Polymarket Insider Trading Guide: How to Follow "Insiders" for Guaranteed Predictions?

TechFlow Selected TechFlow Selected

Polymarket Insider Trading Guide: How to Follow "Insiders" for Guaranteed Predictions?

If you can track the movements of these insiders, you can essentially bet on the correct outcome with near certainty.

Written by: The Smart Ape

Translated by: AididiaoJP, Foresight News

How to Find Polymarket Insiders

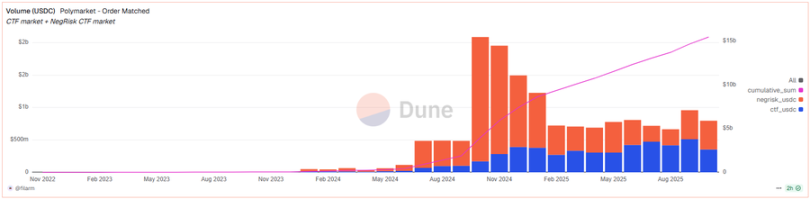

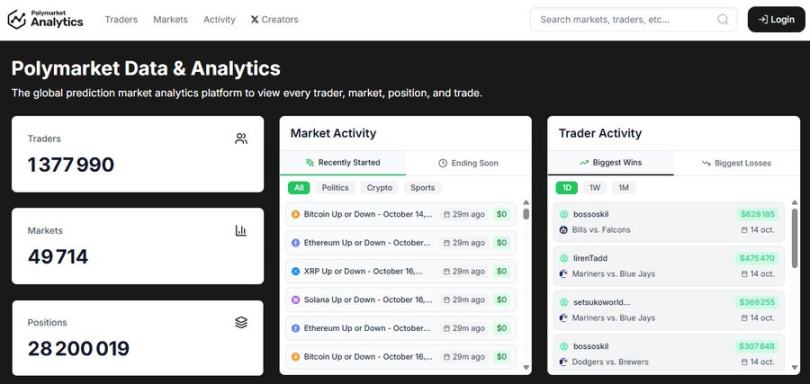

Polymarket is a massive and rapidly growing market, with over $15 billion in trading volume since its launch.

Fascinatingly, users can employ many advanced strategies to profit, such as arbitrage, providing liquidity, discount capture, high-frequency trading, and more.

It remains an early and evolving market, now entering a regulatory phase, meaning there are still many opportunities.

But one method remains largely underutilized: insider analysis.

Polymarket is an open platform, meaning anyone can create markets on anything. Some markets are entirely based on public information, such as "Who will win the next World Cup?", while others involve events where only a small group of people already know the outcome, such as "Who will win the next Nobel Peace Prize?"

In the Nobel Prize market, the committee responsible for selecting the laureate clearly knows the result earlier than anyone else, and some members might quietly use this information to trade on Polymarket.

If you could track these insiders' moves, you could essentially bet on the correct outcome with near certainty, because insiders know exactly what will happen.

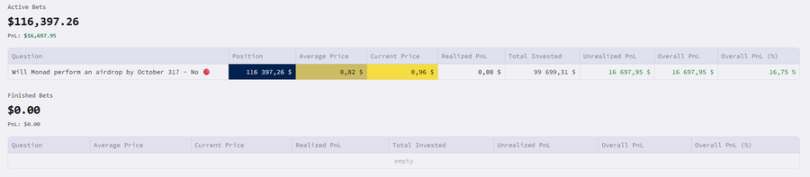

Another example is "Monad airdrop before October 31."

The project team and those closely connected to the project already know whether it will happen, so anyone who can track these wallets gains a significant advantage.

There are several ways to detect potential insider activity.

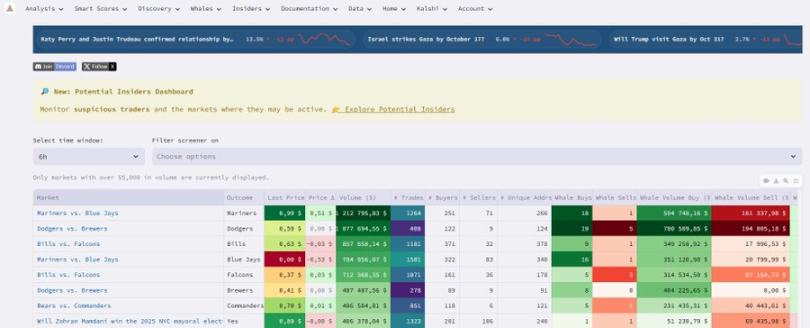

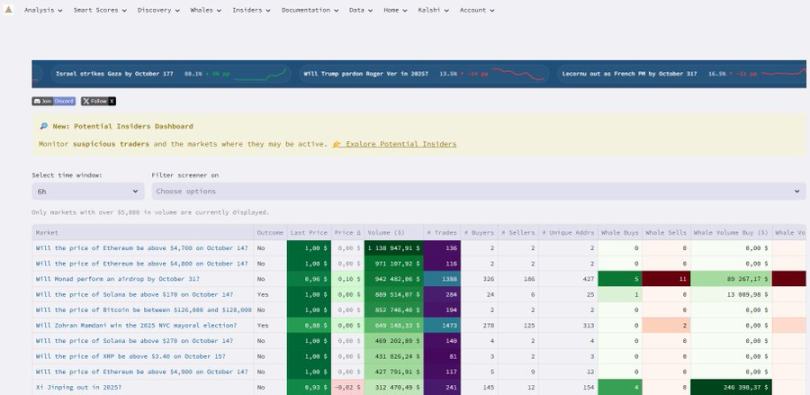

The easiest is using Hashdive(dot)com, currently the best Polymarket analytics tool, offering extensive metrics and data for each market.

-

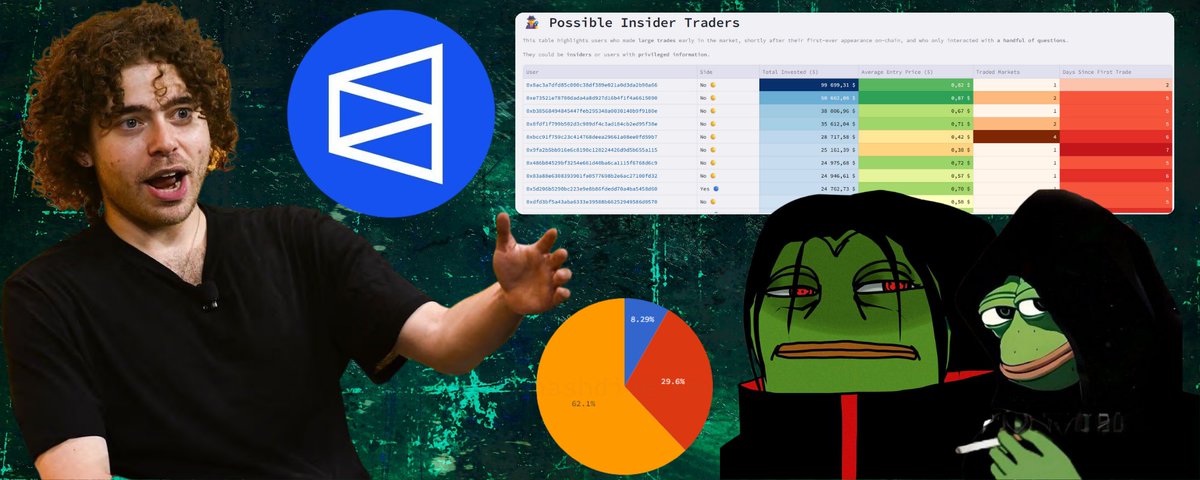

First, pick a market where insider activity is possible, such as the Monad airdrop.

-

Click into the market, and you'll see a detailed page with analysis and metrics.

-

Scroll down to the "Probable Insider Traders" section.

Let’s take the first trader on the list as an example:

He placed $100,000 betting "No," and this is the only market he's trading.

This is suspicious—a new wallet placing a large sum on a single market.

This person is likely part of the Monad team or closely affiliated with them.

The goal isn't to focus on a single trader, but to analyze the collective behavior of the group.

Some may be genuine insiders, others just followers; the key lies in the overall pattern.

In this case, nearly all top traders are betting "No."

The top eight wallets are all on the same side, each using a new wallet and holding large positions in only one or two markets.

This is a clear signal: insiders seem confident that there will be no Monad airdrop before October 30.

Currently, the "No" side trades around $0.83, meaning there’s a potential guaranteed return of nearly 17% by October 30.

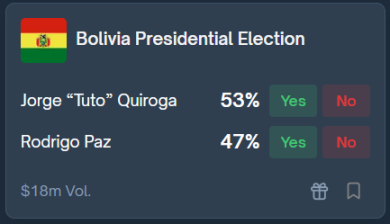

Some markets don’t have a "Probable Insider Traders" section, which is normal.

For example, the "Bolivian presidential election" is unlikely to have real insiders, as in a tight race, no one truly knows how people will vote.

So the key is to select markets where inside information might exist and track insider movements early.

The earlier you spot these moves, the higher your potential profit.

If you wait too long, more insiders will enter, prices will shift, and your profit margin will shrink.

Your edge depends entirely on how quickly you can identify them.

Nobel Prize Case Study

One of the best real-world examples of this strategy is the market:

"2025 Nobel Peace Prize Winner."

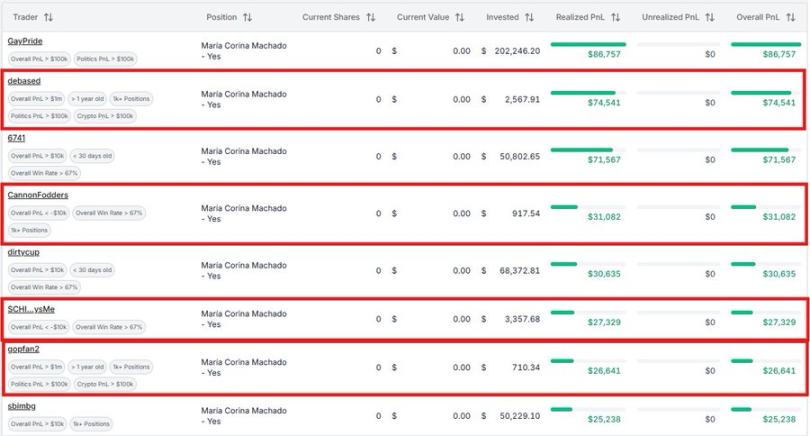

Some traders clearly received information 9 hours before the official announcement.

In seconds, Maria Machado's odds surged from 3.6% to 70%, long before the result was public.

This was clearly insider activity—someone leaked the decision early.

Some traders achieved 20x returns, either by following insider patterns or being insiders themselves:

Debased turned $2,500 into $75,000

CannonFodders turned $900 into $30,000

Gopfan2 turned $700 into $26,000

All entered immediately when Maria Machado's odds began mysteriously spiking.

These individuals could be members of the Nobel Committee, close associates, or even investigative journalists who discovered the leak.

Regardless, the facts are clear: some people had reliable information 9 hours before the official announcement.

When Polymarket odds jump from 3% to 70% within minutes, it's undeniable—insiders are moving.

Norwegian authorities even launched an insider trading investigation into this case.

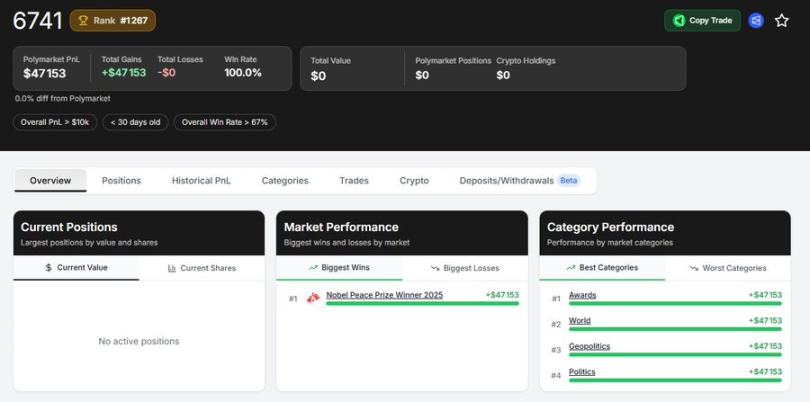

Reports indicate they focused on wallet "6741," which placed a $50,000 bet hours before the announcement.

That wallet traded only once and only in this market—an immediate red flag.

Why Having Insiders Is Actually a Good Thing

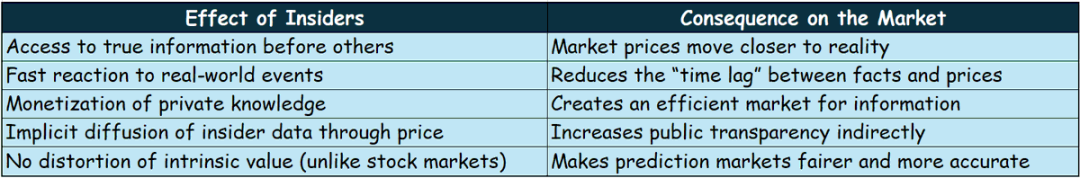

You might initially think insiders harm Polymarket, but in reality, they help it fulfill its true purpose.

Polymarket’s real mission isn’t about making or losing money,

but revealing the collective truth about future events.

The more insiders there are, the more accurate the pricing becomes,

and the more reliable the information the market provides.

Take the Nobel Prize example.

I don’t need to wait for the official announcement—Polymarket has already told me who the winner is.

In this sense, Polymarket beats all major media outlets, which is precisely why it’s so powerful.

Insiders with reliable information help correct mispricing and indirectly pass that knowledge to everyone else through price movements.

It’s an ultra-efficient mechanism for information dissemination.

Without insiders, prices reflect only opinions and guesses.

With them, prices reflect hidden but real facts.

This is why some economists, like the creator of the "prediction market" concept, argue that insider trading is beneficial here:

It narrows the gap between belief and reality.

It also creates a truth-incentive system:

If insiders trade based on true information, they profit.

If they’re wrong or lie, they lose money.

There’s no incentive to spread fake news, because they pay the price for errors.

Most importantly, insiders here don’t harm others.

It’s not like token markets, where insiders dump tokens on retail traders.

Prediction markets are voluntary, and traders knowingly accept the risk of information asymmetry.

It’s a probabilistic game, not a long-term investment.

Therefore, as long as rules are clear, insiders improve prediction accuracy without causing systemic unfairness.

Tools to Track Them

Here are some of the most useful tools for analyzing Polymarket data.

This list is not exhaustive, and new tools keep emerging.

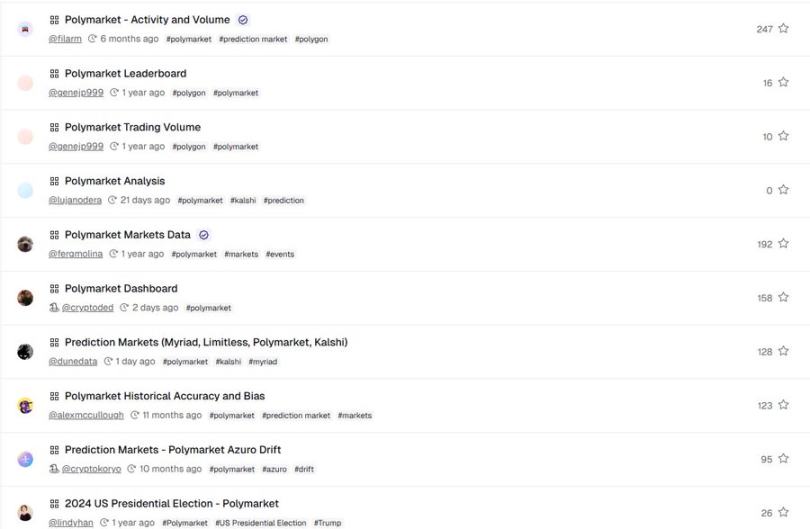

Dune Dashboards: Dozens of Polymarket dashboards, some global (volume, users, trades), others specialized (insiders, airdrop trackers, whales, etc.).

PolymarketAnalytics(dot)com: One of the most comprehensive tools. Allows you to track market traders in real time, discover top alerts, whales, smart money, and analyze performance.

Hashdive(dot)com: Another powerful analytics platform. Each market page includes deep metrics and a new "Insiders" section to help identify potential insider traders.

@polyburg: Tracks "smart money" movements on Polymarket before they go mainstream.

@Polysights: Aggregates real-time and historical data and applies AI/ML layers to generate advanced analytics, trends, arbitrage ideas, and alerts.

@whalewatchpoly: Monitors large trades and well-known wallets in real time.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News