2026 Cryptocurrency Market Lies and Truths: Retail Investors Will Take My Position—Market Predictions Have Just Begun

TechFlow Selected TechFlow Selected

2026 Cryptocurrency Market Lies and Truths: Retail Investors Will Take My Position—Market Predictions Have Just Begun

"Memecoin is over" — truth or lie?

Author: Ignas | DeFi Research

Translation: TechFlow

TechFlow Insight: DeFi researcher Ignas continues last year's "Truths and Lies" series, applying Peter Thiel’s mental framework to analyze the 2026 crypto market.

Core Thesis: The U.S. equity bubble has captured crypto assets; BTC is transitioning from a risk-on asset to a safe-haven narrative; the four-year cycle may already be broken. The article covers multiple major themes—RWA, privacy, regulation, DAT—with extremely high information density.

The full text follows:

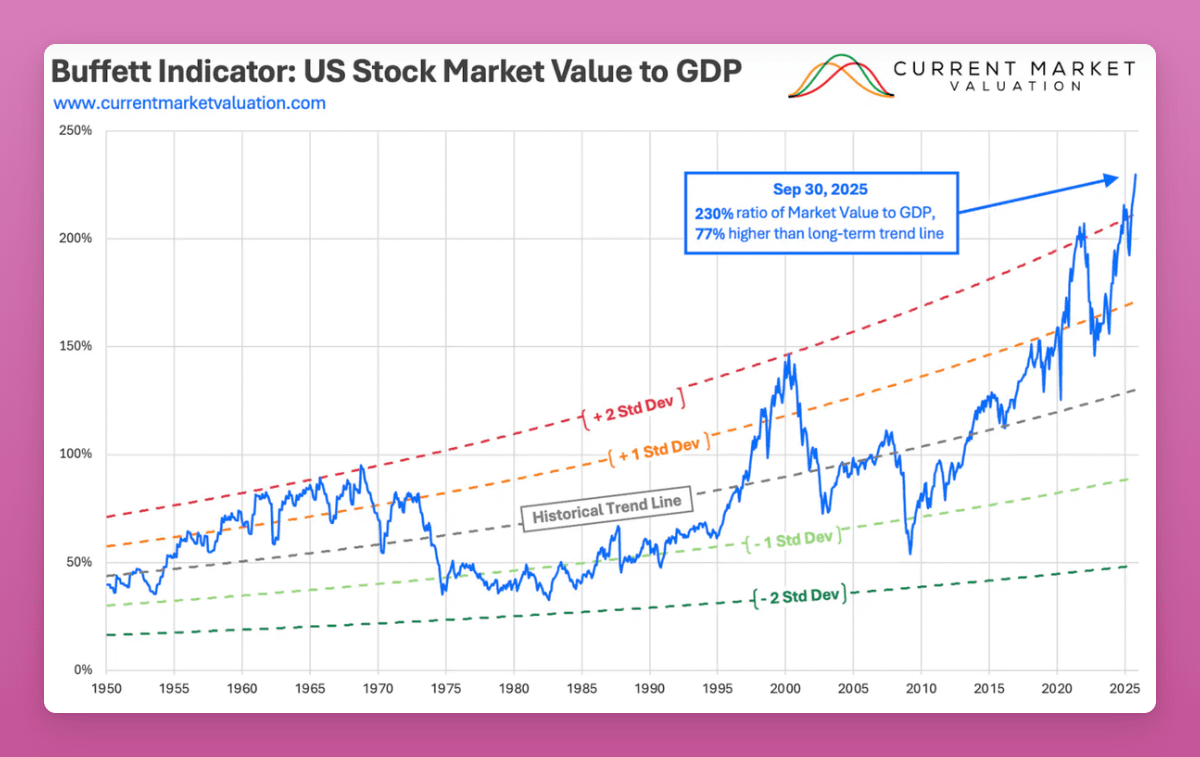

The U.S. stock market is in a “bubble” zone, with valuation levels comparable to the peak of the 1999 dot-com bubble.

Caption: Source Gemini, data for reference only

Current P/E ratio stands at 40.5x, higher than the 32x before the 1929 crash.

And Buffett’s so-called “best single measure of valuation”—total market cap to GDP ratio—is now at 230%, 77% above its long-term trend. Before the 1929 crash, this ratio was 130%.

Caption: Source link

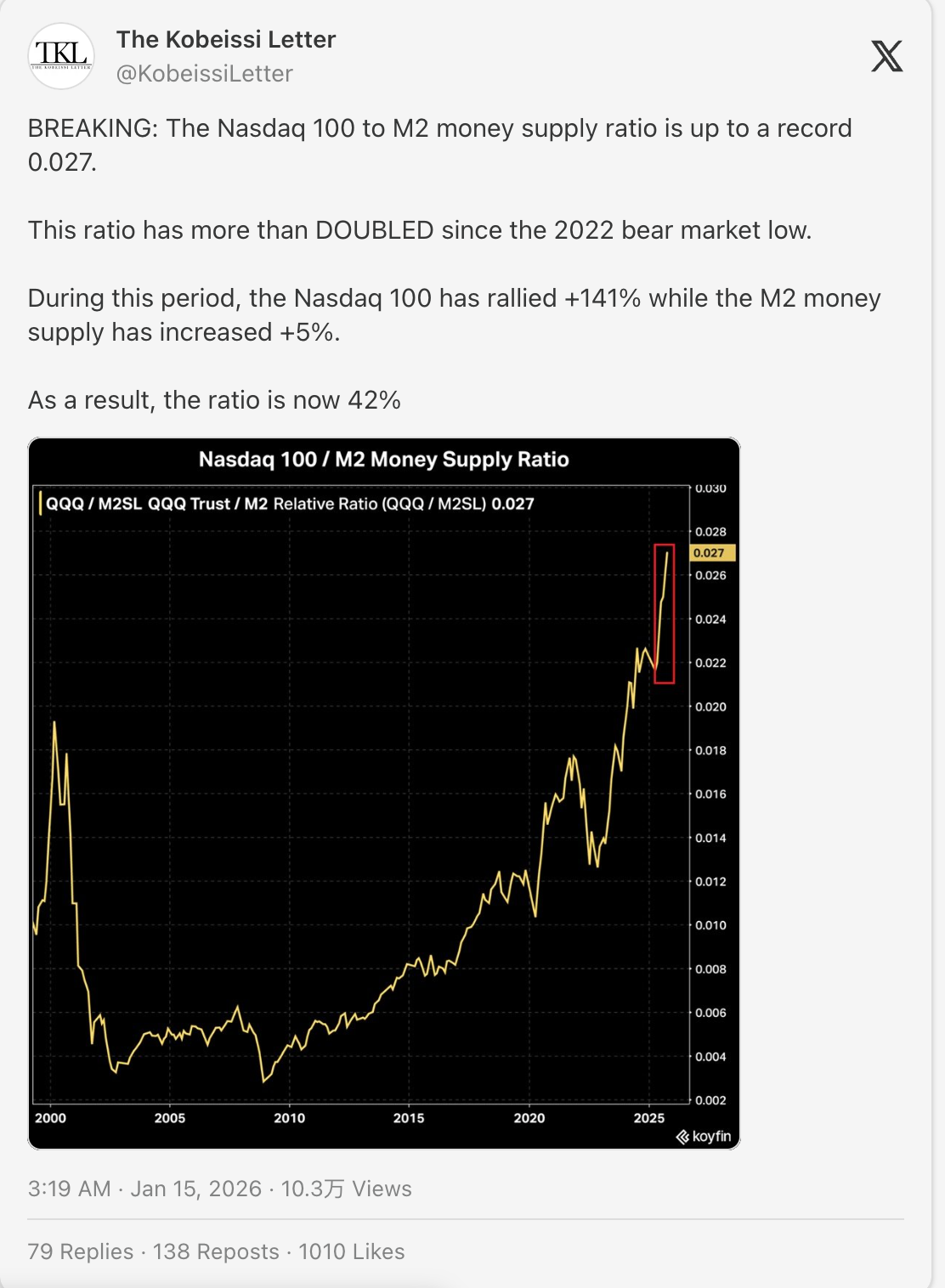

Of course, this time might be different. You could argue it’s a “monetary devaluation trade”—declining dollar purchasing power, global need for inflation to digest debt.

But the claim that “the monetary devaluation trade is real” might itself be a “non-obvious lie.”

If that were true, the line in the chart below should be flat.

If money supply doubles → stocks double → ratio stays constant.

But in reality, the line shoots vertically upward.

This indicates stock prices are rising 28 times faster than money creation.

Or perhaps AI really is transformative, and traditional metrics no longer apply.

With macro uncertainty, inflation, and escalating wars, anxiety is natural.

As Ollie wrote, people live in a state of “universal economic anxiety.”

“You don’t need to be a prophet to know that, for most people, the desire of this era is stability, ownership, and upside exposure. We are still children of capitalism; our desires are inherently capitalist.”

“So for most, the clearest answer is to hold equities and endure another 12 months of Trump waving his fists and calling himself a genius.”

Naturally, fewer people are now willing to go all-in on altcoins.

But BTC’s outlook may differ.

I view BTC as a safe-haven asset: a hedge against macro uncertainty, international order collapse, and fiat devaluation (even if devaluation hasn’t actually occurred).

This was a “non-obvious truth” I shared on my blog last year.

Too many still treat BTC as a risk-on asset, believing it only rises when macro conditions stabilize and Nasdaq soars.

It’s precisely this narrative conflict that suppresses price. Fearful holders must surrender to those who see BTC as digital gold.

I hope the “great rotation” completes this year, cementing BTC’s status as a safe-haven asset.

But there’s one huge risk: if the stock market crashes along with all other assets… crypto falls too.

Therefore, given this macro bubble backdrop, I want to focus on mid-term trends I believe will shape the 2026 crypto market.

There’s no better entry point than distilling truths and lies for 2026.

First, crypto is a prisoner of this macro bubble.

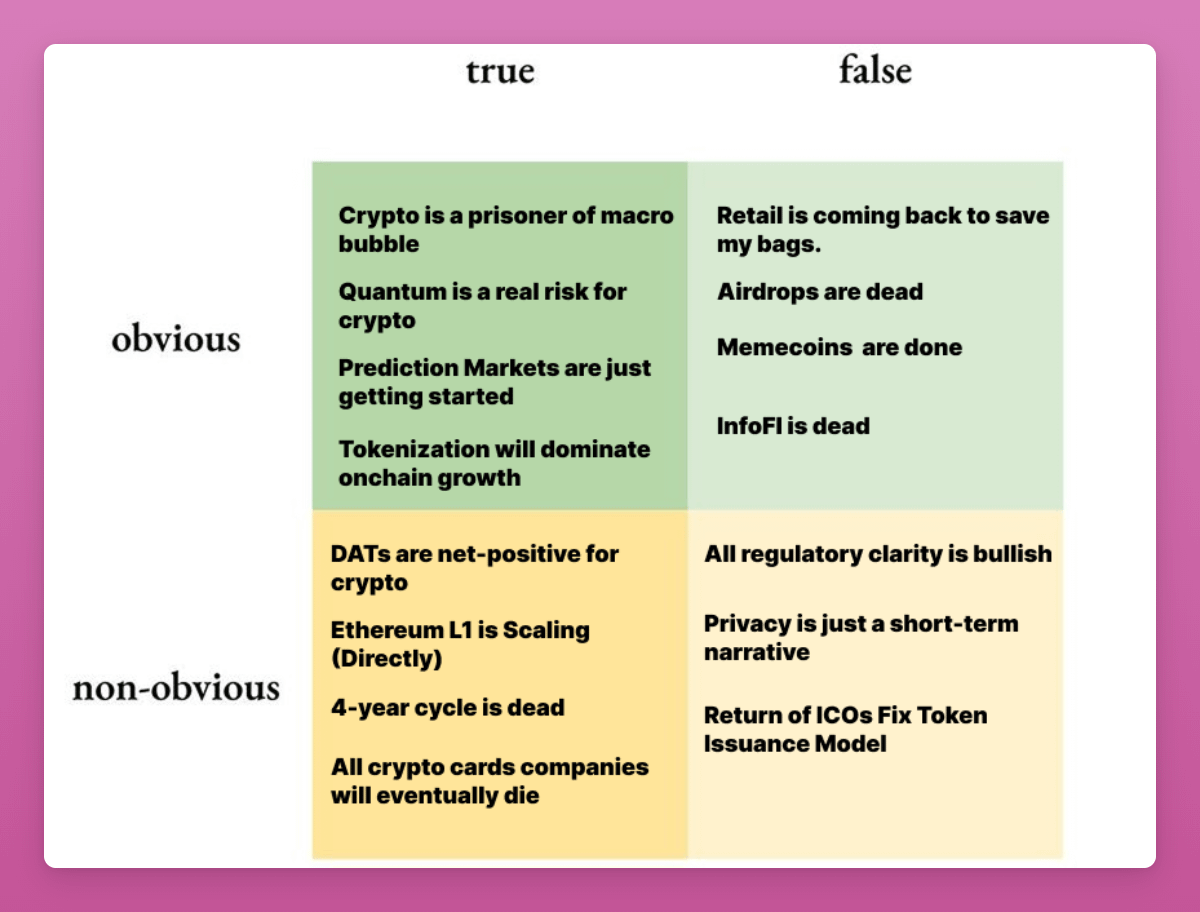

Like last year, I use the mental framework originally proposed by Peter Thiel and adapted by Matti of Zee Prime Capital for crypto.

“What do you think is the obvious truth, the obvious lie? What’s the non-obvious truth, and what’s the non-obvious lie?” — Matti

Non-obvious truths and lies are harder to spot but reveal what everyone will soon realize. These offer the best trading opportunities.

It’s a challenge. I urge you to come up with your own non-obvious truths/lies. I bet it’s harder than you think. As Matti wrote:

“If your insights stay in the obvious realm—you probably have nothing unique to offer, just competing with many others.”

Obvious Truths and Lies

Lie: Retail Will Come Back to Buy the Dip

Crypto Twitter (CT) still seems to be waiting for “normies” to return.

But retail investors have been battered and are more anxious than ever under current macro conditions. They’ve been repeatedly drained by ICOs (2017), NFTs (2021), and Memecoins (2024). Each trend extracted value, with retail serving as exit liquidity.

Thus, the next wave of capital will likely come from institutions.

This is Chainlink’s Zach’s view, which I find compelling.

Unlike retail, institutions won’t buy vaporware. They won’t buy “governance rights” in protocols with zero revenue.

They’ll buy tokens with “dividend-like” attributes (fee switches, real yield), projects with clear product-market fit (stablecoin issuers, prediction markets), and regulated assets.

In fact, Tiger Research predicts “utility-driven tokenomics have failed. Governance voting rights haven’t attracted investors.” They forecast projects unable to generate sustainable income will exit the industry.

But I have a concern for 2026.

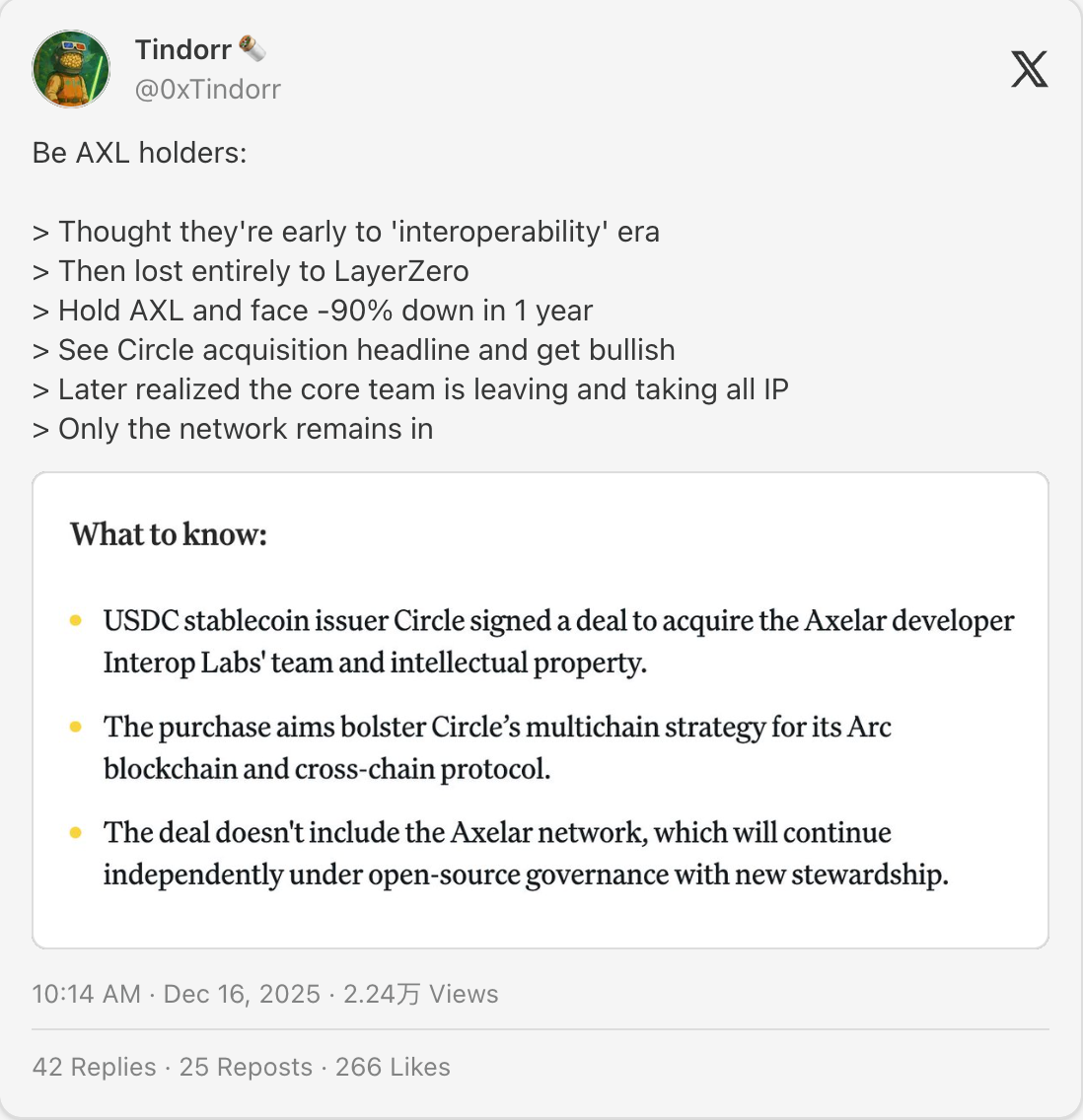

If tokens can’t deliver such value, institutions will bypass tokens entirely and directly buy equity in development companies (like Coinbase acquiring Axelar team but not the token).

We’ve already seen conflicts between token holders and equity holders (Aave Labs vs DAO).

If we don’t solve this, eventually smart money holds equity (real value), while retail holds tokens (exit liquidity).

For crypto to succeed, value must flow to tokens—not Labs companies. Otherwise, we’re just rebuilding the same traditional financial system.

This will be a major issue to watch closely over the coming year.

Truth: Quantum Risk Is Real

The risk here has two layers:

- The actual risk of quantum computers breaking blockchains or wallets relying on non-quantum-resistant cryptography

- The perceived risk—investors believing quantum risk is real

Because 1) very few truly understand quantum tech, and 2) crypto markets are driven by narratives, sentiment, and momentum, crypto is vulnerable to FUD attacks.

My point: until these risks are fully resolved, quantum risk will continue to suppress crypto prices.

We don’t need a quantum computer to empty Satoshi’s wallet to see BTC drop 50%. A Google or IBM headline announcing a “quantum breakthrough” could trigger mass panic.

In such a scenario, I foresee a rotation toward quantum-resistant chains—especially Ethereum.

- Ethereum already has quantum resistance on its roadmap (The Splurge). Vitalik has explicitly stated this need.

- Bitcoin may face civil war over hard-forking signature algorithms (from ECDSA to quantum-resistant schemes).

- New L1s might launch touting “post-quantum cryptography” (PQC) as their main selling point (don’t fall for it).

But if BTC fails to prepare and fractures internally, it will drag down all crypto assets, as market makers, hedge funds, etc., rebalance portfolios.

Truth: Prediction Markets Are Just Getting Started

Opportunities as obvious as prediction markets are rare in crypto.

This insight comes from Andy Hall, research advisor at a16z crypto—so accurate it’s impossible to ignore.

Prediction markets entered the mainstream in 2024. In 2026, they’ll grow larger, broader, and smarter.

Andy says prediction markets are moving beyond questions like “Who wins the U.S. election?” to hyper-specific outcomes.

- More contracts: Real-time odds on everything—geopolitics, supply chains, maybe even “Will Ignas launch a token?”

- AI integration: AI agents will scan the internet for signals to trade these markets, making them more efficient than any human analyst.

The biggest trading opportunity: Who decides the truth? As markets scale, dispute resolution becomes critical. We saw this in Venezuela invasion (?) and Zelenskyy markets. Existing solutions (UMA) failed to capture nuance, leading to disputes and “scam” accusations.

Hence, we need decentralized truth. Andy predicts a shift toward decentralized governance and LLM (AI) oracles to resolve disputes.

Could POLY token play a role here? Where’s your trading edge?

Lie: Airdrops Are Dead

I had to include this.

Airdrops have been and remain the easiest way to make money in crypto. Many believe airdrops are dead because 1) large rewards are harder to get, 2) Sybil detection improved.

But if you’re a genuine user, trying new apps daily and actively using them, I believe the returns are worth it.

Neofinance airdrop should start in 2025, but the real printing press opportunities are Polymarket, Base, Opensea, Metamask…

If CT believes airdrops are dead, even better. Fewer farmers, less competition.

Lie: Memecoins Are Over

To be honest, I dislike memecoins. But sometimes I still trade them.

Winning on memecoins is intellectually fun😉—predicting where sentiment shifts. The volatility is thrilling. No need to study tokenomics, revenue streams—this is the appeal of memecoins.

Institutional-grade L1s, revenue-sharing, or governance tokens can’t provide that thrill. Four-year vesting is boring. Utility tokens based on revenue are ironically less attractive than pure sentiment-driven memecoins.

Financial nihilism won’t vanish on January 1st. Regulation won’t ban them either.

When the crypto market turns bullish, memecoins will reappear. KOL shilling incentives are too high. Retail craves 1000x wins.

If degen trading is your thing, keep an open mind (and wallet).

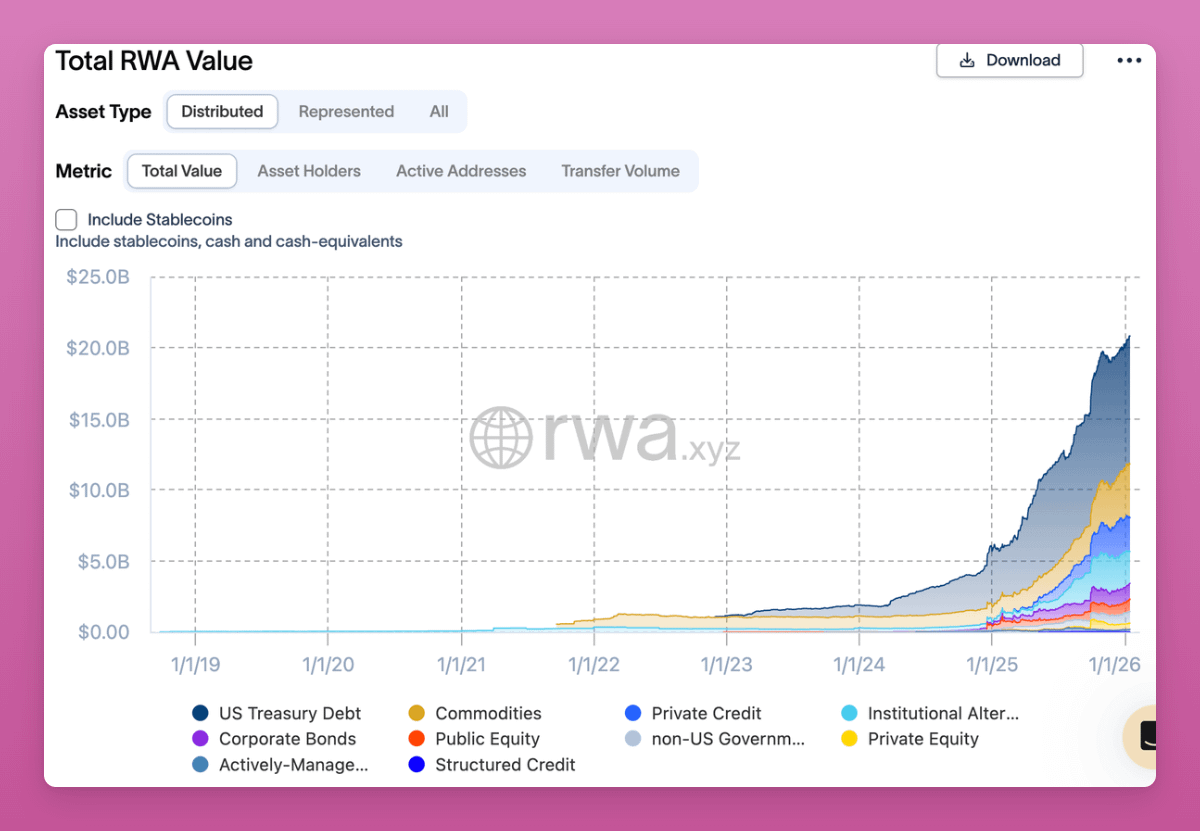

Truth: Tokenization / RWA Will Dominate Crypto Growth

Few charts rose steadily in 2025.

RWA and tokenized assets growth is one of them.

RWA differs sharply from cyclical DeFi, NFTs, prediction markets, or perpetuals. RWA isn’t speculative hype. It’s a long-term shift driven by institutional capital finding product-market fit.

Predictions for 2030 vary wildly:

- McKinsey (conservative): $2–4 trillion

- Citi: $4–5 trillion

- BCG + ADDX: $16 trillion

- Ripple + BCG: $18.9 trillion by 2033

- Standard Chartered (bullish): $30 trillion

Bullish forecasts suggest RWA will exceed total current crypto market cap ($3.3T).

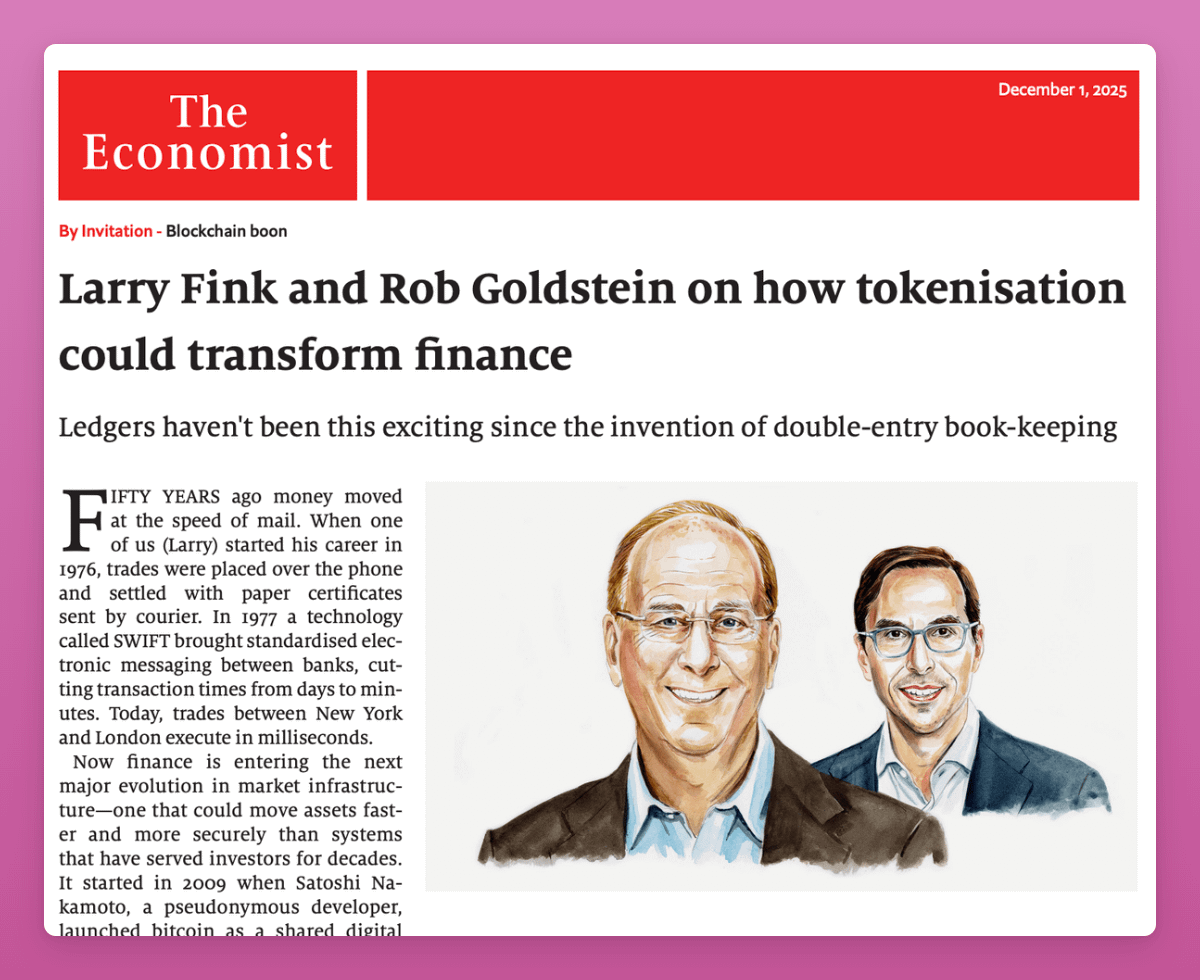

BlackRock and Larry Fink are pushing RWA aggressively. In his 2025 annual letter, he compared the current moment to “1996 internet”—when Amazon was a bookstore, Google didn’t exist.

Caption: Source Economist (free access link)

His argument:

“Every stock, every bond, every fund—every asset—can be tokenized. If realized, this will transform investing.”

Benefits of RWA are obvious to crypto natives, but traditional finance is still learning. We’re early:

- Collateral availability

- DeFi composability

- 24/7 settlement

- Programmable compliance

How can crypto natives profit from this growth?

Several trading ideas come to mind:

- LINK: Dominant oracle market share. UBS, Swift, DTCC all integrated Chainlink for tokenized asset pricing. If RWA scales, LINK captures the data layer.

- PENDLE: Can it attract institutional capital? Allows degen speculation on yields while offering fixed income to long-term holders. Worth watching.

- Lending platforms: Fluid, Aave, Morpho, Euler… Will institutions use these DeFi platforms? Will retail? Key question.

- RWA issuers: Ondo, Backed Finance, Securitize—are gateways for RWA issuance and retail access.

- ETH: 65–70% of on-chain RWA value sits on Ethereum. BlackRock, Franklin Templeton, JPMorgan—all on Ethereum. Institutional settlement layer. This is why Ethereum must deliver institutional-grade privacy, or new L1s may erode ETH’s market cap.

- Stablecoin yield arbitrage: Borrow at 4–6% on Aave, deposit into Pendle’s PT-USD-like tokens to earn 8–12%.

You could also add Maple Finance for private credit exposure, and Centrifuge (though I lost money on it). Anything I missed?

This will be the dominant trade theme in 2026 (and beyond).

Tiger Research predicts: “Corporations may build their own chains to maintain market leadership. RWA projects lacking independent asset supply will lose competitive advantage and be eliminated.”

If you follow one thing, track where new RWA assets are issued: on Ethereum, Solana, or some new L1 you’re not exposed to.

Non-Obvious Truth: Ethereum L1 Is (Directly) Scaling

Most believe Ethereum L1 remains stuck in 2020: slow, expensive, funneling all value to L2s.

But Ethereum L1 is quietly scaling, and the market hasn’t priced it in yet.

When Vitalik says “the blockchain trilemma is solved on Ethereum,” that’s unlike his usual cautious tone.

@VitalikButerin tweeted:

“Now that ZK-EVM is in alpha stage (production-level performance, remaining work is security), and PeerDAS is live on mainnet, it’s time to talk more about what this combo means for Ethereum.

These aren’t minor improvements; they’re transforming Ethereum into…”

After last year’s Fusaka upgrade, gas limit reached 60M (up from 30M). By mid-2026, it could hit 80M, then over 100M.

With ZK-EVM, Ethereum L1 achieves thousands of TPS while maintaining full decentralization.

“Instead of every validator re-executing every transaction, a single proof verifies entire batches, reducing computational load. This allows developers to increase transaction volume or complexity without excluding small participants. Buterin says these VMs have reached ‘production-level performance,’ with ‘security’ as the remaining focus.” — DLnews

More activity on L1 = higher fee burns = stronger deflationary pressure. The ultrasonic money narrative isn’t dead. Well, maybe it died for a few years, but could resurface.

L2s will still dominate ultra-cheap use cases (perpetual DEXs), but the narrative that “everything must permanently migrate to L2” will look painfully outdated.

Oh, and Ethereum Foundation and Vitalik’s push for quantum resistance makes ETH an attractive bet—especially if Bitcoin core devs mess it up.

I consider this a non-obvious truth because rollout is gradual, without a single hype moment.

Non-Obvious Lie: All Regulatory Clarity Is Positive

CLARITY Act passes? Bullish. GENIUS Act implemented? Bullish. EU MiCA? Bullish…?

When I read Coinbase’s celebratory posts on regulation, I wonder—is this really positive for you and me?

Sure, it might benefit Coinbase, but for the broader crypto industry, it’s more complex.

First, the GENIUS Act explicitly bans interest-bearing stablecoins.

But I think this is actually bullish for DeFi.

When stablecoin issuers can’t pay yield directly, where do stablecoin holders go? To DeFi protocols like Aave to earn yield themselves.

DeFi lending hit over $50B TVL in 2025, with stablecoin yields of 4–14% APY. Crypto collateralized lending grew 27% in Q2 2025, reaching $53B.

So yield bans don’t kill yield—they shift it on-chain. Stablecoins flow into protocols, protocols generate fees, tokens capture value from those fees. The entire DeFi ecosystem benefits.

So on this specific issue, regulation may actually accelerate DeFi adoption.

But I worry regulation will further stifle crypto innovation. Our degen era is over.

In the EU, MiCA has already banned USDT on all major exchanges. I can’t trade USDT anymore—terrible.

Beyond stablecoins, MiCA compliance costs are expensive for startups: €250k–500k/year for small firms, over €540M in fines issued since implementation. 75% of European crypto service providers risk losing registration due to compliance costs.

Result: market consolidation, favoring already-established players. Even if Coinbase opposes the current CLARITY Act, they’ll push for regulations that benefit them.

I saw this firsthand in Korea: only 4 exchanges allowed KRW deposits. They pushed regulation—but only to kill competitors.

The U.S. isn’t purely bullish either (The Block explains DeFi platforms will need to share private info).

Banks are lobbying to extend stablecoin restrictions to non-interest rewards. Unclear whether this will pass with the CLARITY Act.

So don’t automatically assume “regulation = bullish.” Some clarity is good, but some clarity restricts what made crypto great in the first place.

Drop the legislation into Claude/Gemini and ask what it really means.

Non-Obvious Lie: Privacy Is Only a Short-Term Narrative

CT is excited about Monero and Zcash rallies. The narrative: “Privacy coins are back.”

My non-obvious truth: the real privacy opportunity lies in privacy infrastructure for institutions.

Privacy coins banned everywhere:

- Dubai’s DFSA just banned privacy tokens

- EU explicitly bans “crypto asset accounts enabling anonymized transactions” and “accounts using privacy-enhancing coins,” effective July 2027. According to EU Crypto Initiative, this regulation is “final.”

- Japan and South Korea banned privacy coins years ago.

- Binance and Kraken delisted privacy tokens (Monero)

If you’re an EU citizen, depositing ZEC from a shielded address to a regulated CEX creates issues in source-of-funds reports. I’m doing forensic reporting right now—believe me.

If funds aren’t traceable, CEXs can’t verify sources, and users get stuck.

But institutions desperately need privacy

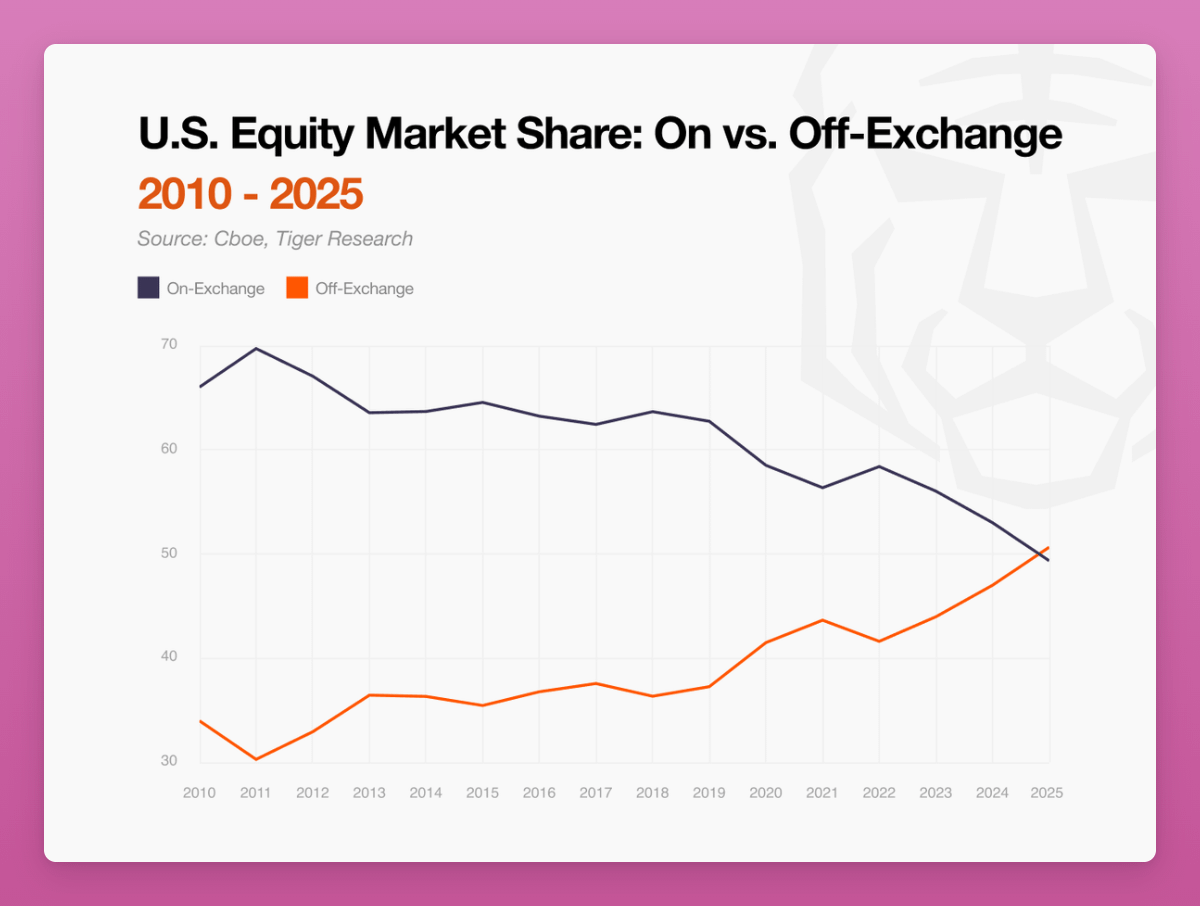

Look at Tiger Research’s chart: U.S. equity market share shifted from ~70% on-exchange (2010) to nearly 50/50 on vs off-exchange by 2025. Bloomberg reports most U.S. stock trading now happens in the “dark.”

Caption: Source Tiger Research

Why? On-chain transparency exposes their trading strategies.

Maybe not the best example, but when James Wynn’s 949 BTC leveraged position—and liquidation price—were visible on-chain at Hyperliquid… maybe his claim of being targeted wasn’t just paranoia :)

“Professional trading firms and institutions are reluctant to deploy complex strategies on public blockchains because every move can be seen, copied, or front-run.”

In this context, I see growing chatter around Canton. Market cap $5.4B, quietly sitting at #33.

DTCC announced they’ll begin tokenizing U.S. Treasuries on Canton from Q2 2026. DTCC—a firm that processed $37 quadrillion in securities trades in 2024.

Canton is the first open blockchain built specifically for institutional finance with privacy support. Participants control which counterparties see specific transaction details—unlike public chains where everything is broadcast.

“Many blockchain architectures were developed for open, permissionless environments with widely visible transaction data. While this model has advantages in certain contexts, it conflicts with requirements of regulated financial markets. Institutions cannot publicly expose positions, counterparties, or liquidity changes.”

Canton’s backers are all traditional finance giants: BlackRock, Blackstone, Nasdaq, S&P Global, Goldman Sachs, Citadel Securities, HSBC, BNP Paribas, Euroclear…

So yes, privacy absolutely matters.

If I’m heavily long ETH and SOL, I’d be nervous facing competition from alt L1s.

But Ethereum is also advancing on privacy.

First, Vitalik clearly recognizes privacy as a “known flaw” in Ethereum’s current architecture.

Vitalik Buterin shared a privacy roadmap with 9 steps to improve L1 privacy: integrating tools like privacy pools and Railgun directly into wallets, making “one address per app” the default, and implementing TEE-based RPC privacy.

At EDCON 2025, Vitalik outlined a roadmap including:

“Efforts for read privacy include Trusted Execution Environments, Private Information Retrieval techniques, dummy queries to obfuscate access patterns, and partial state nodes showing only necessary data. These aim to reduce information leakage during user interactions.”

Ethereum needs to shift from “don’t be evil” to “can’t be evil.” Use cryptography to secure systems even if individual participants are malicious.

Another savior is L2: Aztec Network launched Ignition Chain on Ethereum mainnet. First fully decentralized privacy-preserving L2. Backed by $170M from a16z et al., Aztec enables “programmable privacy,” letting users control what’s public vs private.

Aztec co-founder Zac Williamson said:

“2025–2035 will be the era of privacy rotation.”

Non-Obvious Truth: The 4-Year Cycle No Longer Applies

God, I hope I’m not wrong on this.

But I believe BTC and crypto have changed enough to escape the 4-year cycle. Ironically, the very factors that make crypto—especially BTC—a prisoner of macro forces are what break the old pattern.

This is one of Messari’s theses in their 2026 report.

“As BTC increasingly becomes viewed as a macro asset, traditional frameworks like the 4-year cycle matter less. BTC’s performance will be shaped by broader macro forces.”

We’re now trading a different asset class.

- Miners no longer matter: ~450 BTC (~$42M) issued daily. BlackRock ETF volume digests that in 15 minutes. Supply shock narrative is dead—miners no longer control circulating supply.

- ETFs dampen volatility: Already mentioned in “macro prisoner” section. Plus, institutions, pension funds don’t trade like retail—they have rebalancing duties, offsetting past retail-driven sell-offs.

- Liquidity matters more than halving: Overlay BTC price with global M2 money supply—the correlation is strong. After old-school BTC maxis and 4-year-cycle panic sellers exited, we briefly diverged.

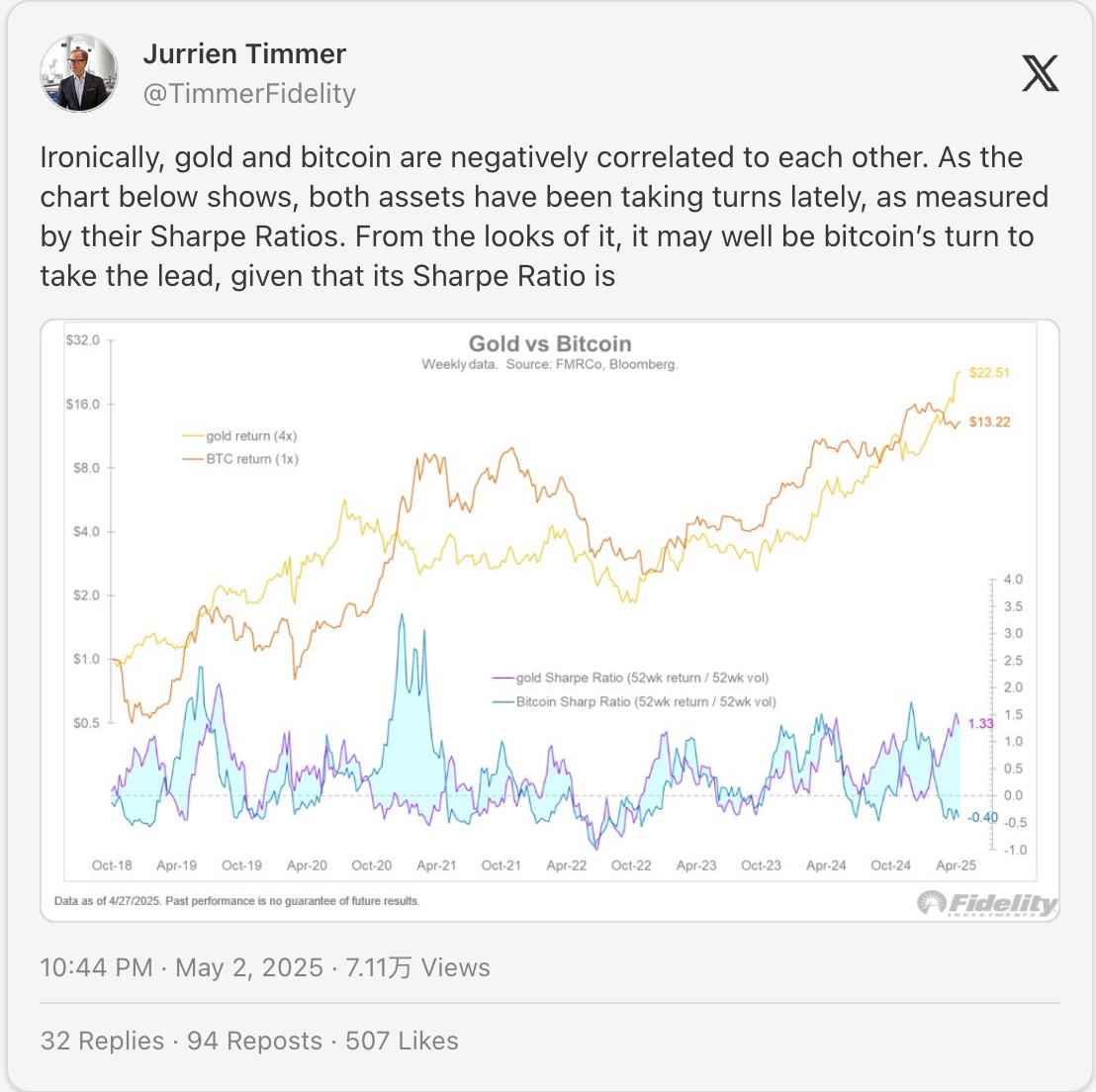

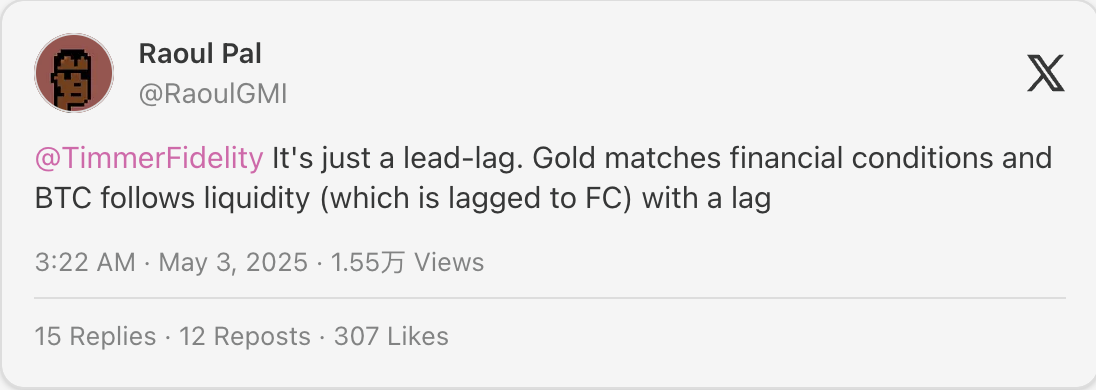

- BTC lags behind gold: Historically, gold leads BTC by 60–150 days. Though many expect BTC to catch up. I believe this catch-up trade and rotation into BTC will be stronger than the 4-year cycle.

In the same Messari 2026 report, they argue BTC will remain strong by absorbing gold’s monetary premium and store-of-value role.

Polymarket prices BTC to outperform gold and S&P 500 in 2026. But the margin is narrow.

So this isn’t an obvious truth.

Non-Obvious Truth: DAT Is Net Positive for Crypto

G. Kendrick of Standard Chartered (Head of Crypto Research) cut his 2026 BTC target from $300K to $150K due to DAT exhaustion:

“...bitcoin digital asset treasury (DAT) company buying may have ended, as valuations... no longer support further DAT expansion. We expect consolidation rather than outright selling, but DAT purchases are unlikely to provide further support.”

“Hence, we now see future BTC price increases driven by only one leg,” he added.

Grayscale’s 2026 Outlook Report shares a similar view:

“Despite high media attention, we believe DATs won’t be a major driver of digital asset market volatility in 2026.”

“There will be much discussion, but we don’t see them as central to the market outlook.”

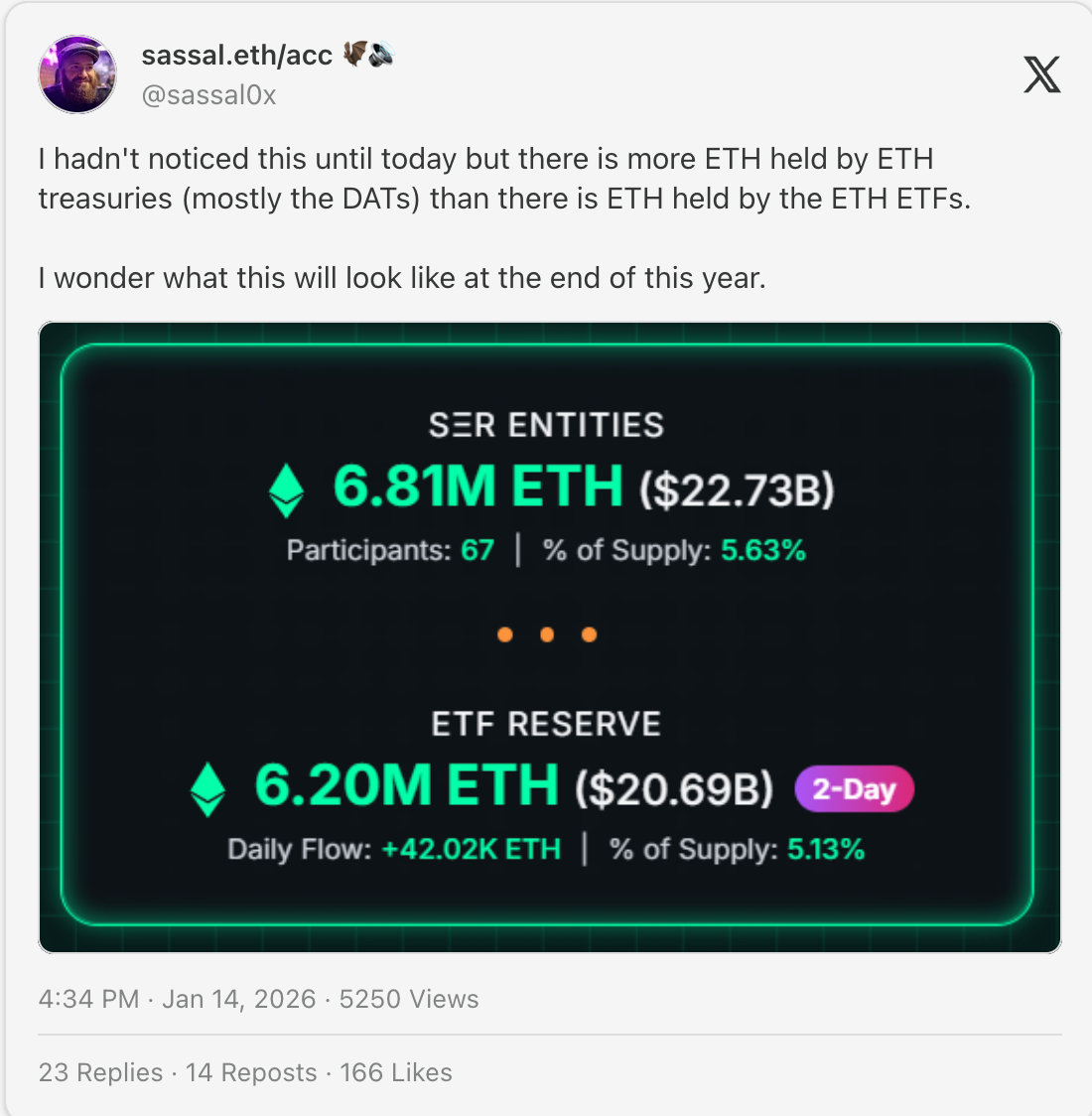

DATs hold 3.7% of BTC supply, 4.6% of ETH, 2.5% of SOL.

Demand has cooled from mid-2025 peak: largest DATs now trade near 1.0 mNAV (see chart below).

Caption: Source Grayscale

However, most DATs aren’t overly leveraged (or at all), so they likely won’t be forced to liquidate during downturns.

The largest market-cap DAT Strategy recently raised a USD reserve fund to keep paying preferred dividends even if BTC price drops.

Grayscale expects most DATs to behave like closed-end funds—trading at premiums/discounts, rarely liquidating assets. DATs may become a permanent feature of crypto, but unlikely to be a major source of new demand or selling pressure in 2026.

Frankly, DATs scare me. I’d be happy if they became “non-news” in 2026.

But they do matter.

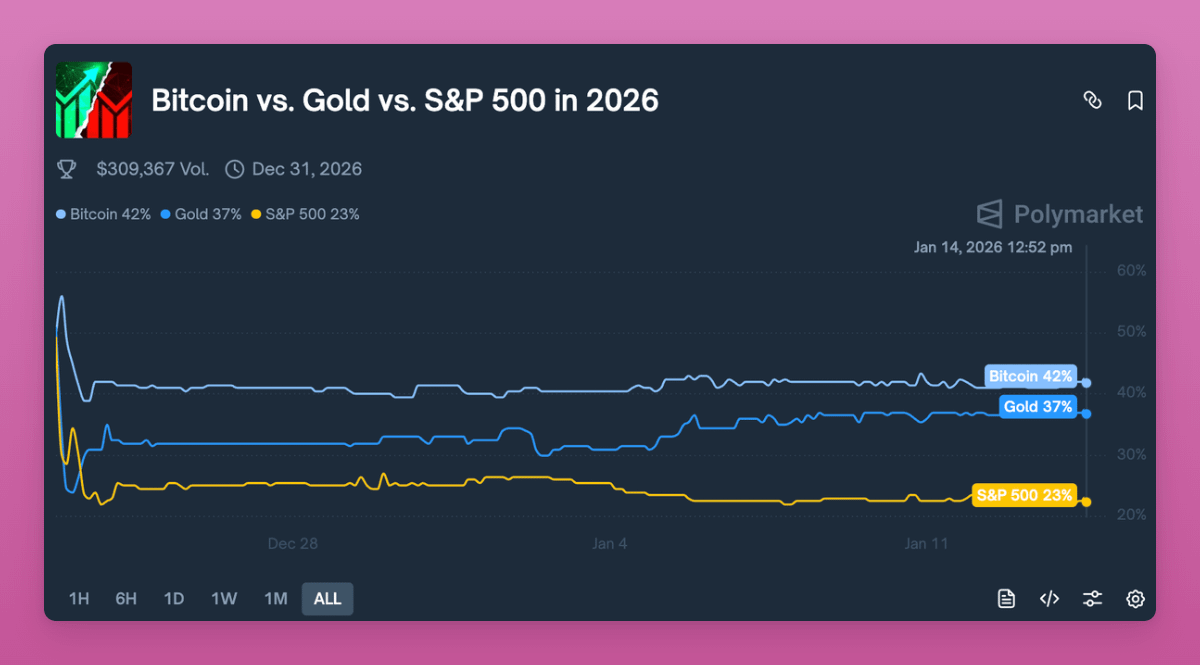

For ETH, DATs already surpass ETFs.

Unlike BTC DATs, ETH treasuries actively use their holdings. BitMine staked 74,880 ETH ($219M) for 3% yield. SharpLink Gaming earned 1,326 ETH (~$6M) from staking rewards since June 2025.

BitMine is developing a “Made-in-America Validator Network” (MAVAN), aiming to earn $363–485M annually in staking rewards via operating its own validators. Also invested in MrBeast. Confusing, but I like experimentation.

BTC generates no yield. But ETH DATs are turning treasuries into productive infrastructure—validators, liquid staking, DeFi yield farming.

This is another reason I’m bullish on $ETH in 2026. Quantum resistance roadmap + L1 scaling + more sustainable DATs.

BTC, SOL, and ETH have ETFs competing with DATs.

But most altcoins remain too risky, illiquid, or legally complex for ETFs.

This makes DATs the “IPO moment” for altcoins—an easy way for institutions to gain compliant exposure.

I believe these DATs can focus attention, deciding which altcoins are worth buying.

With thousands of altcoins, only a few can structure a DAT. This focuses user attention and capital inflows into a select few pumpable assets.

But I fear DAT insider trading. Last year, SEC and FINRA investigatedover 200 DAT firms after stocks spiked days before announcements.

Also, retail hates VCs exiting via DAT instead of dumping on spot markets.

Overall, if:

- BTC DATs become non-news in 2026

- ETH DATs continue staking in PoS and DeFi protocols

- Altcoin DATs expand for high-quality assets

Then I believe DATs are net positive for crypto in 2026.

But during downturns, DATs can amplify sell-offs. But nothing new—retail and institutions both sell.

Non-Obvious Lie: ICO Return Fixes Token Distribution

ICOs are back.

- MegaETH raised $450M in one of the most sophisticated models.

- Echo acquired by Coinbase for $375M.

- Kraken partnering with Legion for a “fair” sale.

- MetaDAO pioneered ownership token sales.

The narrative sounds beautiful: retail finally gets equal access as VCs. Fair launches. Equal terms and democratized participation.

Indeed, returning to ICOs is necessary—low circulation, high FDV airdrops are unsustainable.

We do want to relive early ETH ICO days with 450x returns.

Thus, ICO 2.0 platforms promise to fix this. Legion uses “merit scores” based on on-chain, social, or dev activity. Echo lets retail “invest on equal terms with VCs.”

I love it! My X account got me top deals like a $50k allocation in MegaETH sale.

But ICOs haven’t democratized token distribution:

- All require KYC (excluding most of the world). As an EU citizen, I can’t even buy Monad sale on COINBASE?!

- Reputation scores favor existing insiders, KOLs

- Allocation caps that VCs don’t have—or smart whales bypass via multi-wallets

The token minting mechanism keeps changing: BTC forks (Litecoin), then ICO to IDO. IDO to airdrop. Airdrop to points farming. Points to quota scores.

But value consistently flows to those who 1) already control project flows and 2) know the game rules. I’ve written about this before.

The upside: ICOs demonstrate real token demand. Airdrop farming with inflated numbers masked real demand.

But when/if market heats up, retail may enter at prices 10–50x worse than seed investors, facing unlocks that flood the market—on projects where most upside was already privately captured.

Again, I love the ICO meta-narrative because I get the best deals. But what about most of you?

Non-Obvious Truth: “All Crypto Card Companies Will Eventually Die”

This view comes from Pavel Paramonov:

His main reasons crypto cards will die:

- They run on Visa/Mastercard—no real disruption.

- Easy to copy: most are just brands on shared infrastructure (Rain raised $250M at $2B valuation).

- Centralized + KYC, contrary to crypto’s goals.

- Users won’t tolerate extra fees/taxes long-term.

- Once adopted, wallet-native payments will replace them.

All solid points. I agree most crypto card companies will shut down. Generally, most startups fail—easy call :)

There’s already evidence stablecoins enable direct P2P payments. Interactive Brokers adding USDC deposits is huge for crypto.

But I believe two types of “crypto card companies” will survive:

Those like Etherfi offering crypto-backed lending. Even CeFi platforms like Nexo, Bybit, Crypto.com offer cards—won’t change.

More importantly, crypto card companies are evolving into neo-bank apps: 1) offering banking services, 2) building their own payment networks.

For example, Payy is building a privacy-first but regulation-compliant payment L2. Their card is just the first use case. If their network succeeds, their own success (achieving P2P transactions) will make the card obsolete.

Base is betting big here with the Base app.

But probability is low. Imagine replacing PayPal, Alipay, or other deeply entrenched players in their domains.

More likely: Revolut enables direct stablecoin payments, then most crypto-native payment solutions… die.

The truth is, crypto cards will remain big business for years because 1) banks resist accepting exchange deposits, 2) tax avoidance via crypto cards is a strong PMF.

But regulation will eventually catch up with crypto card firms or their users.

Stablecoin success competes directly with crypto card companies. If stablecoin payments take off, cards become unnecessary.

Most likely, today’s crypto card payments evolve into neo-banks, competing with new financial apps like Revolut. So yes, crypto cards that don’t transform into neo-banks will die.

If they win, upside is massive!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News