Polymarket founder's rags-to-riches story: from broke at 21 to billionaire five years later

TechFlow Selected TechFlow Selected

Polymarket founder's rags-to-riches story: from broke at 21 to billionaire five years later

How did someone with "nothing to lose" build a business that regulators want to destroy?

By: Thejaswini M A

Translated by: Saoirse, Foresight News

June 2020: A broke 21-year-old launched a betting platform from his bathroom during the pandemic.

November 2024: FBI agents raided his apartment, seized his phone, and left without filing any charges.

October 2025: The parent company of the New York Stock Exchange invested $2 billion into his company.

This is Shayne Coplan’s five-year journey—from inventorying items in his Lower East Side apartment, calculating what to sell to pay rent, to becoming the youngest self-made billionaire on Bloomberg's tracked list.

How did someone with "nothing to lose" build a business that regulators wanted to destroy?

And why would a platform banned in its home country win the favor of Wall Street’s most powerful institutions?

These details matter because they reveal the real mechanics behind what seemed impossible. For this reason, Coplan’s story shouldn’t be reduced to just a timeline—this is precisely why we’re writing it.

The Whitepaper Epiphany

In 2019, Shayne Coplan had completely lost faith in cryptocurrency.

Two-and-a-half years after dropping out of New York University (NYU), his multiple startup attempts had all failed. The once-promising "cryptocurrency revolution" had become, in his eyes, a "crypto scam"—projects no longer aimed at creating value but at extracting money.

Broke and disillusioned, he watched the industry he once believed in turn into a "casino" for scammers.

So he paused his frantic entrepreneurial hustle and began reading deeply: academic papers, obscure research reports, especially economist Robin Hanson’s work on "prediction markets."

The core theory of prediction markets is simple: markets aggregate information better than experts, polls, or any traditional forecasting method. When people put their money behind their beliefs, collective wisdom reveals the truth.

This theory had already been academically validated: since 1988, the Iowa Electronic Markets had consistently outperformed traditional polls. Yet such platforms remained niche, academic, and inaccessible to the general public.

Coplan spotted this gap immediately.

"Such a powerful idea shouldn’t stay confined to whitepapers," he wrote in an article.

For the next year, he immersed himself in studying how prediction markets worked, why they hadn’t scaled, and what it would take to make them mainstream. Despite dwindling bank balances, he persisted in his research for a full year.

Most people would have found a job by then.

Then, the pandemic hit.

The Bathroom Office Startup

March 2020: The world went into lockdown.

People were stuck at home, glued to screens, desperate to know what would happen next: Would schools reopen? Would a vaccine succeed? How long would the pandemic last?

Traditional institutions—governments, health agencies, media—struggled to provide reliable answers. Everyone had opinions, but no one knew the truth.

Coplan saw the moment clearly.

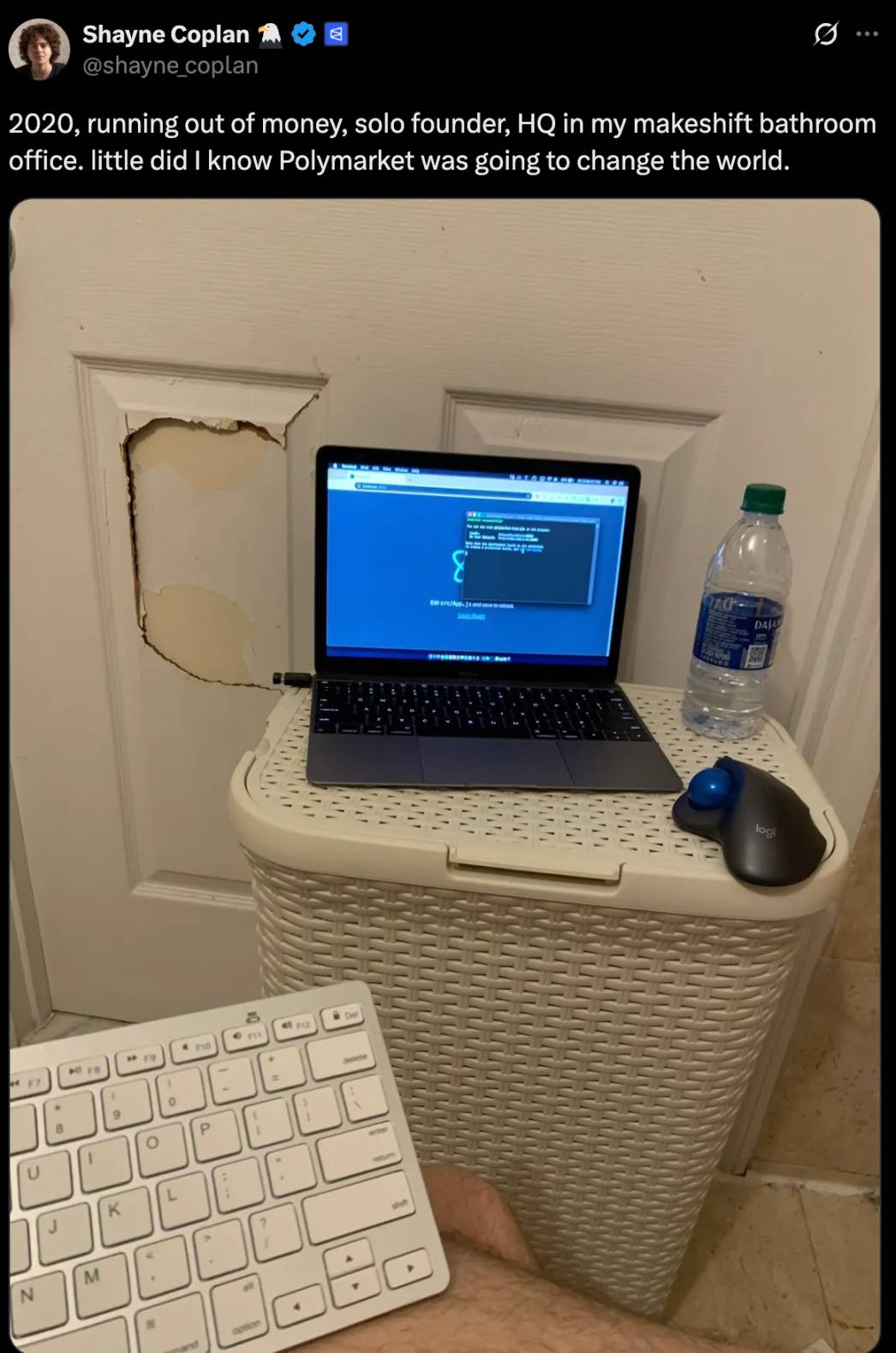

At 21, penniless and still jobless two-and-a-half years after dropping out, he began building his platform—in his words, from a “makeshift bathroom office” in a Lower East Side apartment.

June 2020: The prediction market platform Polymarket officially launched.

@Shayne Coplan

The concept was simple: users bet cryptocurrency on real-world event outcomes. Each question became a “market,” where users could buy shares representing “yes” or “no.” If correct, each share redeemed for $1; if wrong, it was worth $0. The market price itself reflected the crowd’s estimated probability of the event occurring.

For example, if a share traded at 65 cents, it meant the crowd believed there was a 65% chance the event would happen.

Pure information aggregation—no expert commentary, no narrative manipulation, just “beliefs backed by money.”

Building a prediction market required solving technical challenges: data feeds, outcome verification, user experience, and establishing trust among strangers—after all, users were betting on everything from elections to pop culture.

More importantly, it needed to survive in a regulatory gray zone.

To some regulators, prediction markets resembled gambling; to others, financial derivatives. Their legal status remained unclear.

Coplan’s strategy: build first, seek permission later.

It worked—for the first two years.

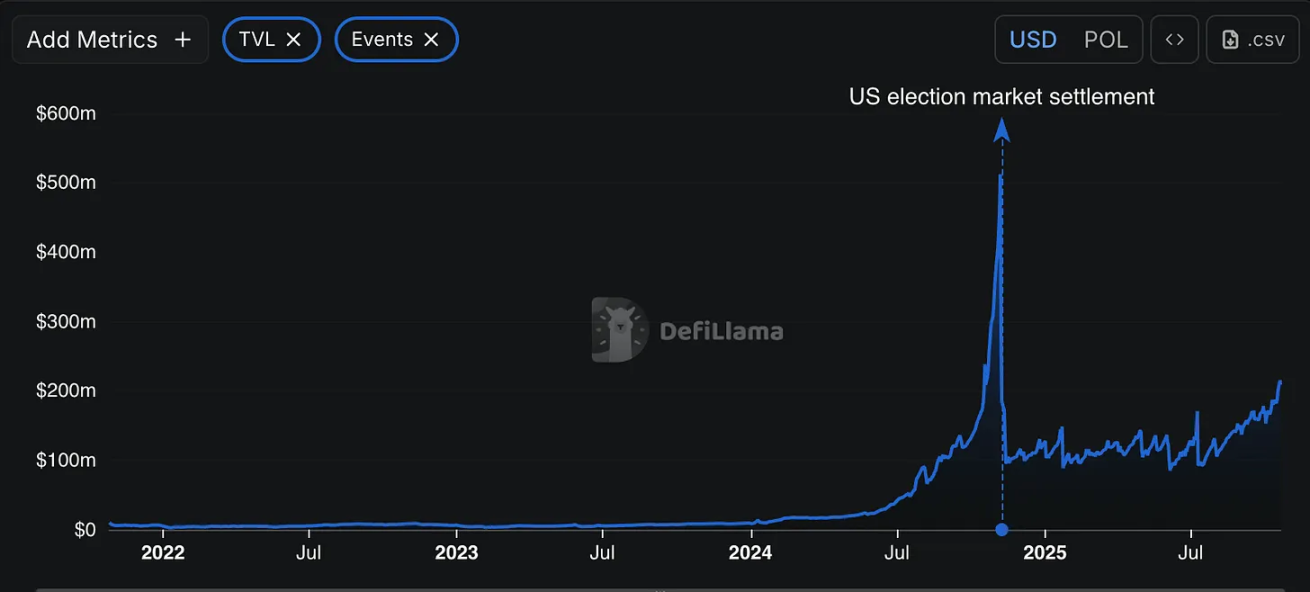

By 2022, Polymarket began gaining attention.

Trading volume grew steadily. Users predicted everything from Oscar winners to economic indicators, gradually emerging as a credible alternative to traditional forecasting.

Then came the Commodity Futures Trading Commission (CFTC).

Regulators accused Polymarket of “offering illegal trading contracts” and “operating an unregistered exchange.” The platform settled for $1.4 million (without admitting or denying guilt).

More critically: Polymarket agreed to block all U.S.-based users.

This created a paradox: the platform could operate globally—but not in the U.S. International users could bet on U.S. elections, while American citizens couldn’t participate in predictions about their own politics.

Yet regulators suspected Polymarket was secretly allowing U.S. users to access the platform.

The 2024 Election: Validation and Regulatory Storm

2024: The U.S. presidential election approached.

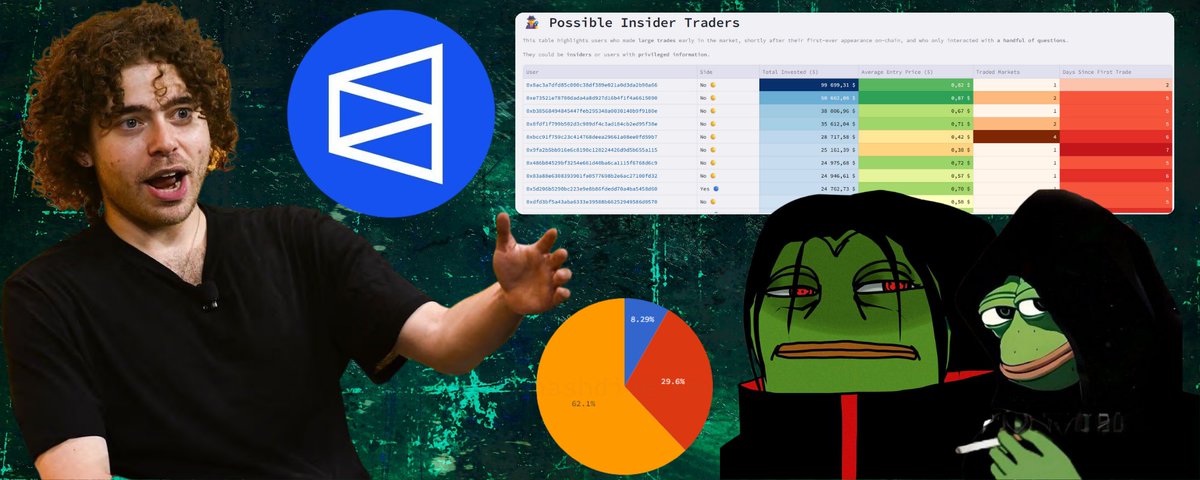

Polymarket became impossible to ignore: over $3.5 billion was wagered on election outcomes. The platform consistently showed Trump leading, while traditional polls indicated a tight race.

A French trader reportedly bet tens of millions on a Trump victory. When Trump won, the trader netted $85 million.

In the end, Polymarket’s forecast accuracy surpassed traditional polls.

@defillama.com

Then came the raid.

November 2024, one week after the election.

Before dawn, FBI agents stormed Coplan’s New York apartment, seizing his phones and electronics. The 26-year-old Coplan was neither arrested nor charged.

He responded on X (formerly Twitter): “New phone, who dis?” (a nod to his confiscated device).

Polymarket called it a “clear act of political retaliation by a lame-duck administration.”

The Department of Justice and CFTC both launched investigations.

The platform that had just proven its predictive power suddenly faced scrutiny from multiple federal agencies.

But Coplan didn’t stop. He kept pushing forward.

And in America, things often shift unexpectedly: investigations started under the Biden administration abruptly ended when the Trump administration took office.

July 2025: DOJ and CFTC formally dropped all investigations—no charges, no additional penalties.

That same month, Polymarket acquired QCEX—a CFTC-licensed exchange and clearinghouse—for $112 million. This fulfilled Coplan’s key goal since the 2022 settlement: establishing a legal framework for U.S. operations.

August 2025: Donald Trump Jr., through his investment firm 1789 Capital, joined Polymarket as an advisor. A company raided under one administration now had support from the incoming administration’s family.

September 2025: Blockratize, Polymarket’s parent company, filed documents with the SEC mentioning “other warrants”—a common signal in crypto projects preceding token issuance.

Coplan posted “$POLY” on X, alongside $BTC and $ETH icons. The implication was clear: a token launch was imminent.

@Shayne Coplan

October 2025: The long-awaited news arrived: Intercontinental Exchange (ICE), parent company of the New York Stock Exchange, invested $2 billion in Polymarket at an $8 billion pre-money valuation.

Jeffrey Sprecher, CEO of ICE, is married to Kelly Loeffler—former Senator, former Administrator of the Small Business Administration, and cabinet member in the Trump administration.

The partnership includes plans for ICE to distribute Polymarket’s data globally and collaborate on financial tokenization initiatives.

A project started by a broke dropout in a bathroom had become part of Wall Street’s mainstream.

At 27, Shayne Coplan entered the Bloomberg Billionaires Index as its youngest self-made billionaire.

@Bloomberg

What Problem Did Polymarket Actually Solve?

Polymarket cracked the barriers that earlier prediction markets failed to overcome.

Early platforms like Intrade had proven the model could work—Intrade correctly predicted the 2008 and 2012 U.S. elections—yet shut down in 2013. These platforms remained niche, complex, academic, and never reached the masses.

Polymarket made prediction markets feel like entertainment.

Its interface was clean. Questions ranged widely: serious ones (“Will the Fed cut rates?”) to lighthearted ones (“Will Taylor Swift and Travis Kelce get engaged in 2025?”). This mix dramatically boosted user engagement.

More importantly, it captured a shift in how people consume information.

Traditional media tells you “what to think.” Polls tell you “what others think.” Polymarket tells you “what people are willing to bet money on.”

For users increasingly distrustful of traditional institutions, this distinction is crucial.

Today, Polymarket has over 1.3 million users, cumulative trading volume near $20 billion, and monthly volume consistently above $1 billion.

The 2024 election proved its potential: while mainstream polls showed a close race, Polymarket users consistently favored Trump—and the result validated that prediction.

Some argue whether the platform aggregates “true wisdom” or merely reflects the political bias of crypto users. But the outcome reinforced the core claim of prediction markets: beliefs backed by money tend to be closer to the truth.

Of course, as a prediction market, Polymarket occasionally faces philosophical questions—like “What counts as a suit?” In June 2025, users wagered nearly $79 million on whether Ukrainian President Volodymyr Zelenskyy would wear a suit before July. When photos surfaced of him at a NATO meeting—wearing a black matching jacket and pants with a collared shirt but sports shoes—debate erupted: Do mismatched shoes invalidate a suit? Does casual tailoring disqualify a formal outfit? The platform brought in fashion critic Derek Guy, who concluded: “It’s both a suit and not a suit.” The issue remained unresolved. The market’s outcome triggered two disputes. This is the cost of “trustless, decentralized real-world verification”: eventually, a blockchain oracle may need to rule on sartorial semantics—with $79 million riding on the verdict.

The Future: Token, Challenges, and Bigger Ambitions

At 27, Shayne Coplan has proven his core belief: prediction markets hold real value.

The token hints signal the next phase has begun. The launch of the $POLY token will transform Polymarket from an “experimental prediction market” into a full-fledged crypto ecosystem.

Token holders may gain governance rights, fee revenue shares, and special platform access. Details remain unannounced, but the direction is clear.

Yet the token strategy carries risks: it might draw renewed regulatory scrutiny just as Polymarket gains legitimacy; it could alienate users who see the platform as a “prediction tool,” not a “crypto project.”

Strategically, however, the move makes sense: crypto projects issue tokens to decentralize ownership, incentivize participation, and align platform-user interests.

If prediction markets truly represent the future of information discovery, tokens might accelerate adoption—and reward early believers.

Coplan’s current routine is surprisingly grounded: every Sunday, he watches football games while testing the beta version of Polymarket’s U.S. app.

The work continues. Bets keep flowing. Markets keep revealing what people truly believe.

From a bathroom-side project to a $9 billion company—Coplan did it in five years.

The next five will determine whether prediction markets can achieve even greater breakthroughs—becoming “new infrastructure for collective intelligence,” or even “markets for truth itself.”

Now, this 27-year-old billionaire is focused on one thing: getting it right.

The bathroom office is history. Financial stress is gone. Regulatory battles are paused.

What drives him remains the original spark: prediction markets are a great idea—they shouldn’t stay in whitepapers.

The market has already proven him right.

What comes next? Time will tell.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News