

Usually, the sum of probabilities is ≥100% (normal state, as market makers earn bid-ask spreads). However, when retail traders trade one specific option, only that option’s price moves—the others remain unchanged. This creates brief market imbalances where the total probability drops below 100%.

This window may last only seconds—or less. But for arbitrage bots running monitoring scripts, it’s pure gold.

"Our bot continuously monitors all multi-option order books 24/7," fish explained. "Once it detects a sum below $1, it automatically buys all options instantly, locking in profit. With a solid bot system, you can monitor thousands of markets simultaneously."

"This is similar to MEV (Miner Extractable Value) atomic arbitrage in crypto," fish continued. "Both exploit temporary market inefficiencies, using speed and technology to execute before others, then rebalancing the market."

Unfortunately, this strategy is now dominated by a few bots, making it hard for ordinary users to profit significantly. What should be universally accessible risk-free arbitrage has become a battle among elite bot operators.

"Competition will only intensify," fish said. "It’ll come down to who has servers closest to Polygon nodes, whose code runs most efficiently, who detects price changes fastest, and who submits and confirms transactions quickest."

At Its Core, This Is Market Making

By now, many may have realized: the arbitrage strategies described earlier essentially function as market making.

A market maker’s job is simply this: deposit USDC into a specific market pool, effectively placing both buy Yes and buy No orders, providing counterparty liquidity for all buyers and sellers. The deposited USDC is split into corresponding contract shares based on current Yes/No ratios. For example, at a 50:50 price, $100 USDC becomes 50 Yes + 50 No shares. As the market fluctuates, your inventory ratio deviates from optimal (e.g., 50:50). Skilled market makers actively trade or adjust capital to rebalance their positions and lock in arbitrage profits.

From this perspective, these arbitrage bots are acting as market makers—they continuously rebalance the market through arbitrage, making prices more accurate and liquidity deeper. This benefits Polymarket’s entire ecosystem. Hence, Polymarket doesn’t charge fees and even rewards makers (liquidity providers).

"In this sense, Polymarket is actually very maker-friendly," Fish said.

"Based on data, market makers on Polymarket likely earned at least $20 million over the past year," Luke revealed to BlockBeats two months ago. "We haven’t updated the numbers since, but it’s definitely higher now."

"In terms of return models, market experience suggests a relatively stable expectation: 0.2% of trading volume," Luke continued.

Suppose you provide liquidity in a market with $1 million in monthly volume (including both buy and sell sides you facilitate). Your expected profit would be: $1M × 0.2% = $2,000.

This yield may seem modest, but the key is its stability—unlike speculative trading, it doesn’t swing wildly. And by scaling up, returns grow: 10 markets yield ~$20K, 100 markets ~$200K. Factoring in platform LP rewards and holding APY, actual returns can be even higher. "But the main income still comes from market-making spreads and Polymarket’s rewards—that’s the core."

Interestingly, while other arbitrage strategies are maxed out by bots, Luke believes market making remains under-competitive.

"Token trading competition is fierce—people compete on hardware. But Polymarket’s market isn’t that intense yet. So right now, the edge lies in strategy, not speed."

This means market making could be an underrated opportunity for players with technical skills and capital. As Polymarket reaches a $9 billion valuation and liquidity keeps growing, the earning potential for market makers will only expand. Now might not be too late to enter.

2028 Election Arbitrage

During conversations with BlockBeats, both Luke and Tim highlighted potential market-making arbitrage opportunities, especially in Polymarket’s 4% yield-bearing 2028 U.S. presidential election market.

Three years before the 2028 election, Polymarket has already started positioning itself. To capture market share and attract early liquidity, the platform offers a 4% annual yield.

"Some might think 4% APY is low for crypto—AAVE and similar platforms offer higher,"

"But I believe Polymarket is doing this to compete with Kalshi," Luke explained. "Kalshi has long offered U.S. Treasury yields on account balances, which is common in traditional finance. For example, Interactive Brokers pays interest on idle cash even if you’re not actively investing. It’s standard in traditional financial products."

"Kalshi is a Web2 product, so implementing this is easy," Luke continued. "But Polymarket hasn’t done it because its funds are locked in the protocol, making it harder. So historically, Polymarket lagged behind Kalshi in this feature."

This disadvantage is more pronounced in long-term markets like the 2028 election. "Imagine depositing money now and waiting three years for settlement, with your funds sitting idle. That feels suboptimal. So to close the gap with competitors, they introduced this yield reward—likely subsidized by the platform itself," Luke said.

"Still, I don’t think market makers are primarily targeting the 4% yield—that’s more for regular users. This subsidy reduces users’ effective trading costs, which is great for those grinding trading volume and transaction counts over time, especially studios that are highly sensitive to cost-benefit calculations."

Tim has deeply researched this area: "If you study the mechanism closely, you’ll find far bigger arbitrage potential beyond the 4% yield."

"A detail many overlook: Polymarket offers an additional $300 daily LP reward per option," Tim elaborated. Beyond the 4% holding APY, Polymarket provides extra incentives. If you provide liquidity—by simultaneously placing buy and sell orders to maintain market depth—you can share in a daily $300 LP reward pool per option.

Tim did a quick calculation. Suppose the "Who will win the 2028 U.S. presidential election?" market has 10 popular candidates, each with a $300 daily LP reward. The total daily LP pool is $3,000. If you hold 10% of the liquidity share, you earn $300 daily—$109,500 annually.

"And that’s just the LP reward. Add in bid-ask spread profits from market making, plus 4% compounded holding yield, and combined returns can easily exceed 10%, even 20% or more."

"If you ask me whether market making on the 2028 election is worthwhile? My answer: if you have the tech, capital, and patience, it’s a severely underestimated opportunity. But honestly, it’s not for everyone."

Tim said: "It suits稳健 players with substantial capital (at least tens of thousands); tech-savvy players who can build automated market-making systems; long-term thinkers who prefer steady returns over get-rich-quick schemes; and those with some understanding of U.S. politics who can assess market trends.

But it’s unsuitable for those with small capital (a few thousand dollars); short-term speculators chasing quick riches who can’t wait four years; complete beginners with no grasp of U.S. politics or market rationality; or players needing liquidity and access to funds at short notice."

News Trading on Polymarket

While analyzing Polymarket’s market data, Luke and his team discovered a counterintuitive phenomenon.

"People always say Polymarket users are smart and prescient—predicting outcomes before results are known," Luke said. "But actually, the opposite is true."

"Most Polymarket users are dumb money—pretty clueless," Luke laughed. "In most cases, they misjudge the event. Only after the result is announced and news breaks do many rush in, front-run, and arbitrage, pushing prices toward the correct level—Yes or No. But before the news drops, they’re often wrong."

"Data shows," Luke continued, "that overall, user betting and price reactions on Polymarket lag behind real-world events. Frequently, the actual event has already happened, yet bets are still pointing the wrong way, leading to massive reversals."

Luke gave a vivid example: "Take the papal election—initially, an American cardinal was elected. Before Vatican announced it, the odds of an American pope were still in the thousandths—extremely low. But as soon as the announcement came, boom—the price surged."

"So you see, users often bet incorrectly," Luke concluded. "If you have access to reliable news sources and can front-run immediately, there’s clear profit potential. I think this is definitely exploitable."

But the barrier to entry remains high.

"This requires strong technical development," Luke admitted. "You need real-time news feeds—similar to MEV strategies. You must reliably capture news, layer in NLP processing, and execute trades quickly. But yes, there’s opportunity here."

On this $9 billion-valued battlefield called Polymarket, we’ve seen various profit strategies. Yet across them all, many quiet winners treat it not as a casino, but as an arbitrage machine.

Our interviews clearly show: Polymarket’s arbitrage ecosystem is maturing fast, and space for newcomers is shrinking. But that doesn’t mean ordinary players have no chance.

Returning to the initial data: PNL over $1,000 puts you in the top 0.51%; trading volume over $50,000 ranks you top 1.74%; 50 trades surpass 77% of users.

So even if you start trading frequently now, on airdrop day—given Polymarket is the highest-funded crypto project in years—it might still deliver a big surprise to ordinary users.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News